What is the Business Document Work Process Management Market Size?

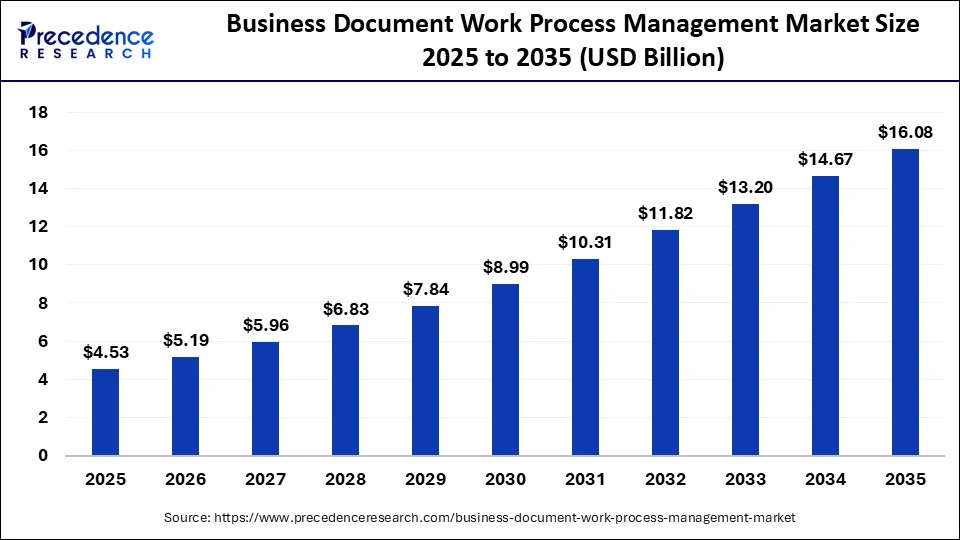

The global business document work process management market size was calculated at USD 4.53 billion in 2025 and is predicted to increase from USD 5.19 billion in 2026 to approximately USD 16.08 billion by 2035, expanding at a CAGR of 13.51% from 2026 to 2035.

Business Document Work Process Management Market Key Takeaway

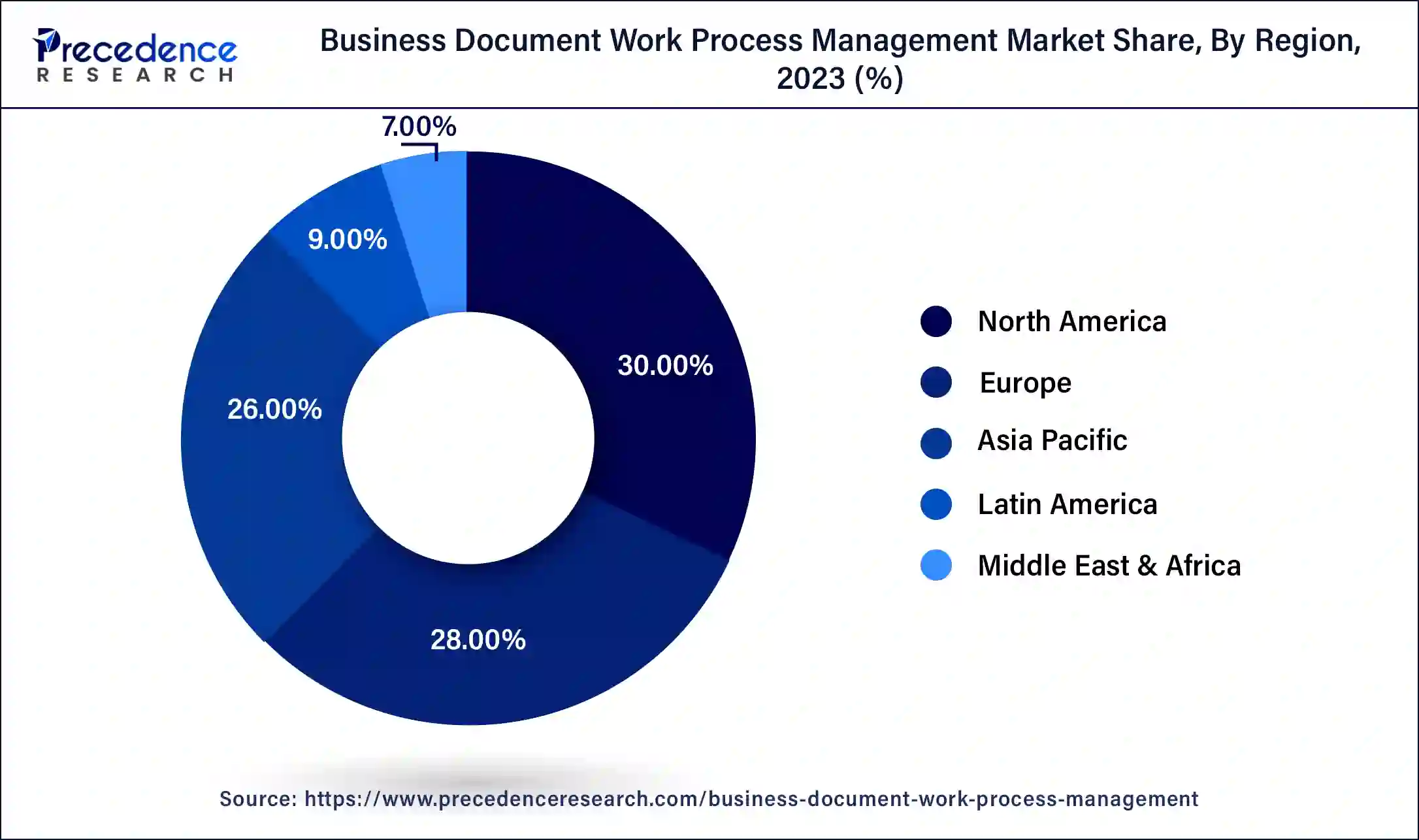

- North America dominated the global business document work process management market in 2025.

- The services segment has held the biggest revenue share of 69.9% in 2025.

- The IT and telecommunication application segment is poised to dominate the target market's share.

What is the Business Document Work Process Management Market?

Integrating robotics and blockchain technology into document management will generate lucrative growth opportunities for key players in the BPO (Business Paper Work Process Management) industry worldwide. The flow of records has now become one of the big headaches for organizations. An alternative to manual handling and processing of inbound documents has been offered by robotic integration.In addition, Blockchain guarantees something similar in the case of record flows in businesses. In order to review and verify all the documents entering and exiting our organization, it is about using these distributed networks of equipment. Another development expected to drive target market growth over the forecast period is a growing requirement for real-time data accessibility. With real-time data, an organization can process and analyses information easily and provide up-to-the-minute information about an enterprise's customers. This helps the company to quickly take decisions, hence increasing the productivity of an organization. In addition, the modifications made in every activity of a company can be instantly mirrored by its personnel. These factors increase the technology's acceptance rate.

How is AI contributing to the Business Document Work Process Management Market?

AI improves the management of the business document working process by using automated tools to eradicate repetitive documentation work that is repetitive, using intelligent document processing to enhance accuracy, and data extraction through OCR. NLP is responsible for semantic search and conversational retrieval. AI is capable of guessing workflow delays, directing approvals, and thereby maximizing operations. It has become a stronghold for compliance by means of privacy checks and access controls. Generative AI aids in the drafting, summarizing, and collaborating process, thus the faster document production and productivity across the applications of finance, legal, healthcare, and HR have all been driven up.

Business Document Work Process Management Market Growth Factors

- High demand due to increased IT spending across the globe

- Increasing adoption from small and medium organizations worldwide

- Increasing demand for the management of cloud documents

- Growing demand for all-in-one document management solutions across the globe

Market Outlook

- Industry Growth Overview: The enterprises that are embracing digital efficiency and upgrading their workflows across the board are the ones contributing the most to the increase in demand.

- Sustainability Trends:The transition to paperless operations and green IT helps in the maintenance of the documentation ecosystems that are using resources efficiently.

- Global Expansion:Adoption of remote-first models is accelerating the worldwide standardization of document workflow automation practices.

- Major investors: Sequoia Capital, Accel, and BlackRock are the major investors that are really pushing the software innovations for workflows globally.

- Startup Ecosystem:Startups that are focused on artificial intelligence are able to automate workflows and thereby increase productivity and enhance user experience.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 16.08 Billion |

| Market Size in 2026 | USD 5.19 Billion |

| Market Size in 2025 | USD 4.53 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.51% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Offering, Organization Size, Application, Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Future of Global Business Document Work Process Management (BPO) Market

The major trend witnessed in the global market in growing numbers of strategic partnerships among major key players. This trend is anticipated to continue and will boost growth of the market in the near future. In September 2019, Parascript Launched CheckXpert.AI for France.In June 2020, Parascript launched FieldXpert.AI for Enhanced RPA Handwriting Recognition. In October 2019, Oracle acquired CrowdTwist, it is an industry-leading provider of comprehensive multichannel loyalty and analytics solutions. In June 2019, Oracle acquired Oxygen Systems, it is specializing in the NetSuite cloud management system.In March 2015, Lexmark acquired Kofax Document Capture, it develops and markets intelligent capture and exchange related solutions and services.In January 2015, Lexmark acquired Claron Technology, it is dedicated to the development of medical image processing solutions

Segment Trends

Services Offerings Segment Testified Leading Market Stake in Year 2025

Services offerings is anticipated to register highest growth rate as well as market share over the forecast period of time. The services segment is expected to register revenue share of 69.9% in year 2025. Along with this the solutions offerings segment will be growing at considerable pace and will fuel growth of the business document work process management (BPO) industry in the near future.

IT and Telecommunication Industry Segment Reported Foremost Market Stake in 2025

IT and telecommunication application segment is expected to account for the major share in the target market. IT and telecommunication industry is adopting business document work process management (BPO) owing to the excellent benefits offered by the business document work process management (BPO). Along with this the banking, financial services and insurance segment is anticipated to grow at the important growth rate approximately 15% and will expand the market revenue in the coming future.

Regional Insights

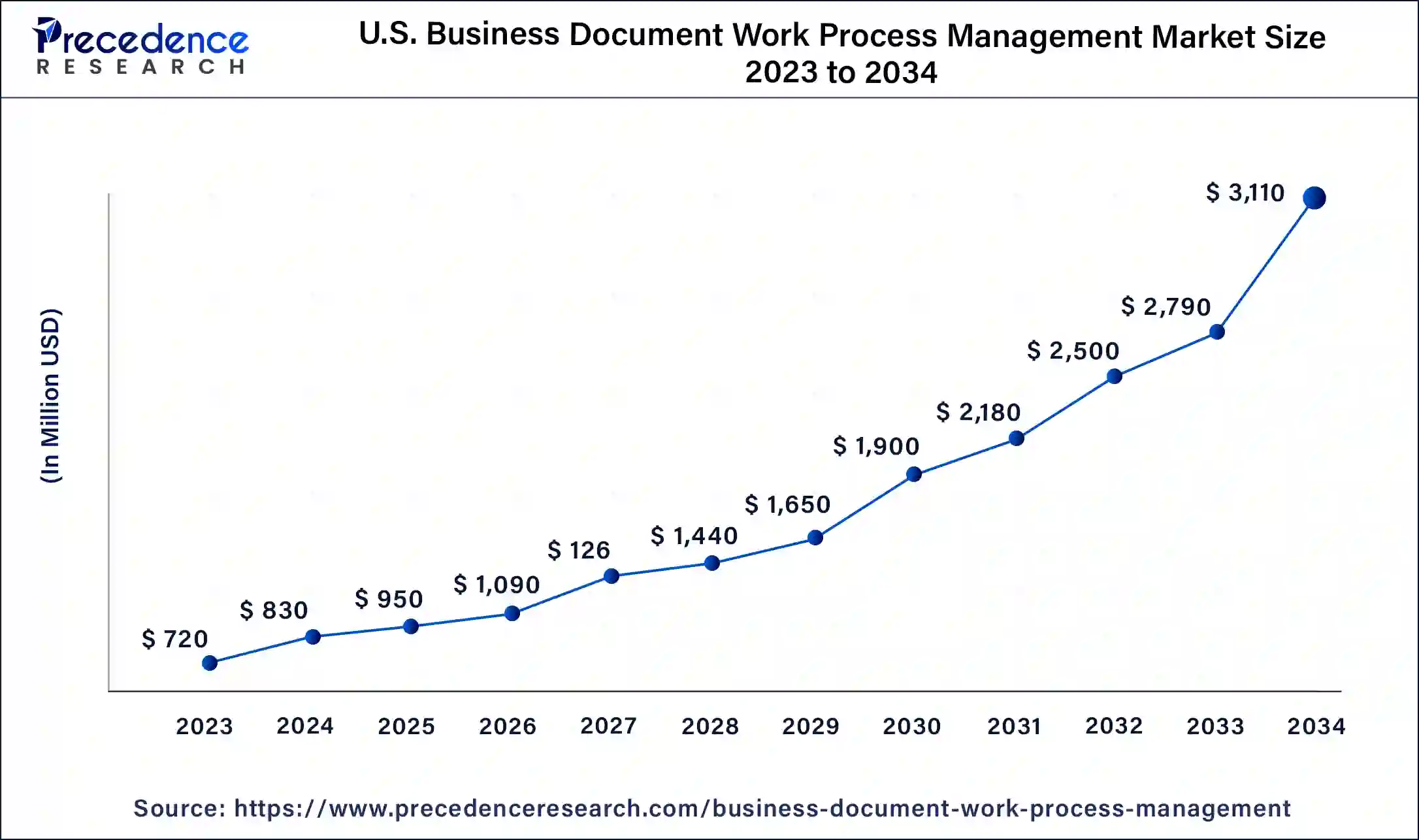

U.S. Business Document Work Process Management Market Size and Growth 2026 To 2035

The U.S. business document work process management market size accounted for USD 950 million in 2025 and is expected to grow to USD 3,410 million by 2035, growing at a CAGR of 13.63% between 2026 to 2035.

North America is Likely to be the Largest Market for Business Document Work Process Management (BPO)

The study report contracts with the business predictions of business document work process management (BPO) products around are as counting Europe, Latin America, Asia-Pacific, North America, Middle East and Africa. Business Document Work Process Management (BPO) market is occupied by North America due to augmented intake of the business document work process management (BPO) in various end use applications, coupled with presence of major companies in the North America and business plans that are executed by the chief players in the nations. Asia Pacific is probable to list the remarkable CAGR, on account of growing demand for the business document work process management (BPO) in IT telecommunication industry. Likewise, utmost of the companies functioning in the market are advancing heavily in order to get the modest edge in the business document work process management (BPO) market in North America. Further, the Latin America as well as Middle East and Africa regions will likely to register moderate growth in the coming.

How is North America leading in the Business Document Work Process Management Market?

North America is connected to a strong digital infrastructure and the presence of IBM, Oracle, and Adobe, making the adoption of automation and advanced predictive analytics possible. Opportunities are data security, compliance strengthening, and scalable solutions in finance, retail, and healthcare.

United States Business Document Work Process Management Market Trends

The U.S. tops the IT adoption chart, merging BDWPM with ERP and CRM systems for better workflow efficiency. Smart document automation, data extraction, and enterprise-wide AI implementation for content analytics and digital operations are areas of great opportunity.

What are the driving factors of the Business Document Work Process Management Market in Europe?

Europe's expansion is mainly due to the GDPR-induced necessity for secure document systems, rising demand for analytics, collaboration tools, and cloud disaster recovery. Companies are pouring money into the automation of compliance management that helps transition to efficient document-centric workflows across various sectors.

Germany Business Document Work Process Management Market Trends

Germany applies artificial intelligence to the text-heavy parts of the manufacturing and construction industries, bringing about better compliance management. The focus of the opportunity is on automatic record handling, processing, storage, and regulatory workflows that have been simplified for the whole industrial documentation ecosystem.

How is Asia-Pacific performing in the Business Document Work Process Management Market?

The digitalization in Asia-Pacific is a fast-paced phenomenon made possible by government-led smart-city projects and the size of the market. The flow of new opportunities includes workflow services adapted to local needs, document systems supporting many languages, and cloud-based BDWPM adoption in the IT and telecom sectors.

India Business Document Work Process Management Market Trends

The Indian IT BPM outsourcing is growing, which in turn, brings about the need for the implementation of scalable BDWPM solutions, adoption of cloud technology, and mobile-first workflows, to name a few. Digital infrastructure investments lead to the cost-effective management of documents and automated business processes utilized by a range of industries.

Value Chain Analysis

Inbound Logistics: Receiving, storing, and distributing raw materials as well as required software resources.

- Key Players: Adobe for PDF standards/software

Operations: Processing of inputs to final products through execution of workflows.

- Key Players: Microsoft with SharePoint, Google Workspace, DocuWare

Outbound Logistics: Finished products are stored and delivered to customers and users within the enterprise.

- Key Players: Amazon Web Services (AWS), Microsoft Azure, Google Cloud

Marketing and Sales: Service promotion and client acquisition through a combination of strategic selling initiatives.

- Key Players: Salesforce selling CRM integration, Adobe selling sign solutions

Service: Activities related to customer support and maintenance, ensuring performance is sustained after the purchase.

- Key Players:Accenture, Deloitte

Business Document Work Process Management Market Key Players' Offering

- Xerox Corporation: The entire process from document digitization through error reduction to better handling efficiency is covered with Xerox managed print services and automation solutions.

- Eastman Kodak Company: Provides workflow automation, pre-press technologies, and digital file management tools through the printing, publishing, and packaging industries.

- Bitrix24: In addition to the collaboration business suite, it also provides document management that has workflow automation and data management functionalities

Other Major Companies

- Exela Technologies

- Adobe

- Dynamik-Gen

- Lexmark International, Inc

- IBM Corp

- Oracle

- Konica Minolta Business Solutions Australia Pty Ltd

- LogicalDOC

- DOMA Document Solutions of Indiana

- Ricoh India Ltd

- Canon

- Revvsales, Inc

- Parascript

Recent Developments

- In December 2025, Zocks launched Document Intelligence, an AI feature that processes client documents, populates CRM and financial planning systems, and integrates with eMoney Advisor to enhance financial planning efficiency. (Source: businesswire.com)

- In May 2025, Accenture and SAP launched ADVANCE, expanding their partnership to provide a pathway to the cloud for organizations with annual revenue up to US$5 billion, fostering connected, intelligent, and responsive enterprises.

(Source: newsroom.accenture.com)

Major Market Segments Covered

By Offering

- Solutions

- Services

By Organization Size

- Small and Medium Sized Enterprises

- Large Enterprises

By Application

- Education and Training

- IT and Telecommunication

- Banking, Financial Services and Insurance

- Government

- Healthcare and Pharmaceuticals

- Marketing and Advertising

- Manufacturing and Automotive

- Transportation and Logistics

- Media and Entertainment

- Travel and Hospitality

- Retail and Consumer Goods

- Legal

- Others

By Deployment

- Cloud

- On-premise

By Geography

North America

- S.

- Canada

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content