What is the Data Center Market Size?

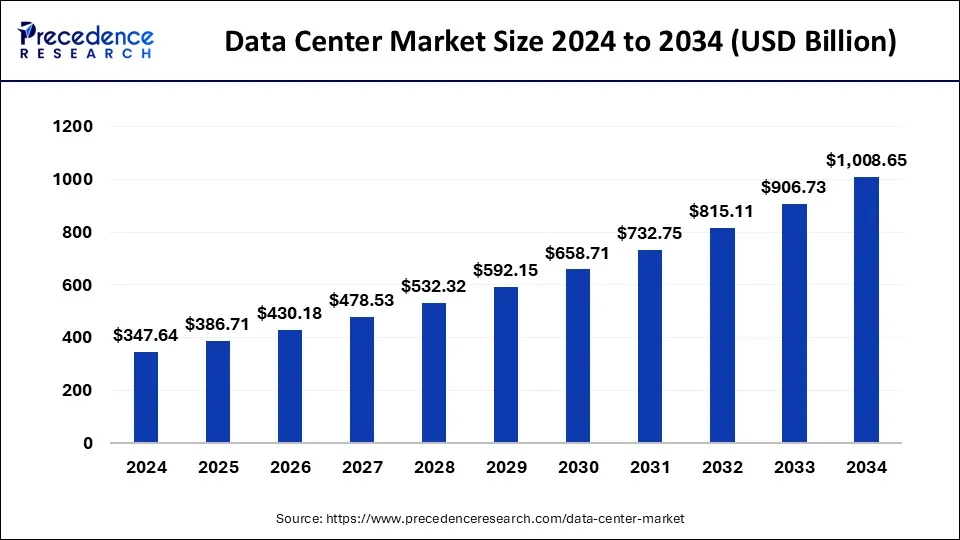

The global data center market size is estimated at USD 386.71 billion in 2025 and is predicted to increase from USD 430.18 billion in 2026 to approximately USD 1,103.70 billion by 2035, expanding at a CAGR of 11.06% from 2026 to 2035.

Market Highlights

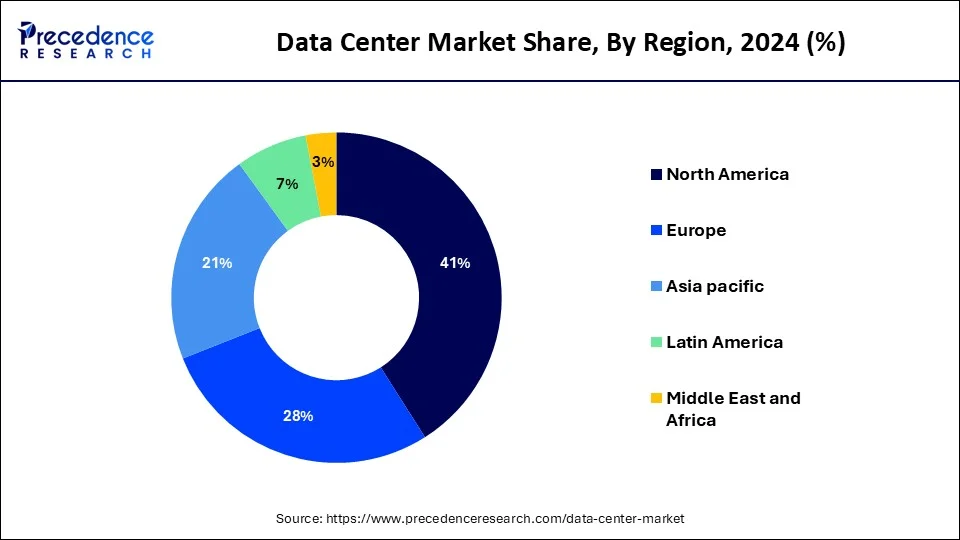

- North America dominated the global market with the largest market share of 41% in 2025.

- Asia Pacific is estimated to expand at the fastest CAGR between 2026 and 2035.

- By component, the solution segment has held the largest market share of 65.76% in 2025.

- By component, the services segment is anticipated to grow at a remarkable CAGR between 2026 and 2035.

- By type, the hyperscale segment is expected to expand at the fastest CAGR over the projected period.

- By enterprise size, the small & medium enterprises segment is expected to expand at the fastest CAGR over the projected period.

- By end-user, the BFSI segment had the largest market share in 2025.

- By end-user, the IT & telecom segment is expected to expand at the fastest CAGR over the projected period.

What is a Data Center?

The data center market refers to the global industry dedicated to designing, building, and managing data centers, essential for storing, processing, and managing vast amounts of digital information. These centers house servers, networking equipment, and storage systems, ensuring seamless and secure data operations for various organizations.

The data center market is propelled by growing demands for cloud computing services, big data analytics, and digital transformation. Key contributors to this dynamic landscape are technology firms, real estate developers, and service providers. Together, they play a vital role in the ongoing evolution of data center infrastructure, adapting to meet the expanding requirements of the digital era and ensuring the seamless operation of critical digital services across various industries.

Revolution in Data Centers Powered by Artificial Intelligence

The explosion of artificial intelligence (AI) is changing the way we use and develop data centers around the world. AI-centric data center facilities are creating an unprecedented worldwide infrastructure expansion to meet the global demand for AI-powered processing. Currently, approximately three out of every four data center projects specifically focus on AI-computing technologies, prompting the creation of advanced product design techniques, including liquid cooling and flexible power solutions, to accommodate increased thermal and power requirements.

In December 2025, The U.S. energy regulator directed U.S. grid operator, PJM Interconnection, to create rules on the connection of AI-driven data centers and large electricity loads located next to power plants. Major technology organizations continue to secure energy sources and expand their capacity to support the rapid expansion of generative AI; meanwhile, new centers of AI innovation are emerging in places such as West Texas. AI will continue to define the future of digital infrastructure.

What are the Growth Factors in the Data Center Market?

- Increasing global demand for cloud computing services propels the expansion of data centers.

- The growing importance of big data analytics drives the need for robust data center infrastructure.

- Organizations' pursuit of digital transformation initiatives contributes to the market's growth, fueled by evolving business models and customer expectations.

- The trend towards edge computing for decentralized data processing, addressing latency and enhancing real-time data analysis.

- Sustainability Practices: Increasing focus on eco-friendly and energy-efficient data center solutions, aligning with corporate sustainability goals.

- Hybrid Cloud Environments: Rise in the adoption of hybrid cloud strategies for enhanced flexibility, combining on-premises and cloud resources for optimized performance.

- Opportunities for companies involved in expanding existing data center infrastructure to meet growing demands.

- Developing and offering environmentally sustainable data center solutions, tapping into the rising demand for green technologies.

- Accelerated adoption of remote work models due to global events, necessitating enhanced data center capabilities for distributed workforce support.

- The deployment of 5G networks drives the need for edge data centers to handle increased data processing at the network edge.

- Integration of artificial intelligence (AI) for predictive analytics and autonomous data center management.

- Growing adoption of modular data center designs for scalability and rapid deployment.

Transformational Trends Shaping the Global Data Centers Market

- Accelerating Hyperscale Expansion: Hyperscale data center growth continues at an accelerated rate by cloud providers in order to meet the increasing demand for streaming services, cloud-native applications and enterprise digital transformation both in mature economies and emerging markets.

- Increased Sustainability and Green Data Centers: As regulations become more stringent and as enterprises become more committed to environmental, social & governance (ESG) standards, operators are placing a greater emphasis on sourcing renewable energy, using innovative cooling technologies, and adopting carbon neutral designs.

- The Rise of Edge Data Centers: Rapid increases in both the use of 5G, internet of things (IoT) and real-time applications have led to greater capital investments into edge data centers to eliminate latency, enhance speed, and to facilitate localized data processing.

- Modular& Prefabricated Data Centers Adoption: Prefabricated and modular construction methods continue to gain popularity for their shorter construction schedules, superior scalable options and reduced construction timeframe risks for rapid capacity builds.

Technological Advancement

Technological advancements in the data center market feature cooling technology, cloud computing, and edge computing. The edge computing process data from the most relevant sources. Machine learning, AI, and cloud computing are used to improve data center infrastructure. The hybrid cloud solution is mostly approached by many organizations to achieve success in cloud infrastructure and on-premises. The cooling technology is the primary approach of data centers, like liquid cooling helps eliminate heat from high-density computing equipment.

The most popular AI technology contributes to the optimization of resource allocation and energy consumption. It also supports automation. The green data centers minimize environmental impact and provide sustainable data center operations. These technologies are encouraging development in the data center market globally.

Data Center Market Outlook

- Industry Growth Overview: The data center market will experience substantial growth from 2026 to 2035 due to increased use of cloud computing and AI during the transition phase of digital transformation, in addition to rising demand for edge computing resourcing. Hyperscale's are increasing their data center market in the Asiaâ€ÂPacific region and the North America region to support low-latency sensitive applications and overall enterprise digital transformation.

- Global Expansion: Major data center operators are expanding their presence in Asia, Europe, and Latin America to capitalize on expanding cloud business and favorable government regulations. For instance, large campus data center operators have constructed extensive data center campuses in Malaysia and Chile to take advantage of growing digital economies in the region and to comply with mandated data sovereignty.

- Major Investors: The increasing interest from private equity firms and other infrastructure investors in the hyperscale and colocation assets is due to increased competition for long-term contracts and significant upfront capital required to build these facilities, as well as very strong demand for AI services.

- Startup Ecosystem: The growth of innovation related to data centers is accelerating, particularly regarding technology for cooling data centers, energy efficiency technology, and modular data centers. Companies such as Submer (Spain), DepthAI Infra (USA), and many others are gaining traction with venture capital investment in the delivery of scalable immersion cooling, AI-based power management solutions, and compact, edge-ready micro-datacenters.

Various Governments Expanding Data Center Infrastructure to Power Digital Growth and Ai Innovation

As part of their digital transformation efforts, governments across major economies are now more focused than ever on establishing data center infrastructure as an important aspect of economic competitiveness and national security. In India, the continued rapid growth of government-approved policies and support for the development of data center capacity is projected to increase from approximately 1.2GW presently to approximately 9 GW by 2032, which is due in large part to an explosive increase in demand attributed to AI, cloud computing, the rollout of 5G services, and government regulations that require the storing of local data.

The UK is seeing a boom in investment into data centers, with a substantial rise in the number of new data center facilities being constructed each year, projected to exceed 10 billion annually by 2029. Government actions that are helping drive investments in the data center sector include AI Growth Zones, which provide streamlined planning processes and opportunities for attracting foreign investment as well as partnerships with global technology companies and technology innovations.

In November 2025 Amazon announced to invest US$50 billion in data centers to power US government AI efforts. This investment will removes the technology barriers that held government back and further positions America to lead in the AI era.

The rapid development of data centers underscores how much data centers represent critical national infrastructure that are necessary for powering AI and cloud services, while also providing safe and secure digital environments for businesses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 386.71 Billion |

| Market Size in 2026 | USD 430.18 Billion |

| Market Size by 2035 | USD 1,103.70 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.06% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Type, Enterprise Size, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

AI integration and hybrid cloud environments

The (AI) in the data center market significantly surges market demand by introducing advanced analytics and automation. AI enhances operational efficiency, allowing for predictive maintenance, intelligent workload management, and proactive issue resolution. With AI-driven insights, data centers can optimize resource utilization, improve energy efficiency, and ensure seamless performance, thereby meeting the evolving demands of modern data processing.

The adoption of hybrid cloud environments plays a pivotal role in driving market demand for data centers. Businesses increasingly leverage hybrid cloud strategies, combining on-premises infrastructure with cloud services for enhanced flexibility and scalability. Data centers, acting as the basis of these hybrid setups, facilitate seamless integration, data mobility, and efficient resource allocation. As organizations prioritize a blend of private and public cloud solutions, the demand for data centers that can effectively support and integrate within hybrid cloud environments experiences a substantial surge.

Restraint

Cybersecurity risks and energy consumption concerns

The data center market faces constraints due to escalating cybersecurity risks, with the increasing sophistication of cyber threats posing a significant challenge. The potential for data breaches, unauthorized access, and cyber-attacks on critical infrastructure raises concerns among businesses and organizations, leading to hesitancy in adopting and expanding data center capabilities. The need for robust cyber security measures and constant advancements to counter evolving threats places a strain on resources, impacting the market's growth potential as stakeholders prioritize security over rapid expansion.

Energy consumption concerns act as a substantial restraint on the data center market. The high-power requirements of data centers contribute to environmental impact and operational costs. With a growing focus on sustainability, businesses are cautious about the ecological footprint of data centers, prompting a shift towards energy-efficient solutions. Balancing the demand for increased computing power with the imperative to reduce energy consumption poses a challenge. Stricter regulations and corporate sustainability initiatives further intensify the pressure, influencing decision-makers to prioritize energy-efficient and environmentally friendly alternatives, impacting the pace of market expansion.

Opportunity

Edge computing solutions and data center expansion

The surge in market demand for the data center market is significantly driven by the adoption of edge computing solutions. As organizations embrace the decentralization of data processing, edge computing brings computing power closer to end-users, reducing latency and enhancing the efficiency of real-time applications. The need for quick decision-making, particularly in applications like IoT devices and autonomous systems, fuels the demand for distributed edge data centers, creating a robust market for compact, high-performance infrastructure.

Data center expansion is a key driver amplifying market demand. With the escalating volumes of digital data generated and processed globally, there's a critical need for expanded data center capacity. The increasing adoption of cloud computing, big data analytics, and digital transformation initiatives further intensify this demand. Companies engaged in data center expansion projects contribute to the market's growth by ensuring scalable, secure, and efficient facilities, catering to the evolving requirements of businesses in the digital age.

Segments Inisghts

Component Insights

The solution segment held 65.76% revenue share in 2025.In the data center market, solutions refer to the technological offerings that address specific challenges or fulfill key functionalities within data center infrastructure. This comprises both hardware and software elements, encompassing servers, storage systems, networking equipment, and management software within the data center market.

The prevailing trend in data center solutions centers on the integration of cutting-edge technologies, including edge computing, artificial intelligence, and modular designs. This integration aims to optimize efficiency, scalability, and overall performance, aligning with the dynamic requirements of digital transformation in the contemporary business landscape.

The services segment is anticipated to expand at a significant CAGR during the projected period. Data center services encompass a range of offerings including consulting, maintenance, and management to optimize the performance and reliability of data center infrastructure. As a trend, there is an increasing focus on managed services, where third-party providers offer comprehensive solutions to handle the complexities of data center operations, ensuring seamless functioning, security, and compliance. The service sector is evolving to meet the demand for specialized expertise and support in the dynamic and complex landscape of data center management.

Type Insights

The colocation segment held the largest market share in 2025. Colocation in the data center market refers to the practice of renting space and resources in a third-party facility. Organizations benefit from shared infrastructure, reducing the need for building and maintaining their data centers. Trends include a rising demand for colocation services due to cost-effectiveness, increased security, and the ability to scale resources as needed.

The hyperscale segment is projected to grow at the fastest rate over the projected period. Hyperscale data centers are massive facilities designed to accommodate high-density computing infrastructure. These centers cater to large-scale cloud providers and internet services, addressing the growing demand for expansive and efficient computing resources. Trends include a surge in hyperscale data center construction to meet the escalating requirements of cloud computing, big data, and emerging technologies.

Enterprise Size Insights

The large enterprises segment had the highest market share in 2025 based on the enterprise size. Large enterprises in the data center market are organizations with extensive IT infrastructure needs, typically characterized by substantial data storage, processing requirements, and complex networking systems. Trends indicate a growing reliance on hyper-scale data centers to meet the demands of cloud computing, big data analytics, and digital transformation initiatives. Large enterprises emphasize scalability, security, and efficiency, driving investments in advanced data center technologies to support their expansive operations.

The Small & Medium Enterprises (SMEs) segment is anticipated to expand at the fastest rate over the projected period. Small & Medium Enterprises (SMEs) in the data center market comprise businesses with more modest IT infrastructure needs. Trends suggest a rising adoption of colocation services and modular data center solutions among SMEs to achieve cost-effectiveness and flexibility. As SMEs increasingly embrace digitalization, there is a growing demand for scalable and manageable data center solutions that cater to their specific requirements, supporting their journey toward enhanced digital capabilities.

End User Insights

The BFSI segment had the highest market share in 2025 on the basis of the end user. In the data center market, BFSI end-users, including banks, financial institutions, and insurance companies, demand secure and resilient data infrastructure. Trends in BFSI data centers focus on regulatory compliance, enhanced cybersecurity, and the adoption of hybrid cloud solutions for seamless operations. With the growing reliance on digital transactions and data-intensive financial services, BFSI entities drive the need for scalable and efficient data center solutions to ensure uninterrupted financial operations.

The IT & telecom segment is anticipated to expand at the fastest rate over the projected period. The IT & telecom sector, a major end-user of data center solutions, requires robust infrastructure to support the increasing demand for digital services and data storage. Trends in this segment revolve around edge computing integration, 5G network deployment, and modular data center solutions. Telecom companies and IT service providers seek agile and scalable data center architectures to accommodate the evolving landscape of technology, enabling faster data processing, reduced latency, and improved network performance.

Regional Insights

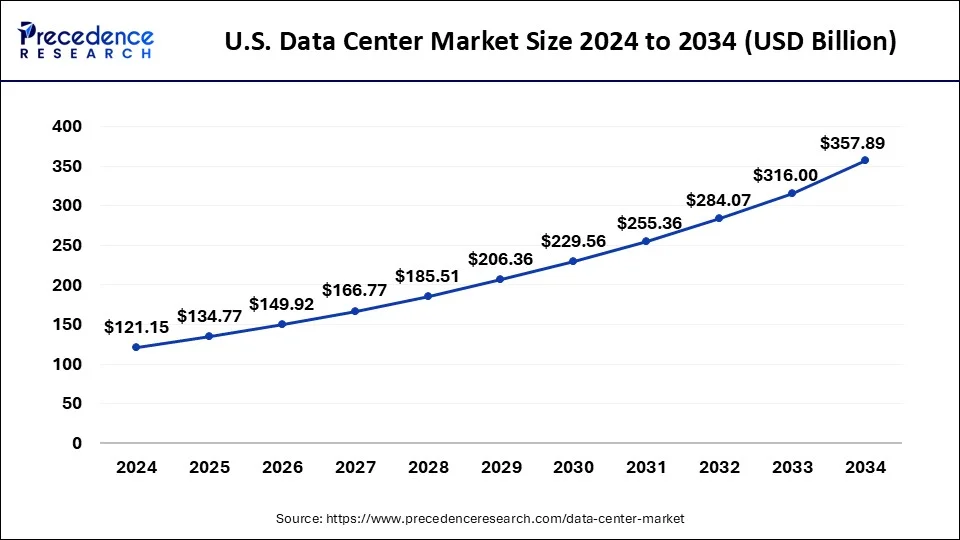

U.S. Data Center Market Size and Growth 2026 to 2035

The U.S. data center market size is exhibited at USD 134.77 billion in 2025 and is projected to be worth around USD 393.14 billion by 2035, poised to grow at a CAGR of 11.30% from 2026 to 2035.

North America has held the largest revenue share 41% in 2025. In North America, the data center market is witnessing a surge in hyperscale data center construction driven by the demand for cloud services and digital transformation. The region emphasizes sustainability, with a growing adoption of green data center practices. Hybrid cloud solutions and edge computing are gaining prominence, reflecting the need for flexible and efficient data processing infrastructures to support diverse industries in the evolving digital landscape.

The expansive construction of hyperscale data centers in North America is a major growth factor for this market. The demand for hybrid cloud solutions is significantly high in the data center industry. The well-established technological infrastructure is fostering development in this market.

Asia Pacific is estimated to observe the fastest expansion.Asia Pacific exhibits a robust data center market marked by substantial investments in data center infrastructure. The region experiences a shift towards modular and prefabricated data centers to address scalability needs. With a dynamic mix of mature and emerging markets, Asia Pacific showcases a strong inclination towards adopting cutting-edge technologies, including AI and edge computing, to meet the increasing demand for digital services and data storage.

China Data Center Market Trends

China's market is experiencing rapid growth driven by soaring demand from AI, cloud computing, and 5G deployments, requiring high-performance facilities capable of handling intensive workloads. Government initiatives such as the East Data, West Computing program and the "New Infrastructure" policy are supporting the expansion of data center clusters, particularly in western provinces with lower power costs and available land. Hyperscale and modular data centers are increasingly deployed to meet the needs of cloud providers and AI applications, emphasizing efficiency and high-density computing.

Why did Europe grow rapidly in the Data Center Market?

Europe's data center market was anticipated to experience robust growth. This growth will be spurred by the implementation of stringent data privacy regulations across Europe and second by the investment into green data center initiatives. These areas include investments in energy-efficient cooling systems and investments made for cloud adoption, which have increased the number of companies conducting artificial intelligence research and the need for a digital upgrade to an enterprise-level solution.

Germany Data Center Market Trends

The data center market in Germany will drive access into Europe, with its strong industrialized digital economy, strict data protection regulations, and high levels of investment in cloud infrastructure. With its location in Central Europe and outstanding interconnectivity, Frankfurt has established itself as the data center capital of Europe. Due to the demand for highly secure hosting solutions, advanced energy-efficient cooling systems, and large-scale capacity for enterprise workloads, many global operators have established data center operations within the country.

Why did Latin America grow steadily in the Data Center Market?

As the cloud becomes increasingly prevalent and businesses make the transition from traditional models to digitally based services in Latin America, the continent will enjoy massive and steady growth over the next several years. Growing investments in optical fiber networks, renewable energy sources, and new hyperscale data centers are just some examples of how Latin America is meeting this demand. The growth of e-commerce, fintech, and mobile data consumption has helped spur demand for more data center capacity in North America, Latin America, and Europe.

Brazil Data Center Market Trends

Brazil is the largest internet user population in Latin America and the biggest user base of cloud services. It was the most attractive market for hyperscale for establishing regional data centers. The rapid growth of Brazil's digital economy has fostered the development of new data centers by hyperscales in Brazil. E-Commerce, digital banking, and streaming services have stimulated new demand for data in Brazil. For this reason, most hyperscalers have selected Brazil as the location for their data centers, primarily due to Brazil's continued growth in both infrastructure development and the availability of renewable energy.

Why did the Middle East & Africa grow rapidly in the Data Center Market?

This region is expected to experience significant growth due to extensive government initiatives on digitalization and new data center developments driven by an increase in cloud computing, as well as significant investments from international operators. The demand for secure hosting services and AI-ready infrastructure has increased, creating a multitude of opportunities related to renewable energy-powered data center development, colocations, and edge data centers, particularly as the Gulf States pursue smart-city initiatives and countries in Africa expand their internet penetration.

UAE Data Center Market Trends

The United Arab Emirates has been established as the leading country with advanced digital hubs, compliant cloud computing policies, and smart city initiatives. International operators have opened many new campus locations in the United Arab Emirates, which allow them to focus on supporting the financial, tourism, and government sectors. With a reliable power grid and a predictably developed regulatory environment for the development of new data centers, the United Arab Emirates has positioned itself as a prime location for establishing data centers.

Data Center Market Companies

- Equinix, Inc.

- Digital Realty Trust, Inc.

- NTT Ltd.

- Global Switch Ltd.

- CyrusOne Inc.

- Interxion: A Digital Realty Company

- China Telecom Corporation Limited

- China Unicom (Hong Kong) Limited

- AT&T Inc.

- Amazon Web Services, Inc. (AWS)

- Microsoft Corporation

- Google LLC

- IBM Corporation

- Oracle Corporation

- Cisco Systems, Inc.

Recent Developments

- In May 2025, the U.S and UAE announced their plan to build a 5GW AI data center campus run by G42 and American hyperscalers. It will be built by the Emirati AI company G42. The collaborative strategy between two regions is a huge contribution to the data center market. (Source - datacenterdynamics.com)

- In May 2025, Sanmina Corporation, a manufacturing solutions company, announced its definitive agreement to acquire the data center infrastructure manufacturing business of ZT Systems. (Source - prnewswire.com)

- In May 2025, Qualcomm launched processors designed for data centers to power artificial intelligence, which will link to Nvidia's chips. The announcement marks a re-entry into the data center market for Qualcomm after previous efforts last decade bore little fruit. (Source - communicationstoday.co.in)

- In 2022, Seagate Technology Holdings and Phison Electronics Corporation have expanded their SSD portfolio to address the rising demand for higher-density and faster storage infrastructure in data management centers. This aims to reduce the total cost of ownership and cater to diverse business applications, including hyper-scale data centers, high-performance computing, and artificial intelligence.

- In 2021, NTT Communications Corporation introduces Data Center Interconnect (GDCI), an integrated network fabric service. GDCI facilitates private and secure connections between NTT's data centers and major cloud service providers, enhancing seamless and reliable connectivity for businesses operating in diverse digital environments.

Segments Covered in the Report

By Component

- Solution

- Services

By Type

- Colocation

- Hyperscale

- Edge

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End User

- BFSI

- IT & Telecom

- Government

- Energy & Utilities

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting