What is the Risk Analytics Market Size?

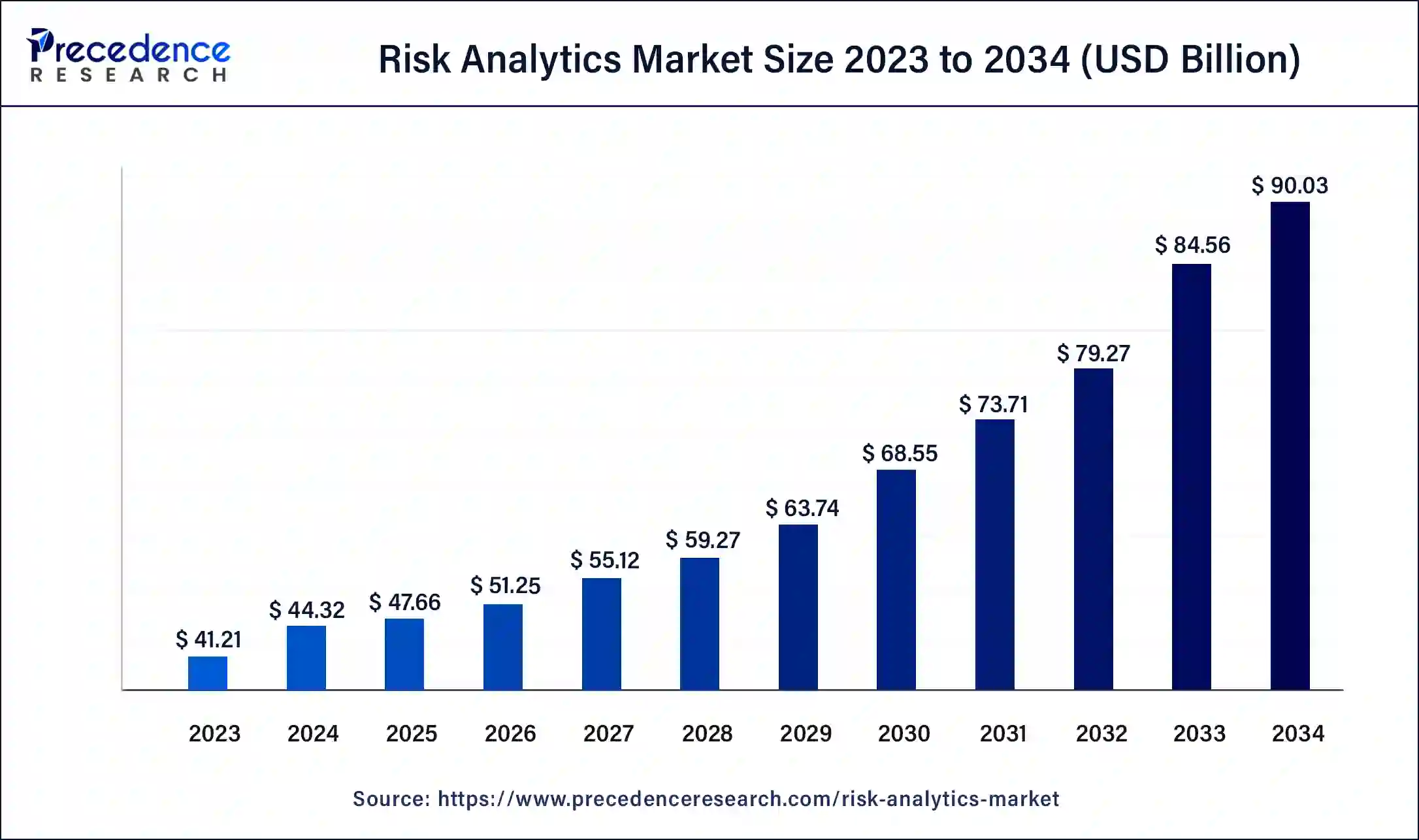

The global risk analytics market size is valued at USD 47.66 billion in 2025 and is predicted to increase from USD 51.25 billion in 2026 to approximately USD 90.03 billion by 2034, expanding at a CAGR of 7.34% from 2025 to 2034.

Risk Analytics Market Key Takeaways

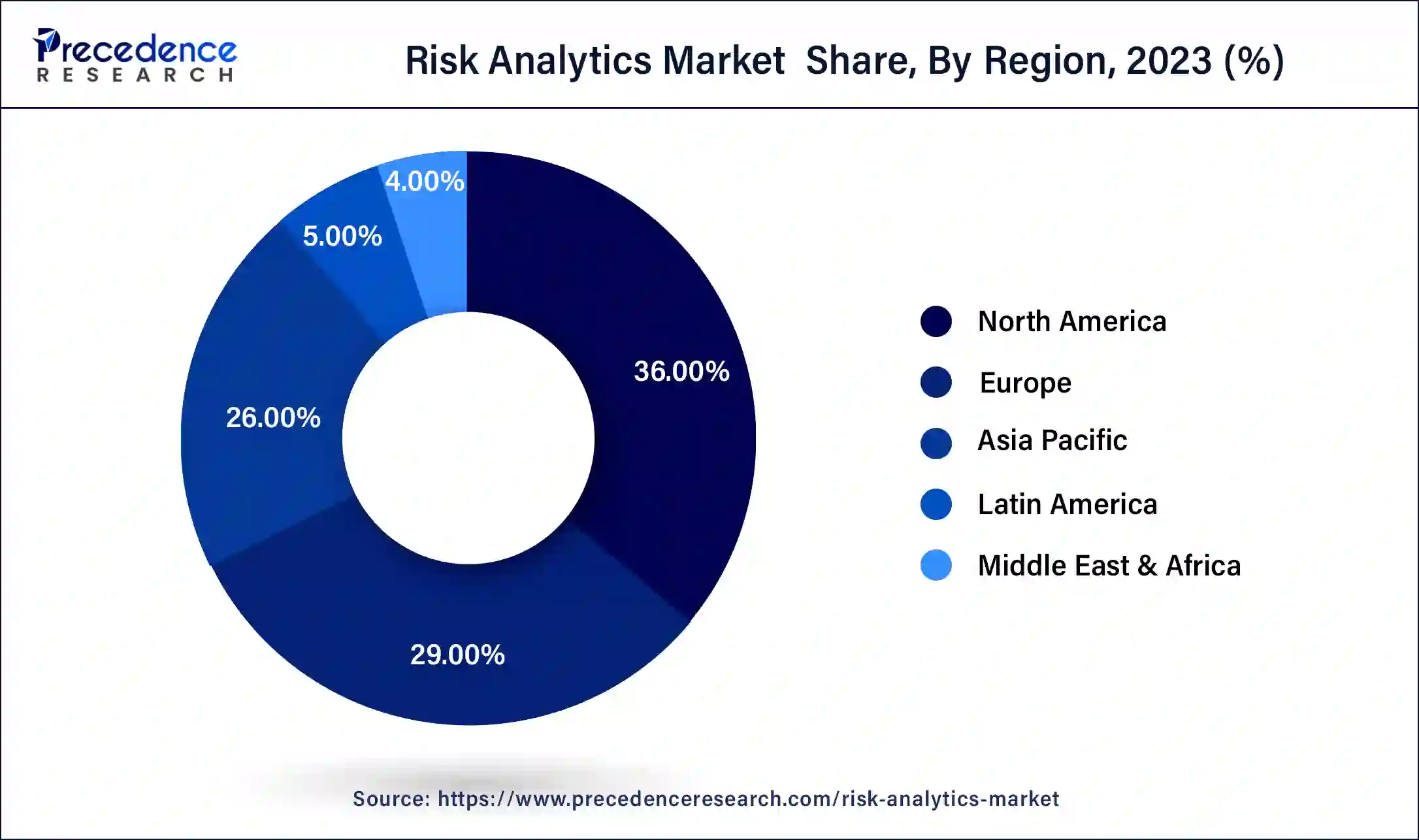

- North America contributed more than 36% of the revenue share in 2024.

- Asia Pacific is expected to witness the fastest rate of growth during the forecast period.

- By Component, the software segment dominated the market in 2024.

- By Deployment, the on-premise segment dominated the global risk analytics market in 2024.

- By Deployment, the cloud-based segment is expected to witness the fastest rate of growth during the forecast period.

- By Enterprise Size, the large enterprise dominated the market in 2024.

- By Risk Type Application, the financial risk segment led the global market in 2024.

- By Risk Type Application, the operational risk segment is expected to grow significantly during the forecast period.

- By End-user, the banking, financial, service, and insurance (BFSI) segment dominated the market in 2024.

- By End-user, the segment is expected to sustain the position throughout the forecast period.

Market Overview

Risk analytics is a tool for analyzing and measuring risk actively. Risk analytics uses statistical methods and data analytics to measure, identify the risk, and manage it systematically and accurately. It collects data insights and analyzes the potential risks and potential effects. Several organizations use this information to make informed decisions, handle risks, and optimize risk management strategies. Risk analytics used in risk identification and assessment like risk analytics helps to find out the potential risks and problems within the organization and projects.

It supports the decision-making process by providing valuable insights. These evaluate the potential risks scenario. Also, risk analytics is helpful for the organization to allocate its resources effectively. Risk analytics allows organizations to develop robust risk-management capabilities.

What Is Driving the Rapid Expansion of the Global Risk Analytics Market?

The global risk analytics market is growing as businesses across finance, healthcare, IT, retail, and manufacturing look to advanced analytics capabilities in order to predict risk, reduce risk of loss, and improve business operations. The willingness to invest in remedial action patterns and plans is changing from a reactive state of risk management decision-making (typically defaulting to prior responses) to focusing on proactive decision-making that is contributing to ongoing vulnerabilities to the risk climate through emerging AI, big data, and cloud environments.

The increasing cyber incidents, regulatory demand to businesses, and the demand for real-time introspection have increased business investment in predictive tools to minimise both their vulnerabilities to risk of loss and support for continued business operations.

Market Outlook

- Industry Growth Overview: Given the shift towards AI-enabled risk intelligence amid heightened cyber threats, increasing regulations, and ongoing economic uncertainty, the risk analytics market is on a sustained upward trajectory. Enterprise-wide digital risk programs will continue to rely on cloud-native platforms and predictive analytics.

- Sustainability Trends: Companies are building ESG-oriented risk tools to help them monitor climate-risk exposure, keep data usage in check, and promote transparency in governance. Sustainable compliance reporting mechanisms are driving investments to embed ethical AI while streamlining operational efficiency.

- Global Expansion: International companies are expanding analytics to multiple jurisdictions to create a singular view of risk visibility and operational regulatory compliance. Cross-regional investments, including multi-cloud architectures of unified threat intelligence support will drive risk monitoring across counterparty jurisdictions and strengthen data governance on a global scale.

- Startup Ecosystem: Aggressive startups are joining the risk analytics sector with lightweight, AI-driven risk platforms that offer real-time anomaly detection, automated decisioning for lower-cost cloud deployment. Their speed and nimbleness to adapt, along with niche focus have heightened competition with their added pressure on technology and evolution.

Risk Analytics Market Growth Factors

Risk analytics tools are responsible for overcoming cyber threats and they measure and predict the risk more precisely. Organizations now improve their performance using increased computing capabilities, big data, and advanced analytics. Risk analytics is used for several applications for organizations. Rising cases of cyber-attacks, and data enforcement in the organization are driving the growth of the risk analytics market.

There are several industries that are adopting risk analytics tools for risk management, industries such as the banking and financial sector, manufacturing, healthcare, IT and telecommunication, etc. are driving the growth of the risk analytics market. The primary point of risk analysis is identifying the problematic area of the business. One of the major factors of risk analytics is to identify and better understand how risk will financially hamper the business. Rising demand from the organization for better risk management of the company is driving the growth of the risk analytics market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 90.03 Billion |

| Market Size in 2026 | USD 51.25 Billion |

| Market Size in 2025 | USD 47.66 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.34% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise, Risk Type Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising risk on cyber attacks

High-profile cyberattacks and data breaches have raised public awareness of cyber risks. As a result, organizations are under more scrutiny and pressure to protect customer data, making risk analytics more critical. Many organizations rely on third-party vendors and service providers, which can introduce additional cyber risk. Risk analytics can be used to assess and manage third-party cyber risk to protect the organization's ecosystem. Risk analytics can help organizations allocate resources more effectively by identifying high-priority vulnerabilities and areas of concern. This ensures that security efforts are focused on the most critical areas.

Restraints

Regularity compliance

Regulatory compliance often involves complex and frequently changing rules and regulations. Financial institutions and other organizations must stay up-to-date with these regulations to ensure they are in compliance. This can make it challenging for them to implement risk analytics solutions that are flexible enough to adapt to changing requirements. Regulatory compliance often requires organizations to maintain detailed records and documentation to demonstrate that they are following the rules.

Opportunity

Advancements in risk analytics methods

As businesses collect and process more data for risk analytics, there is a growing need for advanced methods to ensure data security and privacy. Vendors that can offer robust solutions for data protection will find increased demand in the market. Many industries are subject to stringent regulatory requirements.

Advanced risk analytics methods can help organizations stay in compliance with these regulations and demonstrate their commitment to effective risk management, reducing the risk of legal and financial penalties. Improved risk analytics methods can help businesses streamline their risk management processes and reduce costs associated with risk mitigation and compliance. This is particularly important for financial institutions and industries with heavy regulatory requirements.

Segment Insight

Component Insights

The software segment dominated the risk analytics market in 2024. Risk analytics software uses the technology for the management and organizational dynamics and problems. Risk analytics software is used by several industries like banking and finance, manufacturing, IT and telecommunication, etc. Risk analytics software is used for several operations in organizations such as risk identification and assessment, decision-making processes, increasing risk management strategies, and other organizational operations.

Deployment Insights

The on-premise segment dominated the risk analytics market in 2024. In industries where data security and compliance with regulatory requirements are critical, on-premise deployments may still be preferred. Some organizations, especially in highly regulated sectors like finance and healthcare, may choose to keep their risk analytics solutions on-premises to maintain greater control over data and ensure compliance with data protection regulations. On-premise solutions often offer more flexibility for customization and integration with existing infrastructure. This is important for businesses that have complex IT ecosystems and want to tailor their risk analytics tools to specific needs.

The cloud-based segment is anticipated to witness the quickest growth during the forecast period. Cloud providers handle updates, patches, and maintenance, reducing the burden on internal IT teams and ensuring that risk analytics software is up to date. Cloud-based risk analytics solutions can be easier and quicker to adopt compared to on-premises solutions, making them attractive to businesses looking for rapid deployment.

Enterprise Insights

The large enterprise dominated the risk analytics market in 2024; the segment will continue the trend throughout the forecast period. The rapid adoption of risk analytics tools or software in large-scale enterprises is due to the substantial requirement for risk management tools to resolve major issues. Risk management tools are responsible for improving and monitoring the operations of a large-scale organization.

Risk analytics plays an important role in large enterprises, it helps several industries like the financial sector, insurance industry, supply chain management , healthcare, and cybersecurity. Large enterprises often face issues with data security and data storage; risk analytics tools and software are helpful in managing such concerns with ease. Thereby, these factors are observed to propel the segment's growth in the upcoming years.

The small and medium-scale enterprises segment is expected to witness a significant rate of growth in the risk analytics market during the forecast period. Risk analytics is able to provide a risk measurement tool in small and medium-scale organizations for assessing and management of the existing issues in the enterprises and predicting upcoming issues in the operation by analyzing the existing work process and operation of the business. Small and medium-scale enterprises are likely to be harmed by threats like financial loss, budgeting, and market risks. Risk analytic software is used to help the SMEs to overcome these kinds of risks.

Risk Type Application Insights

The financial risk segment dominated the market in 2024. Financial risk is one of the major concerns in organizational risk management. Financial risk management is the process of evaluation of potential risk and its possible impacts. It evaluates the degree of potential risk. For example, credit risk is one of the most common types of financial risk with the possibility of debtor not fulfilling their obligations. With that predictability, banks or financial institutions take precautionary steps to prevent this and to minimize the impacts as much as possible. Also in multiple organizations, internal factors are also observed to impact the organizational financial activity. Risk analytics services and solutions are widely adopted to resolve poor financial management in an organization.

The operational risk segment is expected to grow at a significant rate during the forecast period. Operational risk is directly associated with the financial loss of the company. Operational risk refers to the risk in process management and operating organizational operations at the time of planning, training, and enforcing policies. Risk analytics works in the operational risk by reducing risk from the linear process of risk assessment, identification, mitigation, measurement, reporting, and monitoring.

End-User Insights

The banking, financial services, and insurance (BFSI) segment dominated the market in 2024; the segment is observed to continue the trend throughout the forecast period. The banking and financial sectors are some of the major platforms where risk analytics is highly used due to their complex operations and financial security issues. There is major three areas of risk in the banking and finance industry that is credit, market, and operational risk. Risk analytics allow the banks to create certain policies in several areas. Security and data breaches are the major concern of the banking and financial sector. Risk analytics is designed to prevent this kind of issue and malicious behavior. The development of artificial intelligence is also impacting the growth of risk analytics in the BFSI segment for the global risk analytics market.

The manufacturing industry segment is expected to witness a notable rate of growth during the forecast period in the global risk analytics market. Manufacturing companies generate vast amounts of data from their processes, equipment, and supply chains. Risk analytics allows them to harness this data to make informed decisions and identify potential risks. This data-driven approach can help in predicting and preventing disruptions. The manufacturing sector relies heavily on complex supply chains. Risk analytics can help in monitoring and mitigating risks associated with supply chain disruptions, such as natural disasters, geopolitical issues, or supplier-related problems. This optimization is crucial to maintaining operational efficiency.

Regional Insights

U.S. Risk Analytics Market Size and Growth 2025 to 2034

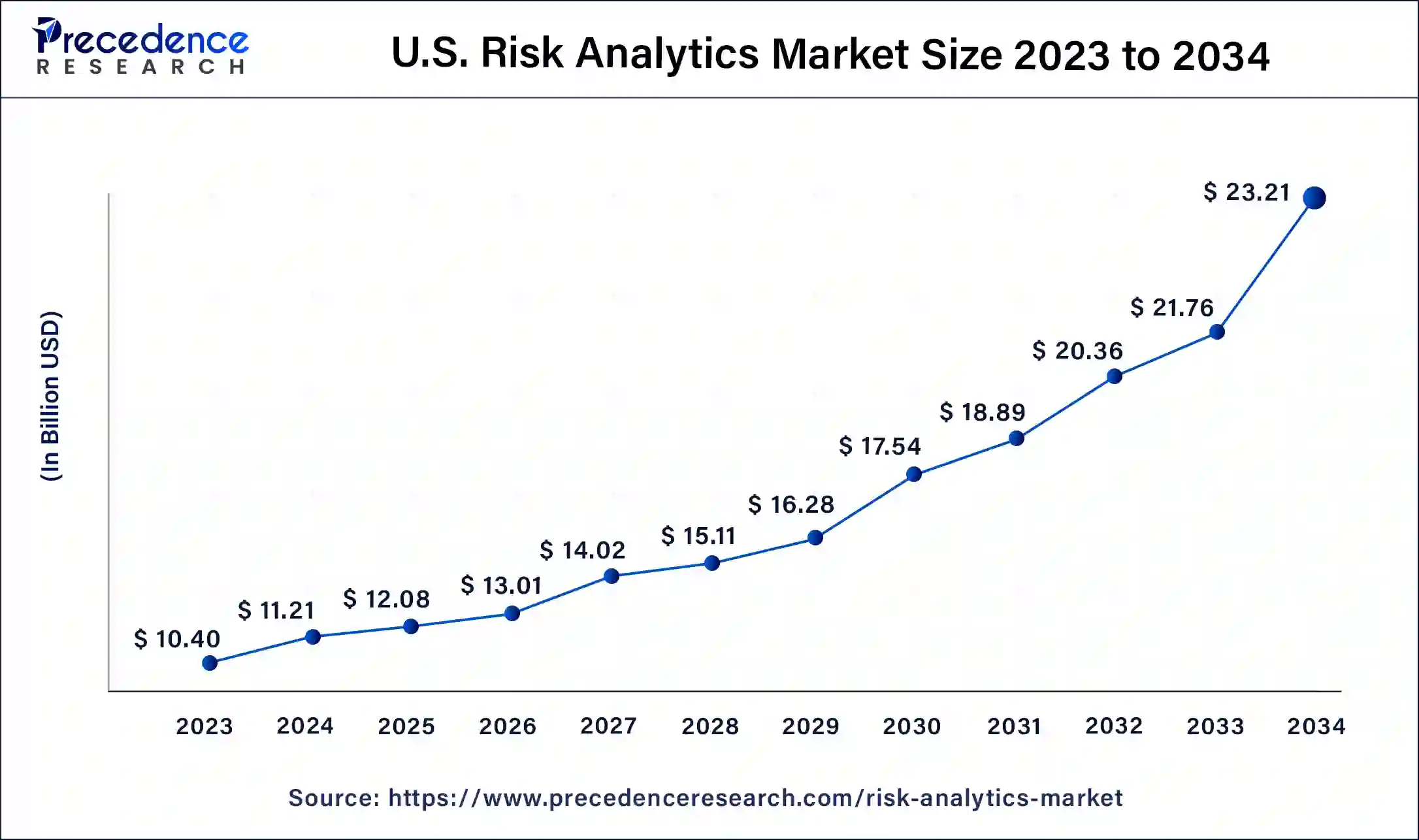

The U.S. risk analytics market size is evaluated at USD 12.08 billion in 2025 and is estimated to reach around USD 23.21 billion by 2034, growing at a CAGR of 7.55% from 2025 to 2034.

North America dominated the global risk analytics market in 2024; the region is expected to sustain the growth rate throughout the forecast period. The dominance of the region can be attributed to the rate of industrialization that requires advanced risk analytics software. Moreover, the penetration of major industries in the market, including IT, banking and other financial sectors promotes the expansion of the risk analytics market in North America. The United States and Canada are observed to be major contributors to the market in North America.

Additionally, multiple banks and financial companies in the region are actively adopting advanced solutions such as artificial intelligence and machine learning for detecting errors and malicious activities. Such expansion of end-users is observed to propel the market's growth in North America.

North America: U.S. Risk Analytics Market Trends

The U.S. market is rapidly evolving as companies increasingly rely on data driven tools to predict and mitigate a broad range of risks, including operational, financial, and strategic threats. Artificial intelligence and machine learning are driving this shift, enabling real time risk detection, adaptive scoring, and predictive risk modelling. Regulatory complexity, especially around ESG, compliance, and cyber risk, is pushing firms to invest more in integrated analytics platforms to manage governance and compliance

Asia Pacific is expected to witness the fastest rate of growth in the risk analytics market during the forecast period. Rising cases of cybercrime and substantial requirements for cyber security in the region are major factors to accelerate the market's growth in Asia Pacific. Asian countries are witnessing significant penetration of internet services in multiple industries, this is expected to boost the requirement for risk analytics software and services.

Asia Pacific: China Risk Analytics Market Trends

China's market is rapidly growing, particularly in the financial sector, as institutions increasingly leverage AI and big data for real-time credit scoring and fraud detection. Edge computing combined with 5G is enabling ultra-fast risk decisions, helping firms identify market anomalies within milliseconds. Open banking models are driving a cross-industry risk ecosystem by sharing data across banks, tech firms, and non-financial platforms.

What is driving the acceleration of Risk Analytics Demand in Latin America?

The increase in risk analytics adoption occurring in Latin America is arising from increasing digitisation, broader threats in the cyber landscape, and several countries are upgrading their regulatory framework across the banking, telecom, and public sectors. Companies are pushing forward in investing in AI-enabled platforms dedicated to improving the performance of fraud detection, credit scoring, and compliance reporting.

Nations such as Brazil, Mexico, and Chile are all looking for digital transformation efforts to motivate the expansion of maintaining transparency, automating manual risk processes and supporting expansion across multi-cloud environments in both private and public enterprises.

What Factors are Contributing to Europe's Emergence as a High-value Hub of Risk Analytics Solutions?

Europe's risk analytics market is driven in a major way by a stable regulatory framework of ensuring compliance, outlined by standards such as GDPR, PSD2, and evolving cybersecurity frameworks. Enterprises in the UK, Germany, France, Nordics are increasing the use of AI-powered analytics and governance, overseeing risk identification, financial risk assessments and stronger cyber defence strategies.

The focus on sustainable operations, building digital trust, and CSR reporting (ESG) is leading organizations to seek single risk platforms that integrate real-time insights of risk and help organizations identify long-term risk and an understanding of whether value and risk can align, whilst keeping responsible use of data as firms drive compliance across various organizations.

Value Chain Analysis

How Does the Risk Analytics Value Chain Bolster Decision-Making in a Business Setting?

The risk analytics value chain encompasses the integrated workflow of data acquisition, data cleansing, data modelling, data visualization, and data-supported decision making to help the organization act quickly to emerging risks. Vendors like SAS Institute, IBM and Oracle help to refine each of these stages, with automated data pipelines, an AI risk engine, and in-the-moment dashboards derived from the risk analytics value chain.

- Data Acquisition & Integration:Providers and platforms aggregate structured and unstructured data, supporting accuracy and consistency downstream for risk modelling.

- Advanced Analytics & Modelling:Vendor engines that are AI-enabled (Ex, IBM and SAS) simulate a risk scenario and facilitate predicting outcomes and/or compliance intelligence process automation.

- Insights Delivery & Governance:Dashboards and reporting, often provided by Oracle and others, provide the organisation with valuable information for strategic direction and business governance processes.

Risk Analytics Market Companies

- Capgemini

- BRIDGEi2i Analytics

- Accenture plc

- SAP SE

- Moody's Analytics, Inc.

- International Business Machines Corporation

- Risk Edge Solutions

- Oracle Corporation

- Fidelity National Information Services

- Inc. (FIS)

- SAS Institute Inc.

Recent Developments

- In October 2023, a major provider of advanced driver performance management solutions, “Idelic” launched SafeView. Safeview is an innovator analytic module designed and business intelligence. The latest launched to provide fleets with transformative vows into potential risks.

- In October 2023, Amwins, the specialty insurance distributor launched Amwins DNA, a proprietary and enlarged portfolio of data and analytic capabilities. The Amwins DNA was designed to serve to ensure fulfilling solutions for clients and insureds, and help in developing innovative, exclusive programs and products.

- In October 2023, a major professional service “Aon plc”, launched Aon's Franchise Solution in North America. Aon's franchise solution is powered by CoverWallet technology for designing to better advice, inform, and fr protection of franchise businesses.

- In October 2023, CENTRL, a major dealer of AI-powered third-party diligence and risk solutions for financial solutions for the financial organization launched an Invoice360 invoice module. Invoice360 is segregated with CENTRL's Bank Management Platform BNM360.

- In October 2023, a financial technology firm Fintrak Software Limited a Fintech company headquartered in Lagos. It set a benchmark in artificial financial intelligence with the launch of Fintrak Credit 360.

Segments Covered in the Report

By Component

- Solution

- Software

- Extract, Transform, and Load (ETL) tools

- Risk calculation engines

- Scorecard and visualization tools

- Dashboard analytics and risk reporting tools

- GRC software

- Others (operational risk management, human resource risk management, and project risk management)

- Services

- Professional Services

- Managed Services

- Software

By Deployment

- On-premises

- Cloud

By Enterprise

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Risk Type Application

- Financial Risk

- Strategic Risk

- Operational Risk

- Others (Reputational Risk, Environmental Risk, Third-Party Risk, And Economic Risk)

By End-User

- Banking and Financial Services

- Insurance

- Manufacturing

- Transportation and Logistics

- Retail and Consumer Goods

- IT and Telecom

- Government and Defense

- Healthcare and Life Sciences

- Energy and Utilities

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting