Data Center Infrastructure Management (DCIM) Market Size and Forecast 2025 to 2034

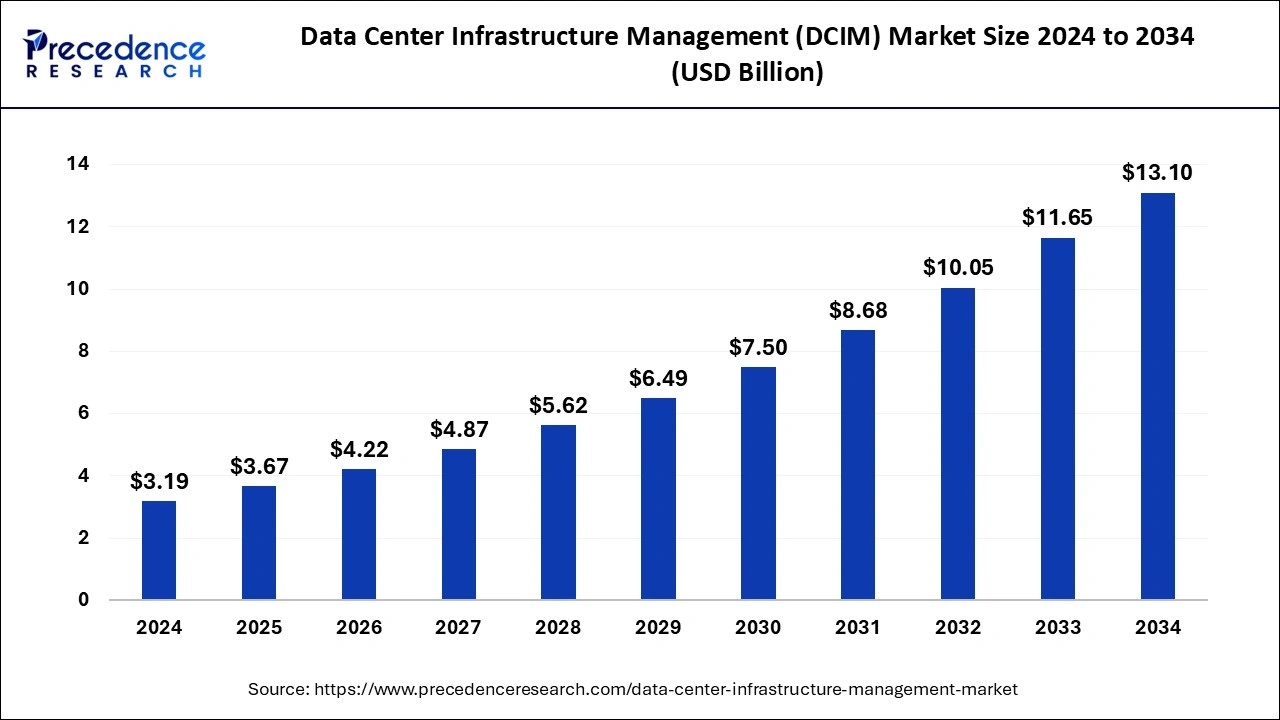

The global data center infrastructure management (DCIM) market size was estimated at USD 3.19 billion in 2024 and is predicted to increase from USD 3.67 billion in 2025 to approximately USD 13.10 billion by 2034, expanding at a CAGR of 15.17% from 2025 to 2034. The data center infrastructure management (DCIM) market is driven by the rapid expansion of cloud computing.

Data Center Infrastructure Management (DCIM) Market Key Takeaways

- The global data center infrastructure management (DCIM) market was valued at USD 3.19 billion in 2024.

- It is projected to reach USD 13.10 billion by 2034.

- The data center infrastructure management (DCIM) market is expected to grow at a CAGR of 15.17% from 2025 to 2034.

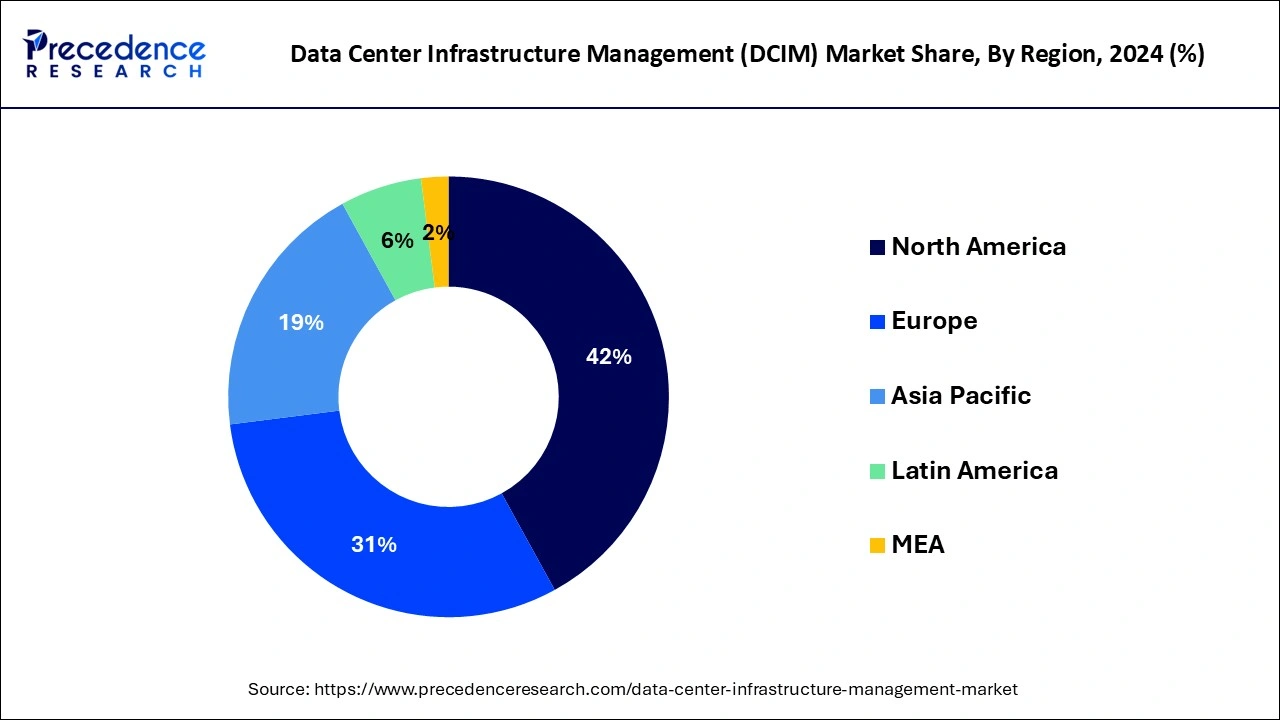

- North America dominated the market with a market share of 42% in 2024.

- By component, the solution segment dominated the market with a 79% market share in 2024.

- By component, the services segment is expected to grow at a CAGR of 18.16% during the forecast period of 2025-2034.

- By data center, the enterprise data center segment held the largest share of 41% in 2024.

- By data center, the cloud and edge data center segment is expected to grow at a CAGR of 17.16% during the forecast period.

- By deployment, the on-premises segment dominated the market with 65% market share in 2024.

- By application, the asset management segment held the largest share of 42% in 2024.

- By application, the BI and analytics segment is observed to grow at a CAGR of 18.16% during the forecast period.

- By enterprise, the large-sized enterprises segment held the dominating share of 76% in 2024.

- By industry vertical, the IT & ITeS segment held the largest market share of 40% in 2024.

- By industry vertical, the healthcare and life science segment is expected to expand at a CAGR of 17.6% during the forecast period of 2025-2034.

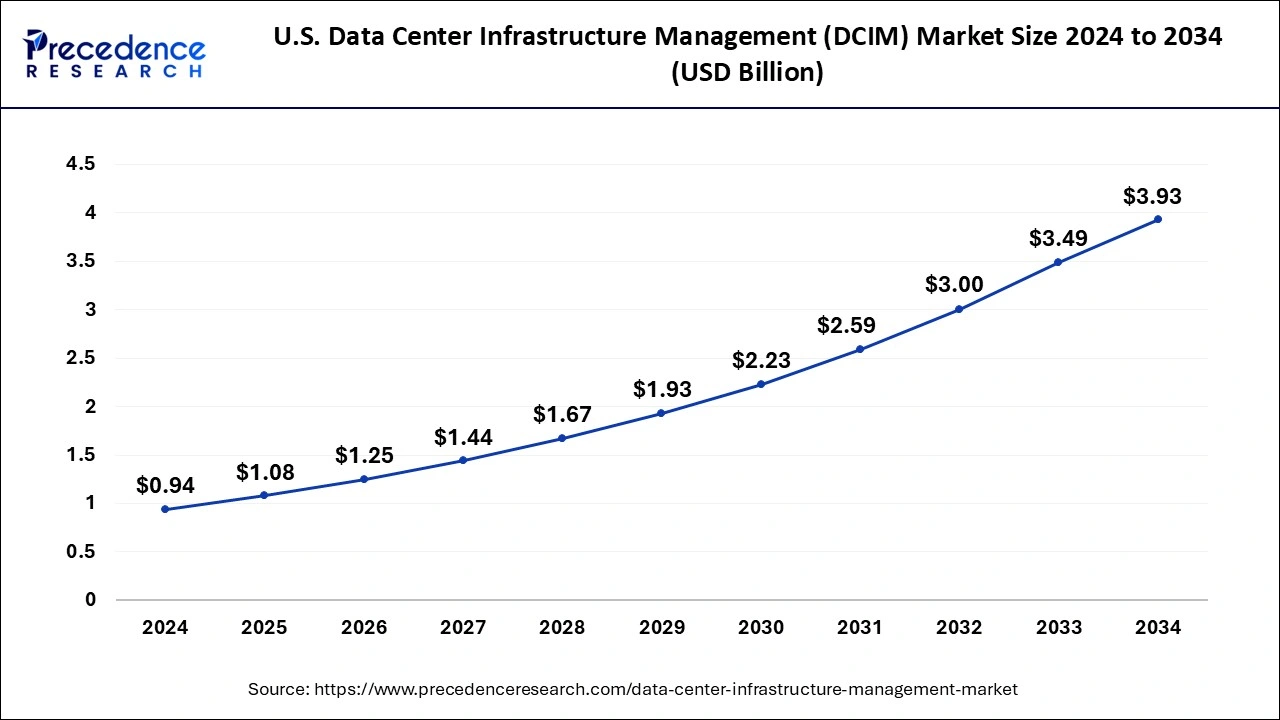

U.S. Data Center Infrastructure Management (DCIM) Market Size and Growth 2025 to 2034

The U.S. data center infrastructure management (DCIM) market size was exhibited at USD 0.94 billion in 2024 and is projected to be worth around USD 3.93 billion by 2034, growing at a CAGR of 15.38% from 2025 to 2034.

North America dominated the market with a 42% market share in 2024. Based in North America, many cutting-edge technology corporations and startups contribute to DCIM solutions. For example, Silicon Valley is a center of innovation and technology that supports creating state-of-the-art data center management systems. To improve their DCIM offerings, numerous technology companies have entered strategic alliances and acquisitions. As a result, they have solidified their position in the industry and offer complete solutions catering to data center owners' changing demands.

- For instance, in January 2024, the first community relations service catered solely to the digital infrastructure industry is the Data Center Community Relations Service, which introduced the full-service PR firm Milldam Public Relations. The new service is being introduced in response to the industry's need for more resources to counteract widespread opposition to data center growth.

Asia-Pacific is expected to observe the fastest rate of expansion in the data center infrastructure management (DCIM) market during the forecast period. Data center expansion is facilitated by the region's businesses' growing use of cloud computing services. Cloud providers frequently need advanced DCIM solutions to optimize and manage their infrastructure. Several governments in the Asia-Pacific area are actively encouraging the digitalization and adoption of new technologies. This entails infrastructural investments in data centers to sustain the growing digital economy.

Market Overview

In the rapidly advancing world of technology, data centers are the foundation of contemporary businesses, facilitating various digital services and applications. The significance of preserving faultless operations and optimizing resource utilization in large data centers cannot be overstated. Benefits from economies of scale have largely driven the trend toward consolidation and the creation of ever-larger data centers. Technological advancements like Web-based applications, system virtualization, more powerful servers provided in smaller footprints, and an abundance of inexpensive bandwidth have all contributed to and exacerbated this trend.

- In August 2023, Over the next three years, Brookfield Infrastructure Partners plans to create almost one gigawatt of data center capacity.

Data Center Infrastructure Management (DCIM) Market Data and Statistics

- New announcements have been made to the sector by colocation providers, including Urbacon Data Centre Solutions and others, as well as hyperscale operators like Microsoft Azure and Google Cloud.

- In June 2023, Ohio's data center infrastructure will get billions of dollars in investment from Amazon Web Services (AWS). Amazon and state governor Mike DeWine unveiled the latest investment plans that will see AWS invest $7.8 billion by the end of 2029/2030 in growing its data center operations in Central Ohio.

Data Center Infrastructure Management (DCIM) Market Growth Factors

- Growing dependence on digital operations and cloud services drives demand for effective data center administration.

- Increasing server density and diverse infrastructure call for intelligent management solutions like DCIM for visibility and control.

- Data centers are moving toward DCIM for optimal power and cooling utilization due to rising energy costs and concerns about sustainability.

- Real-time data analysis and anomaly detection are made possible by DCIM, which also reduces operating expenses and avoids downtime.

- IoT sensors and AI algorithms are incorporated into advanced DCIM systems for proactive resource allocation, automation, and self-optimization.

- Access control and audit trails, two enhanced security features provided by DCIM solutions, address the expanding risks to data protection.

- For smooth administration and optimization, distributed DCIM solutions are necessary for decentralized data processing at the edge.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.17% |

| Market Size in 2025 | USD 3.67 Billion |

| Market Size by 2034 | USD 13.10 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Data Center, Deployment, Application, Enterprise, and Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Emergence of intelligent automation and AI

Intelligent automation and AI are not just tools, they are revolutionizing the landscape of data centers. They amplify resource utilization, energy consumption, and overall efficiency unprecedentedly. By pinpointing and rectifying inefficiencies through real-time monitoring and analysis, they ensure that resources are harnessed to their full potential.

With the power of AI and automation, data centers transform into adaptable powerhouses. They can swiftly respond to fluctuating needs and workloads, allocating resources like processing power and storage precisely where required. This dynamic resource allocation is a key advantage of using intelligent automation in data centers, offering unparalleled control and flexibility.

Restraint

Lack of standardization and fragmented vendor landscape

While the lack of widely recognized industry standards does cause interoperability issues across different DCIM implementations, it's important to remember that these challenges are manageable. The use of proprietary technologies and data formats by several suppliers does make it challenging for users to easily combine disparate systems and create a single management framework. However, with the right approach and tools, it is possible to overcome these hurdles.

The fragmented vendor landscape exacerbates the problem, as many different organizations provide DCIM solutions that differ in features, functions, and compatibility. This diversity can lead to issues with cross-platform communication, higher implementation costs, and infrastructure scaling or upgrading challenges. However, user assistance in choosing and deploying a DCIM solution that suits their requirements cannot be overstated. Their input is crucial in avoiding inefficiencies and achieving optimal performance in data center management.

Opportunity

Growing demand for edge computing integration

Effective resource management at edge locations is necessary for edge computing. Edge data centers may run as efficiently as possible with DCIM solutions, which can help optimize power, cooling, and space requirements. Many businesses use a hybrid strategy that blends cloud services and edge computing. Organizations may use the advantages of both edge and cloud settings when DCIM solutions are smoothly linked with cloud platforms, contributing to a coherent and integrated IT ecosystem.

Component Insights

The solution segment dominated the market with a 79% market share in 2024. Typically, it provides extensive capabilities for controlling, optimizing, and monitoring data center infrastructure. These systems develop to offer increasingly advanced functionality as technology progresses, satisfying the expanding demands of data center operators. Due to the growing emphasis on cyber security and regulatory compliance, DCIM systems with strong security features and industry-standard compliance are more likely to rule the market.

The service segment is expected to grow at a CAGR of 18.16% during the forecast period. Organizations need specialized services to assist them understand and manage the growing complexity of data centers with varying infrastructure components and growing volumes of data. Scalability is made possible by DCIM services, enabling businesses to modify their data center infrastructure in response to shifting demands. Service providers help scale up and down so that the infrastructure keeps up with the company's changing needs.

- For instance, in September 2023, Eaton introduced the Bright layer Data Centers package, a new data center management platform. The suite integrates asset management, enhanced electrical supervision, power quality measures, and IT and operational technology (OT) device monitoring on a single platform.

Data Center Insights

The enterprise data center segment dominated the market with a 41% market share in 2024. Businesses handle enormous volumes of vital and sensitive data. DCIM addresses the enterprise's elevated concerns around data availability and integrity by ensuring data center operations' dependability, security, and effectiveness. Numerous IT and facility management systems are integrated with DCIM. A single platform to monitor and manage many data center features adds efficiency to business operations with heterogeneous IT ecosystems.

The cloud and edge data center segment is expected to grow at a CAGR of 17.16% in the data center infrastructure management (DCIM) market during the forecast period. Operational efficiency is emphasized in the cloud and edge data center market. Real-time monitoring, automation, and intelligent decision-making are made possible by DCIM solutions, which enhance operational effectiveness while lowering costs and downtime.

Data centers are under pressure to run responsibly as environmental issues gain popularity. Energy-efficient technologies and procedures are frequently implemented in the cloud and edge data center market, and DCIM solutions are essential to maintaining the environmentally responsible functioning of these establishments.

Deployment Insights

The on-premises segment dominated the market with a 65% market share in 2024. Organizations have more control over their data and infrastructure when using on-premises solutions. This is especially important for companies dealing with sensitive data and having tight regulatory standards. It answers data sovereignty concerns because businesses have complete ownership and jurisdiction over their data. This is especially crucial for companies where data sovereignty laws are strictly enforced.

The cloud segment is expected to grow at the fastest rate during the forecast period of 2025-2034. Scalability offered by cloud-based DCIM systems enables companies to quickly grow or shrink their infrastructure in response to changing requirements. This flexibility benefits businesses that are increasing or have changing customer needs. Cloud solutions' real-time analytics and monitoring features give users immediate insights into the functionality and condition of data center infrastructure. This immediate access to information makes proactive problem-solving and quicker decision-making possible.

- For instance, in January 2023, In the Indian state of Telangana, Microsoft and AWS want to expand their investments and data center portfolios. The two cloud businesses will significantly increase their investments in the region centered on Hyderabad, where they already have established facilities and cloud regions under development and operation.

Application Insights

The asset management segment dominated the data center infrastructure management (DCIM) market with a 42% market share in 2024. Due to asset management, data center administrators may efficiently distribute resources, such servers, storage, and networking equipment, based on actual usage and demand. This optimization increases operational effectiveness and reduces costs. Improved capacity planning is made possible by the capacity to track and manage assets. To guarantee optimal performance and scalability, data center operators can plan for growth or consolidation, predict future resource needs, and make well-informed decisions.

- The BI and analytics segment is expected to grow at a CAGR of 18.16% in the data center infrastructure management (DCIM) market during the forecast period.

The infrastructure, tools, applications, and various other resources that come together to provide data and insights are called business intelligence (BI) and analytics. These powerful tools hold the potential to help businesses uncover hidden revenue opportunities, instilling a sense of hope and optimism for the future. Companies can look forward to a promising future by making informed decisions and assessing performance.

In data centers, business intelligence (BI) technologies make it easier to track and evaluate key performance indicators (KPIs) and empower businesses to take control. By locating bottlenecks, anticipating possible problems, and enhancing performance, companies can feel confident in their decision-making abilities. This sense of control and empowerment is essential for business owners and managers.

Enterprise Insights

The large-sized enterprises segment dominated the market with a 76% share in 2024. Large companies usually have multiple data centers and a vast IT infrastructure, operating on a much grander scale. To efficiently manage and optimize their complex environments, this calls for sophisticated DCIM solutions. Owing to their intricate workings, big businesses could have needs that call for tailored DCIM solutions. Large-scale enterprise segment vendors frequently provide customized solutions to meet specific goals and challenges.

The small and medium-sized enterprises (SMEs) segment is expected to grow at the fastest rate during the forecast period of 2025-2034. To guarantee the dependability and security of their digital assets, SMEs are forced to invest in vital DCIM tools due to the growing trend of cloud computing and data-driven decision-making. The DCIM market segment's quick expansion is fueled by the requirement for scalable solutions that can adjust to the changing needs of small and medium-sized enterprises.

Industry Vertical Insights

The IT & ITeS segment has dominated the market with 40% of the market share in 2024. The IT and IT sectors are paving the way for the adoption and advancement of digital transformation. Businesses increasingly depend on digital technology, which has increased demand for reliable data center infrastructure and given IT and ITeS providers a significant market share. Numerous global IT and ITeS enterprises function globally, with data centers dispersed over various geographic areas. These geographically scattered data centers may be managed and monitored centrally thanks to DCIM technologies, which offer a unified approach to infrastructure management.

The healthcare and life science segment is expected to grow at a CAGR of 17.6% during the forecast period. The healthcare and life science industries produce massive volumes of data through administrative procedures, clinical trials, patient records, and genomic research. DCIM systems enable storing, managing, and analyzing large amounts of data effectively, improving operational effectiveness and decision-making. Using telemedicine, electronic health records (EHRs), and other digital technologies is part of the healthcare industry's digital revolution. Strong and scalable data center infrastructure is needed for these activities, which means DCIM solutions are essential for effective resource management, allocation, and monitoring.

Data Center Infrastructure Management (DCIM) Market Companies

- ABB

- FNT GmbH

- Huawei Technologies Co., Ltd

- IBM

- Schneider Electric

- Siemens

- Cisco Systems, Inc.

- Device42, Inc.

- EATON

- Sunbird Software, Inc.

Recent Developments

- In October 2023, to accommodate the shift in workloads pushed by artificial intelligence (AI) toward AI-optimized data center design, Schneider Electric released a guide to help with new physical infrastructure design problems for data centers.

- In April 2023, the VC-backed network automation business in January, NS1 broke out to form Net Box Labs, an open-source startup. The company recently said it had acquired $20 million in a Series A fundraising round from several well-known investors.

- In January 2022, Keppel Data Centres announced the purchase of a 94,000-square-foot data center facility in London.

Segments Covered in the Report

By Component

- Solution

- Service

By Data Center

- Enterprise Data Center

- Managed Data Center

- Colocation Data Center

- Cloud and Edge Data Center

By Deployment

- On-premises

- Cloud

By Application

- Asset Management

- Capacity Management

- Power Monitoring

- Environmental Monitoring

- BI and Analytics

By Enterprise

- Small and Medium Sized Enterprises (SMEs)

- Large Sized Enterprises

By Industry Vertical

- BFSI

- Government and Public Sector

- IT &ITeS

- Manufacturing

- Healthcare and Life Science

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting