Enterprise Mobility Market Size and Forecast 2025 to 2034

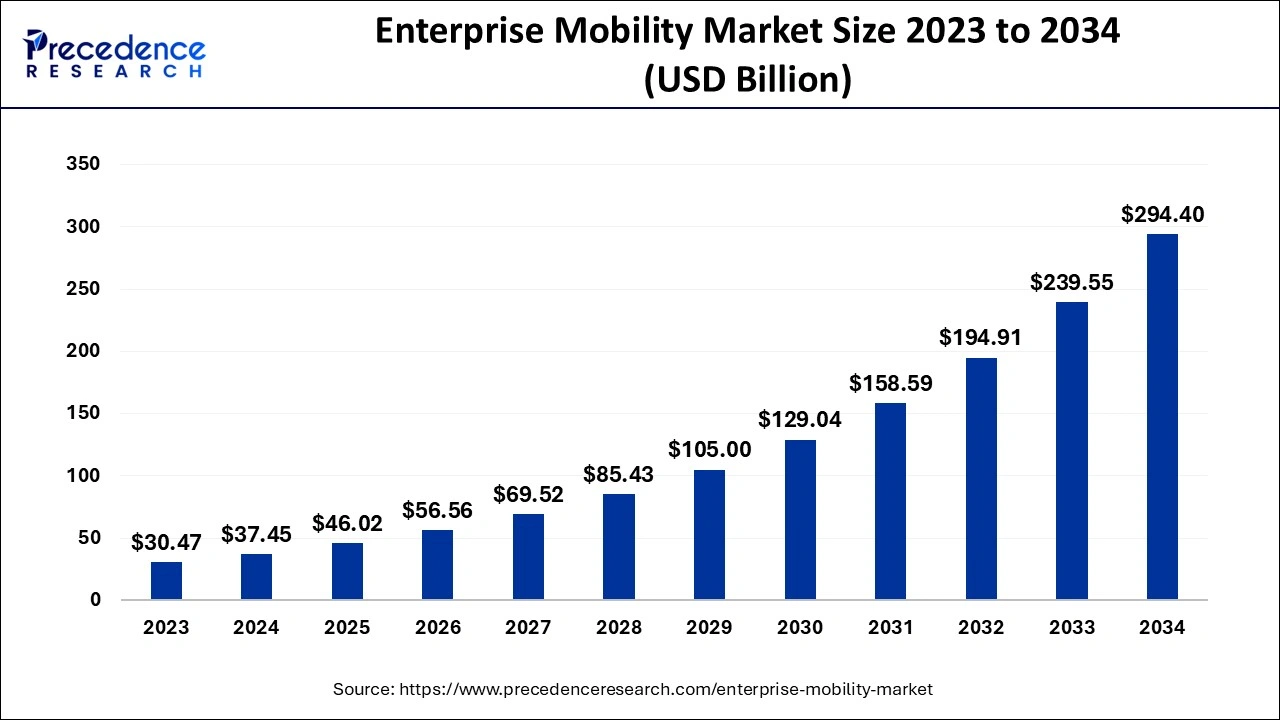

The global enterprise mobility market size was estimated at USD 37.45 billion in 2024 and is anticipated to reach around USD 294.40 billion by 2034, expanding at a CAGR of 22.90% from 2025 to 2034.

Enterprise Mobility Market Key Takeaways

- By enterprise size, the large enterprises segment has captured a revenue share of around 61% in 2024.

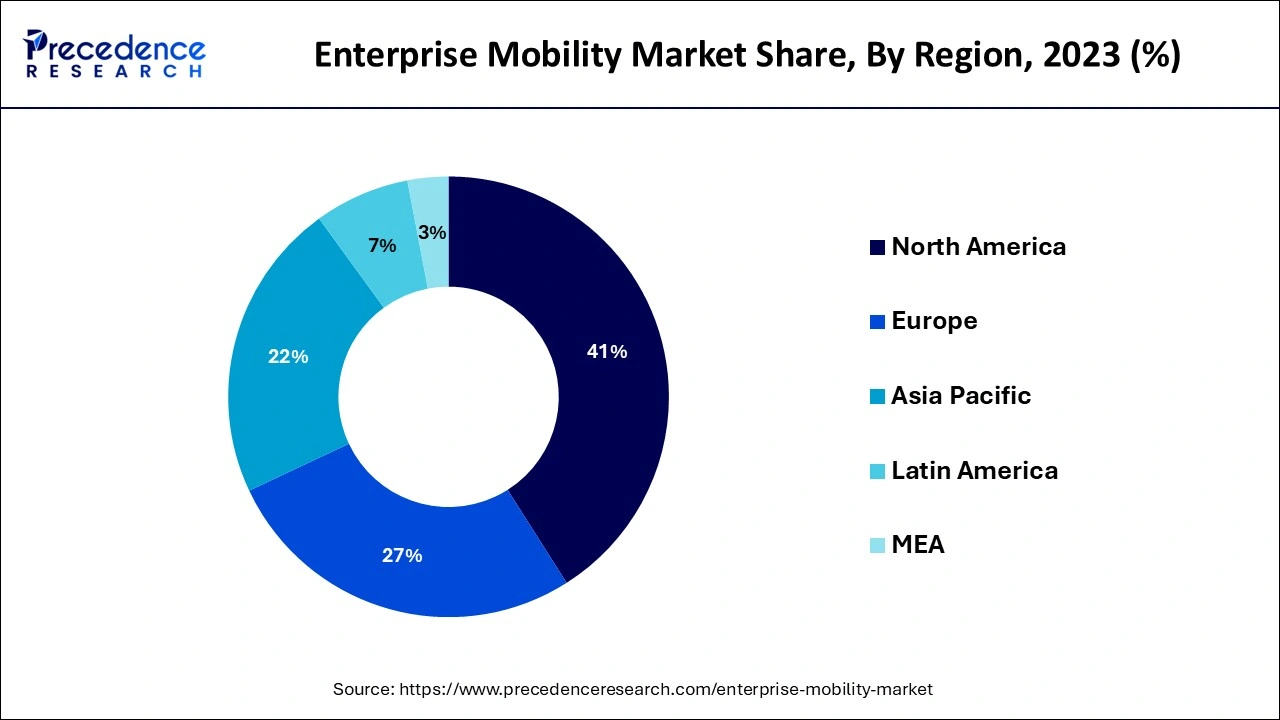

- North America has captured 41% revenue share in 2024.

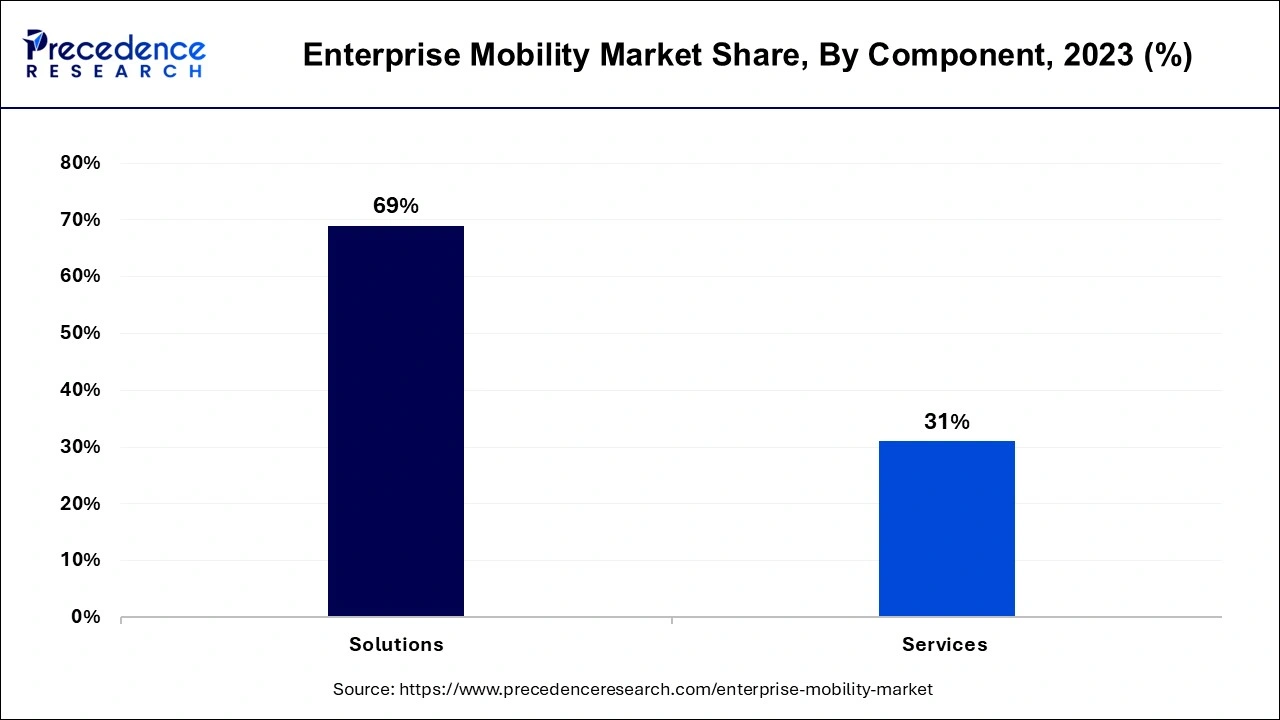

- By component, the solution segment generated a 69% revenue share in 2024.

- By device type, the laptop segment contributed 46% of revenue share in 2024.

- By deployment mode, the on-premise segment has generated a 54% market share in 2024.

U.S. Enterprise Mobility Market Size and Growth 2025 to 2034

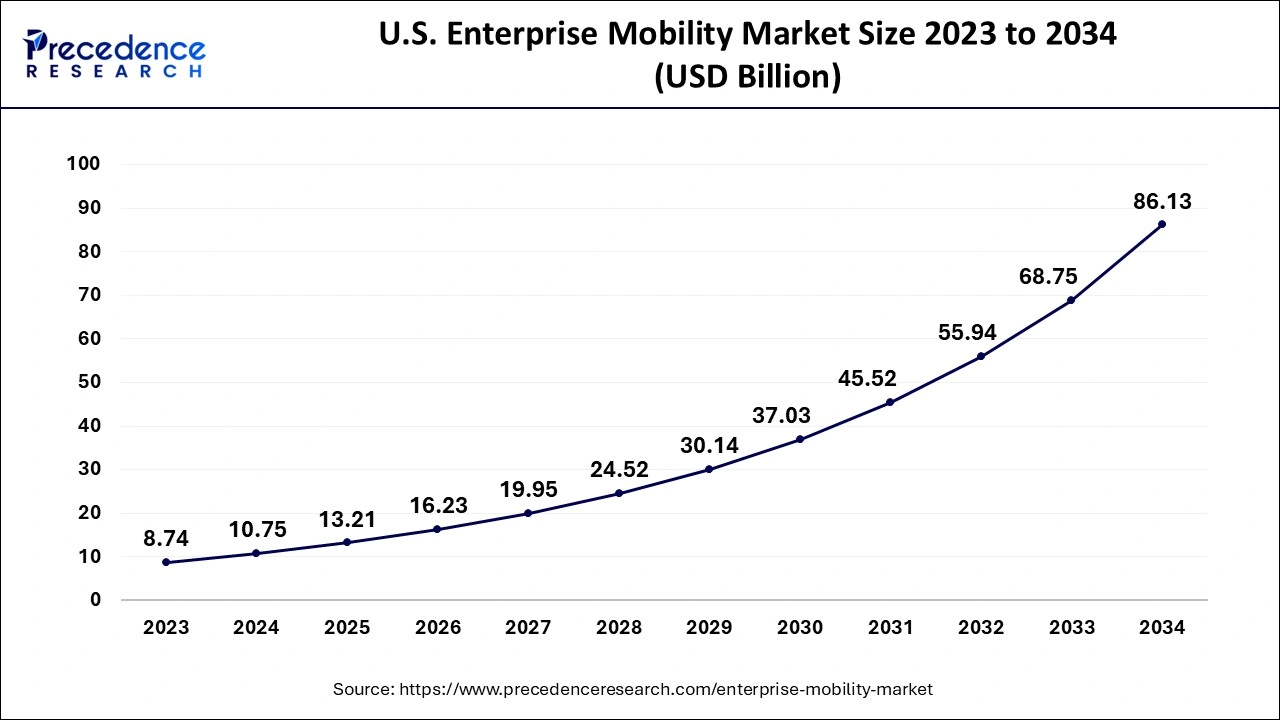

The U.S. enterprise mobility market size was evaluated at USD 10.75 billion in 2024 and is predicted to be worth around USD 86.13 billion by 2034, rising at a CAGR of 23.13% from 2025 to 2034.

North America dominated the enterprise mobility market in 2024. The U.S. dominated the enterprise mobility market in North America region. The growth of North America enterprise mobility market is attributed to the existence of key market players in the region. Due to the fierce rivalry in the North American market, many market players aim for bigger sales and business expansions. To keep up with the latest technologies in the market, North American businesses concentrate on innovation. Verticals such as healthcare, retail, and life sciences in this region use enterprise mobility solutions for a variety of reasons, including more efficient day-to-day transaction management in the banking and financial services vertical, enhanced supply chain management, and improved ability of healthcare machines to track patient health.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the enterprise mobility market in Europe region. The UK is Europe's largest market for workplace mobility management. The country's key source of demand for mobility solutions is the high rate of adoption of these solutions in the banking, retail, manufacturing, and healthcare sectors. With the expanding use of big data analytics in the country's healthcare ecosystem, the healthcare business has a large potential for analytics. Over the projection period, this is expected to help enterprise mobility flourish in the country. Furthermore, prediction aids hospitals in lowering provider-payer expenses. The healthcare sector, with the help of enterprise mobility, ensures the productivity of doctors and other health personnel, resulting in improved clinical outcomes.

Asia Pacific is observed to grow at a considerable growth rate in the upcoming period, propelled by swift digital transformation, greater adoption of cloud-based services, and the widespread use of mobile devices across various sectors. Countries such as China, India, and Japan are making significant investments in digital infrastructure, which is facilitating the deployment of enterprise mobility solutions. The region's varied workforce alongside the growing trend of remote work has further intensified the need for mobile device management and security solutions. Supportive government initiatives and the rollout of 5G networks are also improving connectivity, enabling smooth mobile operations. Together, these elements position the Asia Pacific region as a vital player in the global enterprise mobility arena.

India

India is becoming a prominent market for enterprise mobility, driven by its vast and technologically adept workforce, rising smartphone usage, and the increasing trend of remote work. Organizations are implementing Bring Your Own Device (BYOD) policies and investing in mobile device management solutions to boost productivity and maintain data security. The government's Digital India initiative and the growth of 5G infrastructure further promote the adoption of enterprise mobility solutions across different sectors.

Enterprise Mobility Market Growth Factors

The growing mobile workforce and enterprise adoption of Bring Your Own Devices initiatives to improve worker productivity, permitting employees to work from anyplace, at any time, and admittance corporate information on the go, has surged the demand for enterprise mobility solutions. Furthermore, the rise of new mobile devices on the market inspires regions to connect mobile device management solutions. Security solutions are being developed by key companies in the corporate mobility market to deliver a similar or greater degree of knowledge to the market. In addition, to expand their products and market reach, competitors in the business mobility market are relying on inorganic growth tactics such as strategic alliances and mergers and acquisitions with technology partners.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 37.45 Billion |

| Market Size in 2025 | USD 46.02 Billion |

| Market Size by 2034 | USD 294.40 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 22.90% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Organization Size, Device Type, Deployment Modes, Application, and Geography |

Component Insights

The solutions segment dominated the enterprise mobility market in 2024. Enterprise mobility solutions are being used by businesses to improve customer acquisition, retention, customer experience, and profitability. To increase productivity and ensure business continuity, businesses must handle their data efficiently and effectively. The market players have been pushed to implement corporate mobility solutions to help information technology teams simplify and manage their decision-making process due to the abundance of data that amounts to big data. Enterprise mobility solutions allow for the analysis of massive amounts of social media and sensor-based data in order to discover new insights about customer, product, and operational relationships and display them in an easy-to-understand format.

The services segment is the fastest-growing segment of the enterprise mobility market in 2022. Enterprise mobility helps organizations and clients in terms of consulting, support and maintenance, and deployment and integration. These services help organizations to save time and money. Thus, this segment is expected to grow at a rapid pace.

Deployment Modes Insights

The cloud segment dominated the enterprise mobility market in 2024. The cloud is predicted to grow at a faster rate than the rest of the deployment segment over the projection period. Users can remotely access enterprise mobility solutions through the internet with cloud-based solutions that leverage the Software-as-a-Service concept. Enterprise mobility solutions are given through the internet under this deployment style. Flexibility, affordability, scalability, operational efficiency, and negligible expenditures are some of the benefits of using cloud-based enterprise mobility solutions.

The on-premises segment is the fastest growing segment of the enterprise mobility market in 2020. Lack of control over applications, tight government rules, and private content are some of the drawbacks of cloud-based enterprise mobility solutions. Thus, these limitations are driving the growth of on-premises enterprise mobility segment.

Application Insights

The BFSI segment dominated the enterprise mobility market in 2024. For secure data and regulatory compliance in their financial exchanges, banks and allies are pivoting to allow Bring Your Own Device and need enterprise mobility. The emergence of numerous operating systems, such as macOS and Windows 10, as well as devices and the internet of things, has expanded the mobile hardware context, allowing businesses to focus on enterprise mobility. In addition, the banking industry currently lacks a robust system for managing overall device inventory and tracking whether devices are online or offline. Banks must maintain track of any mobile devices used by their salespeople in the field and guarantee that they are not being misused.

The retail and ecommerce segment is the fastest growing segment of the enterprise mobility market in 2021. The retail industry generates massive volumes of data through numerous channel modalities such as social media, blogs, and applications. Despite the fact that it contains significant information, much of this unstructured data is useless. The retail industry entered the digital age with the implementation of e-commerce, giving retailers the ability to collect more information on their customers. Enterprise mobility is being used by leading retailers in retail services to improve user experience and shop performance.

Enterprise Mobility Market Top Companies

- Amtel Inc

- Blackberry Limited

- Citrix Systems Inc

- IBM Corporation

- Infosys Ltd

- Microsoft Corporation

- SAP SE

- Sophos Ltd

- Soti Inc

- Vmware Inc

Recent Developments

- In November 2023, Broadcom Inc. announced its acquisition of VMware, which will enhance services to update and optimize edge and cloud environments, including VMware Tanzu to expedite application distribution, Advanced Security services, and Application Networking, as well as VMware Software-Defined Edge for Telco and creative edges.

- In October 2023, Deloitte revealed its intention to significantly expand its practices for the SAP Business Technology Platform with Generative AI to provide solutions and services that focus on outcomes and customer value. These applications and productivity tools are centered on proprietary functional and industry content, incorporating Deloitte's Trustworthy AI™ framework to address Artificial Intelligence (AI) risks, including hallucinations, and to bolster consumer confidence and trust.

- In August 2023, Siemens AG announced a partnership with Heliox to service e-truck and e-bus fleets as well as traveler vehicles. This partnership enhances the value provided to the rapidly growing eMobility charging sector, particularly in North America and Europe, while also strengthening expertise in power electronics.

- In June 2020, IBM will launch Watson Works to address the challenges of returning to work. Watson Works is a collection of Watson Artificial Intelligence models and applications that can help businesses with various aspects of the COVID-19 return-to-work problem.

- BlackBerry Spark Suites, which comprise the BlackBerry Spark UEM Express Suite, BlackBerry Spark UES Suite, BlackBerry Spark UEM Suite, and BlackBerry Spark Suite, were launched in May 2020.

- Symantec Corp. declared amount of exceptional security improvements as well as the availability of CASB, SEP, and WSS integrations with SEP Mobile in January 2019, significantly increasing the value proposition for Symantec customers by protecting mobile users and devices from a broader range of mobile use cases than any other single vendor.

- VMware announced new features for its industry-leading Workspace ONE Platform in August 2019. Information technology personnel may use the new modern management, security, and multi-cloud VDI advancements to intelligently manage and safeguard access to any app, on any cloud.

Segments Covered in the Report

By Component

- Solutions

- MDM

- MAM

- MCM

- Identity and Access Management

- Mobile Expense Management

- Services

- Professional Services

- Consulting

- Support and Maintenance

- Deployment and Integration

- Managed Services

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises

By Device Type

- Laptop

- Tablet

- Smartphones

By Deployment Modes

- Cloud

- On-premises

By Application

- BFSI

- Retail and eCommerce

- Healthcare and Life Sciences

- IT and Telecom

- Manufacturing

- Government

- Transportation and Logistics

- Travel and Hospitality

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting