What is the Edge Computing Market Size?

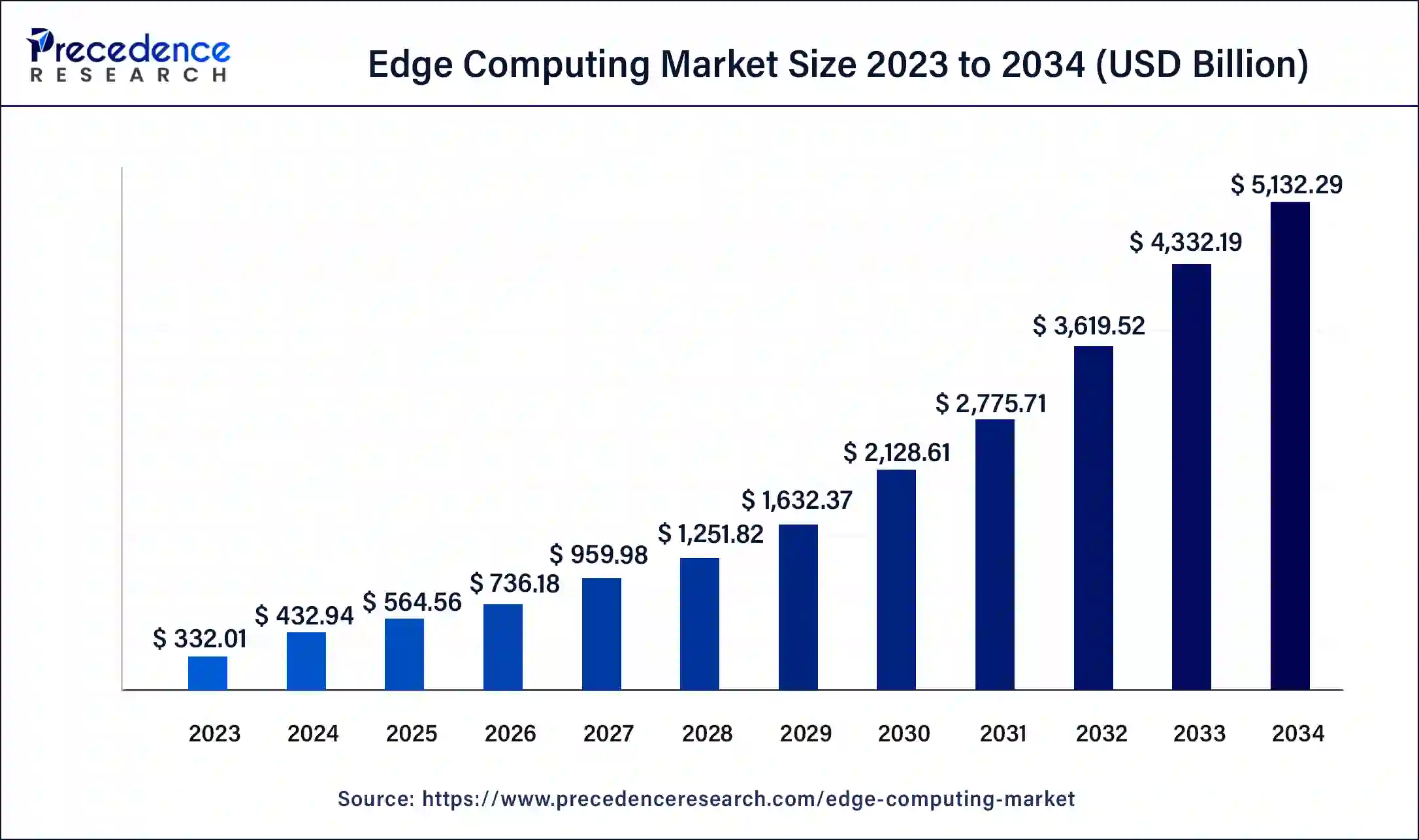

The global edge computing market size is calculated at USD 554.39 billion in 2025 is predicted to increase from USD 709.91 billion in 2026 to approximately USD 6,092.42 billion by 2035, growing at a CAGR of 27.09% from 2026 to 2035.

Edge Computing Market Key Takeaway

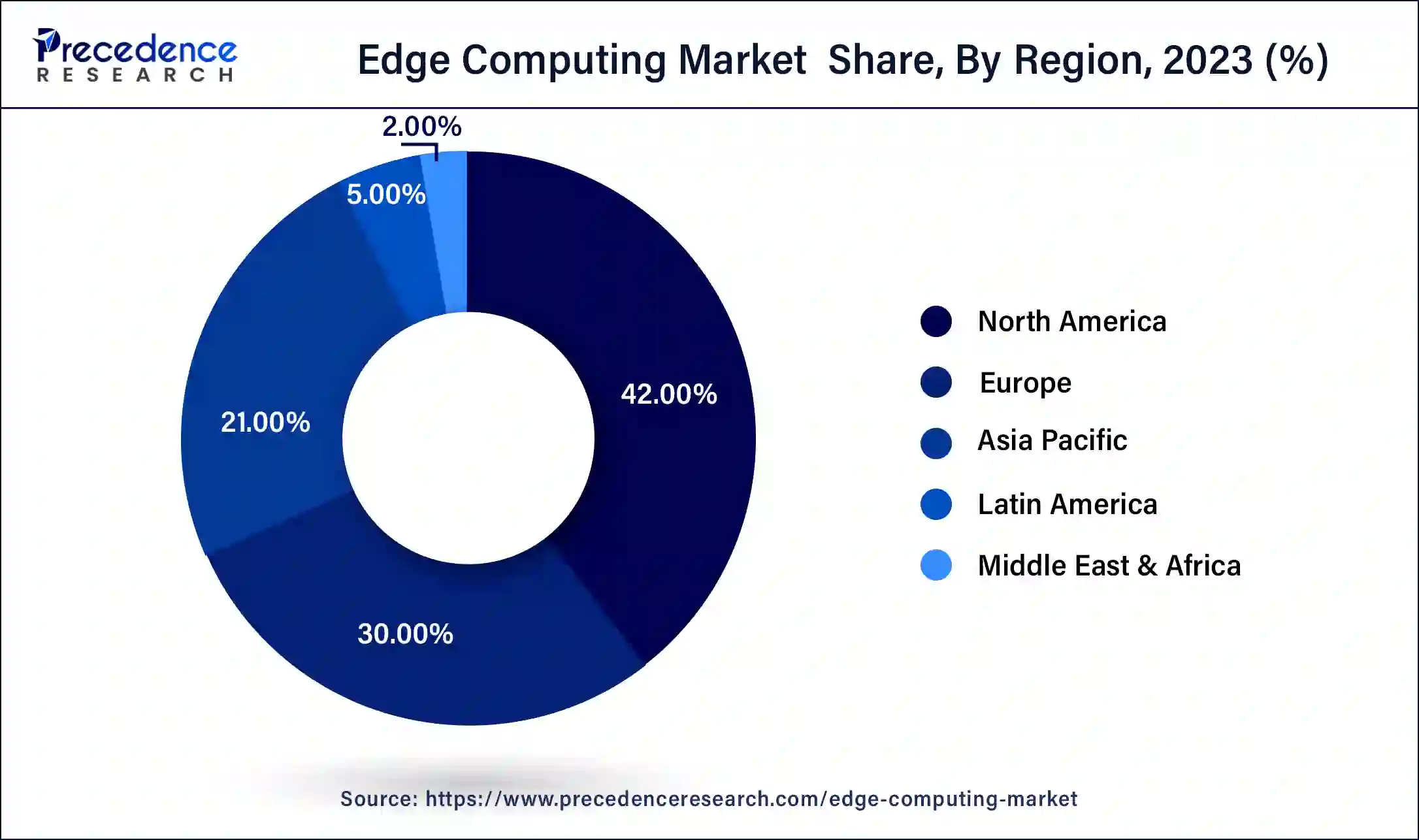

- North America region garnered the largest market share 42% in 2025.

- By component, the server sector held more than 45.5% of total revenue in 2025.

- The revenue share of edge sensors/routers was 25% in 2025.

- The energy and industrial category accounted for more than 18.6% of total revenue in 2025.

- The Industrial Internet of Things (IIoT) application category had a revenue share of more than 33% in 2025.

What is Edge Computing?

The shift of computational capability from centralized data centres or cloud servers to the edge means that computations are now done much closer to where data is created or collected, allowing for lower levels of latency, better decision-making and security.

The increase in use of edge computing technology is attributed to many factors, including advances in the Internet of Things (IoT), the introduction of 5G networks and an increase in the use of Artificial Intelligence (AI) within applications such as manufacturing, health care, smart cities and autonomous systems. Edge computing is quickly becoming a critical component of the next phase of digitally enabled systems.

AI in Edge Computing

Edge computing leverages AI to enhance speed, security, and cost-efficacy by processing data locally and very close to the source, therefore reducing latency and granting real-time responses to key applications such as autonomous driving and industrial automation. This local processing helps with privacy preservation and also reduces bandwidth consumption and transmission costs. Edge AI works on system reliability, supports scalable deployment on devices, optimizes power consumption, and conducts smart filtering of data for transmission of only useful information. All these features make edge artificial intelligence (AI) a must-have in industrial applications for fast, secure, and sustainable computing power.

Edge Computing Market Growth Factors

The COVID-19 epidemic has led to a surge in edge computing and data centres. Nevertheless, with increased deployment, investment on these technologies is projected to fall modestly over the subsequent few months. To attain quick cost reductions, companies across several business verticals are lowering their expenditure or eliminating their resources in modernising software and servers. There are few outliers, such as growing expenditures in edge and IoT in the medical and telecommunications sectors. The telecom industry is growing at a high rate in video conferencing software like as Zoom and Microsoft Teams, and creative approaches are being introduced to meet the increased demand.

- For example, in December 2020, SK Telecom and Amazon Web Services developed edge cloud services centred on the 5G MEC. Corporations are seizing possibilities to address the present circumstances by delivering innovative services.

The severe acceleration in request for the edge computing and is projected to persist for the next three to four years following the COVID-19 pandemic, as the strain on expanding core network will not abate in the near future. Working from home being new normal as well as the healthcare system reaching saturation point with the online consultations, is predicted to give birth to such network architecture requires minimal connectivity and strong security. Telecom firms are likely to seize on this possibility since the cost of setting up advanced compared facilities or establishing full-sized data center will outweigh the cost of edge facilities per unit. This financial advantage will hasten telecom firms' transition to large-scale data centre development in the coming years. Edge computing has evolved into a solution-oriented technology, containing unique designs and hardware designed for specific use cases. This is the first step forward to the future in which the edge becomes a viable portion of the internet with user-friendly platforms for many developers to make the most of it.

Key Trends Influencing the Market's Future

- Proliferation of IoT devices: The rise of smart devices across industries (e.g., manufacturing, health monitoring, transportation) requires improved data management – in other words, the proliferation of IoT devices necessitates real-time, localized data processing. In turn, this is increasing the use of edge computing.

- Demand for low latency applications: Autonomous vehicles, augmented/virtual reality (AR/VR), and real-time business analytics are applications that require ultra-low latency. Edge computing enables low-latency data processing in a more efficient manner than centralized cloud computing.

- 5G implementation: The global introduction of 5G allows users to transmit data significantly faster with considerably lower latency (e.g., millisecond versus second response time). This enhanced capability can support high-bandwidth content and mission-critical applications that edge computing systems can deliver.

- Data privacy or security regulations: Data privacy regulations are increasingly restricting the movement of sensitive data. Processes of transferring sensitive information to centralized computer servers can pose significant risks, so organizations are being encouraged to process data closer to data sources.

- Increasing use of AI at the edge: New artificial intelligence technologies at the “edge” enable smart decision-making and fast data processing at the source. The increased adoption of edge computing in sectors like smart cities and industrial automation exemplifies the benefits of AI enablement.

Market Outlook

- Industry Growth Overview: The market for edge computing is growing rapidly due to a need for faster insights and lower costs associated with cloud computing from businesses. There is increasing use of artificial intelligence (AI), the Internet of Things (IoT), and 5th generation wireless technology (5G) by companies around the world.

- Sustainability Trends: Edge computing has a positive effect on sustainability. By minimizing energy used for data transmission and improving resource utilization, edge computing reduces carbon footprint and provides businesses with the ability to manage energy use efficiently, whether they operate in a factory, utility, or smart building.

- Global Expansion:The expansion of the edge computing market is being driven by global investment in digital infrastructure in both emerging and developed economies. Companies that partner across borders to develop standardization of edge computing technology will be able to grow and adopt it at an increased speed globally.

- Startup Ecosystem: As a whole, the startup ecosystem is thriving as innovators continue to create solutions specifically focused on edge AI, cybersecurity, and vertical markets. These startups are receiving significant amounts of venture capital, which is allowing them to spur innovation to drive advances in edge computing technology.

Edge Computing Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 554.39 Billion |

| Market Size in 2026 | USD 709.91 Billion |

| Market Size by 2035 | USD 6,092.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 27.09% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Organization Size, Deployment, Industry Vertical, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Advancements in Edge Computing

With edge computing, data processing happens close to users and devices; thus, this minimizes latency and bandwidth costs. The lesser the distance data has to travel, the lesser the response time, enabling real-time responses. These applications will stand to benefit from increased efficiency and performance, which include industrial automation, autonomous vehicles, and smart cities. In terms of reducing network congestion and cost savings, edge computing brings a lot to the table with lessdependency on centralized cloud infrastructure. This will create a better user experience for diverse sectors.

Restraint

Challenges in Integration

Challenges of integration and interoperability continue to act as key hindrances to edge adoption. Many legacy systems may require significant changes to work with edge solutions. Its absence of standardized protocols, between devices and platforms, introduces incompatibility issues as well as data silos. Another layer is added to this complexity when managing distributed edge infrastructure comprising heterogeneous hardware and software components, requiring specialized orchestration tools and skillsets. All these complexities translate into increases in implementation costs and thus slow down deployments within various industries.

Opportunity

Emergence of Sustainable Computing Practices

Edge computing nurtures a model for sustainable computing by lessening the transmission of a huge volume of data to centralized cloud data centers. This kind of localized processing decreases the consumption of energy, which is consistent with reducing carbon emissions while also optimizing resource utilization. Such efficiency benefits environmentally conscientious enterprises while at the same time agreeing with the larger agenda of sustainability. Also, sustainable edge deployments will bring down operations costs, all while maintaining high performance, thereby creating modern forms and opportunities to pursue green, efficient, and scalable computing architectures.

Segment Insights

Component Insights

The servers segment dominated the market in 2024. Servers that enable edge apps are often owned by organisations, linked to devices through a private network, and placed on-premises. Servers are progressively being installed in distant and edge locations, reducing latency among data producers and consumers. In addition, as the telco edge evolves, telcos are developing Multi-access Edge Computing (MEC) server architecture for information process technology.

The growing number of available centres in various industries is driving up market for edge routers. The routers serve as a gateway between both the local network and the external WAN. All data packets join the network to be routed through the entire edge router. Furthermore, the edge router is ultimately responsible for the operational security, filtering out unwanted access requests. Edge data centres must be well-equipped with diverse and strong edge routers capable of handling a high volume of traffic coming with low latency.

Edge Hardware set a scene for the dominating segment in the world of edge computing while IoT-IIoT adoption grows and more data is generated. Enterprises use edge hardware for offloading processes that otherwise take place in the cloud or in data centers, which entails maximum speed for local computation and real-time analytics. This growing demand from sectors including managed services, manufacturing, and industrial processes ensures that hardware will have the largest market share.

The software segment is expected to be the fastest-growing during the forecast period, driven by scalable, low-latency frameworks and the integration of AI. Containerization and orchestration tools, plus local intelligence, have spurred acceptance. Enterprises looking for real-time insight and automation increasingly lean toward edge-native software, supporting rapid growth for this segment.

Industry Vertical Insights

The energy and industrial category segment dominated the market in 2024. Smart grids, which operate on device edge infrastructure, are important in contributing to profitability in the energy and utilities industry. Sustainable environmental measures are pushing global attempts to enhance the effectiveness of electricity distribution services, as well as the development of alternative renewable energy sources like wind and solar. Globally, smart grids are being introduced to increase productivity improvements and offer features including as interconnection with smart appliances, real-time consumption control, and micro-grids to support distributed renewable production.

In 2024, the healthcare industry had a sizable revenue share. When it comes to the use of digital technology, the healthcare industry has always been cautious. The industry is highly controlled, with permission driving improvement rather than blatant interruption. Nonetheless, as the healthcare industry becomes more digital, hospitals and clinics are increasingly implementing digital health initiatives with variable degrees of sophistication and effectiveness. Clinics and hospitals are integrating edge computing solutions across critical use cases to enable these objectives, namely remote patient care, patient record management, intervention and constant patient monitoring.

The manufacturing segment dominated the market, supported by Industry 4.0 adoption, real-time analytics, predictive maintenance, and AI-based automation. Edge computing technologies assist production by enhancing efficiency and operational performance, further boosting their influence.

The healthcare segment is the fastest-growing as hospitals advance in digital health. Edge solutions are considered valuable for remote monitoring, patient record handling, and continuous care, allowing positive outcomes and operational efficiency.

Application Insights

The Industrial Internet of Things (IIoT) segment has dominated the market with highest revenue share in 2024. Edge computing has been critical in enabling firms to achieve facility digitalization. A major portion of edge computing in the industrial industry is implemented as machine edge. As system complexity rises and the infrastructures edge becomes more accessible, demands for edge set up to guarantee is projected to rise.

Industry 4.0 stresses speed and flexibility through the use of techniques that allow the integration of physical and cyber systems. Smart factories can use an edge platform to communicate only collected information to their cloud - based solutions. By evaluating data remotely and delivering summary data to the cloud, the edge provides a gateway. In a smart factory, for example, edge devices may proactively correct specific problems and alert plant managers to concerns on the manufacturing floor.

The IIoT dominated as manufacturing and logistics are critically in need of low-latency localized computing. Predictive maintenance, real-time insights, and smart factory modernization are enabled by edge solutions, thereby cementing the dominant position of IIoT.

AR/VR is expected to grow at the fastest rate during the forecast period. Ultra-low latency for immersive experiences drives growth in AR/VR. Near-user edge deployment ensures responsiveness and security while making bandwidth use efficient; adoption has been further pushed by the growth of 5G.

Organization Size Insights

Large enterprises have had a dominant presence in the market, mainly for handling applications and IoT data that need high volume and low latency on edge infrastructures. At least for the foreseeable future, their market dominance will be maintained with their in-built scalability, end-to-end customization attributes, and digital transformation road map.

The small & medium enterprise segment is projected to have the highest growth rate, with transformation on digital fronts to enhance agility and customer experience. SMEs must be targeted for solutions that are to be accepted and forgotten. Edge solutions that are cost-effective and scalable would grant SMEs the edge to process data locally, implement IoT, AI, and real-time analytics, and modernize operations in the least time possible, thereby bolstering the edge as the major fuel for innovation.

Regional Insights

What is the U.S. Edge Computing Market Size?

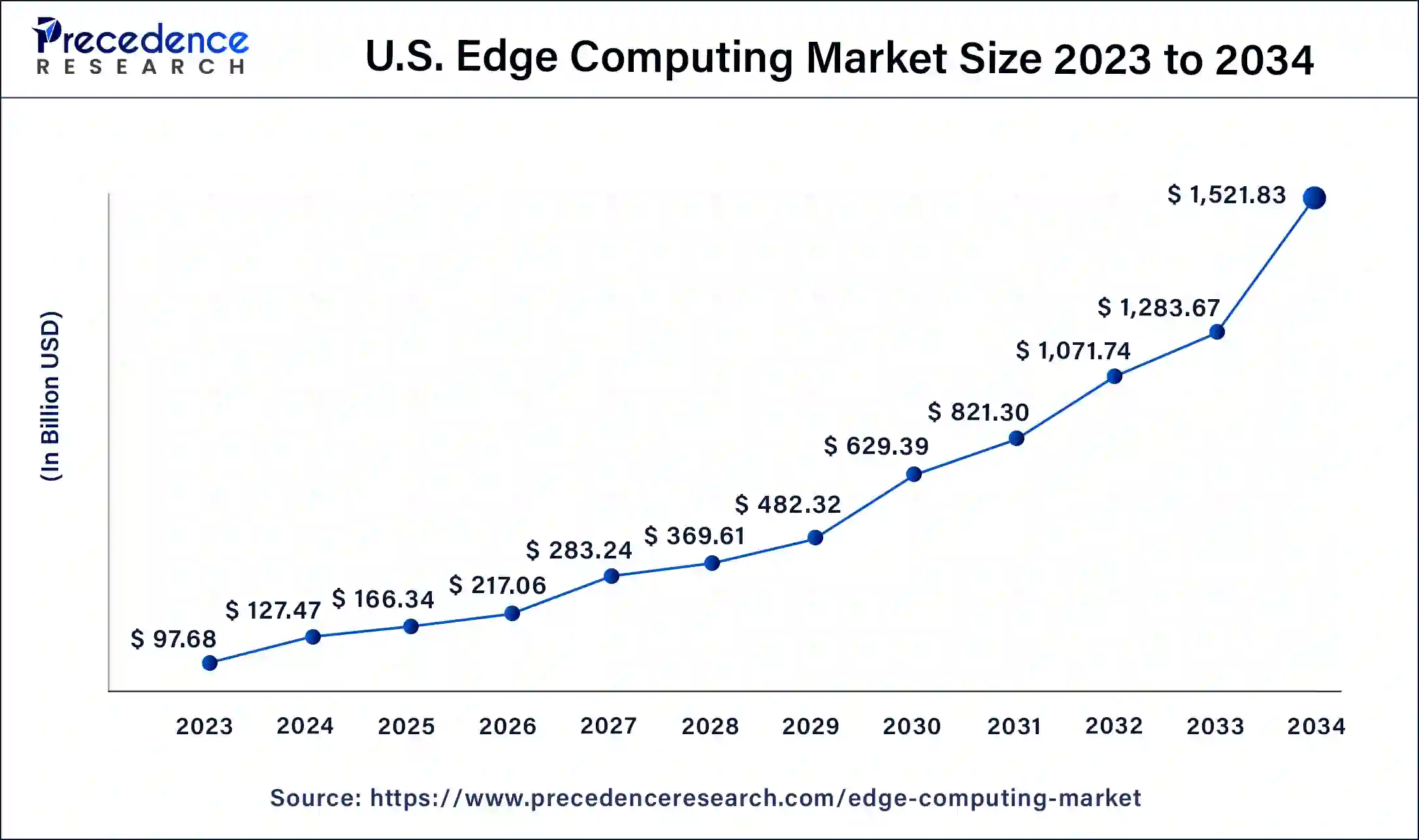

The U.S. edge computing market size was valued at USD 166.34 billion in 2025 and is expected to reach USD 1,742.50 billion by 2035, at a CAGR of 26.48% from 2026 to 2035.

North America led the edge computing market in 2024 with the largest share. North America, particularly the United States, is home to many of the world's leading technology companies and research institutions. This ecosystem fosters rapid advancements in edge computing technologies, including the development of advanced hardware, software, and integrated solutions. Major tech giants such as Amazon, Microsoft, and IBM are at the forefront of offering edge computing solutions, driving market growth through continuous innovation. Industries in North America, including healthcare, manufacturing, and retail, are increasingly adopting edge computing to enhance operational efficiency, reduce latency, and enable real-time data processing. The strong presence of these sectors, coupled with their readiness to invest in cutting-edge technologies, has significantly contributed to the region's leadership in the edge computing market.

U.S. Edge Computing Market Trends

The U.S. is at the forefront of the adoption of edge computations based on AI-inspired hybrid clouds. Businesses are actively focusing on real-time inference containerized solutions and telecom partnerships that can support ultra-low latency applications in retail mobility and autonomous systems, and workloads that are no longer centrally hosted in data centers. The proliferation of 5G networks and the integration of AI and machine learning at the edge are key trends enabling smarter, autonomous applications in healthcare, manufacturing, transportation, and smart cities by enhancing performance and reducing dependence on centralized cloud systems.

APAC is expected to develop at the quickest proportion in the next years. APAC has seen rapid implementation of new and is expected to have the greatest CAGR throughout the projection period. Moreover, IT investment in the zone is steadily growing, which is expected to contribute to an increase in the usage of edge computing. APAC is home to a number of major telecoms and edge network firms, including China Telecom Huawei, Telstra, Vodafone, Optus, and NTT Docomo, Vodafone which contributes to the expansion of the edge computing industry. Yet, as relative to North America and Europe, APAC penetration of edge computing is modest.

This is due to the absence of understanding among many of the region's small and medium-sized businesses (based on a survey by Vertiv, acloud computing technology provider). The poll also revealed that the region's acceptance of edge computing is projected to skyrocket in the next 3–5 years, owing to a trend favoring edge technology across Asian retail and BFSI firms.

China Edge Computing Market Trends

China is expected to grow at a significant rate during the forecast period. The government is supporting large-scale infrastructure projects and integrating edge with manufacturing logistics and smart mobility to accelerate the growth of China. The preference for a hybrid cloud and private deployments facilitates data control with the simultaneous provision of real-time industrial intelligence.

Europe at the Edge: Notable Growth Reshapes the Edge Computing Market Through Digital Transformation

Due to the strong data privacy regulations and governance, and the continued industrial automation growth and overall sustainability goals of the countries within Europe, edge computing has become a driving force for many industries throughout Europe. For instance, many of the European Industrial Automation manufacturers, such as Germany and Italy, use edge computing as part of their Industry 4.0 solutions.

Additionally, European emphasis on data sovereignty has encouraged organizations to process their data in the country through the use of local processing; thereby supporting the continued demand for secure, low-latency edge computing solutions created by smart mobility, healthcare digitization, and energy optimization initiatives in the UK, France, and Nordic Countries etc.

Germany Edge Computing Market Trends

Germany is expected to witness remarkable growth during the forecast period. Germany lays the foundation of European edge advancement with great attention to data sovereignty, industrialization, and conforming structures. Applications in manufacturing have a stronger focus on predictive maintenance quality control, industrial AI, and public efforts promote the use of secure decentralized edge platforms by small enterprises.

Latin America on the Edge: Emerging Growth Redefines the Edge Computing Market Landscapes

There is a lot happening in Latin America with the rise of digital transformation, the increase of mobile connectivity, and countries investing heavily into their infrastructure through technologies such as smart infrastructure, fintech solutions, and industrial automation, creating a favourable environment for the growth of edge computing.

With countries such as Brazil, Mexico, and Chile leading the way with edge computing solutions to help with their network limitations, reduce reliance on the cloud, and enable support for real-time analytics; as well as the continued expansion of the 5g rollout and IoT smart cities initiatives, the pace at which edge computing is being adopted across Latin America is constantly increasing.

Brazil Edge Computing Market Trends

The adoption of edge ridges in Brazil is enhanced by the modernization of the infrastructure and the increased application in the agriculture and mining sectors. Edge improves real-time monitoring, safety, and productivity of remote operations made possible by increasing connectivity and localized analytics.

Edge Computing Market-Value Chain Analysis

- Edge Devices and Hardware Providers: The Edge Hardware layer comprises the processor, Gateway and Edge Server. Companies like Intel provide high-performance, low-power computing devices to connect with the Edge of the Network.

- Edge Platform and Software Development Company: Edge Platform Software manage the Orchestration, Overall Security, and Analytical Role, so the opportunity for this Layer is huge. IBM and Red Hat build Software Frameworks that enable the development of Software for Multiple Cloud Functions/Uses of Edge devices.

- System Integrators and End-User Application Companies: Edge Solutions are customized by Cisco and its Regional System Integrator partners for Telecommunication, Healthcare and Manufacturing companies through Integrated Deployment and Performance.

Edge Computing Market Companies

- Amazon Web Services (AWS), Inc.: Provides distributed cloud services to edge workloads (low latency needs) in both compute and storage analytics and AI extension.

- ABB: ABB's ability platform is offered by ABB, which is an interface between industrial equipment and edge analytics to automate real-time monitoring and provide AI-powered insight into operations.

- Siemens AG: Provides the Industrial Edge and MindSphere platforms that allow secure ingestion, analysis, and implementation of industrial operations through AI models.

Other Major Key Players

- IBM Corporation

- Aricent, Inc.

- Atos

- General Electric Company

- Hewlett Packard Enterprise Development

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Honeywell International Inc.

- SAP SE

- Intel Corporation

- Microsoft Corporation

- Rockwell Automation, Inc

Recent Developments

- In October 2024, Mistral AI launched the Mistral 3B and 8B models for edge computing. These new models focus on on-device computing and edge applications, enhancing capabilities in areas such as knowledge reasoning and function-calling.

- In March 2025, Indian semiconductor startup Netrasemi is set to launch its first AI-optimized system-on-chip (SoC) for edge computing applications.

- In February 2025, Sequitor Edge, LLC, a leader in Next Generation Edge Computing Data Centers™, is excited to announce the launch of its initial data center regional operating company. Sequitor Edge is strengthening its go-to-market launch with a customer-centric focus on data centers, managed services, and expert services to provide innovative Next Gen solutions for customers' IT infrastructure needs.

Segments Covered in the Report

By Component

- Hardware

- Edge Nodes/Gateways (Servers)

- Sensors/Routers

- Others

- Cameras

- Drones

- HMD

- Robots

- Others

- Hardware by Type

- Hardware by End Point Devices

- Software

- Services

- Edge-managed Platforms

By Organization Size

- Large Enterprises

- SMEs

By Deployment

- On Premise

- Cloud

By Industry Vertical

- Industrial

- Energy & Utilities

- Healthcare

- Agriculture

- Transportation & Logistics

- Retail

- Datacenters

- Wearables

- Smart Cities

- Smart Homes

- Smart Buildings

By Application

- IIoT

- Remote Monitoring

- Content Delivery

- Video Analytics

- AR/VR

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content