What is the Cloud Kitchen Market Size?

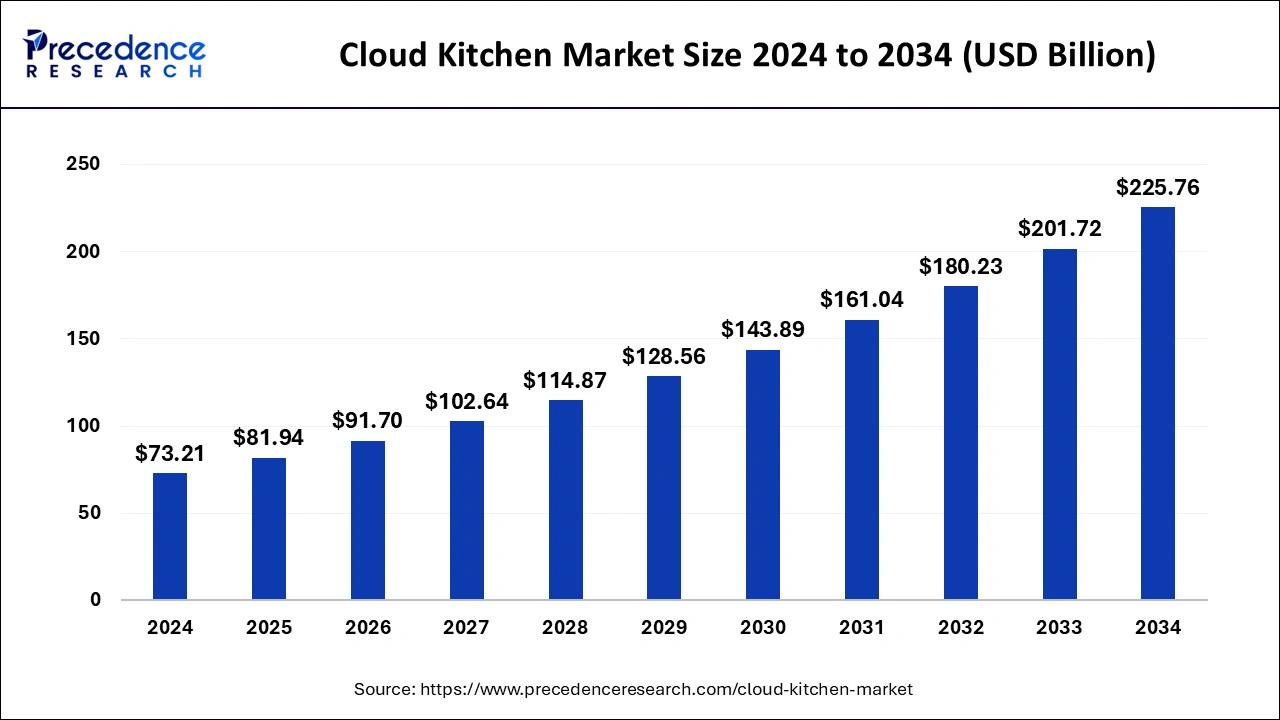

The global cloud kitchen market size is accounted at USD 81.94 billion in 2025 and predicted to increase from USD 91.70 billion in 2026 to approximately USD 225.76 billion by 2034, representing a CAGR of 11.92% from 2025 to 2034. The global cloud kitchen market growth is attributed to the increasing preference for convenient dining options, the increasing busy lifestyles and urbanization, and the rise of food delivery apps.

Market Highlights

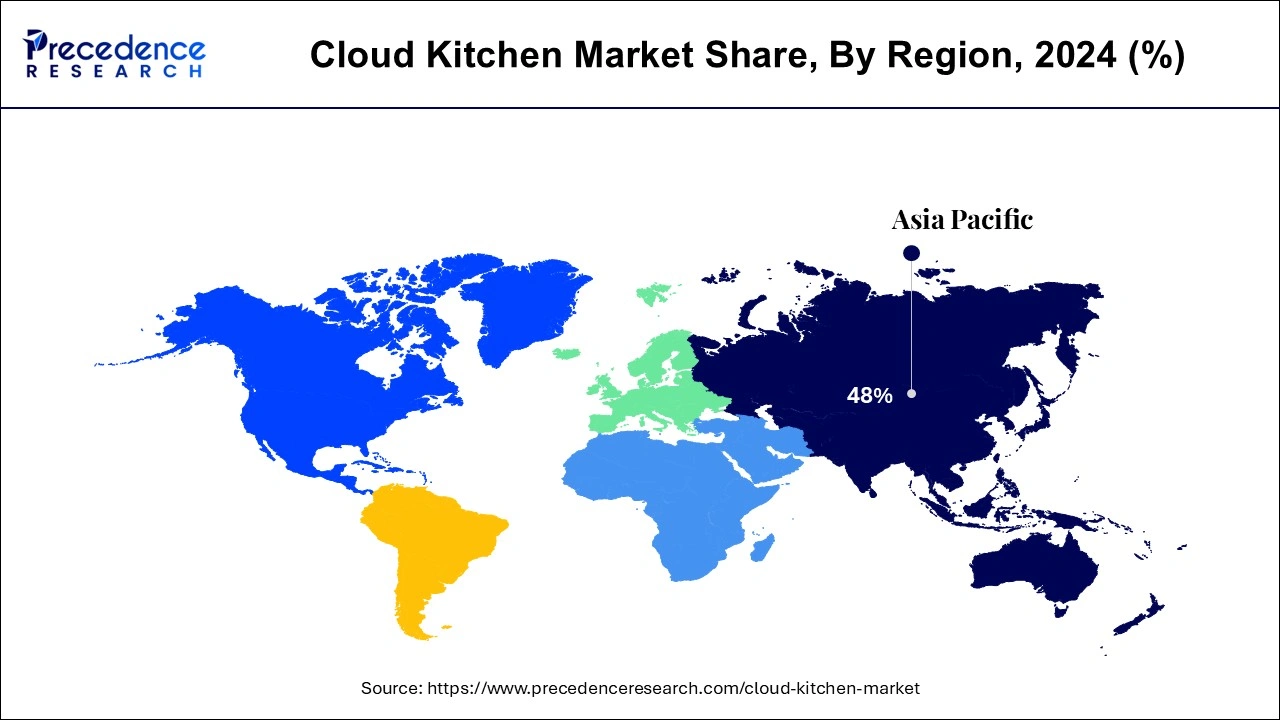

- Asia Pacific dominated the global market with the largest market share of 48% in 2024.

- North America is projected to expand at the notable CAGR during the forecast period.

- By Product, the burger and sandwich segment has held the largest market share in 2024.

- By Product, the Mexican/Asian food segment is estimated to be the fastest-growing segment during the forecast period.

- By Deployment Types, the mobile segment captured the biggest market share in 2024.

- By Deployment Types, the web segment is predicted to be the fastest-growing segment during the forecast period.

- By Solutions, the order management segment captured the biggest market share in 2024.

- By Solutions, the inventory management segment is predicted to be the fastest-growing segment during the forecast period.

Market Size and Forecast

- Market Size in 2025: USD 81.94 Billion

- Market Size in 2026: USD 91.70 Billion

- Forecasted Market Size by 2034: USD 225.76 Billion

- CAGR (2025-2034): 11.92%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

How AI is Revolutionizing the Cloud Kitchen Market?

Artificial Intelligence has become an essential part of our technology in recent years. Artificial Intelligence plays a very important role, from controlling the apps to every device. AI-generated robots can cook customer's favorite food delivered to their doorstep. The installation cost of AI is cost-effective and does not need any manpower. Orders can be accepted by voice commands, with the help of Artificial Intelligence. Customers can easily receive the same treatment as restaurants through their devices and prevent long lines to place their orders at restaurants. The number of daily sales is estimated to go up with less investment in human labor fancy infrastructure, with the installment of Artificial Intelligence. AI-generated restaurants do not require hiring people to track, take orders, cook, and deliver orders. All one needs is an AI assistant to handle all functions. Due to these advanced and convenient AI trends, AI will take food apps and other businesses to a higher level and further revolutionize the growth of the cloud kitchen market.

Market Trends

- The growing demand for food coupled with the rising global population, rising disposable income, increased demand for conveniences, and proliferation of digital technologies are the major factors that drive the global cloud kitchen market.

- The rising preferences for online food delivery over the dine-in experience and the rapid growth and penetration of the various online food delivery apps such as Zomato, Swiggy, EatSure, and Grubhub have exponentially supported the growth of the global cloud kitchen market.

- The ease of doing business and favorable government policies regarding food delivery and kitchens have made it easier to start a cloud kitchen. There are various organizations that train and guide people to start their own cloud kitchens. This has boosted the number of small and independent cloud kitchens, especially in developing countries.

- The increased penetration of the internet, growing adoption of smartphones, and adequate support from food delivery platforms have contributed to the growth of the cloud kitchen market.

- The increasing demand for online food delivery services has forced restaurateurs to start cloud kitchen outlets in order to serve online customers. The increasing penetration of social media and the digital marketing strategies adopted by the top market players is significantly contributing to the market growth.

- The doorstep delivery of food and the availability of 24/7 customer care support are boosting the adoption of food delivery apps among global customers. Cloud kitchens are gaining popularity as operating costs are lower and the profit margins are higher compared to those of the restaurants. Further, flexibility in operations is another major factor that has supplemented the growth of the cloud kitchen across the globe.

Cloud Kitchen Market Outlook:

- Industry Growth Overview: The cloud kitchen will experience high growth between 2025 and 2030 as a continued increase in online food delivery drives expansion with low operating costs. The growth of delivery platforms and changing consumer behavior in the Asia-Pacific and North America will support stronger expansion rates for niche cuisines and premium meals.

- Sustainable Practices Trends: Cloud kitchens adopt eco-friendly packaging, energy-efficient appliances, and waste-reducing systems. Brands such as Rebel Foods and Kitopi are incorporating sustainable sourcing and AI-powered inventory control to reduce food waste and ensure they are able to align operations with sustainability goals globally, while meeting consumers' expectations for greener food delivery.

- Global Expansion: Leading brands are expanding into emerging regions, including Southeast Asia, the Middle East, and LATAM, to capture growing online consumers. Partnerships with delivery aggregators and real estate developers are facilitating faster setups and scales with high-demand urban cores.

- Key Investors: Venture capital and private equity firms are firmly invested in scalable, technology-driven kitchen concepts. These big investors have invested in delivery-first brands and more complex infrastructure startups for high-margin returns in the digital food system.

- Startup Ecosystem: The startup ecosystem has a vibrant community of players developing automation, virtual branding, and AI-driven optimization of menus. CloudEats in the Philippines and Karma Kitchen in the UK are good examples of developing traction with shared kitchen space and data-led culinary development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 81.94 Billion |

| Market Size in 2026 | USD 91.70 Billion |

| Market Size by 2034 | USD 225.76 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 11.92% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment Types, Solutions, Product, Nature, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Segment Insights

Product Insights

By product type, the burger and sandwich segment dominated the market globally. The popularity of burgers and sandwiches as classic comfort foods has gone up substantially. This segment is versatile enough to cater to different consumer tastes and preferences, able to be customized according to the regional palates. Burgers and sandwiches are also convenient for delivery, able to retain consistency and taste, making them suitable for food transportation.

The Mexican/Asian food segment is predicted to witness significant growth in the market over the forecast period. The rising global popularity of Mexican and Asian cuisine due to exposure on social media along with a larger immigrant population, as well as increased accessibility to ingredients is leading to substantial growth in this sector of the market.

Deployment Types Insights

The mobile segment registered its dominance over the global market. Mobile apps are widely accessible, with customers preferring to place orders on dedicated apps due to widespread smartphone usage and convenience. Mobile apps also automatically detect user phone location to suggest nearby cloud kitchens.

By deployment types, the web segment is predicted to witness significant growth in the market over the forecast period. Web access is allowing cloud kitchens to become more popular, allowing customers to easily access food from cloud kitchens through their web browsers, which integrate major food delivery platforms.

Solutions Insights

By solutions, the order management segment dominated the market globally. These apps help monitor orders from various sources, keeping tab of stock and sales figures. These systems also help track order progress, allowing the sales team to keep a record of the customers who have placed orders with the company.

By solutions, the inventory management segment is predicted to witness significant growth in the market over the forecast period. These systems allow for accurate monitoring of inventories of food and ingredients, helping identify usage patterns and assisting businesses in optimizing purchasing decisions. Many of these apps also have barcode scanning capabilities, for quick and accurate data entry.

Type Insights

The independent cloud kitchen segment dominated the market with a 62.10% share in 2024. The dominance of the segment can be attributed to its lower initial investment costs and operational flexibility as compared to conventional restaurants. Also, this cloud kitchen does not necessitate elaborate dining areas or prime real estate, which impacts positive segment growth.

The commissary / shared kitchen segment is expected to grow at the highest CAGR of 11.10% over the forecast period. The growth of the segment can be credited to the growing demand for online food delivery services, along with the rise in demand for convenient, on-demand food delivery services. This kitchen cut the requirement for expensive, prime-location dining areas and storefronts by minimizing overall operational costs.

Cuisine Type Insights

The ethnic cuisine segment held the largest market share of 49.30% in 2024. The dominance of the segment can be linked to the increasing demand for authentic and diverse international food, especially among urban populations with busy lifestyles. Moreover, the increasing global palate for flavorful, bold, and international cuisines is the major factor impacting positive market expansion.

The health-conscious & organic food segment is expected to grow at the highest CAGR of 12.40% over the forecast period. The growth of the segment can be driven by the growing need for transparency in food sourcing and changing consumer preferences for healthier lifestyles. Furthermore, social media and influencers are actively promoting tools for health-conscious brands, driving segment growth soon.

Technology Platform Insights

The order & delivery management software segment dominated the market with a 41.70% share in 2024. These apps help monitor orders from various sources, keeping track of stock and sales figures. These systems also help track order progress, allowing the sales team to keep a record of the customers who have placed orders with the company.

The AI, robotics & automation segment is expected to grow at the highest CAGR of 13.80% during the projected period. The growth of the segment is due to ongoing demand for improved operational efficiency, coupled with the consumer inclination towards speed and consistency. Additionally, AI and machine learning processes large amounts of data on different parameters, leading to further segment growth.

End-User Insights

The startups & small enterprises segment held the largest market share of 44.90% in 2024. The dominance of the segment can be attributed to the extensive adoption of smartphones and internet connectivity across the globe. Also, startups can work at relatively lower costs as they don't need to invest in expensive dine-in spaces and prime retail locations.

The delivery aggregators segment is expected to grow at the highest CAGR of 12.70% during the projected period. The growth of the segment can be credited to the changing consumer behaviour towards online food ordering and cost efficiencies for food businesses. Furthermore, aggregators offer valuable data and insights into popular cuisines and consumer preferences.

Regional Insights

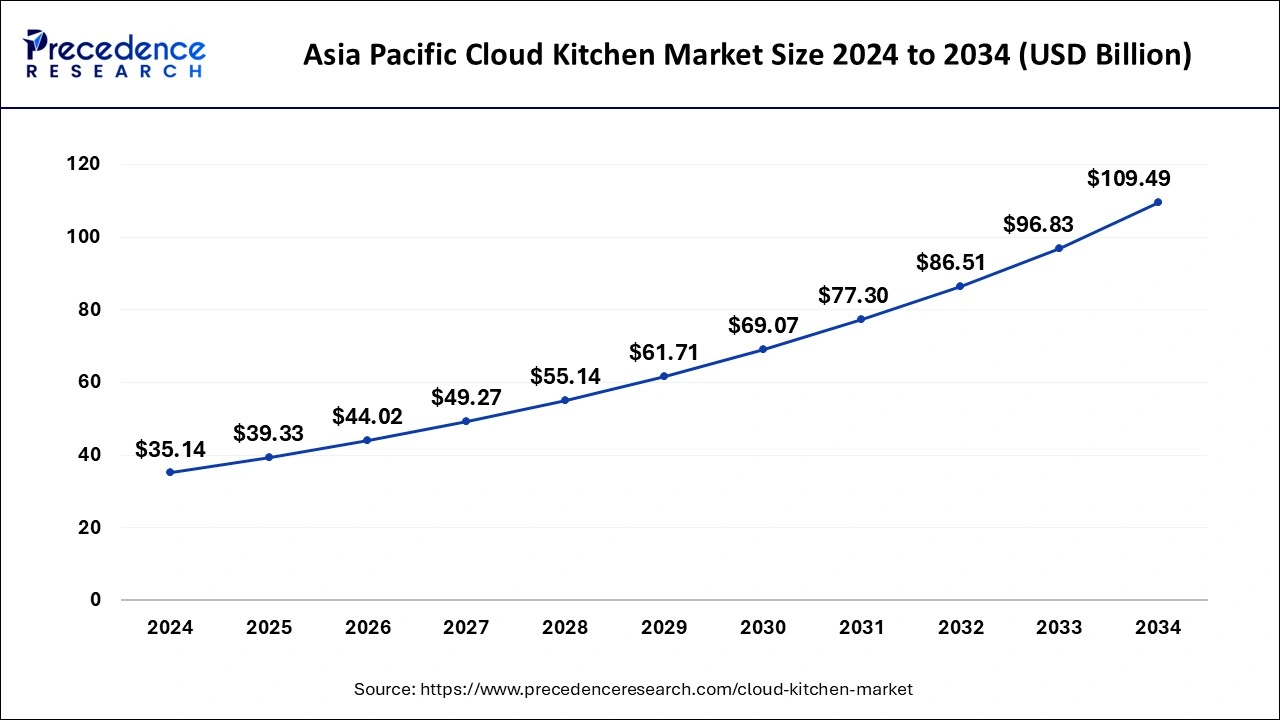

Asia Pacific Cloud Kitchen Market Size and Growth 2025 to 2034

The Asia Pacific cloud kitchen market size is evaluated at USD 39.33 billion in 2025 and is predicted to be worth around USD 109.49 billion by 2034, rising at a CAGR of 12.04% from 2025 to 2034.

Asia Pacific was the leading cloud kitchen market that garnered a market share of more than 60% in 2024. Asia Pacific is the home to more than half of the global population which provides a huge consumer base. The rapid urbanization, rising disposable income, busy and hectic lifestyle, rising penetration of the internet, and the increasing adoption of the smartphones are some of the significant macroeconomic factors that drives the growth of the cloud kitchen market in Asia Pacific. Moreover, the presence of huge youth population and the rising demand for food along with the rising population is supplementing the market growth. The countries like China and India are showing promising growth opportunities for the market players owing to the strong economic growth in the region. The rising demand for the international cuisines and rising preferences for the food delivery over dine-in is supplementing the growth of the Asia Pacific cloud kitchen market. For this, the Asia Pacific is also estimated to be the fastest-growing market.

India has quickly become a stronghold player in the Asia Pacific cloud kitchen market. The youth population, with its technology-led behavior in harmony with the increasing lure of food delivery platforms like Zomato, Swiggy etc. and the advancements in cloud kitchens as a concept has only increased demand for virtual kitchens. Coupled with high urbanization, disposable incomes and the preference of eaters for quick and inexpensive meals, it has rendered cloud kitchens a very lucrative and appealing business idea. With startups like Rebel Foods, EatSure and increasingly other companies developing multi-brand kitchen models, cloud kitchens are gaining traction in sectors and expanding aggressively. Finally, lower operating costs compared to traditional restaurants create exciting opportunities for entrepreneurs/investors across India due to acceptable business models.

North America is estimated to grow at a considerable pace 10% during the forecast period. Increasing buying power, improved access to the digital technologies, higher penetration of internet, and increased adoption of the smart devices are some of the major factors that has propelled the growth of the North America cloud kitchen market. The high demand for the fast foods coupled with the busy and hectic schedules of the consumers is boosting the demand for the cloud kitchen services owing to the conveniences associated with it.

In North America, the cloud kitchen market is still largely dominated by the United States, as demonstrated by the mature state of a digital infrastructure and food delivery services in this region. Companies like CloudKitchens, Kitchen United and DoorDash Kitchens offer efficient, delivery-only models to soon-to-be restaurant operators. Changing consumer preferences toward the convenience of ghost kitchens, allied with the overwhelming preference for discovery, have transformed this space to become the new norm for capitalize. A larger set of accessible and urban customers increases the opportunity for new cuisines and service chargeable opportunities in the food delivery market, supporting the growth of this model whilst basic operating licenses remain limited. Strategic investments have enabled large cloud kitchen networks to scale rapidly in major cities across the USA, through partnerships and strategic investments with national food chains.

The cloud kitchen market in Europe is continuously progressing, and demand for food delivery is accelerating in cities. In Europe, the United Kingdom is at the forefront of the change, with a sophisticated digital ecosystem and strong delivery partners Deliveroo and Uber Eats. Deliveroo has enabled restaurants to launch new brands quickly via its "Editions" cloud kitchen model, while preserving the multi-ordered aspects that dining in brings while avoiding the high costs. The UK's incredibly high urban densities, changing consumer behaviors, and focus on convenience have all assisted this change enormously from eat in environments.

United Kingdom - Europe's Virtual Food Pioneer

The United Kingdom led the European cloud kitchen market due to its well-established delivery platforms like Deliveroo and Just Eat. Cloud kitchen operators have focused more on healthier menus and convenient delivery options, which have aligned nicely with evolving consumer habits and faster overall growth of the market.

Latin America - Flavor Meets Innovation

Latin America is seeing the rapid adoption of cloud kitchens due to its high percentage of youth, smartphone penetration, and expanded food delivery culture. The sectors affordable kitchen rentals and the emergence of app-based platforms have enabled small businesses to rapidly and seamlessly enter the digital food market.

Brazil presents the strongest demand for the cloud kitchen segment, largely fueled by urbanization and working lifestyles. Food delivery platforms such as iFood have partnered with cloud kitchens, creating large opportunities for local restaurants to grow without the fixed costs of retail kitchens.

Middle East & Africa - The Desert's Digital Feast

The Middle East & Africa experienced steady growth from an increase in online delivery and smartphone usage. New virtual food brands benefited from affordable rental kitchens and heightened tourism activity, particularly in major cities such as Dubai and Riyadh.

The UAE has the largest cloud kitchen market in the MEA region, with a tech-friendly population and a large expat population base. Cloud kitchens accelerated rapidly as brands leveraged advanced analytics and AI to optimize their menu management, reduce costs, and account for varied food preferences.

Cloud Kitchen Market Companies

- Kitchen United

- Rebel Foods

- DoorDash Kitchen

- Zuul Kitchen

- Keatz

- Kitopi

- Ghost Kitchen Orlando

- Dahmakan

- Starbucks (Star Kitchen)

- Cloud Kitchen

Recent Developments

- In October 2024, a culinary venture, Karigari by Chef Harpal Singh Sokhi announced the launch of its first cloud kitchen in Noida Sector 4. This marked an important milestone in the brand's continued growth and a key step in its strategy to expand into Tier 1 and Tier 2 cities across India.

- In February 2024, Healthy Food brand Salad Days launched its first cloud kitchen and expanded its operations in Mumbai. The aim behind this launch was to establish a strong foothold across Mumbai's key districts such as Khar, Lower Parel, and Andheri West.

- In December 2024, India's leading cash-flow-based financing platform, Velocity earmarked 200 Cr in 2025 to accelerate and support growth in the cloud kitchen ecosystem and restaurants across India.

Segments Covered in the Report

By Type

- Independent Cloud Kitchen

- Commissary/Shared Kitchen

- Kitchen Pods

- Aggregator-Owned Cloud Kitchens

- Restaurant-Branded Cloud Kitchens

By Nature of Operation

- Single Brand

- Multi-Brand

- Hybrid Models

By Cuisine Type

- Fast Food (Burgers, Pizzas, etc.)

- Ethnic Cuisine (Indian, Chinese, Mexican, etc.)

- Health-Conscious & Organic Food

- Gourmet & Premium Offerings

- Others

By Order Source

- Online Food Aggregators (Swiggy, Zomato, Uber Eats, DoorDash, etc.)

- Restaurant-Owned Platforms/Websites

- Phone Orders

- Walk-in/Takeaway (limited cases)

By Technology Platform

- Kitchen Management Systems

Order & Delivery Management Software - POS & Payment Gateways

- Inventory & Supply Chain Software

- Customer Engagement & Loyalty Tools

- AI, Robotics & Automation (e.g., smart kitchens, robot chefs)

By End-User

- Startups & Small Enterprises

- Established Restaurant Chains

- Delivery Aggregators

- Catering Services

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting