Construction Materials Market Size and Forecast 2025 to 2034

The global construction materials market size was estimated at USD 1.37 trillion in 2024, and is projected to worth USD 1.42 trillion by 2025, and is anticipated to reach around USD 2.01 trillion by 2034, expanding at a CAGR of 3.90% from 2025 to 2034.

Construction Materials Market Key Takeaways

- In terms of revenue, the market is valued at $1.42 billion in 2025.

- It is projected to reach $2.01 billion by 2034.

- The market is expected to grow at a CAGR of 3.90% from 2025 to 2034.

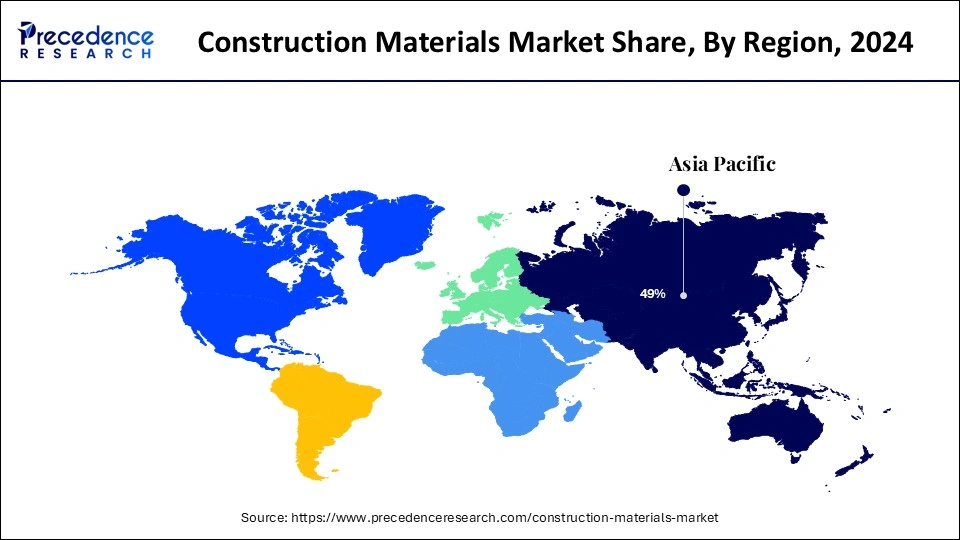

- North America region generated the maximum revenue share in 2024.

- By application, the residential segment contributed the largest revenue share in 2024.

- By type, the construction aggregates segment is predicted to hold a remarkable market share from 2025 to 2034.

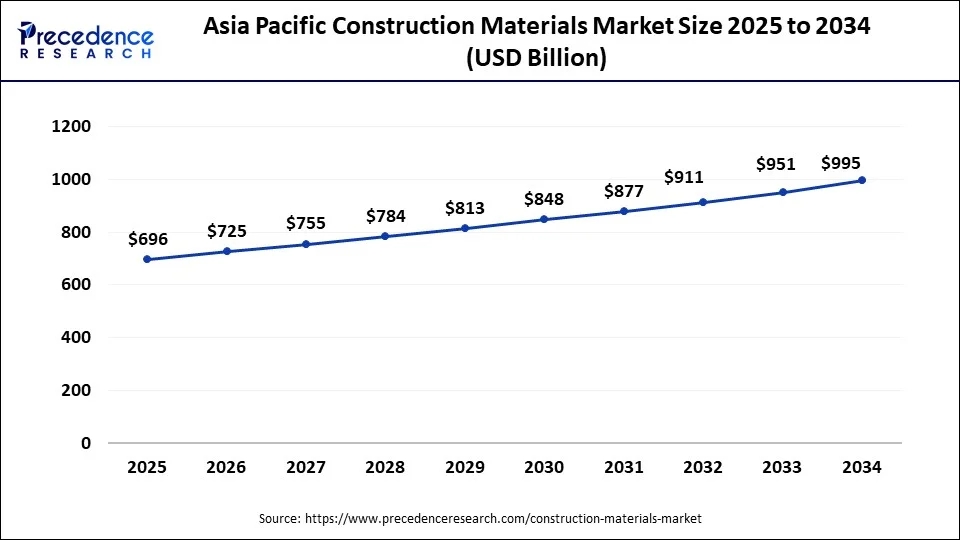

Asia Pacific construction materials Market Size and Growth 2025 to 2034

The Asia Pacific construction materials market size is estimated at USD 696 billion in 2025 and is expected to be worth around USD 994.95 billion by 2034, rising at a CAGR of 3.99% from 2025 to 2034.

In 2024, North America held the largest revenue share in the construction material market.North America is the most developed continent owing to the presence of nations with favorable economic policies, high gross domestic product (GDP), early adoption of advanced infrastructures, and an ecosystem of well-established construction industry.

The immigrant population is rising notably in Canada since past few years. Canada's population is rising at almost double the pace of each G7 country. Approximately 4/5th of the 1.8 million population rise from 2016 to 2021 was attributable to the new arrivals in Canada, either as temporary or permanent immigrants. While the pandemic of COVID-19 slowed the movement of people across the world, nearly 185,000 permanent immigrants arrived in Canada in the financial year 2020. Thus, the rising population in Canada is creating immense scope for the residential real estate market.

The Asia Pacific (APAC) is projected to be a lucrative region for the construction material market over the forecast period. The residential construction sector growth in the APAC region is supported by the government's initiatives that promote housing for all, rising income levels, and people's inclination towards personal housing. Approximately 178,000 new houses are forecasted to be constructed in Australia in the fiscal year 2025.

Due to low literacy, uncertainty, and civil war in African countries, the construction material market in Africa is expected to grow at a comparatively slow rate. The Middle East region is considered to be a fast-growing region with respect to commercial construction. The gulf countries are witnessing various new retail stores, office buildings, factories, and warehouses.

Considering the Kingdom of Saudi Arabia's Vision 2030, the flagship project NEOM is anticipated to create promising opportunities for the construction material market in the Middle East region.

As mentioned by the International Trade Administration (ITA), the United Arab Emirates (UAE) construction sector is predicted to observe a promising recovery in the next 4 years, with construction industry value growing at a significant rate of 3.7-4.7%. The United Arab Emirates is working on the $11 billion Etihad rail project and the $2.7 billion Sheikh Zayed double-deck road project. Such high investment is anticipated to create immense scope for respective construction materials across the UAE.

In March 2022, the government of Egypt announced that it has decided to implement 45 major national and strategic infrastructure projects across the country. As per the Central Bank of Egypt (CBE), the value of the construction industry grew by 8.5% year on year (YoY) in the 4th quarter (Q4) of 2021, preceded by Y-o-Y growth of 10.7% in the 3rd quarter (Q3) and 8.3% in 2nd quarter (Q2) of 2021. Thus, the promising rise in the construction industry in Egypt is anticipated to enhance the requirement for steel, concrete, stone, brick, and wood.

Market Overview

Any substance used in building the infrastructure is referred to as construction material. Buildings have been made with a wide range of naturally existing materials, including pebbles, clay, wood, sand, twigs, and leaves. Major materials involved in the construction industry include bricks, concrete, cement, corrosion additives, timber, ceramics, polymers, steel, recycled materials, glass fibers, rammed earth, bamboo, bituminous materials, and advanced building materials.

The construction material market growth is majorly driven by the increasing use of construction materials in the commercial and residential sectors. In order to meet customer requirements, construction firms are raising their capital investments and focusing more on research & development (R&D) operations and higher-quality products.

Infrastructure projects, growing population, increasing per capita income, loan facilities, and government support are the supporting factors that are expected to boost the construction market growth in the coming years. Countries having tourism opportunities require enhanced infrastructures for tourist accommodation. This is expected to create crucial scope for construction materials required in building hotels, motels, and resorts.

The $20 trillion U.S. economy is relying on a wide network of infrastructure which includes bridges, roads, ports, and freight rail. Considering the Inflation Reduction Act (IRA) and the Infrastructure Investment and Jobs Act (IIJA), the 117th Congress has invested $1.25 trillion for developing the infrastructure in the United States.

Further, government support for housing is creating notable demand for construction materials in many countries. The New South Wales government has introduced the Property Tax (First Home Buyer Choice) Bill 2022. This bill enables the first home buyers to opt to pay an annual property tax, instead of stamp duty, when purchasing their first residential property. In total, the New South Wales (NSW) government authority has predicted that these tax benefits will provide support to around 97% of all first-home buyers, or approximately 57,000 people per year.

Market trends

Growing adoption of smart technologies with sustainable materials offers significant market trends fueling the adoption of construction materials market. To minimize waste, additive manufacturing technologies like 3D printing are beneficial for manufacturers. However, 3D printing cannot fully support automation, skilled laborers need to do crucial manual tasks like insertion of Reber into printed concrete structures.

Increasing urbanization in remote areas with government initiatives is another important factor that positively impacts the construction materials market as it fuels demand for various construction materials on a large scale.

The initiative like smart city integrates infrastructure to offer sustainable and all-inclusive living area with smart core structure with advance technologies is promoting the market on a global scale.

The increased demand for raw materials like cement, steel, bricks and others are essential for building construction. The growing availability of these materials with innovations like eco-friendly materials with high quality further promotes markets growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.52 Trillion |

| Market Size in 2025 | USD 1.42 Trillion |

| Market Size in 2024 | USD 1.38 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 3.90% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

The expansion of airports in the United States is creating significant demand for respective construction materials. In February 2022, John F. Kennedy International Airport was planned to be upgraded with a $1.5 billion modernization and expansion of Terminal 4. This modernization and expansion plan for Terminal 4 consists of the renovation of existing concourses, roadway upgrades; and the addition of 10 new gates which is scheduled to be completed by 2023.

The O'Hare Modernization Program includes the expansion of terminals 3 and 5 and the creation of a new Global Terminal. Around $8.5 billion is expected to be spent on this expansion plan. Thus, rising expenditures on the modernization and expansion of existing airports in the U.S. is creating a high demand for the required construction materials.

In many developing countries in Asia and Africa, the residential and industrial are expanding significantly. As per India Brand Equity Foundation (IBEF), India's real estate industry is predicted to account for US$ 1 trillion in market size by 2030 and is expected to hold 18-20% of India's gross domestic product (GDP). Private market investor, Blackstone has invested significantly in the Indian real estate sector. Blackstone further seeks to invest an additional $22 billion (₹ 1.7 lakh crore) by 2030. Thus, rising investment in the real estate sector creates remarkable demand for construction materials such as sand, metal, bricks, steel, and cement.

The average monthly disposable income of workers' households in Japan in 2021 amounted to approximately ¥ 492,700 ($ 4,621.58). Thus, a high average monthly disposable income of Japanese workers' households increases the home loan installment paying capacity considerably.

The Real Estate Economic Institute had forecasted that 14,000 new flats will enter the Japanese real estate industry in the 23 wards of Tokyo in 2022. In 2021, as per the Kensho calculations, residential real estate witnessed net new investments of worth €10.8 billion ($12.22 billion). Thus, the high income of people and t growing real estate sector drive the construction materials market growth in Japan drastically.

Type Insights

The global construction materials market is segmented into construction aggregates, concrete bricks, cement, construction metals, and others. The Construction Aggregates segment is expected to hold a significant market share during the forecast period. The growth in the segment is attributable to rapid growth in the construction industry in various developing countries of the world.

Aggregates have a wide range of uses in the construction industry. ¬The construction aggregates are most commonly useful in asphalt concrete, portland cement concrete, backfill, railroad ballast, roadway base course, and erosion control. Construction aggregates are a part of¬ bridges, public and private buildings, ¬roads and highways, airports, and seaports.

The top 5 bridge construction projects that began in the United States in the 4th quarter (Q4) of 2021 are Portal Bridge Enhancement ($1,880 million), I-70 Rocheport Bridge & Mineola Climbing Lanes ($240 million), Sherman Minton Bridge Rehabilitation ($137 million), Rumson-Sea Bright Bridge Replacement ($130 million), and Cape Canaveral Spaceport Indian River Bridge Replacement ($126 million). With the construction of such big-budget bridges, the demand for construction aggregates is growing substantially.

Application Insights

The global construction materials market is segmented into the residential sector, industrial sector, and commercial sector. The residential segment had the highest revenue share in 2024, and it is expected that it would continue to dominate the market during the study period as a result of the growing residential real estate sector.

The residential sector in China is expected to grow at a promising rate in the coming years. As of 2022, the urbanization rate in China was 64.7this rate is predicted to reach 75-80% by 2035. In February 2022, banks in almost 90 cities in China cut mortgage rates in order to boost the sales and buying power of the purchaser in the residential property market in the country.

As per the analysts, the turnover in the real estate industry in Germany in 2021 reached a record high of € 337 billion ($381.61 billion). In the coming years, Germany's hotel industry is set to expand with 364 additional properties and 57,926 rooms. Hamburg, the home to Germany's largest seaport, is all set to have 23 new hotels and 5,625 extra rooms in near future. In the capital city of Berlin, 19 hotels are expected to open, which will add up to 4,121 new rooms. The French hotel market is anticipated to have 96 additional properties and 15,485 rooms during the forecast period. Thus, the construction of new hotels is adding significantly to the growth of the commercial sector segment.

Construction Materials Market Companies

- Anhui Conch Cement

- Asahi Glass

- BBMG

- Cemex

- China National Building

- CRH PLC

- Daikin Industries

- Ferguson

- Grasim Industries

- HeidelbergCement AG

- LafargeHolcim

- Masco

- Saint-Gobain

- Sika

Recent Developments

- On 16th May 2025 Forterra made partnership with LKAB minerals aiming to adopt a process that utilizes waste bricks from manufacturing processes to create calcined clay. The material can minimize carbon emission by replacing a part of the cement which further supports a circular approach for construction material. (Source: https://www.edie.net)

- In April 2024, a leading provider of sustainable building solutions-GYPROC from India has introduced its first environmental production declaration with low carbon plaster and marked a revolutionary change in the construction industry. Gyproc is only Indian manufacturers who provide verified gypsum plasters which eco-friendly and engineered in a such way that it minimizes carbon emission. (Source: https://www.msn.com)

- On 23rd April 2025, an event held in Wuhu by conch group, Huawei and the China building materials federation collaboratively showcase their AI model designed for cement building materials sector. It was a profound change that marked in the history of construction sector where AI enters in a dramatic way with innovation.(Source: https://www.huawei.com)

- In April 2022, Adani Road Transport (ARTL) got a Letter of Award (LoA) from the National Highways Authority of India (NHAI) for a road project worth $ 242.71 million (₹ 2,008.47 crores). ARTL is a wholly owned subsidiary of Adani Enterprises and is involved in the business of operation, construction, and maintenance of highways, roads, and expressways.

- The Gas Industry Roads Upgrades in the Northern Territory in Australia will be upgrading priority sections of roads for supporting the development of gas resources around the Beetaloo Sub-basin. Road upgrades particularly will include widening and strengthening. For this project, the Northern Territory Government Contribution allocated $43.4 million and the Australian Government has sanctioned $173.6 million. The construction in this project is scheduled to commence from early 2023 and is expected to be completed by late 2026.

Segments Covered in the Report

By Type

- Construction Aggregates

- Concrete Bricks

- Cement

- Construction Metals

- Others

By Application

- Residential Sector

- Industrial Sector

- Commercial Sector

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting