What is the AI Data Center GPU Market Size?

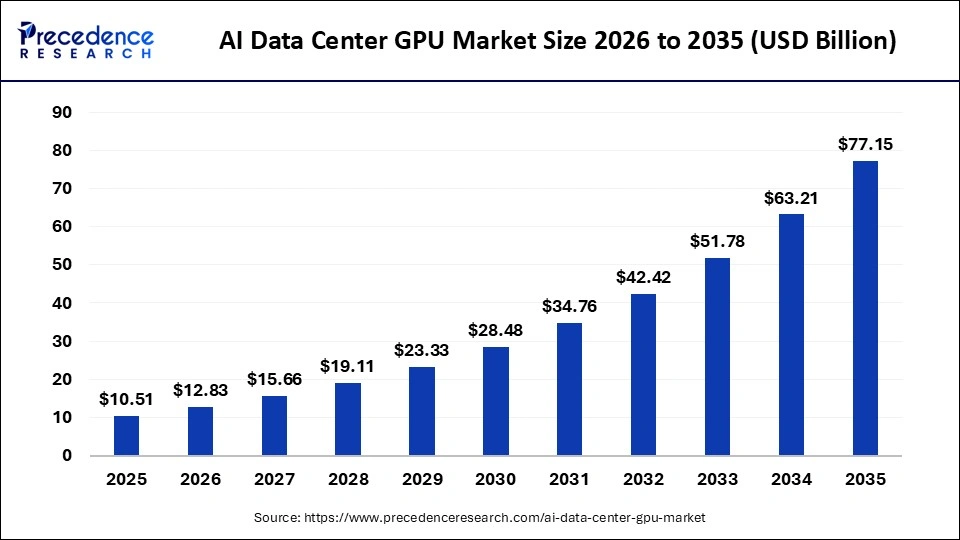

The global AI data center GPU market size accounted for USD 10.51 billion in 2025 and is predicted to increase from USD 12.83 billion in 2026 to approximately USD 77.15 billion by 2035, expanding at a CAGR of 22.06% from 2025 to 2034. The market for AI data center GPUs is witnessing unprecedented growth, driven by the widespread use of artificial intelligence, machine learning, and high-performance computing workloads.

Market Highlights

- North America dominated the market, holding the largest market share in 2025.

- The Asia-Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By deployment model, the on-premises segment contributed the highest market share in 2025.

- By deployment model, the cloud-based segment is growing at a notable CAGR between 2026 and 2035.

- By function/workload type, the inference segment captured the biggest market share in 2025.

- By function/workload type, the training segment is growing at a significant CAGR between 2026 and 2035.

- By end user/buyer/customer type, the cloud service providers segment generated the major market share in 2025.

- By end user/buyer/customer type, the enterprises segment is expanding at a remarkable CAGR between 2026 and 2035.

- By application/use-case type, the AI / ML / Deep Learning / AI-driven workloads segment held the largest share in the AI data center GPU market.

- By application, the Generative AI / Large-Model / Advanced AI workloads segment is set to grow at a notable CAGR between 2026 and 2035.

Understanding the AI Data Center GPU Market: Architecture, Workload Trends, and Capacity Expansion

In the data center, GPUs are increasingly being applied to solve the most complex issues through emerging technologies such as artificial intelligence (AI), simulation or modelling, media and media analytics and rendering. Data center graphics processing units (GPUs) help meet the increasing demand for high computational performance. Modern data centers deploy GPU clusters built on parallel processing architectures that include thousands of CUDA cores or stream processors, high bandwidth memory stacks, and NVLink or PCIe interconnects to support intensive AI and HPC workloads.

GPUs are extensively adopted in both on-premises and cloud data center environments to enable more flexibility and efficiency. Hyperscalers and enterprise data centers are integrating GPU pools into scalable architectures such as GPU as a Service (GPUaaS), multi-tenant virtualized environments and hybrid cloud platforms, making it easier to allocate compute resources dynamically based on workload size. This flexibility is essential for AI training pipelines, generative AI inference operations and large batch data processing, which require different performance levels at different stages.

Modern GPUs are designed to handle AI-related calculations faster and more efficiently, speeding up tasks like training models and making predictions. They accelerate deep learning frameworks, transformer-based language models, reinforcement learning blocks, and high-precision scientific simulations by optimizing tensor core performance, memory bandwidth, and inter-GPU communication. The rise in demand for workloads such as LLM training, real-time video analytics, personalized recommendation engines and synthetic data generation is driving rapid capacity expansion across global data centers.

Key Technological Changes in the AI Data Center GPU Market

The AI data center GPU market is undergoing major technological shifts driven by the rapid evolution of AI workloads, larger model architectures and the push for higher computational density inside hyperscale facilities. One of the most significant developments is the transition toward next-generation GPU architectures featuring advanced tensor cores, higher memory bandwidth (HBM3 and HBM3E), and high-speed interconnects such as NVLink, PCIe Gen5 and CXL that allow multi-GPU clusters to function as a single accelerated compute fabric. GPU virtualization and multi-instance GPU (MIG) capabilities are improving resource efficiency by enabling partitioned GPU compute for mixed workloads, from LLM inference to real-time analytics.

Liquid cooling, direct-to-chip cooling, and immersion cooling are being rapidly adopted to manage rising heat loads as GPU power consumption surpasses traditional air-cooled limits. Data centers are also integrating disaggregated GPU racks and GPU-over-fabric architectures, allowing operators to scale GPU resources independently from CPUs and memory for more efficient AI training pipelines. These innovations collectively support the deployment of extremely large AI models, reduce energy waste and strengthen the overall performance of AI-optimized data center environments.

AI Data Center GPU Market Outlook

Between 2025 and 2030, the AI data center GPU industry is expected to experience accelerated growth. The growth of the market is driven by the growing need for high-performance computing (HPC), the rising expansion of cloud services, the increasing demand for large-scale generative AI models and large language models (LLMs), and the rising integration of AI and machine learning into core business operations across various sectors.

Several leading players in the AI data center GPU market are actively expanding their geographical presence through various strategic initiatives, including partnerships, infrastructure investments, and the launch of new portfolios. For instance, in October 2025, Intel announced plans to expand its AI Accelerator Portfolio with a New GPU. Intel announced a key addition to its AI accelerator portfolio: a new Intel Data Center GPU, code-named Crescent Island, designed to meet the growing demands of AI inference workloads. This GPU will offer high memory capacity and energy-efficient performance.

Several strategic investors are actively engaged in the AI data center GPU market, thereby accelerating market growth during the forecast period. For instance, in June 2024, Google announced the completion of its latest data center and cloud region campus expansion in Singapore. This milestone brings the companys total investments in technical infrastructure in the country to US$5 billion, up from US$850 million in 2018. More than 500 people work in the Google data centers in Singapore. New facility brings Googles infrastructure investments in Singapore to US$5 billion, advances sustainable standards in infrastructure across Southeast Asia.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.51 Billion |

| Market Size in 2026 | USD 12.83 Billion |

| Market Size by 2035 | USD 77.15 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 22.06% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Model, Function, End User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

AI Data Center GPU Market Segmental Insights

Deployment model Insights

On premises: The on-premises segment accounted for the majority of the share in the AI data center GPU market during 2024, owing rising need for data security & privacy and the rising focus on meeting compliance obligations. Several organizations prefer to keep sensitive and proprietary data in-house to maintain full control and significantly reduce security risks. On-premises deployments allow companies to customize AI models, tailor their computing environment, and optimize performance for unique operational requirements.

Cloud / Cloud-Based: The cloud-based segment is expected to grow at a remarkable CAGR between 2025 and 2034, supported by the flexibility and scalability requirements of AI and high-performance computing (HPC) workloads. The cloud-based deployment model is expanding rapidly. The demand for cloud-based GPU services (GPU-as-a-Service or GPUaaS) is increasing due to the rising complexity and computational power required for AI and machine learning tasks

Function Insights

Inference (Model Execution / Serving Predictions): The segment is dominating the AI Data Center GPU market by holding a majority share. The AI inference segment is a rapidly expanding function within the data center GPU market. It involves deploying AI models to process new, real-world data and make decisions in real time. Inference workloads require low-latency, high-throughput GPU architectures capable of running transformer-based models, recommendation engines, fraud detection pipelines, and real-time video analytics across large volumes of incoming data. Data centers use inference-optimized GPUs to support applications such as personalized search, autonomous operations, conversational AI, cybersecurity monitoring, and user behaviour modelling.

Training (Model Development / Training): The training segment is the fastest-growing in the AI Data Center GPU market. The segments growth is primarily driven by the rising complexity and scale of deep learning and generative AI models. Training now requires massive parallel processing capabilities to handle trillion-parameter transformer architectures, multi-modal foundation models and reinforcement learning pipelines that depend on enormous datasets. Trained models are increasingly deployed into real-time production environments in several applications, such as chatbots and autonomous systems. This demand pushes data centers to invest heavily in GPU clusters with high bandwidth memory, fast interconnects and distributed compute frameworks that can accelerate multi-node training and reduce overall training cycles.

End-user/Buyer/Customer Type Insights

Cloud Service Providers: The cloud service providers segment is dominating the AI Data Center GPU market. Hyperscale data centers operated by major Cloud Service Providers (CSPs) are the leading end users, leveraging multi-GPU clusters for AI and cloud workloads. Cloud Service Providers (CSPs) allow enterprises and startups to access GPU technology and scalable AI platforms on a pay-per-use or subscription basis, reducing the need for large capital expenditures on on-premises infrastructure.

Enterprises (Private Companies Across Sectors): On the other hand, the enterprises (private companies across sectors) segment is the fastest-growing in the AI Data Center GPU market, driven by rising demand for secure, customized, and high-performance AI solutions across industries. Enterprises are increasingly investing in GPU clusters to ensure guaranteed and on-demand access to the computational power needed for mission-critical operations. Companies in highly regulated industries prefer on-premises or private-cloud GPU deployments to maintain full control over sensitive or proprietary data and comply with stringent data and privacy regulations.

Government/Public Sector/Others: The segment is anticipated to grow at a considerable rate. Public sectors are using graphics processing units (GPUs) for real-time data analytics and high-performance computing. Several governments around the world are increasingly investing in AI infrastructure to reduce dependency on foreign providers and maintain control over sensitive data. Government/Public sector initiatives are designed with a focus on responsible AI adoption, including governance frameworks that ensure the ethical use of technology and mitigate bias.

Application Insights

AI/ML/Deep Learning/AI Analytics/ML Tasks: The segment dominated the AI Data Center GPU market in 2024 since AI workloads, particularly deep learning and large language models (LLMs), involve massive matrix operations and complex neural network training. Adoption of AI, ML, and deep learning workloads continues to accelerate as organizations require higher computational throughput to train sophisticated models that support tasks such as medical diagnostics, algorithmic trading, fraud detection, autonomous navigation and predictive maintenance. Industries are investing in GPU-dense clusters to improve training speed, enhance model accuracy and support large batch processing, which strengthens their ability to compete in sectors where real-time insights and advanced automation are increasingly essential.

Generative AI / Large-Model / NLP / Computer Vision / Advanced AI Tasks: This segment is seeing significant growth and is poised for rapid growth in the AI data center GPU market. The rapid adoption of Generative AI technologies across industries automates content creation, enhances customer service through advanced chatbots, and accelerates product design. Enterprises across various sectors are developing domain-specific large AI models to address issues, such as fraud detection, medical imaging, and industrial automation. This customization increases the demand for high-performance GPU infrastructure.

AI Data Center GPU Market Regional Insights

North America dominated the AI Data Center GPU market in 2024, holding the majority of the revenue share since the region benefits from a mature cloud computing ecosystem, providing the scalable infrastructure necessary for deploying resource-intensive AI and machine learning applications. The region is home to the worlds leading technology companies and major cloud service providers like NVIDIA, Google, Amazon Web Services, and Microsoft. These companies are increasingly investing in massive AI infrastructure, which drives AI innovation.

North America hosts the largest concentration of hyperscale data centers, GPU-accelerated cloud platforms, and AI research clusters, enabling faster deployment of high-performance GPU architectures for both enterprise users and AI developers. Expanding commitments to build training-focused supercomputers, multi-node GPU fabrics, and advanced cooling systems further support the regions leadership in high-density compute environments. Strong venture capital activity, close collaboration betweensemiconductor manufacturers and cloud operators, and supportive national programs for AI advancement create an environment where GPU demand continues to grow quickly.

In November 2025, NVIDIA is expanding its collaboration with Microsoft, including through the adoption of next-generation NVIDIA Spectrum-X Ethernet switches for the new Microsoft Fairwater AI superfactory, powered by the NVIDIA Blackwell platform.

The United States is currently transforming the AI data center GPU market, driven by a combination of factors such as massive private investment by Cloud Service Providers (CSPs) / Hyperscalers, strategic government incentives and regulation, and advanced technological innovation. The United States is a major contributor to the AI data center GPU market. The country has a well-established digital infrastructure and is the global epicenter of AI innovation.

In November 2025, Prime Data Centers announced a strategic collaboration with Lambda to deploy high-density NVIDIA GPU infrastructure at their flagship LAX01 AI-ready data center campus in Vernon, California. The partnership combines Primes next-generation data center design with Lambdas AI cloud platform to provide the advanced infrastructure enterprises, research institutions, and AI-native companies need to train and deploy increasingly complex models quickly and at superintelligence scale.

Asia Pacific is the fastest growing region in the AI Data Center GPU market. The regions fastest growth is largely attributed to the regions robust digital infrastructure, the emergence of edge computing, the increasing presence of hyperscale cloud service providers, favorable government support and rapid advancements in data visualization. Such a combination of factors is expected to propel the growth of the AI Data Center GPU market during the forecast period.

Countries such as China, Japan, South Korea, India, Singapore, and Australia are building new GPU-dense facilities to meet rising demand for AI-trained models, high-performance computing workloads and cloud-based analytics. Telecom operators in the region are rolling out 5G and fiber networks that support latency-sensitive AI services, prompting the deployment of edge data centers equipped with inference-optimized GPUs for real-time processing. Major cloud providers, including Alibaba Cloud, Tencent Cloud, Huawei Cloud and Google Cloud are expanding hyperscale capacity across Asia Pacific to support domestic enterprises and global customers.

India's AI Data Center GPU Market Analysis

India is experiencing significant growth in the AI Data Center GPU market. The markets expansion is supported by rising private sector investment from both international hyperscalers and large Indian conglomerates that are building new digital infrastructure across major cities. Indias rapidly growing digital economy is also driving a surge in data creation and consumption, which requires stronger local data center capacity. Key sectors such ase-commerce, fintech, telecommunications and digital entertainment are increasingly adopting AI-powered platforms that depend on GPU-accelerated systems for real-time analytics, recommendation engines, and large-scale machine learning workloads.

Government-led initiatives that promote cloud adoption, AI development, and nationwide digital transformation are encouraging enterprises to host workloads within Indias expanding network of GPU-enabled data centers. The rollout of 5G networks, widespread smartphone usage, and the rapid rise of AI-driven applications in logistics, digital payments and customer service further increase demand for high-performance GPU infrastructure. As a result, India is emerging as one of the fastest-growing hubs for GPU-dense data center development within the Asia Pacific region.

The Europe region holds a substantial market share in the AI Data Center GPU market. European countries such as Germany, France and the UK are the leading countries within Europe for AI data center GPU adoption. EU member states are increasingly investing in building independent AI capabilities and ensuring data sovereignty. The region is advancing national compute strategies aimed at reducing reliance on non-EU cloud providers and expanding domestic GPU clusters that support large-scale AI training, generative AI development and real-time inference workloads across public and private organizations.

The growth is largely driven by the massive government initiatives, increasing private sector investments and growing demand for AI and high-performance computing (HPC) across various industries such as healthcare, retail, BFSI, and others. Programs such as the EU Chips Act, the Digital Europe Programme and the European High-Performance Computing Joint Undertaking are funding new supercomputing centers and GPU-dense research facilities. Enterprises in Europe are adopting GPU-powered platforms for tasks such as medical imaging analysis, fraud detection, supply chain optimisation, personalised online retail and advanced automation in manufacturing.

In October 2025, ABB announced that it is accelerating the development of gigawatt-scale next-generation data centers in collaboration with NVIDIA. ABB is leading the development of the key new power distribution technologies that will create the next generation of data centers. Innovation is anticipated to focus on the development and deployment of cutting-edge power solutions needed to create high-efficiency, scalable power delivery for future AI workloads.

Germany AI Data Center GPU Market Trends

Germanys active harmonic filter (AHF) market is experiencing significant growth, driven primarily by the increasing expansion of cloud service providers (CSPs), increasing government support for digital sovereignty, and significant investments from tech players. The country has a strong focus on scientific research and institutions that leverage graphics processing units (GPUs) for HPC workloads, especially in the healthcare and automotive sectors.

In November 2025, Nvidia and Deutsche Telekom announced a data center project in Munich, Germany. Nvidia will provide more than 1,000 DGX B200 systems and RTX Pro servers with up to 10,000 Blackwell GPUs to a data center in Munich, which will be repurposed and begin operating in the first quarter of 2026.

AI Data Center GPU Market Companies

Operates some of the worlds fastest-growing AI data centers and deploys large-scale GPU clusters powered by NVIDIA H100, A100, and custom Azure AI infrastructure. The company is heavily investing in next-gen accelerators and its in-house Maia AI chips for hyperscale training workloads.

Runs advanced AI data centers using NVIDIA GPUs alongside its proprietary TPU accelerators for large language models and deep learning. Google Cloud delivers GPU-optimized instances for generative AI, training, and inference at hyperscale capacity.

Offers high-performance OCI GPU clusters using NVIDIA H100, A100, and upcoming GB200 platforms for distributed AI training. Oracles data center architecture focuses on ultra-high bandwidth networking and cost-efficient, large-scale AI compute.

Provides GPU-enabled AI compute instances for training, inference, and large-scale model development across Asia-Pacific. The company integrates NVIDIA data center platforms into cloud environments optimized for gaming, social media, and enterprise AI.

Operates large-scale GPU clusters supporting generative AI, multimodal models, and enterprise workloads. Alibaba Cloud deploys NVIDIA and custom-designed AI accelerators in its data centers to support Chinas rapidly expanding AI ecosystem.

The global leader in AI data center GPUs, producing industry-standard accelerators such as the H100, A100, L40S, and the Blackwell series. NVIDIA provides complete data center stacks, including networking, software, and AI frameworks.

Offers high-performance data center GPUs, including the MI300X and MI250, used for training foundational models and large-scale inference. AMD focuses on open software ecosystems and competitive performance-per-watt for AI workloads.

Provides AI accelerators such as Gaudi and Habana Lab platforms as alternatives to traditional GPU-based compute. Intel supports hyperscale data centers with flexible architectures and end-to-end AI optimization tools.

Expands into data center AI acceleration with low-power, high-efficiency chips designed for inference at scale. Its cloud AI offerings target cost-effective processing for generative AI and edge-to-cloud integration.

Develops the Ascend GPU/AI accelerator series used in Chinese data centers for training and inference across large models. Huawei integrates its compute with high-bandwidth networking and AI-native data center designs.

Recent Developments

- In December 2024, NVIDIA signed a Memorandum of Understanding (MOU) with the Ministry of Planning and Investment to establish two cutting-edge AI centers in Vietnam. NVIDIAs third global AI research hub is the Vietnam Research and Development Center (VRDC), which also houses an AI Data Center. This partnership between the Vietnamese government and the US chip giant aims to foster technological breakthroughs while strengthening the countrys technology infrastructure and talent pool.(Source: https://www.vietnam-briefing.com)

- In November 2025, Ooredoo Kuwait announced the launch of the countrys first sovereign AI-enabled data center, developed in a strategic partnership with NVIDIA. This milestone marks a new chapter in Kuwaits journey to build national AI capabilities and position itself as a regional hub for digital excellence. This milestone marks a new chapter in Kuwaits journey to build national AI capabilities and position itself as a regional hub for digital excellence.(Source:https://techafricanews.com)

AI Data Center GPU MarketSegments Covered in the Report

By Deployment Model

- On premises

- Cloud-based

By Function

- Training (model development/training)

- Inference (model execution/serving predictions)

By End User

- Cloud Service Providers/Hyperscalers

- Enterprises (private companies across sectors)

- Government/Public-sector/Others

By Application

- AI/ML/Deep Learning/AI analytic /ML tasks

- Generative AI/Large-Model/NLP/Computer Vision/Advanced AI tasks

- Others (graphics rendering, HPC/simulations, general GPU compute)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting