What is the Commercial Greenhouse Market Size?

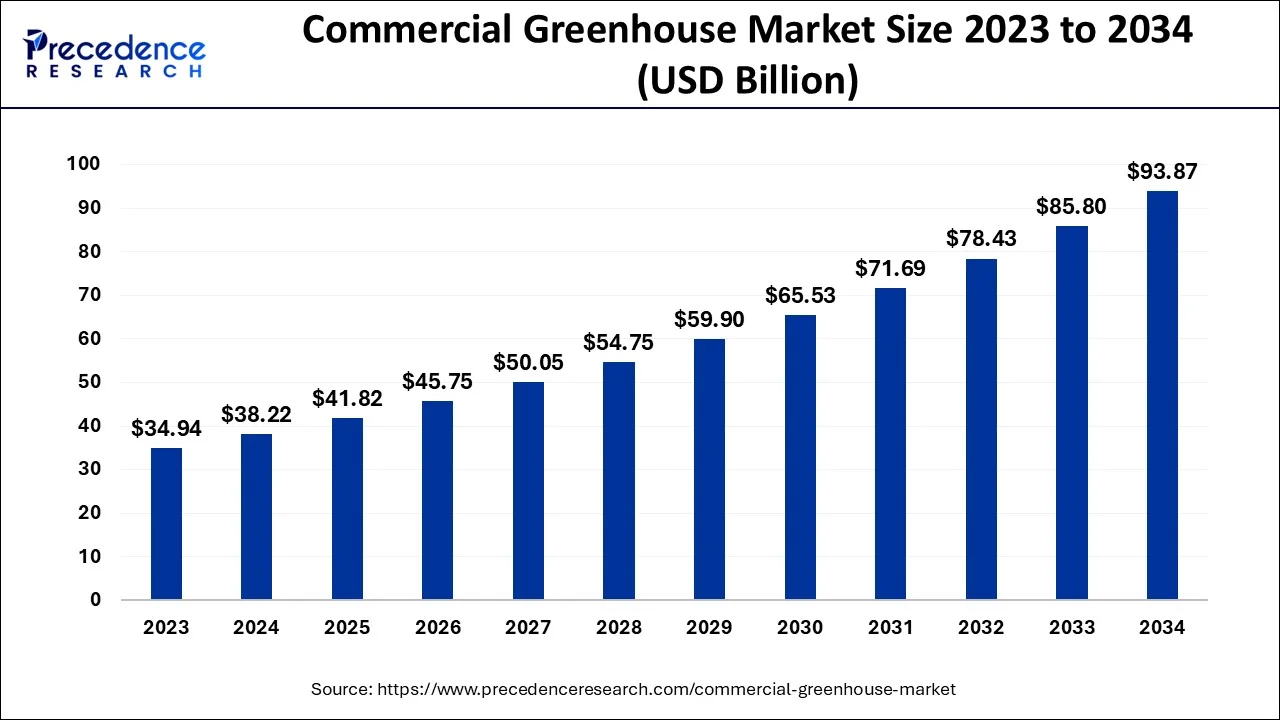

The global commercial greenhouse market size is calculated at USD 41.82 billion in 2025 and is predicted to increase from USD 45.75 billion in 2026 to approximately USD 101.47 billion by 2035, expanding at a CAGR of 9.27% from 2026 to 2035.

Commercial Greenhouse Market Key Takeaways

- The vegetables segment hit a market share of over 42% in 2025.

- The fruits segment garnered a market share of over 25.3% in 2025.

- The flowers & ornamentals segment accounted market share of over 16.5%.

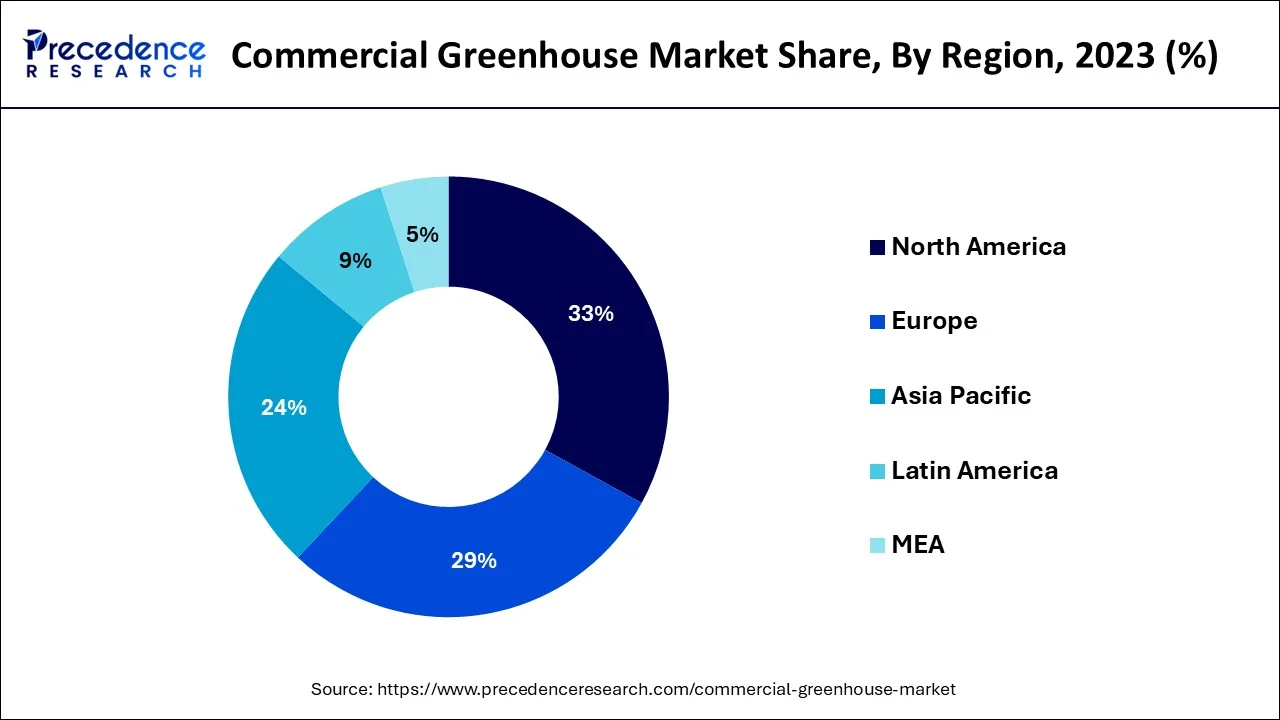

- North America accounted highest market share of over 33% in 2025.

Market Overview

Consumers can grow flowers, fruits, vegetables, and transplants for planting in commercial greenhouses, which provide highly controlled and stable environments. Because of this, greenhouse plants can reliably produce despite regional temperature, soil, or terrain restrictions. In commercial greenhouses, plants are often produced in large quantities for consumers. Farmers have more control over the environment in which their crops grow because to greenhouse farming.

The commercial greenhouse market is expanding mostly due to rapid urbanization and a lack of available arable land. Additionally, the development of commercial greenhouses is a result of the shifting weather patterns that affect conventional farming. More control over the environment in which crops grow is provided through the use of greenhouse farming. A good yield is possible for farmers if they can effectively control the temperature, the irrigation system, the air humidity, and the light. Farmers can estimate how much they will harvest and keep their crops healthier by having that much control over their growth. Farmers are able to grow flowers, vegetables, and fruit crops all year round thanks to their capacity to manage the environment.

Crop genetics can be enhanced by growing them in the controlled atmosphere of a greenhouse, encouraging the development of wholesome cultivars. In addition, less water is required than in an open field. Producers may use all the herbicides and pesticides they need to prevent illnesses and any other plant vulnerabilities because they are not dependent on bees for pollination. In an open field, insects, animals, and locusts may pose a threat to the produce's quality. Due to the controlled medium and environmental factors, crop cycles in greenhouse farming are also quicker than in traditional agriculture, with vine crop productivity more than twice as high. Additionally, compared to traditional agriculture, vertical farming has a land productivity that is more than twice as high and twice as quick. However, there are several obstacles that could limit market expansion, including the need for precise technology in a regulated growth environment and the expensive setup costs.

Key regulation and compliance in 2025

Building Codes & Structural Standards

Environmental concerns, fire safety, and structural integrity are all covered by local and federal building codes that commercial greenhouses must follow. According to the International Building Code, for example, greenhouses fall under the miscellaneous use group and must adhere to strict wind and snow load requirements. For safety and longevity, designs frequently adhere to the National Greenhouse Manufacturers Association (NGMA) standards. Polyethylene films and polycarbonate sheets are examples of materials that must adhere to fire safety regulations and structural specifications suitable for their intended use.

Commercial Greenhouse Market Growth Factors

Rapid urbanization and a lack of arable land are driving the growth of the commercial greenhouse industry. The employment of commercial greenhouses in conventional farming has also been encouraged by changing weather patterns, and this trend will spur the market's expansion even further. Additionally, one of the main factors influencing the growth of commercial greenhouses is their ability to produce high yields in compared to conventional agricultural methods. Another important aspect is the expanding population, which will slow the market's growth pace and increase the need for food. Additionally, the market for commercial greenhouses would benefit from expanding floriculture and decorative horticulture applications as well as rising demand for fruits and vegetables in underdeveloped countries.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 41.82 Billion |

| Market Size in 2026 | USD 45.75 Billion |

| Market Size by 2035 | USD 101.47 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 9.27% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Equipment, Crop Type, Type, Component, and Geography |

Market Dynamics

Key Market Drivers

Higher yields are required while using less water and space

- Less water and area are needed to produce the same amount of produce when using greenhouse farming, which is one of its key advantages over traditional agricultural practices. The Food and Agriculture Organization of the United Nations estimates to meet global food demand, food output must rise by 70% by 2050. Greenhouse farming is a possible solution to assist fulfill the rising population's demand for food because urbanization is displacing arable land and reducing the overall amount of agricultural land. Compared to traditional farming, organic farming wastes less water. In general, greenhouse farming uses 95% less water than outside farming for the same amount of crops. In vertical greenhouses, the transpiration process happens when commodities or plants are produced, allowing farmers to reuse the water for irrigation.

A small number of crops are suited for greenhouse farming

- Growing in a greenhouse is not a popular option among producers because it only works for a few types of crops. A lot of things need to be considered before establishing a greenhouse plantation, including temperature control, adequate water supply management, identification and supply of fertilizer, the growth mechanism to be employed, and specific harvest timings for plants. Fruits and vegetables are the finest crops for vertical farming since they grow more quickly and require less water and light. However, there are just a few fruit and vegetable species that can be grown in regulated environments. For instance, many fruits and vegetables have edible branches, roots, and leaves. Vertical farming is not a good fit for these kinds of plants. In greenhouses, it is difficult to produce crops like sugarcane, rice, and wheat since they require a lot of water and take a long time to harvest. Wheat and rice are two important crops that are produced year-round in the APAC area to feed the region's expanding population. The limited adoption of commercial greenhouse farming in these areas is a result of the challenges associated with cultivating these crops in greenhouses.

Market Growth Driven by Increased Demand for Local, Pesticide-Free Products

- A growing consumer preference for fresh, locally grown, and pesticide-free fruit and vegetables represents an opportunity for the commercial greenhouse sector. The increasing urban population, seeking sustainable sources of food, allows for continued investment in advanced greenhouse environments that support growers in meeting the increasingly health-conscious consumers' expectations with minimal impact to the environment, demonstrating that greenhouses have similar potential to traditional agriculture.

Market Challenges

High Capital Expenditure - Crops grown in greenhouses require particular environmental conditions in order to grow properly. It is crucial to keep an eye on the ideal air quality, temperature, and relative humidity. They require the best possible light and water for growth. According to the requirements of each crop's growth stage, the nutrient levels available to the plants should be regularly monitored and gradually changed to the proper levels. Monitoring and precision of natural resources and fertilizers are essential for growing crops in greenhouses. This entails having a thorough awareness of the crop, the surrounding environment, and the plants' ideal requirements. As a result, these crops are frequently grown properly by expert farmers. The right setup and additional illumination of the irrigation systems are among the other factors. All of these are expensive and difficult for conventional farmers to perform, especially in developing nations.

Market Opportunities

- R&D projects to advance greenhouse agricultural techniques - The majority of scientific R&D is focused on the agricultural sector. The difficulties created by environmental problems and climate change have motivated the development of several ways to ensure food security on a worldwide scale. Interest in greenhouse farming is growing among researchers, academics, and farmers. Experts are working to adopt greenhouse farming in an effort to address the basic problem of managing the climate in temperate zones. The Advanced Horticulture Research Facility claims that active cooling methods might aid in producing the perfect environment. Many strategies are being investigated, including shading methods based on photovoltaic (PV) technology for greenhouse passive cooling. The methods used by the protected cropping sector to regulate humidity are being improved, and experts are identifying new directions for further study in this area.

- Technological innovations - Artificial intelligence, smart irrigation systems, pH monitors, and temperature control software are just a few of the technological advancements that are significant trends in the commercial greenhouse sector. Artificial intelligence, autonomous watering systems, pH sensors, and climate change technologies may be used by indoor farmers to address issues like disease prevention and pest control. For instance, a US-based agriculture firm will introduce LUNA in 2019; it is an optical scanning system run by inch, a US-based company that continuously records imagery in greenhouses and analyzes visual data from growth cycles. The application has the ability to identify crops that are stable and notify farmers when problems occur. High-tech greenhouses are another product offered by businesses like AppHarvest and Kentucky Fresh Harvest, which assist to boost output and enhance harvest quality.

Segment Insights

Equipment Insights

Heating systems will have the greatest CAGR throughout the predicted timeframe. Heating systems are one of the most important requirements for the effective growth of plants in commercial greenhouses. Systems that keep the temperature steady and don't emit any hazardous substances help plants grow.

The best way to maintain the proper temperature is with a heating system. These systems may be administered centrally or decentralized. In colder months, greenhouses commonly use radiant hot water heating systems to keep their interiors warm. Because flow control enables effective temperature adjustment, these heating systems use mixing valves to regulate the temperature of the heating pipes.

Crop Type Insights

Vegetables are predicted to see the highest CAGR increase throughout the course of the projection period. Vegetables do well in greenhouse environments. Without having to worry about the climate, temperature, or other environmental changes, vegetables may be cultivated all year round. Vegetables produced in greenhouses are protected from bad weather, such as cold, wind, pests, drought, searing heat, and animals that would want to eat them. Growing vegetables there also permits the establishment of the optimal circumstances for the crops due to the regulating factors present in greenhouses, such as humidity, light, temperature, fertilizer, moisture, and irrigation.

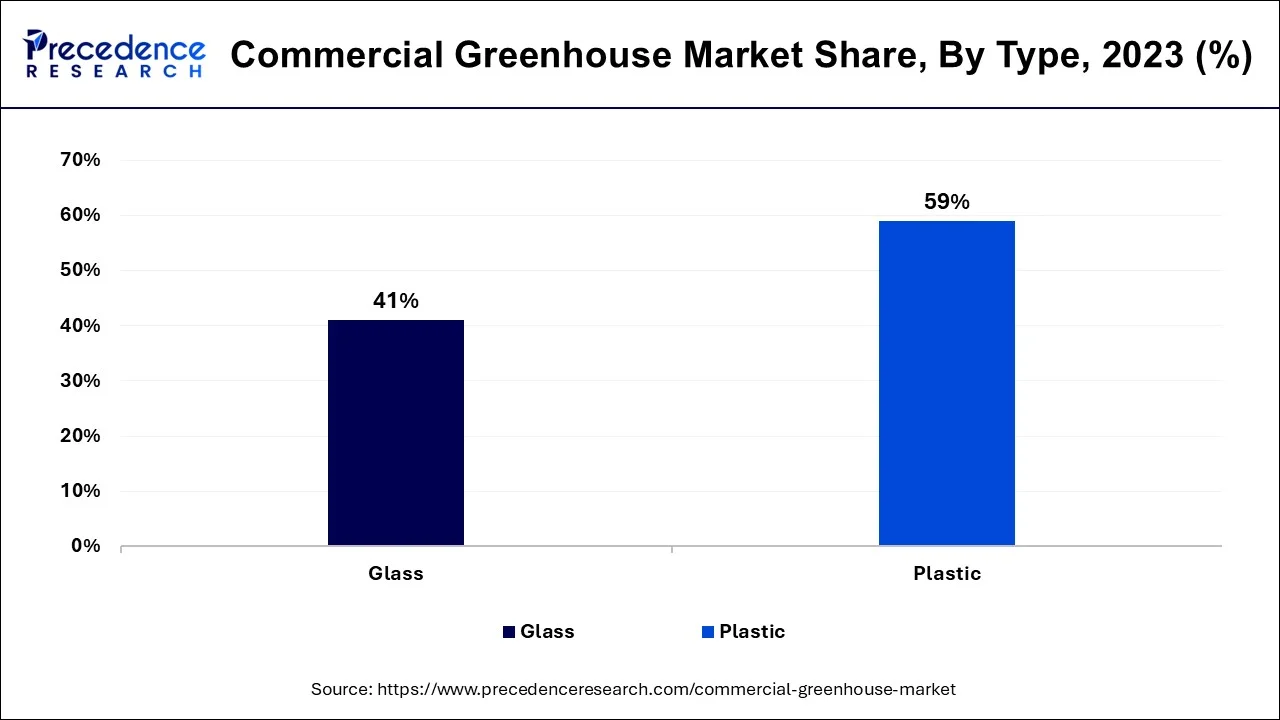

Type Insights

The market for plastic greenhouses is predicted to grow more swiftly than that for glass greenhouses. To make commercial greenhouse plastic more durable than traditional plastic, a distinct manufacturing process is used. The unique design of this material makes it resistant to tearing and extreme weather conditions.

Regional Insights

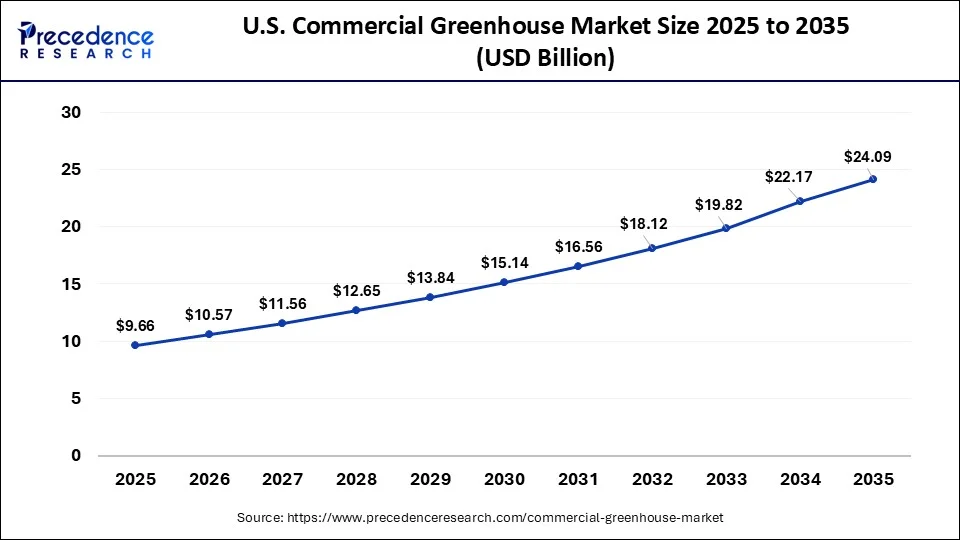

What is the U.S. Commercial Greenhouse Market Size?

The U.S. commercial greenhouse market size is evaluated at USD 9.66 billion in 2025 and is predicted to be worth around USD 24.09 billion by 2035, rising at a CAGR of 9.57% from 2026 to 2035.

North America is Leading with Smart Farming and Innovation

North America continues to dominate the commercial greenhouse segment, driven by adoption of smart farming technologies and support from institutions. In early 2024, the U.S. Department of Agriculture launched $90 million in grants financing climate-smart greenhouse projects. Companies like IUNU and AppHarvest have scaled their AI-driven monitoring systems to increase crop yields — particularly in tomatoes and leafy greens.

U.S. Commercial Greenhouse Market Analysis

Smart agriculture, precision systems, innovative growing methods, urbanization, and food security are advancing the U.S. commercial greenhouse market. The U.S. Environmental Protection Agency (EPR) introduced the Greenhouse Gas Reporting Program (GHGRP), which requires reporting of greenhouse gas (GHG) data and other information from CO2 injection sites, large GHG emission sources, and fuel and industrial gas suppliers in the U.S.

The Fastest Growth of Asia-Pacific is Fueled by Tech Adoption and Urban Demand

Asia-Pacific is experiencing the fastest growth led by China, which has a significant greenhouse footprint with 4 million hectares. As of early 2025, over 60% of new greenhouses in Asia were being constructed with advanced climate control systems, leading to enhanced yield and reduced use of resources. Growing urban demand for pesticide-free produce in India, Japan, and Southeast Asia has intensified investments in hydroponic and vertical greenhouse systems throughout the region.

India Commercial Greenhouse Market Trends

The Indian agriculture sector focuses on high-value crops, climate resilience, and resource efficiency. The Ministry of Agriculture and Farmers Welfare is promoting polyhouse farming or greenhouse farming as a sustainable solution for modern farming challenges. Demand from organized retail, quick commerce, and the HoReCa sector is pushing greenhouse growers to supply uniform, graded produce consistently, while urban hydroponic and D2C channels are creating new premium revenue streams.

Europe

How does Europe reach a Noticeable Position in the Commercial Greenhouse Market?

Europe is expected to grow at a notable rate in the market, owing to the growing consumer demand for local and sustainable food, policy incentives and government support for energy-efficient systems, and technological advances in agriculture. Opportunities are growing with the integration of AI and precision agriculture and the hybridization of vertical farming techniques within greenhouse ecosystems to increase productivity and resource efficiency.

Latin America

What are the Favorable Opportunities in the Commercial Greenhouse Market in Latin America?

Latin America is expected to grow at a significant rate in the market due to the rising trends of smart farming, cost-effective solutions, automation, food security, and more. In November 2025, South Korea-based Green Climate Fund (GCF) and Brazil's finance ministry, national development bank Bndes, planned to launch a Brazil-focused climate fund of $1 billion to promote large-scale sustainability policies and reduce greenhouse gas emissions.

MEA

What is the Potential of the Commercial Greenhouse Market in the Middle East and Africa?

The Middle East and Africa are expected to grow at a lucrative rate in the market, owing to the rapid adoption of smart greenhouses and automated systems, and the expansive reach of solar-powered greenhouses to offset high energy costs for cooling. Greenhouses are becoming the rapidly expanding pillars of food production in the Middle East region.

Value Chain Analysis of the Commercial Greenhouse Market

- Harvesting and Post-Harvest Handling: This stage includes maturity detection, robotic harvesters, optimal timing, rapid pre-cooling, automated sorting and grading, and eco-friendly packaging.

Key Players: Certhon B.V., MetoMotion, Green Automation Group, Logiqs B.V., Source.Ag, JBT Corporation, AgroFresh Solutions, Inc., Hazel Technologies Inc., Sensitech, Apeel Sciences, Tomra Food. - Distribution to Wholesalers/Retailers: This stage prioritizes inventory staging, order fulfillment, sustainability-focused logistics, and specialty transportation.

Key Players: Cox Farms, Costa Farms, Gotham Greens, Lufa Farms, Hort Americas, HydroFarm, Netafim. - Export and Trade Compliance: This stage focuses on mandatory documentation and licensing, phytosanitary and product standards, infrastructure and technology compliance, export incentives, and policy changes.

Key Players: Certhon, Richel Group, Dalsem, Netafim, Argus Control Systems, Gibraltar Industries, Cargill, Flexport.

Commercial Greenhouse Market Companies

- Berry Global (US)

- Signify Holding (Netherlands)

- Heliospectra AB (Sweden)

- Plastika Kritis (Greece)

- Everlight Electronics (Taiwan)

- Richel Group (France)

- Argus Control Systems (Canada)

- Certhon (The Netherlands)

- Logiqs BV (The Netherlands)

- LumiGrow (US)

- Agra-tech, Inc (US)

- Rough Brothers, Inc (US)

- Hort Americas (US)

- Top Greenhouses (India)

- Stuppy Greenhouse (US)

- The Glasshouse Company (Australia)

- DeCloet Manufacturing Ltd (Canada)

- Europrogress (Italy)

- Luiten Greenhouses (New Zealand)

- Sotrafa (Spain)

- Nobutec BV (The Netherlands)

- Ammerlaan Constructions (The Netherlands)

- Ludy Greenhouse (US)

- Saveer Biotech Ltd (India)

- Harford (New Zealand)

Recent Developments

- In March 2025, Source.ag launches new product tiers to accelerate AI adoption in greenhouse operations. These new offerings are designed to help growers unlock significant growth, scale and become more profitable by integrating AI-driven solutions into daily greenhouse operations.

- In March 2024, Central Life Sciences launches ClearLeaf Insecticide/Miticide into commercial greenhouse market. ClearLeaf Insecticide/Miticide can be applied in greenhouses, lathe/shade houses and field-grown ornamentals as part of an integrated pest management program

- In March 2024, Mastronardi , has launched a large-format, greenhouse-grown Romaine lettuce under its Backyard Farms lettuce line. Mastronardi Produce is currently the only greenhouse grower to venture into the large-format Romaine segment and produce a high-quality product. Backyard Farms Romaine lettuce is already on shelves at select retailers.

- On 5 May 2025, Rivenhall Greenhouse Ltd. announced plans to construct a 40 hector 40-hectare greenhouse facility in Essex, UK. This project aims to reduce the UK's reliance on imported tomatoes by producing approximately 30,000 tonnes annually. The greenhouse will utilize heat, electricity, and CO? from a nearby incinerator, offering stable energy prices and creating around 500 jobs.

- In March 2024, Heliospectra AB received an order worth 8.3 million SEK from a leading greenhouse grower in Ontario, Canada. The order includes the MITRA X LED lighting system and helioCORE control solution, aimed at enhancing energy efficiency and crop yield. Deliveries are scheduled throughout 2024 and 2025.

- In January 2024, Lassana Agri initiated a large-scale greenhouse cultivation project covering 10,000 hectares. The project aims to transition farmers to modern agriculture practices, providing advanced greenhouse solutions and financial support to enhance production and sustainability.

- Why Denso invested in Certhon Group in April 2020 to provide customers cutting-edge greenhouse solutions. The second-largest provider of automotive technology in the world is Denso.

- Madar Farms and Certhon Group agreed to work together to build a commercial indoor agricultural facility in the United Arab Emirates in January 2020.

- In order to deliver autonomous and plant-centric solutions for environmental management in greenhouses to cannabis cultivars in North America, Argus Controls and Urban-Gro extended their strategic partnership in 2019.

Segments Covered in the Report

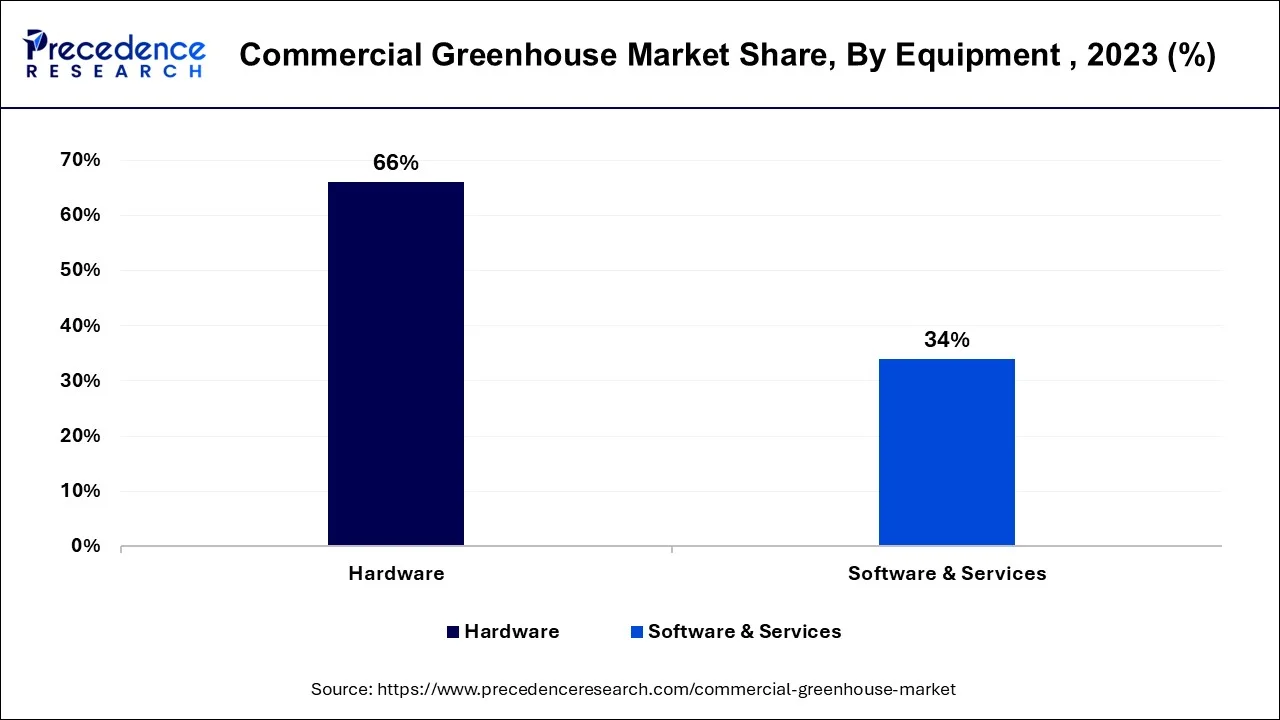

By Equipment

- Hardware

- Software & Services

By Crop Type

- Fruits

- Vegetables

- Flowers and Ornamentals

- Nursey Crops

- Other

By Type

- Glass

- Plastic

By Component

- High-Tech Commercial Greenhouse

- Medium-Tech Commercial Greenhouse

- Low-Tech Greenhouse

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting