What is the Telecom Cloud Market Size?

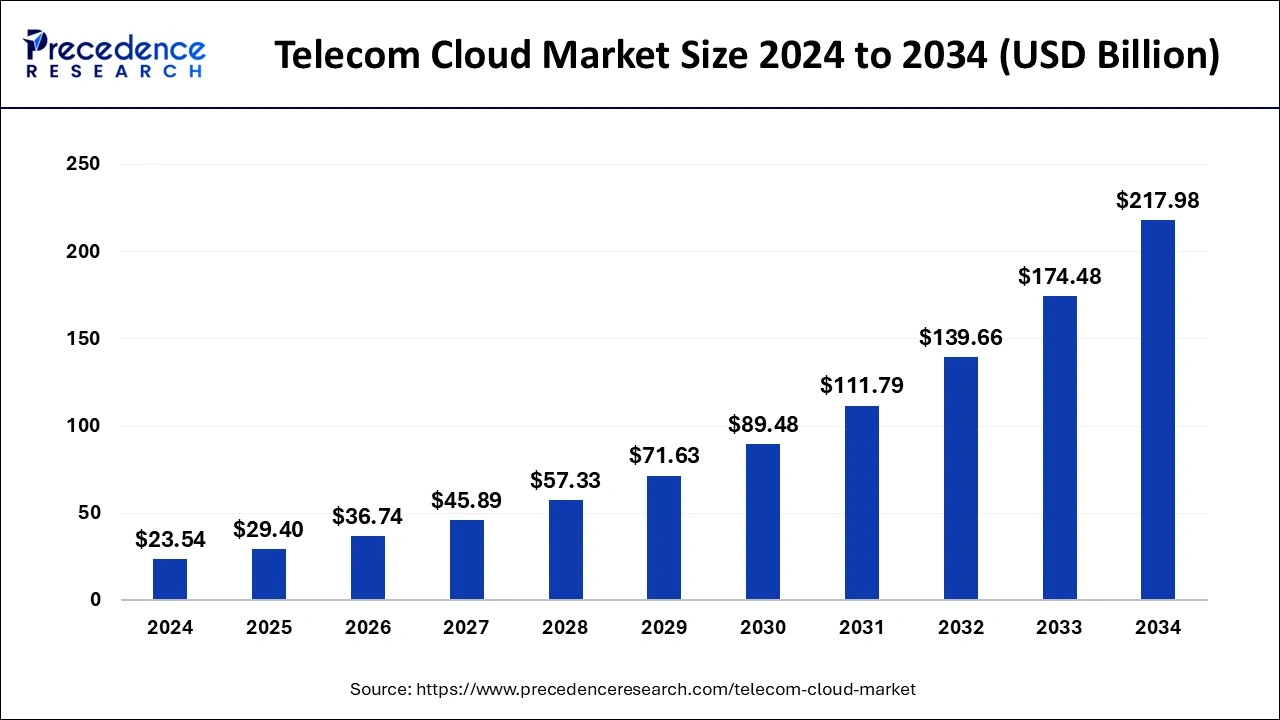

The global telecom cloud market size is calculated at USD 29.40 billion in 2025 and is predicted to increase from USD 36.74 billion in 2026 to approximately USD 255.69 billion by 2035, expanding at a CAGR of 24.15% from 2026 to 2035.

Telecom Cloud Market Key Takeaways

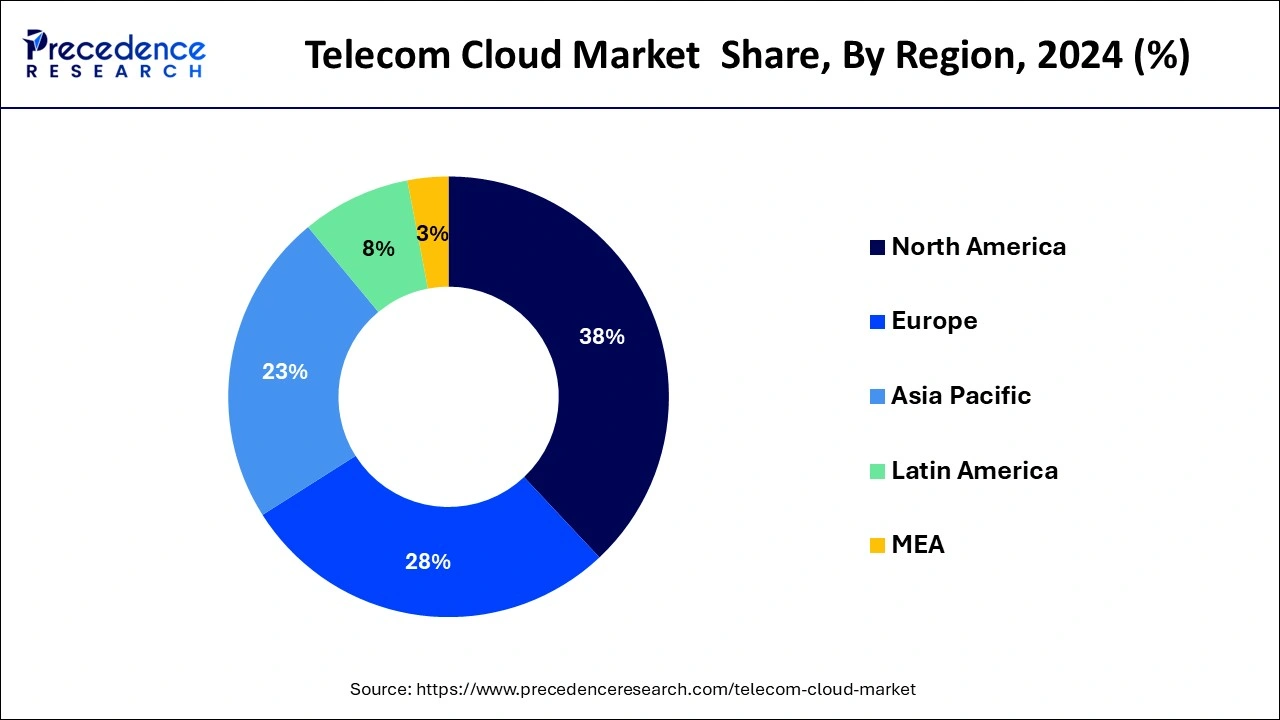

- North America dominated the global market with the largest market share of 38% in 2025.

- Asia Pacific is projected to expand at a notable CAGR during the forecast period.

- By type, the services segment contributed the highest market share in 2025.

- By type, the solutions segment is estimated to be the fastest-growing segment during the forecast period.

- By computing service, the IaaS segment captured the biggest market share in 2025.

- By computing service, the SaaS segment is expected to grow at a significant CAGR from 2026 to 2035.

- By application, the BFSI segment is expected to hold the largest market share in 2025.

- By application, the transportation segment is predicted to be the fastest-growing segment during the forecast period.

How AI is Revolutionizing the Telecom Cloud Market?

AI is transforming various industries globally, and the telecom industry is no exception. Artificial intelligence helps the telecom cloud industry break down data silos across the ecosystem and within companies, build machine learning models, and help companies securely and easily access data in real time. AI also helps increase profitability, maximize operational efficiency, and improve customer experiences. AI technologies can identify threats and network traffic irregularities in real time. In addition, integrating AI in the telecom cloud optimizes network performance, improves customer service via personalized experiences, and enables predictive maintenance.

Telecom Cloud Market Growth Factors

- Rising advancements in communication technologies contribute to market expansion.

- Growing focus on reducing operational costs boosts the growth of the market. Cloud solutions enable telecom companies to reduce infrastructure and operational costs.

- The increasing partnerships between telecommunication and technology companies accelerate the development of telecom cloud solutions, boosting market growth.

- With the growing adoption of IoT devices among telecom companies, there is a high demand for cloud solutions to streamline workflows.

- Increasing awareness about the benefits of telecom cloud solutions further contributes to market growth. Telecom cloud solutions help improve customer experience by optimizing network performance.

- The growing demand for digital services bolsters the growth of the market

Market Outlook

- Industry Growth Overview: The telecom cloud market will grow quickly as Operators move core and edge networks to Cloud platforms. The long-term growth of the telecom cloud market will result from increasing 5G deployment and increasing amounts of data that will be used.

- Sustainability Trends: Telecom cloud solutions are helping to support sustainability by utilizing less energy and optimizing how they use resources. cloud-based networks are also much more efficient to scale, and telecommunication companies' carbon footprints are lower than those of traditional network infrastructures.

- Global Expansion: Telecom Cloud deployment is occurring globally. As quickly developing countries modernize their Networks and develop countries focus on Innovation, Edge computing/deploying Edge computing and providing Digital Services.

- Startup Ecosystem: Startups are developing innovations and are advancing rapidly the digital transformation of the industry by developing tools that are using AI to optimize network operations, cloud security, and automation tools that advance the digital transformation of the telecom cloud ecosystem.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 29.4 Billion |

| Market Size in 2026 | USD 36.74 Billion |

| Market Size by 2035 | USD 255.69 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 24.15% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Packaging Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Adoption of Cloud Computing

The telecom cloud market is expanding at a significant pace due to the widespread adoption of cloud computing across an array of industries. This trend is further accelerated by the rapid digital transformation businesses undergo to adapt to everyday demands. With the introduction of 5G technology, characterized by enhanced speeds, low latency, and increased connectivity, the demand for tele-cloud solutions is rising significantly for a highly scalable and flexible network infrastructure. Additionally, the rapid expansion of the Internet of Things (IoT), with devices becoming increasingly interconnected, necessitates advanced network capabilities that telecom cloud solutions can provide. As organizations strive to improve efficiency and enhance their service offerings, the reliance on cloud-based platforms continues to rise.

Restraints

Data Security Concerns and Regulatory Landscape

Despite the enormous potential, integrating existing telecom infrastructure with cloud-based solutions presents notable challenges. This process can be complex and resource-intensive, often requiring a substantial investment in new technology and skilled expertise. Furthermore, telecom operators must navigate an intricate and constantly evolving regulatory landscape, particularly concerning data privacy and security issues. These regulatory challenges can create significant barriers, hindering the overall growth of the telecom cloud market as operators grapple with compliance while striving to innovate and implement new cloud technologies.

Opportunity

Demand for Hybrid Cloud Solutions

Rising demand for hybrid cloud solutions creates immense opportunities in the market. Adopting hybrid cloud solution provides companies with flexibility to use a combination of public and private clouds, thereby enhancing data security. Furthermore, the telecom cloud solutions market presents exciting avenues for new revenue streams. Operators can explore offerings such as platform as a service (PaaS) and tailored customer solutions, capitalizing on their existing infrastructure while meeting the diverse needs of their clientele. This strategic shift not only drives innovation but also positions operators to thrive in a competitive landscape.

Segment Insights

Type Insights

The services segment dominated the telecom cloud market in 2022. Within the telecom cloud market, network services represented a considerable market share in the services segment. The telecom operators can reuse underutilized networking resources and capitalize on existing business partnerships due to the migration to cloud services. Due to the increasing requirement to sustain telecom infrastructure around the world, network services that include network virtualization in the telecom cloud market are seeing significant growth.

The solutions segment is projected to reach remarkable growth during the forecast period. The content delivery network sub segment is growing at a rapid pace in the solutions segment. The content delivery network adoption is predicted to increase among enterprises in both small and large sectors, since it enables scalability to match the demands of evolving technologies, saves money, and reduces network administration workload.

Computing Service Insights

The IaaS segment dominated the telecom cloud market in 2022. Infrastructure as a service (IaaS) is highly automated and standardized product in which a service provider's computer resources, together with networking and storage capabilities, are made available on demand to consumers. In few minutes, resources can be scaled and flexed, and usage is tracked. The customers have direct access to self service interfaces, which include graphical user interfaces and automated programming interfaces. The customer's data center host multi-tenant or single tenant resources.

The SaaS segment is expected to witness significant growth during the forecast period. The software as a service (SaaS) is a software distribution paradigm in which a cloud provider hosts and makes applications available to end users via the internet. In this arrangement, an independent software vendor may hire a third-party cloud provider to host the application.

Application Insights

The BFSI segment dominated the telecom cloud market in 2022. The BFSI sector are outsourcing non-core activities in order to cut expenses and increase efficiency. As a result, directed content perceptions and precise banking data are required, which can be combined via telecom cloud solution. By providing greater communication choices, the alliances enable banking and financial service providers to give expanded amenities.

The transportation segment is expected to drive strong growth during the forecast period. Every day, the telecommunications business in the transportation sector generates massive amounts of data and information, necessitating extensive data management and storage services. As a result, the use of telecom cloud systems in this area is rapidly increasing.

Regional Insights

U.S. Telecom Cloud Market Size and Growth 2026 to 2035

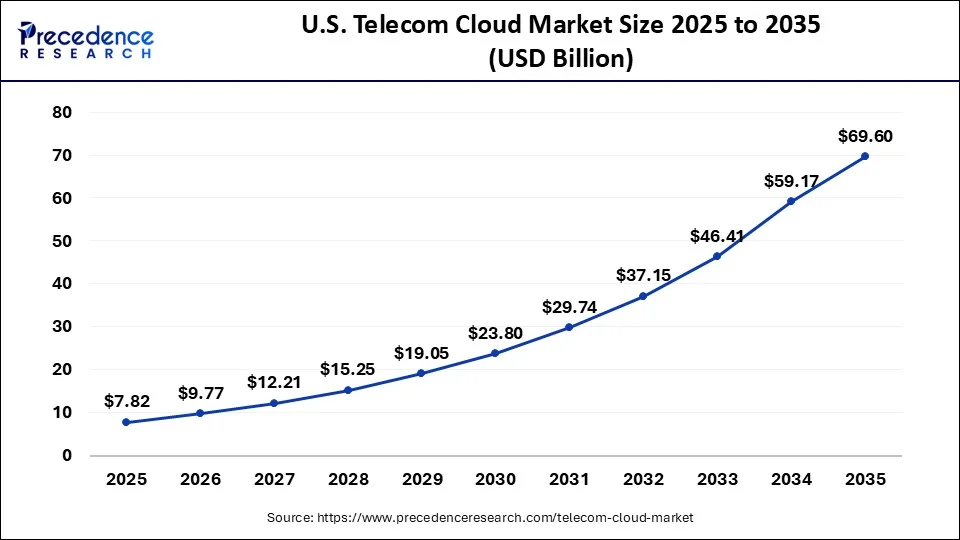

The U.S. telecom cloud market size is exhibited at USD 7.82 billion in 2025 and is projected to be worth around USD 69.60 billion by 2035, growing at a CAGR of 24.43% from 2026 to 2035.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. For better communication and connectivity, businesses in North America are fast acceptance and adoption of telecom cloud services. These companies' personnel have good technical information and are eager to boost the use of telecom cloud services, allowing North America to dominate the telecom cloud industry. In addition, the growing fundings and investments in data centers are also driving the expansion of North America telecom cloud market.

Asia-Pacific dominated the telecom cloud market in 2025. China and India dominated the telecom cloud market in Asia-Pacific region. The telecom cloud market in Asia-Pacific region is being driven by the adoption of latest and advanced technologies as well as growing deployment of 5G networks. The market players adopted innovative technologies such as internet of things, cloud computing, and artificial intelligence. The other factors such as driving the growth of Asia-Pacific telecom cloud market are growing healthcare expenditure, expansion of healthcare sector, and growing government initiatives.

Latin America Telecom Cloud Market Trends:

Latin America is experiencing a rapid increase in telecom cloud adoption due to the growth of mobile subscribers, increasing internet penetration and 5G investments by regional telecom companies in such countries as Brazil, Mexico, and Chile. In these countries, telecoms are beginning to utilize cloud-based network assets to decrease their capital expenditures and upgrade their existing infrastructures to add modern capabilities. Additionally, there are numerous initiatives from the government that promote the transition to digital services and the development of smart cities that also encourage telecom companies to move their core network operations onto cloud infrastructure.

Europe Telecom Cloud Market:

Europe is a well-established but rapidly changing telecom cloud market, as a result of having the most advanced regulatory environment and the most developed digital ecosystem than the rest of the world. Telecom providers are now prioritizing adopting cloud-native architectures to support their increasing edge computing capabilities with the rollout of 5G services across Europe. Within Europe, the regional focus on the security of their data, their networks being fully virtualized, and their commitment to interoperability have led to increased associations between Internet Service Providers and cloud providers for the purpose of providing an innovative, high-speed, and enhanced customer experience.

How MEA Contributed to the Telecom Cloud Industry?

MEA's contribution to this industry is its cloud infrastructure revenue for its services that has made billions of profit. With the Cloud-First popular global strategies, the region turned into a centre for digitisation. The smart infrastructure led to maximum local investments.

Recently, Saudi Arabia has been witnessing new clouds this year, as the governments in Qatar, Saudi Arabia, and the UAE are rapidly adopting the new cloud era (platforms), which will provide national security. The AI-computed hub is a huge regional contribution to the telecom cloud.

North Africa's Telecom Cloud Market Trend

North Africa's attentiveness and responsibility towards data sovereignty laws shape the market trend accordingly. The region follows domestic infrastructure to align best with these laws. Apart from this, the year will witness a new green cloud trend, promoting renewable energy unification, proudly exemplifying Maroc Telecom's collaboration with the Google Cloud.

This partnership intends to establish renewable energy-sponsored data centers, which will accelerate Morocco's wind and solar potential. The green cloud trend is in full power to elevate the growth of the telecom cloud sector and introduce new approaches to the same.

Brazil Telecom Cloud Market Trends

Brazil's market is experiencing rapid growth as operators adopt virtualized, cloud-native network architectures to support 5G deployment, improve agility, and reduce infrastructure costs, with revenue projected to rise steadily through the late 2020s. Strategic partnerships between telecom companies and major cloud providers are accelerating service innovation, particularly in cloud-managed networks and edge computing for low-latency applications.

Hybrid and multi-cloud adoption is increasing as providers seek flexibility, resilience, and regulatory compliance, while AI and automation tools are being integrated to optimize operations and enhance network performance.

The collaboration and policy framework are reshaping the regional initiatives of this sector. The deployment of 5G and edge computing is strengthening regional infrastructure. The neutral networks enable various telcos to share cloud-related infrastructure, which mitigates costs.

Telecom Cloud Market Companies

- AT&T Inc.

- Telus Corporation

- China Telecommunications Corporation

- T-Mobile International AG

- Fusion Telecommunications International, Inc.

- Verizon Communications, Inc.

- CenturyLink, Inc.

- NTT Communications Corporation

- Telstra Corporation Limited

- BT Group PLC

Recent Developments

- In November 2024, a leading provider of integrated information and communication technology solutions, ZTE Corporation, launched an AI-driven Green Telco Cloud solution with diverse hardware architectures in partnership with China Mobile. This solution focuses on the application of artificial intelligence to enhance energy efficiency in telco-cloud environments.

- In October 2023, a leading telecommunications service provider in India, Bharti Airtel, announced the launch of industry's first omnichannel cloud platform, Airtel CCaaS (Contact Center as a Service). This platform provides a unified experience for all contact center solutions required by an enterprise.

Segment Covered in the Report

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Type

- Solutions

- Unified Communication and Collaboration

- Content Delivery Network

- Other Solutions

- Services

- Content Management

- Supply Chain Management

- Business Support system(BSS)

- Colocation Services

- Network Services

- Management Service

By Computing Service

- IaaS

- PaaS

- SaaS

By Organization Size

- SMEs

- Large Enterprise

By Application

- Data Storage

- Achieving

- Computing

- Enterprise Application

- Cloud delievery model

- Communication and collaboration

- Network cloud migration

- Over-The-Top

- Other Applications

End User

- BFSI

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Media and Entertainment

- Government

- Automotive

- Energy and Utilities

- Other End Users

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting