Telecom API Market Size?

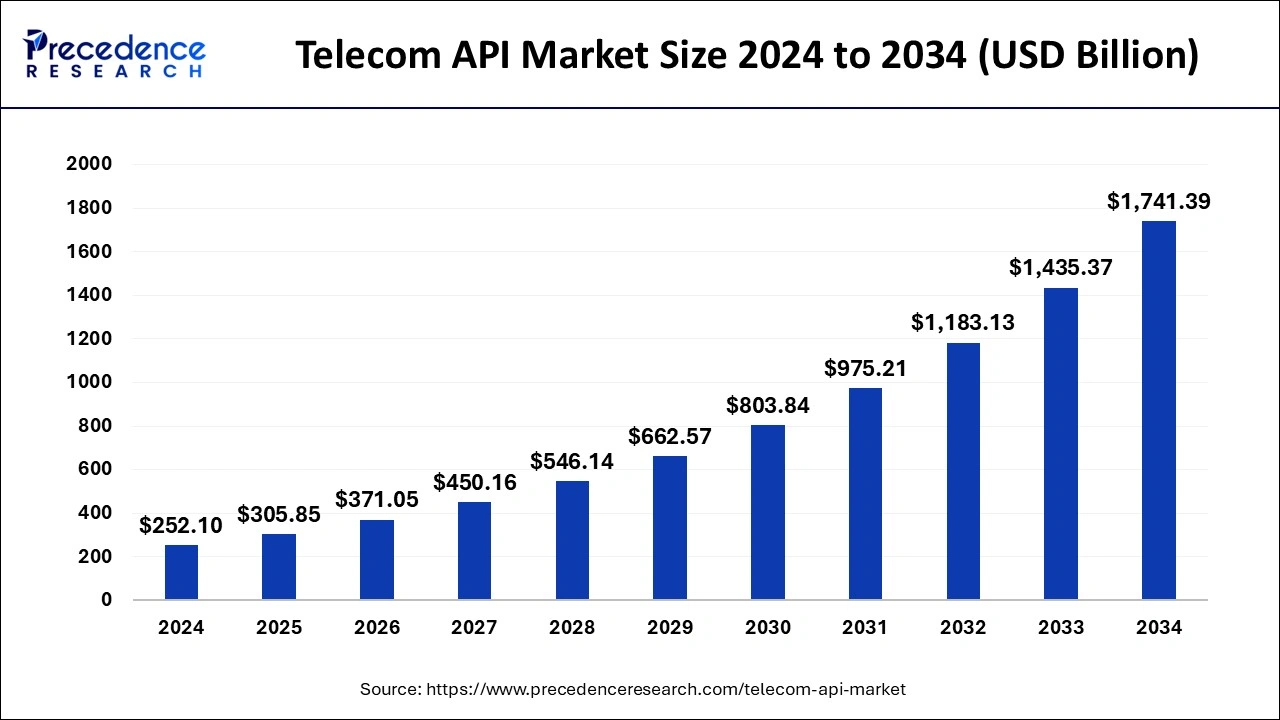

The global telecom API market size is estimated at USD 305.85 billion in 2025 and is anticipated to reach around USD 1741.39 billion by 2034, expanding at a CAGR of 21.32% from 2025 to 2034.

Market Highlights

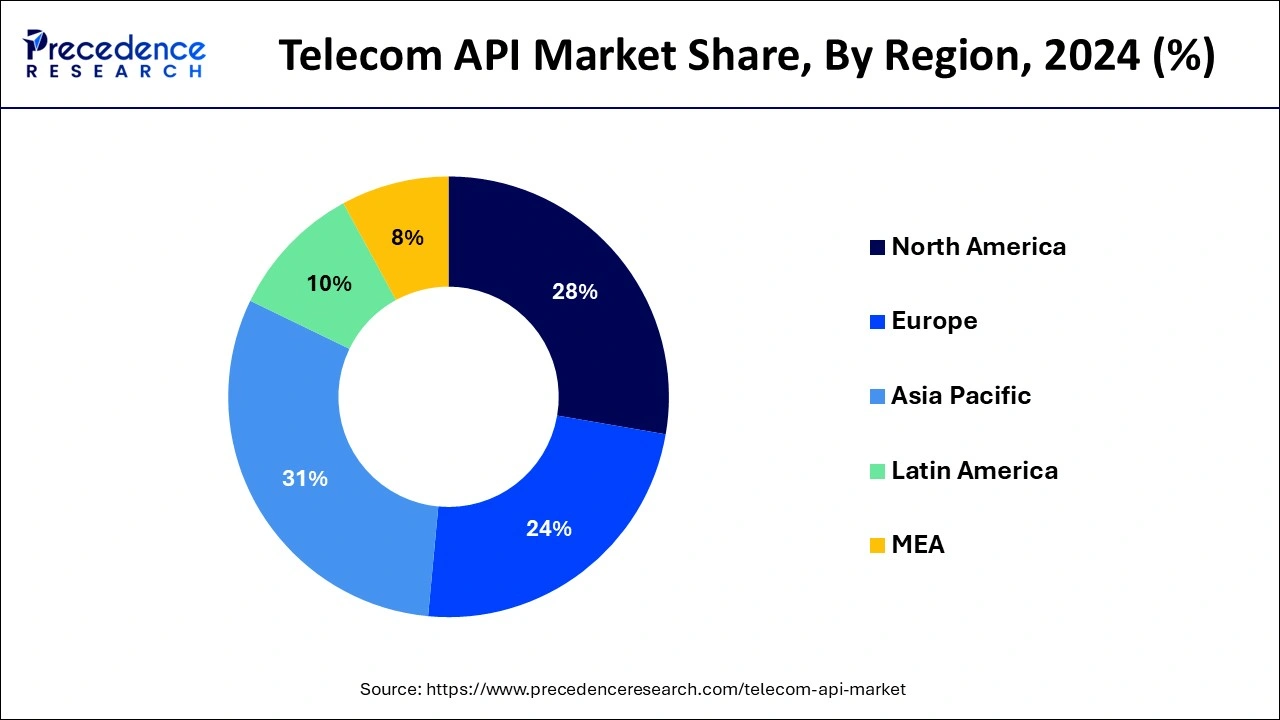

- Asia Pacific dominated the global telecom API market with the largest market share of 31% in 2024.

- North America is expected to expand at a double digit CAGR during the forecast period.

- By API type, the Messaging (API) segment contributed the highest market share of 36% in 2024.

- By API type, the IVR API segment is projected to grow at a notable CAGR during the forecast period.

- By end-user, the enterprise developer segment has held the biggest market share of 37% in 2024.

- By end-user, the partner developer segment is expanding at the fastest CAGR of 21% over the forecast period.

What are the Growth Factors in the Telecom API Market?

One of the factors driving the growth of global telecom API market is growing deployment of 5G technologies and networks. For example, the Small Cell Forum launched a 5G functional application programming interface (API) in April 2020 to allow a 5G small cell vendor ecosystem. The 5G technical application programming interface (API) specifications, which build on the scope of the 5G physical layer application programming interface (API) specification, allow tiny cells to be built piece by piece with components from various suppliers.

Another factor boosting the growth of global telecom application programming interface (API) market is growing number of mobile service subscribers. According to GSMA data, 5.2 billion individuals had enrolled to mobile services by the end of 2021, with that number expected to rise to 5.7 billion by 2025, presenting additional prospects for telecom application programming interface (API) in mobile based applications. The government all around the world is taking constant efforts for the growth and development of global telecom application programming interface (API) market. The government is highly investing in latest technological projects for the development of various types of telecom application programming interface (API) in the global market. Thus, this factor is supporting the telecom application programming interface (API) market growth.

The widespread acceptance of application programming interface (API) related technologies are due to the increased utilization of mobile and smartphones applications. All market participants profit from the growing number of innovative technological breakthroughs. On the other hand, the telecom application programming interface (API) market is restrained by a commercial gap between developer needs and carrier product offerings as well as government regulations and policies governing the telecom sector.

The telecom application programming interface (API) market is highly competitive, and important firms in each region compete fiercely. A few renowned players dominate each region or nation, the most of whom are the region's vendors. In order to expand their market position, these market players are focused on growth and expansion methods like partnerships, acquisitions, joint ventures, mergers, and collaborations.

MarketTrends

- The growing shift towards API API-driven economy fuels the growth of the market.

- The rising demand and shift towards digital transformation and adoption of cloud computing technologies fuel the growth of the market.

- Advancement in 5G technologies for innovation and high-speed 5G data drives the demand and growth of the market.

- Increasing demand from consumers for mobile data due to the increase in adoption of smartphones and tablets is a key growth driver of the market.

- The shift towards digital transformation and adoption of digital communication increases the demand for cloud services, which contributes to the growth of the market.

Telecom API Market Outlook

- Industry Growth Overview: From 2025 to 2030, the telecom API market will continue to expand rapidly, due to the increased focus of operators on cloud-communication, AI-driven services, and enterprise connectivity. The increased need for real-time data, secure authentication, and the growth in demand for scalable messaging APIs will increase the number of consumers adopting those types of APIs. The significant increase in use of telecommunication API services in North America and Asia-Pacific will drive even greater revenue growth, driven by the acceleration of digital transformation.

- Global Expansion: To take advantage of the increasing demand for digital services in Southeast Asia, Africa, and Eastern Europe, Major telecommunications API companies have expanded into those regions. The rapid expansion of businesses to mobile banking, e-commerce, and business process automation has created additional opportunities for Telecommunication API Providers. These companies have also formed stronger local partnerships and developed regionally specific SSL API suites to support interoperability and achieve regulatory compliance in rapidly expanding telecommunications markets.

- Major Investors: Private equity investors and strategic investors were eager to invest due to high margins, recurring revenues, and the increasing dependence of enterprises on telecom APIs. Companies targeting identity verification of APIs, CPaaS Platform APIs, and AI-based analytics APIs attracted heavy investment from major firms, which invested in API developers who deliver secure service orchestration and low-latency Communication APIs.

- Startup Ecosystem: The startup ecosystem is seeing rapid growth, particularly in areas such as CPaaS APIs, Fraud Detection APIs, Voice Interfaces powered by AI, and APIs for accessing 5G Networks. Startups in the USA, such as Telnyx and those supported by Route Mobile in India, have raised a tremendous amount of capital by offering programmable, scalable, and developer-friendly communication APIs that provide automation, omnichannel messaging, and new monetization opportunities for operators.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 305.85 Billion |

| Market Size in 2026 | USD 371.05 Billion |

| Market Size by 2034 | USD 1,741.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 21.32% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | API Type, End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

API Type Insights

Messaging (API) segment contributed the highest market share of 36% in 2024.Any service that allows developers to incorporate numerous messaging technologies in an application through a single programmable interface is referred to as a messaging application programming interface (API). The rising demand for SMS services that use messaging application programming interface (APIs) is driving the expansion of messaging application programming interface (APIs).

The interactive voice response (IVR) API segment is projected to grow at a notable CAGR during the forecast period.The smart interactive voice response helps businesses improve their sales and marketing efforts. Using an interactive voice response system, call centers can process millions of calls each hour to manage real time data. As a result, interactive voice response application programming interface (API) allows developers to create high quality applications with interactive voice response capabilities and voice calling.

End Use Insights

The enterprise developer segment has held the biggest market share of 37% in 2024. The demand for telecom application programming interface (API) is growing among large scale enterprises, which is driving growth of enterprise developer segment. The growing utilization of application to person messages for promotion of certain products and services is driving the demand for telecom application programming interface (API) in enterprise developer segment.

The partner developer segment is expanding at the fastest CAGR of 21% over the forecast period. The partner telecom application programming interface (APIs) aid in the development of services such as streaming and payment services by providing a centralized data exchange platform for developers. The developers can create these services with the help of telecom organizations. In addition, compared to corporate developers, the consumer base for partner developers is fast rising, resulting in their increase during the predicted period.

Regional Insights

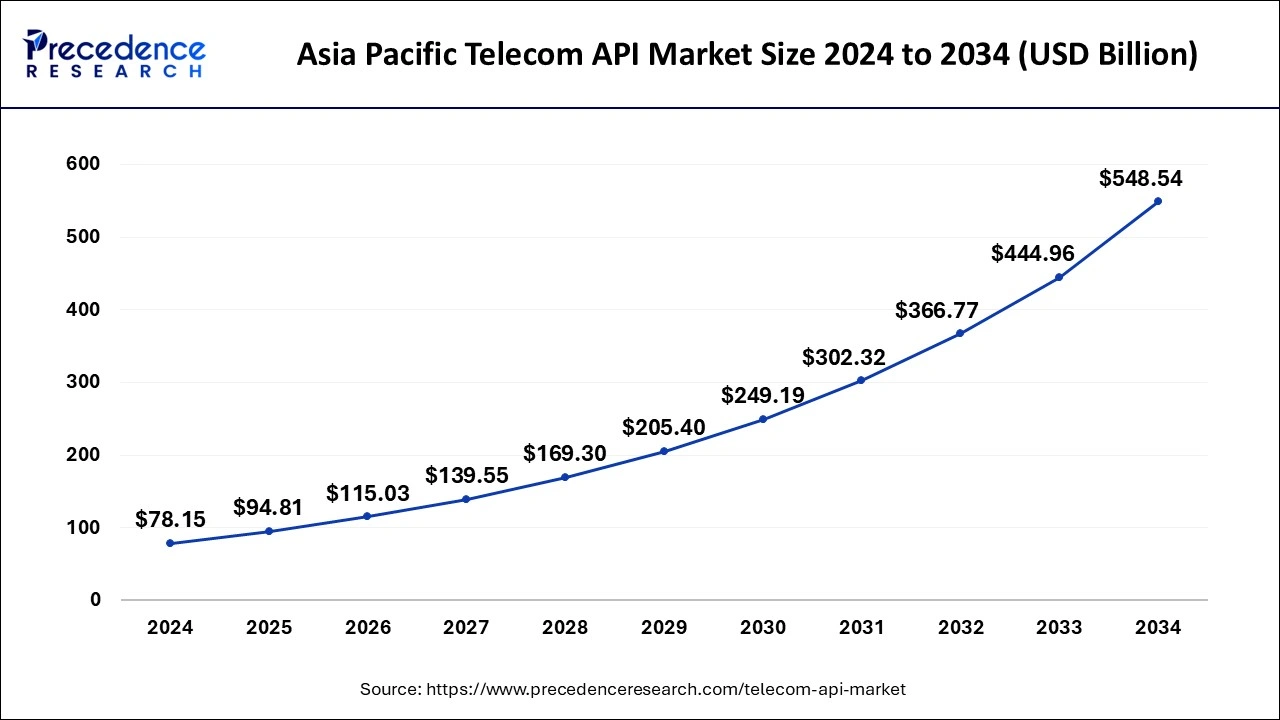

Asia Pacific Telecom API Market Size and Growth 2025 to 2034

The Asia Pacific telecom API market size is evaluated at USD 94.81 billion in 2025 and is predicted to be worth around USD 548.54 billion by 2034, rising at a CAGR of 21.51% from 2025 to 2034.

Asia Pacific dominated the global telecom API market with the largest market share of 31% in 2024. This is due to rising usage of numerous cloud-based services by way of manufacturing systems and several sales channels. Furthermore, due to increased funding, the web-based information technology industry . In addition, major emerging nations have seen an increase in demand for various software-based services. Thus, all of these factors are driving the growth of North America telecom application programming interface (API) market.

Asia Pacific: China & India Telecom API Market Trends

China and India dominated the telecom application programming interface (API) market in Asia-Pacific region. The growing deployment of telecom application programming interface (API) by various market players is driving the growth of Asia-Pacific telecom application programming interface (API) market. In addition, technological developments are paving way for the expansion of telecom application programming interface (API) market in Asia-Pacific region. The market demand is projected to be driven by some of the ongoing partnerships among the region's key players.

For example, China Unicom, one of the top mobile network service providers in terms of subscribers, and Alibaba Group Holding are aiming to partner in the sector of networking services, which is likely to boost telecom application programming interface (API) market growth in the region.

North America is expected to expand at a double digit CAGR during the forecast period. China and India dominated the telecom application programming interface (API) market in Asia-Pacific region. The growing deployment of telecom application programming interface (API) by various market players is driving the growth of Asia-Pacific telecom application programming interface (API) market. In addition, technological developments are paving way for the expansion of telecom application programming interface (API) market in Asia-Pacific region. The market demand is projected to be driven by some of the ongoing partnerships among the region's key players. For example, China Unicom, one of the top mobile network service providers in terms of subscribers, and Alibaba Group Holding are aiming to partner in the sector of networking services, which is likely to boost telecom application programming interface (API) market growth in the region.

North America Emerges as the Telecom API Powerhouse of the Future

North America is witnessing the fastest growth in the market due to rapid adoption of 5G, cloud communications, and API-driven network modernization across major telecom operators and enterprises. The region's strong ecosystem of tech innovators, API platform providers, and developers is accelerating deployment of messaging, payment, location, and IoT APIs across industries. High demand for digital services, automation, and real-time data exchange is further boosting API integration in sectors such as fintech, retail, logistics, and healthcare.

Why did Latin America grow at a rapid rate in the Telecom API Market?

Latin America experienced rapid growth as more people purchased smartphones, started using online banking, and began buying products and services through digital marketplaces. Due to an increase in the need for API capabilities by businesses, telecom companies were able to offer cloud-based communication services. This allowed businesses and end-users to use user-friendly authentication, messaging, and customer service solutions. The proliferation of digital services in cities also created additional opportunities for fintech APIs, e-commerce, and automation.

Brazil Telecom API Market Trends

Due to Brazil's large population, significant investment in telecom infrastructure, and rapid transition toward the use of digital services, the country is leading the region with respect to telecom API use. There are several categories of businesses in Brazil that are using APIs to facilitate payment processing, notifications, and identity verification: banks, retailers, and delivery services. The growth of e-commerce and fintech has resulted in a substantial increase in the number of businesses seeking communication APIs in Brazil; therefore, Brazil has invested heavily in cloud-based systems and the expansion of 5G networks.

Why did the Middle East & Africa grow at a rapid rate in the Telecom API Market?

The Middle East and Africa's growth have resulted from using mobile devices, increasing online services, and significant investment in upgrading telecommunications infrastructure. Additionally, many governments actively supported digital initiatives through financial investment into various digital projects, leading to a greater need for Application Programming Interfaces (APIs) to support electronic public service delivery, banking transactions, and international trade.

Businesses adopted APIs to enable greater security and communication with their customers. The region presents many business opportunities to leverage mobile payment technology, cloud-based communication technology, and 5G-enabled services.

The UAE Telecom API Market Trends

The United Arab Emirates has established itself as a regional leader by providing substantial support for digital advancement through investment and implementation of multiple digital transformation projects, including smart city projects, advanced telecommunication networks, and aggressively implementing the latest 5G technology. As a result, more companies adopted the use of APIs to support payment processing, security checks, client communication, and electronic government services.

The UAE's early deployment of 5G technology and its robust technology ecosystem provided the necessary framework to accelerate the adoption of APIs within the region. Many companies also immediately transitioned to adopting cloud-based communication platforms, which led to increased API usage.

Telecom API Market Companies

- Vodafone Group PLC

- Twilio, Inc.

- Alcatel-Lucent

- AT&T, Inc.

- Telefonica

- Apigee Corporation

- Orange S.A.

- Verizon Communications, Inc.

- Xura, Inc.

- Nexmo, Inc.

Key Developments

- In March 2025, Aduna and Bridge alliance collaborated and announced the partnership to promote and speed up the adoption of CAMARA-based network APIs. Under the partnership deal revealed that Aduna will expand its reach in Asia-Pacific via the Bridge Alliance's operator members, who are adopting open network APIs via the Bridge Alliance API Exchange (BAEx). (Source: https://developingtelecoms.com)

- In March 2025, Verizon Americas telecom service provider, partnered with Aduna to launch its first advanced 5G network Application Programming Interfaces (APIs) for Number Verification and SIM Swap protection in the United States. The partnership aims to support standardized, open network APIs by driving interoperability, fostering industry-wide innovation, and reshaping the global digital landscape. (Source: https://telecomtalk.info)

- Infobip Ltd. established a cooperation with Span, an information technology company that provides professional services and technical assistance to business customers and organizations around the world as they seek to enhance their information systems, in April 2020. Through Infobip's full customer interaction and experience portfolio of Conversations, Moments, and Answers, this alliance could allow Span to design integrated customer experiences throughout all phases of the customer journey.

- Reliance Jio, achieved Open application programming interface (API) Platinum conformance certification in 2021, demonstrating the growing trend toward leveraging Open application programming interfaces (APIs) to assist develop open ecosystems for telecom businesses.

- Twilio Inc. purchased SendGrid Inc., an email application programming interface (API) platform firm, for $2 billion in February 2019 to expand its customer base and product offering. Twilio Inc. can now leverage SendGrid's communication platform like messaging, audio, email, and video as a result of this transaction.

- Nexmo Inc., a Vonage Holdings Subsidiary, announced a next generation messaging system based on two new application programming interfaces (APIs), the Messages application programming interface (API) and the Dispatch application programming interface (API), in October 2018.

Segments Covered in the Report

By API Type

- Messaging (API)

- WebRTC

- Payment (API)

- IVR (API)

- Location (API)

- Others

By Type

- Presence Detection Data

- Location Determination Data

- Service Configuration Management (SCM)

- Subscriber Data Management (SDM)

By End User

- Enterprise Developers

- Internal Telecom Developers

- Partner Developers

- Long Tail Developers

By Deployment

- Hybrid

- Multi-cloud

- Other

By Industry Verticals

- BFSI

- Healthcare & Life Sciences

- Telecommunications & ITES

- Government & Public Sector

- Manufacturing

- Consumer Goods & Retail

- Media & Entertainment

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting