What is the Electronic Health Records Market Size?

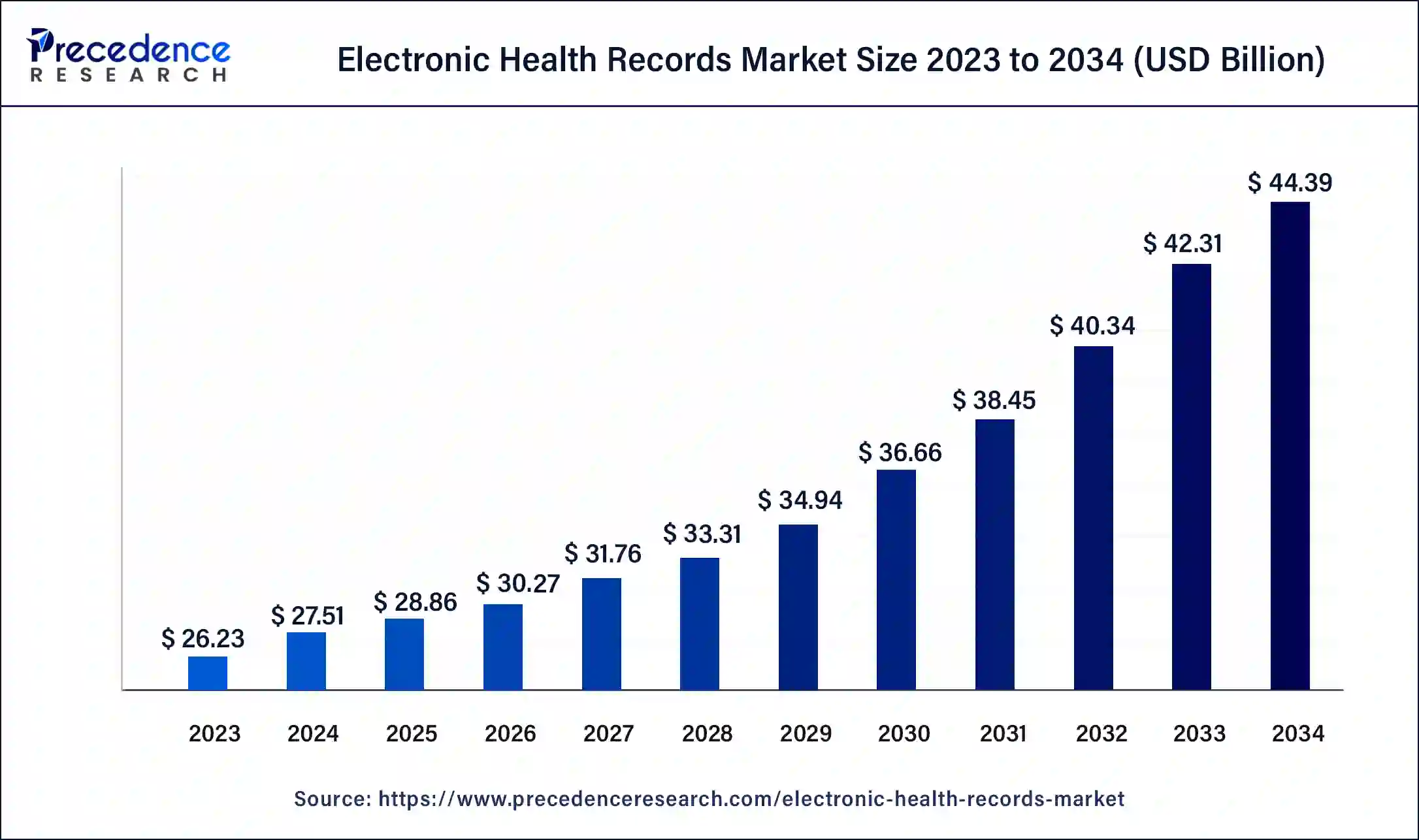

The global electronic health records market size accounted for USD 28.86 billion in 2025 and is expected to be worth around USD 44.39 billion by 2034, at a CAGR of 4.9% from 2025 to 2034. The North America electronic health records market size reached USD 12.07 billion in 2023.

Market Highlights

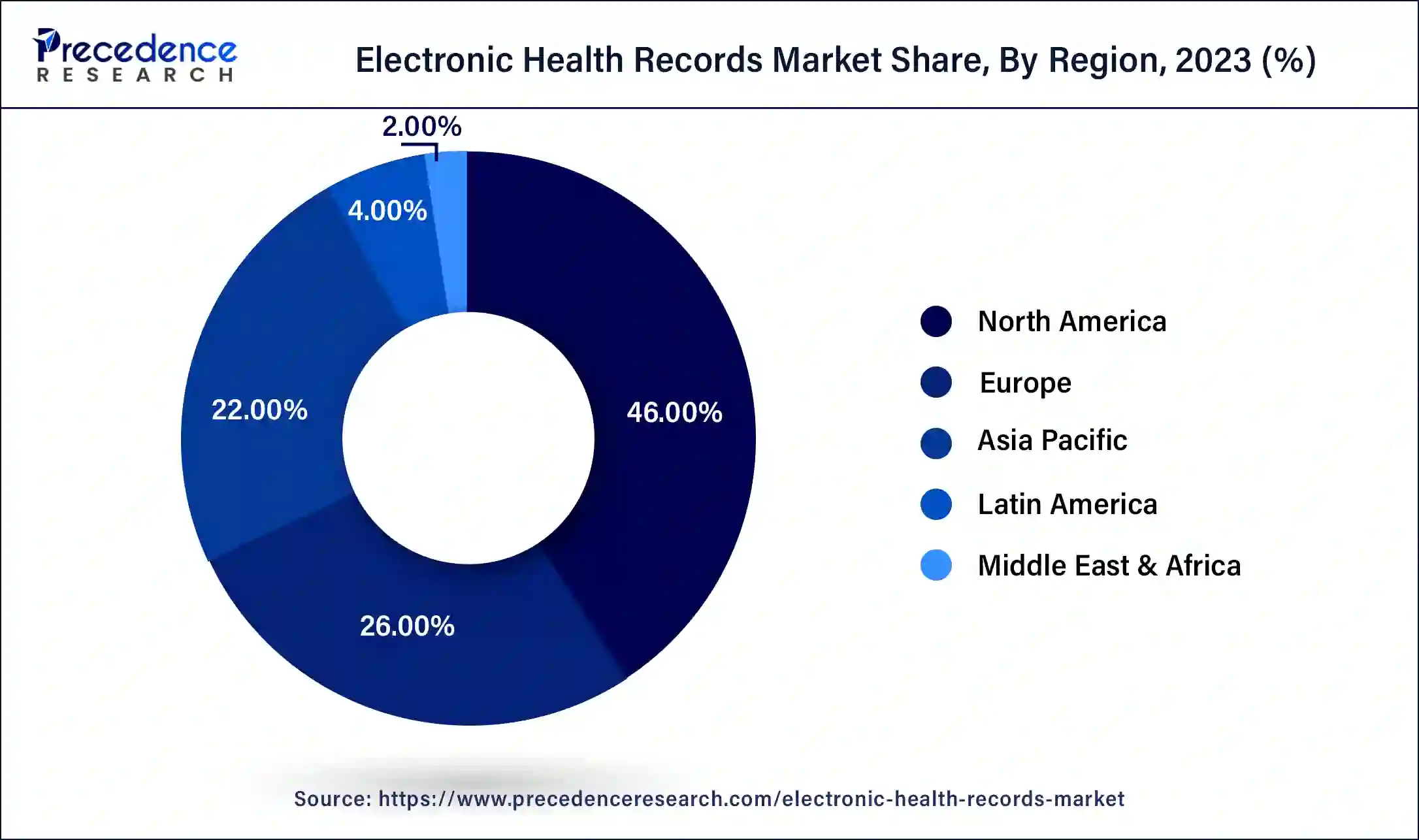

- North America led the global market with the highest market share of 46% in 2024.

- By business model, the professional services segment has accounted revenue share of 32% in 2024

- The professional services segment has captured a revenue share of 32% in 2024.

- The ambulatory surgical centers segment is expected to witness a CAGR of 7.8% from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 28.86 Billion

- Market Size in 2026: USD 30.27 Billion

- Forecasted Market Size by 2034: USD 44.39 Billion

- CAGR (2025-2034): 4.9%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

Electronic Health Records Market Growth Factors

The rising number of patients in the hospitals and other healthcare units is rising owing to the rising prevalence of various chronic diseases and growing geriatric population across the globe. The need for reducing paperwork and demand for digitalization of the healthcare systems is boosting the growth of the global electronic health records market. The government initiatives to digitalize the healthcare facilities is a major contributor to the growth of the electronic health records market. For instance, My Health Record is a digital health record platform for the Australian citizens. These health records can enhance the patient care in the hospitals as the past medical and health records of a particular patient can be analyzed to provide better treatment to the patient. The growing adoption of electronic health records platform among the hospitals, clinics, and diagnostic labs is expected to significantly drive the global market during the forecast period.

The presence of the numerous market players and various developmental strategies adopted by them such as new product launches, acquisitions, partnerships, and agreements is a major factors that influences the growth of the electronic health records market. For instance, Allscripts Healthcare Solutions entered into a strategic partnership with the US Orthopedic Alliance to introduce improved electronic health records. The rising government and corporate investments to develop a strong and sophisticated IT and telecommunications infrastructure is expected to foster the adoption rate of electronic health records across the globe. Furthermore, the growing need for the integration of healthcare system and introduction of the big data in the healthcare industry is expected to drive the growth of electronic health records market during the forecast period. In March 2021, the European electronic health record exchange was a recommendation adopted by the European Commission, which will securely transfer health related data across the European nations. These types of government initiative to promote electronic health records is expected to fuel the adoption rate across the globe.

- The rise in cases, fueled by chronic diseases and the aging population, is creating the need for more refined systems for patient data handling, thereby presenting growth possibilities to the EHR market.

- The hospitals, clinics, and diagnostic labs are adopting EHR platforms across the globe as a part of the larger healthcare reform-driven by digitization and reduction in paperwork.

- Government initiatives for digital health records, comprising national platforms and cross-border data exchange programs, also do a lot in favor of the EHR implementation.

- The strategic initiatives comprising new launches, partnerships, mergers, and collaborations undertaken by key EHR providers continue to propel market growth.

- Infrastructural investments in IT and telecom under large-scale programs on big data analytics in healthcare have further nurtured the growth of EHR adoption across the globe.

- Increasing incidences and the demographic growth of the elderly population are factors driving patient volume and, thus, creating demand for efficient health data management systems.

- Digital healthcare efforts, emphasizing paperwork reduction and increased efficiency, are underpinning the adoption of EHR platforms.

- While government initiatives and favorable policies encouraging national digital health records and cross-border data exchanges are ensuring widespread implementation.

- With the leading EHR vendors pursuing strategic activities such as partnerships, acquisitions, and product innovations, which in turn promote competitiveness and adoption rate.

- The expansion of IT infrastructure amidst growing investments and the integration of big data analytics continue to advance the capabilities and penetration of electronic health records worldwide.

AI in the Market

Artificial intelligence is changing the EHR industry with enhanced efficiency, accuracy, and patient care. It offers the automation of mundane day-to-day duties such as appointment scheduling, billing, and documentation so that healthcare professionals can attend to their patients. The ability to process data at large enables AI to allow earlier diagnoses and personalized treatments and to provide real-time monitoring. These systems essentially reduce medical errors and costs by alerting patients and clinicians to dangers such as adverse medication interactions and price risks. Cost savings from implementation include lower administrative costs, more effective resource allocation, and fewer hospital readmissions. The AI-based EHRs offer advanced clinical decision support, early warning systems, and predictive analytics, which put power into the hands of clinicians to make informed decisions.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 28.86 Billion |

| Market Size in 2026 | USD 30.27 Billion |

| Market Size by 2034 | USD 44.39 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.9% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type,Product, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

Increased Need for Efficient Healthcare Data Management

Electronic health record systems are imperative for reducing the traditional administrative activities that include scheduling, billing, and documentation, to ensure maximum efficiency in healthcare provision. Due to EHRs, data are more easilyaccessible to healthcare providers, who can retrieve patient details swiftly, thereby circumventing delays and medical errors. Along with a well-argued diagnosis goes a treatment plan. Demand for low-cost and efficient health delivery globally is one of the big driving forces for the implementation of EHRs, as they help to coordinate health professionals in providing care and further ensure that care outcomes have the right information at all times, preferably the latest.

Constraint

Complexity of the EHR system

Some health practitioners may find Electronic Health Record systems very intricate and difficult to navigate, setting a very high learning curve and eventually dampening productivity. Contrary to paper records, the very interfaces of some EHRs build against the users and cause frustration while sometimes interrupting workflows. Such complexities slow acceptance, translate into more training expenses, and sometimes outright resistance at other times. The NIH asserts that these usability issues rebel against healthcare delivery to an extent that clinicians engage in more record keeping than in actual patient care.

Opportunity

Technological Enhancement

Emergences in technology, comprising cloud computing, artificial intelligence (AI), and machine learning, will probably transform the EHR landscape for increased system functionality and accessibility. Cloud-based EHR offers scalable, secure, and inexpensive options for data storage that can be accessed anytime and anywhere from any device, thereby permitting the smooth collaboration of healthcare providers. The inclusion of AI in the system, in turn, helps perform analytical tasks on data and performs automation of routine tasks and supports clinical decision-making, rendering EHR systems highly intuitive and efficient. Such technologies will certainly remove hurdles by streamlining user workflow and offering user-centric interfaces to globally grow the opportunity in the EHR market.

Segment Insights

Type Insights

Based on type, the acute segment accounted for around 48% of the market share in 2024 and is estimated to sustain its dominance during the forecast period. The increased government initiatives to implement the adoption of electronic health records in the small healthcare facilities have significantly contributed towards the growth of this segment.

On the other hand, the post-acute segment is estimated to be the most opportunistic segment during the forecast period. This is attributed to the extensive usage of post-acute electronic health records in the rehabilitation centers, home health service providers, and long term healthcare units. The segment's growth is expected to grow owing to the rising consumer expenditure on the rehabilitation services.

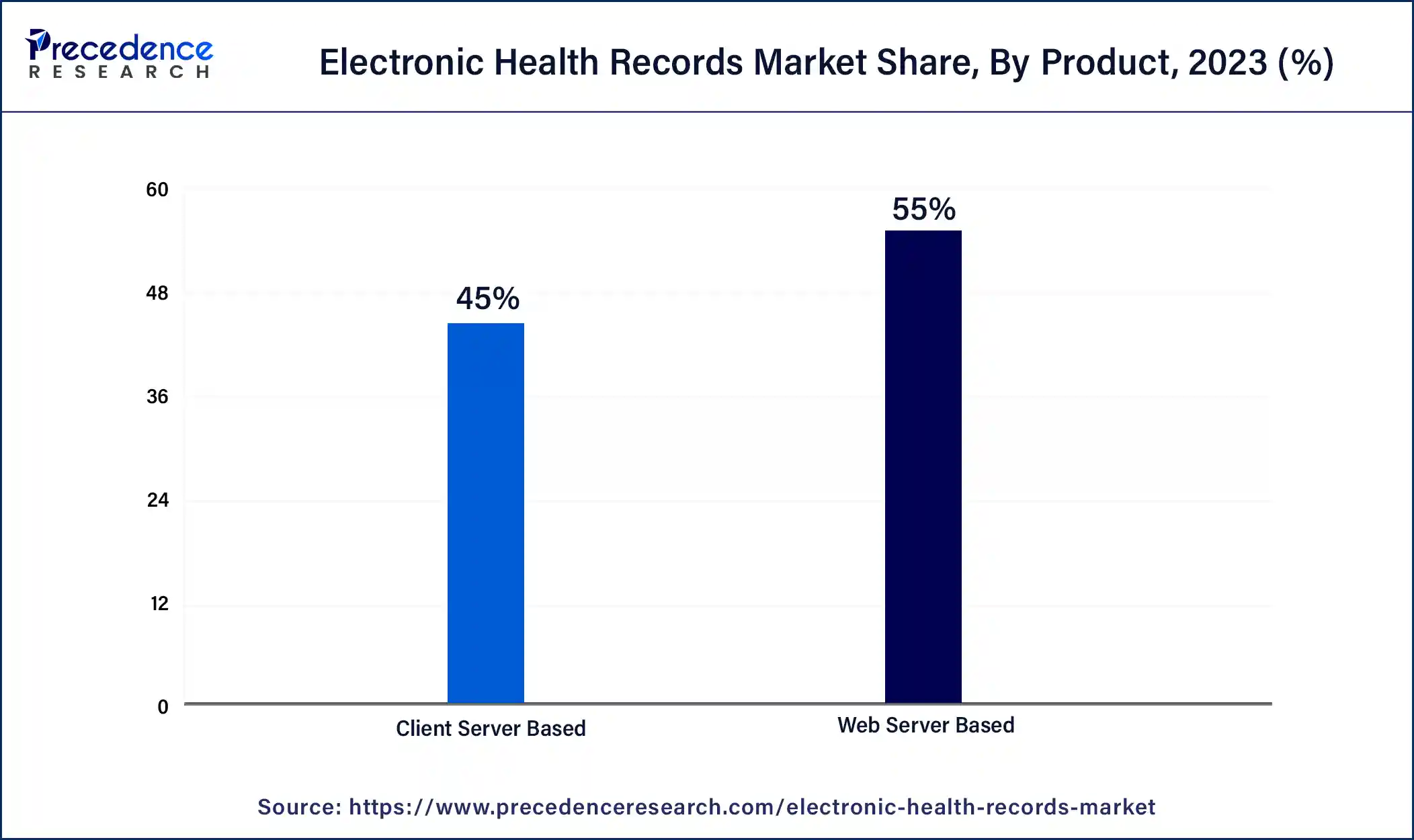

Product Insights

Based on product, the web based segment accounted for around 55% of the market share in 2024 and is estimated to sustain its dominance during the forecast period. This is attributed to the increased popularity and higher adoption of the web based electronic health records among the doctors/physicians and other small scale healthcare service providers across the globe. The web based electronic health records can be customized and altered as per the requirements and hence, the demand for this is higher.

On the other hand, the client server based segment is expected to be the fastest-growing segment during the forecast period. The client server based electronic health records offers in-house data storage that provides high data security and eliminates the chances of data breach and data theft. Moreover, it can be operated without a stable internet connection and is considered to be an idle choice for the multi-physician healthcare units.

The software segment held the largest share of 61.40% in the 2025 global electronic health records market. The software segment is typically divided into two popular categories: cloud-based EHR software and on-premise EHR software. The cloud-based EHR software is for remote servers, and on-premises solutions need internal IT management and hardware involvement. Either of them is suitable based on the healthcare provider's infrastructure, budget, and requirements, respectively.

Alongside the segment characterizes a wide range of applications from the known commercial systems, such as Oracle Cerner, and Epic systems, specially designed for open-source platforms such as openMRS. This segment is emerging due to the need for assessing healthcare in action.

The services segment is expected to grow at a CAGR of 8.70% during the forecast period. The services vary from different stages of advancement in the electronic health records. The implementation, consulting, managed, training, education, support, and maintenance services are essential to excel in software intelligence on the deployment of either on-premises or cloud-based EHR software systems.

With the technological shift to healthcare services, the traditional chain needs an extension and expertise of services to incorporate smooth and functional operations across the electronic health records market.

End User Insights

Based on end user, the hospitals segment accounted for around 60% of the market share in 2024 and is expected to sustain its dominance during the forecast period. This can be attributed to the increased number of hospital admissions which generates huge amount of data. This data needs to be stored safely and this need is perfectly served by the electronic health records systems. The rising number of private hospitals across the globe is expected to further drive the growth of this segment during the forecast period.

On the other hand, the ambulatory services segment is estimated to be the most opportunistic segment during the forecast period. Ambulatory services includes pharmacies, laboratories, and clinics that are popular for the conveniences they offer to the patients. The rising number of pharmacies and clinics across developed and developing nations is expected to drive the growth of this segment in the foreseeable future.

Type of EHR Insights

The inpatient EHR segment held the largest share of 46.80% in the 2024 global electronic health records market. The segment is a digital-centric system mainly for hospitals to maintain patient health records, aiming at data sharing throughout different departments such as pharmacies and labs. The intensive care unit (ICU), emergency department, and hospital information systems (HIS) unified EHR adoption is rapidly growing with the boost from the digital health trends.

Also, providers' initiatives add value and growth to the inpatient EHR segment and electronic health records. The key global development is concentrating on winning over the challenges, such as standardization, data security, interoperability, etc.

The specialty-specific EHR segment is expected to grow at a CAGR of 9.30% during the forecast period. The segment simplifies care by adding decision support and clinical workflows to excellent medical fields. To manage crucial data of major health conditions, each has a different register of EHR, for instance, cardiology, orthopaedics, mental health, pediatric, dental, and oncology EHRs.

The segment is steadily emerging as the need for seamless and accurate access to the records has acted as a compulsion to be considered quickly, especially in emergency cases and severe health conditions.

End-user Insights

The hospitals segment held the largest share of 41.70% in the 2025 global electronic health records market. The hospitals are the center for care, equally responsible for maintenance, documentation (data management), and patient records. The adoption of the EHR has largely occupied the hospital sector at the core of precision assessment and data identification. The inpatient EHR plays a significant role in the hospital space. This has reduced paperwork and has offered a dynamic digital scope to accelerate patient care.

The ambulatory surgical centers (ASCs) segment is expected to grow at a CAGR of 8.90% during the forecast period. The ASCs adopted EHR by embedding EHR systems to enhance patient care quality and manage patient data. The development in this EHR is a benefit to ASCs that includes cloud-based systems and a standardized data format to expand availability and the integration of patient support tools at a secure ASC platform.

The ASCs are driven by the implementation of specialty-specific EHR that further advances the precision care and is promotionally integrated into the precise center of records. The increasing demand for suitable treatment options with the advanced infrastructure is enhancing this segment rapidly.

Functionality Insights

The clinical documentation and charting segment held the largest share of 24.20% in the 2024 global electronic health records market. The segment plays a crucial role in global EHRs by delivering accurate, accessible, and secure patient details to improve care quality and efficiency via standardized data. The development has witnessed a beneficial move from unstructured to structured notes. The documentation and charting thereby promote alternatives in the EHR spectrum.

The clinical decision support segment is expected to grow at a CAGR of 9.50% during the forecast period. This CDS system is an addition to the electronic health records. It offers insightful data, proven guidance, and personalized recommendations. This smooth functionality and flexibility of the CDS with the approach of EHR has best met the demands of the patients for evidence-based health support and justified the healthcare professionals' efforts.

Regional Insights

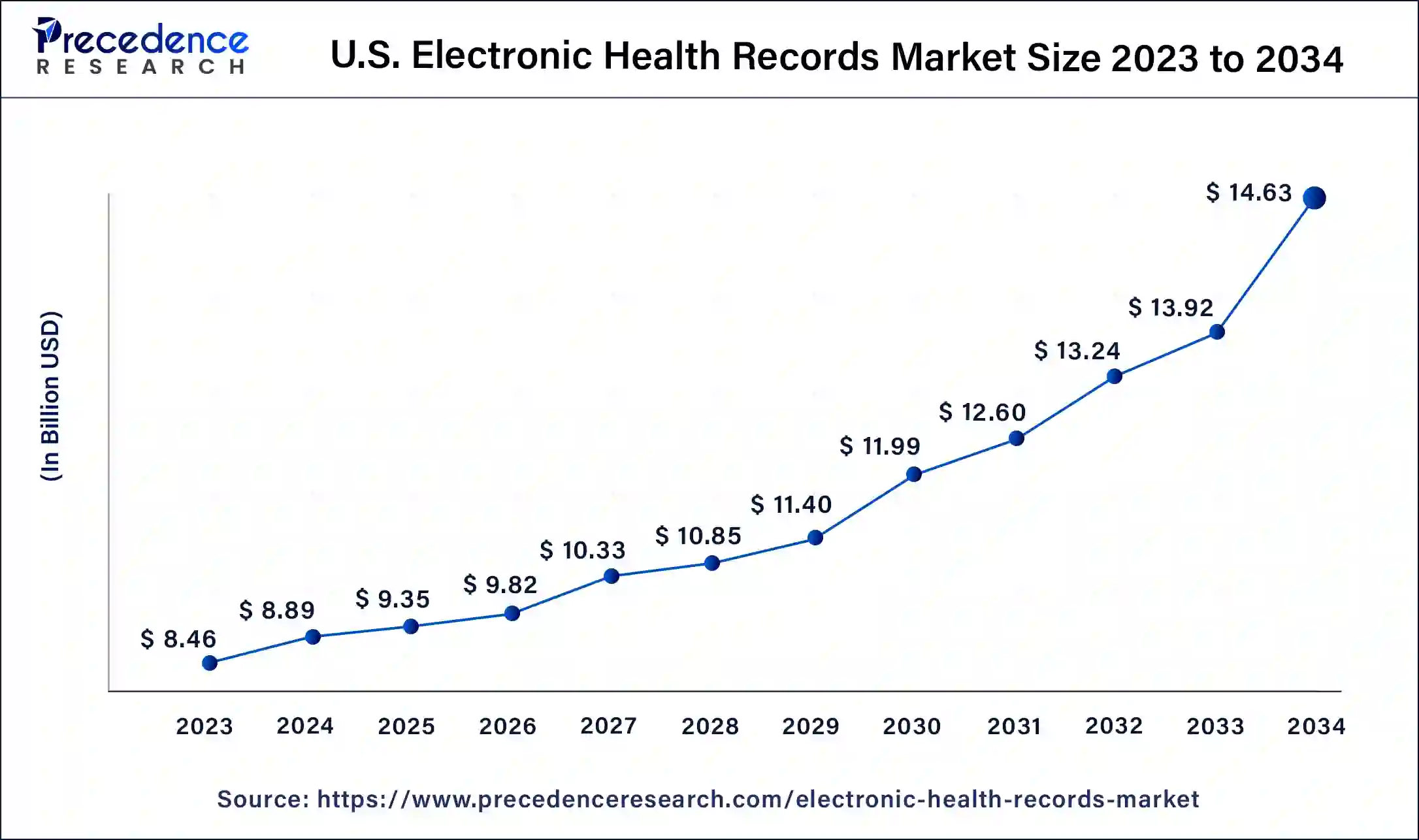

U.S. Electronic Health Records Market Size and Growth 2025 to 2034

The U.S. electronic health records market size was estimated at USD 9.35 billion in 2025 and is predicted to be worth around USD 14.63 billion by 2034, at a CAGR of 5.10% from 2025 to 2034.

Based on region, North America accounted for a significant market share of around 46% in 2025 and is estimated to sustain its dominance during the forecast period. North America is characterized by higher adoption rate of innovative and digital technologies in the healthcare industry, which fueled the market growth in this region. Moreover, well-established IT and telecommunication infrastructure and presence of developed healthcare infrastructure facilitates the adoption of electronic health records across the North America.

- In September 2024, Becton Dickinson De Colombia Ltda is an exporter and importer based in the United States. The company has exported 691 shipments to 41 buyers. The primary markets for these exports were Ecuador, Peru, and Mexico. The major buyers involved were Simed S.a., Importadora Distribuidora Makol Ecuador Cia. Ltda., and Becton Dickinson Del Uruguay Sa Suc Peru.

The Asia Pacific is estimated to be the most opportunistic market during the forecast period. The growing government initiatives to develop strong healthcare infrastructure and adopt digital technologies across the healthcare units. The nations like China, Japan, India, and South Korea presents a lucrative growth opportunity owing to the increased demand for the quality and standard services in the healthcare units.

How Does Europe Modify the Electronic Health Records Market?

Europe is expected to grow at a considerable rate in the upcoming period, stemming from the increasing adoption of healthcare IT solutions, including improved data accuracy, better clinical decision-making, and enhanced patient outcomes. Furthermore, the rising prevalence of chronic diseases and an aging population, along with the strong push for digital transformation in healthcare, contributed to the growth of the market in the region, with improved patient care and at an affordable cost.

Value Chain Analysis:

- R&D (Research and Development): This stage basically entails the initial exploration, design, and conceptualization of EHR system functionalities, working interface, and general technological architecture.

Key Players: Epic Systems, Oracle Health

- Clinical Trials and Regulatory Approvals: This relates to testing and validating EHRs in real health settings to ensure that clinical needs are being met and standards for safety are in place in compliance with healthcare regulations, such as HIPAA and other laws of data privacy.

Key Players: Office of the National Coordinator for Health Information Technology, eClinicalWorks

- Formulation and Final Dosage Preparation: In EHR form, it becomes the setting of software and hardware configurations and integration of several modules into one fully operational EHR solution designed for the specific healthcare organizations.

Key Players: Epic Systems, Oracle Health, MEDITECH

- Packaging and Serialization: While software is deployed, installation and customization processes are part of packaging and, under the umbrella of packaging and serialization, data integrity and security protocols will be guaranteed to protect patient information, possibly including unique identifiers for patient records.

Key Players: Epic and Oracle Health

- Distribution to Hospitals, Pharmacies: Marketing, selling, and implementing the EHR system for health providers involves these steps to foster adoption.

Key Players: Epic, Oracle Health, Veradigm

Electronic Health Records Market Companies

- Epic Systems Corp

- Cerner Corp

- GE Healthcare

- Allscripts Healthcare, LLC.

- eClinicalWorks

- CPSi

- McKesson Corp

- Medical Information Technology, Inc.

- NextGen Healthcare, Inc.

- HMS

Recent Developments

- In July 2025, the Delhi government introduced an expanded Health Information Management System (HIMS) to facilitate online appointment booking for patients, a significant move towards digital healthcare. (Source: https://www.newindianexpress.com)

- In July 2025, the Trump Administration introduced a new initiative allowing Americans to share their medical records across various tech-managed apps, despite concerns about potential data security risks. (Source: https://time.com)

- In April 2023, Microsoft and Epic announced their strategic collaboration to develop and integrate generative AI into healthcare by combining the scale and power of Azure OpenAI Service with industry-leading electronic health record (EHR) software of Epic by focusing on delivering a comprehensive array of generative AI- powered solutions integrated with HER of Epic to increase productivity and enhance patient care.

- In October 2024, Oracle launched a brand-new electronic health record, its most significant health-care product update, where the latest EHR is equipped with cloud and artificial intelligence capabilities that will make it easier to navigate and set up. Also, there are no drop-down screens, and doctors can pull up the information they require by asking questions with their voices by enabling doctors to spend less time searching through records and more time caring for patients.

Key Companies Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

- In October 2019, Meditech and Google merged to provide electronic health records data through the Google Cloud.

The various developmental strategies like acquisition, partnerships, mergers, and government policies fosters market growth and offers lucrative growth opportunities to the market players.

Segments Covered in the Report

By Product Type

- Software

- On-premise EHR software

- Cloud-based EHR software

- Services

- Implementation services

- Support & maintenance

- Training & education

- Consulting services

- Managed Services

By Type of EHR

- Inpatient EHR

- Hospital Information Systems (HIS) integrated EHR

- Intensive Care Unit (ICU) EHR

- Emergency Department EHR

- Ambulatory EHR

- Outpatient clinics

- Physician offices

- Specialty care centers

- Specialty-specific EHR

- Oncology EHR

- Cardiology EHR

- Orthopedics EHR

- Mental health EHR

- Dental EHR

- Pediatrics EHR

By End-User

- Hospitals

- Clinics & Physician Offices

- Ambulatory Surgical Centers (ASCs)

- Specialty Centers

- Pharmacies

- Others (e.g., Rehabilitation Centers, Academic Institutions)

By Functionality

- Patient Demographics & Registration

- Clinical Documentation & Charting

- Medication Management

- Laboratory & Diagnostic Integration

- Radiology Information System Integration

- Clinical Decision Support

- Computerized Provider Order Entry (CPOE)

- Electronic Prescribing

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting