Facility Management Market Size and Growth 2025 to 2034

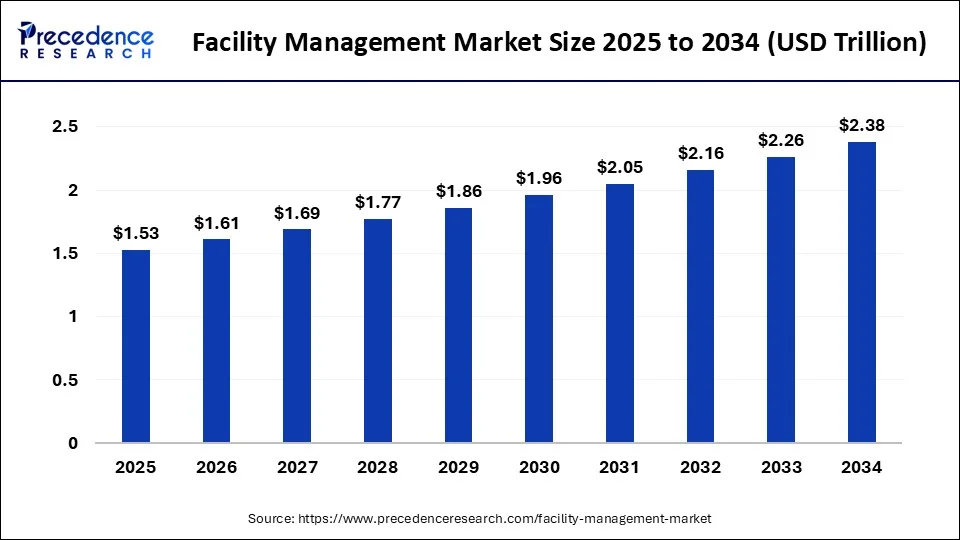

The facility management market size accounted for USD 1.46 trillion in 2024 and is expected to reach around USD 2.38 trillion by 2034, expanding at a CAGR of 5% from 2025 to 2034.

Facility Management Market Key Takeaways

- In terms of revenue, the market is valued at $1.53 tillion in 2025.

- It is projected to reach $2.38 tillion by 2034.

- The market is expected to grow at a CAGR of 5% from 2025 to 2034.

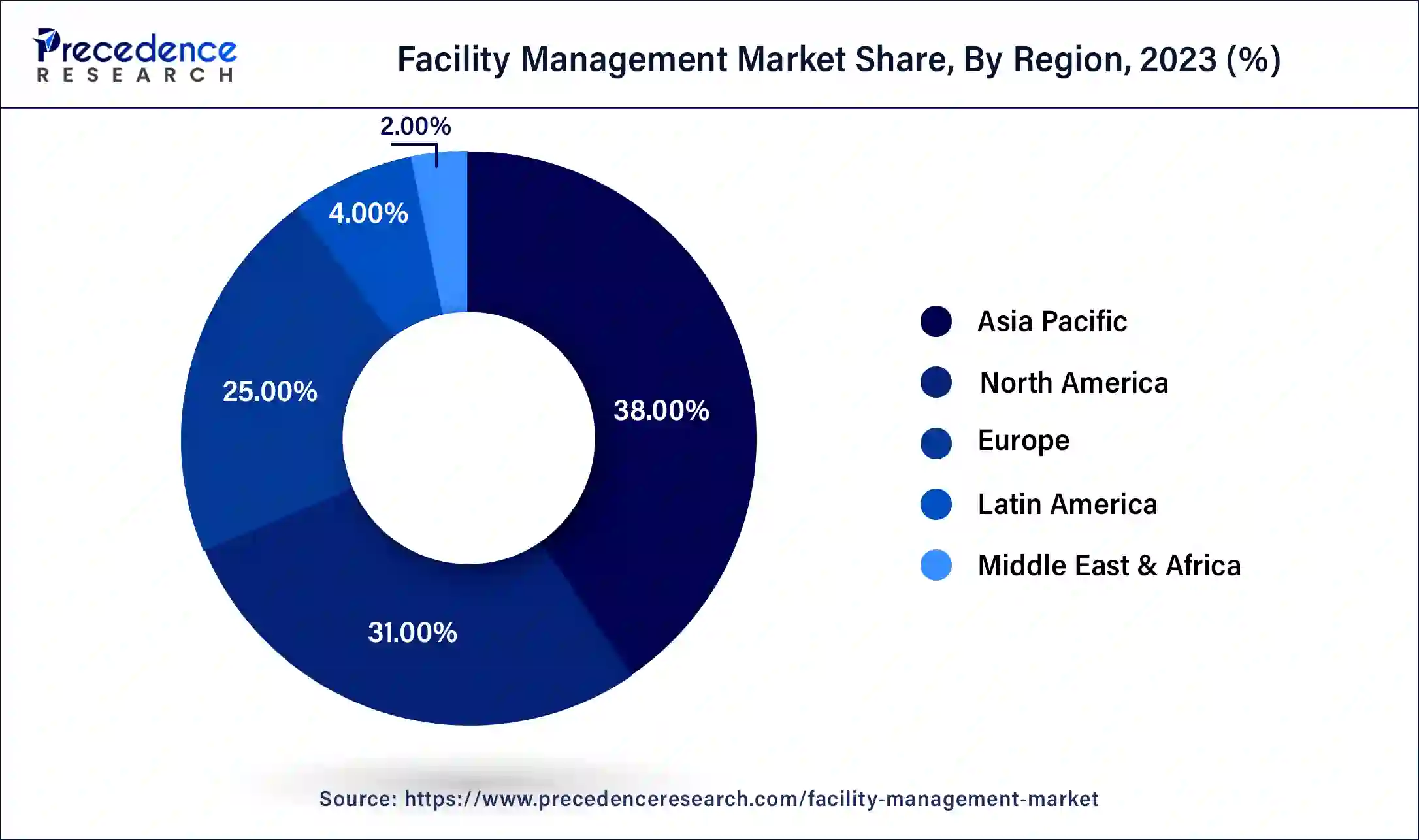

- Asia Pacific led the global market with the highest market share of 38% in 2024.

- By service, the hard services segment has held the largest market share in 2024.

- By industry, the real estate segment captured the biggest revenue share in 2024.

How is AI Enhancing the Facility Management Industry?

AI is significantly enhancing the facility management (FM) industry by enhancing efficiency, reducing expenses, and improving safety. AI-powered tools can determine data from numerous sources, which includes building management systems as well as sensors, to optimize energy consumption, forecast equipment failures, along with streamline maintenance schedules.

AI can improve energy consumption by determining data from sensors as well as building management systems, resulting in remarkable cost savings and a decreased environmental impact. AI can automate routine tasks such as generating reports, scheduling maintenance, together with handling basic service requests, and even freeing up facility managers for more strategic tasks.

Asia Pacific Facility Management Market Size and Growth 2025 to 2034

The Asia Pacific facility management market size was estimated at USD 550 billion in 2024 and is predicted to be worth around USD 900 billion by 2034, at a CAGR of 6.1% from 2025 to 2034.

Asia-Pacific dominated the facility management market in 2024. To offer their services to end users and extend their geographical footprint, established important players are focusing on partnering with local players.

Asia Pacific dominated the global facility management market with the largest share in 2024. Rising investments by governments in construction and various ongoing infrastructure projects are creating the need for efficient facility management services for maintenance and optimization of these assets. Growing adoption of smart technologies like artificial intelligence (AI), Internet of Things (IoT) and building automation systems is enhancing operational efficiency and predictive maintenance with improved energy management and real-time monitoring, leading to reduced costs and reliable service delivery. Furthermore, initiatives for smart city development in rising economies and increased emphasis on adopting sustainable practices are expected to boost the market expansion in the upcoming years.

North America, on the other hand, is expected to develop at the fastest rate during the forecast period. With the implementation of new technologies such as internet of things, artificial intelligence, robot adoption, and others, the facility management market in North America is predicted to rise steadily.

North America is anticipated to witness lucrative growth in the market over the forecast period. Increased focus towards implementation and management of sustainability initiatives provided by facility management services such as waste reduction programs, energy-efficient systems and green building certification like LEED (Leadership in Energy and Environmental Design) and WELL (The WELL Building Standard). Furthermore, increased awareness regarding health and safety in workplaces, integration of advanced technologies like Building Information Modeling (BIM) and data analytics, aging infrastructure creating the need for retrofitting of existing buildings, supportive government initiatives and stringent regulatory frameworks are contributing to the market growth.

Market Overview

The facility management encompasses a variety of services and disciplines aimed at ensuring the functionality, comfort, and efficiency of the built environment, including buildings, real estate, and infrastructure. Communications management, operations and maintenance, business continuity, emergency management, as well as environmental responsibility and sustainability are all aspects of facility management. The project management, hospitality and human aspects, real estate and property management, and ergonomics are just a few of the topics covered in this course. Outsourcing facility management services allows businesses to better manage their corporate social responsibilities, comply with health and safety regulations, and maintain the overall quality of their core operations.

Facility Management Market Growth Factors

The facility management encompasses a variety of services and disciplines aimed at ensuring the functionality, comfort, and efficiency of the built environment including buildings, real estate, and infrastructure. The communications management, operations and maintenance, business continuity, and emergency management as well as environmental responsibility and sustainability are all aspects of facility management. The project management, hospitality and human aspects, real estate and property management, and ergonomics are just a few of the topics covered in this course. Outsourcing facility management services allows businesses to better manage their corporate social responsibilities, comply to health and safety regulations and maintain the overall quality of their core operations.

The expansion of the facility management market is being fueled by the rising focus of governments in a number of nations on infrastructure development particularly in the construction of ports, railways, airports, and other infrastructural projects. The facility management market is also predicted to increase due to numerous collaborations with several commercial contractors and various government initiatives involving multinational players. As a result, the facility management market is developing in accordance with the expansion of infrastructure.

Governments in both established and emerging countries are investing in the tourist industry as well as a variety of other industries. These tourism related expenditures are assisting in the construction of new infrastructure, which will help the facility management market to flourish. In addition, cloud-based solutions have provided dependable hosting facility management software that minimizes operating costs, improves security, and facilitates collaboration among diverse teams and subsidiaries located throughout the globe. The data can be accessed at any time and from any location. For the sustainability of the facility management market, all of these advantages have resulted in a growth in the use of cloud-based solutions.

Over the previous two decades, the global penetration of outsourced facility management services has expanded dramatically. Customers nowadays expect their facility management service provider to have a thorough understanding of the company's goal and the ability to respond to the customer's individual requirements, which is predicted to drive the global facility management market in the long run. With the growth of the facility management outsourcing market, facility management providers are expanding.

The facility management companies are concentrating their efforts on developing new and inventive methods to make facility assets and services not only relevant but also essential to improving customer experience, business administration, occupational physiology, and supporting their core business. The property management services are tailored to meet the financial goals of property owners in the short and long term. For their customers, service and solution providers create a strategic property operations plan based on a zero-based operating budget and capital plan. The experienced property managers and accounting professionals collaborate closely with engineering sciences staff to monitor and control all running costs in order to get the best potential return on investment.

One of the most important developing facility management market trends is the use of internet of things in facility management. The internet of things uses technology like predictive maintenance to reduce operating expenses while also increasing productivity. The lighting and refrigeration, security and safety alarms, fire suppression systems, and remote monitoring can all be automated via the internet of things. The internet of things solutions is also being offered by a variety of third-party outsourcing organizations such as building management service providers.

The infrastructure investment is a priority for governments in a number of countries. They have begun to make significant investments in the construction of trains and airports. There have been a number of cooperation with a variety of private companies including service providers to keep the infrastructure clean and green. Furthermore, governments are entering into agreements with a number of multinational players to finish and connect their infrastructure both inside and beyond borders. As a result, the facility management market is likely to be driven by the expansion of the infrastructure sector in various nations. Furthermore, service providers all around the world have multiple options for obtaining contracts from the private sector.

- Rising government emphasis on infrastructure development across diverse sectors of transportation, real estate, and tourism drives the demand for facility management globally.

- There has been an increased popularity of outsourcing due to the ability of organizations to gain efficiency, reduce burdens of an operational nature, and shift focus to core areas of production.

- The cloud facility management approach advances collaboration, data access, cost efficiency, and security of operations that are carried out in different geographic locations.

- The deployment of Internet of Things (IoT) within facility management activities helps to enable predictive maintenance, automation, and promotes efficient optimization of operations.

- The increasing number of partnerships between private ventures with the government fosters innovations within the services and develops long-term opportunities for facility managers.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.38 Trillion |

| Market Size in 2025 | USD 1.53 Trillion |

| Market Size in 2024 | USD 1.46 Trillion |

| Growth Rate from 2025 to 2034 | CAGR of 5% |

| Largest Market | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Deployment Mode, Industry, Component, Organization Size and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is expanding cities and infrastructure development the driver for the facility management market?

Due to the increased demand for managing and handling new buildings, infrastructure, and urban spaces. As urban areas expand, so does the need for facility management services to guarantee the efficient operation and even upkeep of these expanding environments. Companies are expanding their facility management to require specialized providers to emphasize their core business operations. This trend is thus fueling the expansion of the facility management market.

Restraint

Why are high initial implementation costs a restraint for the facility management market?

High initial implementation costs are a significant restraint in the facility management market because they can deter businesses, mainly smaller ones, from accepting comprehensive integrated facility management (IFM) solutions. A shortage of trained professionals to handle and maintain these new systems can even add to the cost, as companies may require us to invest in training or hire specialized personnel. These high initial expenses can be especially prohibitive for smaller businesses, restricting their ability to engage with larger organizations that can provide to invest in these technologies.

Opportunity

Why is the integration of IoT devices, sensors, and AI-powered systems an opportunity for the facility management market?

The integration of IoT devices, sensors, and AI-powered systems presents a significant opportunity for the facility management market by permitting data-driven decision-making, improving resource allocation, and improving operational efficiency. By determining data from sensors and IoT devices, AI can forecast potential equipment failures as well as maintenance needs before they occur. This predictive maintenance approach reduces downtime, lowers repair costs, and even extends the lifespan of assets.

- For example, smart sensors can expose unusual vibrations in machinery, triggering a notify for maintenance before a breakdown happens.

Value Cain Analysis

- Research and Development and Software Development: Designs and develops digital platforms and service models, ensuring innovation and operational efficiency.

Key Players: Accruent, AkitaBox, FMX, IBM - Technology and Platform Sourcing: Refers to the application, selection, and procurement of digital tools, infrastructures, and platforms supporting scalable, secure, and reliable operations.

Key Players: Broadcom, Cushman & Wakefield, FM:Systems, IBM - Data and Business Intelligence Development: Theorizing and methodology to gather data from the facility and analyze it to generate operational improvement insights or strategic business planning.

Key Players: Accenture, Capgemini, CBRE Group - Regulatory Compliance Management: To ensure the strict adherence to the regulatory framework, such as a safety regulation or environmental framework, thus avoiding penalizing measures and maintaining goodwill.

Key players: Accruent, AkitaBox, eFACiLiTY - Deployment and Implementation: Coalescing with facility management systems covering maintenance, safety, energy management, and efficient space utilization, among other relevant use cases across the physical assets.

Key Players: MaintainX, Planon, ServiceChannel

Type Insights

The outsourced segment dominated and the fastest growing in the facility management market in 2024. This supremacy is primarily driven by the cost-effectiveness as well as scalability offered by outsourcing, permitting companies to target core business operations while relying on customized service professionals for non-core functions. Specialized facility management providers provide access to skilled personnel, developed technologies, and best practices, usually exceeding the capabilities of in-house teams.

- For example, offices, retail centers, as well as coworking spaces depend on outsourcing for cleaning, security, and even other essential services.

Service Insights

In 2024, the hard services segment dominated the facility management market. The key driver driving the hard services segment is the rapid growth of the building and construction industry as a result of increased urbanization around the world.

The soft services segment, on the other hand, is predicted to develop at the quickest rate in the future years. Increased investments in waste management, wastewater management, energy management, and other green energy management industries have contributed to the growth of the segment.

Component Insights

The services segment dominated and the fastest growing in the facility management market in 2024. Hard services always hold a larger market share because of the essential nature of maintaining electrical, building infrastructure, and mechanical systems, and even safety installations. This supremacy is driven by factors such as regulatory mandates for building safety, the demand for operational efficiency, and even increasing infrastructure development. While not as enormous as the hard services segment, soft services are undergoing significant growth because of increased focus on productivity, employee well-being, and a positive workplace environment. For instance, security personnel, cleaning services, landscaping, and even catering are examples of soft services.

Industry Insights

The real estate segment dominated the facility management market in 2024 with a market share of around 30%. The real estate sector is expected to be driven by continued growth in the building industry around the world over the projected period.

The government industry segment is fastest growing segment of the facility management market in 2024. In the global facility management market, the government sector is predicted to increase at a steady pace. This is due to the government's emphasis on infrastructure development.

Deployment mode Insights

The on-premises segment dominated the facility management market in 2024. This influence is assigned to organizations preferring control as well as ownership over their facility management systems and information by deploying solutions within their infrastructure.

The cloud segment is the fastest growing in the facility management market during the forecast period. This growth is boosted by the increasing need for centralized, flexible, and even easily deployable facility management solutions over diverse property portfolios. Cloud platforms provide easy scalability, permitting businesses to adjust their resources based on their needs. It permits centralized management of numerous facility management functions, streamlining operations and enhancing efficiency.

Organization size Insights

The large enterprises segment dominated the facility management market in 2024. This is due to their complex requirements and greater budgets for facility management services. These organizations usually manage multiple locations, large workforces, as well as have stringent compliance requirements, creating them remarkable consumers of facility management services. By outsourcing facility management, large enterprises can target their core business activities while guaranteeing efficient and compliant facility operations.

The small and medium-sized enterprises (SMEs) segment is the fastest growing in the facility management market during the forecast period. Due to a combination of factors, including increased knowledge of cost-effectiveness, the demand for scalable solutions, and the acceptance of digital technologies. Small and medium-sized enterprises are growing and seeking to improve operations and lowers costs by outsourcing facility management, while even benefiting from the flexibility along with scalability that these services provide. Small and medium-sized enterprises are increasingly conscious of the benefits of outsourcing facility management, including operational efficiency, cost savings, and improved service quality.

Facility Management Market Companies

- Sodexo

- Compass Group

- Jones Lang LaSalle Incorporated

- Johnson Controls International PLC

- Dussmann Group

- CBRE Group Inc.

- Aramark

- ISS A/S

- Tenon Group

- Cushman & Wakefield PLC

Recent Developments

- In May 2025, SPIE, an independent European leading multi-technical services company focused on energy and communications, has been granted the contract for providing technical facility management services to the Commerzbank's service centre in Frankfurt am Main for an extensive period of six years.

- In May 2025, FlowPath, a key provider of Computerized Maintenance Management System (CMMS) software, launched its breakthrough Work Order AI Automation Package, designed specifically for serving as a 24/7 digital coordinator. The innovative facility management software leverages customizable AI agents for transforming facility operations with automation of work order management, monitoring and analysis.

- In January 2025, Krystal Integrated Services Limited (KISL), a Mumbai-based facility management firm, secured contracts with the Airports Authority of India (AAI), Mumbai International Airport Limited (MIAL), and Maha Mumbai Metro Operation Corporation Limited (MMMOCL). Through the contract, Krystal will provide comprehensive services like housekeeping services at Aurangabad Airport and landside security services at Chhatrapati Shivaji Maharaj International Airport

- Sodexo and Bureau Veritas launched a hygiene verification mark for Sodexo services in June 2020, providing consumers with quality assurance. This collaboration includes on site facility management and culinary services.

- Oracle teamed with Propre Japan Inc. in May 2020. Oracle Japan assist Propre Japan Inc. in developing Propre's real estate big data platform, which will be available in 17 countries across the world.

- Fortive purchased ServiceChannel in July 2021. ServiceChannel is a leading provider of multi-site software as a service. Along with Accruent and Gordian, it increased Fortive's offering of facility and asset lifecycle workflow solutions.

- Trimble was acquired by MRI Software in April 2021. Manhattan Real Estate and Workplace Solutions was acquired by MRI Software from Trimble.

- In September 2025, MINT Incorporation Limited launched its subsidiary, Axonex Intelligence Limited, aiming to expand into smart facility management. The company plans to leverage robotics, IoT, and AI technologies to improve property management and experiences.

https://www.media-outreach.com - In May 2025, FlowPath launches Work Order AI Automation, enhancing CMMS by automating work order management, enabling efficient and confident facility operations.

https://www.businesswire.com

Segments Covered in the Report

By Type

- Outsourced

- In-house

By Component

- Solutions

- Lighting Control

- HVAC Control

- Video Surveillance and Access Control

- Emergency and Incident Management

- Sustainability Management

- Waste Management

- Lease Accounting and Real Estate Management

- Asset Maintenance Management

- Workspace and Relocation Management

- Reservation Management

- IWMS

- BIM

- Facility Operations and Security Management

- Facility Environment Management

- Facility Property Management

- Services

- Electrical

- Civil

- Mechanical

- Specialized Hard Services

- Others

- Cleaning

- Laundry

- Landscaping

- Security

- Others

- Contract Management

- Energy & Utilities

- Maintenance Planning & Control

- Others

- Hard Services

- Soft Services

- Other Services

By Industry

- Healthcare

- Government

- Education

- Military & Defense

- Real Estate

- Others

By Deployment Mode

- Cloud

- On-premises

By Organization Size

- Large enterprises

- Small and medium-sized enterprises (SMEs)

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting