What is the 5G Infrastructure Market Size?

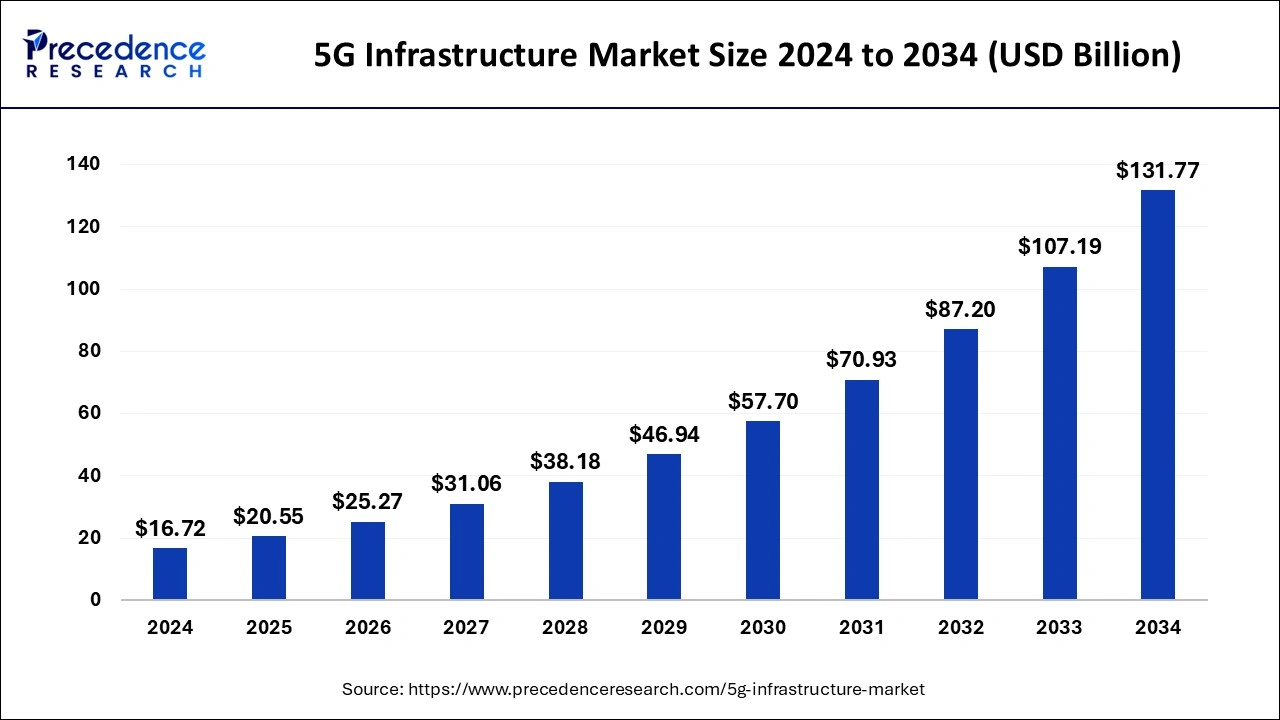

The global 5G infrastructure market size is calculated at USD 20.55 billion in 2025 and is predicted to increase from USD 25.27 billion in 2026 to approximately USD 153.29billion by 2035, expanding at a CAGR of 22.26% from 2026 to 2035.

5G Infrastructure Market Key Takeaways

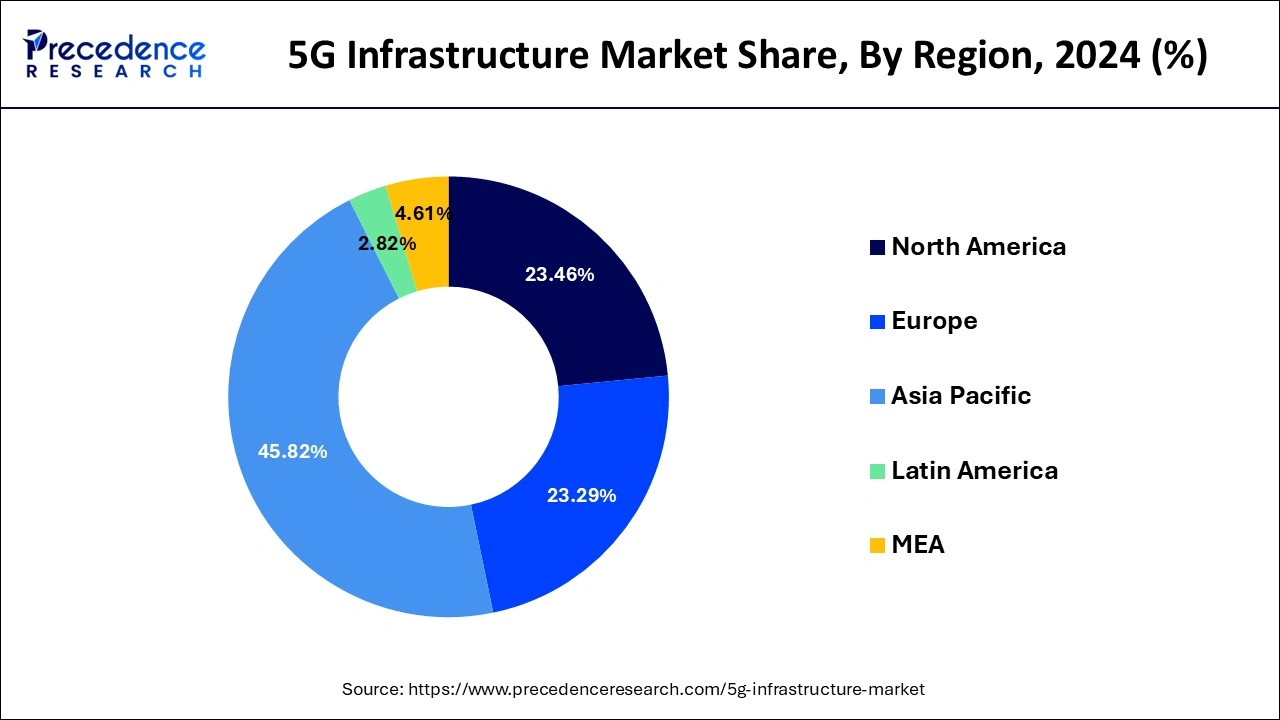

- Asia Pacific dominated the global market with the largest market share of 45.82% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By type, the private type segment contributed the highest market share in 2025.

- By component , the hardware segment captured the biggest market share of 78% in 2025.

- By spectrum, the sub-6 GHz segment has held the largest market share in 2025.

Market Overview

5G infrastructure comprises of a network of small-cell and macrocell base stations needed for fifth-generation of cellular networks. Usually, the 5G network has two infrastructure options including standalone and non-standalone (NSA) infrastructures. Out of these infrastructures, a non-standalone infrastructure partially depends on existing 4G LTE infrastructure; however, standalone infrastructure does not rely on LTE networks. Both of these infrastructures has an edge computing capabilities which is desired for functionality of 5G technology. It offers low latency coverage for data streams associated with applications such as semi-autonomous vehicles, IoT devices, and augmented reality. Businesses are rapidly implementing 5G technology as it provides them with a highly reliable form of wireless connectivity in the form of speed and capacity.

This infrastructure can support about 10 times more bandwidth as compared with 4G infrastructure. A productive feature of 5G infrastructure include higher multi-Gbps peak data speeds, more reliability, increased availability, ultra-low latency, massive network capacity, and an uniform user experience to large number of users. An emerging range of 5G infrastructure applications consists of improved remote education, enhanced agricultural productivity, smarter logistics, personalized and efficient retail, advanced healthcare, improved manufacturing operations, and modernized mining, oil and gas operations. Along with aforementioned applications, 5G technology infrastructure is anticipated to boost global innovation across enterprise networking, critical communications, and industrial Internet of Things (IoT).

How does AI represent the 5G Infrastructure Industry?

AI represents the industry as a brain, a main and smart function holding immense potential value to excel across the data centres. The AI modestly handles the severity of 5G with more patience via self-curing and refining networks. The 5G paves the way for AI models to regulate and bolster the genuine timeframe on edge devices such as AR glasses and autonomous robots.

The 5G needs an impeccable predictor like AI to detect traffic hurdles and modify the networking accordingly, ensuring convincing performance in the crucial apps such as industrial robotics and remote surgery.

AI can pinpoint the exact active hardware failures even before they appear for real. This will save operational costs and mitigate downtime. The AI-inspired frameworks will spot anomalies in infinite 5G nodes, which will play a major role in the cybercrime agency for its quick automated response to the threatening cyberattacks.

5G Infrastructure Market Growth Factors

5G technology offers significantly lower latency rate, which is the delay between the receiving and sending information. This decrease in end-to-end latency improves user experiences and creates new opportunities for innovative use cases. Also, there is a trend of Ultra-Reliable Low Latency Communications (URLLC), a subdivision of 5G network architecture which enables an efficient scheduling of data transfers and caters various advanced services across applications such as factory automation, the industrial internet, smart grid, autonomous driving, and or robotic surgeries. Hence, demand for lower latency rate among aforementioned applications is significantly boosting growth of the global 5G infrastructure market.

In addition, continuous growth in smartphone adoption coupled with an upsurge in video consumption is significantly boosting mobile data traffic. This has also led to enhancements in performance of deployed networks to meet demand posed byimproved device capabilities. According to various researches, the overall mobile data traffic is expected to grow at a rapid pace in upcoming years. This growth in mobile data traffic is considerably boosted demand for higher network infrastructure capabilities of 5G technology.For instance, as per the recent Ericsson study, the share of 5G technology in global mobile data traffic was about 10% in 2021; however, this share is expected to grow to around 60% in 2027.

On the other hand, ongoing demand for 5G technology across various industry verticals is expected to create lucrative growth opportunities for the global market. For instance, in healthcare sector, 5G has enabled high levels of connectivity for new health ecosystem to meet patient and provider needs conveniently, accurately, efficiently, and cost-effectively at substantial scale. 5G connectivity is expanding use cases of artificial intelligence (AI) and health-related IoT devices to monitor patients and making the recommendations related to the treatment of disease has driven demand for 5g technology. Furthermore, healthcare organizations are actively moving towards 5G technology under their digital transformation plans. Such factors are projected to create lucrative growth opportunities for the market.

Market Outlook

- Industry Growth Overview: The 5G infrastructure market is experiencing rapid growth as telecom operators and governments globally invest heavily to meet surging demand for high-speed, low-latency connectivity. Market growth is also driven by the widespread adoption of IoT devices, smart-city initiatives, industrial automation, and the rollout of private 5G networks across enterprise segments.

- Global Expansion: The market is expanding worldwide due to the growing demand for high-speed, low-latency connectivity, driven by applications such as IoT, autonomous vehicles, smart cities, and enhanced mobile broadband. Emerging regions offer significant opportunities as telecom operators invest in network rollouts, governments support digitalization initiatives, and businesses seek to leverage 5G for industrial automation, healthcare, and e-commerce growth.

- Major Investors: Major investors in the market include telecom operators, technology companies, and government bodies that fund large-scale network deployments and innovation. These investors accelerate market growth by expanding base stations, advancing core network technologies, and supporting research and development that enables faster, more reliable, and widely accessible 5G connectivity.

- Startup Ecosystem: The startup ecosystem in the market is highly dynamic, with agile firms driving innovation in private networks, edge computing, virtualization, and IoT. These startups frequently collaborate with established telecom operators and academic institutions, using supportive testbeds and regional grants to accelerate development, disrupt traditional models, and create new value across the 5G landscape.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.55 Billion |

| Market Size in 2026 | USD 25.27 Billion |

| Market Size by 2035 | USD 153.29Billion |

| Growth Rate from 2026 to 2035 | CAGR of 22.26% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Communication Infrastructure, Core Network Technology, Network Architecture, Spectrum, Component, End User, and Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Communication Infrastructure Insights

Depending upon the communication infrastructure, the small cell segment is the dominant player and is anticipated to have the biggest impact on 5G Infrastructure market. Small cells are an essential component in 5G infrastructure to provide high-band 5G across the indoor areas and dense urban environments including downtown, malls, stadiums, train stations, and other areas that need high data capacity and coverage. In addition, the small cell base stations are mainly designed to merge with an existing landscape, taking up least real estate. Hence, implementation of small cell infrastructure allows a smooth network evolution as well as a high frequency 5G radio spectrum.

Moreover, as the 5G commercial networks are going live around the globe, the telecom operators are actively prioritizing a need to improve user experiences. Due to this, new generation 5G small cells are being developed to meet market expectations for enhanced Mobile Broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (MTC). Different types of 5G small cells including picocells, femtocells, and microcells are used to provide different coverage limits.

On the other hand, there is an emerging challenge of industry definitions and standards for 5G small cells. Hence, the Small Cell Forum (SCF) has been introduced by industry players including Airspan, CommScope, Ericsson, Nokia, Qualcomm, Samsung, AT&T, Cisco, Huawei, and Vodafone. This association is publishing consensual and informed overview of 5G small cell network architectures along with the product definitions. This association is offering an informed view of important specifications and configurations for enterprises that are deploying small cells by year 2025.

End User Insights

Depending upon the end user, the residential segment is the dominant player and is anticipated to have the biggest impact on 5G Infrastructure market. A number of factors including growing dependency on the internet and upsurge in demand for fast data has led to growth of this segment. Communication service providers (CSPs) are rapidly deploying 5G networks across the suburban areas and an increasing number of cities to address demands created by video streaming and other high-bandwidth residential applications.

Most of the densely populated areas around the globe are creating need for high-speed and high-bandwidth connectivity. Due to this, telecom operators have rapidly been introducing 5G technology. For instance, in August 2019, China Unicom and China Telecom signed an agreement to cooperatively build and share 5G network infrastructure. Also, some of smartphones are getting discounts over their 5G models such as Vivo, Xiaomi, and Samsung. Such strategies are further boosting growth of the global 5G infrastructure market.

Furthermore, in January 2021, the Ministry of Science and ICT in South Korea announced to increase coverage of 5G mobile networks to 85 cities. Under this strategy, the government has also introduced an extended support for local firms for transition towards ultra-fast networks. In addition, the government of South Korea is significantly investing in research and development (R&D) of mobile edge computing which is an essential component for 5G in virtual reality applications. Such government strategies are opportunistic for growth of residential segment.

Regional Insights

What is the Asia Pacific 5G Infrastructure Market Size?

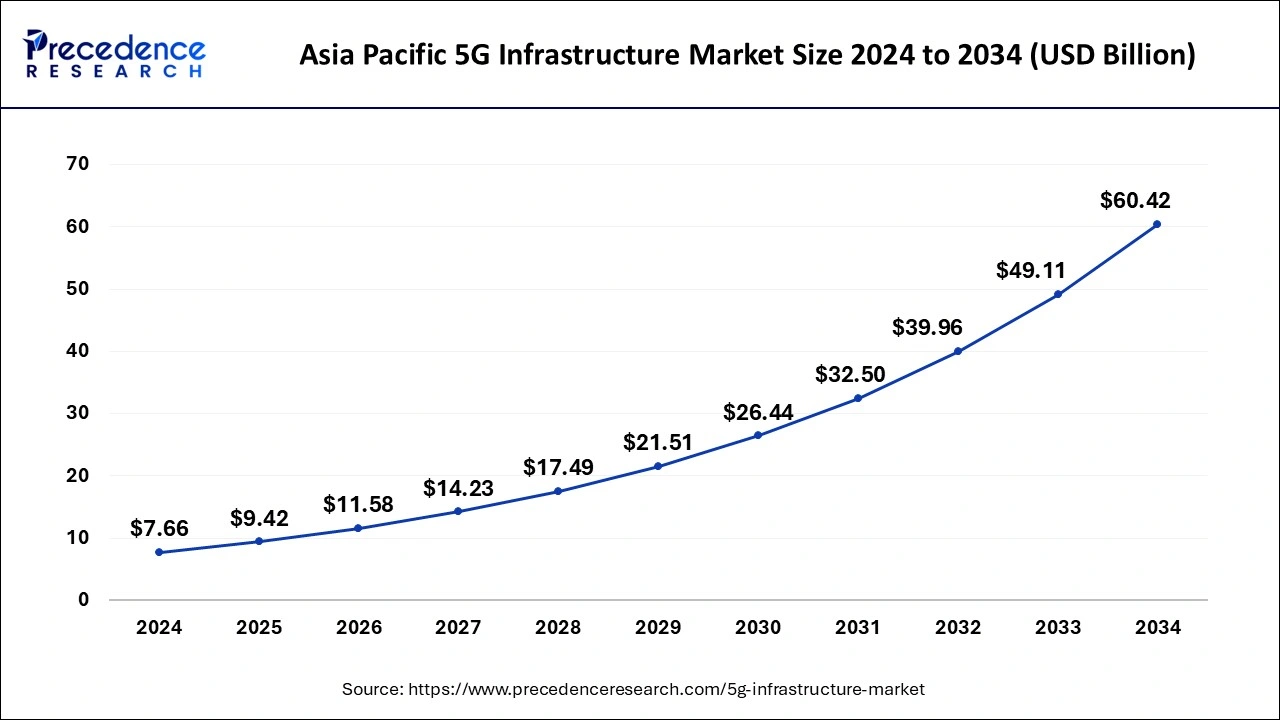

The Asia Pacific 5G infrastructure market size is evaluated at USD 9.42 billion in 2025 and is predicted to be worth around USD 70.29 billion by 2035, rising at a CAGR of 22.94% from 2026 to 2035.

What Makes North America the Fastest-Growing Market?

The highest market share and dominant position in the 5G Infrastructure market belongs to North America during the forecast period. This region includes U.S. and Canada. Growth of the market in this region is mainly attributed to increasing R&D activities in 5G technology and significant presence of key market players. In addition, as the region is a home to leading 5G Infrastructure industry leaders, there is comparatively higher R&D investment. This factor is expected to create lucrative growth opportunities for the 5G Infrastructure market.

Also, increasing wireless 5G connections in the region is further projected to boost North America market. For instance, according to data from Omdia, North America accounted for a total of 44.6 million 5G connections by the end of second quarter of 2021, which is 67% quarter over quarter growth as compared to previous year. In addition, heavy government investments in 5G infrastructure is further anticipated to fuel growth of North America 5G infrastructure market.

U.S. 5G Infrastructure Market Trends

The U.S. 5G infrastructure made headlines with the major transformation to standalone networks. The dedication towards Open RAN (O-RAN) and extension to Fixed Wireless Access (FWA) has changed the overall dynamics of the vendors' operations. In the region, crucial operators and federal initiatives have encompassed O-RAN testing to cut the need for hardware suppliers and balance the costs.

To adopt ultra-low latency and network slicing, the standalone transition has been installed in the 5G frame to operate independently across the

What Made Asia Pacific the Dominant Region in the Market?

Asia-Pacific is considered as highest growing region in 5G Infrastructure market. This region includes China, India, Japan, South Korea, and rest of the world. The number of 5G subscriptions is growing at rapid pace in Asia-Pacific coupled with an increased network traffic. For instance, according to the GSMA estimates, this region is anticipated to lead the worldwide 5G connections with China accounting for 828 million 5G connections (about 50% of all global connections). This will make telecom operators to install rising number of cutting-edge network solutions to efficiently manage network traffic.

On the other hand, ongoing investments in infrastructure development in this region is boosting deployment trend of 5G networks. For instance, as per the data from the China Academy of Information and Communications Technology (CAICT), the country is estimated to invest over $215 billion in the 5G network infrastructure by 2025. Further, according to the Ericsson AB's latest Mobility Report, Asia Pacific is anticipated to be the one of the fastest growing region with about 10% of all subscriptions being 5G in 2022. Such factors are opportunistic for growth of the 5G infrastructure market.

China 5G Infrastructure Market Trends

China upholds the finest and promising 5G base stations covering around 95% of administrative native areas. The station is backed by the national optical fiber network, covering millions of kilometres. China thinks ahead of time and big, as the region confirms 6G system construction. Following the 5G potential and utilising it to assess the power and role of the 6G system is a dedicated move.

How Big is the Success of Europe in the Market?

Europe is expected to grow at a notable rate in the coming years, supported by strong government funding and regulatory backing for national digital-connectivity strategies. This growth is further driven by the rapid deployment of public and private 5G networks for Industry 4.0 applications, rising demand for machine-to-machine communications and connected devices, and the expansion of smart-city initiatives across major Western and Nordic countries. Germany is a major contributor to the European 5G infrastructure market, thanks to its strong industrial base and heavy investment in private 5G networks for smart factories and Industry 4.0 applications.

Germany 5G Infrastructure Market Trends

Germany is promoting its 5G standalone (SA) ecosystem to work independently without 4G cores. The leaders like Vodafone Germany and Deutsche Telekom have met a convincing amount of customer demand and are satisfied with 5G SA. With this, Germany ranks in the 5G infrastructure sector.

The region also stands tall and is reputed for its 5G Campus Networks, providing commendable reach to the service. To date, the campus has offered around 400 licensed companies across the healthcare, logistics, and manufacturing industries.

How Crucial is the Role of Latin America in the 5G Infrastructure Market?

Latin America is a significant market due to the rapid expansion of mobile broadband and rising demand for high-speed connectivity in urban and rural locations, which are driving infrastructure roll-out. Telecom operators are increasing investments in network densification, fiber-optic backhaul, and small-cell deployment to support higher-frequency 5G bands. In addition, regulatory reforms and government-led initiatives to drive digital inclusion and enterprise deployment of private 5G networks are creating strong growth momentum.

Brazil 5G Infrastructure Market Trends

Brazil's Vivo's 5G subscriptions meet success, alongside Claro's 5G advanced trial speed accelerates achieving 5.5G. These impressive efforts from the regional providers introduced a smooth connection and flexibility to Open RAN. Brazil's 5G base station grip was fascinating in 2024.

Continuing to prove its initiative and commitment, the giant companies have stepped into expanding the 5G network to the rural areas to provide convenience and access to connect with the latest world.

How Big is the Opportunity for the Market in the Middle East & Africa?

The Middle East & Africa (MEA) presents significant opportunities in the 5G infrastructure market, driven by rising demand for high-speed connectivity and a young, digitally engaged population. Governments across the GCC and African nations are actively supporting digital transformation initiatives, investing in spectrum allocation, fiber-optic networks, and modern telecom infrastructure. Increasing enterprise adoption of private 5G networks, industrial IoT, smart logistics, and smart city projects continues to boost market growth. Moreover, collaborations between global vendors and local operators are speeding up network deployments across the region.

Top Companies in the 5G Infrastructure Market & Their Offerings

- Ericsson

Offers end‑to‑end 5G infrastructure, including RAN (antennas, radios, baseband), 5G Core, and transport. Provides cloud-native, dual-mode core supporting both 4G and 5G, enabling smooth migration. Supports advanced features like network slicing and dynamic spectrum sharing. - Huawei

Delivers a full-stack 5G solution: RAN (including massive MIMO radios), baseband units, small cells, and transport equipment. Offers 5G core networks, including cloud‑native core and policy, charging, and signaling capabilities. Provides end-to-end E2E 5G solutions that integrate hardware and software. - Nokia

Delivers RAN (AirScale radios, Massive MIMO) and transport. Strong in 5G Core: cloud-native, automated, scalable core with many live SA deployments. Offers “anyRAN” approach (hybrid of cloud-native and purpose-built) and supports Open RAN. Enables enterprise/private 5G use cases via edge‑slicing and network slicing solutions. - Samsung Electronics

Provides end-to-end 5G infrastructure: chips (5G modems), RAN (mmWave and sub‑6 GHz), core, and transport. Produces massive MIMO antenna units, virtualization-ready solutions, and integrated network hardware + software. - ZTE

Supplies 5G base stations (macro and small cell), core networks, and transport systems. Supports both non-standalone (NSA) and standalone (SA) 5G architectures. - NEC

Provides 5G infrastructure with strong support for open, software-defined networks: Open RAN radios (RU), CU, and cloud‑native 5G core. Their 5G core is fully containerized and supports both 4G EPC and 5G UPF via converged architecture. Offers systems integration, orchestration (via Netcracker), and multi-vendor Open RAN deployment. - Mavenir

Specializes in software-based, cloud-native 5G core: its Converged Packet Core supports 2G–5G in a single platform. Provides an open vRAN (virtualized RAN) portfolio using open interfaces, helping drive Open RAN adoption. Its architecture emphasizes cloud-native containerization, automation, and scalability for modern networks. - Cisco (honorary mention)

Focuses on transport and xHaul (fronthaul/midhaul/backhaul) for 5G networks, emphasizing converged, secure, and flexible transport layers. Strong in SDN, routing, gateways, and converged IP transport to support multi-vendor, open 5G architectures.

5G Infrastructure Market Companies

- Huawei

- Ericsson

- Nokia Networks

- Samsung

- Cisco Systems Inc.

- CommScope

- ZTE

- NEC

- Comba Telecom Systems

- Siklu Communication

- Mavenir

- CommScope

- Comba Telecom Systems

- Siklu Communication

Key Market Developments

- In January 2021, Ooredoo Group, a Qatari multinational telecommunications company signed an agreement with Ericsson for the supply of 5G core, radio, and transport solutions and products, along with associated integration and implementation services. The agreement will help Ooredoo with end-to-end 5G support from Ericsson to modernize and transform Ooredoo's existing mobile networks.

Recent Developments

- On 3rd November 2025, Datakorum and Sateliot signed a partnership deal to provide 5G IoT connectivity throughout the remote UAE infrastructure. The infrastructure is designed to promote quality industrial connectivity on point. (Source:https://www.datakorum.com)

Segments covered in the report

By Communication Infrastructure

- Small Cell

- Macro Cell

- Ran

- Das

By Core Network Technology

- Software-Defined Networking (SDN)

- Network Function Virtualization (NFV)

By Network Architecture

- Standalone

- Non-Standalone

By Spectrum

- Sub-6 GHz

- Low Band

- Mid Band

- mmWave

By Component

- Hardware

- Radio Access Network (RAN)

- Core Network

- Backhaul & Transport

- Services

- Consulting

- Implementation & Integration

- Support & Maintenance

- Training & Education

By End User

- Residential

- Commercial

- Industrial

- Government

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting