Enterprise Asset Management Market Size and Growth 2025 to 2034

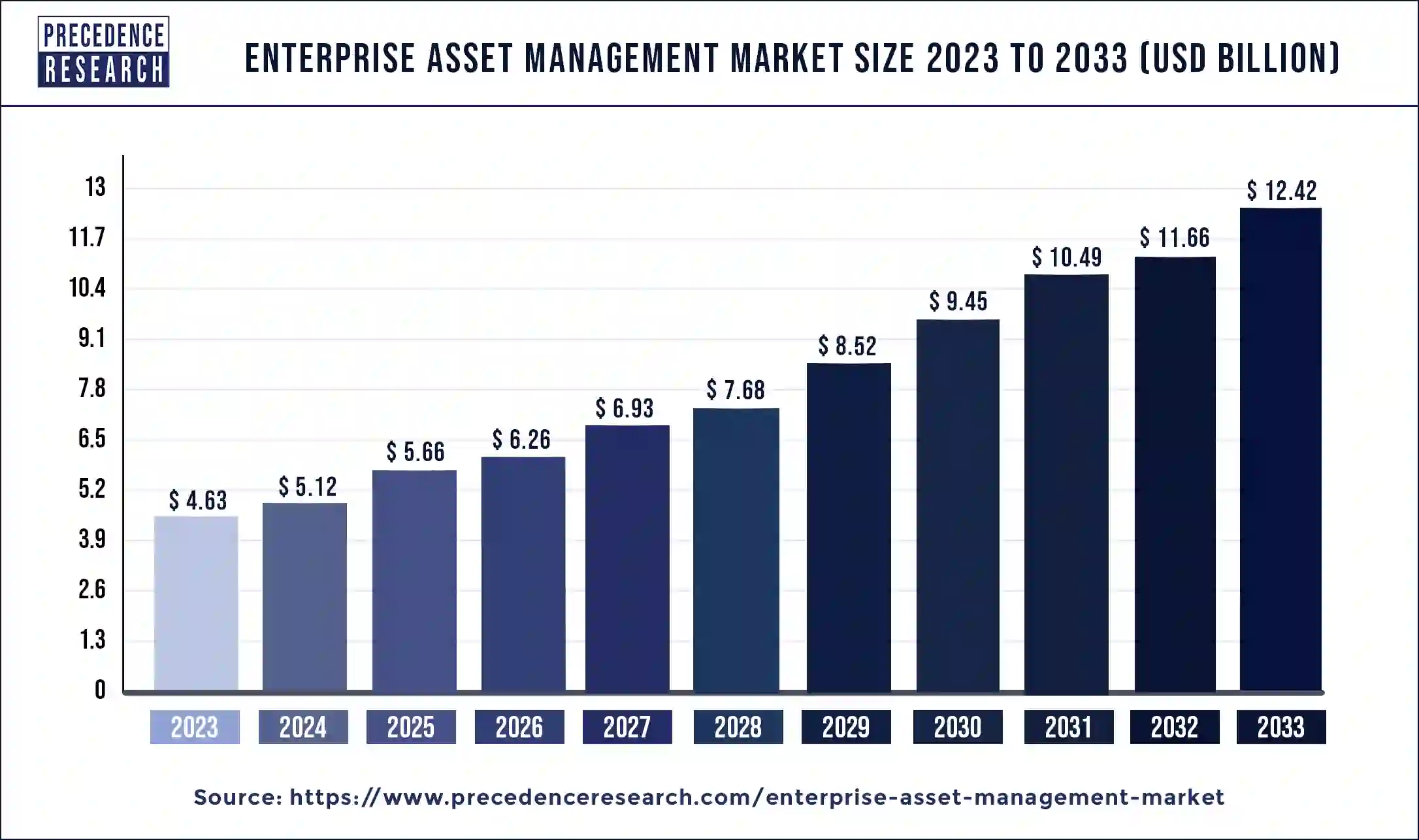

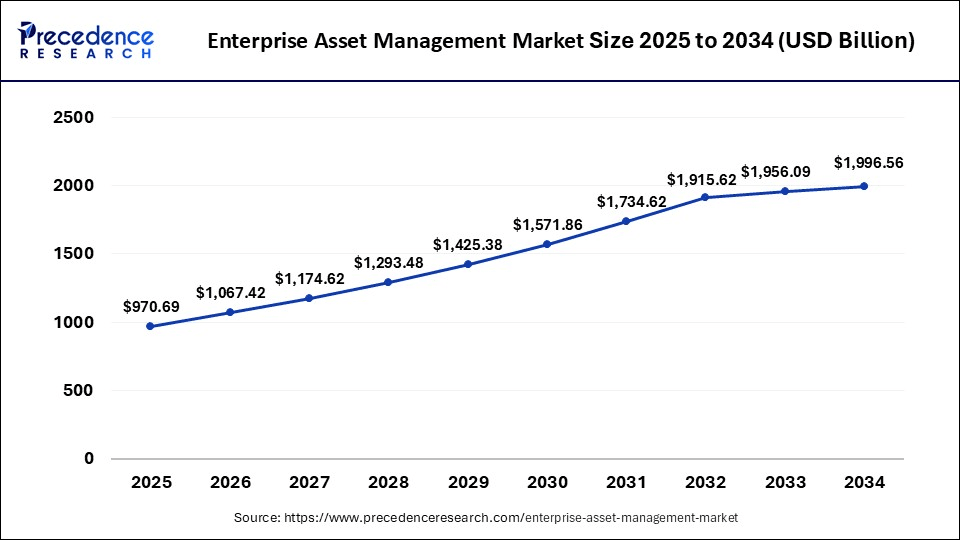

The global enterprise asset management market size was valued at USD 5.12 billion in 2024 and is expected to hit around USD 13.84 billion by 2034, poised to grow at a compound annual growth rate (CAGR) of 9.92% during the forecast period 2025 to 2034. The North America enterprise asset management market size was estimated at USD 1.50 billion in 2023.

Enterprise Asset Management Market Key Takeaways

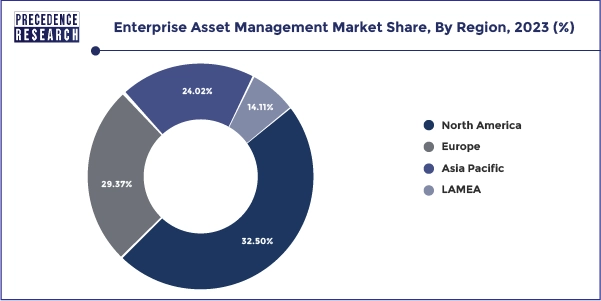

- North America has contributed the highest revenue share of 32.50% in 2024.

- By region, the Asia Pacific segment is projected to expand rapidly over the forecast period of 2025 to 2034.

- By component, the software/cloud-based segment is expected to grow with the highest CAGR in the market during the forecast period.

- By deployment, the cloud deployment segment is anticipated to grow at the fastest rate in the market between 2025 and 2034.

- By organization size, the SME (small and medium enterprise) segment is expected to grow at the fastest rate during the forecast period.

- By End user, the government segment is projected to experience the fastest rate of market growth over the forecast period.

- By application, the healthcare segment is anticipated to gain a significant share of the market over the studied period.

AI in the Market

Artificial intelligence in the Enterprise Megasystem Asset Management field creates upheaval in the birth of an endowed maintenance and operational process. AI prediction seeks to keep downtime at a minimum while guaranteeing maximum availability of the asset. And based on automated workflows, real-time data analytics further unlocks operational capacity to allow humans to focus on strategic thinking. It aids in risk management, such as regulatory compliance and institutional knowledge codification. Its ability to scale is a perfect tool for management in complex operations while providing resource optimization for smaller concerns. It likewise leads to sustainability by optimizing energy use and resource allocation. Autonomous AI agents enable coordinated operations that require minimal human intervention.

MarketOverview

Enterprise asset management is extremely beneficial for the organizations as it helps in the planning, optimization, execution and tracking of all the activities of maintenance according to the priorities, tools, materials, cost, skills and different types of information. The enterprise asset management market is expected to grow well in the coming years as it helps in improving the performance of the assets and helps in the growth of the industries or businesses.

From the time of procuring different types of physical assets like buildings, equipment, vehicles and machines till the time these assets are disposed they are trapped with the help of tools and processes that also help in their management and all of these are provided through the enterprise asset management system.

The use of these systems is expected to grow in the coming years as it is dependent on the physical infrastructure. The use of cloud-based systems and integration of big data will help in the growth of the enterprise asset management market in the coming years and it will also provide major opportunities for the growth of the business during the forecast period.

U.S. Enterprise Asset Management Market Size and Growth 2025 to 2024

The U.S. enterprise asset management market size was estimated at USD 883.33 million in 2024 and is expected to be worth around USD 1,996.56 million by 2034, poised to grow at a CAGR of 8.50% from 2025 to 2034.

On the basis of geography, the North American region has dominated the market in the past with a maximum share in terms of revenue and it is expected to grow well in the coming years. The demand for enterprise asset management solutions has grown to a great extent in the North American region due to the availability of new technologies. The use of Internet of Things in various industries has increased due to which the market is expected to grow well in the coming years. Internet of Things plays an instrumental role in deriving and monitoring data from different sites.

Apart from the North American region, the Asia Pacific region is also expected to see or significant growth in the coming years. Some of the factors that will help in the growth of the Asia Pacific regional rocket are an increase in suppliers that provide enterprise asset management, Stringent regulatory policies associated with the management of the assets, and Other favorable aids provided by the government for the enterprise asset management.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.84 Billion |

| Market Size in 2025 | USD 5.66 Billion |

| Market Size in 2024 | USD 5.12 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.92% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Ingredient Type, Packaging Format, End User, and Distribution Channel |

Enterprise Asset Management Market Growth Factors

The demand for the enterprise asset management systems is expected to grow in the coming years as the businesses seek better productivity. Enterprise asset management systems are also used on a large scale in streamline processes. It also helps in managing various facilities of the organization. The services provided by the use of the enterprise asset management cloud-based software will help in optimizing the assets of the corporates and it also helps in better decision making as it provides us an analysis of the business.

The amount of money spent on the overheads is also reduced due to the use of the enterprise asset management systems. They offer better services and support through the use of the cloud-based systems. These systems also provide monitoring tools for the performance of the organization. As there has been an increased demand for the cloud-based enterprise asset management solutions in the recent years the market is expected to grow well during the forecast period. Most of the basic operations in various organizations are enhanced due to the use of the enterprise asset management softwares. And the investments made by the organization in acquiring these softwares there's nothing as compared to the benefits associated with the use of these softwares.

- Introduction of the cloud-based models has helped the enterprise asset management market to a great extent

- Growing demand for the enterprise asset management softwares and services for improving the performance of the assets

- The introduction of advanced technologies will help in the growth of the market.

- The evolution in IIoT will also create greater demand for the enterprise asset management systems in the coming years

- Insightful information can be obtained through the use of these systems due to the integration of the data which is procured from the Internet of Things.

- The need to optimize the performance of assets and extend their lifecycle has been driving the adoption of EAM solutions by organizations.

- Being cloud offerings, they provide flexibility, scalability, and access to enterprises with distributed operations.

With IoT and advanced technologies in play, real-time monitoring and data analysis yield presents actionable insights. - The rising focus on cost reduction and resource maximization on the operations side increases their adoption across sectors.

- Increase in compliance and regulatory requirements along with demands for automated EAM to chop down on reporting and governance has escalated the demand.

What are the market drivers of the enterprise asset management market?

- Cloud based deployment and advanced technologies- The use of the Internet of Things devices in various industries and the use of artificial intelligence in the management of the assets will help in the growth of the market in the coming years. The availability of the enterprise asset management solutions that are cloud based will also help in the growth of the market in the coming years.

- Reduced maintenance costs- Predictive maintenance is one of the factors that will lead to the growth of the market as it helps in reducing the amount of money spent on the maintenance of various assets in the organization.

What are the challenges in the enterprise asset management market?

- Selecting the correct solutions- As there has been an increase in the awareness about the benefits associated with the use of enterprise asset management tools there are many vendors in the market that provide these solutions. It is a task for the organizations to select a perfect solution or a collection of various solutions in order to improve its business.

- Data security- Growing concern about data loss may lead to the intangible as well as the tangible loss of business due which the adoption of the enterprise asset management systems could be hampered.

What are the opportunities in the enterprise asset management market?

- Digitization- Various measures taken by the government of various nations has led to an increased adoption of digitization in various verticals. This is expected to be an instrumental factor in the growth of the enterprise asset management market.

- Increase in the investments made by the organizations for procuring advanced technologies- The adoption of the latest technologies in the enterprise asset management system will help the organizations to have a radical transformation, and it will also help in improving the operational processes of their business.

Enterprise Size Insights

On account of their requirements for integrated systems to administer complex operations as well as fleets and industrial assets, large enterprises dominate the market. Asset performance tracking, regulatory compliance, and downtime minimization demand their rampant adoption. EAM allows them cost savings while simultaneously improving productivity and operational visibility-based conditions.

Small and medium enterprises are growing the fastest in this Industry. These facilities are going from manual- or spreadsheet-based systems to major digital solutions. Because Cloud-based EAM Platforms enable SMEs to streamline workflows to lower operational costs and maintain centralized control of assets, their top adoption rate is vehemently promoted by rising awareness and government-based policies.

Component Insights

The software segment, particularly cloud-based EAM platforms, is expected to grow with the highest CAGR in the market during the forecast period. The rise of SaaS driven models is enabling enterprises to access advanced analytics, IoT-driven monitoring, and AI-powered predictive maintenance without heavy upfront infrastructure investments. These platforms allow for seamless integration with ERP systems and mobile devices, making asset information available in real time to distributed teams.

The increasing complexity of asset information available in real time to distributed teams. The increasing complexity of asset portfolios in industries like energy, manufacturing, and transportation has made digital asset management essential for optimizing performance and extending asset lifecycles. Furthermore, the scalability of cloud-based solutions assures that organizations of all sizes can implement and expand their EAM capabilities as operational needs evolve.

Enterprise Asset Management Market, By Component, 2022-2024 (USD Million)

| Component | 2022 | 2023 | 2024 |

| Solutions | 2,587.31 | 2,862.10 | 3,168.25 |

| Services | 1,615.22 | 1,777.49 | 1,957.37 |

Deployment Insights

The cloud deployment segment is anticipated to grow at the fastest rate in the market between 2025 and 2034. The cloud model offers significant benefits, including lower capital expenditure, faster implementation, and the ability to access EAM platforms from any location. This is particularly advantageous for companies with geographically dispersed operations or field service teams that need real time access to asset data. Cloud hosted systems also benefit from continuous updates, robust cybersecurity measures, and easy integration with IoT devices and sensors, enabling a proactive approach to maintenance. As industries increasingly embrace hybrid and remote work models, cloud based EAM solutions are becoming the preferred choice for assuring operational continuity and flexibility.

Enterprise Asset Management Market, By Deployment, 2022-2024 (USD Million)

| Deployment | 2022 | 2023 | 2024 |

| Cloud-Based | 2,440.91 | 2,705.54 | 3,000.92 |

| On-Premise | 1,761.62 | 1,934.05 | 2,124.70 |

The on-premise deployment segment accounts for the bulk of the market, being on the preferred side of those organizations who have sensitive data and strict compliance rules that want to maintain full control over their infrastructure. These types of solutions are preferred in industries where internet connectivity may be scarce and data security is under threat, letting enterprises maintain their compliance while protecting crucial asset information.

Cloud deployment is the fastest-growing segment with increasing demand for remote monitoring and centralized asset supervision. These cloud platforms allow distributed facilities to have the advantage of real-time dashboard and mobile solutions, speeding up response time and improving strategic planning. And now, more cloud adoption is backboned by the flexibility, scalability, and cost efficiency of the cloud solutions.

Organization Insights

The SME segment is expected to grow at the fastest rate during the forecast period. Historically, smaller businesses have limited access to advanced asset management systems due to high costs and complex implementation requirements. However, the proliferation of affordable, subscription based EAM solutions has lowered entry barriers, allowing SMEs to leverage the same capabilities as large enterprises.

These solutions help SMEs optimize asset usage, reduce downtime, and comply with regulatory requirements without needing large IT teams. In addition, cloud based EAM offerings tailored for SMEs often include user friendly interfaces, rapid deployment options, and built in analytics, enabling smaller companies to compete more effectively in asset intensive sectors such as manufacturing construction, and logistics.

Enterprise Asset Management Market, By Organization, 2022-2024 (USD Million)

| Organization | 2022 | 2023 | 2024 |

| Large Enterprises | 2,486.33 | 2,739.42 | 3,020.33 |

| SMEs | 1,716.20 | 1,900.18 | 2,105.28 |

Application Insights

The healthcare segment is anticipated to gain a significant share of the market over the studied period, being the fastest-growing application area. Hospitals, clinics, and other healthcare facilities operate in asset intensive environments, with equipment ranging from diagnostic machines of life support systems requiring strict compliance with safety and performance standards. EAM solutions enable healthcare providers to track maintenance schedules, manage spare parts inventory, and assure equipment uptime, all of which devices and AI I healthcare asset management is further enhancing predictive maintenance capabilities, reducing unplanned downtime, and extending the life of high value medical equipment. The sector's stringent regulatory requirements and need for cost optimization are expected to sustain strong demand for EAM solutions in the years ahead.

Enterprise Asset Management Market, By Application, 2020-2023 (USD Million)

| Applications | 2022 | 2023 | 2024 |

| Asset Lifecycle Management | 1,192.23 | 1,320.18 | 1,462.85 |

| Labor Management | 431.91 | 474.92 | 522.57 |

| Inventory Management | 602.93 | 670.96 | 747.18 |

| Predictive Maintenance | 822.50 | 906.22 | 999.15 |

| Work Order Management | 338.56 | 374.14 | 413.75 |

| Others | 814.40 | 893.18 | 980.12 |

End User Insights

On the basis of the end user the utilities and energy sector are expected to have the largest market share in the coming years. The increased add option of the enterprise asset management systems in these industries will help in the growth of the market in the coming years period this segment has dominated the market in the past. In the utilities and energy industry rapid digitalization has proved to be instrumental in the growth of the enterprise asset management systems.

Industry 4.0 is one of the recent advancements that will be helpful and the growth of the market in the coming years. In order to reduce the malfunctions of the machine the demand for enterprise asset management software is expected to grow in the coming years.

Global Enterprise Asset Management Market, By End User, 2022-2024 (USD Million)

| End User | 2022 | 2023 | 2024 |

| Manufacuring | 960.94 | 1,061.93 | 1,174.35 |

| Energy & Utilities | 763.54 | 845.47 | 936.84 |

| Transportation | 636.68 | 707.81 | 787.43 |

| Oil & Gas | 446.96 | 495.91 | 550.60 |

| Government & Defense | 411.89 | 453.36 | 499.35 |

| Healthcare | 344.64 | 378.20 | 415.31 |

| IT & Telecom | 257.65 | 282.16 | 309.23 |

| Others | 380.25 | 414.74 | 452.50 |

The manufacturing sector leads the market since EAM implementation is highly attractive for reducing maintenance costs, extending asset lifecycles, and enhancing overall production efficiency. According to the clients, real-time tracking and monitoring of machinery should be made possible by digital tools to ensure the highest uptime. By using the asset performance data in the workflows, manufacturers can reduce operational costs and be more competitive in highly demanding markets.

Government organizations are the fastest-growing segment with agencies increasingly focusing on matters of accountability, transparency, and compliance. EAM solutions replace archaic manual procedures with IT-based systems and enhance efficiency and data protection. With these measures to raise asset lives and support efficient operations, governments increasingly use EAM to meet regulatory requirements and improve public service delivery.

RecentDevelopments

- In May 2025, IFS has secured the #1 global market share in EAM for the fourth consecutive year, achieving 19.4% of the market with $500 million in 2024 revenue. The company continues to innovate by embedding industrial AI like IFS.ai into its cloud solutions, enhancing asset lifecycle automation, performance optimization, and ESG alignment.

(Source: IFS ranked #1 for EAM market share in the Gartner Market Share) - In June 2025, seven leading asset management firms, ActiveG, BPD Zenith, EAM Swiss, InterPro solutions, Lexco, Peacock Engineering, and Project have merged to form Naviam, now the world's largest and most experienced provider of IBM Maximo solutions. This consolidation aims to enhance service quality and global delivery strength.

(Source: Naviam Completes Strategic Acquisitions of ZNAPZ and Sharptree to Expand Global Maximo Capabilities )

Enterprise Asset Management Market Companies

- IBM (US)

- SAP (Germany)

- Oracle (US)

- Infor (US)

- IFS (Sweden)

- ABB (Switzerland)

- CGI (Canada)

- Rfgen Software (US)

- Assetworks (US)

- Ultimo Software Solutions (UK)

- UpKeep (US)

- Asset Panda (US)

- EZOfficeInventory (US)

- Intelligent Process Solutions (Germany)

- Maintenance Connection (US)

- Aveva (UK)

- Aptean (US)

- Emanit (US)

- EZMaintain.com (US)

- Pazo (India)

- Asset Infinity (India)

- KloudGin (US)

- Fracttal (Chile)

- InnoMaint Software (India)

- Aladinme (UAE)

- Limble (US)

- Redlist (US)

- TrackX (US)

- Cheqroom (Belgium)

- The Asset Guardian (Canada)

- GoCodes (US)

Recent Developments

- In May 2025, IFS has secured the #1 global market share in EAM for the fourth consecutive year, achieving 19.4% of the market with $500 million in 2024 revenue. The company continues to innovate by embedding industrial AI like IFS.ai into its cloud solutions, enhancing asset lifecycle automation, performance optimization, and ESG alignment.

(Source: IFS ranked #1 for EAM market share in the Gartner Market Share) - In June 2025, seven leading asset management firms, ActiveG, BPD Zenith, EAM Swiss, InterPro solutions, Lexco, peacock Engineering, and Project have merged to form Naviam, now thw world's largest and most experienced provider of IBM Maximo solutions. This consolidation aims to enhance service quality and global delivery strength.

(Source: Naviam Completes Strategic Acquisitions of ZNAPZ and Sharptree to Expand Global Maximo Capabilities )

Segments Covered in the report

By Component

- Solutions

- Asset Lifecycle Management

- Predictive Maintenance

- Work Order Management

- Labor Management

- Facility Management

- Inventory Management

- Services

- Professional Service

- Managed Service

By Application

- Asset lifecycle management

- Labor management

- Inventory management

- Predictive maintenance

- Work order management

- Others

By Organization

- Large enterprises

- Small and medium enterprises

By Deployment

- Cloud

- On premises

By End User

- Healthcare

- Energy and utilities

- Government and defense

- Automotive and transportation

- Manufacturing

- Retail

- IT and telecom

- BFSI

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting