What is Data Center Cooling Market Size?

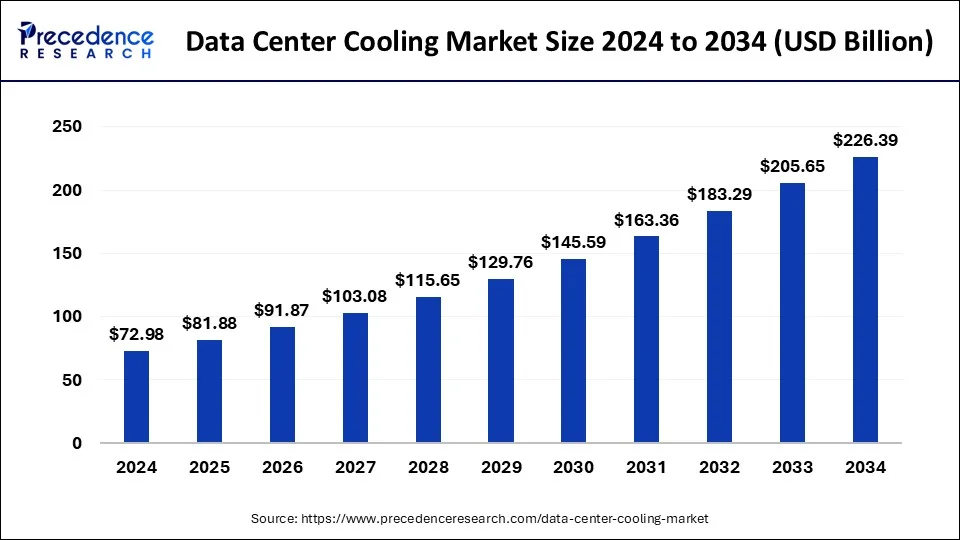

The global data center cooling market size accounted for USD 81.88 billion in 2025 and is expected to exceed around USD 248.21 billion by 2034, growing at a CAGR of 11.73% from 2026 to 2035.

Market Highlights

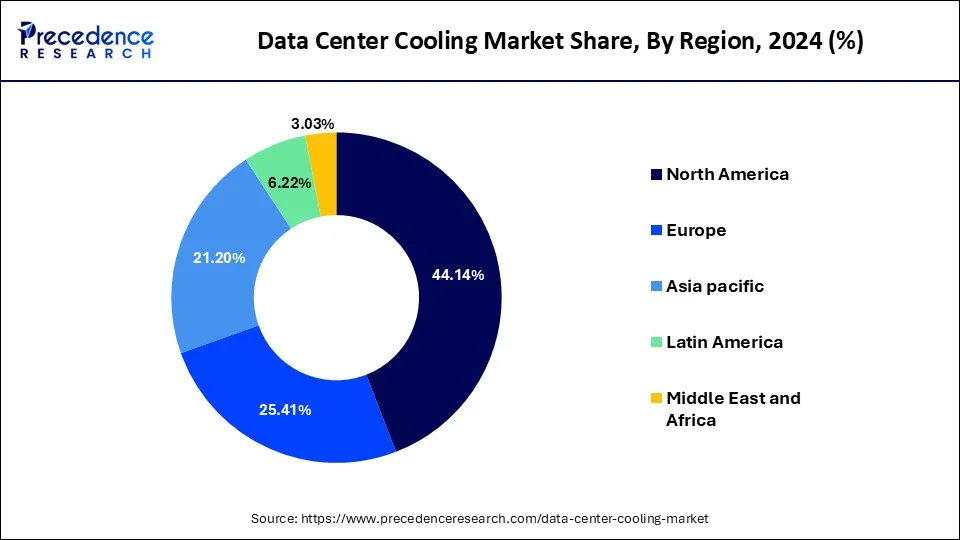

- North America led the global market with the highest market share of 51% in 2025.

- By product, the air conditioners segment has captured around 31% of the overall revenue in 2025.

- The precision air conditioners segment is growing at a CAGR of 18.2% over the forecast period.

- By containment, the containment segment has captured a sizeable revenue share of around 51% in 2025.

- The retail segment is poised to grow at a CAGR of 15.3% from 2025 to 2025.

- The telecom segment is projected to reach at a CAGR of 18.7% from 2025 to 2025.

How has AI benefited the Market?

The artificial intelligence is transforming the data center cooling market by improving energy efficiency, enabling predictive maintenance, and optimizing resource use. Using sensor data, the AI algorithms adjust cooling systems interactively to avoid energy wastage and curb operational costs. Predictive maintenance infers operational faulty conditions early enough to steer clear of downtime and cost in repair. AI, on the other hand, distributes workloads across servers to avoid hotspots and defend cooling from actual requirements. All these increase uptime and reduce latency, thus improving reliability and energy efficiency, and making the data center an affordable environment.

Data Center Cooling Market Growth Factors

Rising need for energy-efficient data centers, significant spending by colocation service and managed service providers, and rising construction of hyperscale data centers are the prime factors expected to propel the market growth. In addition, emergence of big data, cloud technology, and Internet of Things (IoT) has permitted organizations to spend in new data centers to maintain the business continuity. This is the other important factor likely to boost the market size over the upcoming years.

Additionally, increasing demand for security, operational efficiency, improved mobility, and bandwidth anticipated to prosper the industry development. Software-based data centers contribute to the market growth by offering improved automation level. Advent of IoT and connected technology has propelled various businesses to shift towards digital transformation that has again surged the necessity for an advanced data center ecosystem that ensures scalability, quick deployment, security, flexibility, and availability. This shift in business trend is paving way for the advancement and development of innovative solutions that is highly agile, cost-effective, and software-defined. The above mentioned factors projected to impel the market growth over the forthcoming years.

- Feverish demand for energy-efficient data centers is causing investments to be channeled toward advanced cooling technologies.

- Increasing spends by colocation and managed service providers favor the development of data center infrastructure.

- Rapid deployment of hyperscale data centers introduced a great demand for cooling solutions.

- Rising focus on security, operational efficiency, mobility, and bandwidth drives software-defined and automated cooling systems.

- Digital transformation creates a need for scalable, flexible, cost-effective data center ecosystems to foster innovations in cooling technologies.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 81.88 Billion |

| Market Size in 2026 | USD 91.87 Billion |

| Market Size by 2035 | USD 248.21 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.73% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Containment, Structure, Product, and Application, and region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of Cloud Computing and Big Data

It is said that data centers exploit the rapid expansion of cloud computing and big data analytics. To put it more technically, they require a big data center with high-density server racks. Such a data center generates lots of heat; therefore, it must be properly cooled to maintain its efficacy and to avoid damage to the equipment from overheating. The limitation of having scalable and efficient cloud infrastructure still sees investments in pioneering cooling technologies to support the worldwide growth of digital services and data processing capability.

Restraint

Technical Challenges

New cooling techniques are very difficult to set up in existing data centers. An existing outdated facility will either need to be technically upgraded or redesigned to accommodate such systems. These technical roadblocks might dissuade operators from adopting innovative cooling methods promptly, stunting the market growth and acting as a barrier to realizing enhanced energy efficiency and cooling performance of aging data center infrastructures, being a costly, complex, and lengthy process.

Opportunity

Liquid Cooling Technologies

Liquid cooling is gaining momentum as a more promising technology to be installed for the realization of high-density data centers because of its fast heat dissipation and energy efficiency. It deals with thermal loads so well that traditional air-cooling lacks, thus allowing for better server performance but also less energy to run it. As liquid cooling approaches more powerful computing support in these data centers, it harbors a huge potential for growth due to a higher level of sustainability and operational efficiency.

Data Center Cooling Market Segment Insights

Product Insights

Air conditioners segment dominated the global data center cooling market and accounted for more than 30% of the market share in 2023 as well as projected to exhibit prominent growth over the upcoming years. Densely packed racks tend to generate huge amounts of heat while storing and analyzing data for effective decision-making. Because of this reason, air conditioners help organizations to maintain a required temperature level along with ensuring the proper functioning of systems.

Additionally, air conditioner is a type of heat exchanger that maintains an adequate level of room temperature in a sensitive IT environment. In the meantime, the precision air conditioners register the fastest growth rate during the analysis period. Technological advancements along with the introduction of energy-efficient units estimated to uplift the demand for precision air conditioners. Moreover, they provide numerous benefits that include a demonstration of better air distribution, precise humidity control, continuous operation, along with automatic control of different AC loads for effective cooling.

Application Insights

Based on application, retail segment is estimated to exhibit a CAGR of more than 13% over the analysis period. The significant growth of the segment is attributed to the extensive application of social media, smartphones, Image Processing Verification Tools (IPVT), and tablet computers that in turn spur the volume of data.

Moreover, the telecom segment occupied the largest value share in 2023 and is anticipated to witness the fastest growth rate over the upcoming years. Rapid expansion of IT & telecom industry across the world is expected to propel the growth of the data center cooling market. Additionally, significant development in the telecommunication infrastructures fuels the need for equivalent storage facilities that are projected to impel the demand for data center cooling solutions.

Component Insights

The solution segment contributed the highest revenue share of 72.50% in 2024. The segment, which is increasingly focused on energy efficiency and is expanding rapidly, includes key solutions such as air conditioning, chillers, economizers, and cooling towers. The surge in adoption of modern technologies, such as big data analytics, artificial intelligence (AI), and edge computing, results in higher server power consumption and, consequently, increased heat loads. Moreover, the growing awareness of energy consumption and government mandates, particularly in emerging markets, is significantly driving the demand for energy-efficient and sustainable cooling.

Cooling technique Insights

The air based cooling segment held a dominant presence in the data center cooling market in 2024, with 63.40%. Air-based cooling involves circulating air for cooling and continues to hold a dominant market share. The segment includes cold aisle containment, hot aisle containment, in-room cooling, in-rack cooling, and in-row cooling. Air-based cooling requires Lower initial capital expenditure than liquid cooling and is the most widely adopted method, particularly for conventional data centers and smaller deployments. The market is experiencing a rapid shift toward liquid cooling technologies for high-density computing, supported by the growth of Artificial Intelligence (AI) and advanced computing.

Type of data center Insights

The hyperscale data centers segment held the 37.80% market share in 2024. The growth of the segment is mainly driven by the rising investment in IT infrastructure, the proliferation of digital services, and the rise of hyperscale data centers, especially in developing nations.Hyperscale data centers have unique cooling needs that require specialized and high-density liquid-ready suites. Hyperscale facilities are specifically designed for massive and scalable operations, which allow for economies of scale in infrastructure deployment, including cooling systems. The incorporation of big data, artificial intelligence (AI), and cloud computing has significantly increased the construction of hyperscale data centers. These facilities often require advanced and high-capacity cooling systems to efficiently handle the immense heat generated by shop-sourced servers and computing environments.

Cooling Capacity Insights

The 20�100 kW segment contributed the biggest market share of 33.10% in 2024. The growth of the segment is attributed to the rising demand for energy efficiency, government initiatives, growing demand to support edge computing and smaller deployments, and the and the rising need to manage heat in localized, smaller data environments. Several governments around the world are increasingly focus on promoting sustainable IT practices and offering attractive incentives for data centers to adopt energy-efficient cooling technologies.

End User / Industry Vertical Insights

The IT & Telecom segment held the largest share of 29.40% in 2024. The IT & Telecom industry is the leading and major end-user for data center cooling, accounting for the highest share of market revenue. The expansion of hyperscale facilities, operated by major IT companies, has led to an increasing need for massive and efficient cooling systems. Telecom carriers are increasingly focusing on deploying edge data center pods near 5G towers which creates the demand for compact, efficient cooling with liquid loops. The rising need to ensure uninterrupted performance and extend equipment life in large-scale environments has substantially increased the significance of advanced cooling systems in the IT & Telecom industries. Additionally, the increased energy demands from AI/ML, surging government initiatives, strong focus on sustainability, rising power densities of IT equipment, and the expansion of hyperscale and edge data centers, driving the growth of the segment during the forecast period.

Data Center Cooling MarketRegional Insights

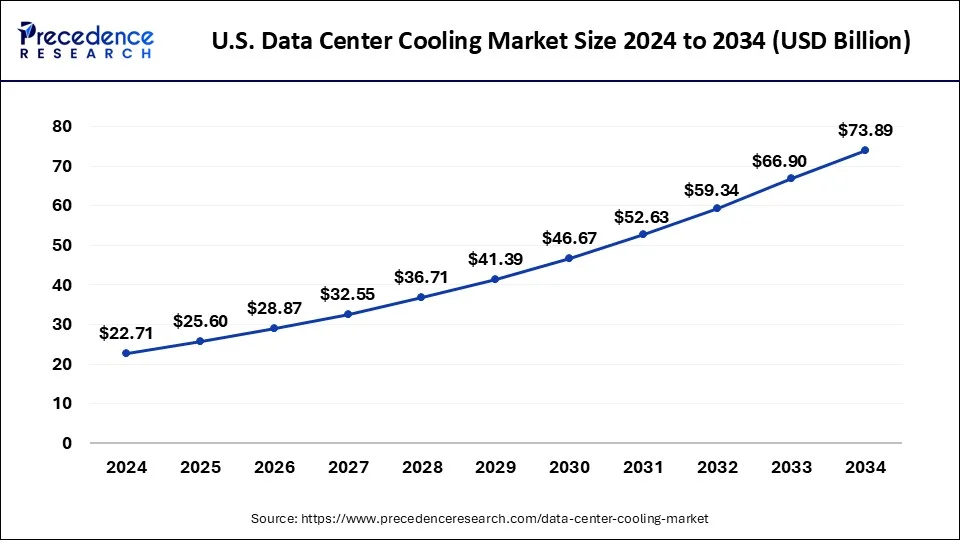

The U.S. data center cooling market size is exhibited at USD 25.60 billion in 2025 and is projected to be worth around USD 81.26 billion by 2035, growing at a CAGR of 12.24% from 2026 to 2035

North America led the global data center cooling market in 2024 and predicted to retain the same trend over the years to come owing to the largest market dedicated for the technology oriented solutions. Further, the region has also witnessed a healthy growth in the global economy, particularly for the development and implementation of new and upcoming technologies. Moreover, with presence of significant companies for example Amazon Inc., Facebook, and Google Inc.contribute positively towards the growth of the region.

The Asia Pacific anticipated to gain prominence during the upcoming period because of significant growth opportunity for the application of telecom sector. This is mainly due to the significant rise in the number of service providers that offer external IT infrastructure services as well as manage and operate critical business applications and information.

Data Center Cooling Market Companies

- Asetek

- Air Enterprises

- Climaveneta Climate Technologies (P) Ltd.

- Fujitsu Limited

- Coolcentric

- Hitachi Ltd.

- Rittal GmbH & Co. KG

- Netmagic Solutions

- STULZ GMBH

- Telx Holdings, Inc. (Digital Realty Trust, Inc.)

- Schneider Electric

- Vertiv Co.

Recent Updates on Data Center Cooling Market- 2025

Schnider Electric and Nvidia Unveil AI-optimized Cooling Reference Designs

- In December 2024, Schneider Electric teamed up with Nvidia to roll out AI-ready data center reference architectures. These designs support high-density liquid cooling at the rack level, cutting energy use and speeding up deployment. Their collaboration extends sustainable infrastructure solutions to hyperscale clients.

AWS Debuts In-Row Heat Exchanger to Support Nvidia GPU Clusters

- In July 2025, AWS introduced a proprietary liquid cooling system, IRHX co co-designed with Nvidia, to cool GPU racks without major facility changes. It fits within standard rack footprints and enables smooth scaling of AI workloads in legacy data centers. AWS may extend this tech to its Graviton chipsets as their heat demands rise.

The Industry Shifts Toward Liquid and Immersion Cooling Amid Rising AI Heat Loads

- In July 2025, traditional air and evaporative cooling systems are increasingly falling short, prompting providers like Liquid Stack, Caddis Cloud, and Databank to adopt immersion and direct chip techniques. While the pace of adoption varies globally, the physics of AI workloads is pushing cooling closer to silicon.

Recent Developments

- On 13 May 2025, Samsung Electronics announced acquisition of Flak Group to expand HVAC offering in data center Samsung entered a $1.5 billion agreement to acquire Flak Group, a Germany based HVAC leader. The move strengthens Samsung position in climate. (Source: https://www.reuters.com)

- On 21 March 2025. Vertiv rolled out a complete services suite for liquid cooling, including its Liebert XDU1350 system for CDU (cooling distribution units). The services target hyperscale and AI-focused data centers transitioning to liquid-based thermal management. (Source: https://www.vertiv.com)

Data Center Cooling MarketSegments Covered in the Report

By Component

- Solution

- Air Conditioning

- Room-based air conditioning

- Row-based air conditioning

- Rack-based air conditioning

- Chillers

- Water-cooled chillers

- Air-cooled chillers

- Economizers

- Air-side economizers

- Water-side economizers

- Cooling Towers

- CRAC (Computer Room Air Conditioner) Units

- Precision Air Conditioners

- In-Row Cooling

- Rack Cooling

- Liquid Immersion Cooling Systems

- Direct-to-Chip Cooling

- Hybrid Cooling Systems

- Air Conditioning

- Services

- Installation & Deployment

- Consulting & Design

- Maintenance & Support

- Retrofit Services

By Cooling Technique

- Air-Based Cooling

- Cold aisle containment

- Hot aisle containment

- In-room cooling

- In-rack cooling

- In-row cooling

- Liquid-Based Cooling

- Liquid immersion cooling

- Direct-to-chip liquid cooling

- Chilled water cooling

- Refrigerant-based cooling

By Type of Data Center

- Enterprise Data Centers

- Hyperscale Data Centers

- Colocation Data Centers

- Edge Data Centers

- Cloud Data Centers

By Cooling Capacity

- Below 20 kW

- 20�100 kW

- 100�500 kW

- Above 500 kW

By End User / Industry Vertical

- IT & Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Healthcare

- Retail & E-Commerce

- Energy & Utilities

- Manufacturing

- Media & Entertainment

- Government & Defense

- Education & Research

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content