What is the Data Analytics Market Size?

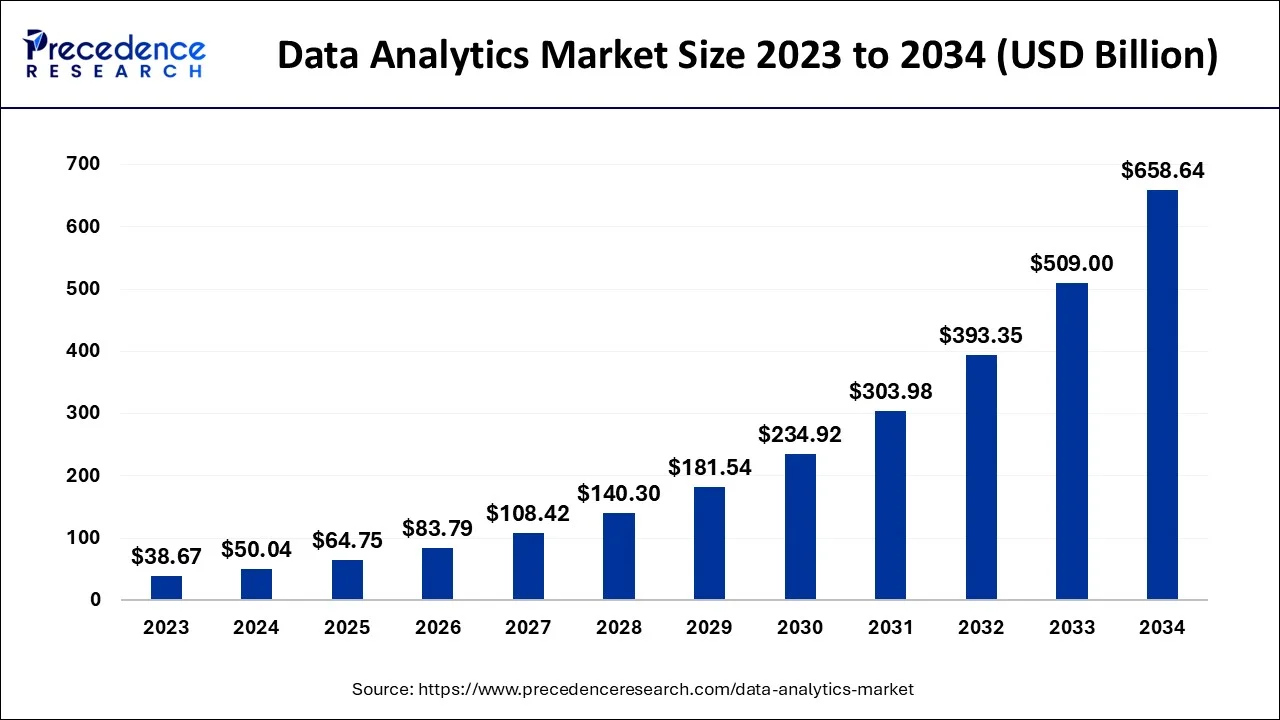

The global data analytics market size is calculated at USD 64.75 billion in 2025 and is predicted to increase from USD 83.79 billion in 2026 to approximately USD 785.62 billion by 2035, expanding at a CAGR of 28.35% from 2026 to 2035.

Data Analytics Market Key Takeaways

- By component, the software segment dominated the market with a 67.80% share in 2025.

- By component, the services segment is expected to grow at the highest CAGR of 13.20% in 2025.

- By type, the descriptive analytics segment held a 26.30% market share in 2025.

- By type, the augmented analytics segment is expected to grow at the highest CAGR of 28.35% in 2025.

- By deployment mode, the cloud segment led the market by holding 58.60% share in 2024 and is expected to grow at the highest CAGR of 13.80% over the forecast period.

- By application, the customer analytics segment dominated the market with a 19.40% share in 2025.

- By application, the fraud detection & prevention segment is expected to grow at the highest CAGR of 14.70% in 2025.

Data Analytics Market Growth Factors

Businesses need data analytics because it gives them the ability to manage, process, and simplify large datasets in real time while also enhancing their capacity for data-driven decision-making. Additionally, the main objective of big data and business analytics is to help businesses better understand their clients and target markets, hence enhancing marketing efforts. These qualities are anticipated to boost acceptance by numerous companies from various industries, which would propel the expansion of the big data market.

Numerous new business prospects are anticipated to arise as a result of recent breakthroughs in big data analytics, including social media analytics and text analytics. Furthermore, many businesses have turned to social media as their main source for a range of advertising campaigns, product promotions, and events because it is more efficient than traditional advertising. Additionally, the expansion of social media analytics is encouraged by the rise in popularity of internet-connected mobile devices like smartphones and tablets, as well as the rising number of users on social media platforms. Client demands are always changing in a business climate where organizations must operate quickly.

Companies look to historical data about their past performances in addition to current information about their customers, goods, services, and business processes in order to obtain insights and discover historical trends and patterns. In order to examine these patterns, find new business opportunities, and create strategies based on recent insights, several industries have adopted business analytics software and solutions. This is then anticipated to further accelerate the expansion of the big data market.

- Due to its ability to help businesses manage, streamline, and analyze massive amounts of data, data analytics has become an essential component of big businesses.

- Due to factors including the growing need for improved insights, rising disposable incomes, and competitive advantages, the worldwide data analytics market has grown recently.

- The rise of SaaS-based big data analytics, the rise of virtual offices generating large data volumes, and rising cloud technology expenditures are all anticipated to accelerate the market's growth.

- Emerging trends like social media analytics are projected to accelerate the rise of the market over the course of the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 64.75 Billion |

| Market Size in 2026 | USD 83.79 Billion |

| Market Size by 2035 | USD 785.62 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 28.35% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Deployment, Enterprise Size, End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Key Market Drivers

The growing trend of edge computing

- IoT device connectivity is growing as a result of machine learning algorithms, the internet of things, and artificial intelligence. The international data corporation predicts that by 2025, 152,200 IoT devices would link every minute. The need for connected devices is growing, which speeds up the implementation of edge computing. Edge computing solutions are structures that, as opposed to clouds, situate the processors closer to the data source or destination.

- Data that is located close to the source or the destination reduces network and server strain and speeds up data uploads to on-premises or cloud systems. Along with the ability to process data in real-time and with a speedier response time, edge computing is particularly applicable to the industrial IoT

Key Market Challenges

Growing security concerns

- The technology raises serious security issues, including the necessity for real-time security, the privacy of client data, and security, among others. Some of the most pressing issues that require attention are remote storage, shoddy identity administration, a lack of investment in the system and network security, human error, linked devices, and IoT applications. The company faces a significant task in overcoming these difficulties. The rise in data loss incidents and cyberattacks on customer data that have been kept across businesses is anticipated to impede market expansion.

Key Market Opportunities

Consumption of the data is rising

- Because of the development of mobile technology like smartphones or tablets and advancements in mobile networks and Wi-Fi, both data generation and consumption are constantly rising. The amount of data created, stored, duplicated, and used worldwide increased by almost 5,000 % between 2010 and 2020, going from 1.2 trillion GB to 59 trillion GB

- The data analytics industry is essential for improving business operations and minimizing data loss. The four key components of this service are volume, diversity, and velocity. Data analytics gives firms leverage by creating greater insight through unstructured data and finding data that might support business ideas. The use of analytical tools may give business analysts as well as other corporate users a competitive advantage and generate company value. Additionally, it gives companies the ability to develop their marketing strategies, accelerate corporate growth, and differentiate themselves from competitors while maintaining procurement efficiency.

Segment Insights

Component Insights

The software segment dominated the market with a 67.80% share in 2025. The dominance of the segment can be attributed to the growing demand for real-time data processing along with the increasing trend of digital transformation across various industries. Data analytics software helps market players to control the influx of data, such as complex unstructured formats, to get valuable information.

The services segment is expected to grow at the highest CAGR of 13.20% in 2025. The growth of the segment can be credited to the ongoing adoption of cloud services and the proliferation of big data in the sector. Businesses are rapidly using advanced analytics services to improve customer experience and fuel operational efficiency across all sectors.

Type Insights

The descriptive analytics segment held a 26.30% market share in 2024. The dominance of the segment can be linked to the rapid digital transformation, which results in a surge in Big Data along with the growing user engagement on social media platforms. Also, organisations use descriptive analytics to identify patterns and consumer behaviour.

The augmented analytics segment is expected to grow at the highest CAGR of 15.10% in 2024. The growth of the segment can be driven by a surge in the integration of AI and machine learning, coupled with the growing demand to extract value from large, complex datasets. Moreover, augmented analytics enables more precise and faster decision-making by minimizing reliance on specialized data scientists.

Deployment Insights

The cloud segment led the market by holding 58.60% share in 2024 and is expected to grow at the highest CAGR of 13.80% over the forecast period. Cloud solutions demand is anticipated to expand as IoT and cloud computing become more widely adopted. Modern cloud analytics tools continue to have an impact on how businesses manage, organize, and utilize the data produced by digital channels.

Enterprise Size Insights

In 2025, the large companies' market share was over 60%, making it the largest. The increased use of sophisticated analytics solutions, like customer & business analytics, for major organizations' efficient management of their enormous customer and asset databases, can be contributed to the segment's growth.

In addition, a number of significant businesses are implementing data analytics to boost their revenues, advance analytics expertise, and strengthen risk management competencies. Data analytics also helps businesses better analyze the data and disseminate critical information to those who need it.

In 2025, the SME sector controlled more than 35% of the market. It is projected that SMEs would increase their need for data analytics solutions due to the increased need for dashboards for data visualization. Additionally, SMEs choose data analytics tools to improve customer service and take better risk-related decisions.

End User Insights

In 2024, the BFSI sector held the greatest share of almost 25%. The continued use of data analytics for spotting fraudulent transactions, streamlining workflows, and managing data risks can be blamed for the segment rise. In addition, it is anticipated that the market would grow as a result of the increased utilization of BI software to offer continuous access to customer databases, secure transactions, and advance the client experience.

These technologies assist financial organizations in sorting unstructured data, guaranteeing regulatory compliance, and improving operational efficiency and consumer experiences.

In 2025, the IT and telecom sectors had a share of more than 20%. The increase in demand for tools like video conferencing and web conferencing is responsible for the market growth. Additionally, businesses in this industry are implementing cutting-edge analytical techniques to stop fraud like unauthorized access, or cloning.

Furthermore, thanks to big data analytics, telecom businesses can create micro-segments for the numerous clients they service. As a result, these businesses might be able to identify their most important clients and tailor their offers to suit their demands.

Application Insights

The customer analytics segment dominated the market with a 19.40% share in 2025. The retail sector makes extensive use of customer analytics to create individualized communications in addition to marketing initiatives. The retail industry's customers' rising demand for an omnichannel experience has fuelled the segment's rise. Well-known businesses like Walmart and Amazon have been effective in leveraging the advantages of various social media sites like Facebook. The segment is expected to develop as a result of more retail businesses focusing on providing omnichannel services to their customers.

The fraud detection & prevention segment is expected to grow at the highest CAGR of 14.70% in 2025. The growth of the segment is owing to the rise in mobile banking and online transactions, along with the need for AI- and ML-driven solutions. Furthermore, companies are treating fraud prevention as a crucial revenue-protection lever.

Regional Insights

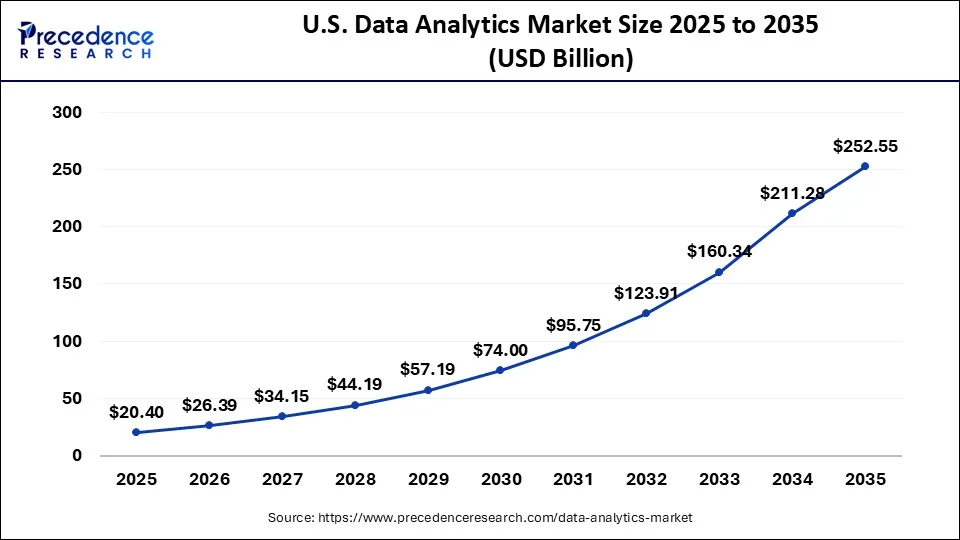

U.S. Data Analytics Market Size and Growth 2026 to 2035

The U.S. data analytics market size is estimated at USD 20.40 billion in 2025 and is expected to be worth around USD 252.55 billion by 2035, rising at a CAGR of 28.61% from 2026 to 2035.

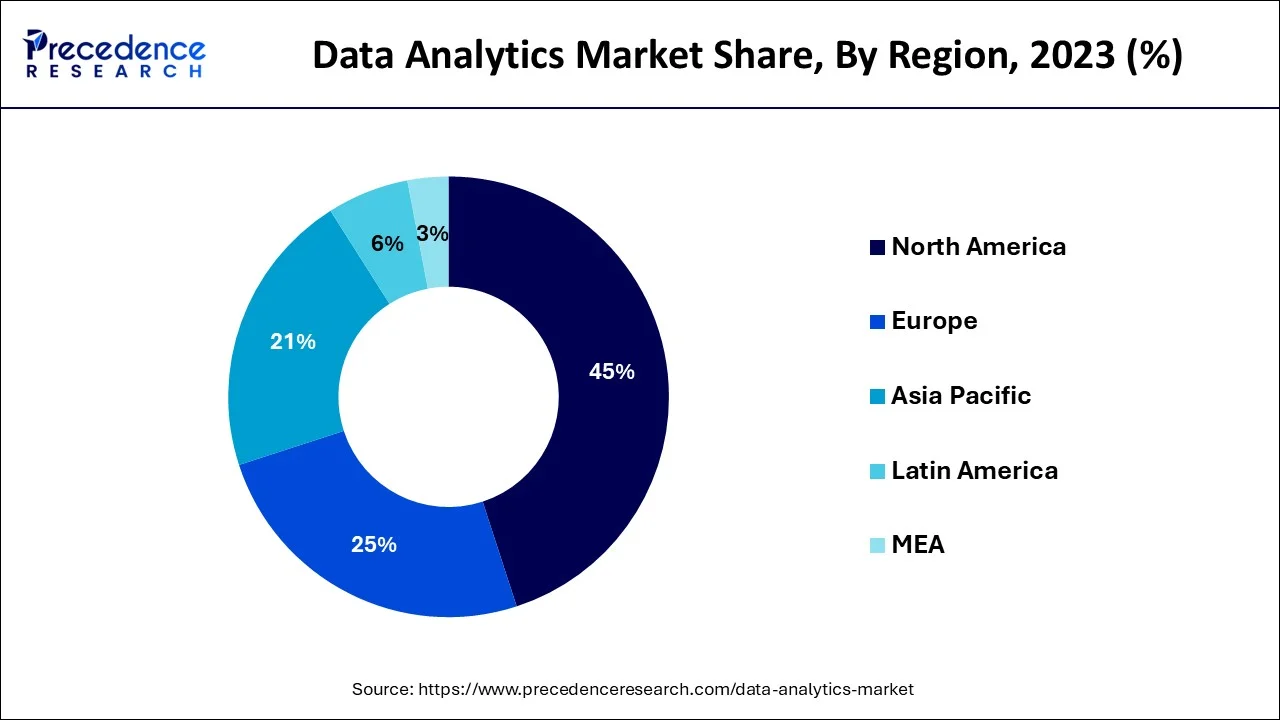

In 2024, North America accounted for a significant 45% of the worldwide market for data analytics. This is due to the availability of infrastructure that supports the use of cutting-edge analytics and the rise in the usage of cutting-edge technologies like AI and machine learning.

Over the course of the projected period, the Asia Pacific market is predicted to display a noteworthy CAGR of 23.5%. The regional market is expanding as a result of big data analytics tools and solutions being widely used there. Additionally, a number of businesses in the area are making significant investments in customer analytics to boost productivity and efficiency. Additionally, regional travel agencies including TNT Korea Travel, China Ways LLC, and Trafalgar are implementing analytical tools for uses like monitoring bus timetables, railway schedules, train breakdowns, and traffic management.

Data Analytics Market Companies

- Alteryx, Inc (US)

- IBM Corporation (US)

- SiSense Inc (US)

- Microsoft (US)

- Zoho Corporation Pvt. Ltd. (India)

- Oracle (US),

- ThoughtSpot, Inc. (US)

- SAP SE (Germany),

- Mu Sigma (US)

- Dell Inc. (US)

- Amazon Web Services, Inc. (US)

- Looker Data Sciences, Inc. (US)

- Tableau Software, LLC. (US)

- Datameer, Inc. (US)

- SAS Institute Inc. (US)

Recent Developments

- On April 20, 2022, An Augmented Intelligence business named DataRobot and Wipro formed a strategic alliance. The goal of the alliance is to accelerate the business impact of customers by delivering augmented intelligence at scale and assisting them in becoming AI-driven organizations. This collaboration will ensure that the AI strategy is implemented more quickly and that businesses receive their "data to value" more quickly. During August 2021

Segment Covered in the Report

By Component

- Software

- Data Management Tools

- Data Mining and Warehousing

- Predictive Analytics Software

- Visual Analytics Tools

- Data Discovery & Exploration Tools

- Reporting Tools & Dashboards

- Services

- Managed Services

- Professional Services

- Consulting

- Support & Maintenance

- Deployment & Integration

By Type

- Descriptive Analytics

- Diagnostic Analytics

- Predictive Analytics

- Prescriptive Analytics

- Augmented Analytics

- Real-Time Analytics / Stream Analytics

- Others

By Deployment Mode

- On-Premises

- Cloud

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Application / Use Case

- Customer Analytics

- Risk Management

- Sales & Marketing Analytics

- Supply Chain Analytics

- Operations & Process Optimization

- Financial Analytics

- Fraud Detection & Prevention

- Human Resource Analytics

- IT Operations Analytics

- Product Development & Innovation

- Others

By Organization Size

- Large Enterprises

- Small & Medium-Sized Enterprises (SMEs)

By Industry Vertical

- Banking, Financial Services & Insurance (BFSI)

- Retail & E-Commerce

- Healthcare & Life Sciences

- Manufacturing

- Telecom & IT

- Government & Public Sector

- Energy & Utilities

- Transportation & Logistics

- Media & Entertainment

- Education

- Hospitality & Travel

- Others

By Technology / Analytical Techniques

- Big Data Analytics

- Edge Analytics

- Text Analytics / Natural Language Processing (NLP)

- Social Media Analytics

- Machine Learning & AI-based Analytics

- IoT Analytics

- Mobile Analytics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting