What is Cannabidiol Market Size?

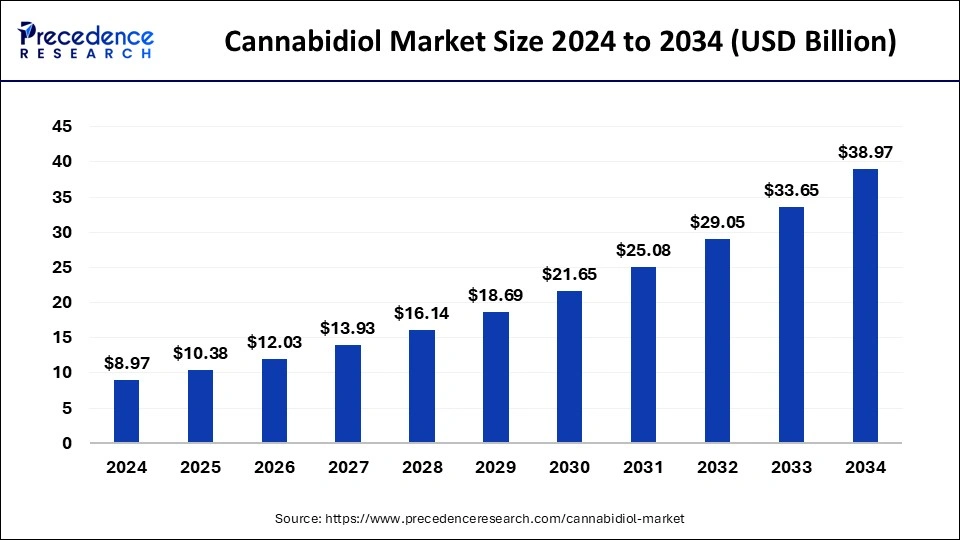

The global cannabidiol market size is calculated at USD 10.38 billion in 2025 and is predicted to increase from USD 12.03 billion in 2026 to approximately USD 38.97 billion by 2034, expanding at a CAGR of 15.83%.

Market Highlights

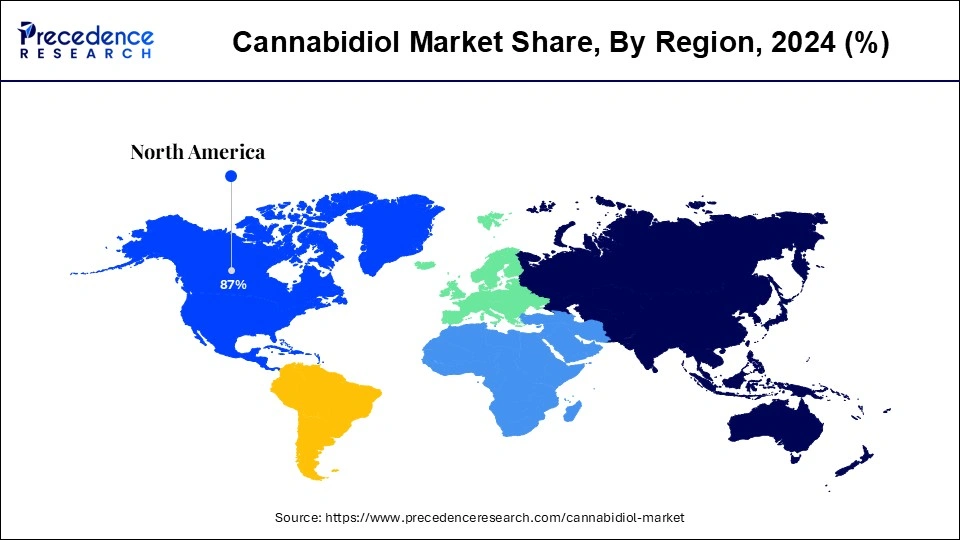

- North America held the largest market share of 87% in 2024.

- By source type, the hemp segment held the largest market share.

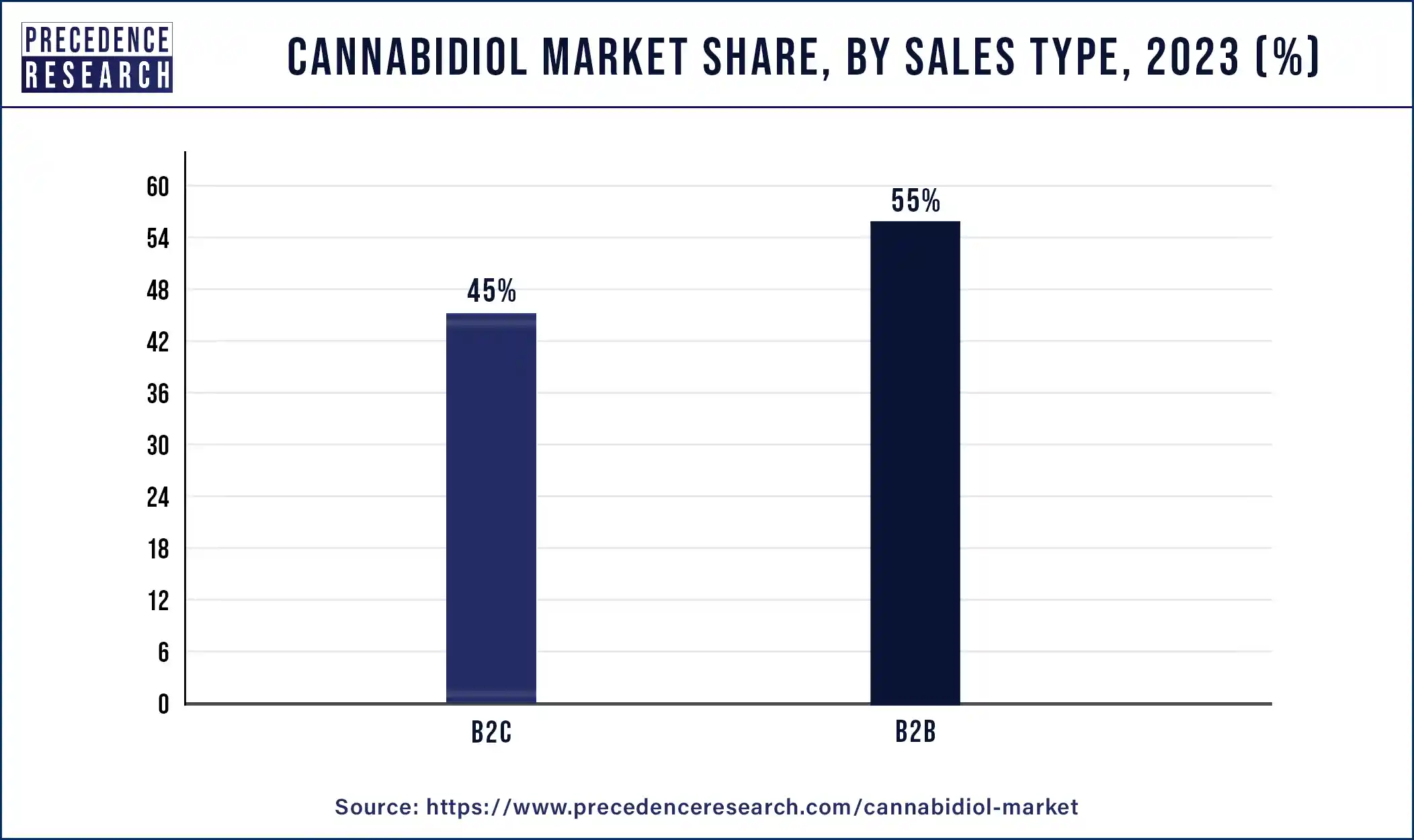

- By sale type, the B2B segment holds the largest market share.

- By end use, the pharmaceutical segment holds the largest market share.

Market Overview

Cannabidiol (CBD), a compound found in marijuana, has gained recognition as a non-impairing substance devoid of the psychoactive effects associated with tetrahydrocannabinol (THC). Derived from hemp or non-hemp plants, CBD has been notably utilized as an adjunctive treatment for managing seizures linked to Lennox-Gastaut syndrome or Dravet syndrome, as well as providing relief for moderate to severe neuropathic pain and other painful conditions, including cancer.

The legal landscape surrounding CBD underwent a significant shift with the passage of the Agriculture Improvement Act in 2018, which removed hemp from the federal Controlled Substances Act, effectively legalizing CBD derived from hemp at the federal level. However, variations in state regulations persist, with some states maintaining hemp under their controlled substances acts, leading to discrepancies in CBD product legality across jurisdictions.

Ongoing research trials continue to explore CBD's potential across various therapeutic areas, contributing to a growing body of evidence regarding its efficacy and safety profile. Despite regulatory complexities and evolving perceptions, CBD remains a promising agent in medical treatment, particularly for conditions such as Lennox-Gastaut syndrome, Dravet syndrome, and neuropathic pain.

Epidiolex, an FDA-approved medication containing purified CBD from hemp, stands as a notable milestone in CBD's pharmaceutical application. Recognized by the FDA as safe and effective for treating rare seizure disorders, Epidiolex represents a validated therapeutic option.

- In September 2023, Aurora Cannabis partnered with leading Brazilian company Herbarium to expand its CBD portfolio into Brazil.

Cannabidiol Market Growth Factors

- The use of non-FDA-approved CBD has surged in recent years, propelled by its growing popularity and extensive marketing for various health conditions. This heightened awareness and promotion stimulate the expansion of the cannabidiol market.

- The cannabis plant produces numerous chemical compounds, including over 100 cannabinoids, such as CBD and delta-9 THC. While CBD offers therapeutic potential without psychoactive effects, THC's psychoactive properties drive demand, thus fueling market growth.

- Only one FDA-approved CBD product, Epidiolex, exists for treating severe seizure disorders. Despite a limited understanding of its mechanism of action, this approval signifies credibility and encourages market growth.

- CBD products beyond Epidiolex are available across states, with differing regulations. Accessibility through various retail channels, notably online platforms, contributes significantly to market expansion, with online sales dominating the cannabidiol market.

- Despite widespread availability, the FDA has not approved CBD for food additives or dietary supplements. This regulatory ambiguity necessitates the development of a new regulatory pathway, potentially driving market growth through regulatory clarity.

- Growing consumer attention towards CBD, particularly as an alternative to THC, drives market growth. With CBD emerging as the primary cannabinoid in industrial hemp, consumer education efforts further stimulate demand.

- Endorsements by celebrities and athletes serve as powerful marketing tools, enhancing consumer trust and encouraging product trials. Such partnerships amplify product visibility and positively influence consumer perception, driving the growth of the cannabidiol market.

Cannabidiol MarketTrends

- Mainstream Acceptance CBD is increasingly seen as a natural wellness option for stress relief, sleep support, pain management, and overall health, moving it from a niche product to a mainstream lifestyle supplement.

- Evolving Regulations Legalization of hemp-derived CBD in more regions is opening new markets and creating more opportunities for businesses to expand.

- Expansion into Skincare, Food, and Beverages CBD is being infused into a wider range of products such as cosmetics, functional drinks, and edibles, offering consumers more ways to use it.

- Product Innovation Companies are developing advanced formulations, including water-soluble and nano-emulsion products, as well as introducing minor cannabinoids like CBG and CBN to improve effectiveness and convenience.

- Growth of Digital and E-Commerce Channels Online sales and direct-to-consumer platforms are becoming a key distribution method, making CBD more accessible and expanding its reach globally.

- Emerging Market Growth Regions outside North America, including parts of Europe and Asia-Pacific, are seeing faster adoption due to rising awareness, improving affordability, and supportive regulations.

- Lifestyle and Wellness Focus CBD is increasingly marketed as part of a broader wellness routine, promoting benefits like recovery, relaxation, and skin health, appealing to a wide range of age groups.

- Quality and Differentiation Challenges Despite growth, companies face hurdles like inconsistent regulations, quality concerns, and a crowded market, requiring innovation and strong branding to stand out.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.38 Billion |

| Market Size in 2026 | USD 12.03 Billion |

| Market Size by 2034 | USD 38.97 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.83% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source Type, Sales Type, and End-use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Real-world evidence

In the rapidly evolving healthcare landscape of CBD treatments, the surge of interest has outpaced scientific research and regulatory advancements, creating a murky terrain of misinformation and unverified claims. This environment poses significant challenges, particularly concerning product quality, dosages, and clinical guidelines, leading to skepticism among consumers and healthcare professionals alike. However, amidst these uncertainties, a beacon of hope emerges in the form of real-world evidence (RWE).

Derived from countries with robust regulatory frameworks, RWE offers invaluable insights into the efficacy, safety, and real-world outcomes of CBD treatments. By bridging critical gaps in knowledge and regulation, RWE not only addresses the pressing needs of patients and healthcare professionals but also serves as a driving force behind the growth and legitimacy of the cannabidiol market. Clinical evidence supporting CBD's efficacy in treating certain forms of epilepsy and providing analgesia in various conditions has fueled its adoption among patients seeking relief from persistent pain.

As the landscape of chronic pain management evolves, the cannabidiol market has emerged as a promising therapeutic service provider, garnering significant attention and driving growth in the market. CBD, derived from Cannabis sativa L., stands out for its non-psychoactive nature, making it an attractive alternative to traditional treatments containing tetrahydrocannabinol (THC). The growing acceptance is further fueled by ongoing preclinical and clinical studies, which continue to unveil CBD's potential across a spectrum of chronic pain conditions.

Enhanced therapeutic potential

The increasing recognition of cannabidiol as a potent treatment for intractable chronic pain across diverse conditions has propelled its prominence in the market. Supported by clinical evidence demonstrating efficacy in epilepsy treatment and analgesic properties, CBD's appeal lies in its non-psychoactive nature, distinguishing it from tetrahydrocannabinol (THC). As preclinical and clinical studies continue to unveil its potential in addressing chronic pain, the growth of the cannabidiol market surges, driven by rising demand for effective pain management solutions in various medical contexts.

- In December 2023, Astrasana Holding AG completed the majority acquisition of Relief for Pets, Europe's premier approved CBD veterinary product line.

- In November 2023, British Cannabis announced a new partnership with Kanabo.

Restraints

Lack of regulation and potential contamination risks

Against the backdrop of increasing demand for effective pain management solutions, CBD's therapeutic promise has positioned it as a cornerstone in the evolving landscape of chronic pain treatment, driving robust growth in the cannabidiol market. However, a lack of regulatory framework combined with potential risks of contamination or incorrect labeling, especially in the healthcare sector, is a significant concern. These regulatory and safety concerns act as barriers to the growth of the market, limiting consumer confidence and adoption.

Despite the increasing popularity of hemp and CBD products, a significant restraint lies in the lack of FDA regulation. In the cannabidiol market, this absence of oversight exposes consumers to potential risks, as products labeled as hemp or CBD may inadvertently contain THC or other contaminants, such as heavy metals, bacteria, pesticides, or fungi. Moreover, the presence of THC in certain products can lead to psychoactive effects and adverse events, highlighting the importance of consumer awareness and vigilance.

Potential risks for pregnant and breastfeeding women

Among the burgeoning interest in CBD products, a significant restraint emerges concerning their safety for pregnant and breastfeeding women. The lack of clarity regarding potential contaminants in CBD products poses risks to fetal and infant health, urging caution and avoidance of use during pregnancy and lactation. With a limited understanding of the health effects associated with CBD use during pregnancy, consumer confidence wanes, hindering the growth potential of the cannabidiol market.

Opportunity

Unveiling CBD's therapeutic potential in neurological diseases

The expanding horizon of research on CBD's therapeutic applications in neurological illnesses presents a significant opportunity for the cannabidiol market. As future research endeavors aim to overcome obstacles and fully harness CBD's potential, optimism surrounds its transformative impact on medicinal practices and patient outcomes. Especially in the neurology sector of the healthcare industry, CBD's therapeutic potential is examined in neurological diseases.

CBD, distinguished as a non-psychoactive component of cannabis, emerges as a promising therapeutic agent in neurology, supported by extensive studies. Its multidimensional role in controlling neurotransmitter release, mitigating oxidative stress, and exerting anti-inflammatory actions underscores its versatility in addressing neurological disorders. With ongoing exploration and validation of CBD's efficacy, the market stands poised to capitalize on the growing therapeutic potential of CBD, driving substantial growth opportunities within the cannabidiol market.

- In October 2023, Cantourage Group SE, in partnership with Astrasana, introduced a range of high-THC medicinal cannabis flowers in Switzerland.

Segment Insights

Source Type Insights

The hemp segment, in 2024, asserted dominance in the cannabidiol market,driven by its definition as any part of the cannabis sativa plant containing no more than 0.3% THC. Notably, 9% of respondents exclusively use hemp-derived CBD due to its lower THC content compared to CBD from cannabis. However, regulatory challenges loom large, with Colorado struggling to manage the regulatory abyss surrounding industrial hemp. Unlike medical marijuana, industrial hemp falls outside stringent regulations, leading to quality and concentration concerns in both marijuana and hemp extracts. Despite these hurdles, the federal government's hands-off approach to states with legalized retail marijuana fosters an environment where the Colorado Department of Agriculture oversees hemp regulation, propelling market growth.

Sales Type Insights

In the cannabidiol market, the B2B segment stands out as the dominant force, with hemp-derived CBD wholesale emerging as an enticing option for retailers. The surging demand for cannabidiol is evidenced by one in seven Americans being CBD consumers. Moreover, with the rise of CBD wholesale companies marketing products online, sales are forecasted to skyrocket in 2023. The abundance of distributor opportunities for hemp-derived CBD, not limited to oils, allows resellers to select specific product types tailored to their target market. Additionally, mass retailers are seizing the opportunity to rejuvenate their brands by incorporating CBD products, thus contributing to the continued growth of the market.

According to a recent Gallup poll, CBD presents lucrative opportunities for resellers. The diverse range of product options, including tinctures, vape oils, and topical salves, further amplifies the profit potential for CBD resellers. Projections from Brightfield Group analysts indicate a staggering 706% year-over-year growth in CBD sales in the United States, reaching approximately $5 billion this year alone.

End-use Insights

The pharmaceuticals segment held the largest share of the cannabidiol market in 2024. In the pharmaceutical sector, cannabidiol stands as a prominent chemical derived from the Cannabis sativa plant, commonly known as cannabis or hemp. While one specific form of CBD is FDA-approved for treating seizures, it's important to note that CBD is primarily obtained from hemp, which contains minimal THC. CBD exhibits distinct effects on brain chemicals compared to THC.

In the cannabidiol market, although only prescribed for seizure disorders, CBD is also utilized for various conditions such as anxiety, pain, dystonia, Parkinson's disease, and Crohn's disease, despite limited scientific evidence supporting these uses. Non-regulated CBD products are widely used for self-treatment, driven by perceived health benefits lacking robust scientific backing. The efficacy of CBD is often attributed to its diverse biological targets, although concrete evidence primarily stems from observations rather than controlled clinical trials.

Regional Insights

U.S.Cannabidiol Market Size and Growth 2025 to 2034

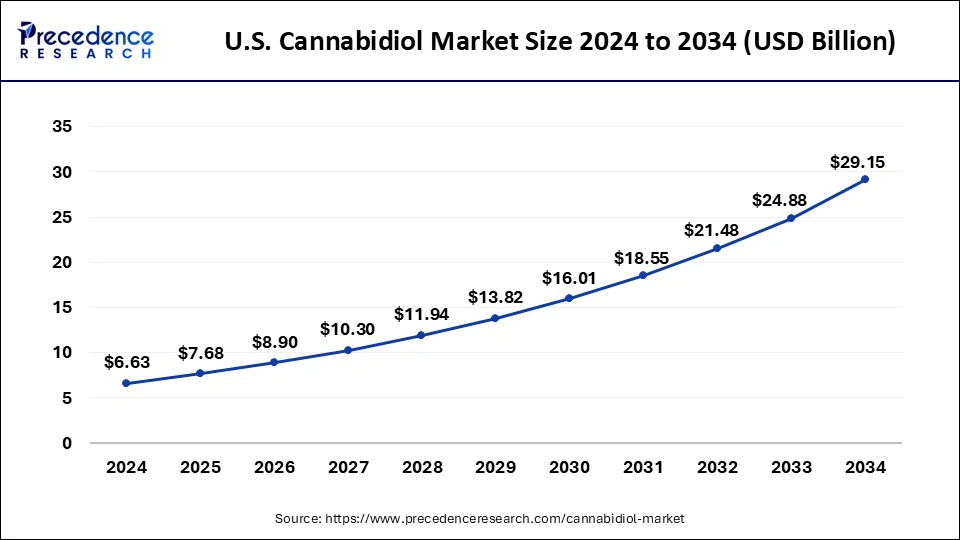

The U.S. cannabidiol market size is exhibited at USD 7.68 billion in 2025 and is projected to be worth around USD 29.15 billion by 2034, growing at a CAGR of 15.96%.

North America held the dominant market share of 87% in 2024, with products derived from cannabis sativa L. plant, commonly known as marijuana, gaining widespread attention. Advertisements tout CBD as a remedy for various ailments, driving its incorporation into an array of products, including massage oils, lotions, balms, makeup, and edibles. However, despite CBD's non-psychotropic nature, the presence of tetrahydrocannabinol (THC) poses challenges, as its consumption can yield positive drug tests and subsequent disciplinary actions.

Recent trends indicate shifting preferences, with sales of CBD products declining by 29 percent in Nevada in the first quarter of 2022. In contrast, sales of cannabinol (CBN) and cannabigerol (CBG) surged during the same period, reflecting evolving consumer preferences.

Cannabis has a complex history in America, including both utilization and criminalization. The legalization of marijuana for medical and recreational purposes in several states further shapes the cannabidiol market landscape, with California and Maine emerging as key hubs for medical marijuana users. Flower remains the most popular form of marijuana consumed by U.S. adults, with recreational facilities, friends, and medical dispensaries serving as primary distribution channels. Despite fluctuations in CBD sales, the North American market continues to evolve amidst regulatory changes and shifting consumer preferences.

- In March 2023, Irwin Naturals launched its cannabis products nationwide in Canada, with availability through the Starseed Medicinal Medical Platform.

The European market for cannabidiol (CBD) products is expanding rapidly, driven by regulatory changes as well as growing consumer acceptance. Germany is leading the way, having decriminalized possession of cannabis and small-scale cultivation in April 2024, and there has been a large demand explosion for medical cannabis. For example, following the decriminalization, the Bloomwell Group reported they had witnessed a 1,000% increase in new patients. Germany has also simplified the prescription process for cannabis after removing cannabis from their list of narcotics, and it is projected that the market for medical cannabis will grow to 120 tons by 2025.

Cannabidiol Market Companies

- ENDOCA

- Cannoid, LLC

- Medical Marijuana, Inc.

- Folium Europe B.V.

- Canopy Growth Corporation

- Elixinol

- NuLeaf Naturals, LLC

- Isodiol International, Inc.

- PharmaHemp

- The Cronos Group

Recent Developments

- In February 2025, Innocan Pharma Corporation, a pioneer in the pharmaceutical and biotechnology industries, announced that it had been granted a patent in India covering a prolonged-release pharmaceutical formulation that utilizes liposomes to encapsulate cannabinoids. The Indian patent, granted in a pharmaceutical market estimated at US$ $55 billion (Bain & Company), complements Innocan's global patent applications, strengthening the proprietary value of its novel liposome-based cannabinoid technology. (Source: https://www.indianpharmapost.com)

- In January 2024, Akumentis Healthcare Limited, a leading pharmaceutical company in India, launched Clasepi, tailored to combat seizures. This DCGI-approved prescription cannabidiol (CBD) is uniquely formulated to target seizures associated with Lennox-Gastaut syndrome (LGS), Dravet syndrome, or Tuberous Sclerosis Complex (TSC) in patients aged 1 year and older. (Source: https://health.economictimes.indiatimes.com)

- In January 2023, the NCL released a statement regarding the FDA's decision on the CBD regulatory framework.

- In February 2024, Avicanna reported a new supply and licensing agreement for two products.

- In November 2022, PrograMetrix & WUNDERWORX launched a partnership to assist cannabis and CBD brands in achieving mainstream marketing success.

- In November 2023, The CURE Brand expanded its cannabis wellness consumer products into Asia.

- In February 2024, Curaleaf International acquired Can4Med, expanding its presence in Poland's growing medical cannabis market.

Segments Covered in the Report

By Source Type

- Hemp

- Marijuana

By Sales Type

- B2B

- By End-use

- Pharmaceuticals

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

- Others

- By End-use

- B2C

- By Sales Channel

- Hospital Pharmacies

- Online

- Retail Stores

- By Sales Channel

By End-use

- Medical

- Chronic Pain

- Mental Disorders

- Cancer

- Others

- Personal Use

- Pharmaceuticals

- Wellness

- Food & Beverages

- Personal Care & Cosmetics

- Nutraceuticals

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content