Cloud Infrastructure Market Size and Forecast 2025 to 2034

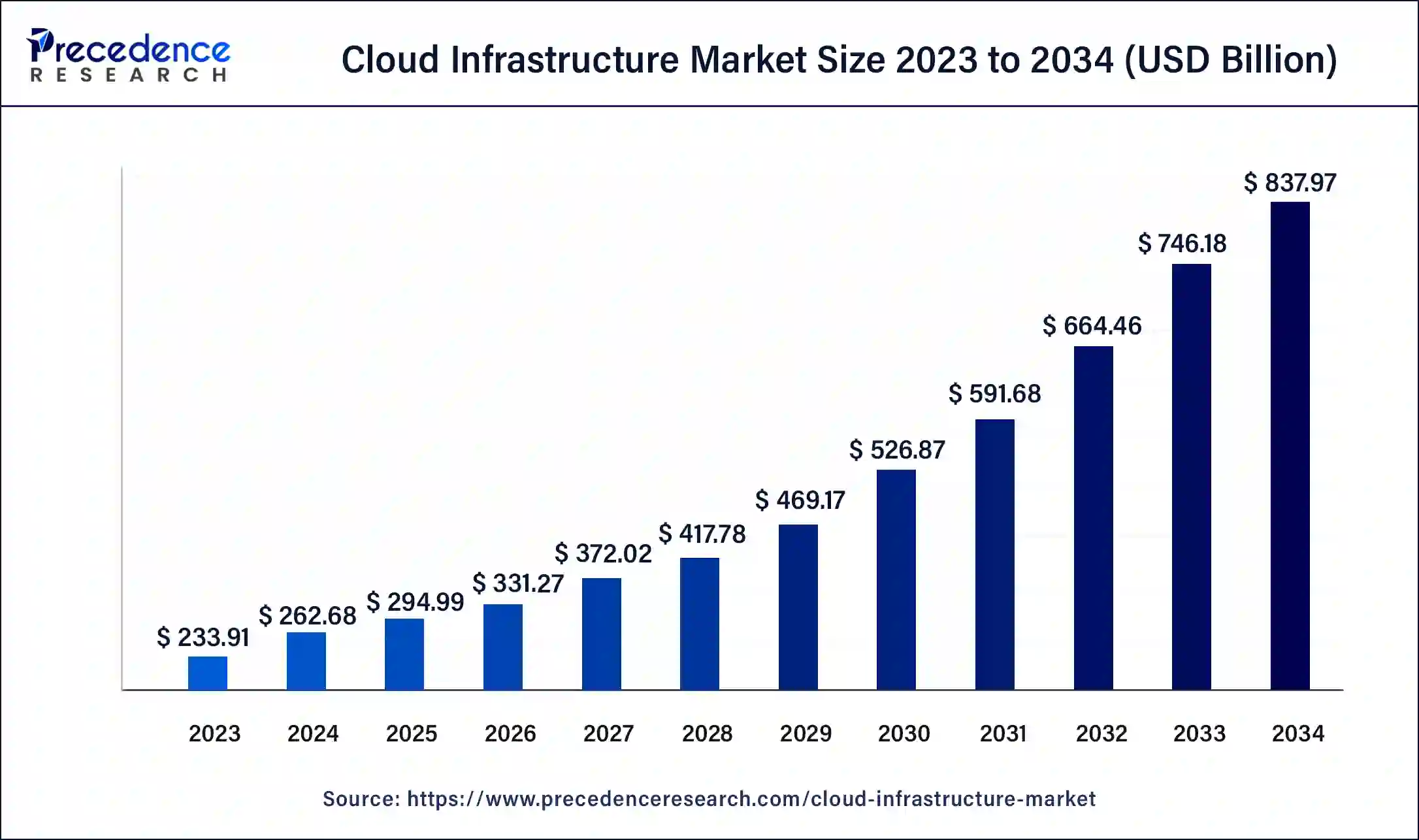

The global cloud infrastructure market size was valued at USD 262.68 billion in 2024 and is expected to be worth around USD 837.97 billion by 2034, at a CAGR of 12.30% from 2025 to 2034. The North America cloud infrastructure market size reached USD 98.24 billion in 2023.

Cloud Infrastructure Market Key Takeaways

- In terms of revenue, the cloud infrastructure market is valued at USD 294.99 billion in 2025.

- It is projected to reach USD 837.97 billion by 2034.

- The cloud infrastructure market is expected to grow at a CAGR of 12.30% from 2025 to 2034.

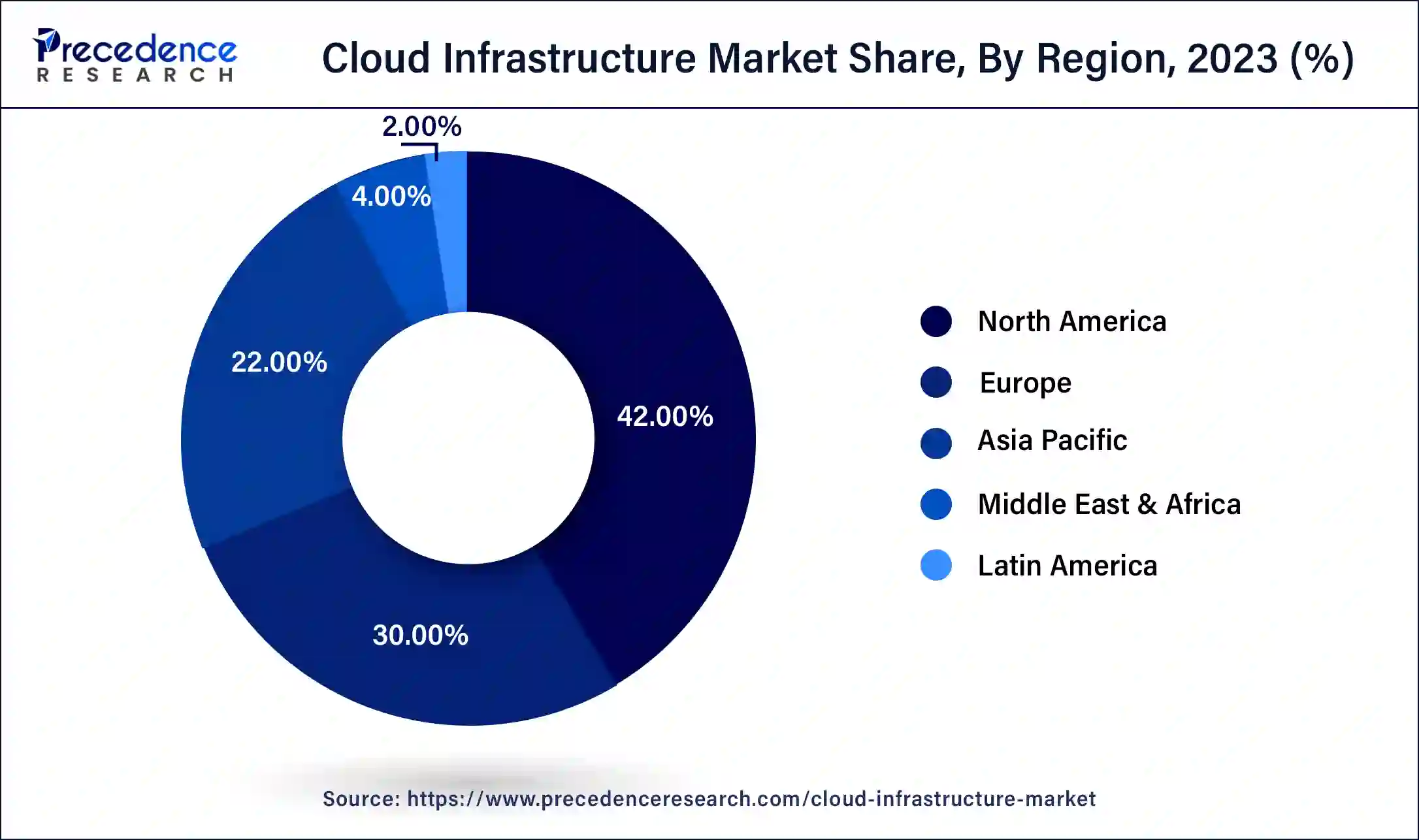

- North America contributed more than 42% of revenue share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By type, the hardware segment has held the largest market share of 56% in 2024.

- By type, the services segment is anticipated to grow at a remarkable CAGR of 13.4% between 2025 and 2034.

- By end use, the IT & telecom segment generated over 28% of revenue share in 2024.

- By end use, the healthcare segment is expected to expand at the fastest CAGR over the projected period.

Impact of Artificial intelligence on the Cloud Infrastructure Market

Artificial Intelligence AI is used to optimize the control of cloud resources so that companies self-manage and allocate the resources dynamically and per their active usage. This cuts down several operating costs while at the same time enhancing the efficiency of Cloud applications. Additionally, AI helps to improve data security by using various tools for analyzing threats and responding to them instantly making the environment safer for data.

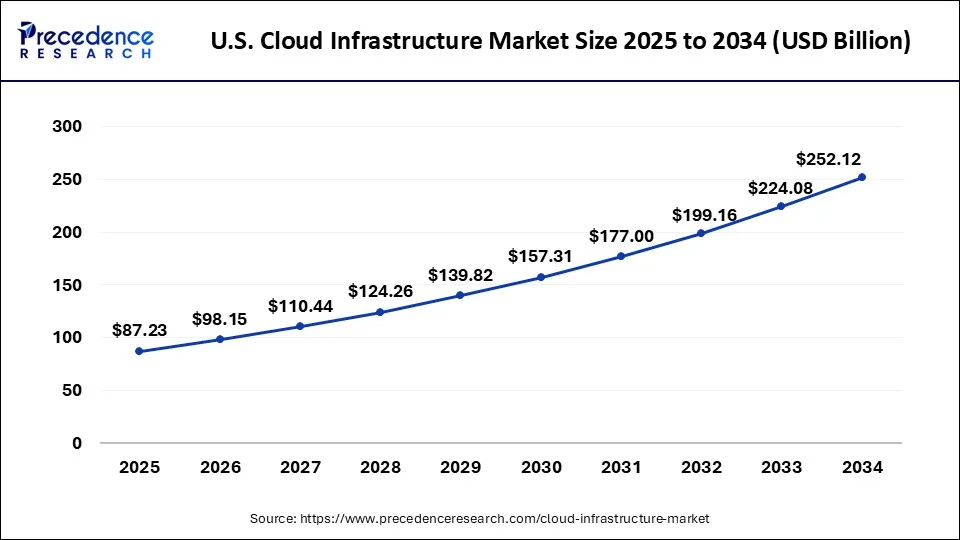

U.S. Cloud Infrastructure Market Size and Growth 2025 to 2034

The U.S. cloud infrastructure market size was estimated at USD 77.53 billion in 2024 and is predicted to be worth around USD 252.12 billion by 2034, at a CAGR of 12.50% from 2025 to 2034.

North America holds a share of 42% in the cloud infrastructure market due to a confluence of factors, including early technology adoption, robust IT infrastructure, and a thriving ecosystem of cloud service providers. The region's businesses prioritize digital transformation, driving a substantial demand for scalable and flexible cloud solutions. Moreover, a mature regulatory environment and a strong emphasis on data security contribute to the confidence of enterprises in adopting cloud infrastructure services. The U.S. Census Bureau reported in the year 2024 that about 85% of the companies in the United States have incorporated cloud technologies. Laws such as the CCPA, and FISMA provide a mature compliance foundation, which enhances the confidence to enterprise in data safety and regulation. These factors collectively position North America at the forefront of cloud infrastructure adoption, holding a major market share in the evolving global landscape.

Asia-Pacific is set for substantial expansion in the cloud infrastructure market, propelled by a convergence of factors. Swift digital transformation, widening internet access, and the integration of emerging technologies across various sectors are fueling the demand for adaptable and scalable cloud solutions. ITU shows that the internet usage in the region has increased and grew to 61% in the year 2022. Government-led initiatives advocating cloud adoption, coupled with a thriving startup environment, contribute to the region's rapid growth in cloud infrastructure. Thus, cloud adoption is growing under the governmental slogans such as India's Digital India program or China's 14th Five-Year Plan. This momentum is also supported by the region having over 21 000 startups in India to name only the crucial 2024 figure. The imperative for advanced data storage, robust processing capabilities, and the overall modernization of IT frameworks is energizing this momentum, positioning the region as a pivotal player in the dynamic global cloud landscape.

Europe is observed to grow at a considerable growth rate in the upcoming period, driven by strict data protection laws such as GDPR and initiatives like Gaia-X that advocate for data sovereignty. Companies are increasingly embracing hybrid and multi-cloud approaches to improve flexibility and prevent vendor lock-in. Sustainability is a major priority, with providers pledging to the Climate Neutral Data Centre Pact, aiming for climate-neutral operations by 2030. Edge computing is becoming more popular, especially in industries that require immediate data processing. These elements, along with investments in green technologies and energy-efficient facilities, are fueling the region's cloud infrastructure expansion.

Germany plays a crucial role in Europe's cloud infrastructure sector, supported by governmental initiatives such as the "Cloud Computing Strategy" and the Gaia-X project, which prioritize data sovereignty and secure cloud services. As of February 2024, the nation boasts 522 data centers, the highest in Europe. Notable investments, including Microsoft's USD 3.57 billion commitment to bolster AI and cloud capabilities, highlight Germany's emphasis on digital transformation and technological progress.

Market Overview

Cloud infrastructure refers to the digital foundation of cloud computing, comprising virtual resources and services. This includes both hardware and software elements housed in data centers, accessible over the internet. This setup allows users to conveniently access computing resources like storage and processing power without the hassle of physical hardware ownership or upkeep. Critical features of cloud infrastructure involve virtualization, facilitating the creation of virtual instances of servers, and software-defined networking for streamlined data transmission.

Leading cloud infrastructure providers like AWS, Microsoft Azure, and Google Cloud offer a variety of services, empowering businesses and individuals to effortlessly deploy and manage applications and data storage. This approach not only ensures adaptability and scalability but also emphasizes cost-effectiveness and widespread accessibility.

Cloud Infrastructure Market Data and Statistics

- In November 2022, Amazon Web Services Inc. introduced a supply chain management application, streamlining access to critical network data for businesses by eliminating the need for multiple systems and vendors.

- In May 2023, IBM launched the IBM Hybrid Cloud Mesh, a SaaS solution designed to simplify enterprise access to their hybrid multi-cloud infrastructure.

- Also in May 2023, Amazon Web Services announced a USD 12.7 billion investment in cloud infrastructure in India by 2030. This investment, as per AWS, is expected to generate an average of 131,700 full-time equivalent jobs annually within Indian businesses.

- Verizon reported 1,829 cyber incidents in the financial industry worldwide in 2022.

- According to the OECD, the annual inflation rate in the Organization for Economic Co-Operation and Development (OECD) rose steadily from February 2021 to October 2022, reaching 10.7% compared to the same month the previous year.

Cloud Infrastructure Market Growth Factors

- The growing adoption of cloud-based solutions across various industries serves as a crucial driver propelling the advancement of the cloud infrastructure market. Businesses are increasingly attracted to the cost-effectiveness, scalability, and convenient accessibility offered by the cloud.

- Companies involved in digital transformation initiatives are playing a significant role in driving the momentum of the cloud infrastructure market. The necessity to modernize IT frameworks, improve operational agility, and optimize efficiency is fueling an increased demand for cloud infrastructure services.

- The emergence and ascent of edge computing, a paradigm emphasizing decentralized data processing, necessitate a robust and scalable cloud infrastructure. Cloud services play a pivotal role in supporting the distributed computing resources integral to the tenets of edge computing.

- The relentless surge in data creation across corporate and individual spheres underscores the imperative for scalable and efficient storage solutions. Cloud infrastructure providers, with their diverse storage options, are positioned to meet the burgeoning demands for adept data storage and management.

- The continual strides in technology, marked by the evolution of cutting-edge virtualization methodologies, software-defined networking, and containerization, are steering the trajectory of cloud infrastructure. These technological innovations augment the performance, security, and adaptability of cloud services.

- Leading cloud service providers, exemplified by the expansive footprints of Amazon Web Services, Microsoft Azure, and Google Cloud, persist in broadening their global presence. The establishment of data centers in novel regions facilitates the provision of low-latency services and compliance with data sovereignty regulations, thereby intensifying the dynamic growth of the cloud infrastructure market.

Major Key Trends in Cloud Infrastructure Market

- Hybrid and Multi-Cloud Adoption: Organizations are increasingly implementing hybrid and multi-cloud strategies to enhance performance, boost flexibility, and comply with regional regulations, decreasing dependence on a single cloud provider.

- Emphasis on Sustainability: Cloud providers are pledging to environmentally friendly practices, such as utilizing renewable energy and energy-efficient data centers, aligning with broader climate objectives in Europe and meeting client expectations for green computing.

- Integration of AI and Edge Computing: The merging of AI and edge computing is facilitating real-time data processing closer to the sources, improving performance and supporting applications in sectors like manufacturing, healthcare, and telecommunications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 837.97 Billion |

| Market Size in 2025 | USD 294.99 Billion |

| Market Size in 2024 | USD 262.68 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 12.30% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in data generation and storage needs

The exponential surge in data generation and the accompanying need for efficient storage solutions have become primary drivers for the escalating demand in the cloud infrastructure market. In 2024, global data creation reached 97 zettabytes, according to Statista, and is projected to soar to 181 zettabytes by 2025. With businesses and individuals producing an unprecedented volume of data, traditional on-premises storage solutions often prove inadequate in terms of scalability and flexibility. Cloud infrastructure offers a dynamic and scalable alternative, allowing organizations to effortlessly scale their storage capacity based on evolving data requirements.

Moreover, the demand for real-time data access and analytics further intensifies the reliance on cloud storage solutions. According to IDC, spending on cloud infrastructure for data storage grew by 23% in 2024. As industries across the spectrum, from healthcare to finance, experience a data deluge, cloud infrastructure providers present a compelling solution for secure, accessible, and cost-effective data storage. This surge in data generation and the subsequent need for robust storage capabilities underscore the indispensable role of cloud infrastructure in meeting the evolving and expanding demands of the digital era.

Opportunity

The increasing adoption of hybrid and multi-cloud strategies presents lucrative opportunities in the cloud infrastructure market. Businesses are recognizing the benefits of combining on-premises infrastructure with public and private cloud services, providing flexibility and optimization of resources. According to a report by Gartner in 2024, 75% of organizations are expected to adopt a hybrid cloud model by 2024, recognizing the benefits of combining on-premises infrastructure with public and private cloud services. This approach provides flexibility and optimization of resources. Hybrid cloud solutions allow organizations to leverage the scalability and cost-effectiveness of public clouds while maintaining control over sensitive data through private clouds. Moreover, the rise of multi-cloud architectures, where enterprises use services from multiple cloud providers, fosters healthy competition and innovation.

This approach mitigates vendor lock-in risks and enables businesses to select the best-suited services from different providers. The diversity in cloud service offerings encourages interoperability and customization, allowing organizations to tailor their infrastructure solutions to specific needs. As a result, the growing trend of hybrid and multi-cloud adoption opens up extensive opportunities for cloud infrastructure providers to offer diverse and integrated solutions to meet the evolving demands of modern businesses.

Type Insights

The hardware segment had the highest market share of 56% in 2024. Within the cloud infrastructure market, the hardware segment refers to the tangible elements like servers, storage devices, and networking equipment. Ongoing trends in cloud hardware center around boosting performance, scalability, and energy efficiency. According to IDC, the global market for cloud infrastructure hardware is expected to reach $99 billion by 2025, driven by increasing data center investments and the rise of cloud service providers. Notably, advancements like hyper-converged infrastructure (HCI) are becoming increasingly popular for their streamlined integration of hardware components, enhancing overall agility. Furthermore, a noteworthy shift involves the adoption of specialized hardware, like AI accelerators, addressing the diverse needs of cloud services and reflecting the market's commitment to staying at the forefront of technological innovation.

Type Insights

The hardware segment had the highest market share of 56% in 2024. Within the cloud infrastructure market, the hardware segment refers to the tangible elements like servers, storage devices, and networking equipment. Ongoing trends in cloud hardware center around boosting performance, scalability, and energy efficiency. Notably, advancements like hyper-converged infrastructure (HCI) are becoming increasingly popular for their streamlined integration of hardware components, enhancing overall agility. Furthermore, a noteworthy shift involves the adoption of specialized hardware, like AI accelerators, addressing the diverse needs of cloud services and reflecting the market's commitment to staying at the forefront of technological innovation.

The services segment is anticipated to expand at a significant CAGR of 13.4% during the projected period. In cloud infrastructure, the services segment encompasses vital elements for deploying and overseeing cloud resources. This involves Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). IaaS provides basic computing resources, PaaS offers a development platform, and SaaS delivers software applications online. Current trends in this sector include the rise of serverless computing, a heightened emphasis on containerization services like Kubernetes, and an increased demand for industry-specific cloud services.

End-use Insights

The IT & telecommunications segment held a 28% revenue share in 2024. The IT and telecommunications segment in the cloud infrastructure market refers to the utilization of cloud services by businesses in the information technology and telecommunications sectors. This encompasses cloud-based storage, computing, and networking solutions to enhance operational efficiency and scalability. A prominent trend in this segment involves the increasing reliance on hybrid and multi-cloud architectures to optimize performance, manage workloads effectively, and support digital transformation initiatives. The flexibility and cost-effectiveness of cloud infrastructure services make them integral to the evolving needs of IT and telecommunications companies.

The healthcare segment is anticipated to expand fastest over the projected period. In the cloud infrastructure market, the healthcare segment refers to the utilization of cloud services and infrastructure by healthcare organizations to enhance data management, storage, and accessibility. The trend in healthcare cloud adoption is driven by the need for efficient data sharing, secure storage, and advanced analytics. Cloud solutions in healthcare enable collaboration among medical professionals, facilitate seamless access to patient records, and support innovative applications like telemedicine, contributing to improved patient care and operational efficiency in the healthcare industry.

Cloud Infrastructure Market Companies

- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Cloud

- Alibaba Cloud

- Oracle Cloud

- VMware

- Cisco Systems

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Red Hat

- Salesforce

- SAP

- Intel Corporation

- NetApp

Recent Developments

- In February 2024, Microsoft declared a USD 3.57 billion investment aimed at expanding its cloud and AI infrastructure in Germany. This initiative encompasses doubling data center capacity and providing digital skills training to over 1.2 million people, reinforcing Germany's status as a frontrunner in cloud technology and digital transformation.

- In October 2023, Oracle has unveiled its EU Sovereign Cloud to meet data residency and compliance needs within the European Union. This initiative seeks to offer customers cloud services that comply with EU regulations, thus enhancing data security and sovereignty.

- In June 2024, Persistent Systems formed a strategic alliance with Google Cloud to expedite digital transformation across various regions, including Europe. This partnership aims to utilize Google Cloud's AI capabilities to create customized solutions, encouraging the broader adoption of generative AI technologies across different sectors.

- In April 2023, Alibaba Cloud introduced cost-effective alternatives for its Elastic Compute Service (ECS) and Object Storage Service (OSS), aligning with the escalating demand for cloud services. The newly unveiled ECS Universal ensures comparable stability to ECS while offering up to a 40% reduction in costs. Tailored for applications like web hosting, enterprise office tools, and offline data analysis, ECS Universal addresses diverse computing needs. Additionally, Alibaba Cloud introduced the OSS Reserved Capacity (OSS-RC), enabling customers to reserve storage capacity in a specific cloud region for a year, resulting in potential savings of up to 50%.

- In November 2022, Amazon Web Services (AWS) inaugurated India's Second Infrastructure Region, enhancing options for Indian customers in workload execution, resilience, and data storage. This expansion aims to provide heightened resilience, secure data storage, and lower latency for end-users. AWS's investment of over USD 4.4 billion in the new AWS Asia Pacific (Hyderabad) region by 2030 is expected to generate more than 48,000 full-time employment opportunities annually, contributing significantly to India's economic landscape.

Segments Covered in the Report

By Type

- Hardware

- Services

By End-use

- IT & Telecom

- BFSI

- Retail & Consumer Goods

- Manufacturing

- Healthcare

- Media & Entertainment

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting