What is the Consumer IoT Market Size?

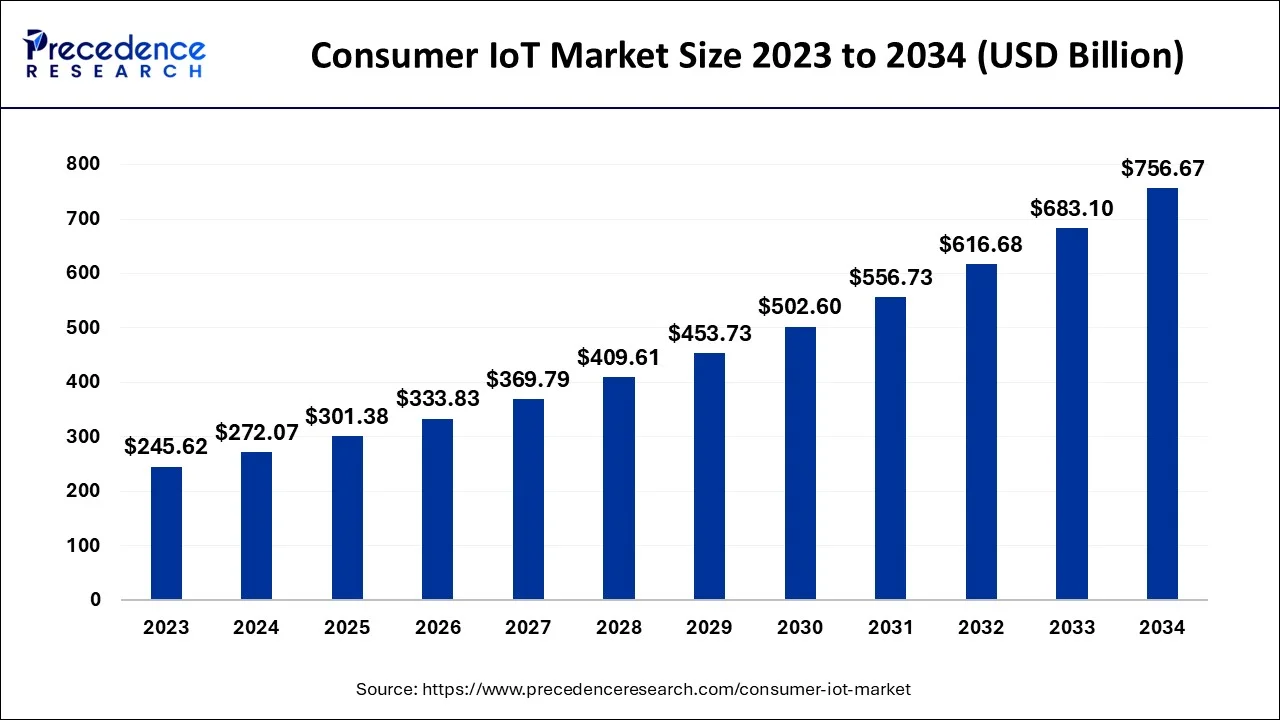

The global consumer IoT market size is accounted at USD 301.38 billion in 2025 and predicted to increase from USD 333.83 billion in 2026 to approximately USD 830.24 billion by 2035, representing a CAGR of 10.66% from 2026 to 2035.

Consumer IoT Market Key Takeaways

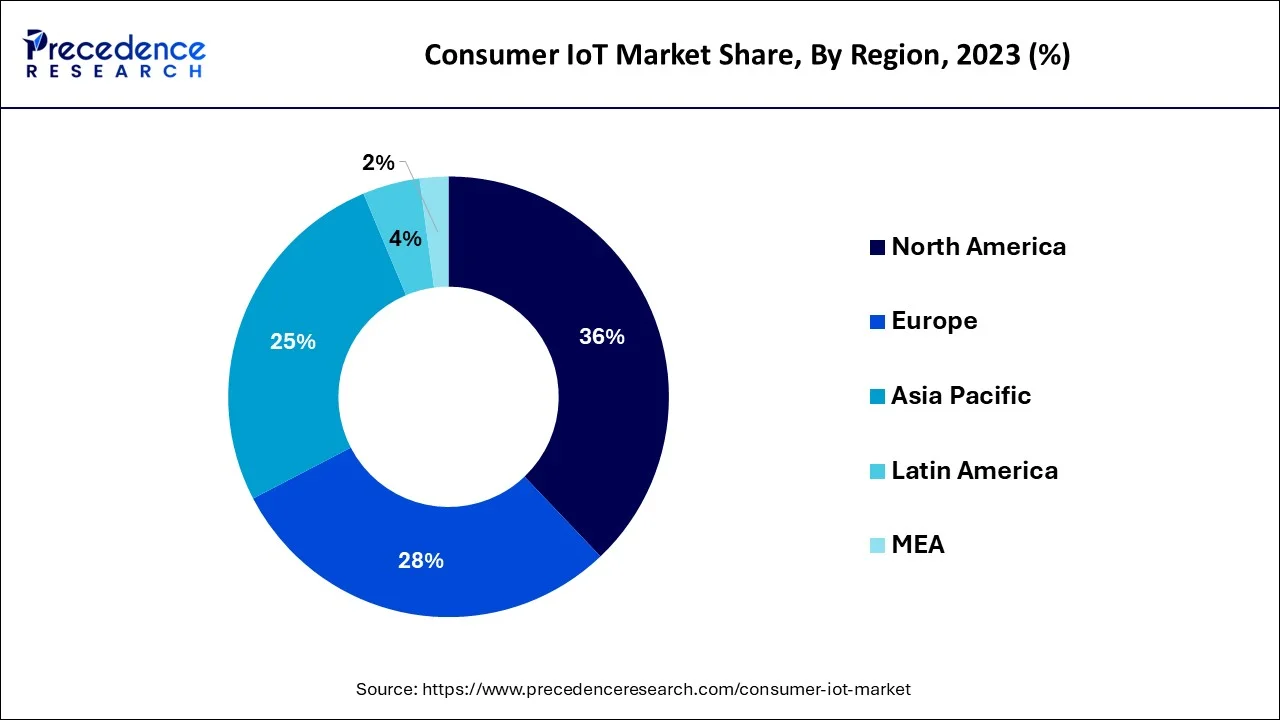

- By geography, the North America captured more than 36% of the total share in 2025.

- By component, the hardware components segment generated more than 37% of revenue share in 2025.

- By component, the services components segment is expected to expand at the fastest rate between 2026 and 2035.

- By connectivity technology, the wireless connectivity technology segment is predicted to grow at the largest market share of approximately 12% in 2022.

- By application, the consumer electronics segment generated more than 35% of the total share in 2025.

- By application, the wearable devices segment is projected to grow the fastest from 2024 to 2034.

What is Consumer IoT?

The Internet of Things (IoT) is evolving in every part of the globe, impacting every industry, particularly the consumer. The consumer Internet of Things (IoT) altered how consumers go about their everyday routines. Various businesses have integrated functionalities and sensors into their products to improve interaction with people, resource tracking, and product control.

The increasing popularity of advanced technological devices and home appliances can be attributed to growth. Consumer internet of things (IoT) tools are equipped with several microcontrollers and wireless technologies, enabling them to reveal data without requiring direct contact between users and computers. Consumer IoT represents an interconnected system of physical and digital objects designed for consumer markets, such as smart wearables, smartphones, and smart home appliances.

For instance, according to consumer research by Ampere Analysis, 52% of internet households in the UK have a voice assistant device. In the firm's survey of 25 countries, 32% claim to own a voice assistant-enabled device.

According to IDC, $742 billion will be spent on IoT technology globally by 2020. With COVID-19, 2020 experienced less spending than the previous year because hotels, theme parks, casinos, and movie theatres were closed for most of 2020. However, IoT spending double-digit by 2021 and is expected to exceed $1 trillion by 2023.

How is AI contributing to the Consumer IoT Industry?

The influence of artificial intelligence is such that the Consumer IoT devices have become a category of adaptive systems that can recognize and interpret user behavior and environmental patterns. The functions that AI provides are very diverse; among them, we find the following: autonomous decision-making, personalization, predictive maintenance, security monitoring, and efficient resource usage.

AI consumes a lot of data from different sources, such as sensors, and interprets it very skillfully, thus turning it into useful information, and at the same time, it gets rid of noisy data, refining the communication with people through voice.

Market Outlook

- Industry Growth Overview:

Consumption of IoT is a steady expansion as smart homes and personal devices are becoming a must in daily digital lifestyles. - Sustainability Trends:

Design strategies focus on energy efficiency, circular materials, ethical sourcing, and the reduction of electronic waste being reduced - Global Expansion:

Consumer IoT is being adopted globally, not only by tech hubs but also in various emerging consumer markets. - Major Investors:

SoftBank Vision Fund, BlackRock, Intel Capital, and Jeff Bezos are the prominent investors. - Startup Ecosystem:

Niche solutions are provided by startups, and hence, they drive

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 301.38 Billion |

| Market Size by 2035 | USD 830.24 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 10.66% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Connectivity Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

The introduction of 5G

The 5G is predicted to accelerate market expansion. The 5G networks are anticipated to improve the reliability and execution of connected gadgets significantly. IoT and 5G lay the groundwork for medical devices, wearables, smartphones, and vehicles. Developing a 5G-powered IoT system propels the growth of smart cities and connected vehicle networks, benefits manufacturing firms, and enhances healthcare operational efficiency.

According to Ericsson, 5G will have 40% of the total population and 1.5 billion subscription services by 2024, making 5G the highest generation globally incorporated. This is driven by novel, inventive solutions reprocessing present infrastructure and a spectrum. Parallel to 5G deployment, cellular IoT achieves significant benchmarks toward becoming the leading method for broad IoT applications.

According to the Department of Telecommunications (DoT) 2018 National Digital Communication Policy (NDCP), an eco-system for 5 billion connected devices will be created by 2022. As a result, it is predicted that approximately 60% of the 5 billion connected devices, or 3 billion, will exist in India by 2022.

Restraints

Data breach

Cyberattacks risk increases as these digital technologies become more prevalent in our daily lives as consumers. New products are constantly introducing flaws into the market. According to Consumer Reports, 11 security flaws were discovered in four new video doorbells and home security cameras in 2021, alerting their owners to hacking or leaks of personal data, such as email addresses and Wi-Fi passwords.

Challenges

Inadequate updates, as well as outdated software

Updates are required to ensure the security of IoT devices. Devices should be updated regularly as soon as new vulnerabilities are discovered. Smartphones and computers typically receive monthly (or more frequently in some cases) updates, but this is only sometimes the case for IoT devices. These devices often lack a well-defined process for security updates and patches.

When designing IoT devices, OEMs frequently need to prioritize cyber security. As a result, devices that are more vulnerable to cyber-attacks are produced. This means that a device that was secure when the customer first purchased it is now unsafe and easily accessible to hackers and other security concerns.

Component Insights

The global consumer IoT industry comprises hardware, services, and software components. Due to the growing demand for IoT devices, the segment of hardware components accounts for approximately 37% of total revenue in 2023. These devices comprise actuators, gadgets, sensors, machines, and appliances that conduct data across networks and are designed for applications. Furthermore, ongoing technological advances are anticipated to favor segmental expansion during the projected period.

The sector of services component is predicted to expand at the fastest rate between 2023 and 2032, owing to the growing demand for solutions that encourage the operation of consumer IoT tools. The end-to-end software development solutions, including project planning, testing, and deployment, are offered by service providers to consumer IoT. They also provide consulting services like IoT tech stack, architectural engineering, software audit, and others.

Connectivity Technology Insights

The wireless connectivity technology sector is estimated to grow at the highest market share of approximately 12% in 2023due to the network's better scalability. Hardware installations are not required in wireless connectivity technology and are easily extended without regard for facility obstructions. Wireless sensors are made up of nodes which may expand by adding more nodes as needed. Furthermore, they are cost-effective due to current developments in wireless technology and the rising amounts of firms.

The wired connectivity technology section also reported a major share in 2022 and is predicted to expand steadily as this connectivity method remains popular among users. Ethernet is typically used for the connectivity of networks in wired networks, which makes them exceptionally efficient. Additionally, as this technology is not influenced by device distance or placement, they provide faster data transmission speeds. Furthermore, wired networks are assured because they are equipped with a LAN firewall.

Application Insights

The consumer electronics division accounted for greater than 35% of the total share in 2023 due to the rising consumer preference for embracing innovative consumer electronics gadgets throughout residential areas. Home automation is now a reality due to the advancement of technologies like digital assistants, sensors, cloud computing, and advanced networking. According to reports, by 2023, almost 15% of households worldwide are estimated to have a smart home electrical device installed.

The wearable segment is expected to grow fastest from 2023 to 2032 due to expanding disposable incomes, rising internet users, and substantially lower retail prices of such devices. Furthermore, wearable devices benefit healthcare providers and patients by assisting in heart-rate monitoring, hand hygiene monitoring, glucose monitoring, depression monitoring, Parkinson's disease monitoring, and other activities.

As a result, the market is expected to benefit from the increasing acceptance of wearable consumer IoT devices for healthcare monitoring.

Regional Insights

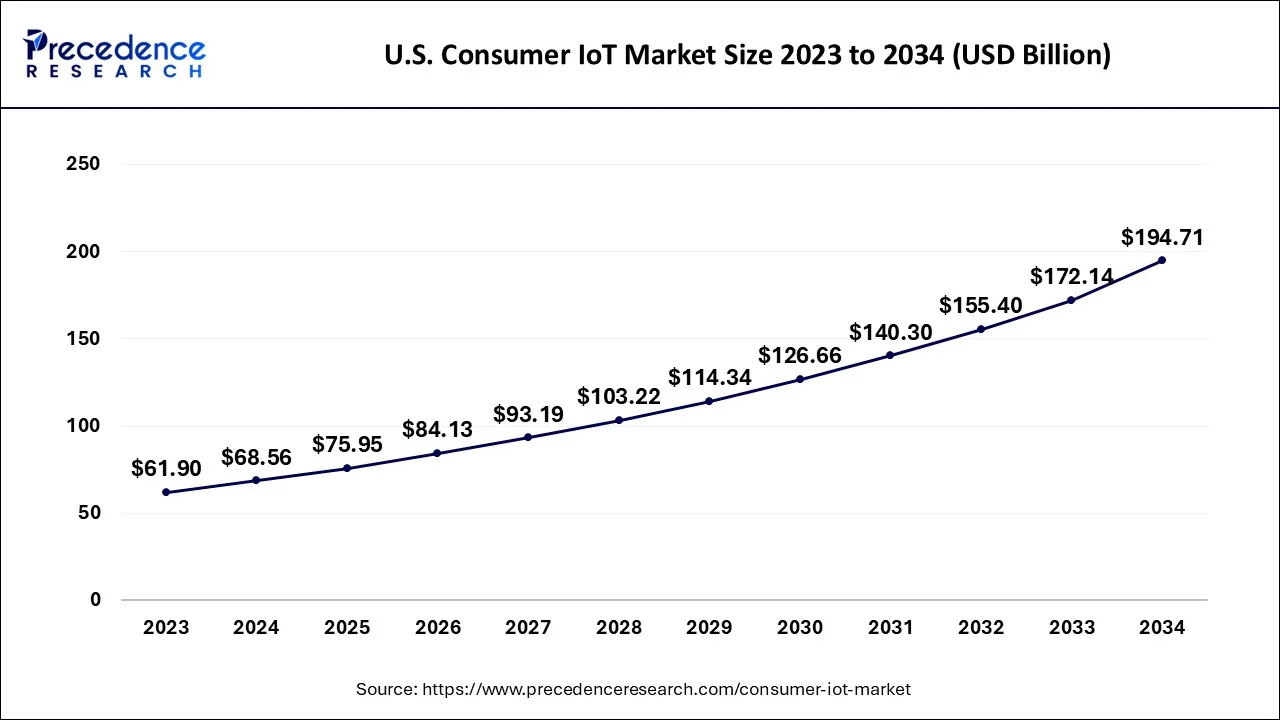

U.S. Consumer IoT Market Size and Growth 2026 to 2035

The U.S. consumer IoT market size is exhibited at USD 75.95 billion in 2025 and is predicted to be worth around USD 213.39 billion by 2035, expanding at a CAGR of 10.88% between 2026 and 2035.

North America reported approximately 22% of the total share in 2025 and thus is predicted to expand during the projected period. This is attributed to enhanced product demand in the region, particularly for fitness-tracking gadgets. Furthermore, the growing health consciousness due to the increasing prevalence of chronic diseases and the number of diabetes patients, as well as the convenience of the use of medical devices, are driving market growth in this region.

The increased adoption of smart connected devices and the rapid digitalization of various consumer end-use applications have fueled the growth of IoT in North America. As per the 2022 ValuePenguin survey of around 1,500 users, 45% of Americans already use smartwatches, for instance, Apple Watches and Fitbits, and 69% are ready to utilize a fitness tracker to have health insurance discounts.

With the increasing acceptance of innovative home solutions in the area, Asia Pacific recorded a significant CAGR between 2023 to 2032. Asia Pacific is expected to be one of the important markets for IoT market growth. Asia Pacific is growing due to rising internet penetration, increased adoption of cloud-based services among small and medium-sized businesses, and government policies encouraging digitalization and innovative city development.

Furthermore, introducing high-speed networking technologies has been a major driving force in the market. Moreover, the growing interest of multinational players in the region and rising demand from developing economies such as India and China are expected to drive market growth. Ericsson predicts that cellular IoT connections will surpass 4 billion by 2024, owing to strong adoption in North-East Asia.

According to IDC's recent Worldwide Semiannual Internet of Things Spending Guide, the APAC IoT market will grow by 9.1% in 2022, up from 6.9% in 2021.

How is North America leading in the Consumer IoT Market?

North America is the leader in the Market mainly because of its significant purchasing power, cutting-edge digital infrastructure, and the adoption of smart technologies among the first. The demand is coming from areas like smart homes, wearables, and health devices, which are all supported by strong connectivity, mature platforms, and the industry's thorough focus on secure, user-centric device ecosystems.

U.S. Consumer IoT Market Trends:

The U.S. is the main contributor to the growth of the region by creating a technology pool consisting of companies that cooperate in the development of the Consumer IoT. Growing trust in the market is due to the fact that the companies are giving priority to user-friendly devices, and security issues are being considered through international certification schemes, which are opening up the adoption of smart home systems, wearables, and connected mobility solutions among consumers.

How is Asia-Pacific performing in the Consumer IoT Market?

The Asia Pacific region is the fastest developing market for Consumer IoT, with urbanization, more people with disposable income, and better digital connectivity all playing an important role. The wide acceptance of smart devices, government-supported smart city projects, and price cuts are the factors that lead to the fast penetration of IoT across a large variety of consumers.

China Consumer IoT Market Trends:

China is the undisputed leader in the market in the Asia Pacific, thanks to its unbeatable production capacity and the huge number of potential customers. The market for smart homes, mobile devices, and platforms that are interconnected is so large that it allows for the quick scaling up and taking over of the entire lifestyle tech space.

What are the Driving Factors of the Consumer IoT Market in Europe?

Europe has a wide range of opportunities to develop the market, as it is still at a mature stage, and it is mostly driven by factors such as smart city investments, sustainability, and privacy regulations that are being enforced strictly. The regulations on interoperability and cybersecurity are also contributing to the gradual uptake of energy-efficient smart devices in households, thus promoting responsible innovation across the application areas of residential, urban, and consumer technology.

Germany Consumer IoT Market Trends:

Germany is one of the top European countries when it comes to adopting Consumer IoT technologies, especially in the area of smart home automation. The combination of excellent engineering skills, an innovation-driven culture, and the market's need for high-quality and reliable products compels device manufacturers to produce and market highly dependable and durable connected solutions.

Consumer IoT Market-Value Chain Analysis

- Inbound Logistics: Receiving, storing, and managing raw materials or inputs from suppliers internally by including them in operational systems.

Key players: Qualcomm, Intel for chipsets - Operations: Producing end-products that are Consumer IoT products and connected digital services from raw materials and inputs.

Key players: Foxconn, Samsung - Outbound Logistics: Collecting finished Consumer IoT products, storing them, and then distributing them physically to the end customers.

Key players: UPS, FedEx, DHL, Amazon Logistics - Marketing and Sales: Notifying consumers about the existence of, and then persuading them to purchase, connected consumer devices, and finally, helping them transact.

Key players: Google (Nest/Pixel), Apple (HomeKit products), Amazon - Consumer IoT Service: Handling installation, repair, customer support, warranty, and lifecycle management of devices in the Consumer IoT category.

Key Players: Amazon Customer Service, AppleCare, Google Nest Support

Top Companies in the Consumer IoT Market & Their Offerings:

- Alphabet Inc. (Google): Offers the Android ecosystem and Google Nest smart home devices, thus allowing connected living through integrated platforms and automation.

- Cisco Systems, Inc.: Provides networking infrastructure and security technologies that support consumer IoT ecosystems by making them scalable and secure.

- AT&T Inc.: Supplies cellular connectivity services that give access to a dependable network for consumer wearables, vehicles, and connected devices.

Consumer IoT Market Companies

- Alphabet, Inc.

- Cisco Systems, Inc.

- AT&T

- Amazon.com, Inc.

- Apple Inc.

- IBM Corp.

- Honeywell International Inc.

- Texas Instruments

- LG Corp.

- Microsoft

- Intel Corp.

- Schneider Electric

- Sony Corp.

- Samsung

- TE Connectivity

Recent Developments

- Amazon.com, Inc. released the Halo Band in June 2020, which includes an accelerometer, temperature sensor, two microphones, and heart rate monitor.

- Alphabet Inc.-owned Google acquired Fitbit in 2021 to develop its mark in the wearables market. The company does not create wearables but offers software to build smartwatches.

- Koninklijke Philips N.V. earned CE marking and FDA approval for its wireless wearable biosensor to monitor coronavirus patients in May 2020.

- Sony unveiled new true wireless earbuds and over-ear headphones in April 2020, including two new mid-range models. These earphones continuously analyze ambient sound components and, among other things, provide one-touch access to Siri.

- In February 2025, Verizon Business partnered with the Atlanta Hawks and State Farm Arena to launch Verizon Sensor Insights, a solution for managing IoT infrastructure. It offers near real-time data intelligence to optimize the performance of technical equipment in the arena.

(https://www.verizon.com) - In July 2025, the ICO is consulting on draft guidance for consumer IoT products and services. A public consultation is running from 16 June to 7 September NUM0. (https://www.lewissilkin.com)

Segments Covered in the Report

By Component

- Processor

- Hardware

- Sensors

- Temperature

- Accelerometers

- Pressure

- Camera Modules

- ECG

- Humidity

- Light

- Others

- Logic Devices

- Memory Devices

- Sensors

- Software

- Data Management

- Security

- Remote Monitoring

- Network Management

- Others

- Services

By Connectivity Technology

- Wired

- Wireless

By Application

- Consumer Electronics

- Dishwasher

- Washing Machine

- Others

- Healthcare

- Pulse Oximeter

- Blood Pressure Monitor

- Blood Glucose Meter

- Others

- Wearable Devices

- Body-worn Cameras

- Smart Watch

- Fitness Tracker

- Smart Glasses

- Others

- Automotive

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting