5G Devices Market Size and Forecast 2025 to 2034

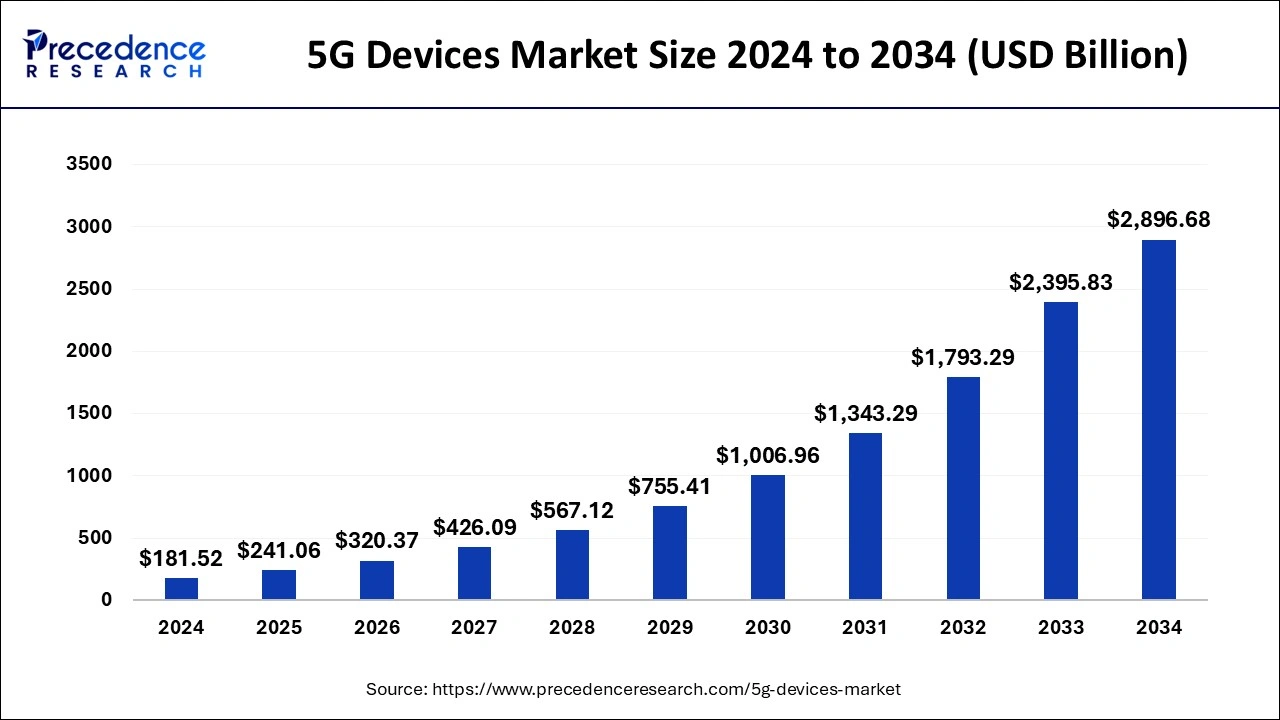

The global 5G devices market size was calculated at USD 181.52 billion in 2024 and is predicted to increase from USD 241.06 billion in 2025 to approximately USD 2,896.68 billion by 2034, expanding at a CAGR of 31.92% from 2025 to 2034.

5G Devices Market Key Takeaways

- The global 5G devices market was valued at USD 181.52 billion in 2024.

- It is projected to reach USD 241.06 billion by 2034.

- The market is expected to grow at a CAGR of 31.92% from 2025 to 2034.

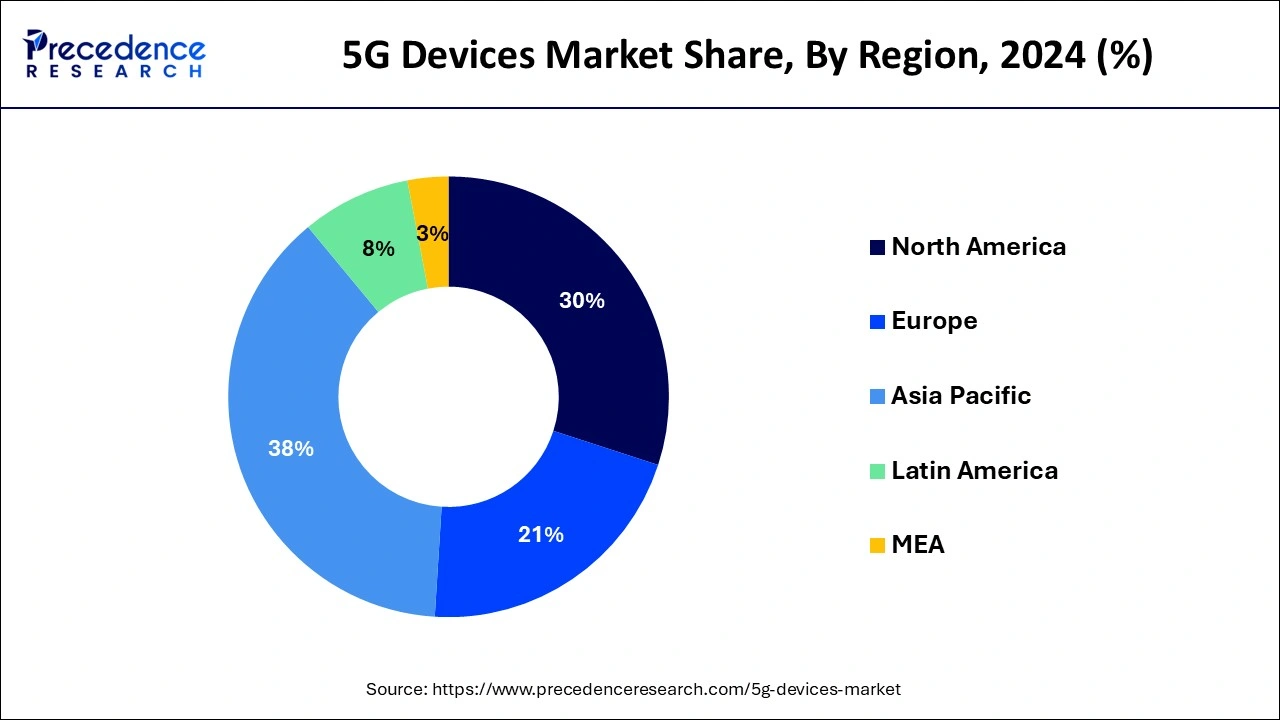

- Asia-Pacific contributed the largest market share of 38% in 2024.

- North America is estimated to expand at the fastest CAGR between 2025 and 2034.

- By form factor, the phones segment has held the largest market share of 52% in 2024.

- By form factor, the laptop segment is anticipated to grow at a remarkable CAGR of 34.9% between 2025 and 2034.

- By spectrum, the sub-6 GHz segment generated over 68% of the market share in 2024.

- By spectrum, the mmWave segment is expected to expand at the fastest CAGR over the projected period.

Asia Pacific 5G Devices Market Size and Growth 2025 to 2034

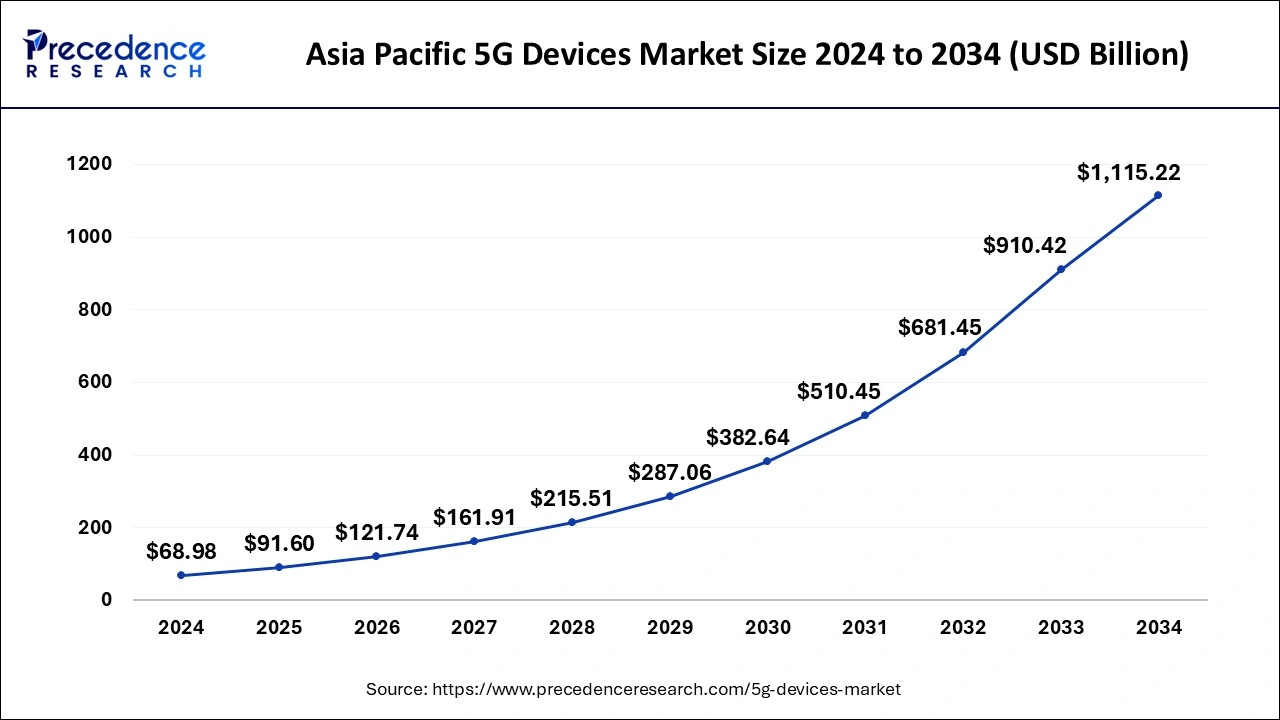

The Asia Pacific 5G devices market size was exhibited at USD 68.98 billion in 2024 and is projected to be worth around USD 1,115.22 billion by 2034, growing at a CAGR of 32.09% from 2025 to 2034.

In , Asia-Pacific held the largest market share of 38% in 5G devices marketdue to its rapid adoption of 5G technology. Countries like China, South Korea, and Japan are leading in deploying extensive 5G infrastructure, fostering a significant demand for 5 G-enabled devices. The large population, coupled with increasing smartphone penetration, drives the region's dominance. Additionally, government initiatives, substantial investments by telecom operators, and a tech-savvy consumer base contribute to the robust growth of the 5G devices market in the Asia-Pacific region.

North America is poised for rapid growth in the 5G devices marketdue to robust infrastructure development, substantial investments, and widespread consumer adoption. The region's advanced technological ecosystem, coupled with strong support from governments and telecom operators, creates a favorable environment. Increasing demand for high-speed connectivity, coupled with a competitive landscape driving innovation, positions North America as a key player in the global 5G devices market. This growth is further propelled by the integration of 5G in various industries and the rising popularity of advanced applications and services.

Meanwhile, Europe is experiencing notable growth in the 5G devices market due to widespread network deployments and increasing consumer demand. The region's proactive approach to 5G infrastructure development, supportive regulatory frameworks, and collaborations among telecom operators and device manufacturers have fueled the market's expansion. As 5G networks become more accessible across European countries, consumers are adopting 5G-enabled devices to enjoy faster internet speeds, low latency, and improved connectivity. This growing demand, coupled with strategic investments and technological advancements, is driving the robust growth of the 5G devices market in Europe.

Market Overview

5G devices are advanced communication tools that connect to the fifth-generation wireless network, offering faster and more reliable internet connectivity compared to previous generations. These devices include smartphones, tablets, routers, and other gadgets designed to harness the benefits of 5G technology. With enhanced speed and lower latency, 5G devices enable quicker downloads, seamless streaming, and improved overall performance for various applications. One notable aspect of 5G devices is their ability to support innovative technologies like augmented reality (AR) and the Internet of Things (IoT).

This means faster and more efficient communication between devices, opening up possibilities for smart homes, connected vehicles, and diverse applications across industries. As the 5G infrastructure continues to expand globally, 5G devices play a pivotal role in transforming the way we connect, communicate, and engage with digital content in our daily lives.

5G Devices Market Growth Factors

- The ongoing global rollout of 5G networks is a primary driver for the growth of 5G devices. As more countries and telecom operators invest in deploying 5G infrastructure, there is a corresponding increase in the demand for compatible devices to leverage the enhanced connectivity.

- Growing consumer awareness and demand for high-speed, low-latency connectivity are fueling the adoption of 5G devices. Consumers seek faster download speeds, improved streaming quality, and enhanced overall performance, prompting the market to offer a variety of 5G-enabled devices to meet these expectations.

- Beyond consumer applications, industries are adopting 5G for various use cases, such as IoT, smart manufacturing, and augmented reality. This increased industrial adoption is driving the demand for specialized 5G devices tailored to meet the unique requirements of different sectors.

- Ongoing advancements in 5G technology and device capabilities contribute to the market's growth. Manufacturers continually innovate to enhance device performance, energy efficiency, and support for emerging technologies like edge computing and AI, driving consumer and enterprise adoption.

- Intense competition among device manufacturers is spurring innovation and driving the production of a diverse range of 5G devices. This competition results in a wider selection of 5G-enabled smartphones, tablets, IoT devices, and other gadgets, catering to various consumer preferences.

- Many governments recognize the strategic importance of 5G technology and provide support through regulatory frameworks and policies. Initiatives aimed at accelerating 5G adoption, including spectrum allocation and infrastructure development, contribute to the overall growth of the 5G devices market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 31.92% |

| Market Size in 2025 | USD 241.06 Billion |

| Market Size by 2034 | USD 2,896.68 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form Factor and Spectrum |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Consumer demand for high-speed connectivity

- The number of global 5G subscriptions is projected to reach around 3.5 billion by the end of 2026, according to Ericsson Mobility Report 2021.

The surge in consumer demand for high-speed connectivity is a driving force behind the growing market demand for 5G devices. As people increasingly rely on the internet for activities like streaming, gaming, and remote work, there is a heightened need for faster and more reliable connections. Consumers seek to experience seamless downloads, buffer-free streaming, and quick responsiveness in their online activities.

In response to this demand, the 5G devices market has witnessed a significant boost. 5G technology offers unparalleled speed and low latency, meeting the expectations of users who crave enhanced internet experiences. Whether it's downloading large files in seconds or enjoying high-definition video calls without disruptions, the consumer appetite for high-speed connectivity is propelling the adoption of 5G devices, making them integral to meeting the evolving connectivity needs of modern users.

Restraint

Spectrum allocation and availability

Spectrum allocation and availability pose significant restraints on the market demand for 5G devices. The allocation of specific radio frequencies, or spectrum, for 5G networks is crucial for ensuring efficient and high-speed wireless communication. However, regulatory challenges and limited availability of suitable spectrum can slow down the deployment of robust 5G networks. This limitation is particularly evident in regions where regulatory frameworks are still adapting to the demands of 5G technology, leading to delays in spectrum auctions and allocations.

The scarcity of spectrum can result in congestion and compromises in the quality of 5G services, impacting the overall user experience. In addition, different countries may adopt varying spectrum bands for 5G, creating challenges for device manufacturers to produce devices that are compatible across diverse regional standards. Addressing these spectrum-related challenges requires international collaboration, effective regulatory policies, and timely spectrum auctions to ensure a steady and widespread deployment of 5G networks, subsequently driving the demand for 5G devices.

Opportunity

Emergence of smart cities

The emergence of smart cities presents significant opportunities in the market for 5G devices. 5G technology plays a pivotal role in the development of smart urban infrastructure by providing high-speed, low-latency connectivity. This enables the seamless integration of various smart city components, such as intelligent transportation systems, connected street lighting, and smart grids. As cities worldwide invest in becoming more connected and efficient, the demand for 5G devices grows. Devices like sensors, cameras, and communication hubs embedded in urban infrastructure rely on 5G networks to transmit real-time data, optimizing city services and enhancing the overall quality of life for residents.

Opportunities in the 5G devices market extend to the development of smart city-centric applications, including connected vehicles, automated surveillance systems, and environmental monitoring devices. Manufacturers of 5G devices can explore partnerships with urban planners and technology providers to create innovative solutions tailored for the evolving needs of smart cities, driving technological advancements, and contributing to the ongoing transformation of urban landscapes.

Form Factor Insights

The phones segment held the highest market share at 52% in 2024. In the 5G devices market, the phones segment refers to 5G-enabled smartphones. These devices leverage 5G technology to deliver faster internet speeds, reduced latency, and enhanced connectivity. A prominent trend in this segment includes the increasing availability of affordable 5G phones, enabling a broader consumer base to access the benefits of 5G connectivity. As more manufacturers launch diverse 5G smartphone models, the market witnesses a growing demand for feature-rich devices, contributing to the widespread adoption of 5G technology in the mobile phone industry.

The laptop segment is anticipated to witness rapid growth at a significant CAGR of 35% during the projected period. The laptop segment in the 5G devices market refers to portable computers equipped with integrated 5G connectivity. These laptops leverage 5G technology to offer users high-speed internet access on the go. The trend in this segment involves the increasing demand for laptops that combine the convenience of mobility with the enhanced connectivity of 5G networks. Users seek seamless video conferencing, fast downloads, and smooth online experiences, driving the adoption of 5G-enabled laptops as an essential tool for productivity and connectivity in various work and personal settings.

Spectrum Insights

The sub-6 GHz segment has held a 68% market share in 2024. In the 5G devices market, the sub-6 GHz spectrum refers to a frequency band that facilitates reliable and widespread 5G coverage. Devices operating in this spectrum offer a balance between range and data speed. The sub-6 GHz segment is crucial for urban and suburban deployments, providing enhanced connectivity for a broad range of applications. A trend in the market is the widespread adoption of sub-6 GHz technology, driven by its ability to deliver extended coverage and improved penetration through obstacles, making it a preferred choice for many 5G devices.

The mmWave segment is anticipated to witness rapid growth over the projected period. In the context of 5G devices, the mmWave (millimeter wave) spectrum refers to a range of radio frequencies above 24 GHz. This high-frequency spectrum offers increased data transfer rates, enabling exceptionally fast and responsive 5G connections. The mmWave segment is key for delivering enhanced mobile broadband services. Despite its shorter range compared to lower-frequency bands, mmWave's increasing adoption is notable for urban deployments, providing ultra-fast speeds and supporting applications like augmented reality and high-definition video streaming in the 5G devices market.

Recent Developments

- In September 2022, Nokia and Telia Finland jointly unveiled one of the initial commercial 5G standalone (SA) networks featuring network slicing for Fixed Wireless Access (FWA) services. This collaboration empowered Telia to integrate 5G SA into its 5G Fixed Wireless Access (FWA) home broadband offerings, allowing the provision of diversified broadband packages with guaranteed service levels to its customer base in Finland. These advancements aimed to reinforce Telia's existing market standing by delivering enhanced connectivity and increased capacity benefits through continuous deployment efforts.

- In September 2022, ZTE Corporation, in collaboration with the Fujian Branch of China Mobile, introduced the first trial of a 5G industrial comprehensive emulator and analyzer product in Fuzhou, Fujian Province. This initiative was part of leveraging 5G technology for the digital transformation of various industry verticals, marking a significant step towards the integration of 5G into industrial applications.

- In July 2022, Samsung launched the Galaxy M13 5G, positioned as one of India's most affordable 5G smartphones. The company introduced the phone in two variants: one with 4GB RAM and 64GB storage, and another with 6GB RAM and 128GB storage, priced at INR 13,999 and INR 15,999, respectively. Notably, these smartphones supported a total of 11 5G bands in India, providing users with a comprehensive and versatile 5G experience.

5G Devices Market Companies

- Qualcomm

- Huawei Technologies Co., Ltd.

- Samsung Electronics Co., Ltd.

- Ericsson

- Nokia Corporation

- Intel Corporation

- MediaTek Inc.

- Cisco Systems, Inc.

- Verizon Communications Inc.

- AT&T Inc.

- Apple Inc.

- ZTE Corporation

- Motorola Solutions, Inc.

- LG Electronics Inc.

- Sony Corporation

Segments Covered in the Report

By Form Factor

- Phones

- CPE

- Modules

- Hotspots, Switches & Routers

- Laptop

- Tablets

- Others

By Spectrum

- sub-6 GHz

- mmWave

- sub-6 GHz + mmWave

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting