What is the AI Data Centers Market Size?

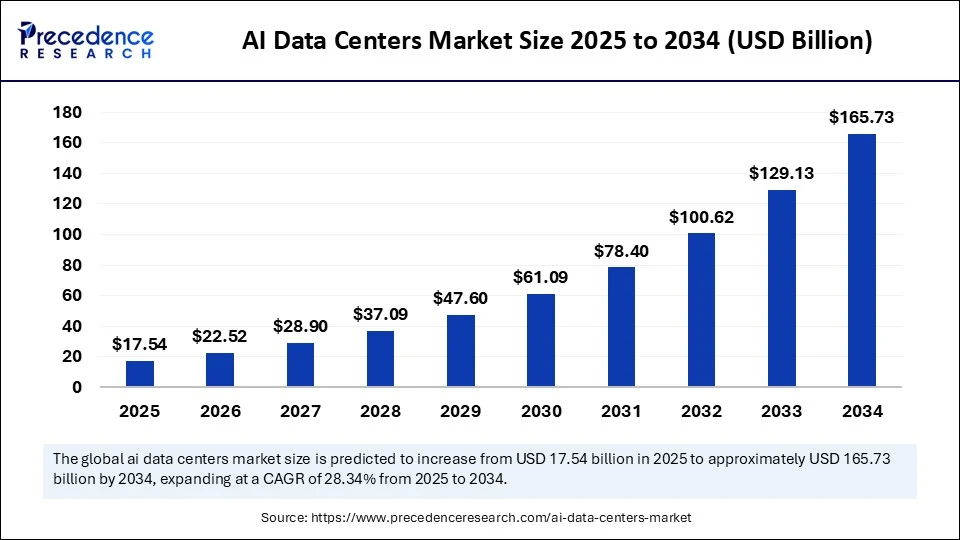

The global AI data centers market size is valued at USD 17.43 billion in 2025 and is predicted to increase from USD 22.26 billion in 2026 to approximately USD 197.57 billion by 2035, expanding at a CAGR of 27.48% from 2026 to 2035. The rising adoption of AI technologies to streamline data transmission drives the growth of the AI data centers market. The demand for high-performance computing power has increased, further contributing to market growth.

AI Data Centers Market Key Takeaways

- In terms of revenue, the global AI data centers market was valued at USD 17.43 billion in 2025.

- It is projected to reach USD 197.57 billion by 2035.

- The market is expected to grow at a CAGR of 27.48% from 2026 to 2035.

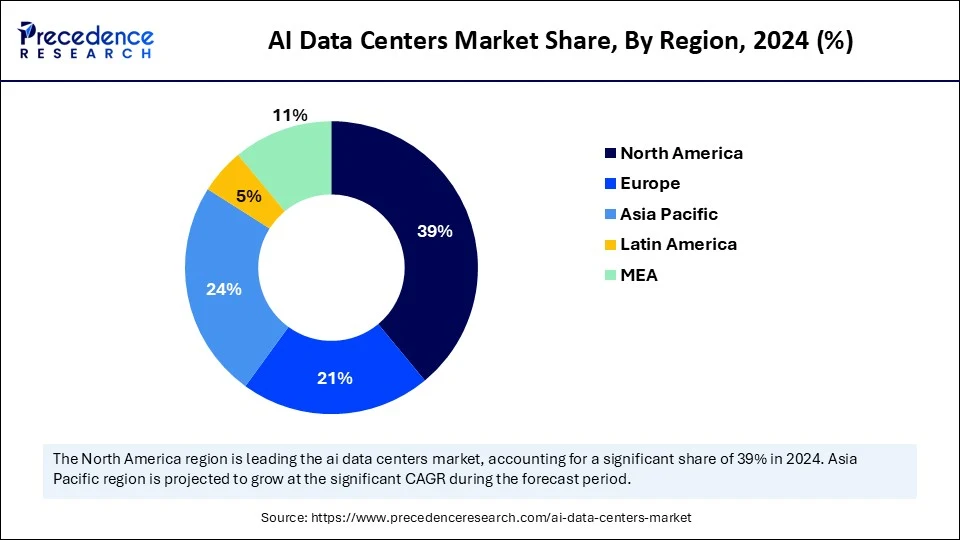

- North America dominated the AI data centers market with the largest share of 38% in 2025.

- Asia Pacific is expected to grow at a significant CAGR from 2026 to 2035.

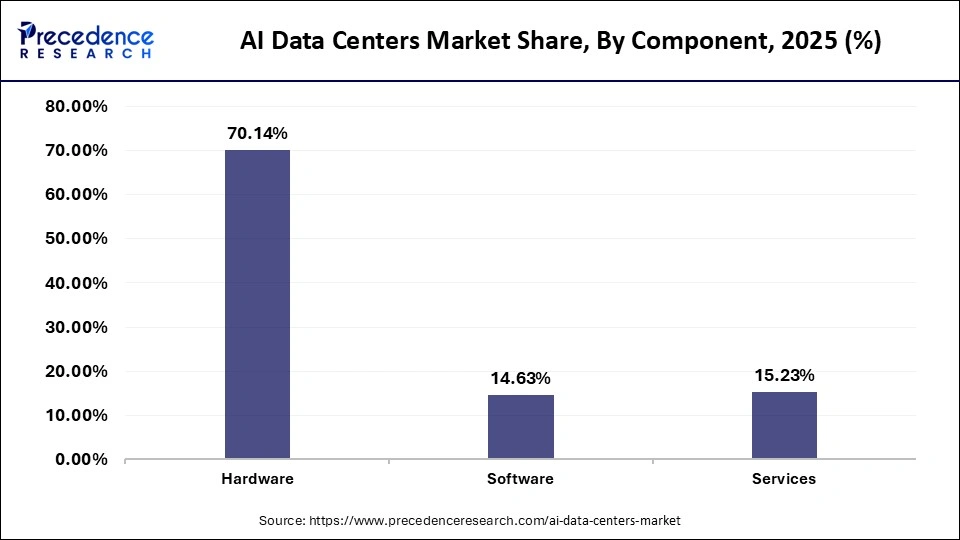

- By component, the hardware segment contributed the biggest market share of 70.14% in 2025.

- By component, the services segment will expand at a significant CAGR between 2026 and 2035.

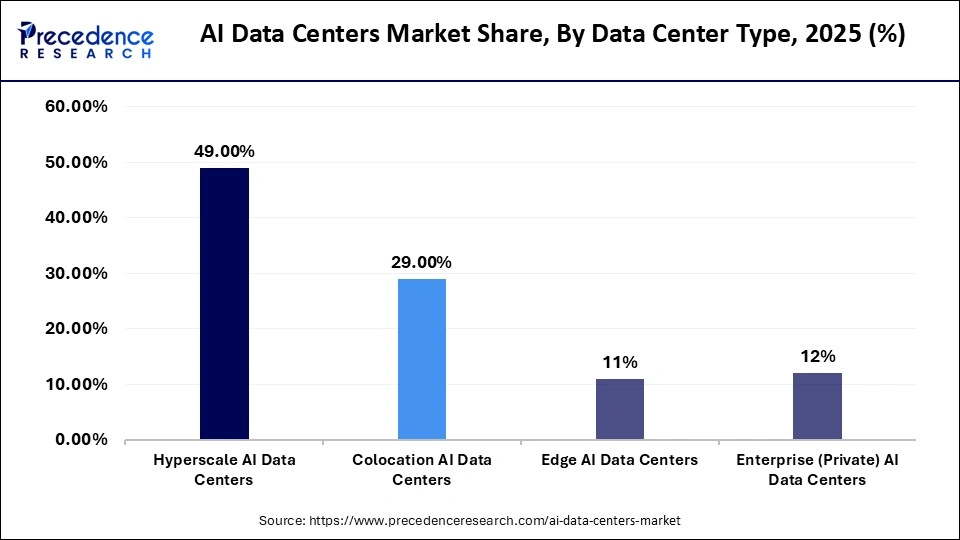

- By data center type, the hyperscale AI data centers segment captured the highest market share of 49% in 2025.

- By data center type, the edge AI data centers segment will grow at a notable CAGR between 2026 and 2035.

- By AI workload type, the Inference Workloads segment held the largest market share of 35% in 2024.

- By AI workload type, the generative AI segment will expand at a significant CAGR between 2026 and 2035.

- By cooling infrastructure, the air cooling segment contributed the biggest market share of 38% in 2025.

- By cooling infrastructure, the liquid cooling segment will expand at a significant CAGR between 2026 and 2035.

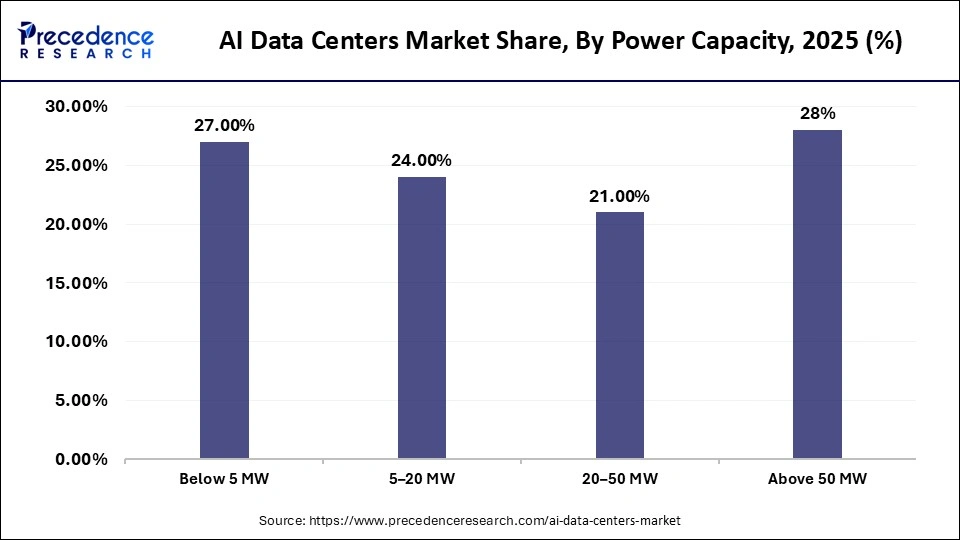

- By power capacity, the above 50 MW segment led the market generated the major market share of 28% in 2025.

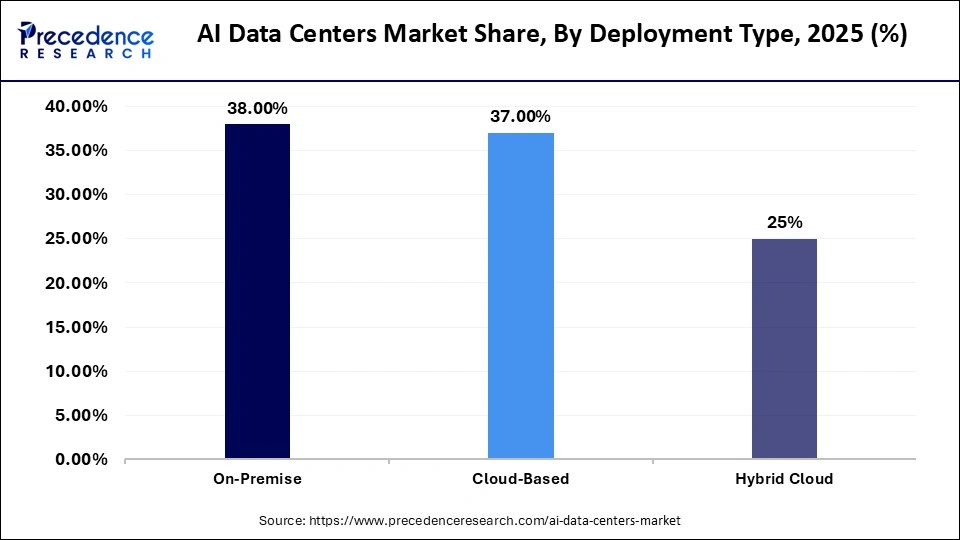

- By deployment Type, the on-premise segment accounted for a significant market share of 38% in 2025.

- By deployment Type, the cloud-based segment will expand to a remarkable CAGR between 2026 and 2035.

- By end-user industry, the technology & cloud service providers segment held the major market share of 48.10% in 2025.

- By end-user industry, the telecom segment will expand at a significant CAGR between 2026 and 2035.

AI Data Centers Market Overview: The Market Trends and Insights

AI data centers are specialized computing facilities designed and optimized to handle the massive data processing and compute-intensive workloads associated with Artificial Intelligence (AI) and Machine Learning (ML) applications. Unlike traditional data centers, AI data centers integrate high-performance hardware (e.g., GPUs, TPUs), advanced cooling systems, and AI-specific infrastructure software to train and infer AI models at scale. They support workloads like generative AI, deep learning, NLP, computer vision, and real-time analytics. Companies are investing heavily in hardware like AI-optimized chips and services, leading to improved data center performance. The rising need for cutting-edge data centers in industries like BFSI is fueling the market expansion.

What are the Key Trends in the AI Data Centers Market?

- Expanding Cloud Computing: The expanding cloud computing is driving the need for cutting-edge data center infrastructure with AI integration.

- Demand for High-Performance Computing Power: The demand for high-performance computing power has increased to handle complex AI models and large datasets, driving innovations in AI data centers.

- Adoption of AI Applications: AI applications have increased in industries like data analytics, machine learning, and generative AI, driving the need for strong data center infrastructures.

- Technological Advancements: Advancements in technologies like 5G networks, AI-driven analytics, and IoT devices prompt the urgent need for robust data center infrastructure.

- Sustainability Concerns: The growing emphasis on building data centers with less environmental impact, the implementation of energy-efficient cooling systems, the use of renewable energy sources, and the utilization of eco-friendly materials in construction are driving focus on AI data centers.

AI Data Centers Market Outlook: Forecasting the Next Wave of Innovations

- Industry Growth Overview: The growing proliferation of generative AI and large language models, advances in cooling solutions, expanding hyperscale and edge facilities, and massive investments in specialized hardware are driving the industry growth in the market.

- Sustainability Trends: The sustainability trend focuses on the use of renewable energy, advanced cooling systems like liquid immersion to handle heat load, and the utilization of AI to optimize energy use.

- Global Expansion:The growth in demand for AI and large language models, strategic pursuit of readily available scalable power, global data volume, and advanced cooling infrastructures are responsible for the global expansion of the market.

- Major Investors: Hyperscale cloud providers, private equity firms, and institutional investors are the major investors in the market. Microsoft, Google, Blackstone, KKR, DigitalBridge, etc, are the major investors in the market.

- Startup Ecosystem:The development of specialized, high-performance, and energy-efficient infrastructure solutions is the focus of the startup ecosystem. CoreWeave, Lambda, Vigyan Labs, and RackBank are some of the startups actively participating in the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 17.43 Billion |

| Market Size in 2026 | USD 22.26 Billion |

| Market Size by 2035 | USD 197.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 27.48% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Data Center Type, AI Workload Type, Cooling Infrastructure, Power Capacity, Deployment Mode, End-User Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Digital Transformation

The rapid digital transformation is boosting the need for AI-driven data centers globally. The demand for AI-powered applications has increased. Data centers support these demanding applications, including infrastructures for deep learning, generative AI, and machine learning. The growth of cloud computing is driving the need for AI data centers, driven by the requirement for scalable and flexible cloud services. Additionally, the growing adoption of edge computing and low-latency processing contributes to digital transformation accelerations. The government initiatives in promoting the use of digital technologies in various industries like healthcare, banking, automotives, and others, with growing emphasis on sustainability and energy efficiency, are fostering this transformation. These promotions are mitigating high-energy consumption and reducing greenhouse gas emissions, making a significant step toward AI-powered data centers.

Restraint

Concerns Over Data Privacy and Cybersecurity

Data privacy and cybersecurity concerns are the major challenges for the global AI data centers market. Data centers have a high risk of data breaches, making them challenging ecosystems for regulatory damage, regulatory analyses, and overall financial loss. AI data centers are vulnerable to cybersecurity attacks, like ransomware attacks, hacking, and malware, which hampers data integrity and availability. The Government has implemented several strict data protection regulations, including GDPR and CCPA, making it essential for AI data centers to implement security measures, which leads to increased cost and complexity. AI data centers can mitigate such barriers by implementing strong security measures, conducting regular security audits, and investing in cybersecurity talents.

Opportunity

Government Investments and Regulations

Government initiatives in promoting the use of digital technologies and investments in digital infrastructure, like data centers, are fostering innovations and advancements in AI-driven data centers. Governments worldwide have implemented several regulations for data protection and privacy, such as the General Data Protection Regulation (GDPR), which contributes to the increasing need for secure data storage solutions. Government funding for AI research and development, and support for adoption of cloud computing and data centers policies, are bringing significant opportunities for the AI data centers. Additionally, green initiatives and support for sustainability plans are further leveraging initiatives in AI data center infrastructure.

- On July 23, 2025, President Donald Trump signed three AI-related Executive Orders for implementing the recently released White House's Artificial Intelligence (AI) Action Plan. (Source: https://www.workforcebulletin.com)

Segment Insights

Component Insights

Which Component Segment Dominate the AI Data Centers Market in 2025?

The hardware segment dominated the market with the largest share in 2025. This is mainly due to its ability to enhance the performance and power efficiency of AI workloads. Hardware is playing a crucial role in enhancing sustainability and energy efficiency in data centers. The demand for specialized hardware like GPUs and ASICs has increased for AI computer capacity. Additionally, the growing adoption of liquid cooling and advancements in chip designs are driving the importance of hardware to enhance the efficiency and power of AI data centers.

The services segment is expected to grow at the fastest rate during the projection period, driven by increased AI deployment complexity and the requirement for expert supporting services in infrastructure management. The adoption of hybrid and multi-cloud ecosystems has increased, driving demand for services to handle both on-premises and cloud-based systems. Services like consulting, implementation, integration, managed, and maintenance services are highly in demand.

AI Data Centers Market Revenue, By Component, 2022-2025 (USD Million)

| By Component | 2022 | 2023 | 2024 | 2025 |

| Hardware | 6,001.86 | 7,596.69 | 9,628.94 | 12,222.17 |

| Software | 1,154.41 | 1,501.90 | 1,955.80 | 2,549.29 |

| Services | 1,280.89 | 1,630.63 | 2,078.83 | 2,654.01 |

Data Center Type Insights

What Made Hyperscale AI Data Centers the Dominant Segment in the AI Data Centers Market in 2025?

The hyperscale AI data centers segment dominated the market in 2025. This is mainly due to their ability to offer scalable, flexible, high computing power, and networking required for meeting growing demands. The hyperscale AI data centers can handle large-scale AI workloads. The advanced architecture of hyperscale AI data centers helps to support high-density services and AI accelerators, including TPUs and GPUs.

The edge AI data centers segment is expected to expand a the fastest CAGR over the forecast period, due to increased demand for real-time data processing and low-latency applications. The edge AI data centers enable quick decision making through their real-time data processing and reduce bandwidth constraints. The increasing adoption of IoT devices and 5G networking has increased the need for AI decentralization in industries like smart manufacturing, healthcare, and automotives to reduce latency and process data closer to the source.

AI Data Centers Market Revenue, By Data Center Type, 2022-2025 (USD Million)

| By Data Center Type | 2022 | 2023 | 2024 | 2025 |

| Hyperscale AI Data Centers | 3,966.90 | 5,111.21 | 6,594.25 | 8,518.76 |

| Colocation AI Data Centers | 2,541.06 | 3,184.29 | 3,995.02 | 5,017.96 |

| Edge AI Data Centers | 869.53 | 1,119.02 | 1,441.88 | 1,860.19 |

| Enterprise (Private) AI Data Centers | 1,059.66 | 1,314.69 | 1,632.43 | 2,028.57 |

AI Workload Type Insights

Why Did the Inference Workloads Segment Dominate the AI Data Centers Market in 2025?

The inference workloads segment dominated the market in 2025 due to high computational requirements and specialized facilities. The inference workloads are crucial in high-performance computing. The increased adoption of AI and ML into applications ike pattern recognition, data analysis, and predictive modelling is driving the need for training workloads.

AI Data Centers Market Share, By AI Workload Type, 2025 (%)

| Segment | Share (%) |

| Training Workloads | 33% |

| Inference Workloads | 35% |

| Real-Time Analytics | 19% |

| Generative AI | 10% |

| Reinforcement Learning | 3% |

The generative AI segment is expected to expand at the highest CAGR in the upcoming period, driven by the increased demand for strong infrastructure to support large amounts of data processing and complex computations. Generative AI streamlines the data centers' workflow. The expanding generative AI movements have contributed to increased demand for data center GPUs, CPUs, DPU, AI ASICs, and networking ASICs.

Cooling Infrastructure Insights

Which Cooling Infrastructure Segment Dominate the AI Data Centers Market in 2025?

The air cooling segment dominated the market with the largest share in 2025, due to its ability to maintain an optimal temperature level. The expanding data centers drive the need for efficient cooling solutions like air cooling. Air-cooling solutions like room-based cooling and air handling units are essential in maintaining optimal airflow, temperature, and humidity levels. Ongoing advancements in air cooling, like enhanced efficiency and reduced energy consumption, further contribute to the segment's growth.

AI Data Centers Market Share, By Cooling Infrastructure, 2025 (%)

| Segment | Share (%) |

| Liquid Cooling | 14% |

| Immersion Cooling | 3% |

| Direct-to-Chip Liquid Cooling | 8% |

| Air Cooling | 38% |

| CRAH/CRAC Units | 21% |

| Chilled Water Systems | 11% |

| Hybrid Cooling Systems | 4% |

The liquid cooling segment is likely to grow at the fastest CAGR in the upcoming period. The growth of the segment is driven by increased demand for energy-efficient cooling solutions. High-performance computing and AI-related workloads require liquid cooling solutions. The Direct-to-Chip Liquid Cooling sub-segment is leading the charge, driven by increased demand for thermal efficiency in high computational environments.

Power Capacity Insights

What Above 50 MW the Dominant Segment in the AI Data Centers Market in 2025?

The above 50 MW segment dominated the market in 2025, due to its wide use in enterprises running AI workloads along with traditional applications. The small to medium data centers typically range between 20-50 MW. The above 50 MW segment power capacity enables a balance between power capacity and scalability.

The above 50 MW segment is expected to grow at the fastest rate over the forecast period, driven by its utilization in large-scale facilities with higher power capacity demands. The AI data centers with above 50 MW power capacity offer hyperscale applications, high-performance computing, and support large AI workloads. The increased use of digital technologies has driven the need for large-scale AI data centers with more than 50 MW power capacity.

AI Data Centers Market Revenue, By Power Capacity, 2022-2025 (USD Million)

| By Power Capacity | 2022 | 2023 | 2024 | 2025 |

| Below 5 MW | 2,329.38 | 2,926.80 | 3,681.82 | 4,637.08 |

| 5�20 MW | 2,131.56 | 2,678.69 | 3,370.56 | 4,246.53 |

| 20�50 MW | 1,734.88 | 2,229.86 | 2,870.15 | 3,699.54 |

| Above 50 MW | 2,241.34 | 2,893.86 | 3,741.04 | 4,842.32 |

Deployment Type Insights

How Does the on-premise Segment Leads the AI Data Centers Market?

The on-premise segment led the market in 2025 due to increased adoption of AI and cloud computing. The on-premise AI data centers are flexible, scalable, cost-effective, and speed to setup. These data centers offer pre-configured AI tools, helping to reduce costs and enhance efficiency. The growing popularity of AI-as-a-service has contributed to the need for cloud-based AI data centers.

The cloud-based segment is likely to grow at the fastest rate in the coming years due to its scalability, flexibility, and affordability. The cloud-based data centers combine both on-premises and cloud infrastructures. The deployment of cloud-based has increased for more security & compliance, growing demand for edge computing, and AI integration for enabling cutting-edge data analysis and automations.

AI Data Centers Market Revenue, By Deployment Type, 2022-2025 (USD Million)

| By Deployment Type | 2022 | 2023 | 2024 | 2025 |

| On-Premise | 3,432.62 | 4,285.92 | 5,357.12 | 6,703.14 |

| Cloud-Based | 2,938.63 | 3,812.48 | 4,951.44 | 6,437.57 |

| Hybrid Cloud | 2,065.91 | 2,630.81 | 3,355.02 | 4,284.75 |

End-Use Industry Insights

Why Did the Technology & Cloud Service Providers Segment Dominate the AI Data Centers Market in 2025?

The technology & cloud service providers segment dominated the market in 2025, due to increased demand for cloud computing services. The technology giants and cloud service providers are becoming more visible due to increased adoption of cloud services and the need for data centers. Additionally, the adoption of multi-cloud strategies and hybrid strategies is driving the need for hybrid cloud management solutions, interconnection platforms, and services. The technology & cloud providers play a crucial role in increased AI and ML integration.

AI Data Centers Market Share, By End-Use Industry, 2025 (%)

| Segment | Share (%) |

| Technology & Cloud Service Providers | 48.10% |

| BFSI | 10.06% |

| Healthcare & Life Sciences | 8.11% |

| Automotive (AutonomoAustria Driving) | 6.88% |

| Retail & E-commerce | 9.08% |

| Government & Defense | 6.99% |

| Telecom | 6.02% |

| Energy & Utilities | 2.39% |

| Education & Research | 2.36% |

The telecom segment is expected to expand at the highest CAGR during the forecast period due to increased adoption of AI in the Telecom industry. The utilization of AI for personalized medicine and genomics areas is contributing to the market growth. Personalized medicine and genomics require a large amount of data storage and analysis, driving demand for AI data centers. Additionally, the rapid digital transformation in the healthcare industry is fostering this growth.

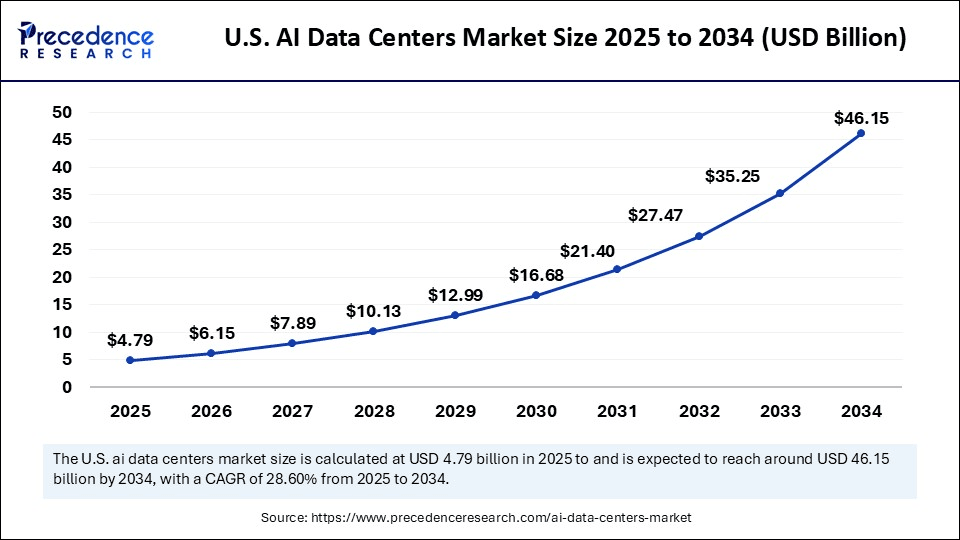

U.S. AI Data Centers Market Size and Growth 2026 to 2035

The U.S. AI data centers market size is evaluated at USD 5.21 billion in 2025 and is projected to be worth around USD 57.25 billion by 2035, growing at a CAGR of 27.08% from 2026 to 2035.

What Made North America the Dominant Region in the AI Data Centers Market in 2025?

North America dominated the AI data centers market with a major revenue share in 2025 due to its robust, technologically advanced infrastructure, strong investors in AI-ready data center infrastructures, and rapid AI adoption in various industries, aligning with government support and initiatives. The rising demand for AI technologies across various industries and the growing focus on green AI data centers are boosting the regional market growth. Additionally, the strong existence of key market players like Microsoft. IBM and NVIDIA are driving innovative approaches in AI data centers.

U.S. Driven by Advanced Technological Infrastructure

The U.S. is a major player in the regional market. The U.S. has an advanced technological infrastructure with the presence of key market player and their investments in AI capabilities. The U.S.-based companies are increasing their AI-ready data center infrastructure investments to support emerging technologies like big data analytics, machine learning, and generative AI. The rapid adoption of AI across the country is fostering market growth.

- In July 2025, the U.S. Department of Energy (DOE) announced a new step on the Donald Trump administration's plan for accelerating the development of AI infrastructure by siting on DOE lands. The DOE has selected its four sites, such as Idaho National Laboratory, Oak Ridge Reservation, Paducah Gaseous Diffusion Plant, and Savannah River Site, while inviting private sector partners for the development of advanced AI data centers and energy generation projects. (Source:energy.gov)

Asia Pacific AI Data Centers Market Trends

Asia Pacific is expected to grow at the fastest rate in the coming years, driven by the increasing adoption of AI services and adoption of cutting-edge computer infrastructure. The government of Asia is implementing several regulations and policies to promote the use of digital technologies and cloud services. The government-led AI initiatives are boosting the adoption of AI-enabled analytics and edge technologies. Additionally, the smart city projects are further contributing to the need for robust AI-ready data centers in Asia. Cities like Singapore, Tokyo, and Sydney are the major hubs for AI-driven data centers in Asia.

Expanding Digital Economy Drives China

China is a major player in the regional market, contributing to growth due to the expanding digital economy and government investments in AI infrastructure. The government initiatives in promoting AI adoption, developments, and data center constructions are fostering this growth. Additionally, country investments in innovations, including underwater cooling technology for data centers, further add to market growth.

Rapid AI Adoption Boosts India

India is a significant player in the regional market. This is mainly due to rapid AI adoption, expanding IT infrastructures, and government promotion for digitalization across various industries. The Government of India is investing heavily in advancing data center infrastructure, leveraging AI in its practices, and fueling the market.

- The cutting-edge data centers in India, including Yotta NM1, Reliance Jio's AI data centers, AdaniConneX data centers, CtrlS AI Mega Campus, and ST Telemedia Global Data Centers (STT GDC India), are driving significant innovations and investments in data center infrastructure.

Europe AI Data Centers Market Trends

Europe is expected to grow at a notable rate during the projection period due to rapid digitalization and demand for IoT technologies in the region. The adoption of cloud computing has increased. Europe is a hub for sustainable initiatives, emphasizes renewable energy sources and energy designs, and has a significant focus on AI data centers. The hyperscalers are taking the largest portion of data center capacity in Europe, which is expected to bring out significant and novel data center capabilities by 2025.

Countries like the UK, Germany, and France are leading the regional market, driven by the UK's national AI strategy, Germany's larger data center abilities, the digital transformation and sustainability, and France's AI for Humanity strategies.

- In January 2025, the European government released its AI Opportunities Action Plan, which includes a large number of policies and actions for the government to take part in its overarching aspiration to enhance economic growth.

- In February 2025, France invests �109 billion in its AI sector, with a �30 billion and a �50 billion commitment from the UAE to finance a 1-gigawatt data center, which is four times the power capacity of the UK's largest operational facility. (Source: https://www.pillsburylaw.com)

Regional analysis

Advanced Digital Infrastructure Uplift UK

The UK consists of an advanced digital infrastructure, which is increasing the use of AI data centers. The expanding tech ecosystems and government initiatives are also increasing their adoption rates. Additionally, the skilled personnel are focusing on the development of AI and cloud-based data centres.

Growing Digital Transformation Propels South America

South America is expected to grow significantly in the AI data centers market during the forecast period, due to growing digital transformation. The growing shift toward the use of AI-driven services is also increasing the AI data centers. The expanding ICT infrastructure, startups, and government initiatives are increasing their use, promoting market growth.

Large Enterprise Base Fuels Brazil

The presence of a large enterprise base in Brazil is increasing the use of AI data centers. They are relying on high-performance AI data processing solutions, where the growing digitalization and government support are increasing their use for smart cities development. The companies are also developing cloud platforms and localized AI data processing services.

Expanding ICT Infrastructure Transforms MEA

MEA is expected to grow significantly in the AI data centers market during the forecast period, due to expanding ICT infrastructure. Additionally, growing digitalization, demand for AI analytics, the startup ecosystem, and government investments are increasing their innovations, driving the market growth.

UAE AI Data Centers Surge

Driven by government initiatives and rapid digital transformation, the UAE's AI data center market is expanding significantly to meet increasing demand for advanced computing power across various industries.

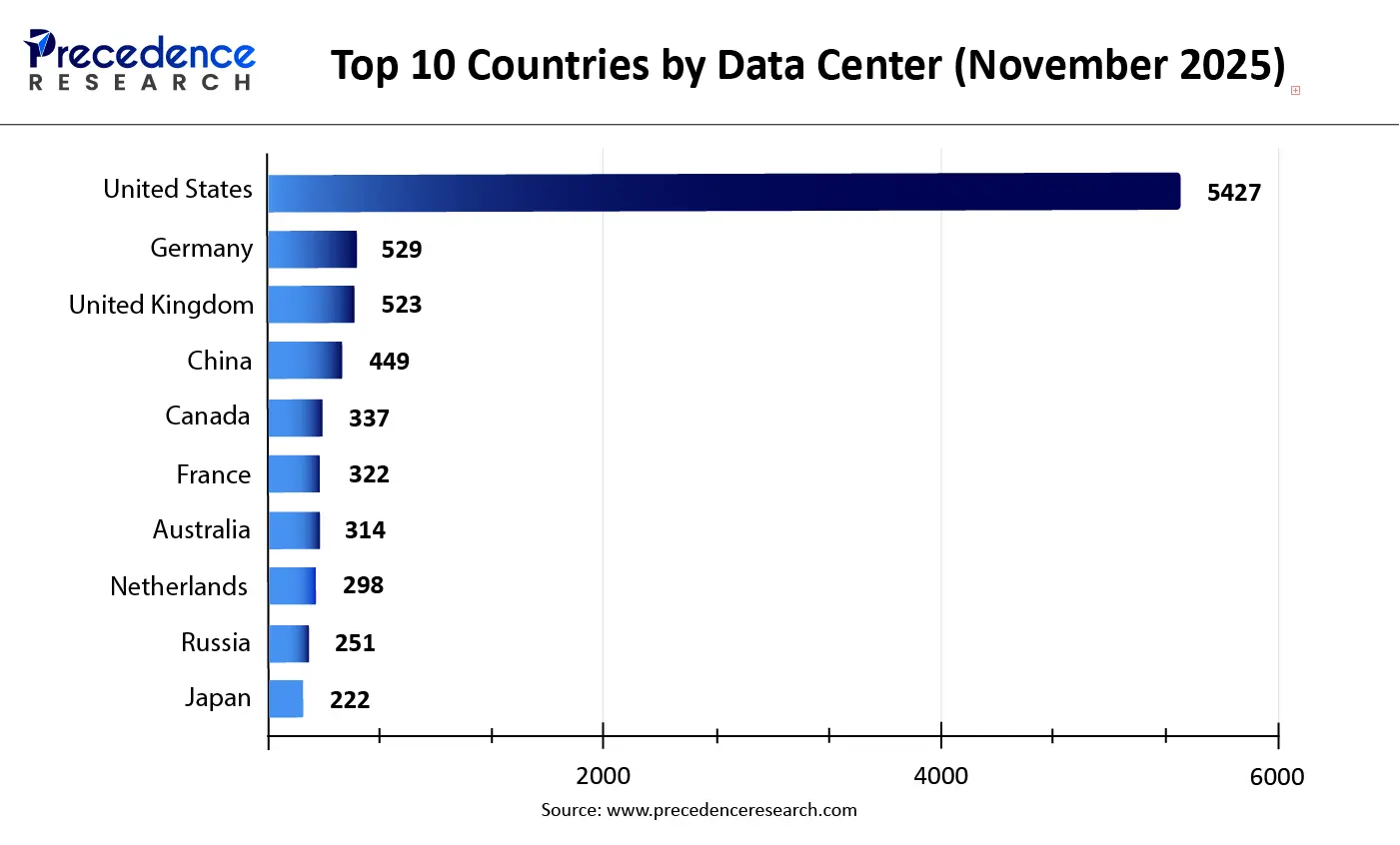

The global data center landscape remains highly concentrated, with the United States dominating infrastructure deployment by a wide margin as of November 2025. According to Cloudscene data summarized by Cargoson, the United States hosts 5,427 operational data centers, accounting for roughly 45% of the more than 12,000 facilities worldwide, far exceeding any other country. Germany and the United Kingdom follow at a distant second and third with 529 and 523 data centers, respectively, while China ranks fourth with 449 sites.

This sharp disparity reflects long-standing advantages in cloud adoption, hyperscale investment, power availability, and digital demand in the United States, which anchors North America's position as the world's largest data center region. Europe shows a more distributed pattern across multiple countries, while Asia-Pacific infrastructure remains concentrated in a smaller group of leading markets, underscoring structurally different growth models across regions.

AI Data Centers Market Companies

- AMD (Advanced Micro Devices): The company provides EPYC CPUs, Inst MI300X accelerators.

- Broadcom Inc.: High-bandwidth switches and optical interconnects are provided by the company.

- Micron Technology: The company offers HBM3E, DDR5 DRAM, and high speed NVMe SSDs.

- Marvell Technology: To provide the connective tissue of AI infrastructure is the focus of the company.

- Samsung Electronics: HBM memory and high-capacity SDs are provided by the company.

- TSMC (Taiwan Semiconductor Manufacturing Company): Most advanced AI chips are provided by the company.

- Equinix, Inc. (data center infrastructure & interconnection): The company operates over 240 data centers globally and provides enterprise systems.

Other Major Key Players

- NVIDIA Corporation

- Intel Corporation

- SK hynix Inc.

- Vertiv Holdings Co. (power & cooling systems)

- Supermicro (Super Micro Computer, Inc.)

- Dell Technologies

- Hewlett-Packard Enterprise (HPE)

- Lenovo Group Ltd.

- Inspur Group

- Cisco Systems, Inc.

- Arista Networks

- Eaton Corporation

- Huawei Technologies Co., Ltd.

Recent Developments

- In July 2025, Google announced investments of $25 billion in data centers and artificial intelligence infrastructure, more than the next two years, in states across the biggest electric grid in the U.S.(Source: cnbc.com)

- In April 2025, Nvidia announced $500 billion for building AI infrastructure in the U.S. over the next four years, under the collaboration of TSM, the latest American tech firm backing the Trump administration's push for local manufacturing giants.

(Source: cio.economictimes.indiatimes.com) - In January 2025, Microsoft announced investments of $80 billion in FY25 for the construction of data centers to handle artificial intelligence workloads. Over half of the expected AI infrastructure spending took place in the U.S.

(Source: cnbc.com) - In July 2025, a global leader in hyperscale digital infrastructure, Khazna Data Centers, partnered with Eni, a global integrated energy company, under a Heads of Terms (HOT) agreement set up as a joint venture for the development of an �AI Data Center Campus� with a total IT capacity of 500 MW in Ferrera Erbognone, Lombarly. (Source: eni.com)

- In April 2025, a leading AI-ready data center provider in India, ST Telemedia Global Data Centers, announced enhancing its data center landscape in Eastern India by launching its state-of-the-art facility in New Town, Kolkata. This next-generation campus is established on 5.59 acres and engineered to support the rising demands of AI computing with high-density rack configurations, cutting-edge cooling systems, and a modular and scalable design. (Source: sttelemediagdc.com)

Segment Covered in the Report

By Component

- Hardware

- Compute (GPUs, CPUs, TPUs, ASICs)

- Memory (HBM, DRAM, Flash)

- Storage (NVMe SSD, HDD, Object Storage)

- Networking (Switches, Routers, Interconnects)

- Software

- AI Workload Management Platforms

- Orchestration Tools (e.g., Kubernetes for AI)

- Virtualization & Containerization Software

- AI Model Training/Inference Frameworks

- Services

- Deployment & Integration

- Managed Services

- Consulting & Support

By Data Center Type

- Hyperscale AI Data Centers

- Colocation AI Data Centers

- Edge AI Data Centers

- Enterprise (Private) AI Data Centers

By AI Workload Type

- Training Workloads

- Inference Workloads

- Real-Time Analytics

- Generative AI

- Reinforcement Learning

By Cooling Infrastructure

- Liquid Cooling

- Immersion Cooling

- Direct-to-Chip Liquid Cooling

- Air Cooling

- CRAH/CRAC Units

- Chilled Water Systems

- Hybrid Cooling Systems

By Power Capacity

- Below 5 MW

- 5-20 MW

- 20-50 MW

- Above 50 MW

By Deployment Type

- On-Premise

- Cloud-Based

- Hybrid Cloud

By End-User Industry

- Technology & Cloud Service Providers

- BFSI

- Healthcare & Life Sciences

- Automotive (Autonomous Driving)

- Retail & E-commerce

- Government & Defense

- Telecom

- Energy & Utilities

- Education & Research

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content