What is the Biopolymers Market Size?

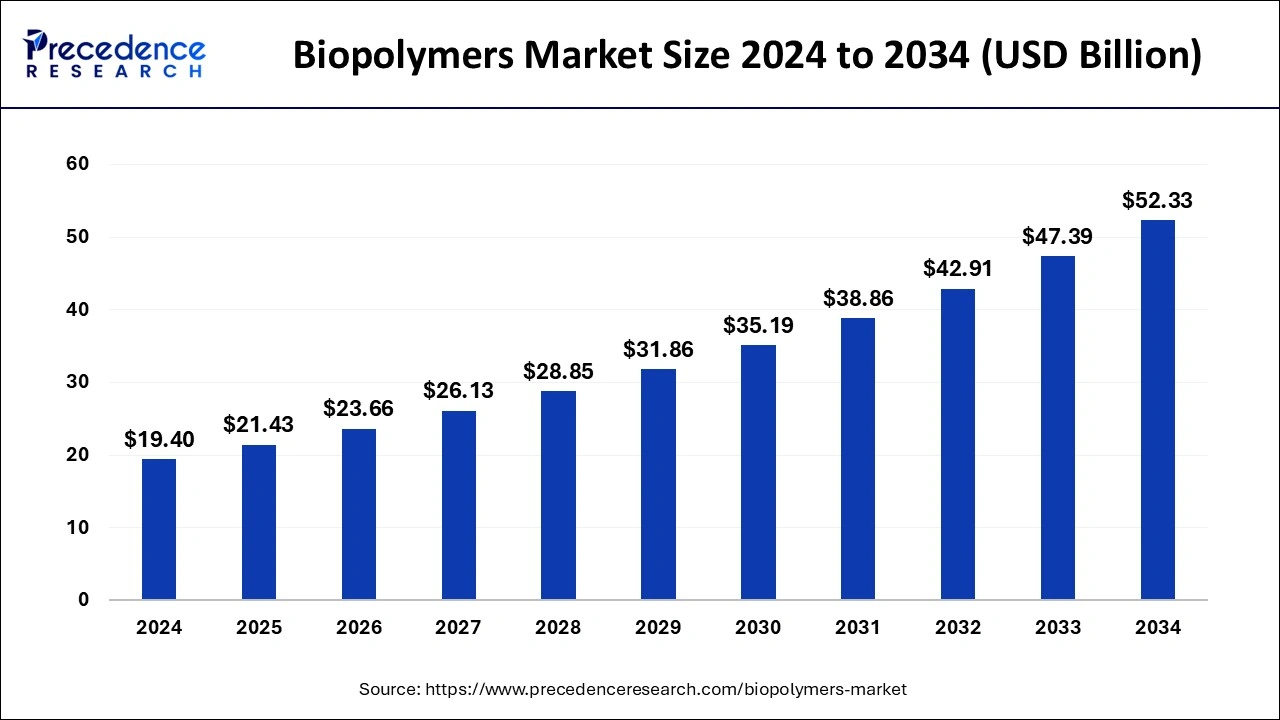

The global biopolymers market size is accounted at USD 21.43 billion in 2025 and predicted to increase from USD 23.66 billion in 2026 to approximately USD 52.33 billion by 2034, representing a CAGR of 10.43% from 2025 to 2034. Consumer demand, regulatory pressure, biotechnology innovations, applications in food, healthcare, and nutricosmetics, and the waste management benefits from agricultural waste drive the biopolymers market.

Biopolymers Market Key Takeaways

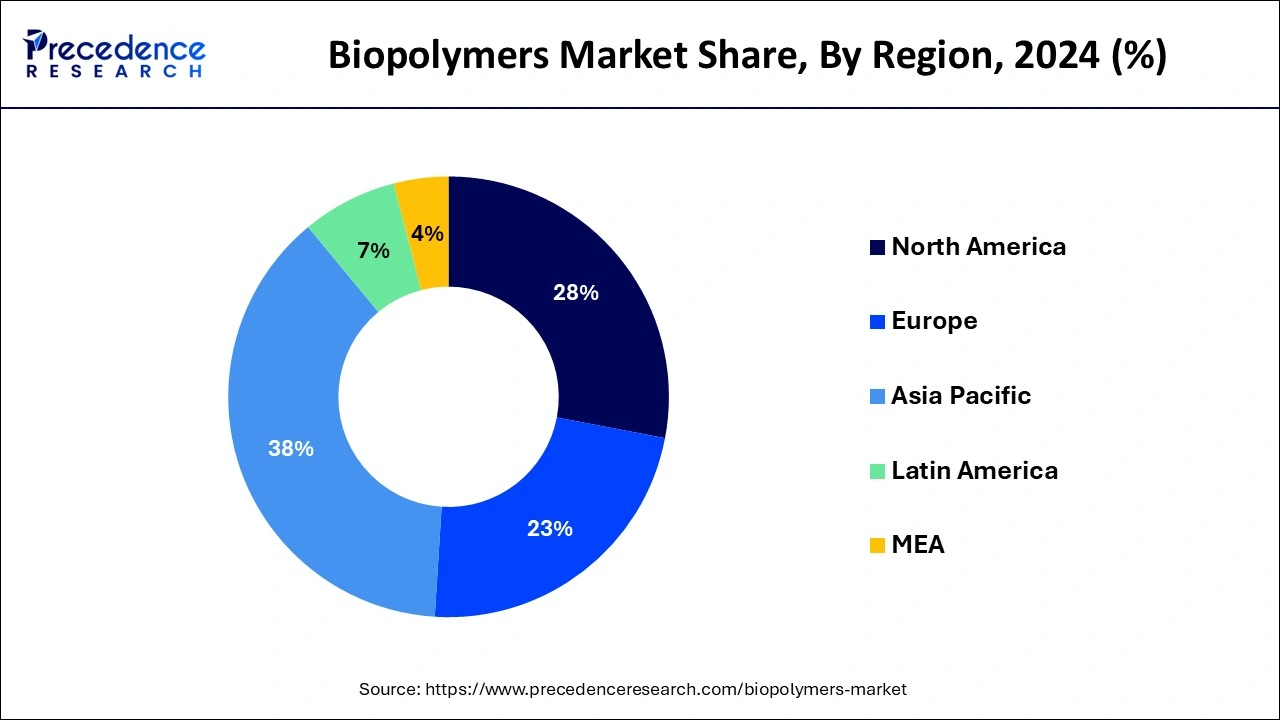

- Asia pacific dominated the global market with the largest market share of 38% in 2024.

- Europe is projected to expand at the notable CAGR during the forecast period.

- By End User, the packaging segment contributed the highest market share in 2024.

Market Overview

Flexible plastic produced using synthetic mixtures got from or incorporated by microorganisms like microbes or hereditarily adjusted plants. Bioplastics are thermoplastics produced using bio-based materials like sugar, kelp, and starch. Biopolymers are a general class of materials that incorporates bioplastics as well as regular polymers like silk, chitosan, and fleece. Starch, alginate and cellulose are instances of polysaccharides, which are straight or stretched polymeric sugars. Regular rubbers, suberin and lignin, cutin and cutan, and melanin are instances of biopolymers. Human and creature squander, plant items, and agrarian waste are utilized to make bio-plastics, which are then reused and transformed into new items utilizing state of the art innovation.

Biopolymers are produced using waste starch, biomass and other sustainable feed stock. There are a few economically accessible polymers, (for example, polylactic corrosive, bio-nano composites and poly-hydroxy-alkanoate, and so on) which are utilized in the hardware and car businesses.

Legislatures are empowering the utilization of biodegradable polymers over ordinary polymers to diminish carbon impression. A few significant auto organizations are presently choosing biopolymers in their vehicles; for example, the Ford Motor Company is involving biopolymers for inside applications.

How AI is Fast-Tracking the Next Generation of Biopolymers?

Artificial intelligence revolutionizes biopolymer manufacturing through its processing, waste minimization, and production of higher-quality products. Machine learning and machine vision are used to analyze historical and real-time data, which can pre-empt possible issues with defects and wastage. Thus, AI automates nearly all quality control operations, leading to more accurate results. All of these translate to significant potential benefits from the integration of AI into polymer manufacturing, such as improved process efficiency, enhanced product quality, reduced maintenance costs, and better optimization of the supply chain. Most applications of AI relate to process optimization combined with quality control and supply chain management, providing important practical applications in these fields. The applications of digital transformation in the plastics industry will continue to highlight the invaluable role of AI.

Biopolymers Market Outlook

- Industry Growth Overview: The biopolymers market is projected for rapid expansion from 2025 to 2034, driven by strict environmental regulations, increasing consumer awareness, and growing demand for sustainable alternatives to traditional plastics. Key growth areas include packaging, automotive parts, and medical implants, with Polylactic Acid (PLA) and polyhydroxyalkanoates (PHA) as the main material types.

- Major Trends: Key trends include a strong shift toward bio-based and biodegradable materials made from renewable feedstocks like corn starch, sugarcane, and agricultural waste. The industry is also adopting the circular economy model, focusing on recycling programs and the development of certified compostable materials.

- Major Investors:Major investors are actively supporting the biocomposites market, attracted by its strong growth potential and alignment with ESG objectives. Leading chemical companies, private equity firms, and venture capitalists are funding expansion and innovation initiatives. Key players such as BASF, Braskem, NatureWorks LLC, and Novamont are investing heavily in R&D to enhance material performance, scale up production capacities, and develop next-generation sustainable biocomposite solutions.

- Startup Ecosystem:The startup ecosystem is maturing, with innovation focused on cost-effective production, novel formulations, and AI-driven material design. Emerging firms are attracting significant funding by offering scalable, high-performance, and sustainable alternatives to traditional petrochemical processes.

Biopolymers Market Growth Factors

- Polymers and plastics are by and large utilized in covering and packaging applications. Around 80% of polymeric materials are created from the petrol business while handling non-renewable energy sources.

- The expanding utilization of plastics is troubling the climate with its rising carbon impression because of ozone-depleting substance discharges, alongside different factors, for example, soil and groundwater contamination.

- Hence emerging a requirement for climate cordial other options. The developing concentration towards practical improvement is supposed to set out freedom for bio-based plastics and polymers before very long. Biopolymers are polymers that are degradable when exposed to dampness and intensity, under the activity of miniature creatures.

- Increasing cases of land pollution.

- Increasing prevalence of chronic diseases due to its consumption by mistake.

- The rising demand for eco-friendly products among customers worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.43 Billion |

| Market Size in 2026 | USD 23.66 Billion |

| Market Size by 2034 | USD 52.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 10.43% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

- Shift in purchaser inclination toward eco-accommodating plastic items- Purchaser awareness in regards to sustainable plastic arrangements and unavoidable endeavors to dispense with the utilization of non-biodegradable regular plastics are adding to the market development of bioplastics. Conventional plastics, which are for the most part oil based, require a very long time to separate or corrupt and lay in the landfills for a significant stretch. Biodegradable plastics separate quicker when they are disposed of and are retained once more into the normal framework. Likewise, the pace of decay of biodegradable plastics by the exercises of microorganisms is a lot quicker than that of customary plastics.

- Biodegradable plastics separate 60% and more in the span of 180 days or less as contrasted and conventional plastics, which require about 1,000 years to separate. Expanding landfills and waste heaps have arisen as serious ecological risks and brought about various unfavorable consequences for the verdure of the biological system.

- The developing shopper awareness with respect to these unfriendly impacts (emerging from the utilization of conventional plastics) is empowering the utilization of biodegradable plastics. Besides, the utilization of regular polymers might represent a danger to human wellbeing and security because of their poisonous substance. For instance, PVC might cause hereditary issues, ulcers, deafness, and vision disappointment. The table underneath records the dangers related with the utilization of traditional polymers/plastics. Such high dangers increment the interest for items that are alright for human wellbeing. Subsequently, expanding shopper awareness, alongside administrative regulation, is driving the utilization of bio-based items like biodegradable plastics and bio-based plastics.

Challenges

- Higher costs of bioplastics than traditional plastic- The greater expense of bioplastics than that of customary polymers controls the development of the market in numerous application fragments. By and large, the expense of creation of bio-based polymers is 20% to 100 percent higher than that of traditional polymers. This is principally because of the great polymerization cost of bio-based polymers as the vast majority of the cycles are still in the formative stage and thus have not accomplished economies of scale. For instance, PHAs, which have various applications in fasteners, manufactured papers, clinical gadgets, electronic parts, food packaging, and agribusiness, have high creation costs, low yields, and restricted accessibility. PLAs, which have a much lower cost of creation contrasted with PHAs, are even more costly than oil based PE and PP. By and large, the bio-based materials are currently at the improvement stage and have not been marketed to similar level as their petrochemical partners, which have been growing quickly for over 50 years.

- As of now, the expense of biodegradable plastics differs from USD 2/kg to USD 6/kg as contrasted and that of customary plastics, which is around, USD 1/kg to USD 2/kg. Higher R&D and creation costs because of limited scope creation and the huge cost contrast in contrast with customary oil based plastics are the key variables, which add to the low entrance of bioplastics in different ventures.

Opportunities

High possible in arising nations of APAC- The bioplastics and biopolymers market players are persistently executing natural and inorganic methodologies for their development. Lately, the players have made numerous essential advancements in the arising nations of APAC. For example, in 2019, Total Corbion set up a PLA Plant in Rayong, Thailand, with a creation limit of 75,000 tons each year. Moreover, Indonesia is investigating bioplastic choices, like kelp. Evoware, a neighborhood player, gives licensed ocean growth based packaging. The organization is delivering compartments produced using ocean growth. The guidelines connected with the climate are supposed to expand, which would ultimately push the interest for bioplastics in these nations later on. Also, Southeast Asia is rich in bio-based feedstock expected to deliver bioplastic as it has nearby admittance to sustainable natural substances. Consequently, guidelines, combined with the simple accessibility of feedstock, will, thusly, assist with supporting the interest for bioplastics during the estimate time frame.

Type Insights

Focal point of states on green acquirement arrangements and guidelines to expand the interest for bioplastics and biopolymers.

The developing need to decrease the reliance on regular petroleum derivatives is impelling the interest for bio-based items. This is likewise upheld by the new strategies and guidelines carried out and took on by the public authority bodies around the world. These guidelines incorporate prohibiting or executing extra additional charges on the utilization of regular plastics in applications, like shopping sacks, packaging materials, and disposables. These rising guidelines and denials against plastic packs and other plastic things are driving the market for bioplastics, particularly biodegradable plastics, around the world.

End User Insights

The packaging is projected to represent the biggest portion of the bioplastics and biopolymers market, by end-use industry, during the estimate time frame.

Packaging is the biggest end-use industry for the utilization of bioplastics and biopolymers. They represented the portion of 62%, in 2024, for the worldwide bioplastics and biopolymers market. Expanding ecological guidelines and changes in the way of life of buyers have expanded the interest for bioplastics and biopolymers in the packaging business. Plastics have high strength and impermeability to water, which has supported their utilization in packaging. Packaging utilizations of bioplastics and biopolymers incorporate food packaging, medical services packaging, corrective and individual consideration packaging, shopping sacks, and others.

The packaging business utilizes bioplastics and biopolymers. Therefore, bio-based unrefined components like starch and vegetable waste yield side-effects, are being utilized to agree with rigid government natural guidelines. Thus, item quality is lower in this industry than in customary plastic item producing enterprises.

Food and refreshment packaging, drug packaging, and convey sacks are conceivable packaging portions for bioplastics and biopolymers. Organizations in the PLA business utilize recyclable items, which help to drive the market. The interest for PLA-based polymers is being driven by the developing interest for harmless to the ecosystem packaging produced using bio-based polymers.

Regional Analysis

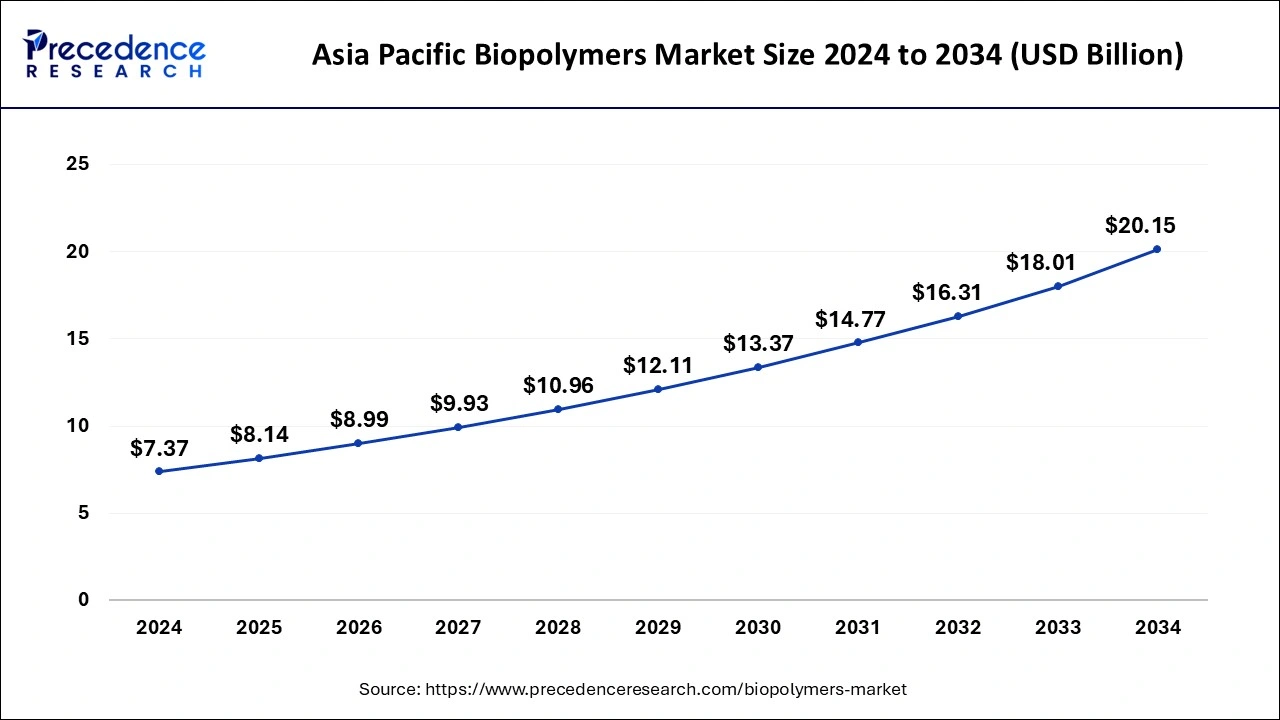

Asia Pacific Biopolymers Market Size and Growth 2025 to 2034

The Asia Pacific biopolymers market size is evaluated at USD 8.14 billion in 2024 and is predicted to be worth around USD 20.15 billion by 2034, rising at a CAGR of 10.58% from 2025 to 2034.

Asia Pacific dominated the biopolymers market in 2024 by capturing the largest share. Increased environmental concerns and heightened demand for sustainable materials are major factors contributed to region's dominance. Governments in Asian countries have also imposed stringent regulations to reduce plastic packaging waste and promote the use of bioplastic. In addition, the rapid expansion of the packaging industry and the increased demand for biopolymers in various industries bolstered the growth of the market in the region.

India Biopolymers Market Trends

India holds a unique position in the global biocomposites market, emerging as both a major domestic consumer and a cost-effective manufacturing hub. The country leverages abundant agricultural resources to produce sustainable feedstocks, supported by rising environmental awareness and government initiatives such as plastic bans. Significant domestic production of bioplastics like PLA is fostering a circular economy, positioning India to become a leading global player and exporter of sustainable materials.

The market in Europe is anticipated to expand at the fastest growth during the forecast period. This is mainly due to the rising usage of bio-based products, including bioplastics. There is a strong focus on sustainability in European countries. The European Union has imposed stringent regulations on plastic use, encouraging industries to adopt bioplastics. Moreover, rising awareness of environmental sustainability is boosting the adoption of bio-based products, contributing to regional market growth.

What Makes Europe the Fastest-Growing Region in the Biopolymers Market?

Germany Biopolymers Market Trends

Germany maintains a leading position in the European biopolymers market, serving as a key hub for R&D and production of advanced bio-based materials. The country's strong engineering expertise, combined with a high concentration of chemical and manufacturing companies like BASF and Covestro, drives innovation in biopolymers. This robust industrial ecosystem supports the widespread adoption of sustainable packaging solutions and other bio-based industrial applications.

How is the Opportunistic Rise of North America in the Biopolymers Market?

North America is witnessing significant growth in the biopolymers market, fueled by strong sustainability initiatives and high consumer awareness. The U.S. serves as a central hub for R&D, attracting substantial investment from both established companies and startups to develop advanced bio-based materials. Key global players, such as NatureWorks LLC and DuPont, have a strong presence in the region, driving innovation, expanding production capacities, and promoting adoption across multiple industries.

U.S. Biopolymers Market Trends

The U.S. dominates the North American biopolymers market, driven by robust R&D efforts and the presence of key players like NatureWorks LLC and DuPont. Federal and state initiatives, including the USDA BioPreferred Program and various plastic bans, are boosting demand for sustainable alternatives, solidifying the country's leadership in advancing bio-based materials.

What potentiates the Growth of the Latin American Biopolymers Market?

The market in Latin America is driven by growing environmental awareness, strict plastic waste regulations, and ample agricultural resources that supply feedstocks for bioplastic manufacturing. Although the region currently holds a smaller share of the global market, countries like Brazil, Mexico, and Argentina are emerging as important players. The main focus is on using biopolymers for both flexible and rigid packaging applications, taking advantage of the trend toward sustainable consumer products.

Brazil Biopolymers Market Trends

Brazil is the powerhouse of the Latin American biopolymers market, mainly because of its large and efficient sugarcane industry, which is a key raw material for bioethanol and bioplastics like Green Polyethylene. The country hosts major producers such as Braskem, which pioneered large-scale production of renewable plastics. The market is driven by national sustainability goals, rising corporate social responsibility among local companies, and increasing domestic demand for eco-friendly packaging solutions.

What Factors Contribute to the Growth of the Biopolymers Market in the MEA?

The MEA biopolymers market is growing steadily, fueled by the urgent need to combat plastic pollution, government initiatives encouraging sustainable practices, and the development of the region's petrochemical industry, which is exploring value-added bio-based chemicals. The UAE, Saudi Arabia, and South Africa are at the forefront, implementing bans on single-use plastics and promoting the use of compostable and biodegradable materials by emphasizing environmental tourism and global sustainability.

Saudi Arabia Biopolymers Market

Saudi Arabia plays a unique role in the market by using its expertise in petrochemical production to explore integrating bio-based feedstocks and technologies. Inspired by national environmental initiatives and an increasing focus on waste management, more biopolymers are being adopted in the packaging and agricultural sectors, helping the country transition toward a circular carbon economy while fulfilling global sustainability standards.

Value Chain Analysis

- Biomass Feedstock Supply & Processing

This stage involves sourcing renewable materials, such as corn and sugarcane, and processing them into starches and sugars.

Key Players: Cargill, Tate & Lyle, Corbion, and ADM. - Research and Development (R&D) & Polymerization

This focuses on developing new, high-performance biopolymers using methods like fermentation and chemical synthesis.

Key Players: TotalEnergies Corbion, BASF, DuPont, Novamont, Mitsubishi Chemical Corporation, Danimer Scientific. - Manufacturing and Production

Involves the large-scale production of biopolymer resins (pellets) with strong quality and sustainability controls.

Key Players: NatureWorks LLC, TotalEnergies Corbion, BASF, Novamont, Danimer Scientific. - Distribution and Supply Chain Management

This manages the delivery of biopolymer resins to processors and manufacturers globally.

Key Players: Univar Solutions, Brenntag, IMCD - Compounding, Processing, and Fabrication

Biopolymer resins are blended with additives and processed using standard plastic manufacturing techniques to create various products.

Key Players: RTP Company, PolyOne. - End-of-Life Management

This addresses sustainable disposal through industrial composting or recycling.

Key Players: Waste Management and Republic Services, Veolia, Suez.

Biopolymers Market Companies

- NatureWorks (US): Produces polylactic acid (PLA) biopolymers for packaging, fibers, and consumer goods, leading innovation in sustainable materials.

- Braskem (Brazil):Manufactures bio-based polyethylene from sugarcane, focusing on renewable and eco-friendly plastic alternatives.

- BASF (Germany): Develops advanced biopolymers and bio-based chemicals for packaging, automotive, and industrial applications.

- Total Corbion (Netherlands):Specializes in PLA production and biodegradable solutions for packaging, agriculture, and consumer products.

- Novamont (Italy): Produces biodegradable and compostable bioplastics for packaging, agriculture, and industrial uses.

- Biome Bioplastics (UK):Develops plant-based and biodegradable polymers for packaging, consumer products, and medical applications.

Mitsubishi Chemical Holding Corporation (Japan): Offers bio-based polymers and materials for packaging, electronics, and industrial sectors. - Biotec (Germany): Manufactures PLA-based biodegradable plastics for packaging and disposable consumer products.

- Toray Industries (Japan):Produces bio-based polymers and fibers, supporting sustainable solutions in textiles, automotive, and industrial applications.

- Plantic Technologies (Australia): Develops biodegradable films and coatings for packaging and specialty applications using renewable resources.

Recent Developments

- In December 2024, the French company SNF plus a major European supplier of chemical-enhanced oil recovery solutions was recently authorized to implement a polymer production project in Oman, eight months after announcing an expansion budget of $250 million. Oman is becoming a prominent country in the Middle East polymer market.

- In June 2024, S D Polymers Pvt. Ltd. became the first polymer compounding company in India to receive BIS certification for its PP polymer product. This will not only establish the highest standards of quality and adherence to the regulations required in India, but it will also add another feather to its cap, marking it as an industry leader.

- In April 2024, Stratasys entered into an exclusive partnership with Select Additive Technologies for polymer 3D printing. Select Additive Technologies is a division of Morris Group, Inc., one of the largest importers in the USA. Therefore, this will open avenues for Stratasys into one of the most popular machine tool distributors in the USA market.

Segments Covered in the Report

By Type

- Biodegradable

- PLA

- Starch Blends

- PHA

- PBS

- Others

- PCL

- PBAT

- Non-Biodegradable/Biobased

- BIO-PET

- BIO-PABIO-PE

- BIO-PTT

- Others

- BIO-PP

- BIO-PEF

By Application

- Films

- Bottles

- Fibers

- Seed Coating

- Vehicle Components

- Medical Implants

- Others

By End User

- Packaging

- Rigid Packaging

- Flexible Packaging

- Consumer Goods

- Electrical Appliances

- Domestic Appliances

- Others

- Automotive & Transportation

- Interior

- Exterior

- Under Hood

- Textiles

- Medical & Healthcare Textile

- Personal care, clothes and other textiles

- Agriculture & Horticulture

- Tapes & Mulch Films

- Others

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting