What is Enterprise Artificial Intelligence (AI) Market Size?

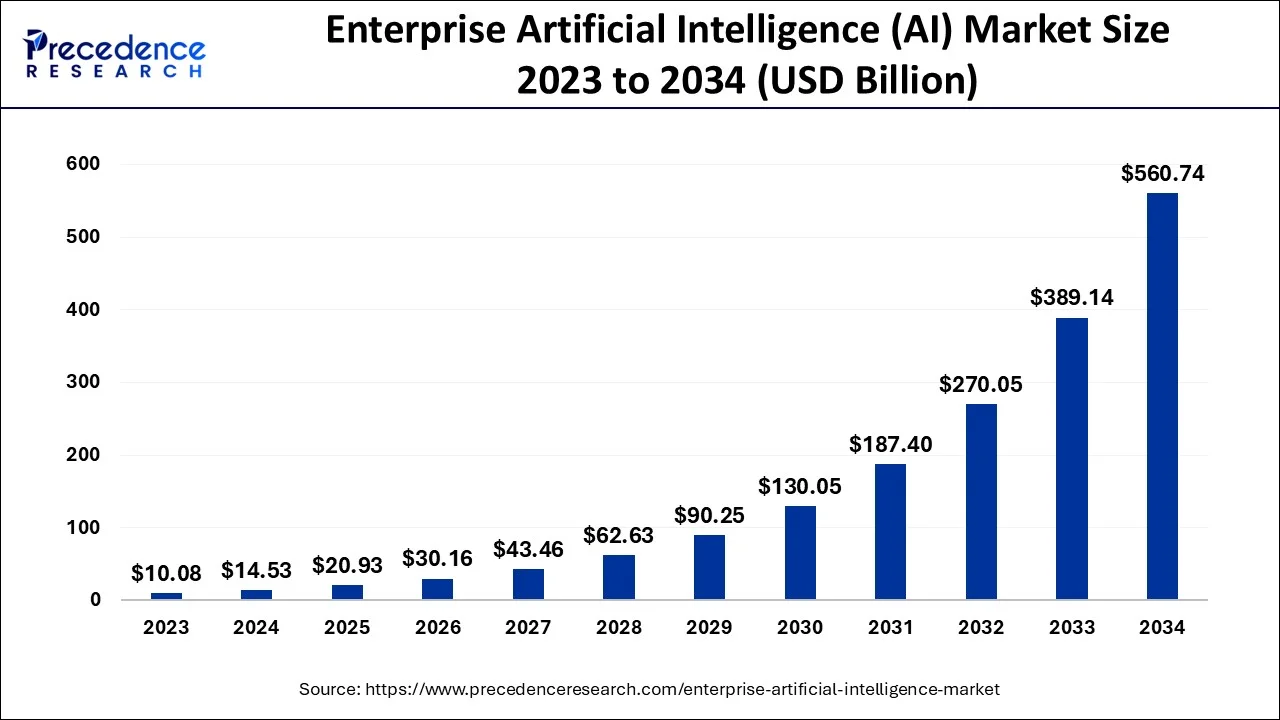

The global enterprise artificial intelligence (AI) market size is estimated at USD 20.93 billion in 2025 and is anticipated to reach around USD 560.74 billion by 2034, expanding at a CAGR of 44.10% between 2025 and 2034. Enterprise artificial intelligence (AI) is the capacity to use AI methodologies that integrate human learning, perception, and interaction abilities at a degree of complexity that will aid businesses in forecasting financial results.

Market Highlights

- By deployment type, the cloud segment accounted for around 62.9% of total revenue in 2024 and is projected to grow at the greatest CAGR of around 36.40% from 2025 to 2034.

- By technology, the natural language processing segment is predicted to increase at a CAGR of 33.40% from 2025 to 2034 and contribute to the highest revenue share of over 33.40% in 2024.

- By technology, the computer vision segment is anticipated to develop at a CAGR of 36.6% from 2025 to 2034.

- By end use, it & telecom segment is projected to increase at a CAGR of 32.40% from 2025 to 2034 and has captured USD 2.98 billion revenue share in 2024.

- By organization size, the large enterprises segment held the largest revenue share of around 64% in 2024.

- By organization size, the small and medium enterprises segment is predicted to experience the quickest CAGR of 38.6%.

Market Size and Forecast

- Market Size in 2025: USD 20.93 Billion

- Market Size in 2026: USD 30.16 Billion

- Forecasted Market Size by 2034: USD 560.74 Billion

- CAGR (2025-2034): 44.10%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

Enterprise Artificial Intelligence (AI) Market Growth Factor

Through Artificial Intelligence, computer systems are able to construct and carry out activities like speech recognition, decision-making, visual perception, and language translation that would otherwise require human intervention and assistance. Enterprise artificial intelligence (AI) is the capacity to use AI methodologies that integrate human learning, perception, and interaction abilities at a degree of complexity that will aid businesses in forecasting financial results. Enterprise artificial intelligence (AI) integration serves as a crucial organizational resource for business performance at all levels of the organization. Some businesses use artificial intelligence (AI) technology to analyze their consumers, spot fraud and other hazards and use machine learning to take preventive action.

The deployment of AL apps in businesses is rising in popularity. Businesses and businesses are rapidly seeing the benefits of integrating AI into daily operations. AI has shown to be helpful to businesses in a variety of ways that alter how businesses interact, innovate, and improve their operations. Government, retail, financial services, manufacturing, the automobile industry, and advertising are just a few of the main end-use industries that employ artificial intelligence services.

AI is capable of effectively handling tasks including natural language creation, social intelligence thinking, and problem-solving. Another reason driving the expansion of the sector is the organizations' control over data and the data-driven nature of AI technologies.

- Due to the benefits of integrating artificial intelligence (AI) into business operations, businesses and enterprises are moving toward these applications.

- Due to a spike in demand for cutting-edge AI-based corporate services and solutions during the pandemic, the market for enterprise artificial intelligence (ai) saw substantial growth.

- The need for virtual assistants, chatbots, robotics, and video conferencing technologies also grew exponentially across a variety of industries, propelling the industry's expansion.

- The main causes propelling the need for artificial intelligence in organizations are the growing usage of technology to improve customer happiness, offer better organization management, and organize data sets.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.93 Billion |

| Market Size in 2026 | USD 30.16 Billion |

| Market Size by 2034 | USD 560.74 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 44.10% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Type, End Use, Technology,Organization Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising adoption of digitalization in organization

- One of the main reasons fueling the market expansion is the end-use industries' rising digitalization. Additionally, the manufacturing industry has experienced tremendous development as a result of new technologies including edge computing, augmented and virtual reality (AR/VR), industrial robots, self-driving cars, digital manufacturing, industrial internet of things (IIOT), and digital manufacturing. These solutions aid in enhancing the personalization, adaptability, and agility of production processes. In addition, the development of trustworthy cloud computing infrastructures and advancements in dynamic AI solutions for preventative maintenance, consumer behavior research, and the identification of fraud and threats are giving market growth a significant push. Additionally, the market growth is being positively impacted by the extensive product usage among several companies for analyzing and interpreting massive volumes of data. Another growth-promoting aspect is the rising demand for AI in the healthcare sector, which is caused by its capacity to analyze enormous volumes of genetic data and provide more precise treatment and accident prevention. In addition, the market is predicted to increase as a result of continued advancements in robotics and intelligent virtual assistants, growing disposable incomes, and the deployment of several government programs supporting industrial automation.

Key Market Challenges

A small number of AI specialists

- Deep learning, machine learning, image recognition, and cognitive computing should all be known to the workforce working with AI systems. It is difficult to integrate AI technologies with the present systems and requires intensive data processing to faithfully replicate the operation of the human brain. A system can malfunction or fail due to even little errors, which has an enormous influence on the outcome and anticipated results. A data scientist or developer is needed to modify an existing ML-enabled AI service. There aren't many individuals in the workforce who have complete knowledge of AI technology because it is still in its infancy. As a result, it is projected that this constraint will have a substantial influence over the first few years of the prediction.

Key Market Opportunities

Increasing investment in artificial intelligence technologies

- The capacity of Artificial Intelligence technology to successfully assess the gathered data and anticipate judgments using essential algorithms assists in increasing efficiency. For instance, Netflix makes movie recommendations based on user viewing history. By combining technology for workflow management, brand purchase advertising trend prediction, and other things, AI has fundamentally revolutionized how organizations are handled in the current business climate. These are the primary reasons why investments in artificial intelligence technologies are increasing. To increase the efficiency of their value chains, several small startups and IT firms have started investing in the adoption of open-source AI platforms. Additionally, the expansion of low-cost, high-quality AI technologies is anticipated to support the expansion of the corporate artificial intelligence market.

Segment Insights

Deployment Type Insights

The cloud sector, which accounted for 62.9% of total revenue in 2024, is anticipated to grow at the greatest CAGR of more than 36.40% throughout the projection period. The rise might be ascribed to elements like rising technological investments and the desire to lower the price of on-premise infrastructure upkeep. Businesses may use cloud deployment to upgrade their current systems with AI-based technologies without having to spend in their capital expenditures.

Over the projection period, the on-premise category is anticipated to expand at a CAGR of 31.80%. The rise in worries over the security of data pertaining to research, account transactions, personal information, and other kinds of data can be ascribed to the expansion of the on-premise sector.

Technology Insights

Technology such as planning, scheduling, and optimization, robots, and expert systems are also included in the other sub-segment. Natural language processing (NLP) is expected to increase at a CAGR of 33.40% throughout the projection period, accounting for the biggest revenue share of over 33.40% in 2024. The rise in business adoption of virtual support services and increased investments in AI technology by several industry verticals are both factors contributing to the expansion of this market. The need for NLP technology among businesses is also being driven by the capability to produce and extract intent from a document in a legible, grammatically accurate, and stylistically natural manner. However, computer vision is predicted to develop at a CAGR of more than 36.6% over the next few years, making it the fastest-growing market.

End Use Insights

With a USD 2.98 billion revenue share in 2024, the IT & telecom category is expected to increase at a CAGR of more than 32.40% throughout the projection period. The development is linked to an increase in investments made in AI solutions by various IT and telecom firms. Additionally included in the other sub-segment are manufacturing, aerospace & military, and academics. With a USD 2.98 billion revenue share in 2024, the IT & telecom category is expected to increase at a CAGR of more than 32.40% throughout the projection period. The development is linked to an increase in investments made in AI solutions by various IT and telecom firms.

Organization Size Insights

Large firms held the biggest revenue share of 64% in 2024, and it is anticipated that they will continue to hold that position throughout the projection period. This market's expansion may be attributable to factors including the growing need for productivity improvements, infrastructure cost savings, and an increase in flexibility and agility through the elimination of duplicate jobs.

Over the projection period, the small and medium businesses category is anticipated to experience the quickest CAGR of 38.6%. The surge in small and medium-sized businesses use of AI to speed up laborious tasks, boost decision-making, and increase scalability, productivity, and cost-efficiency is credited with the segment's expansion.

Regional Insights

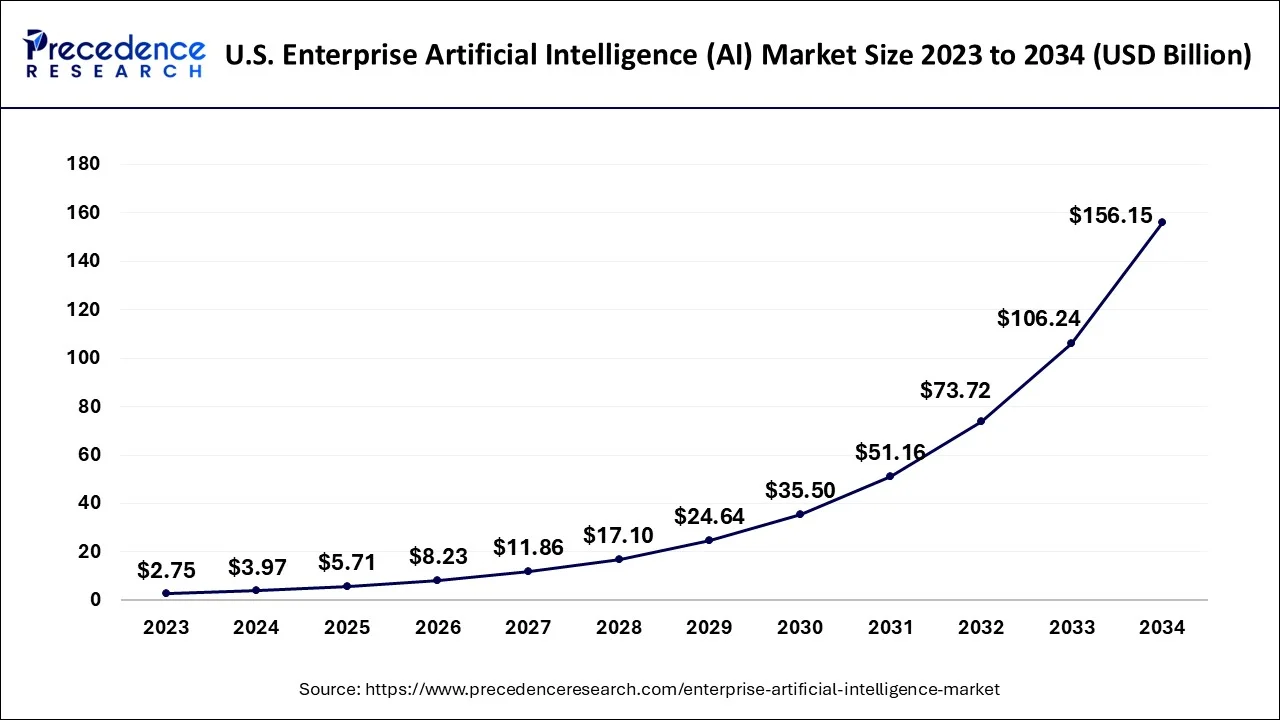

U.S. Enterprise Artificial Intelligence (AI) Market Size and Growth 2025 to 2034

The U.S. enterprise artificial intelligence (AI) market size accounted for USD 5.71 billion in 2025 and is expected to be worth around USD 156.15 billion by 2034, growing at a CAGR of 44.37% between 2025 and 2034.

North America, which accounted for 38.50% of global revenue in 2024, is expected to grow at a CAGR of more than 33.0% over the projected period. The existence of leading companies that develop AI solutions and services, technical infrastructure facilities, and the significant number of end users using data management devices are all factors that are driving the market in the region.

For instance, as part of a goal to expand leadership in artificial intelligence, the president unveiled the American AI Initiative in February 2019. Additionally, as part of these programs, federal authorities have established criteria for the development and deployment of AI-based systems in the real world across a variety of industrial sectors. During the projection period, Asia-Pacific is anticipated to experience the quickest CAGR of 36.60%. The usage of AI is growing, and data management systems are being installed. These developments address problems with privacy and security, teamwork, and the setting of moral standards for businesses. The main growth drivers are the development of AI technology, rising government investment spending, and the adoption of cutting-edge technologies across many industries.

For instance, the Asia Pacific Artificial Intelligence Association (AAIA), located in Hong Kong, was founded in 2021 by 663 academics from across the world. Its major goal is to support scientists working in the fields of AI and other related disciplines. Through academic research and interactions, the group seeks to advance AI development and application.

Enterprise Artificial Intelligence (AI) Market Companis

- Amazon Web Services, Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Intel Corporation

- Alphabet Inc.

- SAP SE

- C3.ai, Inc.

- DataRobot, Inc.

- Hewlett Packard Enterprise Development LP

- Wipro Limited

- NVidia Corporation

Recent Developments

- A strategic relationship between Kyndryl and Google Cloud was announced in December 2021. As a result, the service provider will provide a number of new digital transformation services with a focus on data analytics, machine learning, and AI. Kyndryl wants to use Google Cloud to grow its managed SAP services, create a newer edge and data-centric apps, and assist its biggest financial clients with hastening their cloud migrations.

- The integration of H2O AI Hybrid Cloud, the business's cutting-edge AI platform, with Teradata's multi-cloud data platform Vantage was announced in October 2021 by Teradata, an enterprise analytics company with a linked multi-cloud data platform. Customers of Teradata and H2O.ai can now rapidly and simply create, implement, and run AI solutions that address business issues and increase company value thanks to the connection.

Segment Covered in the Report

By Deployment Type

- Cloud

- On-premises

By Technology

- Natural Language Processing (NLP)

- Machine Learning

- Computer Vision

- Speech Recognition

- Others

By Organization Size

- Large Enterprises

- Small And Medium Enterprises

By End Use

- Media & Advertising

- Retail

- BFSI

- IT & Telecom

- Healthcare

- Automotive & Transportation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting