What is the Edge Data Center Market Size?

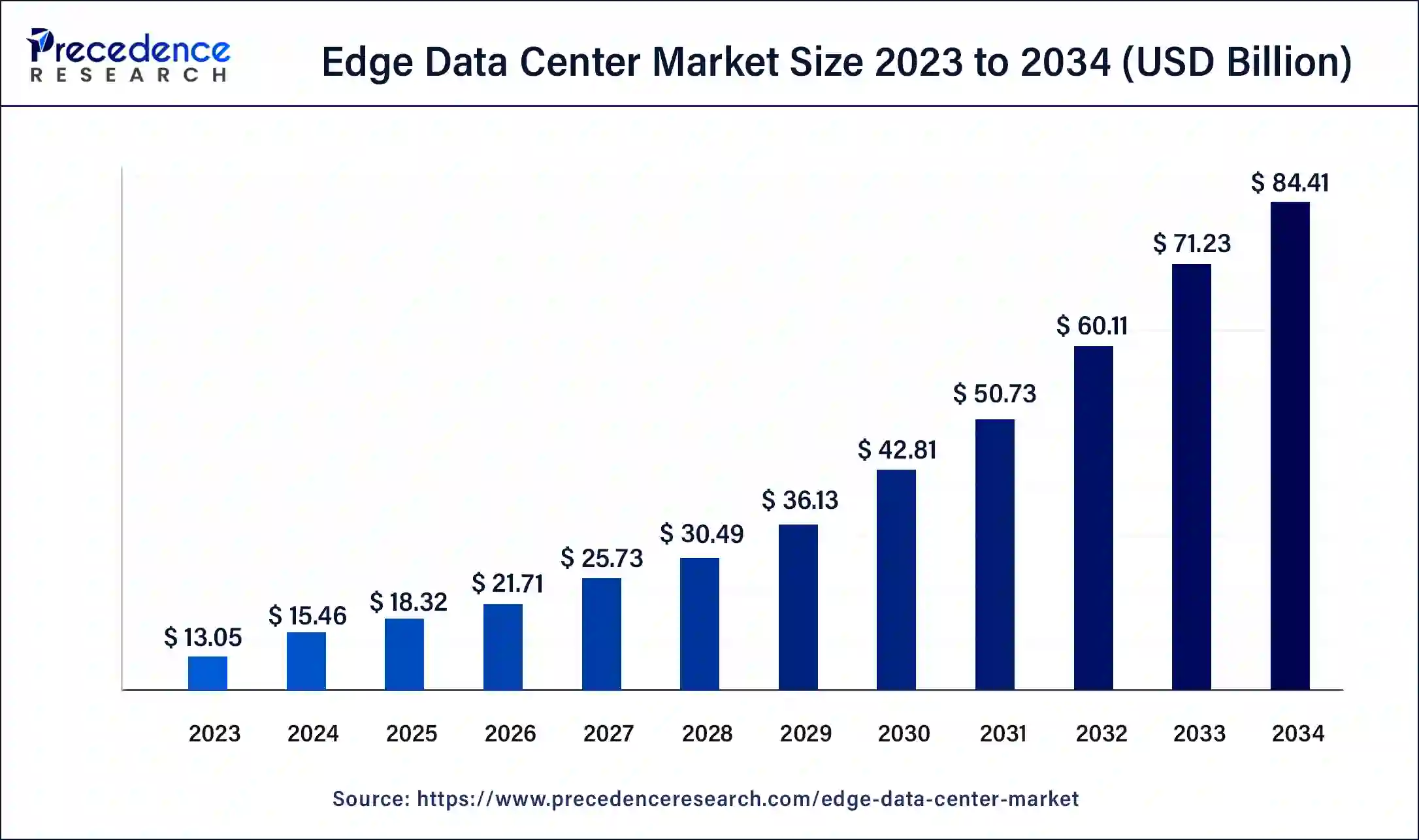

The global edge data center market size is calculated at USD 18.32 billion in 2025 and is predicted to increase from USD 21.71 billion in 2026 to approximately USD 84.41 billion by 2034, at a CAGR of 18.50% from 2025 to 2034.

Edge Data Center Market Key Takeaways

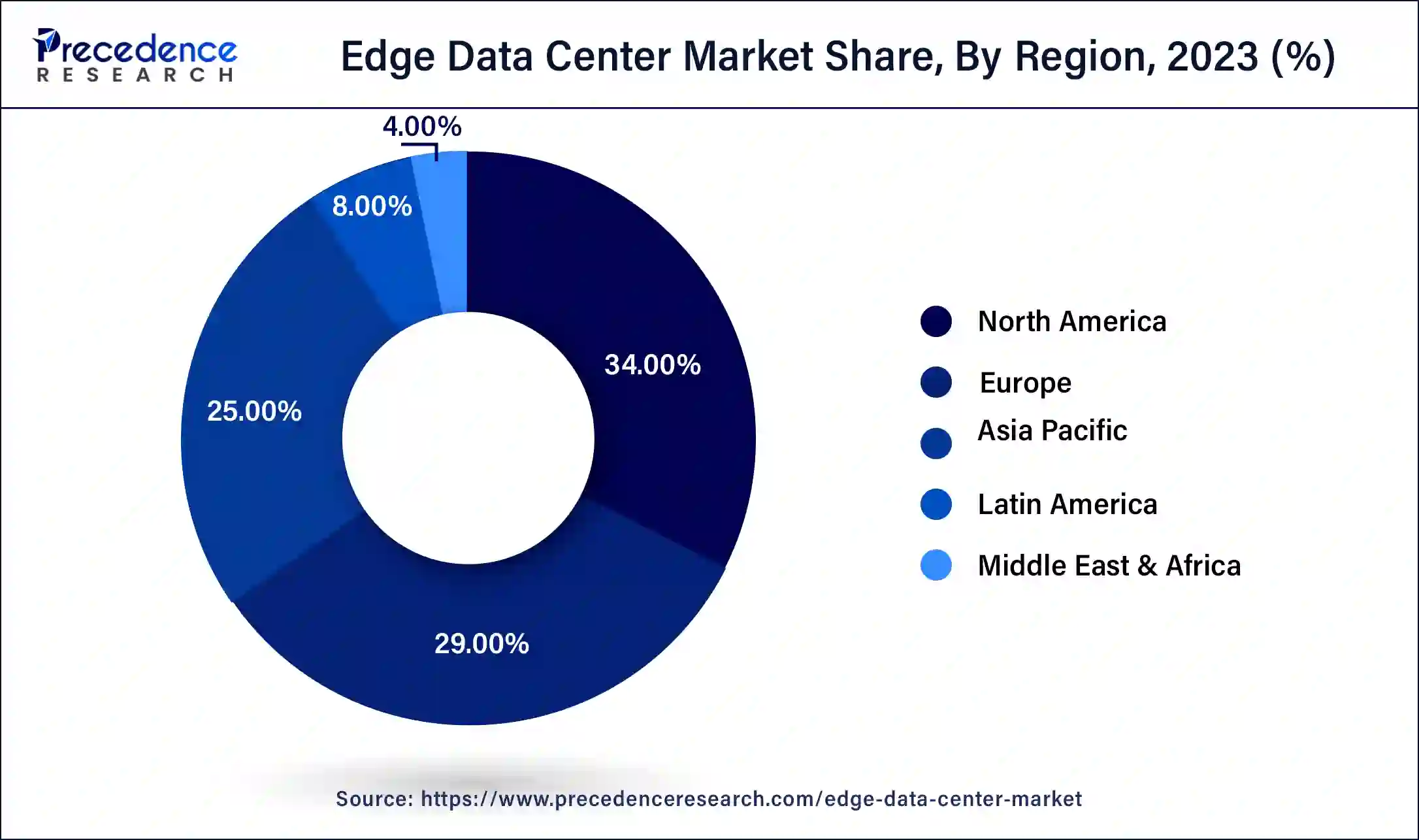

- North America led the market with the biggest market share of 34% in 2024.

- Asia Pacific is observed to witness the fastest rate of CAGR during the forecast period of 2025 to 2034.

- By component, the solution segment held the largest share of the market in 2024.

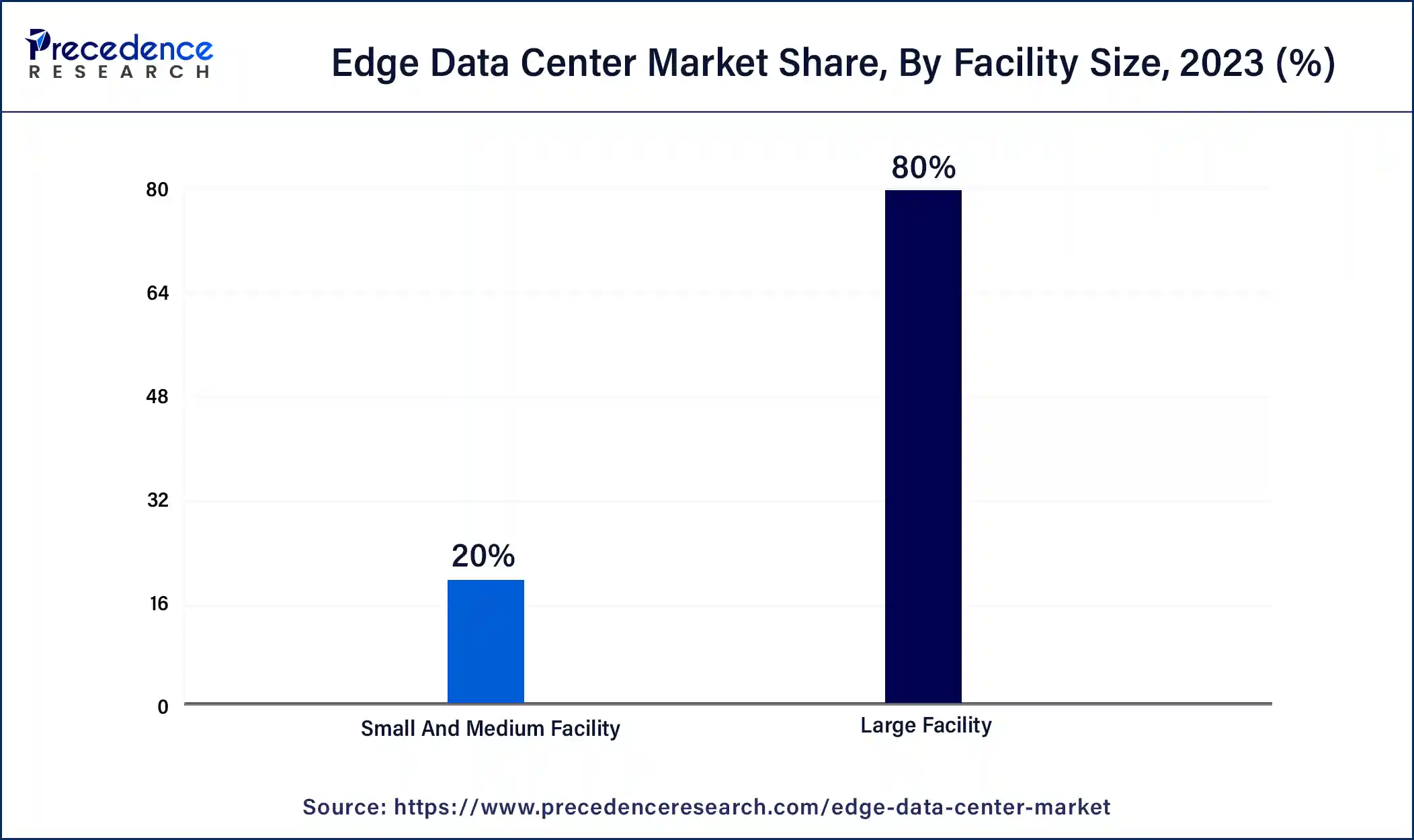

- By facility size, the large facility segment dominated the market in 2024. The segment is observed to grow at the fastest pace during the forecast period.

- By end-use industry, the IT and telecom segment dominated the market in 2024.

Transformation of Digital Landscape

The edge data center market offers facilities that are designed to process and store data closer to the location where it is generated, rather than relying on a centralized data center. The concept of edge computing involves bringing computing resources closer to the "edge" of the network, where data is generated and used, to reduce latency, improve performance, and enhance the overall efficiency of data processing. Edge Data Centers are particularly well-suited for applications that require real-time processing, such as autonomous vehicles, smart cities, industrial automation, and healthcare applications. By distributing computing resources closer to where data is generated, edge data centers contribute to more efficient and responsive data processing, making them a critical component in the evolving landscape of computing infrastructure.

Edge Data Center Market Growth Factors

- The increasing adoption of edge computing is a major driver for the edge data center market. Edge computing brings processing closer to the data source, reducing latency and improving real-time processing capabilities. Applications such as IoT, augmented reality, and autonomous vehicles benefit from edge computing, fueling the demand for edge data centers.

- The proliferation of IoT devices across various industries has led to a massive influx of data. Edge Data Centers play a crucial role in processing and analyzing this data at the edge of the network, allowing for faster decision-making and reduced dependence on centralized data centers.

- The deployment of 5G networks is a significant driver for Edge Data Centers. The increased bandwidth and low latency offered by 5G networks complement the capabilities of edge computing, making Edge Data Centers crucial for supporting 5G-enabled applications and services.

- The growth of autonomous vehicles and the integration of edge AI (Artificial Intelligence) in various applications contribute to the demand for Edge Data Centers. These centers provide the computational power needed for real-time decision-making in autonomous systems.

Edge Data Center Market Outlook: The Road Ahead

- Industry Growth Overview: The growing need for low-latency data processing to support applications like 5G, AI, and IoT is contributing to the industrial growth in the market.

- Sustainability Trends: The sustainability trends of edge data centers focus on the optimization of energy efficiency, integration of renewable energy sources, and implementation of circular economy principles for waste management.

- Major Investors: Large private equity firms and infrastructure investment firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystems are focused on developing innovative hardware and software solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 84.41 Billion |

| Market Size in 2025 | USD 18.32 Billion |

| Market Size in 2026 | USD 21.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Facility Size, End-use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing digitalization in various industries

Strong data management infrastructure is now more important than ever as digital transformation is becoming a strategic necessity for companies across many industries. Digital tools and platforms are being used by several industrial sectors, including healthcare, for telemedicine, digital health records, and remote patient monitoring. This necessitates fast and reliable data services. Additionally, the retail industry is using digital platforms for inventory tracking, customer data management, and e-commerce. This is driving up the demand for edge data centers to handle and store data efficiently. Additionally, the manufacturing sector's rising embrace of Industry 4.0 methods and the increasing penetration of automated technologies and connected gadgets that produce massive volumes of data are helping to increase the edge data center market.

Restraints

Security concerns and infrastructure challenge

Distributing data processing closer to the edge raises security concerns. Edge devices may be more vulnerable to physical attacks, and securing numerous distributed data centers poses additional challenges compared to a centralized cloud model. In addition, establishing edge data centers requires significant investment in physical infrastructure. The deployment and maintenance of these facilities can be complex, especially in remote or challenging locations. Thus, the security concern and infrastructure challenges might be a major restraining factors for the edge data center market over the forecast period.

Opportunity

The increasing proliferation of advanced technologies such as IoT, big data, and AI

The emergence of big data, AI, and IoT technologies has led to the creation of enormous amounts of data that need to be processed and analyzed quickly. This has increased the demand for edge data centers. Particularly, IoT devices constantly produce data that must be processed right away to maximize functionality and produce real-time insights. Furthermore, rapid data availability is necessary for AI and machine learning systems to facilitate effective learning and decision-making. In addition, growing big data applications in a variety of industries, including retail, healthcare, finance, and others, are having a beneficial effect on market expansion. Additionally, because edge data centers are close to the data sources, they are the best option for meeting these growing needs because they offer faster data processing rates and reduced latency. Thus, this is expected to offer an attractive opportunity for the edge data center market during the forecast period.

Component Insights

Based on the component, the solution segment led the edge data center market in 2024 with the largest share. Networking equipment, IT racks and enclosures, data center infrastructure management (DCIM) software, and data center analytics solutions are examples of hardware and software solutions included in the solution category. The need for edge data center solutions is being driven by several factors, including the introduction of next-generation DCIM services, the increase in data center workloads during COVID-19, and the requirement to increase data center energy efficiency. Hardware solutions are customized to meet the specific needs of a business and installed on-site or in a third-party data center. In edge data centers, the software controls and arranges processing and data storage. Applications that allow real-time data processing, data analytics tools, and software-defined networking systems can all fall under this category.

Facility Size Insights

Based on the facility size, the large facility segment held the largest share of the edge data center market in 2024. Low-latency processing and storage capabilities closer to the source are becoming more and more necessary as a result of the explosive rise of data-intensive applications and technologies like 5G networks, AI, and the Internet of Things.

Simultaneously, a major growth-inducing element is the increasing adoption of products in small and medium-sized facilities to meet local or regional data processing requirements, enable quicker data processing, reduce network congestion, and enhance application performance. This is especially important for applications like smart cities, linked cars, and industrial automation that need real-time analytics, autonomous systems, and localized data storage. Additionally, the market is expanding due to the rising demand for cloud computing, streaming services, and content delivery.

End-use Industry Insights

Based on the end-use industry, the IT and telecom segment dominated the edge data center market in 2023. Growing to meet the demands of huge data processing and low latency in the IT & telecom industry. Technologies like IoT, 5G, augmented and virtual reality, and AI/ML have all contributed to this rise. Edge data centers are becoming more and more in demand as a result of the change that IT and telecom data centers are going through to accommodate low latency and high data volume requirements.

Besides, the manufacturing & automotive segment is expected to grow at a rapid rate over the forecast period in the edge data center market. The primary driver of the segment's growth is the automobile industry's growing embrace of technologies like edge computing and 5G, which can deliver mobile apps securely and dependably together with high bandwidth and low latency. Edge data centers provide real-time monitoring and control of linked equipment and systems, which advances automation in the automotive and industrial industries. This can enhance safety, boost productivity, and get rid of human mistakes. The automotive and industrial sectors can benefit from enhanced supply chain management through the use of edge data centers. For instance, by analyzing data from sensors and other connected devices in real-time, edge data centers may offer insights into the location of various objects, their condition, and performance, enabling businesses to optimize logistics and reduce cost.

Regional Insights

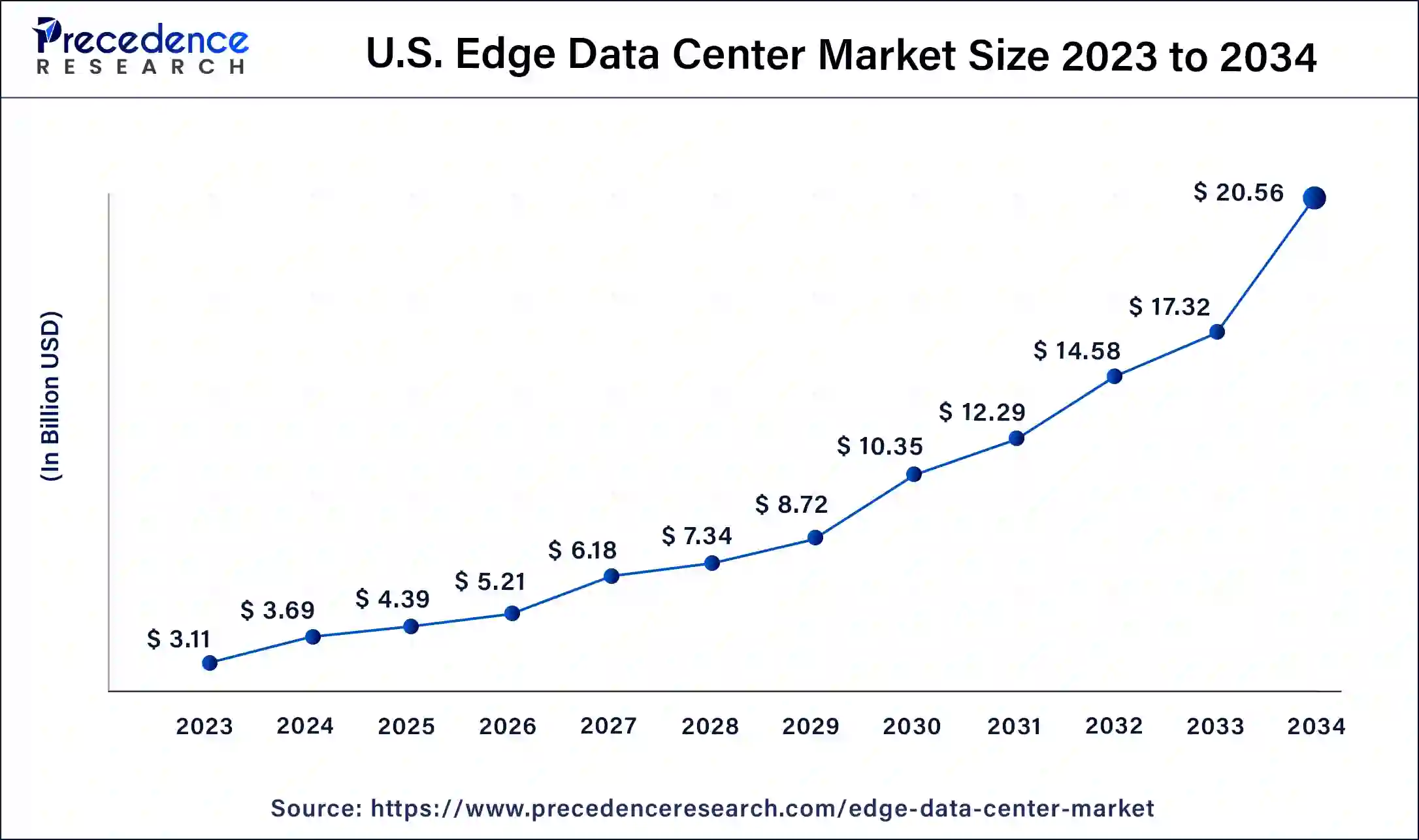

U.S. Edge Data Center Market Size and Growth 2025 to 2034

The U.S. edge data center market size is estimated at USD 4.39 billion in 2025 and is predicted to be worth around USD 20.56 billion by 2034, at a CAGR of 18.70% from 2025 to 2034.

Growing Adoption of Edge Data Services Drives North America

North America has the largest market share of 34% in 2024. The primary driver of the market expansion in this area is the increased uptake of edgedata center services and solutions. North America is a potential location for the market since it also includes well-known edge data center solutions and service providers. Due to the increasing commercialization and rollout of 5G networks, the region is probably going to experience rapid growth. The expansion of edge data centers in North America is ascribed to several factors, including the necessity of supporting upcoming technologies like 5G, internet of things (IoT), and artificial intelligence (AI), which require high bandwidth connections and low latency. By providing end users with direct access to data processing and storage capabilities, edge data centers may significantly improve application and service performance by reducing latency.

Rise in IoT Devices Propels U.S.

The rapid growth of data center edge data center market in the US is showing a strong demand due to rise of IoT devices and utilization in many Industries such as manufacturing, healthcare and smart cities where edge computing, edge data center is playing crucial role due to its demand for low latency and real time data response.

Surge in the IT Sector Boosts the Asia Pacific

Besides, the Asia Pacific is expected to grow at the fastest CAGR during the forecast period. The expansion of end-use sectors, the surge in IT sector investments, and the increasing number of edge computing firms like Huawei Technologies Co., Ltd. and Fujitsu are driving this region's market for edge data centers. The Asia Pacific region's massive population and fast urbanization are two of the main factors driving the deployment of edge data centers in the area. As more people move into cities and choose digital services, there is an increasing need for faster and more reliable connectivity. By putting storage and processing capacity closer to end users, cutting latency, and enhancing the quality of software and services, edge data centers can meet demand.

Real-Time Data Processing Fuels China

The demand for real time data processing is driving the edge data centre market in China. It is showing robust growth because of rapid expansion of 5G networks and massive investments made by government. The government is actively investing in various initiatives like Eastern data Western computing projects which is transforming the edge computing and data centre market in China.

Europe Driven by Advanced Technologies

Europe is expected to grow significantly in the edge data center market during the forecast period. The demand for edge data centers is increasing in various sectors in Europe. At the same time, with the use of advanced technologies and enhanced networking, various advancements, as well as their adoption, are increasing. The UK is increasing the demand for edge data centers as they are being utilized in the healthcare sector. While in Germany, the advancing automotive and telecommunication sectors are adapting to edge data center services. Furthermore, to maintain their privacy and security, the government, as well as the regulatory bodies, are providing their support. Thus, all these factors are promoting the market growth.

Mobile Connectivity Push South America

South America is expected to grow significantly in the edge data center market during the forecast period, due to growing mobile connectivity and increasing internet users is enhancing the demand for edge data centers. They are used to dealing with the growing data traffic, where the expanding centres are providing various services for gaming and streaming.

Digital Economy Powers Brazil

The presence of a large digital economy is increasing the use of edge data centers. The expansion in the 5G and IoT sectors leads to an increase in their use across smart cities, manufacturing, etc. Additionally, the growing online platforms are utilizing their services to enhance user experiences.

Digitalization Transforming MEA

MEA is expected to grow in the edge data center market during the forecast period, due to growing digitalization, which is backed by government initiatives. Additionally, the increasing use of the internet and expanding 5G networks are driving their demand, where the investments are enhancing their services, promoting the market growth.

Digital Infrastructure Strengthens Saudi Arabia

Expanding digital infrastructure in Saudi Arabia is increasing the demand for edge data centers. The growing government initiatives, cloud computing, and smart cities are also increasing their use. Additionally, investments are supporting their expansion.

The Edge Data Center Market Leaders: Key Players' Offering

- NVIDIA Corporation: Jetson, EGX platform, and IGX are provided by the company.

- Cisco Systems Inc.: the company offers Industrial routers, switches, gateways, Edge intelligence, and IoT Operations Dashboard.

- IBM: Platforms like IBM Edge Application Manager, IBM Cloud Pak, and IBM Cloud Satellite are provided by the company.

- Eaton: the company offers products like UPS systems, PDUs, Power Management software, and enclosure systems.

- EdgeConneX Inc.: the company provides build-to-suit solutions.

- Fujitsu: Edge networking solutions, PRIMERGY servers, and INTELLIEDGE IoT solutions are offered by the company.

- Hewlett Packard Enterprise Development LP: the company provides HPE Edgeline systems, HPE Aruba Networking, and HPE GreenLake.

- Schneider Electric: APC NetShelter SX is provided by the company.

Edge Data Center Market Companies

- NVIDIA Corporation

- Cisco Systems Inc.

- IBM

- Eaton

- EdgeConneX Inc.

- Endeavor Business Media, LLC.

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Schneider Electric

Recent Developments

- In July 2025,India's edge data centre expecting significant expansion up to 200-210 megawatt (MW) till 2027, currently the capacity is 60-70 MW, the aim is to gain three times increase which will be driven by proliferation of emerging technologies. Currently edge data center strength of total India is around 5 percent which is expected to reach up to 8 percent by 2028. (Source: https://cio.economictimes.indiatimes.com)

- In July 2025,Located in Houston, Calpine Corporation decleared a letest 190-megawatt (MW) contract with Dallas-based CyrusOne, a data center developer and operator on a global level, which will provide data center services to the Thad Hill Energy Center in Bosque County, Texas. The deal covers power, grid connection and land to support a new under construction facility. The facility is expected to be operational by 2026. The Thad Hill Energy Center is a natural gas-fired combined cycle plant with a nameplate capacity of 250 MW, located in Bosque, Texas. (Source: https://www.power-eng.com)

- In April 2025, RailTel Corporation of India Ltd., a crucial Public Sector Undertaking (PSU) under Ministry of Railways, which ensures the Information Communication and Technology (ICT) services has made a strategic partnership with the National Buildings Construction Corporation (NBCC), a state-owned company, to build data centers. The both companies have signed a Memorandum of Understanding (MoU) to develop data centers throughout the country even in abroad in the period of next five years. (Source: https://w.media)

- In June 2025, the development of advanced edge and containerised data centres nationwide was announced by the NES Data Pvt Ltd. Moreover, the new-age data centre companies will offer these state-of-the-art facilities as a key offering. At the same time, sustainable, scalable, and modular solutions that can be customized for remote deployments, AI, and real-time applications will be provided by these data centres, which are anticipated to be available online from next month.(Soucre: https://analyticsindiamag.com)

- In May 2025, to deploy a new edge data center (EDC) in Victoria, Texas, a collaboration between Duos Edge AI, Inc. which is the operating subsidiary of Duos Technologies Group, Inc, and a provider of streamlined, adaptive, and versatile EDC solution tailored to meet evolving needs in any environment, with Region 3 Education Service Centre (ESC) was announced. Moreover, the continued traction in rural markets and reinforcement of the Company's presence in the education sector will be reflected by this launch and is considered the latest execution in Duos Edge AI's national rollout strategy.(Source: https://www.morningstar.com)

- In May 2023, leader in hybrid multicloud computing Nutanix introduced Nutanix Central, a cloud-delivered solution that offers a single interface for visibility, control, and monitoring of hosted edge, and public cloud infrastructure. This will expand the Nutanix Cloud Platform's universal cloud operating architecture to dismantle silos and streamline uniformly managing apps and data everywhere.

- In June 2023, NTT Ltd., a prominent worldwide provider of IT infrastructure and services and a market leader in the Indian data center sector, announced the opening of Chennai 2, a hyperscale data center campus, as well as the arrival of MIST, a subsea cable system, in the city. The Chennai 2 campus, which spans six acres and is a cutting-edge project, is situated in Ambattur. Its two data center buildings can accommodate a combined 34.8 MW of vital IT load. 17.4 MW of IT load capacity is available at the first facility, which goes online on the date of publication.

Segments Covered in the Report

By Component

- Service

- Professional

- Managed

- Solution

- Hardware

- Software

By Facility Size

- Large Facility

- Small And Medium Facility

By End-use Industry

- Healthcare And Lifesciences

- BFSI

- IT And Telecom

- Manufacturing & Automotive

- Gaming And Entertainment

- Government

- Retail And E-Commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting