Cloud Security Market Size and Forecast 2025 to 2034

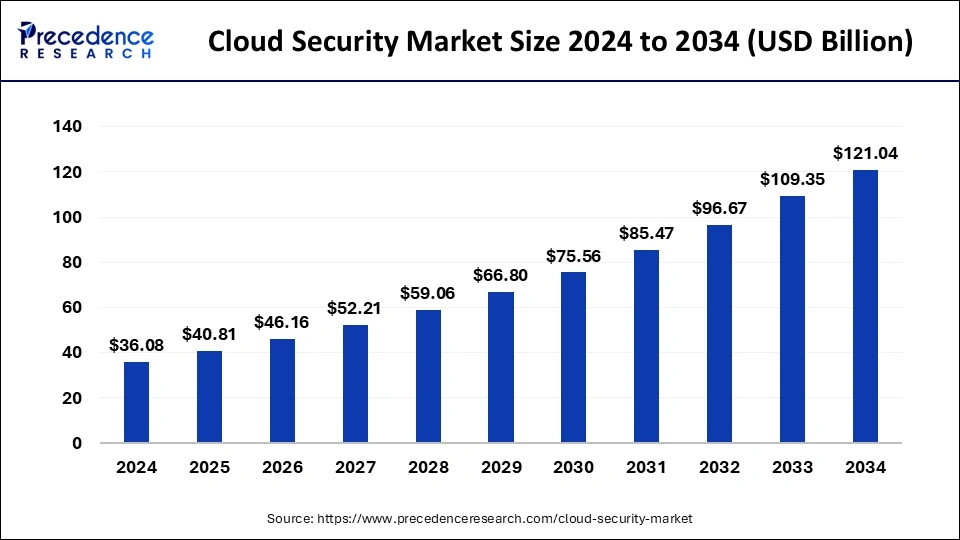

The global cloud security market size was estimated at USD 36.08 billion in 2024 and is predicted to increase from USD 40.81 billion in 2025 to approximately USD 121.04 billion by 2034, expanding at a CAGR of 12.87% from 2025 to 2034. Increasing security threats due to the inclination towards rapid digitalization among various leading industries, which need a robust cyber security structure fueling the growth of the market globally.

Cloud Security Market Key Takeaways

- The global cloud security market was valued at USD 36.08 billion in 2024.

- It is projected to reach USD 121.04 billion by 2034.

- The market is expected to grow at a CAGR of 12.87% from 2025 to 2034.

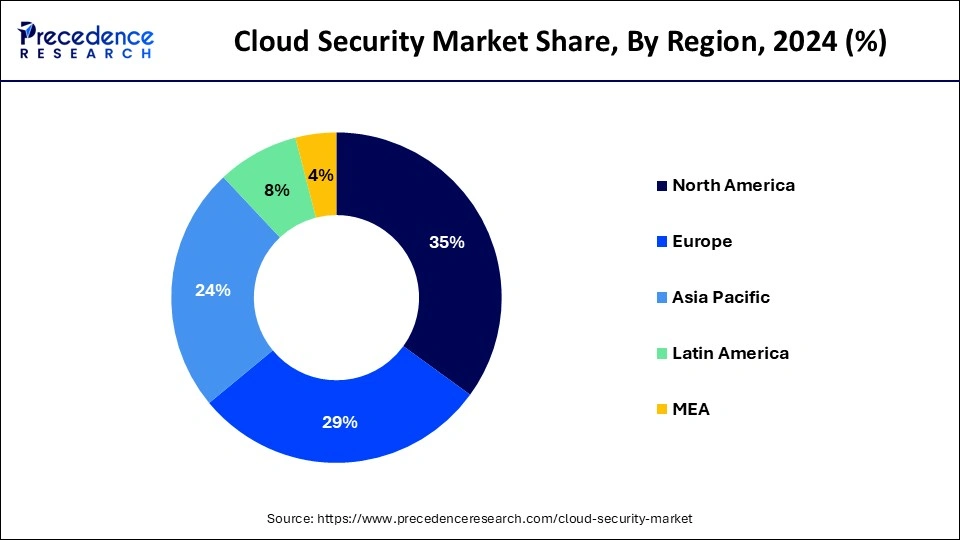

- North America dominated the market with the largest revenue share of 35% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR of 14.82% over the foreseeable period.

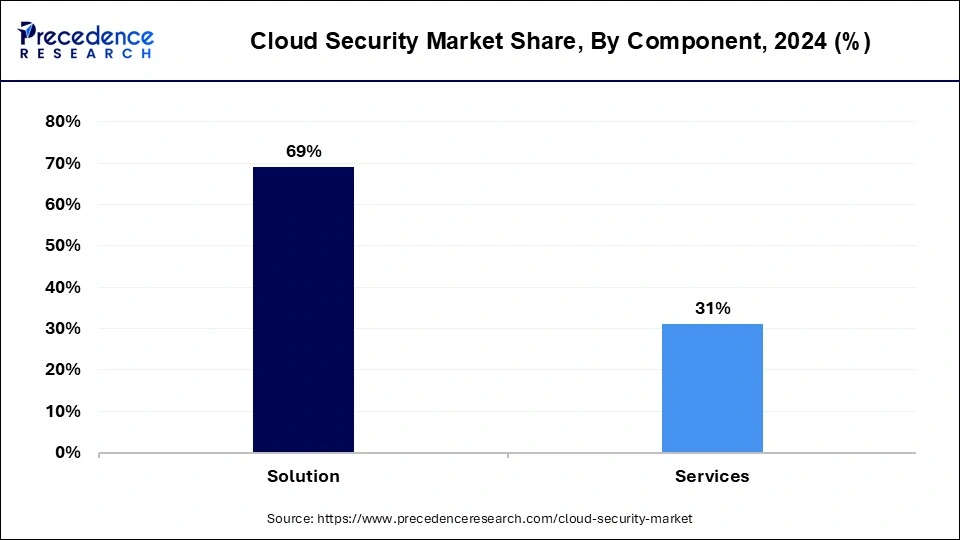

- By components, the solution segment has held a major revenue share of 69% in 2024.

- By components, the services segment is projected to at a solid CAGR of 14.52% during the foreseeable period.

- By deployment, the private segment has contributed more than 48% of revenue share in 2024.

- By deployment, the hybrid segment is anticipated to witness notable CAGR of 13.51% over the upcoming period.

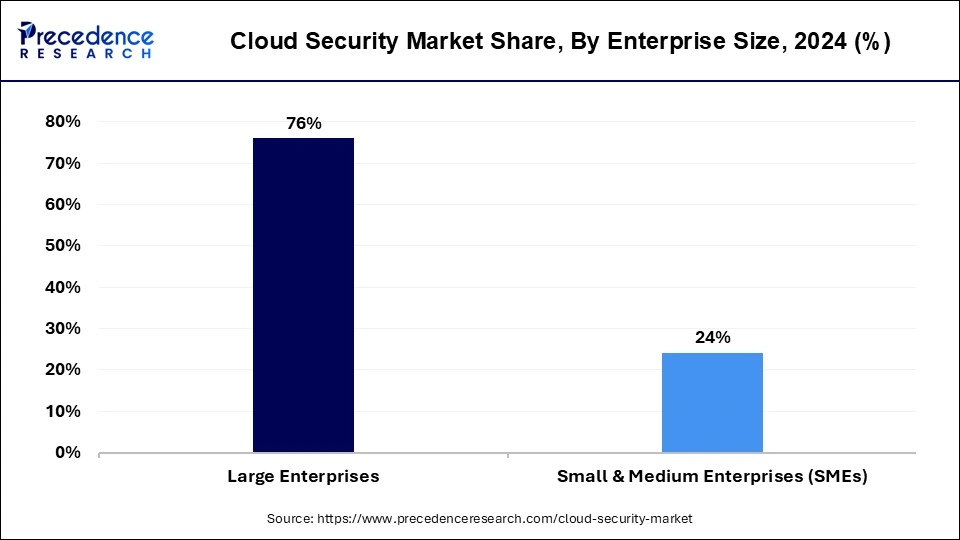

- By enterprise size, the large enterprise segment accounted for the highest revenue share of 76% in 2024.

- By enterprise size, the small & medium enterprises (SMEs) segment is expected to show solid CAGR of 15.51% over the forecasted years.

- By end-use, the IT & telecom segment registered with the highest revenue share of 18% in 2024.

- By end-use, the healthcare segment is anticipated to witness the fastest CAGR of 15.31% in the market during the foreseeable period.

U.S. Cloud Security Market Size and Growth 2025 to 2034

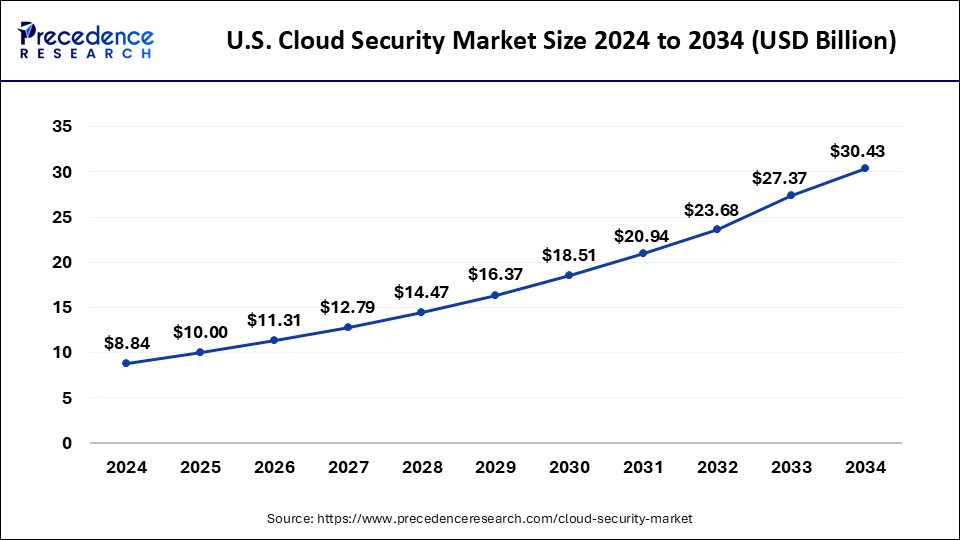

The U.S. cloud security market size surpassed USD 7.82 billion in 2024 and is projected to attain around USD 27.37 billion by 2034, poised to grow at a CAGR of 13.34% from 2025 to 2034.

North America held the largest share of the cloud security market in 2024. The region is home to numerous leading cloud service providers and cybersecurity firms, including AWS, Microsoft Azure, and Google Cloud, which drive innovation and market growth. Additionally, the region's stringent regulatory environment, with laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), compels organizations to invest heavily in cloud security solutions to ensure compliance. The presence of major industries such as finance, healthcare, and IT, which handle vast amounts of sensitive data, further accelerates the demand for robust cloud security measures.

Asia Pacific will witness significant growth in the cloud security market over the foreseeable period. Driven by rapid digital transformation and increasing cloud adoption across various industries. Countries such as China, India, Japan, and South Korea are witnessing significant investments in cloud infrastructure and services, which in turn boosts the demand for advanced cloud security solutions. The region's small and medium-sized enterprises (SMEs) are also increasingly leveraging cloud technologies to enhance operational efficiency and competitiveness, further propelling market growth.

Additionally, rising cyber threats and data breaches in the region are compelling organizations to prioritize robust cloud security measures. Government initiatives promoting digitalization and stringent data protection regulations are key factors contributing to the accelerated growth of the market in this region. The ongoing expansion of internet connectivity and mobile device usage adds to the necessity for effective cloud security solutions, positioning Asia Pacific as a critical player in the global market.

Market Overview

The cloud security market is rapidly growing, driven by the increasing adoption of cloud services across industries. Businesses are shifting to cloud platforms for better scalability, cost efficiency, and remote work capabilities, heightening the need for robust security solutions to protect sensitive data and applications. Key drivers include the rise in cyber threats, regulatory compliance requirements, and the need to safeguard data from breaches. Cloud security encompasses various solutions like identity and access management, data encryption, threat detection, and compliance management.

Major players in the cloud security market include AWS, Microsoft Azure, Google Cloud, and cybersecurity firms like Palo Alto Networks, Cisco, etc. The market is expected to expand significantly, with small and medium enterprises (SMEs) increasingly investing in cloud security solutions alongside large corporations. As digital transformation accelerates, the demand for comprehensive cloud security measures continues to grow, making it a critical component of modern IT infrastructure.

Cloud Security Market Growth Factors

- Businesses of all sizes are migrating to cloud platforms for better flexibility and scalability.

- The growing frequency and sophistication of cyber-attacks drive the need for robust cloud security measures.

- Stringent data protection regulations require organizations to implement secure cloud practices.

- The shift to remote work environments necessitates secure access to cloud resources.

- Heightened awareness around data privacy and protection fuels investment in cloud security.

- Innovations in AI and machine learning enhance threat detection and response capabilities.

- Cloud security solutions often offer cost-effective protection compared to traditional on-premises security.

- Small and medium enterprises are increasingly investing in cloud security as they adopt cloud.

- Ongoing digital transformation initiatives across industries require robust security frameworks.

- Collaborations between cloud providers and security firms boost the development of integrated security solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 40.81 Billion |

| Market Size by 2034 | USD 121.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 12.87% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment, Enterprise Size, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Cloud computing solutions

Increased adoption of cloud computing solutions and services can be the major driver of the cloud security market. As the digitalization of work becomes an essential part of enterprises, many enterprises invest in cloud platforms, which help improve the scalability, flexibility, and cost-effectiveness of operations. Due to the rising adoption of digital platforms, they encounter new security cyber threats by unauthorized access attempts by hackers.

To combat this effectively, cloud computing solutions and services offer safeguard techniques to protect against data breaches and data losses. Cloud security providers are continuously exploring and presenting various techniques to address these evolving threats, further fueling the growth of the cloud security market globally. Also, digital transformation initiatives and remote work accelerated cloud adoption, which amplified the need for a robust cybersecurity structure while maintaining the regulatory requirements set by authorities. Hence, rising cloud adoption due to digitalization and stringent regulations about security measures are the propelling factors of the market.

Restraint

Substantial budget for maintenance

A major restraint for the cloud security market is the high cost and complexity of implementing and managing advanced security solutions. Cloud security is essential for protecting sensitive data and maintaining compliance. The financial burden can be significant, particularly for small and medium-sized enterprises (SMEs) with limited budgets.

In the cloud security market, the complexity of integrating cloud security solutions with existing IT infrastructure can pose significant challenges. Organizations often need specialized expertise to configure and manage these systems effectively, leading to increased operational costs and potential skill gaps. Also, the rapid evolution of cyber threats requires continuous updates and enhancements to security measures, adding to the long-term costs and resource demands. These financial and logistical barriers can hinder the adoption of comprehensive cloud security solutions, slowing market growth despite the rising need for robust cybersecurity.

Opportunity

Incorporation of AI and ML

One significant opportunity in the cloud security market is the growing demand for artificial intelligence (AI) and machine learning (ML) based security solutions. As cyber threats become increasingly sophisticated thus traditional security measures often fall short. AI and ML technologies can enhance threat detection, predict potential vulnerabilities, and automate responses, providing more proactive and efficient security.

These advanced technologies enable real-time analysis of vast amounts of data, identifying patterns and anomalies that could indicate security breaches. By leveraging AI and ML, cloud security solutions can offer more accurate and faster threat detection, reducing the time to respond and mitigate cyber-attacks. The integration of AI and ML in cloud security not only improves protection but also optimizes resource use, making security operations more cost-effective. This opportunity is particularly appealing as organizations seek to enhance their cybersecurity posture while managing costs and driving growth and innovation in the cloud security market.

Component Insights

The solution segment was estimated to hold the largest share of the cloud security market recorded in 2024. In the cases of rising digital applications worldwide and their immersive experience with quick solutions, people prefer to leverage benefits from digital platforms in every aspect; hackers may have some intricate methods to do cyber-attacks either on major firms or on individual accounts. To avoid such attacks from unauthorized sources and prevent the data, enterprises are compelled to employ a comprehensive approach for safety purposes by using cloud security solutions such as multi-layered protections, including a spectrum of tools, technologies like end-to-end encryption, security analytics, preventive methods to protect a data and threat intelligence.

The services segment is expected to grow exponentially in the cloud security market during the foreseeable period due to the increasing frequency of cyber-attacks, enterprises conclude to build robust security structures which is nearly impossible to break by using security protocols. To achieve this, the service segment possesses the ability to merge itself into cutting-edge technologies like AI and ML with cloud security frameworks. Cloud security frameworks can benefit from predictive analytics and behavioral analytics by AI tools, while ML can be used to understand patterns and receive insights from huge amounts of data. Such a defensive approach against cyber threats can mitigate the frequency of cyber-attacks.

Deployment Insights

The private segment accounted for the largest share of the cloud security market in 2024. The growth of this segment is attributed to the fact that an increasing number of enterprises are incorporating the private cloud service to serve secure data transmission for critical mission applications, as delaying in such cases causes huge financial losses and increases the overall burden on the enterprises. Thus, it becomes a crucial step for many enterprises to deploy a private cloud platform that holds the potential to accomplish whatever enterprises are looking for. Hence, such a shift towards exclusive cloud services provides absolute control to the enterprise, leading to efficient operations.

The hybrid segment is anticipated to witness substantial growth in the cloud security market over the upcoming period. The growth of this segment is due to the effective management of data without centralizing it in one place, which offers reliability without compromising the performance of enterprises. By considering the economic status, the enterprises can leverage hybrid cloud solutions as they provide cost-effective solutions for optimizing operations; therefore, by realizing the benefits of hybrid cloud setup, enterprises are largely investing in the market to upscale themselves globally and technologically.

Enterprises Size Insights

The large enterprise accounted for the highest share of the cloud security market in 2024. The dominance of large enterprises is primarily due to the substantial investment into cloud development and infrastructure by enterprises, which in turn increases the risk of cyber-attacks and data breaches. Since these enterprises handle complex datasets with sensitive information, it's essential to build a robust cloud security infrastructure within the enterprise.

The small & medium enterprises (SMEs) segment is expected to show rapid growth in the cloud security market over the forecasted years. SMEs are increasingly adopting cloud services to enhance their overall operational efficiency while keeping a proactive approach to their data security. Also, SMEs are compelled to follow regulatory requirements that mandate the protection of sensitive data, further driving the investment by SMEs in the cloud security structure, which will act as a catalyst to propel the growth of the market on a larger scale.

End-use Insights

The IT & telecom segment registered with the highest revenue share of the cloud security market in 2024. The growth of this segment is due to operational complexity in the IT and telecom industry encompassing various software, a number of devices, and large networks. Furthermore, emerging fields such as 5G and IoT carry a significant security challenge in the market, which needs to be resolved to leverage these technological advancements. Security protocols in IT and telecom must encompass the security of a spectrum of devices and networks to ensure the integrity of innovative technologies like IoT.

The healthcare segment is anticipated to witness the fastest growth in the cloud security market during the foreseeable period. The proliferation of the healthcare segment is due to ongoing inventions in the healthcare sector, like the IoMT- the Internet of Medical Things. Such solutions come with security challenges as patients' health data is crucial to protect and avoid the misuse of it. Hence, cloud security plays an important role in healthcare, specifically in telehealth solutions, where data breaches can be a higher risk.

Cloud Security Market Companies

- Amazon Web Services, Inc.

- Broadcom, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- Extreme Networks, Inc.

- Fortinet, Inc.

- F5, Inc.

- Forcepoint

- International Business Machines Corporation

- Imperva

- Palo Alto Networks, Inc.

- Proofpoint, Inc.

- Sophos Ltd.

- Trellix

- Zscaler, Inc.

Recent Developments

- In February 2024, a novel infinity AI copilot platform was launched by checkpoint software technologies, which aids in enhancing cloud technologies' operational efficiency with the help of AI technology.

- In May 2023, Light Spin Technologies Ltd., a cloud security software company, was acquired by Cisco Systems, Inc. This acquisition strengthens Cisco's roots by providing end-to-end cloud security by adding a CSPM system to cloud-native resources.

Segments Covered in the Report

By Component

- Solution

- Cloud Access Security Broker (CASB)

- Cloud Detection and Response (CDR)

- Cloud Security Posture Management (CSPM)

- Cloud Infrastructure Entitlement Management (CIEM)

- Cloud Workload Protection Platform (CWPP)

- Services

- Professional Services

- Managed Services

By Deployment

- Private

- Hybrid

- Public

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-use

- BFSI

- Retail & e-commerce

- It & Telecom

- Healthcare

- Manufacturing

- Government

- Aerospace & Defense

- Energy & Utilities

- Transportation & Logistics

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting