What is the Asset Management Market Size?

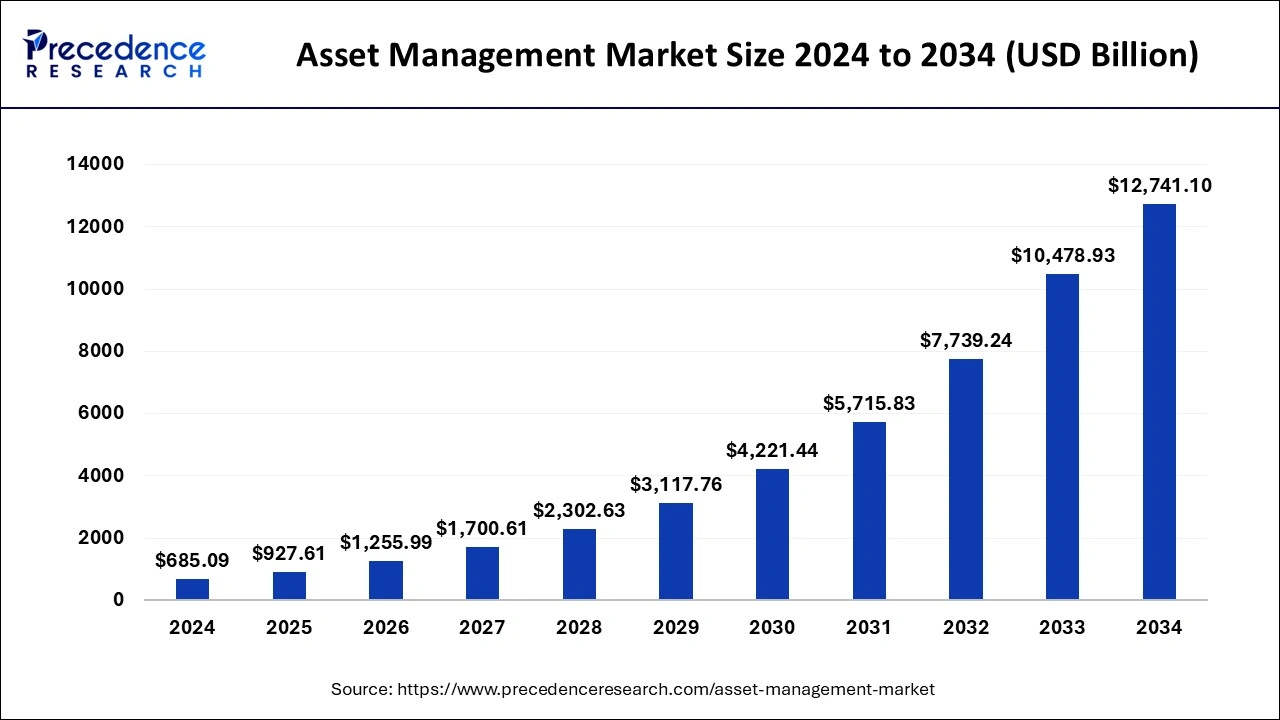

The global asset management market size is calculated at USD 927.61 billion in 2025 and is predicted to increase from USD 1,255.99 billion in 2026 to approximately USD 15,321.62 billion by 2035, expanding at a CAGR of 32.37% from 2026 to 2035.

Asset Management Market Key Takeaways

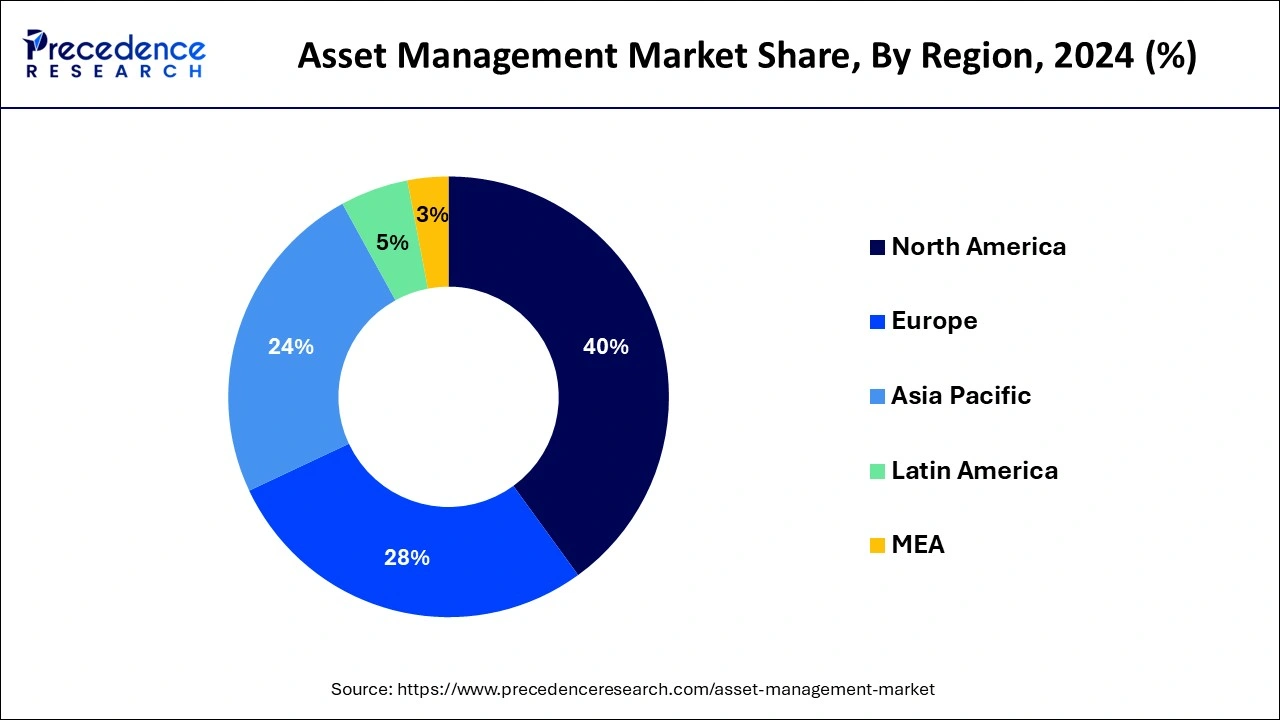

- North America dominated the market and generated more than 39.14% of the revenue share in 2025.

- By Component, the solution segment contributed more than 57% of revenue share in 2025.

- By Asset Type, the digital assets segment recorded around 25.8% revenue share in 2025.

- By Application, the aviation segment generated more than 82% of the revenue share in 2025.

Market Overview

Asset management is a professional service that involves managing financial assets on behalf of individuals, institutions, or governments. It comprises a range of investment products, including stocks, bonds, and real estate, among others, with the aim of maximizing returns while minimizing risk by customizing investment strategies to meet the client's needs.

Asset managers leverage different tools, such as market analysis, risk management techniques, and asset allocation, to manage investments. They also use various investment vehicles, such as mutual funds, exchange-traded funds (ETFs), and alternative investments, to achieve clients' objectives. A team of financial analysts and portfolio managers is responsible for monitoring clients' investments, making investment decisions, and executing trades. The asset management industry is highly competitive and regulated to ensure that asset managers offer the best service and safeguard clients' interests.

Compensation of asset managers is typically based on the level of assets under management, and fees can vary based on the level of service provided and the type of investments managed. Asset managers may offer additional financial services, including financial planning, retirement planning, and estate planning, to help clients achieve their long-term financial objectives.

Asset management is a crucial part of the financial industry, helping individuals, institutions, and governments manage their financial assets, maximize returns, and minimize risk. With investment strategies and financial planning, asset managers assist clients in achieving their financial objectives and creating long-term wealth.

How is AI Influencing the Asset Management Industry?

AI is transforming asset management by driving efficiencies, improving portfolio performance, and allowing hyper-personalized client services via machine learning and advanced data analysis. AI processes huge amounts of structured and unstructured data to gain insights and identify patterns, improving alpha generation. AI tools, like those used by firms such as Goldman Sachs, analyze complex data to forecast market issues and assess credit risk.

Asset Management Market Growth Factors

Asset management is an organized approach to managing both current and fixed assets, including the entire portfolio of infrastructure assets, with the aim of reducing the costs of acquiring, operating, maintaining, and renewing assets. Financial institutions, such as investment banks or individuals, manage clients' funds as a primary function of asset management. Asset management is preferred by various industries and organizations because it allows them to track their assets, ensure the accuracy of amortization rates, and identify and manage risks.

The global asset management market is being driven by increased demand for optimal asset utilization, the need for efficient tracking and management of assets, and a desire to minimize maintenance downtime. However, the cost and maintenance expenditures required for adopting new asset management systems can hinder the market growth.

Nevertheless, asset management presents lucrative opportunities for growth, such as increased demand for asset management solutions in developing countries and the manufacturing industry's adoption of asset management.

Asset management is crucial as it helps to optimize the life cycle of assets, from acquisition to disposal, by systematically determining the best investments to make in order to ensure portfolio growth. For instance, purchasing an expensive, high-specification stainless steel piping system in an industrial process is a good asset management decision as it minimizes overall organizational risk and ensures low maintenance costs over the system's long life.

According to a survey conducted by PWC in 2020, the SAAAME (South America, Asia, Africa, and Middle East) region is an untapped market for asset management compared to developed countries. This region's more than $59 trillion in affluent and HNWI customers is a key factor driving the adoption of asset management among consumers, making it an opportunity for asset managers to create a new pool of assets.

While 40% of asset managers are currently in developed countries, they are seeking to expand to create more wealth from untapped assets, making the SAAAME region a highlight for future growth. However, the majority of assets are still dominated in the US and Europe.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 927.61 Billion |

| Market Size in 2026 | USD 1,255.99 Billion |

| Market Size by 2035 | USD 15,321.62 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 32.37% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Asset Type, and Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rise in demand for optimum asset utilization

Organizations may seek to maximize returns on investment or increase productivity and efficiency by demanding optimal asset utilization. Asset management tools and strategies can be employed to gain a better understanding of which assets are most valuable and how they can be used most effectively. This can enable informed decisions about resource allocation and investment in new assets.

Efficient tracking and management of assets

The asset management market is also influenced by the need for effective asset tracking and management. As organizations have a higher volume and complexity of assets, having a centralized system for managing and tracking them has become more important. This helps to reduce costs related to lost or misplaced assets and enhance operational efficiency by simplifying the process of finding and utilizing the required assets.

Although the implementation of asset management systems can be expensive, the benefits of enhanced asset utilization, tracking, and maintenance can surpass these expenses. Furthermore, the rise of asset management in developing countries and industries presents promising opportunities for the asset management market to advance and flourish. In conclusion, the major market drivers indicate the increasing significance of asset management in assisting organizations to enhance their operations and investments.

Key Market Challenges

The cost associated with adopting new asset management systems

The global asset management market encounters several challenges that may impede its growth and profitability. A major obstacle is the high cost of implementing new asset management systems, which can be a significant barrier, particularly for small and medium-sized businesses that have limited budgets.

Furthermore, companies may face difficulties integrating the new asset management systems with their existing IT infrastructure. Another challenge is the maintenance costs associated with asset management systems, as they require regular upkeep to ensure they work effectively, adding to the overall cost of the system. Additionally, companies may face difficulties in locating and retaining qualified personnel who can manage and operate these systems.

Data privacy and security

The asset management industry encounters a significant challenge concerning data privacy and security. Asset management systems contain and store confidential data that organizations must safeguard from cyber-attacks and data breaches. Organizations must ensure that the sensitive data collected is well protected from unauthorized access. Furthermore, compliance with data privacy regulations such as GDPR and CCPA can be a challenging process, which may demand a considerable investment of resources.

Opportunities

Increasing demand for asset management in developing countries

One of the key growth opportunities for the asset management market lies in the increasing demand for asset management solutions in developing countries. As businesses in these regions continue to expand and grow, the importance of effective asset management becomes more pronounced. This creates an opportunity for asset management companies to expand their services and operations into these new and emerging markets.

Increasing adoption of asset management systems by the manufacturing industry

The asset management industry can take advantage of various opportunities for expansion, one of which is the growing adoption of asset management systems in the manufacturing sector. As the manufacturing industry continues to grow, it requires more efficient asset management strategies to manage its large number of assets. This provides an opportunity for asset management companies to cater to the industry's unique requirements by offering customized solutions.

Another opportunity is the use of emerging technologies such as the Internet of Things (IoT) and artificial intelligence (AI). Asset management companies can leverage these technologies to enhance the precision and efficiency of their asset tracking and management systems. Real-time tracking and monitoring of assets can be achieved using IoT sensors, while AI can be utilized to examine data and offer insights into asset performance.

Segment Insights

Component Insights

The solution segment held the largest market share in 2025, accounting for over 57% of the market revenue. Within the solution segment, there are several sub-segments, including Real-Time Location System (RTLS), barcode, mobile computer, labels, Global Positioning System (GPS), and others. The dominance of the solution segment is largely attributed to the increasing adoption of image-based barcode readers, particularly in industries such as healthcare, logistics, food and beverage, and consumer goods. These readers offer multiple code-reading abilities, long-term reliability, and the capability to read 2D codes.

On the other hand, the service segment is expected to witness a high CAGR during the forecast period. The growth of the service segment can be attributed to the increasing adoption of strategic and operational plans by organizations worldwide. These services are designed to help organizations achieve their goals by ensuring that every function works efficiently towards improving the Return on Assets (RoA) through long-term investment management strategies.

Asset Type Insights

The market was dominated by the digital segment in 2025, accounting for a revenue share of over 25.8%. To streamline business processes and decrease operational costs, companies are increasingly adopting digital solutions and services. This trend of digitalization is expected to benefit providers of digital solutions and services. Over the forecast period, the demand for digital solutions is anticipated to be driven by the increasing volumes and densities of digital assets in organizations.

The growth of the segment can be attributed to the rising e-commerce activities worldwide, which have increased the demand for in-transit solutions to track shipped goods. Additionally, transportation service providers can use in-transit management solutions to track and locate their assets in transit. As the population grows and digitalization continues, the demand for in-transit management solutions is projected to increase.

Application Insights

In 2025, the aviation sector held a dominant position in the market, accounting for more than 82% of the revenue share. The growth of this segment can be attributed to the increase in air passenger traffic and the introduction of new aircraft models. Effective management of interdependent assets is crucial for the aviation industry to ensure long-term profitability and reliability. Predictive and prescriptive maintenance solutions, GR-aware software suites, and tracking solutions are some of the popular aviation management solutions.

Over the forecast period, the infrastructure segment is expected to exhibit a significant CAGR. Infrastructure management solutions and services can reduce procurement and maintenance costs, leading to increased demand for such solutions.

Regional Insights

What is the U.S. Asset Management Market Size?

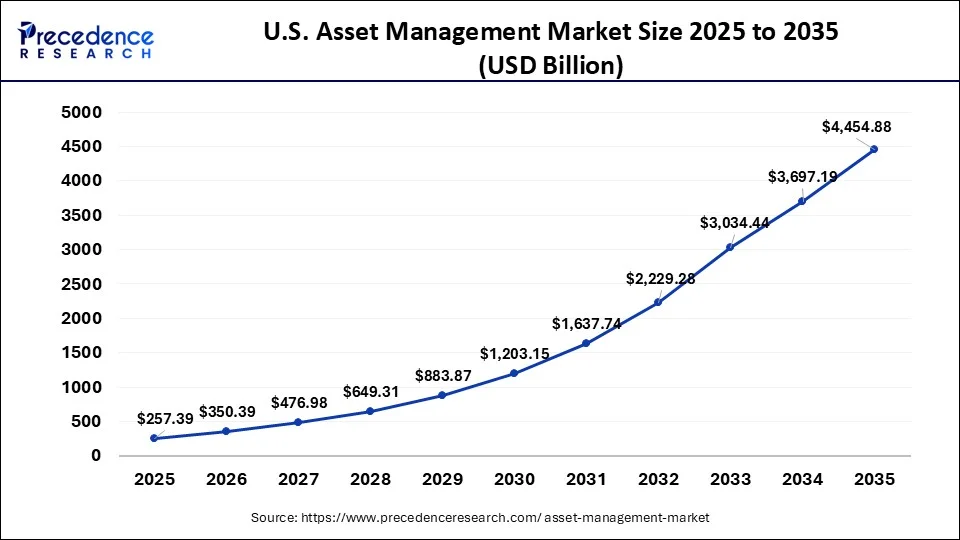

The U.S. asset management market size was exhibited at USD 257.39 billion in 2025 and is projected to be worth around USD 4,454.88 billion by 2035, growing at a CAGR of 32.99% from 2026 to 2035.

The asset management market can be regionally analyzed into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. In North America, the market is driven by the presence of major market players and the early adoption of advanced technologies. The region's well-established infrastructure and regulatory framework support asset management growth.

Expansion of Private Equity and Pension Funds in North America

North America is expected to grow at the fastest CAGR throughout the forecast period. It is driven by a search for higher, long-term returns to meet rising retirement liabilities, portfolio diversification to hedge against market volatility, and the demand for greater capital appreciation than conventional stocks and bonds offer.

The demand for digital solutions and services drives the asset management market in Europe. The region is also expanding its services and infrastructure to meet various industries' growing needs. The Asia Pacific region is expected to experience significant growth in the asset management market, driven by the increasing demand for effective asset management solutions in developing countries like China and India.

Digital Transformation in the Asset Management Market Across Europe

Europe is expected to grow at a significant rate throughout the forecast period. It is driven by fee compression and the demand for data-driven, personalized investment goods; firms are adopting AI, cloud, and blockchain to reduce costs, enhance security, and stay competitive.

In Latin America and the Middle East and Africa, the growth of the asset management market can be attributed to the increasing demand for asset management solutions in various industries, such as healthcare, transportation, and oil and gas. The adoption of advanced technologies like AI, IoT, and cloud computing is also driving the asset management market growth in these regions.

Rising Institutional and Retail Investments Driving the Asia Pacific Asset Management Market

Asia Pacific dominated the asset management market in 2025. It is driven by the growth of insurance and pension funds, mainly in emerging markets. These institutions are seeking higher yields and, because of volatile local markets, are increasingly diversifying into private credit, real estate, and alternative assets.

Strategic Developments and Market Expansion Opportunities in Latin America

Latin America is expected to grow at a notable rate throughout the forecast period. As the global need for critical minerals, food, and renewable energy rises, the region is a major source for lithium and copper, along with green energy projects. The region is undergoing rapid expansion in digital adoption, with e-commerce anticipated to exceed $1 trillion by 2027. Increased internet penetration and even mobile usage are fueling a vibrant digital ecosystem.

Asset Management Market Companies

- ABB Ltd.: ABB Ltd. providings combine industrial IoT, artificial intelligence (AI), machine learning (ML), along with deep domain expertise to transition maintenance strategies from reactive to proactive and prescriptive.

- Hitachi Ltd.: Hitachi Ltd. provides comprehensive, data-driven asset management solutions that combine IoT, AI, and digital twins to improve the lifecycle, performance, and even maintenance of physical assets across industries such as energy and rail.

Other Major Key Players

- IBM Corporation

- SAP SE

- Oracle Corporation

- Infor Inc.

- CGI Group Inc.

- Siemens AG

- Schneider Electric SE

- General Electric Company

- Cisco Systems Inc.

- Johnson Controls International plc

- Rockwell Automation Inc.

- Wipro Limited

- Honeywell International Inc.

Recent Developments

- In April 2019,IBM Corporation revealed its partnership with Sund & Bælt Holding A/S to create AI-driven IoT solutions and extend its IBM Maximo offerings.

Segments Covered in the Report

By Component

- Solution

- Real-Time Location System (RTLS)

- Barcode

- Mobile Computer

- Labels

- Global Positioning System (GPS)

- Others

- Service

- Strategic Asset Management

- Operational Asset Management

- Tactical Asset Management

By Asset Type

- Digital Assets

- Returnable Transport Assets

- In-transit Assets

- Manufacturing Assets

- Personnel/ Staff

By Application

- Infrastructure Asset Management

- Transportation

- Energy Infrastructure

- Water & Waste Infrastructure

- Critical Infrastructure

- Others

- Enterprise Asset Management

- Healthcare Asset Management

- Aviation Asset Management

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting