What is the Computer Numerical Control (CNC) Machine Market Size?

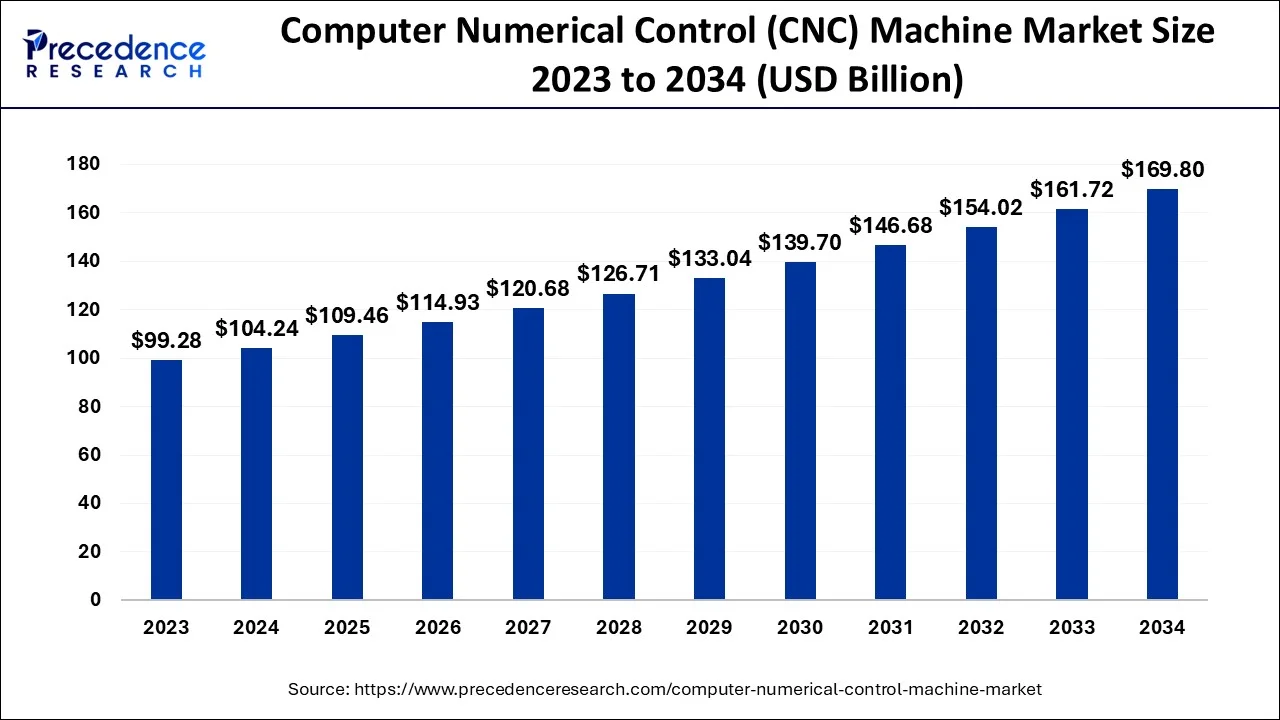

The global computer numerical control (CNC) machine market size is calculated at USD 109.46 billion in 2025 and is predicted to increase from USD 114.93 billion in 2026 to approximately USD 109.46billion by 2035, expanding at a CAGR of 4.96% from 2026 to 2035. The efficiency and accuracy are further improved making CNC technology even more suitable for use in manufacturing.

Computer Numerical Control (CNC) Machine Market Key Takeaways

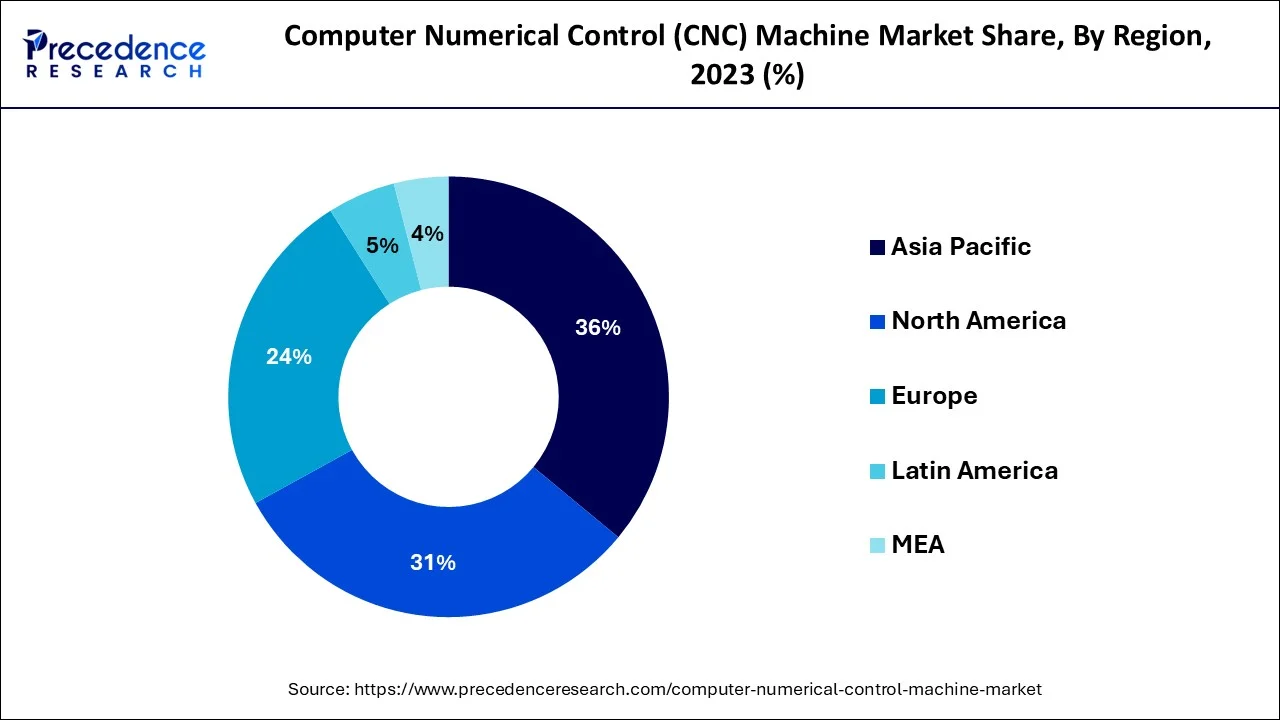

- Asia Pacific dominated the market with the largest market share in 2024.

- By region, Europe is expected to show the fastest growth during the forecast period.

- By type, the CNC lathe machines segment dominated the market in 2024.

- By type, the CNC milling machines segment is expected to grow significantly during the studied period.

- By end-use, the industrial segment dominated the market in 2024.

- By end-use, the automotive segment is expected to grow significantly during the studied period.

Market Overview

By 2035, it is predicted that there would be a demand for more than 2800 thousand CNC machines. The main driver anticipated to propel market expansion throughout the projected period is the rising need for medical devices, electric vehicles (EV), telecom communication equipment, and equipment used in the fabrication of semiconductors. The necessity for five-axis milling and ultra-precision machinery to meet the demands of EV manufactures is also projected to fuel expansion.

Due to increased machine orders across sectors, particularly from Europe, Asia Pacific, and North America, the CNC machine market rebounded strongly in 2022. Due to the pandemic's pent-up demand and backlog of orders, the market had significant growth in 2022. In the near future, this pattern will continue as backlogs from 2020 are caught up. However, it is anticipated that the sales revenues of OEMs would be hampered until 2023 by the global shortage of semiconductors, rising steel prices, and logistical expenses.

Over the course of the projection period, the market for computer numerical control (CNC) machines is anticipated to rise favourably due to automated CNC systems linked with industrial robots including simulation software to boost output. Automation of CNC machines are being used primarily to alleviate the present shortage of trained personnel that most sectors are now experiencing. This makes it possible for manufacturing sectors to boost productivity and efficiency. Incumbents in this market, such Fanuc Corporation and OKAMA America Corporation, focus on integrating new technologies with the current product line to meet this demand. Market difficulties are anticipated as a result of rising raw material costs and a potential scarcity of semiconductors used in CNC machines. In these market circumstances, it is anticipated that used CNC machine demand would rise, limiting the market expansion of new CNC machines. Over the course of the projection, the tendency is anticipated to persist. Long-term changes in the price of raw materials are anticipated to drive up the average unit cost of CNC machines.

AI Impact on the Computer Numerical Control Machines Market?

AI advances the functions of CNC machines, making them more efficient, accurate, and cheaper. CNC machining is currently being driven by artificial intelligence (AI), which increases precision and efficiency as well as automating processes. CNC machines which include using IoT devices to control machines and even rate their performance can be altered with the help of AI.

Machine tools, specifically CNC machining, are being driven by artificial intelligence (AI) and this brings about high levels of precision, efficiency, and automation. AI while the machine service times are predicted and there are real-time adjustments made to minimize wastage, and faster and cheaper production processes.

What are the Factors Behind the Rapid Expansion of the Global Computer Numerical Control Machine (NCM) Industry?

The Computer Numerical Control (NCM) machine sector has become an essential element of the current generation of automated and precisely built manufacturing processes. CNC advances the current trends in commercial vehicle, aeronautical, electronic and metal fabrication manufacturing methods through the application of robotics, real-time monitoring, and software-based optimization processes.

Manufacturers are increasingly utilizing CNC's level of mass customization and digital production processes to boost total manufacturing efficiencies by integrating robotics with existing processes, to produce more consistent products and increase the frequency and quantities produced with reduced labour costs.

Major Applications on CNC Machines:

| Aerospace Industry | CNC machining has a variety of trustworthy applications. Engine mounts, fuel flow parts, landing gear parts, and fuel access panels are a few examples of machinable aerospace parts. |

| Automotive Industry | CNC milling machines are frequently used in the automotive sector for both production and prototyping. |

| Electronics Industry | CNC machining is used in the electronics industry for both prototyping and making actual products. |

| Defence Industry | Making complicated custom designs for the bodies of weapons to making the parts inside of missiles. |

| Healthcare Industry | CNC machining is the only method for producing metal components and any complicated elements. |

Computer Numerical Control Machines Market Growth Factors

- Growing interest in the automation of the production line and smart manufacturing strengthens the need for using CNC machines due to increased accuracy in the production processes.

- CNC machines become critically important as industries offer more customized products.

- CNC machines cut down the cost of labor and minimize material usage hence aiding manufacturers to cut down on their cost.

- Industries are growing at a faster pace especially aerospace, automotive, and more especially in the overall healthcare sector are demanding the use of CNC machines.

Market Outlook

- Industry Growth Overview: Trends in manufacturing provide insight into a very positive outlook for the long-term market for CNC machines due, primarily, to rapid growth in manufacturing automation and precision engineering requirements through digitization for all major world economies. As CNC machine manufacturers adopt and adapt to the usage of AI to drive technology advancements, the trend will only accelerate.

- Sustainability trends: Trends in sustainability have seen an increase in the use of energy-efficient systems, recyclable materials, and improved machining practices that promote waste reduction and smart energy management through recycling efforts.

- Global Expansion: Trends in globalization have created a high level of interest from CNC machine manufacturers to build joint ventures within the manufacturing sector in the growing markets of Asia, the Middle East, and South America through global strategic alliances for business growth and expansion.

- Startup Ecosystem: Trends in the startup community are resulting in the creation of many new companies producing CNC controller, simulation toolsbased on cloud technology, and inexpensive mini machines, resulting in increased innovation for the small CNC manufacturers and increased options for the manufacturers of the future.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 114.93 Billion |

| Market Size in 2025 | USD 109.46 billion |

| Market Size by 2035 | USD 177.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.965% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Increase in demand in mass production plants

Due to their capacity to produce very precise parts and components, CNC systems are being used more often in factories that produce large quantities of goods. Additionally, a variety of procedures utilized in CNC to create standardized components using machine tools, such CAD and CAM, are totally interchangeable. Additionally, the use of CNC in manufacturing facilities directly affects cost reduction while also significantly improving productivity and product quality. Thus, all of the aforementioned CNC capabilities have an impact on the development of industrial sectors like automotive and aerospace & military and present a profitable market potential for U.S. CNC machines.

Demand for Various Industrial Devices and Equipment

One of the key drivers propelling the growth of the computer numerical control (CNC) machine market is the rise in demand for a variety of industrial devices and equipment, such as medical devices, semiconductor manufacturing equipment, telecom communication devices,and electric vehicles (EV).

Growing use of industrial automation in the world's manufacturing sector

The adoption of industrial automation systems in the worldwide manufacturing sector is primarily driven by the growing significance of real-time data for process modelling and predictive maintenance in manufacturing sectors. Automation has several benefits, including higher productivity and lower operating costs for businesses that produce components for the automotive, medical, aerospace, and military sectors. It also improves manufacturing processes quality, safety, uniformity, and accuracy. Due to the increased adoption of sophisticated automated systems, such as CNC machines by automakers to automate their manufacturing processes.

Key market challenges

- Inadequate skills - The market is significantly challenged by the lack of qualified personnel to operate these automation systems. Training programs are desperately needed to educate people about how CNC machines work. In tiny factories, there aren't many skilled personnel available to run CNC equipment. A significant market hurdle is the labor force's lack of knowledge about how CNC machines work and their inability to operate them. Lack of training may dramatically alter market prospects for CNC machines.

Key market opportunities

- Popularity of Automated CNC Systems - The desire for automated CNC systems that are integrated with industrial robots is growing, which has an additional impact on the market. To improve production, alleviate the shortage of experienced laborers, and increase productivity, these systems use simulation software. Additionally, the market for computer numerical control (CNC) machines is favorably impacted by rising urbanization, a shift in lifestyle, a spike in investments, and higher consumer spending.

- Strong Adoption of Internet-of-Things (IoT) - Machine tools are controlled by CNC (Computer Numerical Control) machines, which utilize computerized systems. Strong Internet of Things adoption is projected to increase product demand. Additionally, the usage of CNC is anticipated to increase across a number of sectors with the inclusion of modern digital technology. Industries may see increased product uptake as a result of rapid digitization and the move to automated production methods. In addition, growing manufacturing sector expenditures in IoT are anticipated to accelerate the technology's adoption across several industries. For instance, according to reports, the industrial industry would invest up to USD 267 billion in the creation of IoT services by 2020. These elements might fuel the market expansion for CNC (Computer Numerical Control) machines.

- Robust Demand for CNC from the Healthcare Sector - Due to the healthcare industry's strong need for CNC (Computer Numerical Control) machinery, the market is anticipated to benefit from the COVID-19 pandemic. Numerous companies adopted automation as a result of the unexpected increase of COVID-19 infections. The need for technology in the healthcare industry was increased by this issue. Due to the high need for effective technology to provide healthcare goods and services, the pharmacy sector also supported this industry. Additionally, quick digitization encourages the use of CNC equipment. Throughout the epidemic, these elements promoted industry expansion.

Segment Insights

Type Insights

The market for CNC lathe machines was worth USD 17 billion in 2025, and it is anticipated to grow at a CAGR of more than 10.4% during the forecast period. Over the next mid-term, the automotive industry's growing need for CNC lathe machines to produce bespoke parts including cylinder heads, gearboxes, starter motors and other prototype applications is anticipated to propel market expansion. Additionally, the market expansion is anticipated to benefit from technical developments in current CNC lathe systems with new features employed for a variety of applications. For instance, the Cincom L32 XII, a sliding headstock style automatic CNC lathe machine with an automatic tool changer, was introduced by Citizen Machinery Co., Ltd in February 2021. The characteristics allow for the simultaneous execution of several tasks and the machining of complicated structures, such as implants used in medical treatment.

By 2032, there will be a need for more than 600 000 units of CNC laser equipment, representing a CAGR of 9.3% over the projected period. The category is anticipated to develop during the projected period due to the rising demand for CNC laser cutting machines from semiconductor manufacturing businesses to solve the persistent scarcity of semiconductors in all industries. Additionally, market growth is anticipated to be favorable in the next years due to the growing use of CNC fiber laser cutting equipment in the sheet metal processing and kitchenware sectors.

End Use Insights

The automobile, aerospace & military, construction equipment, power & energy, industrial, and others subcategories are further divided into the end-use section. By 2035, the industrial sector is expected to account for more than 28 billion and hold more than one-fourth of the market share in 2024. The general manufacturing sectors of packaging, electronics, medicine, and other general industries are included in the industrial section. Growth over the projection period is anticipated to be driven by rising demand for fully automated and turnkey CNC machines to scale up production to fulfill backlogs starting in 2020.

It is anticipated that the surge in EV sales and the rise in demand for the production of ultra-precision components for EVs would be favorable for the expansion of the automotive sector throughout the projected period. It is anticipated that the need for customized automobile parts such crankshafts, cylinder heads, and motor pumps would continue to support market expansion. These variables suggest that by 2032, the automobile industry would require more than USD 24 billion in CNC machines.

Regional Insights

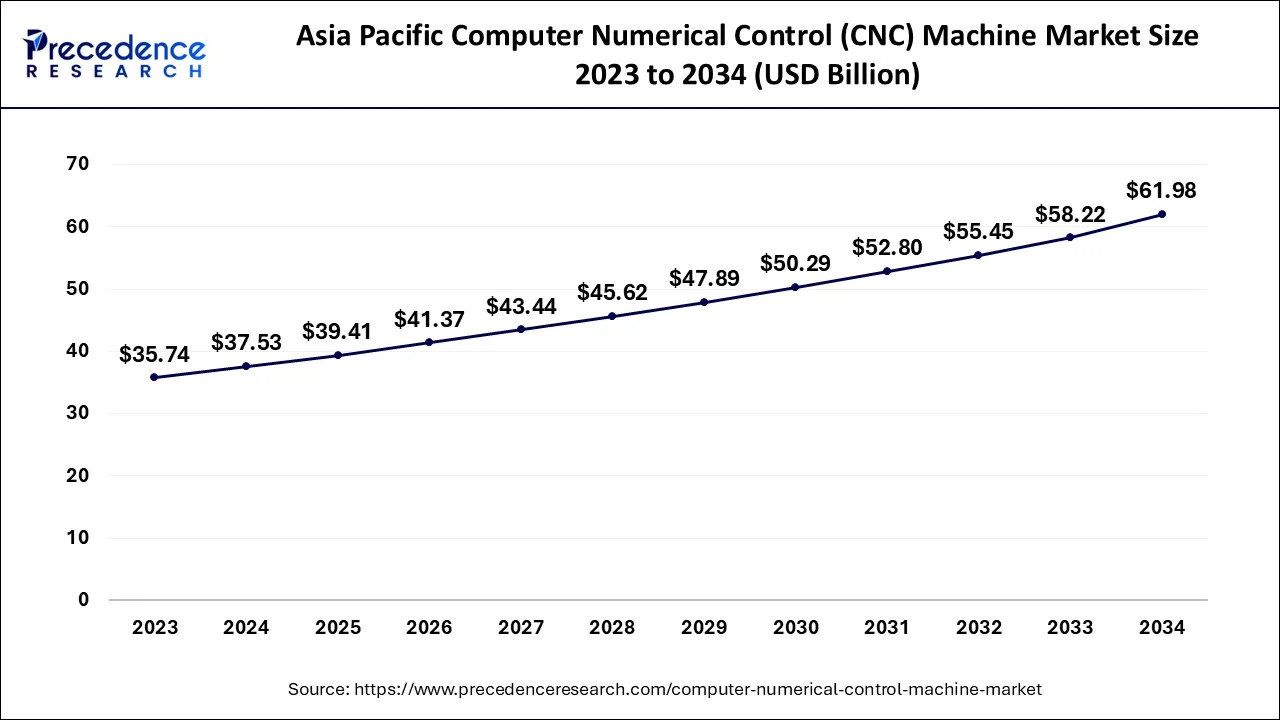

The Asia Pacific computer numerical control (CNC) machine market size is exhibited at USD 39.41 billion in 2025 and is projected to be worth around USD 65.08 billion by 2035, growing at a CAGR of 5.14% from 2026 to 2035.

In 2024, the Asia Pacific region had more than 36% of the global market share, and it is anticipated that it would continue to hold the top position during the projected period. Sales of CNC machines are expected to reach 790,000 units in 2022 and quadruple by 2032. The market demand is attributed to the surge in industrial equipment manufacturing outsourcing services, the availability of inexpensive raw materials in abundance, and low operational costs that fuel the demand for manufacturing outsourcing and increase the sales of CNC machines over the forecast period.

Emerging Landscape of Japan's CNC Machine Market

Japan held a prominent position in the computer numerical control machine market. The Japan Computer Numerical Control (CNC) Machine market is witnessing substantial growth as companies across the country demand greater automation and precision in manufacturing processes. The preliminary demand for CNC machines stems from industries that need high levels of automation, speed, and accuracy. The automotive sector significantly contributes to this market, as these machines are utilized to create intricate engine parts, transmission systems, and other components that need strict tolerances.

On the other hand, the development in the aerospace industry is increasing the demand for CNC machines to produce lightweight and durable materials for aircraft and spacecraft, guaranteeing operational safety and performance. With the advanced digital age, Japan grabbed computer-aided manufacturing and computer-aided design technologies. This change to digital systems further concreted Japan's position as a leading market in CNC machines, allowing for seamless involvement of CNC machines in automated production methods.

Due to Europe's engineering expertise and large industrial base, Europe has been able to retain its leadership position for the manufacturing of CNC machines. The automotive ecosystem is robust within the region, high quality aerospace production takes place in Europe, as well as large-scale machine tool manufacturers producing at world-class levels. Digital twins, predictive maintenance, and automation systems integrated into CNC machines have significantly improved the quality of production.

During the predicted period, Europe is anticipated to experience an 8.7% CAGR. Italy, France, Germany, and the other nations of Europe are the main drivers of the expansion. Over the next few years, market growth is expected to be fueled by a lack of workforce forcing metalworking businesses to raise their spending in automation to boost the productivity of their CNC machines.

Advancing Market of CNC Machines in Germany

Germany distinguishes itself as having the largest CNC machine market in Europe, based on the workforce size in the sector. Gieni states that Germany has a workforce of 559,200 in the CNC segment, mainly catering to the automotive, aerospace and defense, energy, and construction machinery sectors. As one of Europe's largest manufacturing hubs, the country is embracing CNC technology to enhance precision, productivity, and operational efficiency.

The combination of innovative technologies such as artificial intelligence, machine learning, and the Internet of Things is advancing the scope of Industry 4.0, advancing the CNC machines market. German producers are making significant investments in advanced tooling and cutting techniques. Advancements in tool materials, coatings, and designs improve machining efficiency and prolong tool longevity, lowering production expenses. Producers can customize equipment to satisfy particular manufacturing requirements, guaranteeing maximum efficiency and performance.

As Latin America becomes an increasingly significant hub for CNC machine use, manufacturers in the region are beginning to modernize their operations to comply with the standards of global industry. As significant investment occurs in metalworking, machining parts for automotive production, automation, and the automation industry; manufacturers are relying on precision tools and a larger number of automated systems to support their products.

The government has an initiative supporting the digitization of the entire manufacturing sector across the region and forming alliances with manufacturers of CNC equipment, thereby strengthening Latin America's capacity for CNC machine production.

Computer Numerical Control (CNC) Machine Market Companies

- Yamazaki Mazak Corporation (Japan)

- Doosan Machine Tools Co., Ltd. (Korea)

- Trumpf (Germany)

- Amada Machine Tools Co., Ltd (Japan)

- JTEKT Corporation (Japan)

- MAG IAS GmbH (Germany)

- Schuler AG (Germany)

- Makino (Japan)

- Hyundai WIA (Korea)

- Komatsu Ltd. (Japan)

- Okuma Corporation (Japan)

- FANUC Corporation (Japan)

- XYZ Machine Tools (U.K.)

- Mitsubishi Heavy Industries Machine Tool Co., Ltd. (Japan)

- General Technology Group Dalian Machine Tool Corporation (Liaoning Province)

- ANCA Group (Australia)

Recent Developments

- In July 2024, Meltio and its partners introduced new hybrid CNC machines. Incorporating the Meltio Engine CNC Integration into JMT's range of products enables the production of intricate metal components from wire feedstock, ensuring full material utilization and a safe working atmosphere.

- In September of 2023, DMG MORI CO., LTD. declared the acquisition of KURAKI, a CNC machine manufacturer. The former company plans to increase the market for CNC horizontal boring and milling machines by integrating digitalization and automation technologies through the acquisition.

- In August 2023, OKUMA Corporation launched a next-generation machine control - Okuma OSP-P500. The device comes with twin-core computer processors that provide enhanced machine processing capabilities. It also comes with Digital Twin Technology, enabling accurate machining simulations to be generated on a computer.

- In April 2023, Mitsubishi Electric India CNC merged forces with SolidCAM, a provider of computer-aided manufacturing (CAM) software. SolidCAM provides various machining solutions, including high-speed roughing and finishing, for industries like Medical, Die & Mold, Auto & Aerospace, and Machine Element parts, among others, through collaboration.

- In July 2022, DMG Mori Co. Ltd. revealed the creation of a new subsidiary named “WALC Inc.” to advance the digital transformation of the manufacturing industry by innovating AI, IoT, and cloud computing technology.

- In March 2022, WIDMA introduced the Hobgrind HG200, a five-axis CNC machine designed specifically for regrinding high-precision hobs and shaper cutters of spur and helical types. This machine is perfect for gear manufacturers, particularly those who want to carry out re-grinding operations in their facilities with comprehensive quality control, as well as enjoying the advantages of lower inventory levels and lead time.

Market Segmentation

By Type

- Lathe Machines

- Milling Machines

- Laser Machines

- Grinding Machines

- Welding Machines

- Winding Machines

- Others

By End Use

- Automotive

- Aerospace & Defense

- Construction Equipment

- Power & Energy

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting