What is the Cyber Security Market Size?

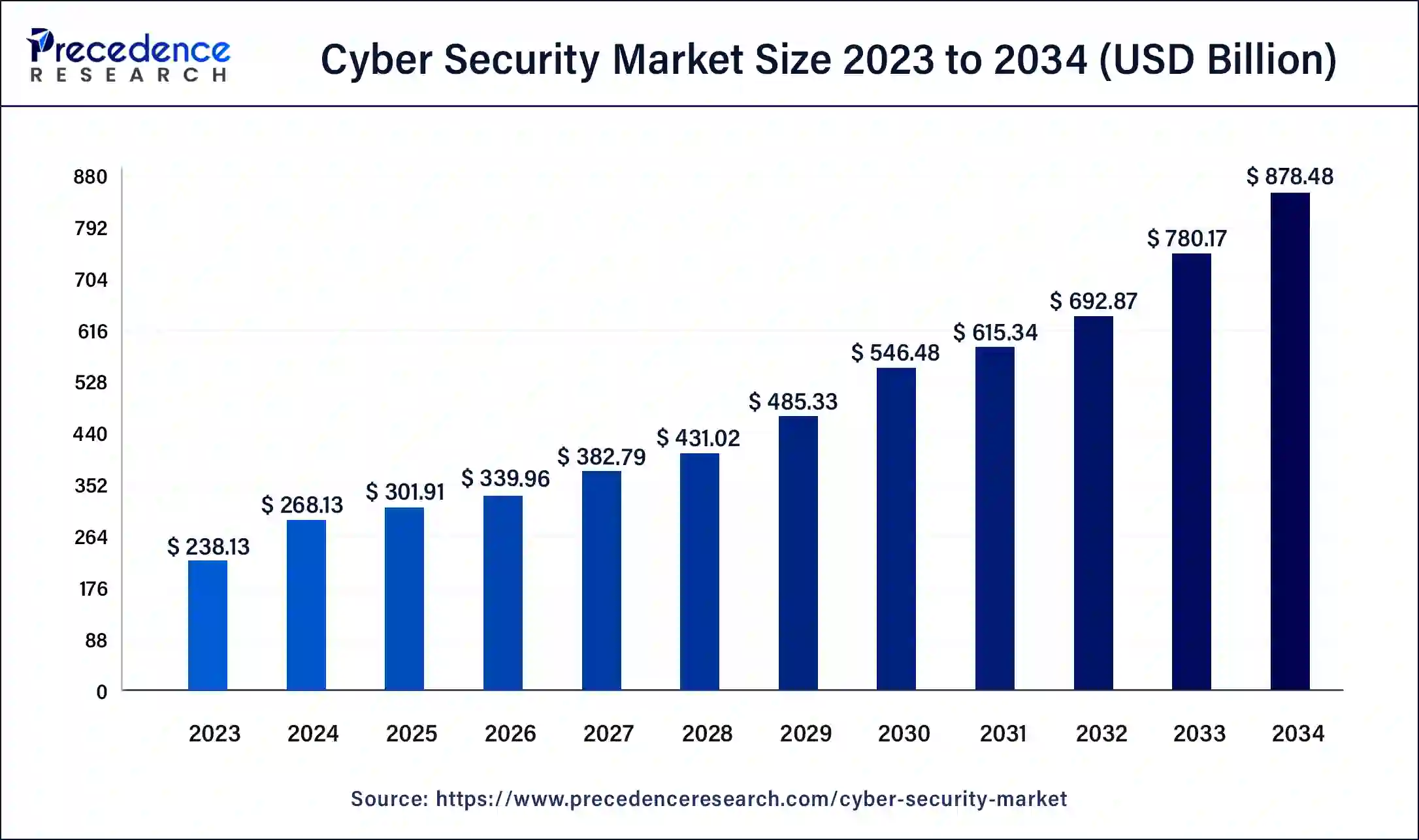

The global cyber security market size was valued at USD 301.91 billion in 2025, calculated at USD 339.96 billion in 2026, and is expected to reach around USD 878.48 billion by 2034. The market is expanding at a solid CAGR of 12.6% over the forecast period 2025 to 2034.

Market Highlights

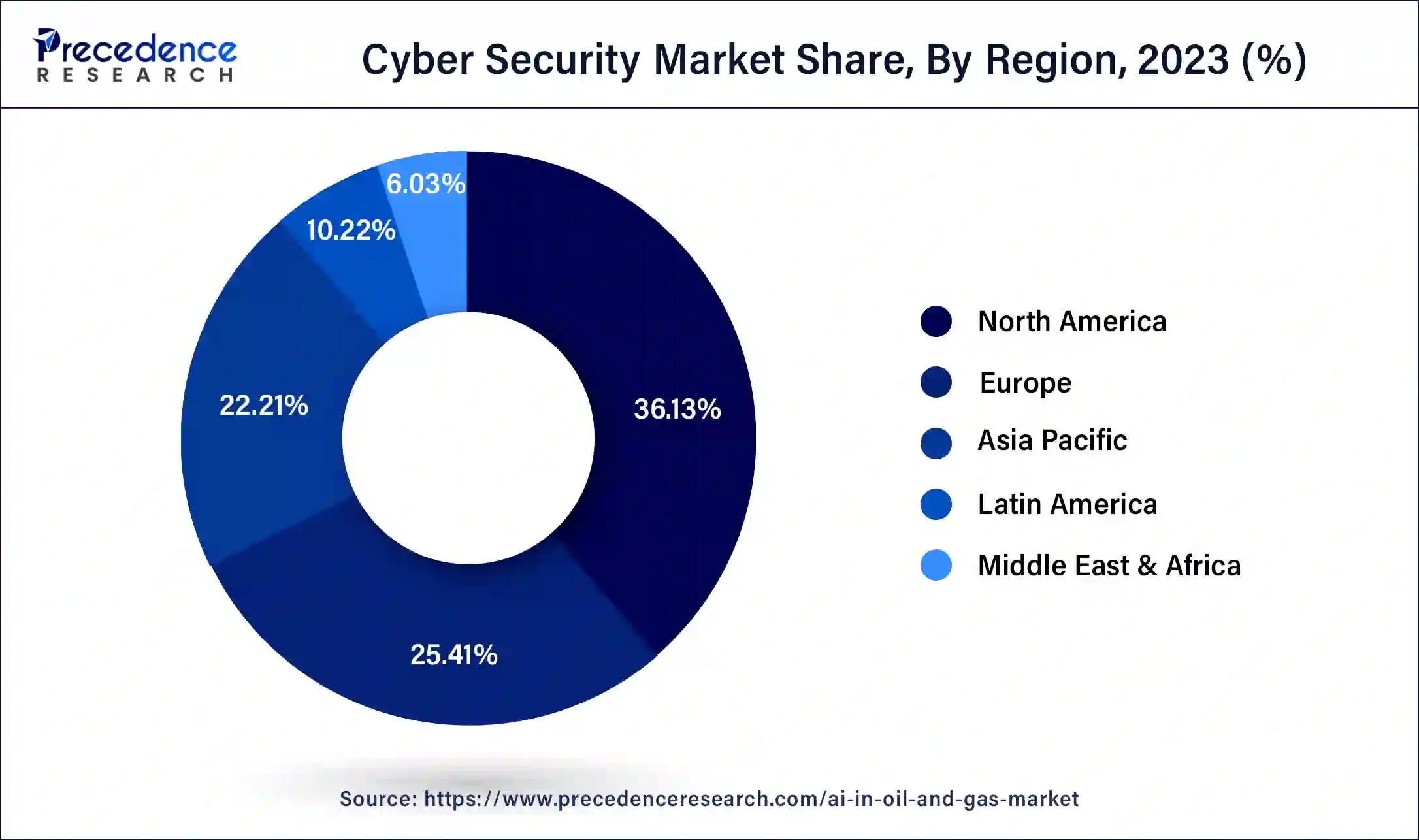

- North America contributed more than 36.13% of revenue share in 2024.

- By component, the solution segment dominated the market with 68.40% share in 2024.

- By component, the services segment is expected to grow at the highest CAGR of 11.20% over the forecast period.

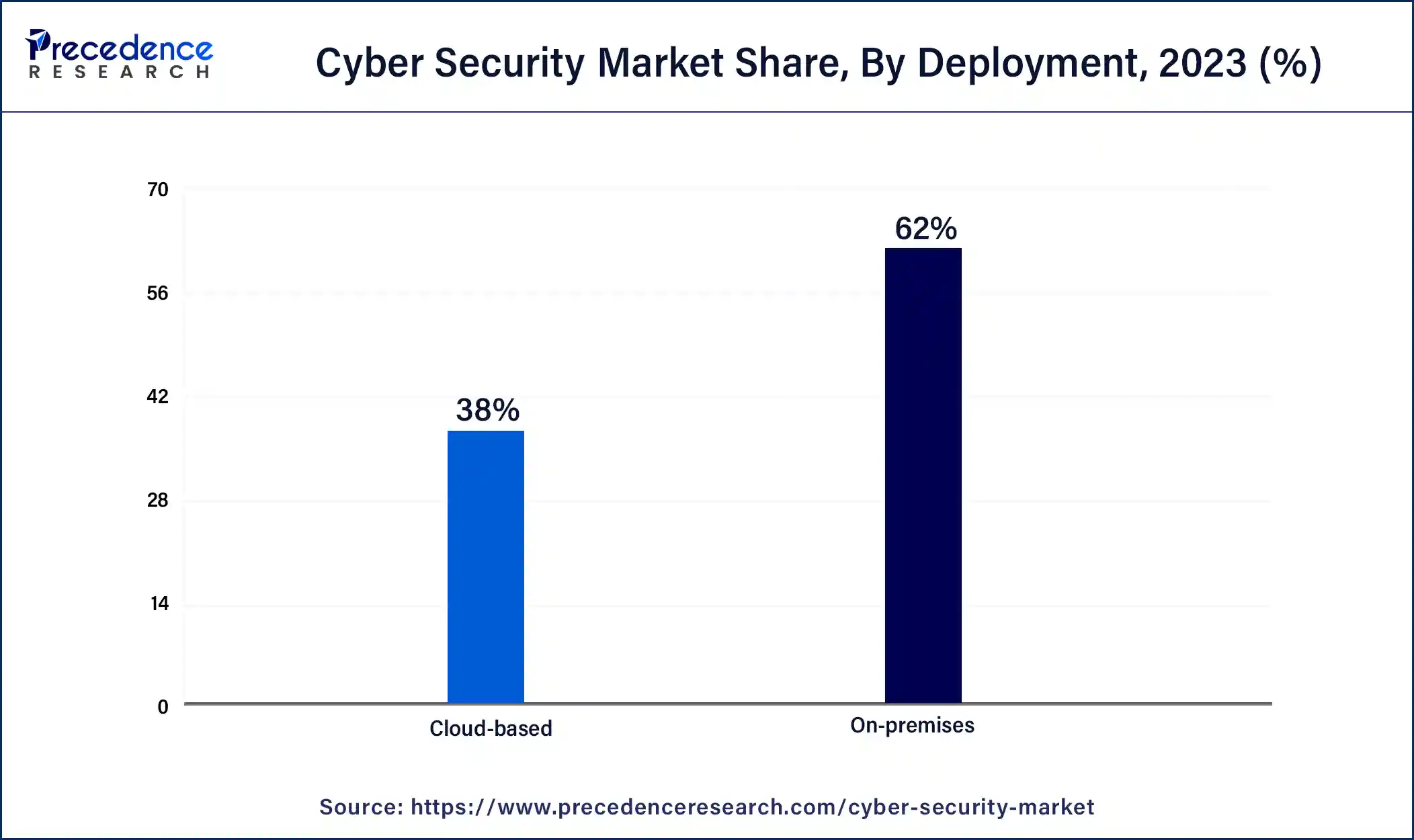

- By deployment mode, the on-premises segment held a 55.10% market share in 2024.

- By deployment mode, the cloud-based segment is expected to grow at the highest CAGR of 12.50% over the forecast period.

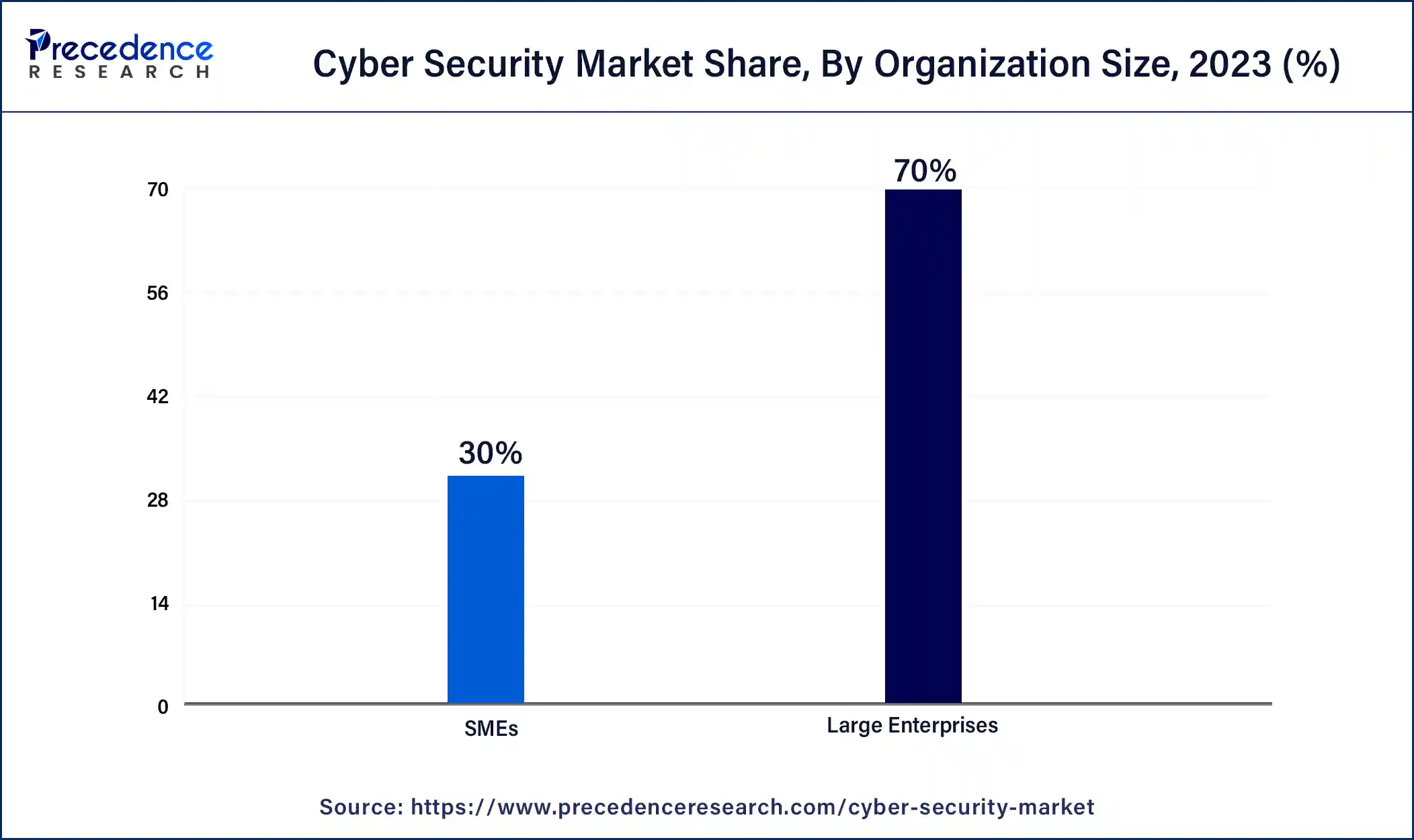

- By organisation size, the large enterprises segment dominated the market by holding 62.70% share in 2024.

- By organisation size, the small & medium enterprises (SMEs) segment is expected to grow at the highest CAGR of 11.80% in 2024.

- By security type, the network security segment dominated the market with a 26.80% share in 2024.

- By security type, the cloud security segment is expected to grow at the highest CAGR of 12.90% in 2024.

- By industry vertical, the BFSI segment held a 21.60% market share in 2024.

- By industry vertical, the healthcare segment is expected to grow at the highest CAGR of 11.70% in 2024.

Market Size and Forecast

- Market Size in 2025: USD 301.91 Billion

- Market Size in 2026: USD 339.96 Billion

- Forecasted Market Size by 2034: USD 878.48 Billion

- CAGR (2025-2034): 12.6%

- Largest Market in 2024: North America

Market Overview

Cyber security is a critical and rapidly evolving field that focuses on protecting computer systems, networks, and data from various forms of cyber threats, including cyberattacks, data breaches, and unauthorized access. It encompasses a range of technologies, processes, and practices designed to safeguard digital information and the infrastructure that processes, stores, and transmits it. Cyber security measures and practices include a wide range of strategies and technologies, such as firewalls, antivirus software, intrusion detection systems, encryption, access control, vulnerability assessments, and incident response plans. As technology becomes increasingly deployed into daily lives, businesses, and governments, the importance of cyber security cannot be overlooked. The cyber security market plays a pivotal role in addressing these evolving threats and safeguarding digital assets.

- According to new statistics from the Australian Bureau of Statistics (ABS), more than two in ten enterprises (22%) experienced a cyber security attack during the 2021–22 fiscal year, compared to roughly one in ten (8%) in 2019–20.

- The Australian Cyber Security Centre reported an unprecedented 76,000 cybercrime incidents, a 13% rise from the prior fiscal year, according to the most recent Annual Cyber Threat Report 2021–2022.

- The FBI received 800,944 complaints of cybercrime in 2022, a 5% decline from 2021, according to the FBI's Internet Crime Report. However, the total possible loss rose from $6.9 billion in 2021 to $10.2 billion in 2022. The states with the most victims of cybercrime were California, Florida, and Texas.

- In 2022, the Consumer Sentinel Network of the Federal Trade Commission (FTC) received over 5.1 million reports, in which 46% involved fraud and 21% involved identity theft. A total of 43.7 percent of identity thefts involved credit card fraud, followed by miscellaneous identity theft.

Market trends

- In July 2025, to combat modern threats, a collaboration between Huntress and Microsoft was announced, where they will also focus on enhancing their security investments. The cybersecurity solutions of Huntress will offer protection for employees, endpoints, and identities by merging with Microsoft environments. Moreover, the 24/7 Security Operations Center (SOC) is continuously reinforcing the comprehensive suite of Huntress, which includes Security Awareness Training (SAT), Security Information and Event Management (SIEM), Endpoint Detection and Response (EDR), and Identity Threat Detection and Response (ITDR).

- In May 2025, to enhance the technology, a total of $60 million was secured by OX Appsec Security Ltd., which is a startup, helping developers to find the most urgent vulnerabilities in their code. The investors present at this Series B investment round were DTCP, Team8, Microsoft Corp., Swisscom Ventures, IBM Ventures, and Evolution Equity. $94 million was secured as outside funding by OX Appsec Security. Furthermore, annual recurring revenue, which topped with $10 million, was announced by the company during the funding round. New features, such as better AI models to detect the severity of vulnerabilities, will be developed using this funding.

Cyber Security Market Growth Factors

The cyber security market is driven by numerous factors such as rising cyber threats, data privacy regulations, digital transformation, technological advancements, data breaches and privacy concerns and many others. The global cyber security market is expected to grow at a robust pace with the rising rate of digitization across the globe. The market aims on offering multiple solutions for tackling with cyber-attacks and crime. The rising demand from banking and other financial sector for controlling cyber-attacks create a significant growth factor for the market to grow. Moreover, multiple governments are focused on protecting confidential data and sites with advanced cyber security services and solutions, the element is observed to act as a major growth factor for the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 301.91 Billion |

| Market Size in 2026 | USD 339.96 Billion |

| Market Size by 2034 | USD 878.48 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.6% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, ecurity Type, Solution, Services, Deployment, Organization Size, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rise of automotive hacking

Autonomous software that provides seamless communication for drivers in engine timing, door locks, and airbags along with a cutting-edge driver support system. These cars' communication methods, Bluetooth and WiFi, expose them to several security flaws and hacking risks. In 2023, as autonomous cars become more prevalent, there may be an increase in attempts to take control of them or listen in on conversations via microphones. Self-driving or autonomous cars employ a process that is significantly more complicated and calls for stringent cybersecurity precautions. Thus, driving the market growth during the forecast period.

Restraint

Lack of skilled professionals

There is a shortage of qualified cybersecurity professionals with the skills and expertise needed to protect organizations from evolving threats. This skills gap hampers organizations' ability to implement and manage effective cybersecurity measures. Thus, the shortage of skilled professionals is expected to be a major restraining factor to the market growth over the forecast period.

Opportunity

Emergence of remote working culture

Many businesses have been compelled to transition to remote working because of the pandemic, which has created additional cybersecurity issues. Due to the frequently less secure networks and devices they use, remote employees may be more susceptible to cyberattacks. To safeguard their remote workers, firms must implement proper security measures, such as multi-factor authentication, secure VPNs, and automatic patching. Thus, the emergence of a remote working culture is expected to offer a lucrative opportunity for market growth during the forecast period.

According to the article published by the Stanford Institute for Economic Policy Research (SIEPR), working from home rose fivefold from 2019 to 2023, with 40% of US employees now working remotely at least one day a week.

Segments Insights

Component Insights

The solution segment dominated the market with a 68.40% share in 2024. The dominance of the segment can be attributed to the sheer number and sophistication of cyber threats, along with the ongoing adoption of technologies such as IoT, cloud computing, and AI. Also, the extensive use of online shopping platforms, with the extensive use of mobile and other gadgets, has grown the attack surface, propelling the need for security solutions.

The services segment is expected to grow at the highest CAGR of 11.20% over the forecast period. The cybersecurity market encompasses a wide range of services designed to help organizations protect their digital assets and defend against cyber threats. These services are offered by cybersecurity firms, consulting companies, managed security service providers, and others. The widespread adoption of cybersecurity in numerous sectors is being driven by enterprises' strong desire to implement appropriate solutions according to organizational structures.

Security Type Insights

The network security segment dominated the market with a 26.80% share in 2024. Infrastructure protection includes the protection of essential systems and assets, such as power grids, water treatment facilities, nuclear plants, and transportation networks, from cyber threats. Ensuring the continuous and reliable operation of this critical system is paramount.

The cloud security segment is expected to grow at the highest CAGR of 12.90% in 2024. The need for cloud security is anticipated to be driven by the rising demand for managed security solutions and expanding cloud usage. To attract new business consumers, organizations in the cloud security sector are concentrating on expanding their product lines.

Solution Insights

Based on the solution, the global cyber security market is segmented into Unified Threat Management (UTM), IDS/IPS, DLP, IAM, SIEM, DDoS, Risk and compliance Management and Others. The IAM segment is expected to capture the largest market share over the forecast period. Identity and Access Management (IAM) is a critical component of the cyber security market that focuses on managing and controlling user identities, access privileges, and authentication to secure digital resources and systems. IAM solutions play a pivotal role in ensuring that the right individuals or entities have appropriate access to systems, data, and applications, while also enhancing security and compliance.

Services Insights

Based on the services, the global cyber security market is segmented into professional services and managed services. Professional services are expected to dominate the market during the projected period. The sizeable market share may be attributable to the growing demand for professional services like penetration testing, business risk analysis, and physical security testing. Another important reason fueling the segment's expansion is the shortage of qualified cybersecurity personnel. Additionally, end-user businesses favor the advice and experience of professional service providers to reduce business security risks through the installation of affordable security solutions.

Deployment Insights

The on-premises segment held a 55.10% market share in 2024. The dominance of the segment can be linked to the stringent regulatory compliance and the growing demand to protect critical infrastructure and sensitive data. Furthermore, on-premises solutions give organisations better control over their intellectual property, sensitive data, and operational systems.

The cloud-based segment is expected to grow at the highest CAGR of 12.50% over the forecast period. Cloud-based cybersecurity solutions can easily scale to accommodate the growing needs of organizations. Whether it's protecting a small business or a large enterprise, cloud-based solutions can adapt to the changing threat landscape. Moreover, cloud-based solutions often follow a subscription or pay-as-you-go model, reducing the upfront costs associated with traditional on-premises security solutions.

Organization Size Insights

The large enterprises segment dominated the market by holding a 62.70% share in 2024. Large enterprises often have extensive and complex IT infrastructures, including data centers, multiple offices or locations, and a wide range of devices and applications. This complexity requires comprehensive security solutions.

The small & medium enterprises (SMEs) segment is expected to grow at the highest CAGR of 11.80% in 2024. The growth of the segment can be linked to the rise in the number of cyberattacks and their convenience globally. Moreover, SMEs handle valuable confidential data, such as intellectual property and personal information, which makes them the main targets for cybercriminals.

Application Insights

Based on the application, the defense/government segment is expected to capture a significant market share over the forecast period. The cybersecurity market for defense and government is a specialized and critical segment within the broader cybersecurity industry. Defense and government organizations face unique cybersecurity challenges due to their role in national security, the sensitivity of the data they handle, and the constant threat of cyberattacks from nation-states and others. Thus, driving the market revenue growth.

Industry Vertical Insights

The BFSI segment held a 21.60% market share in 2024. The dominance of the segment is owing to the ongoing shift towards mobile payments, digital banking, and cloud computing, coupled with the growing complexity of the IT environment and the lack of skilled cybersecurity professionals. Additionally, BFSI institutions are using machine learning, AI, and blockchain technologies for fraud detection and prevention.

The healthcare segment is expected to grow at the highest CAGR of 11.70% in 2024. The dominance of the segment is due to the extensive adoption of digital health technologies such as IoMT devices and EHRs, telemedicine, and the push towards 5G-enabled healthcare systems. Furthermore, the proliferation of IoT and other medical devices in healthcare expands the attack surface further, requiring sophisticated cybersecurity frameworks.

Regional Insights

U.S. Cyber Security Market Size and Growth 2025 to 2034

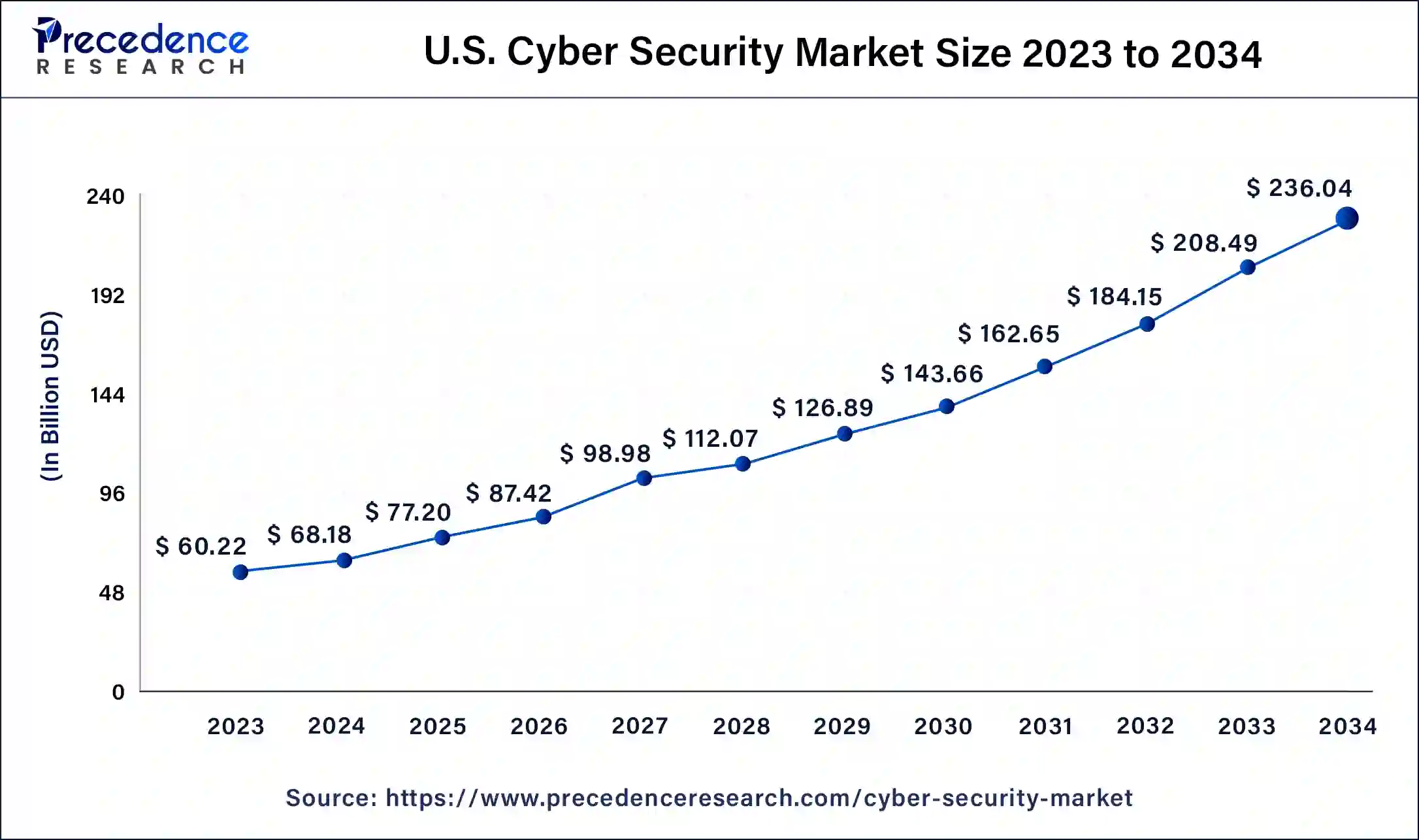

The U.S. cyber security market size was estimated at USD 87.42 billion in 2025 and is predicted to be worth around USD 236.04 billion by 2034, at a CAGR of 13.2% from 2025 to 2034.

North America is expected to dominate the market during the forecast period.The region experiences a wide range of cyber threats, including ransomware attacks, data breaches, nation-state-sponsored cyber espionage, and various forms of cybercrime. The region is a prime target due to its economic significance and technological advancements. For instance, the second-highest number of data intrusions in the United States in a single year occurred in 2022, according to The Identity Theft Research Center's (ITRC) Annual Data Breach Report.

In February 2023, the Technology Modernization Fund (TMF) raised over $650 million in funding, aiming to build and improve cybersecurity and digital services at the Social Security Administration. Such investments facilitate improvement in cybersecurity services, accelerating the expansion of the global cybersecurity market.

A minimum of 422 million people were affected. Moreover, the favorable regulatory environment is another important factor that propels market penetration over the projection period. Both the United States and Canada have stringent data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) equivalent in Canada (PIPEDA) and various state-level data breach notification laws in the U.S. Compliance with these regulations drives cybersecurity investments. Thereby, driving the market growth in the region.

Asia Pacific emerges as the fastest-growing region with surging threats and investment in cybersecurity. Organizations in India experienced 3,201 weekly attacks per organization, which is second to Taiwan in the region. With cyberattacks rising, governments in the region have now responded with swift action by enacting stronger cybersecurity legislation, including the Active Cyberdefense Law in Japan and the Digital Personal Data Protection Bill in India.

Asia Pacific entered 2024 with a demand for digital security that was at record levels. In the year of 2024, the region is at risk for unprecedented cyberattacks, web application attacks increased 73%, resulting in 51 billion attacks worldwide, and specifically 17.3 billion attacks in India. (Source: https://www.businesstoday.in).

Taiwan's government experienced cyberattacks daily on average, totaling 2.4 million attacks a day, mostly attributed to Chinese cyber forces. (Source: https://economictimes.indiatimes.com)

In June 2025, the Sethu Institute of Technology (SIT) at Kariapatti near Madurai has signed a Memorandum of Understanding (MoU) with Kiryavan Cyber Forensic Services Private Limited to foster collaborative initiatives that will promote cyber security awareness, hands-on training, and career opportunities to students, research projects for faculty and internship projects in cyber security domain. The initiatives are expected to bridge the gap between academia and industry, and to equip students andfaculty with competencies that are required to tackle modern cyber threats and contribute towards a safer digital ecosystem.

According to the Ministry of Electronics and Information Technology, as reported by the Indian Computer Emergency Response Team (CERT-In), India has witnessed a significant rise in cyberattacks targeting government bodies, marking a 138% increase in the number of such incidents from 85,797 incidents in 2019 to 204,844 in 2023.

Cyber Security Market Companies

- BAE Systems Plc

- Broadcom, Inc.

- Centrify Corporation

- Check Point Software Technology Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- Fortinet, Inc.

- International Business Machines Corporation

- Lockheed Martin Corporation

- LogRhythm, Inc.

- McAfee, LLC.

- Palo Alto Networks, Inc.

Recent Developments

- In June 2025, Antigen Security, LLC announced a new partner program with Microsoft, affirming Antigen as one of Microsoft's Top 150 Managed Partners. This collaboration enables Microsoft 365 E3/E5 Security and Microsoft Azure Security customers to benefit from an average of 20-60% savings on their cyber insurance premiums when leveraging Microsoft's robust security suite as part of a risk-informed, standards-aligned cyber risk management strategy.

- In February 2025, Check Point unveiled the expansion of its Partner and Customer Advocacy Management Services, providing direct access to advocacy experts. These services enhance stability, streamline engagement, and facilitate proactive collaboration between Check Point, its partners, and their customers. Organizations gain a single point of contact to improve security operations, accelerate executive engagement, and optimize cybersecurity strategies.

- In June 2025, Verax AI, a B2B software start-up, announced the launch of Verax Protect - a new solution aimed at companies operating in highly regulated industries that protects and mitigates against the risks of using generative AI. Verax stated 40% of businesses in the U.S. currently have paid subscriptions to AI platforms, models, and tools, up from just five percent in 2023, and 30 % have already experienced an AI-related security breach.

- In March 2025, PortSwigger, a renowned application security software provider, launched Burp AI, Pioneering AI-powered web Application and API Security Testing. By harnessing artificial intelligence, Burp AI enhances human-led security testing, setting a new benchmark for web application and API security. (Source: https://www.businesswire.co)

- In April 2025, Corgea launched BLAST: Transforming Cybersecurity with an AI-Driven Code Security Platform. This is designed toaddress the increasing risks of hidden code vulnerabilities, human error, and security flaws introduced by AI-assisted coding tools.

- In January 2025, ZeroPath Corp. launched a next-generation code security platform powered by artificial intelligence. ZeroPath's security testing platform, among the first of its kind, attempts to combine deep program analysis with large language models to detect more complex security vulnerabilities.

- In April 2025, Palo Alto Networks, the global cybersecurity leader, announced the acquisition of Protect AI, an innovative leader insecuring the use of Artificial Intelligence (AI) and Machine Learning (ML) applications and models. This strategic acquisition reflects Palo Alto Networks' commitment to remaining at the forefront of next-generation cybersecurity innovation and expanding its capabilities to protect the dynamic new attack surface created by the explosion of AI.

- In April 2023, the cybersecurity partner ecosystems of Google Cloud and Mandiant are being combined to provide the most open, complete, and intelligent platform in the market for clients' end-to-end cybersecurity requirements. Mandiant, Google Cloud, and more than 100 other top cybersecurity suppliers are integrated into the united ecosystem, which combines their knowledge and technology. To keep ahead of security threats and close typical gaps that afflict older networks, infrastructure, and tools, Google Cloud offers enterprises the variety and breadth they need for incident response through the proactive defense. With new partner integrations, Google Cloud is enhancing these capabilities even further, enabling users to defend against intrusions across cloud environments and react to cybersecurity incidents more swiftly.

- In August 2023,World Wide Technological (WWT), a global provider of technological solutions, and Akamai Technologies, Inc., the cloud business that drives and protects life online, recently announced a strategic agreement to deliver Akamai's security solutions to WWT's international clients. Worldwide, WWT provides Akamai's security solutions to its business, service provider, and public sector clients. The presence of Akamai at WWT's Advanced Technology Center (ATC) is crucial to the collaboration. The ATC, which has a global presence, includes a variety of technologies that give consumers access to an innovation, research and thought leadership environment. Since Guardicore Segmentation and Akamai API Security are operating in WWT's ATC, Akamai proof-of-concept, lab, demo, and testing are quick and easy.

Segments Covered in the Report

By Component

- Solutions

- Identity and Access Management (IAM)

- Risk and Compliance Management

- Encryption

- Firewall

- Antivirus/Antimalware

- Intrusion Detection System (IDS)/Intrusion Prevention System (IPS)

- Unified Threat Management (UTM)

- Security Information and Event Management (SIEM)

- Disaster Recovery

- Data Loss Prevention (DLP)

- Others (DDOS Mitigation, Patch Management, etc.)

- Services

- Professional Services

- Consulting

- Training & Education

- Support & Maintenance

- Managed Security Services (MSS)

- Professional Services

By Deployment Mode

- On-Premises

- Cloud-based

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Security Type

- Network Security

- Endpoint Security

- Application Security

- Cloud Security

- Data Security

- Infrastructure Protection

- Web Security

- Wireless Security

By Industry Vertical

- BFSI (Banking, Financial Services, Insurance)

- IT & Telecom

- Healthcare

- Government & Defense

- Retail & E-Commerce

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Education

- Media & Entertainment

- Others (e.g., Hospitality, Legal Services)

By Threat Type

- Malware

- Phishing

- Ransomware

- Denial of Service (DoS/DDoS)

- Insider Threats

- Advanced Persistent Threats (APT)

- Zero-Day Exploits

- Man-in-the-Middle Attacks (MITM)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting