What is the 5G Enterprise Market Size?

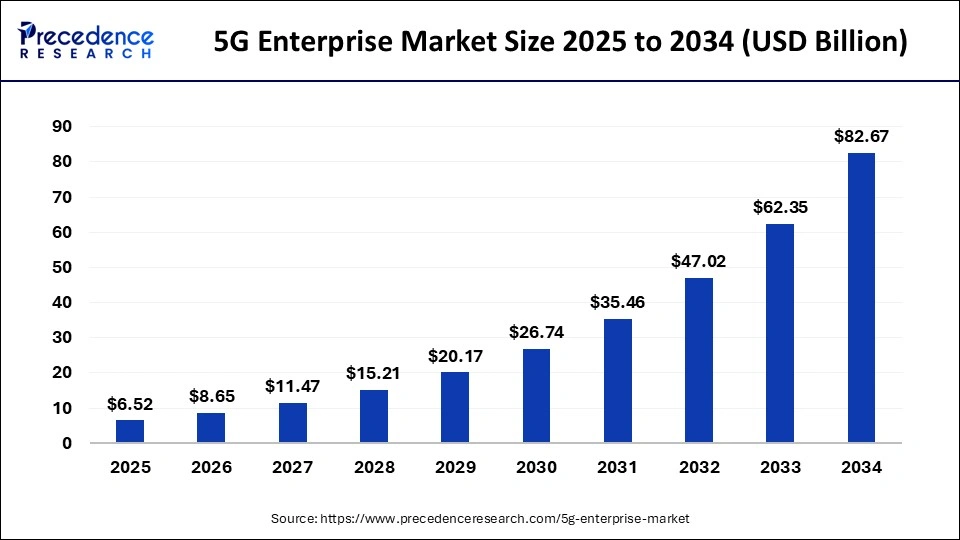

The global 5G enterprise market size is calculated at USD 6.52 billion in 2025 and is predicted to increase from USD 8.65 billion in 2026 to approximately USD 99.66 billion by 2035, expanding at a CAGR of 31.35% from 2026 to 2035.

5G Enterprise Market Key Takeaways

- By Spectrum, the licensed segment had the majority of the 5G enterprise market share in 2025.

- By Frequency, the mmWave frequency segment dominated the market with the largest market share of 60% in 2025.

- The sub-6 GHz frequency segment contributed more than 40% of revenue share in 2025.

- By Organization Size, large-scale organizations dominate the 5G enterprise market.

- Asia-Pacific is anticipated to experience the strongest growth in the 5G enterprise market during the forecast period.

Market Overview

The 5G wireless network, or 5G enterprise, is an improvement over the fourth-generation (4G) wireless network. It is accomplished by using the radio spectrum's high frequency and short-range band. Low latency and fast internet speeds are offered by 5G Enterprise. It provides more than 1Gbps of network performance, which is ten times quicker than the 4G network. With the help of the 5G enterprise technology, enterprises will be able to enable a variety of services and build up their own private wireless platform with a wide range of operational capabilities. Additionally, it makes it possible for the high-tech internet of things platform, which is crucial for the deployment of industry 4.0 and industrial automation.

How is AI Redefining the 5G Enterprise Market?

AI plays a vital role in the telecom industry. AI is being integrated into 5G enterprises to enhance network optimization and management, as well as to detect threats within 5G networks. Numerous AI providers have designed advanced platforms for analyzing 5G network data to facilitate resource allocation and deploy automation in end-user industries. Thus, the integration of AI in 5G networks redefined the overall landscape of the 5G enterprise market.

- In November 2025, Sutherland collaborated with Celona. This collaboration is aimed at launching an AI-based Private 5G network for enterprises globally.

(Source: https://www.businesswire.com )

5G Enterprise Market Growth Factors

Businesses all across the world have been severely affected by the global COVID-19 outbreak. Due to the global lockdown that forced employees of different industry verticals, the global pandemic has positively affected the adoption of 5G enterprise solutions in the industry vertical. Increased internet traffic is anticipated as a result of this. The adoption of the 5G enterprise has been delayed as a result of restrictions placed on the 5G spectrum auction due to the global shutdown.

However, communication service providers (CSPs) are investing quickly in the 5G enterprise in post-COVID-19 areas like Europe and North America, which is projected to accelerate the growth of the market internationally. Companies are concentrating on employing cutting-edge technology, such as augmented reality, virtual reality, and the internet of things, to undertake contactless operations in the manufacturing, energy and utility, and educational sectors in the post-COVID-19 environment. This is anticipated to fuel the worldwide 5G enterprise market.

The worldwide 5G enterprise market is expanding due to a number of factors, including the increased use of network slicing to offer various 5G services and the rise in smartphone and wearable device usage among all age groups. Additionally, the worldwide expansion of smart telecommunications infrastructure also propels the market. The market's expansion is hampered by the high start-ups and construction costs of 5G corporate solutions as well as security issues in 5G core networks.

In addition, increased demand for low latency connection and increased investment in mobile computing and communication solutions by several nations are predicted to open up attractive 5G corporate market opportunities.

The usage of cell phones in emerging nations has been rising steadily over the past ten years due to a variety of causes, including an increase in per capita income, cost affordability, the availability of several low-priced choices with significant capabilities, and others. Due to the COVID-19 pandemic and the expanding usage of work-from-home policies by many firms, cell phones are increasingly being used for social reasons. Many businesses and institutions are adopting smartphones, tablets, and other smart gadgets to connect with their staff members and students. As a result of the rising demand for high-speed internet and communication services, as well as for online mobile video streaming, the global market for the 5G enterprise is expected to grow.

The connected device space in the sectors that are now advancing toward the fourth industrial revolution is predicted to undergo a transformation thanks to the 5G enterprise market. Through the growth of the Internet of Things and machine-to-machine communications, Industrial Revolution 4.0 is assisting cellular connectivity across the sector.

- The private 5G network will be wirelessly connected to the machines on the assembly line, enabling connected manufacturing with M2M applications, IIoT, and robots, to name a few. Control applications for wireless technology are still in their infancy.

- Offshore oil platforms are anticipated to take the lead in yet another substantial adoption. Running a cable from the platform to the shore to provide connection on these platforms is challenging. As a result, oil platforms have been plagued by slower speeds and sporadic connectivity for a long time.

Major Key Trends in 5G Enterprise Market

- Private 5G Network Adoption: The adoption of private 5G networks is on the rise among enterprises, aiming to improve security, reliability, and customization, especially within manufacturing, logistics, and healthcare sectors, which facilitates real-time operations and decreases network latency.

- Edge Computing Integration:The combination of 5G with edge computing is revolutionizing enterprise functions by allowing for quicker data processing at the location of generation, enhancing efficiency, lessening bandwidth requirements, and enabling mission-critical applications.

- Network Slicing for Industry-Specific Solutions:Network slicing enables companies to create virtual networks with custom features. This development caters to various use cases, such as autonomous vehicles, smart factories, and remote surgeries, by providing dedicated performance levels.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.52 Billion |

| Market Size in 2026 | USD 8.65 Billion |

| Market Size by 2035 | USD 99.66 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 31.35% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Spectrum, By Frequency, By Organization Size, By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

Market Dynamics

Key Market Drivers

Developments of open-access architectures

- Additionally, the equipment suppliers have been directly serving business clients by creating open-access designs versus Radio Access Networks (RAN) and Core. In order to provide a 5G Open virtualized RAN (vRAN) Solution to the Japanese Enterprise Market, NEC Corporation (NEC) and Mavenir, a supplier of end-to-end cloud-native 4G/5G network software for Communication Service Providers (CSPs), announced their partnership in February 2020.

- Such a move is anticipated to increase local and private 5G network prospects for businesses, regional authorities, and other groups in the area. The conventional limitations of the proprietary standards and interoperability concerns may be removed by exploiting the O-RAN open interface.

Key Market Challenges

- Growth of Wi-Fi communication technology - In the present market environment, the expansion of wi-fi communication technology as the de-facto connection technology among businesses and a lack of authority in controlling the corporate network are having a negative influence on the growth of this industry.

Key Market Opportunities

- 5G is now ready to enter the transformational phase - The revolutionary phase of 5G is now poised to begin, three years after its commercial introduction. 5G-Advanced, a release update that will significantly increase mMIMO, uplink (UL) coverage, dynamics spectrum sharing (DSS), and integrated access backhaul, will be a major driver of this phase (IAB). Above all, the transformative phase of 5G-Advanced will be a tipping point for allowing new use cases and providing fresh commercial prospects in the industry. The introduction of additional features and functions is to blame for everything.

- About to exploit use case clusters to their full potential – In order to assess the prospects by use case type, or cluster, as opposed to just by industry, we have combined use cases with comparable qualities. We discovered that the market potential size for service providers is covered by nine use case clusters or almost 90% of it.

Segment Insights

Spectrum Insights

Depending on the spectrum, the licensed segment had the majority of the 5G enterprise market share in 2024, and this trend is anticipated to continue over the next several years. Numerous benefits offered by this spectrum type, including excellent connectivity quality that reduces costs when adding additional resources, strong security, and others, are credited with the segment's expansion. But in the next years, the unlicensed/shared market is anticipated to increase at the fastest rate. Due to its independent and cost-effective operation, unlicensed infrastructure is also increasingly being adopted by end users, which significantly aids in the expansion of the 5G enterprise market.

Frequency Insights

The mmWave frequency band led the total 5G enterprise market in 2024, and this trend is anticipated to continue over the course of the forecast period. since it enables a large number of users to connect to a single access point, which is advantageous in densely populated areas of big cities. Adoption of this technology accelerates the start-up of new businesses, optimizes the value of already-existing mobile and wearable resources, and reduces data costs, all of which contribute to the market's continued expansion.

However, the sub-6Ghz frequency band is anticipated to have the fastest development in order to obtain a strategic and competitive advantage over their rivals, businesses are increasingly adopting 5G enterprise solutions. Additionally, it offers a broad coverage area and permits complete network access inside of nearby locations like homes and offices, which promotes market expansion.

Organization Size Insights

Large-scale organizations now dominate the 5G enterprise market in terms of organization size, and this trend is anticipated to continue over the forecast period. The market is expanding due to both the significant investments made by big-size organizations in 5G networks and the rising demand for high-speed internet among these organizations. However, in the market in 2024, small and medium-sized businesses had the greatest growth. This expansion is attributable to a change in small and medium-sized businesses toward digitalization and the use of the internet of things in routine operations that necessitate high-speed and affordably priced internet, which fuels the global 5G enterprise market.

Industry Vertical Insights

Given that top manufacturers are already implementing AR and VR technologies in training applications and equipment maintenance, Gabler, the manufacturing sector is anticipated to dominate the 5G enterprise market throughout the projection period. A 5G infrastructure can easily provide the 100 Mbps bandwidth requirement for a fluid AR/VR experience.

Regional Insights

How Does North America Dominate the 5G Enterprise Market?

Enterprise apps that use the cloud are quite popular in North America. Since 5G enables a significantly higher internet connection, it may further improve the connectivity experience. Cloud-based solutions require internet access to operate in the hosted environment. In comparison to other areas, the region is experiencing the biggest growth in demand for cutting-edge technology including machine-to-machine communication, linked autos, andartificial intelligence. Consequently, it is predicted to present significant growth prospects for the 5G enterprise market.

Additionally, according to Ericsson, the number of 5G mobile subscribers is predicted to reach 318 million by the end of 2025 or more than 80% of all mobile subscriptions in the North American area. This might increase demand for 5G networks. Network operators in the US are investing in their networks to achieve the highest performance at the lowest cost per bit, using innovations like network function virtualization (NFV) and software-defined networking (SDN) to maximize network efficiency, in order to meet the capacity, coverage, and efficiency requirements of future 5G services.

5G-operated connected automobiles present a further potential for mobile carriers since low latency communication is increasingly essential for onboard computers in autonomous vehicles to convey their presence as well as perceive and respond to obstacles, traffic signals, and surrounding vehicles. The majority of US providers currently provide platforms for connected cars, with AT&T leading this market.

What Makes Asia Pacific the Fastest-Growing Region in the 5G Enterprise Market?

However, Asia-Pacific is anticipated to experience the strongest growth during the 5G enterprise market forecast period. This is because the region's emerging economies are experiencing rapid economic growth and the telecom industry is continuing to develop, which encourages businesses to concentrate on the deployment and implementation of 5G enterprises in order to maintain growth and boost productivity. The quick rollout of the 5G network across the nation is also being spearheaded by nations like India, China, and Japan, which propels the industry. In order to remain competitive in the market, leading companies in Asia-Pacific are also concentrating on improving their operations and raising their overall efficacy, which is anticipated to present profitable prospects for the market's growth throughout the course of the projected year.

How is the Opportunistic Rise of Europe in the 5G Enterprise Market?

Europe is observed to grow at a considerable growth rate in the upcoming period, fueled by the implementation of private 5G networks in industries such as manufacturing, logistics, and healthcare. Leading this shift are countries like Germany, the UK, and France, which are utilizing 5G to improve automation and operational effectiveness. The European Union's push for digitalization and the adoption of sustainable technology has further expedited the rollout of 5G. Nevertheless, challenges such as regulatory hurdles and the requirement for significant infrastructure investments continue to exist. Regardless of these obstacles, partnerships between telecom operators and businesses are driving innovation, establishing Europe as a major contender in the global 5G enterprise arena.

Germany

Germany is leading the charge in Europe's 5G enterprise sector, focusing heavily on the rollout of private 5G networks to bolster its strong manufacturing industry. The government's allocation of spectrum for industrial purposes has allowed firms to set up exclusive 5G networks, promoting advancements in automation and real-time data analysis. Germany's proactive strategy to incorporate 5G into industrial applications highlights its dedication to digital transformation and Industry 4.0 efforts.

What Potentiates the Latin American 5G Enterprise Market?

In Latin America, the market is primarily driven by the growing adoption of 5G networks by manufacturing companies across numerous countries, including Brazil, Argentina, Peru, and Venezuela. The rapid investment by telecom operators in expanding the 5G network, along with technological advancements in the logistics sector, is playing a vital role in shaping the market landscape. Moreover, the presence of various 5G operators, such as América Móvil, Telefónica, Antel, and Bitel, is expected to propel the growth of the market in this region.

- In September 2025, Telefónica invested around US$500. This investment is made to begin the rollout of the 5G network in Venezuela.

(Source: https://www.bnamericas.com )

What Opportunities Exist in the MEA for the 5G Enterprise Market?

The Middle East & Africa (MEA) presents significant opportunities for the market. These opportunities arise from the surging deployment of 5G technology in the oil & gas industry across several nations, including the UAE, Saudi Arabia, South Africa, and Qatar. Also, numerous government initiatives aimed at funding the SMEs for adopting digitalization, as well as the rapid adoption of private 5G networks by the healthcare sector, are positively contributing to the market. Moreover, the presence of several market players, comprising e& (Etisalat and), du, and Telkom, is expected to foster growth of the market in this region.

- In December 2025, du partnered with Nokia. This partnership is aimed at implementing a 5G network slicing solution in the UAE.

(Source: https://techafricanews.com )

5G Enterprise Market Companies

- AT&T

- Ericsson

- Huawei Technologies co. Ltd.

- Juniper Network,

- NEC Corporation

- Nokia Corporation

- Samsung

- SK Telecom,

- Verizon Communications LTD

- ZTE Corporation.

Recent Developments

- In January 2026, Quectel Wireless Solutions launched the RG600QA and RG660QB 5G modules. These 5G modules support a wide array of next-generation 5G networks used in homes and businesses.

(Source: https://www.businesswire.com ) - In August 2025, T-Mobile US launched 5G network slicing. This network is designed for prominent enterprises, including Delta Air Lines and Axis Energy Services.

(Source: https://www.rcrwireless.com ) - In May 2025, e& launched a 5G network slicing service in the UAE.

(Source: https://developingtelecoms.com ) - In December 2024,the UK's Competition and Markets Authority authorized the USD 18 billion merger of Vodafone UK and Three, resulting in the largest mobile network operator in the nation. The newly merged entity pledged to invest USD 11 billion in 5G infrastructure over the forthcoming decade, with the goal of improving 5G coverage and services for business clients.

- In January 2025, Telefónica declared the successful deployment of network slicing on its 5G+ network in Spain. This innovation allows the establishment of virtual networks customized to particular enterprise requirements, enhancing services in industries like manufacturing, healthcare, and emergency response.

- In March 2025, Belgium's Proximus Group finalized the sale of its data centers to Datacenter United for USD 144.66 million. This strategic decision enables Proximus to focus on its primary telecommunications operations, including the growth of its 5G offerings for enterprise customers.

- By the end of 2021, 20 million Germans are expected to have access to a commercial 5G network thanks to a partnership between Ericsson and Vodafone.

Segments Covered in the Report

By Spectrum

- Licensed

- Unlicensed

- Shared

By Frequency

- Sub-6Ghz

- mmWave

By Organization Size

- Small and medium-sized enterprises

- Large enterprises

By Industry Vertical

- BFSI

- Manufacturing

- Retail

- Healthcare

- Energy and Utilities

- Transportation and Logistics

- Government and Public Safety

- Media and Entertainment

- Office Buildings

- Aerospace and Defense

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting