What is Bricks Market Size?

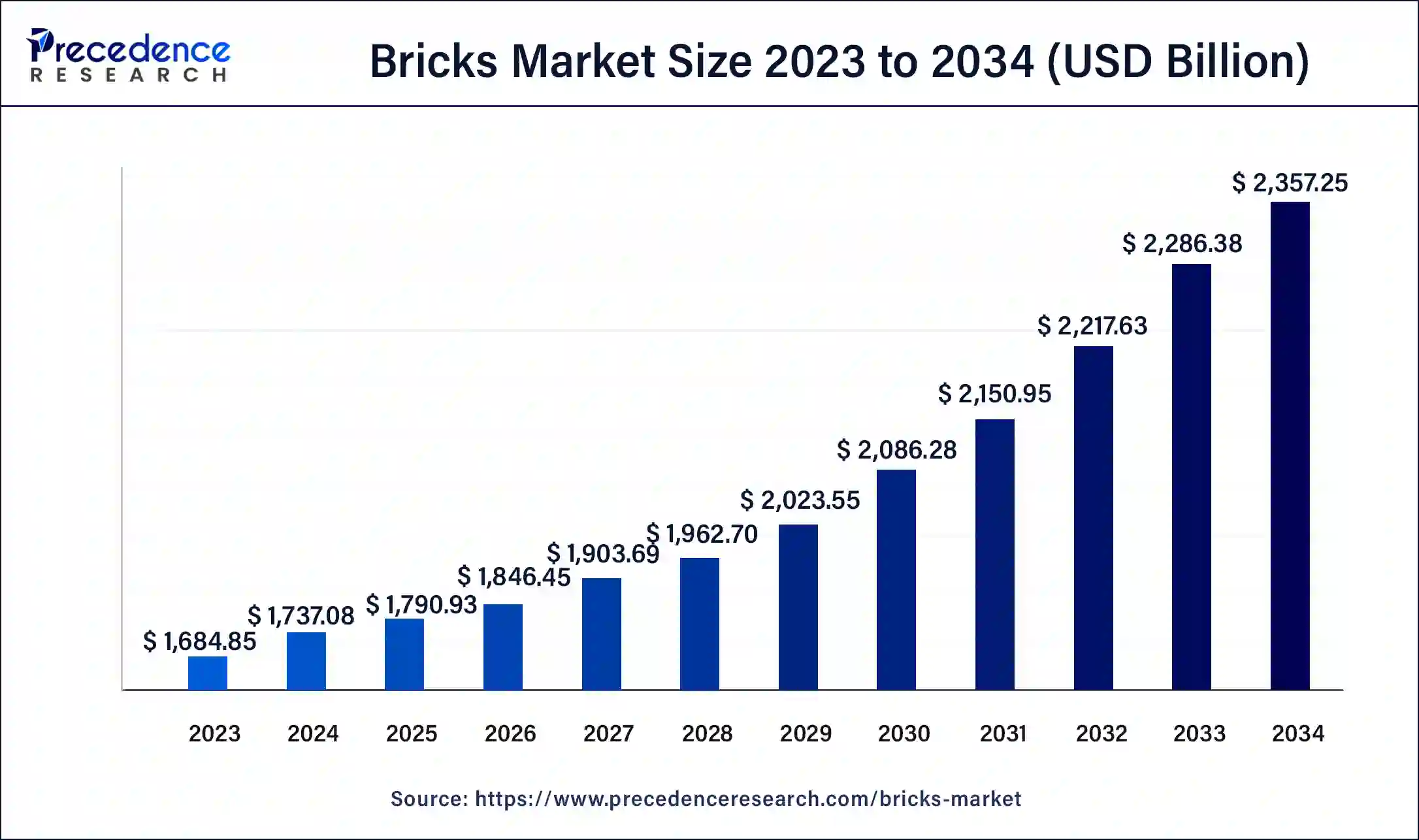

The global bricks market size accounted at USD 1.79 trillion in 2025 and is expected to be worth around USD 2.36 trillion by 2034, at a CAGR of 3.09% from 2025 to 2034.

Market Highlights

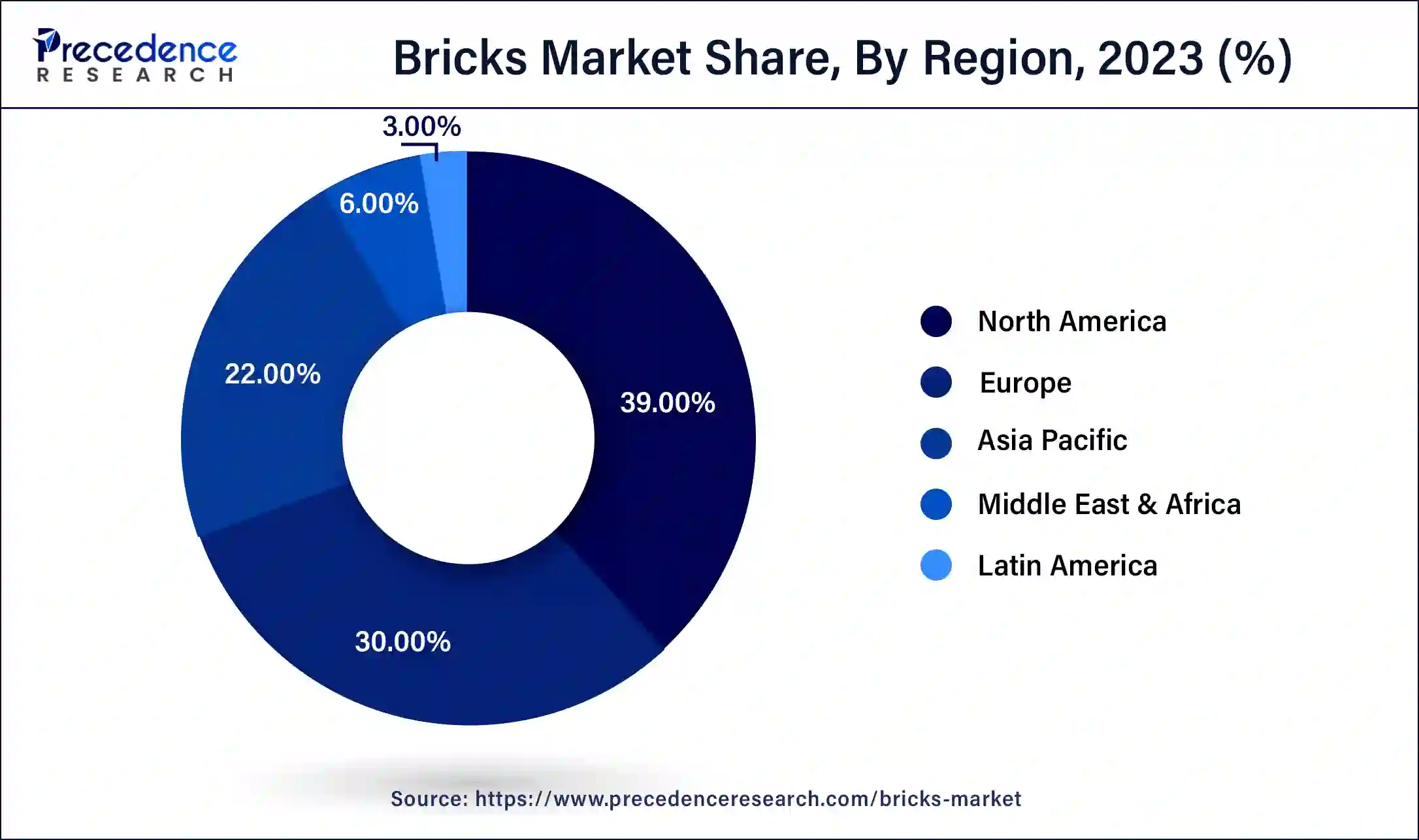

- North America contributed more than 39% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By brick type, the clay bricks segment held the largest market share of 41% in 2024.

- By brick type, the concrete segment is anticipated to grow at a remarkable CAGR of 4.1% between 2025 and 2034.

- By size, the standard segment generated over 48% of revenue share in 2024.

- By size, the modular segment is expected to expand at the fastest CAGR over the projected period.

- By application, the residential segment generated over 32% of revenue share in 2024.

- By application, the infrastructure segment is expected to expand at the fastest CAGR over the projected period.

Bricks Market Overview: Understanding Solid Foundation

Bricks are rectangular building materials typically made of clay, shale, or concrete, which are widely used in construction for centuries. These versatile units serve as the fundamental building blocks for structures ranging from simple walls to elaborate architectural designs. The production process involves molding the raw materials, followed by drying and firing in kilns to achieve durability and strength. Bricks come in various types, including common bricks for general use, firebricks for high-temperature applications, and specialized bricks with specific characteristics. Their modular size and uniformity facilitate easy assembly, making them a preferred choice for constructing load-bearing walls, facades, and pavements.

Beyond their structural utility, bricks also contribute to aesthetic appeal, with different colors, textures, and finishes available. Modern construction techniques incorporate innovative materials, such as interlocking bricks or those made from recycled materials, to enhance sustainability. Despite advancements in construction technology, traditional bricks continue to play a crucial role in the global building industry, symbolizing resilience and endurance in architectural heritage.

Bricks Market Data and Statistics

- The International Energy Agency (IEA) envisions the global building construction sector surpassing the USD 6.3 trillion milestone in 2021, marking a 5% ascent from the previous year.

- The Institution of Civil Engineers underscores the potential contributions of China, India, and the United States, forecasting that these nations will collectively propel almost 60% of the sector's worldwide expansion by 2025.

- As per the U.S. International Trade Administration, China, recognized as the globe's largest construction market, is projected to witness an average annual growth rate of 8.6% between 2022 and 2030.

- In 2021, the United States, a pivotal player in the global construction landscape, solidified its standing among the foremost markets. Data from the United States Census Bureau discloses that construction endeavors tallied USD 1.589 trillion, comprising approximately 4.3% of the nation's overall GDP.

- In Indonesia, Statistics Indonesia (BPS) reports that the GDP of the construction sector in 2021 amounted to IDR 1,771.73 trillion (~USD 0.177 trillion).

- Looking ahead, the Indonesian construction market, as per World Cement, is poised for a real-term growth of 7.2% in 2022, underlining the sector's resilience and potential economic influence.

Bricks Market Growth Factors

- The growth of the bricks market is intricately tied to the overall expansion of the construction industry. Increasing construction activities, driven by infrastructure development, residential, and commercial projects, contribute significantly to the demand for bricks.

- Growing awareness and emphasis on sustainable and eco-friendly construction practices drive the demand for bricks with enhanced energy efficiency and reduced environmental impact. This includes the adoption of alternative brick materials and manufacturing processes that align with green building standards.

- Technological advancements in brick manufacturing, such as the development of high-performance and specialized bricks, contribute to market growth. Innovations in design, durability, and insulation properties enhance the appeal of bricks in modern construction.

- Government policies and initiatives promoting affordable housing, infrastructure development, and sustainable construction can significantly influence the demand for bricks. Incentives or regulations that favor the use of certain types of bricks may impact market dynamics.

- Overall economic growth, including GDP expansion and rising disposable incomes, tends to correlate with increased construction activities. As economies grow, there is often a surge in residential and commercial construction projects, driving the demand for bricks in various applications.

Bricks Market Outlook: The Future Trends

- Industry Growth Overview: Rapid urbanization, growing demand for sustainable and energy-efficient building materials, and government-led infrastructure projects are driving the industry growth.

- Major Investors:Large institutional investment firms, diversified public companies, and family-owned investment houses are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on automation, sustainability, and technological integration to develop eco-friendly building materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.79 Trillion |

| Market Size in 2026 | USD 1.85 Trillion |

| Market Size by 2034 | USD 2.36 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 3.09% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Brick Type, By Size, and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Urbanization trends

- According to the United Nations, over 55% of the world's population resided in urban areas in 2021, with estimates suggesting an increase to 68% by 2050.

Urbanization trends significantly drive market demand for bricks as the global population increasingly gravitates towards urban areas. With over half the world residing in cities, urbanization fuels a surge in construction projects, emphasizing the need for durable and versatile building materials like bricks. As cities expand, there is a growing requirement for residential and commercial infrastructure, resulting in a consistent demand for bricks in housing developments, office complexes, and other urban structures.

Moreover, the trend towards vertical urbanization, seen in the construction of high-rise buildings, further amplifies the reliance on bricks as a fundamental construction material. Bricks provide structural integrity, fire resistance, and insulation essential qualities in dense urban environments. The ongoing urbanization trajectory is, therefore, a pivotal factor propelling sustained growth in the bricks market, aligning with the dynamic needs of modern urban development.

Restraint

Lack of innovation

The bricks market faces a significant restraint in the form of a lack of innovation in manufacturing techniques and designs. Traditional brick production methods have seen limited advancements, potentially hindering the market's ability to meet evolving demands in the construction industry. The absence of innovative approaches in material composition, energy efficiency, and sustainable practices may make bricks less attractive to architects, builders, and developers seeking modern, eco-friendly solutions.

In an era where construction trends are shifting towards green building practices and cutting-edge design aesthetics, the lack of innovation in the bricks market poses a challenge. Failure to incorporate technological advancements and adapt to changing architectural preferences may result in a diminished market share as alternative materials that offer greater versatility, sustainability, and energy efficiency gain prominence in the construction sector.

Opportunity

Architectural innovation

Architectural innovation is creating significant opportunities in the bricks market by redefining traditional construction practices. Collaborations between architects and brick manufacturers have led to the development of innovative designs that go beyond conventional rectangular shapes. Bricks are now available in unique forms, sizes, and textures, allowing architects to explore creative possibilities in modern construction.

Moreover, the demand for sustainable and energy-efficient building materials has prompted architectural innovation in brick manufacturing. Eco-friendly bricks, incorporating recycled materials or utilizing low-carbon production processes, align with green building initiatives. These advancements not only cater to evolving architectural preferences but also position bricks as a versatile and environmentally conscious choice in contemporary construction, making way for market expansion and capturing the attention of architects, builders, and environmentally conscious consumers alike.

Segment Insights

Brick Type Insights

The clay bricks segment had the highest market share of 41% in 2024. Clay bricks, a fundamental category in the bricks market, are crafted from natural clay, typically through the firing process. These bricks are renowned for their durability, thermal insulation properties, and traditional aesthetic appeal, making them a staple in construction. The clay bricks segment is witnessing a resurgence in demand due to sustainable practices. Manufacturers are exploring energy-efficient kiln technologies and incorporating recycled content, aligning with the industry's green initiatives. This trend reflects a growing preference for eco-friendly materials in the construction sector.

The concrete segment is anticipated to expand at a significant CAGR of 4.1% during the projected period. In the bricks market, the concrete segment refers to bricks manufactured from cement, aggregates, and water. Concrete bricks offer durability, strength, and a versatile aesthetic. A prominent trend in the concrete brick segment is the increasing preference for precast concrete bricks, which are manufactured off-site and transported for construction. This trend aligns with the growing demand for efficient and sustainable construction practices, as precast concrete bricks reduce on-site labor requirements and enhance construction speed, making them a popular choice in the contemporary building industry.

Size Insights

The standard segment held a 48% market share in2024. In the bricks market, the standard segment pertains to widely adopted sizes conforming to industry standards. Common sizes include modular (7 5/8 x 3 5/8 x 2 1/4 inches), queen (7 5/8 x 2 3/4 x 2 3/4 inches), and king (9 x 2 5/8 x 2 3/4 inches). A prevailing trend favors modular bricks for their user-friendly dimensions, reflecting contemporary construction preferences that prioritize efficiency and standardized sizing in the industry.

The modular segment is anticipated to witness rapid growth over the projected period. In the bricks market, the modular segment refers to bricks that adhere to standardized dimensions, facilitating easy and precise construction. This segment is characterized by uniformity in size, allowing for efficient assembly and reducing construction time. A notable trend in the modular bricks market is the increasing preference for these standardized units, driven by their versatility in various construction applications. The modular segment's growth is attributed to its convenience, cost-effectiveness, and compatibility with contemporary construction methods, reflecting a shift towards streamlined and efficient building practices.

Application Insights

According to the application, the residential building segment held a 32% revenue share in2024. The residential building segment in the bricks market refers to the use of bricks in the construction of houses and residential complexes. A notable trend in this segment is the growing preference for bricks in sustainable and energy-efficient housing projects. Architects and builders are increasingly incorporating innovative brick designs and eco-friendly materials to meet the demand for aesthetically pleasing yet environmentally conscious residential structures. This trend aligns with the global emphasis on green building practices, positioning bricks as a key material for sustainable residential construction.

The infrastructure segment is anticipated to expand fastest over the projected period. In the bricks market, the infrastructure segment refers to the application of bricks in large-scale construction projects, including roads, bridges, and public utilities. A prevailing trend in this segment involves the increasing preference for durable and cost-effective materials, positioning bricks as a fundamental choice for infrastructure development. The robust nature of bricks makes them well-suited for heavy-duty applications, contributing to the resilience and longevity of infrastructure projects globally. This trend is particularly notable as governments invest in extensive infrastructure initiatives to support economic growth and urban development.

Regional Insights

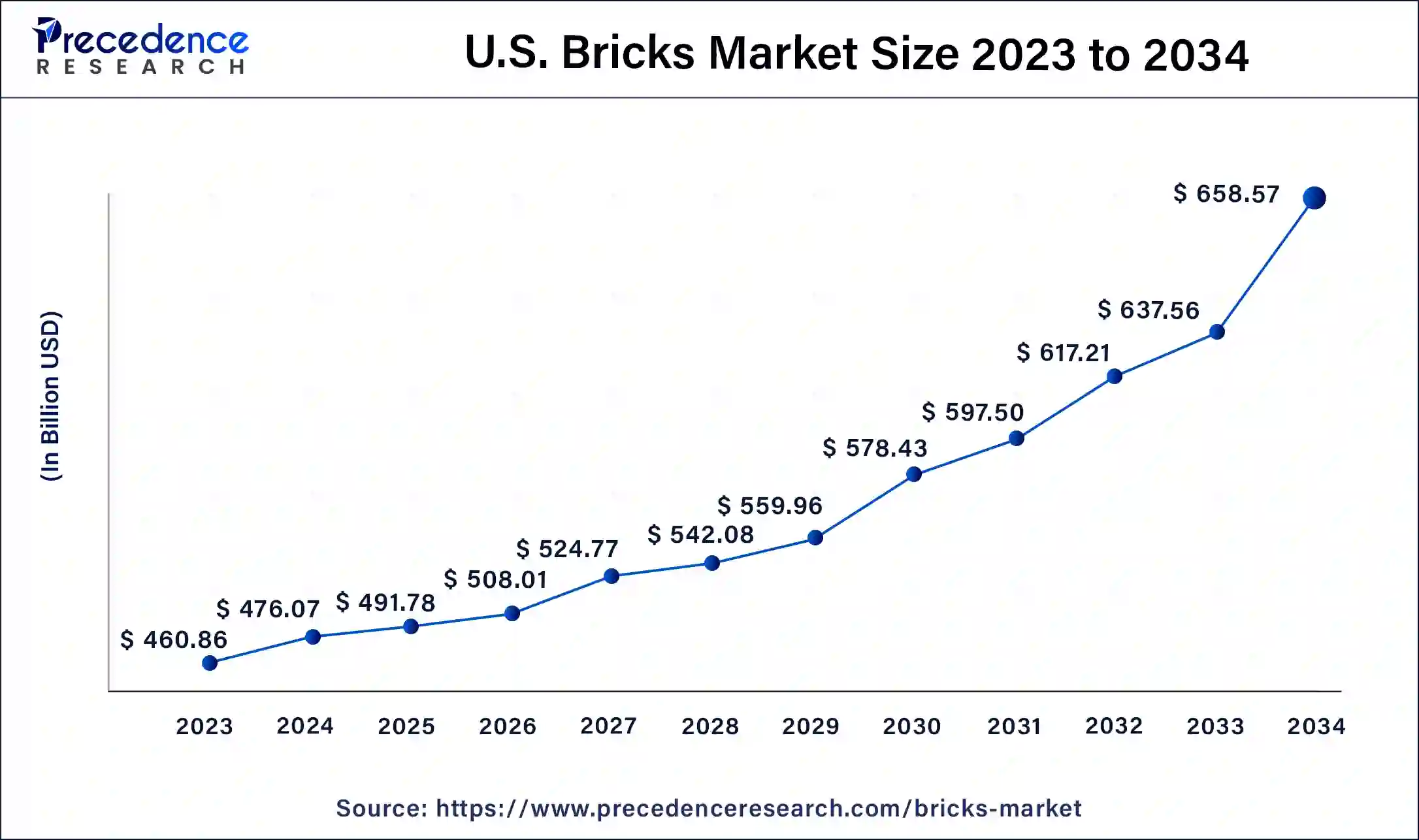

U.S. Bricks Market Size and Growth 2025 to 2034

The U.S. bricks market size is estimated at USD 491.78 billion in 2025 and is predicted to be worth around USD 658.57 billion by 2034, at a CAGR of 3.30% from 2025 to 2034.

Mature Construction Sector Boosts North America

North America holds a major share of 39% in the bricks market due to a mature construction sector and a strong emphasis on sustainable building practices. The region's well-established infrastructure and a growing trend towards eco-friendly construction contribute to the steady demand for bricks. Additionally, stringent building codes and regulations promoting energy-efficient materials further drive the adoption of bricks. With a focus on durability and resilience, North America continues to be a significant market for bricks, particularly in residential and commercial construction projects.

Large Construction Sector Uplift U.S.

The U.S. consists of a large construction sector, which is increasing the use of bricks in the development of buildings and infrastructure. This is driving the development of modern brick manufacturing plants to develop high-quality clay facilities. They are also focusing on the development of eco-friendly bricks.

Asia Pacific Driven by Rapid Urbanization

Asia-Pacific is poised for rapid growth in the bricks market due to burgeoning urbanization, extensive infrastructure projects, and increased construction activities. The region's robust economic development has led to a surge in demand for affordable housing and commercial spaces, driving the need for construction materials like bricks. Moreover, supportive government initiatives, coupled with a rising population, contribute to sustained growth. The construction boom in countries such as China and India further solidifies Asia-Pacific as a key market for bricks, with the potential for continued expansion in the future.

- As per Invest India and IBEF, the construction Industry in India is expected to become the 3rd largest construction market globally and to reach USD 1.4 trillion by 2025. Moreover, Real Estate Industry in India is expected to reach USD 1 trillion by 2030 and will contribute to India's GDP.

- According to the Ministry of Finance of Japan, the construction industry in Japan generated sales of approximately JPY 136.7 trillion (~USD 1.22 trillion) in the fiscal year 2021 registering an increase of 2.1 % as compared to the FY 2020.

Growing Construction Activities Drive Europe

Meanwhile, Europe is experiencing notable growth in the bricks market due to a resurgence in construction activities, driven by urban development projects and infrastructure investments. The region's focus on sustainable and energy-efficient construction aligns with the eco-friendly attributes of modern bricks. Additionally, stringent building regulations promoting durability and thermal insulation contribute to increased brick usage. As European countries prioritize environmentally conscious building practices, the demand for bricks, with their versatility and green building potential, continues to grow, reflecting the region's upward trajectory in the market.

Rapid Urbanization Fuels India

India is experiencing rapid urbanization, which is increasing the demand for various purposes. The growing population is also driving the utilization of housing schemes, which is increasing their adoption rates. The industries are therefore developing sustainable and modern bricks, which are supported by government initiatives.

Growing Housing Initiatives Propel UK

The growing housing initiatives are increasing the use of bricks in the UK. The expanding construction sector is also driving the demand. Thus, these advancements and new investments are promoting the development of modern bricks with enhanced quality and sustainability.

Expanding Infrastructure Transforming MEA

MEA is expected to grow significantly in the bricks market during the forecast period, due to expanding infrastructure. The presence of advanced raw materials is also driving their development, where government schemes are increasing their use in the development of smart cities. The expanding industries are also driving their demand, promoting the market growth.

GCC Bricks Market Braces for Exponential Growth

Robust construction initiatives across the GCC region, driven by Vision 2030 and infrastructure demands, are significantly fueling the expansion of the bricks market. This growth is supported by sustainable building material trends and innovative manufacturing processes, leading to substantial market value appreciation and increased investment opportunities.

Bricks Market Value Chain Analysis: Uncovering the Opportunities

- Feedstock Procurement

The feedstock procurement of bricks involves the sourcing of raw materials, additives, and industrial waste products from industrial suppliers.

Key players: Wienerberger AG, Honeywell. - Quality Testing and Certification

Quality testing and certification of bricks includes the standardized laboratory assessments and dimensional tolerances.

Key players: Wienerberger AG, Boral Limited. - Regulatory Compliance and Safety Monitoring

Adherence to building codes and materials standards, ensuring their safety and performance, is involved in the regulatory compliance and safety monitoring of bricks.

Key players: Wienerberger AG, Boral Limited.

Key Players in Bricks Market and their Offerings

- Wienerberger AG: The company provides Porotherm, Terca, Argex, and Pura.

- Boral Limited: The company provides clay bricks, pavers, concrete blocks, and retaining walls.

- CRH plc: Common bricks, architectural facing bricks, patver, etc, are provided by the company.

- Ibstock plc: The company provides wirecut, handmade, soft mud, and specially shaped bricks.

- Acme Brick Company: Clay bricks, concrete blocks, etc, are provided by the company.

Recent Developments

- In December 2022, Siam Cement BigBloc Construction Technologies, a joint venture between BigBloc Construction Limited and SCG INTERNATIONAL INDIA PVT LTD, successfully secured land in Gujarat, India. The purpose of this acquisition is to establish a factory dedicated to the production of AAC (Autoclaved Aerated Concrete) Blocks and Panels. The anticipated annual production capacity of 300,000 cubic meters is scheduled to commence operations in 2023, reflecting the company's strategic expansion plans in the Indian market.

- In October 2021, Wienerberger completed a significant acquisition by taking over Meridian Brick in North America, encompassing operations in the United States and Canada. Meridian Brick, a prominent brick manufacturer, produces over 1.1 billion bricks annually, establishing itself as a leading supplier in regions including Texas, the southeastern USA, Ontario, and Canada. This strategic move enhances Wienerberger's presence and market share in the North American construction materials industry.

Segments Covered in the Report

By Brick Type

- Clay

- Concrete

- Calcium Silicate

- Fly Ash

- Stone

By Size

- Standard

- Modular

- Jumbo

By Application

- Residential Building

- Commercial Building

- Infrastructure

- Path

- Parterre

- Landscaping

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content