Backscatter X-Ray Devices Market Size and Forecast 2025 to 2034

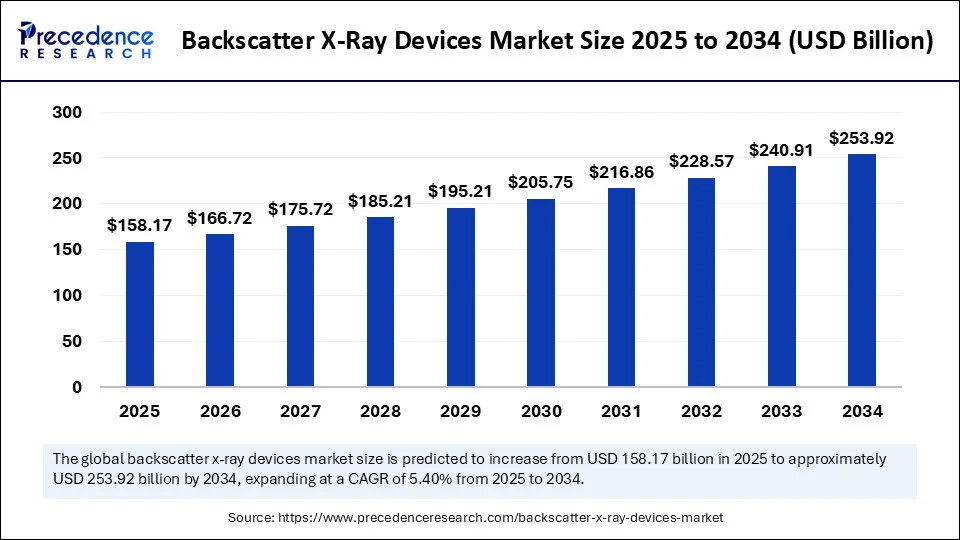

The global backscatter X-ray devices market size was calculated at USD 150.07 billion in 2024 and is predicted to increase from USD 158.17 billion in 2025 to approximately USD 253.92 billion by 2034, expanding at a CAGR of 5.40% from 2025 to 2034. The market is expanding rapidly due to heightened global security needs, especially for detecting concealed weapons, contraband, and narcotics at airports, borders, and public venues, and technological advancements that enhance image clarity, reduce scan time, and improve portability.

Backscatter X-Ray Devices Market Key Takeaways

- In terms of revenue, the global backscatter X-ray devices market was valued at USD 150.07 billion in 2024.

- It is projected to reach USD 253.92 billion by 2034.

- The market is expected to grow at a CAGR of 5.40% from 2025 to 2034.

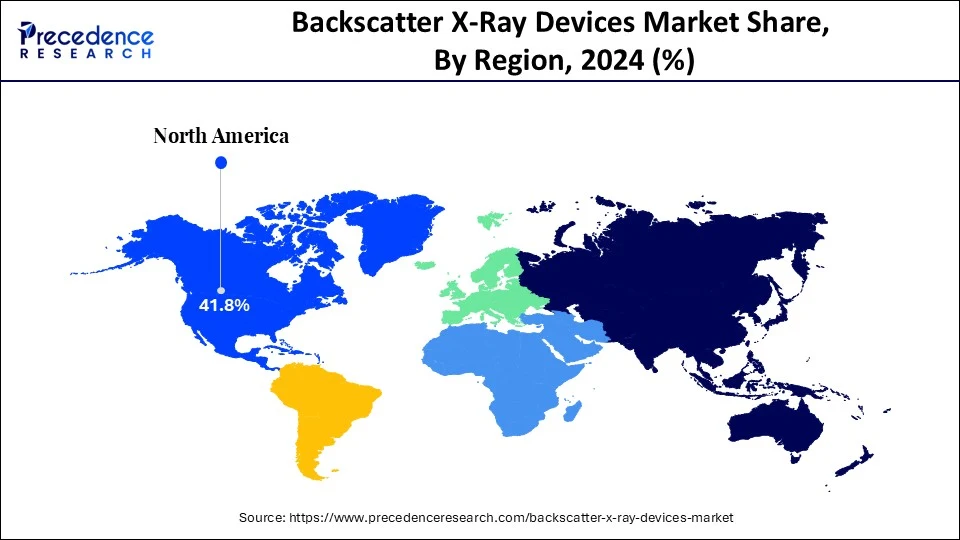

- North America dominated the backscatter X-ray devices market with the largest market share of 41.8% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

- By product type, the portable devices segment captured the biggest market share of 48.3%.

- By product type, the handheld devices segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the security & surveillance segment contributed the biggest market share of 61.5% in 2024.

- By application, the industrial inspection segment is expected to grow at the fastest CAGR during the forecast period.

- By imaging mode, the single-view imaging systems segment held the highest market share of 54.7% in 2024.

- By imaging mode, the multi-view/3D reconstruction systems segment is expected to grow at the fastest CAGR during the forecast period.

- By end user, the aviation & transportation segment generated the major revenue shares of 40.2% in 2024.

- By end user, the defense forces segment is expected to grow at the fastest CAGR during the forecast period.

- By technology, the backscatter-only systems segment accounted for the significant market share of 59.6% in 2024.

- By technology, the hybrid transmission & backscatter systems segment is expected to grow at the fastest CAGR during the forecast period.

How Can AI Affect the Backscatter X-ray Devices Market?

Artificial intelligence is affecting the market by enhancing image processing, threat detection, and operational efficiency. Machine learning algorithms enable faster and more accurate identification of concealed items, reducing human error and improving security outcomes. Advanced AI-driven pattern recognition can also help distinguish between harmless and dangerous materials, minimizing false positives and streamlining security checks. In addition, AI-enabled predictive maintenance can optimize device uptime and lower operational costs for airports, border security, and industrial users. AI integration also supports automated screening, real-time data analysis, and predictive maintenance of systems. These advancements are making backscatter technology more reliable and scalable, driving its adoption in high-security environments such as airports, customs, and public infrastructure.

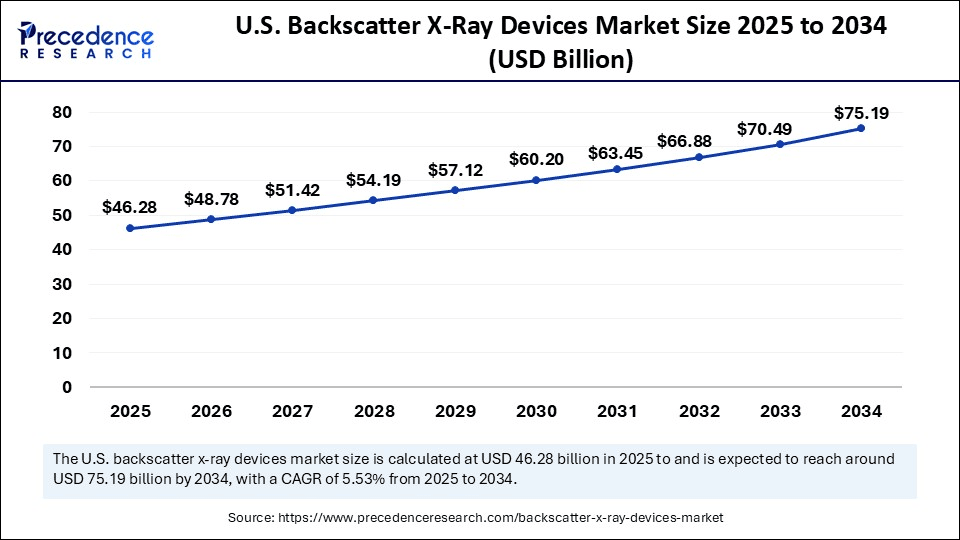

U.S. Backscatter X-Ray Devices Market Size and Growth 2025 to 2034

The U.S. backscatter X-ray devices market size was exhibited at USD 43.91 billion in 2024 and is projected to be worth around USD 75.19 billion by 2034, growing at a CAGR of 5.53% from 2025 to 2034.

How is North America contributing to the Expansion of the Backscatter X-ray devices Market?

North America dominated the market in 2024 due to high investments in security infrastructure, a strong presence of key industry players, and strict regulatory standards for public safety. The region's extensive use of advanced screening technologies at airports, border checkpoints, and government facilities supported steady demand. Additionally, increased defense spending and ongoing technological advancements in imaging systems further boosted the adoption of backscatter X-ray devices, securing North America's leading position in market revenue.

The U.S. Backscatter X-Ray Devices Market Trends

In 2024, the U.S. market experienced steady growth, driven by escalating federal investments in airport and border security infrastructure and heightened regulations requiring enhanced threat detection systems. Agencies such as the TSA rolled out portable scanning units to improve passenger throughput and contraband detection efficiency. Additionally, increased defense procurement for field-deployable imaging tools further propelled demand, reinforcing strong market momentum across both civil and military end-users.

The Canada Backscatter X-Ray Devices Market Trends

Canada's market is witnessing growth due to increased focus on border protection, cargo inspection, and law enforcement modernization. The government is enhancing its screening capabilities at key entry points to address rising concerns over smuggling and unauthorized transport. Additionally, adoption of mobile and handheld X-ray units for rapid field inspections is gaining momentum, supporting demand across customs, transportation hubs, and critical infrastructure sectors nationwide.

How is Asia-Pacific Accelerating the Backscatter X-Ray Devices Market?

The Asia-Pacific region is projected to register the fastest CAGR in the market, driven by expanding transportation networks, rising defense budgets, and heightened security concerns. Emerging economies are increasingly adopting advanced screening technologies to support growing passenger traffic and cross-border trade. Supportive government policies, infrastructure upgrades, and the need for efficient threat detection in densely populated areas are further propelling market demand across key countries like India, China, and Indonesia.

The China Backscatter X-Ray Devices Market Trends

China's market is expanding due to escalating investments in border control, aviation security, and urban surveillance infrastructure. Rapid growth in international trade and passenger traffic has amplified demand for efficient, non-invasive screening technologies. Chinese manufacturers are also improving localization and affordability, making these systems more accessible across government agencies and transportation hubs. Additionally, rising public safety concerns and regulatory focus on threat detection are accelerating adoption across the nation.

The India Backscatter X-Ray Devices Market Trends

India's market is witnessing steady growth due to increased focus on enhancing national security and streamlining inspection procedures. With rising cargo movement and expanding transportation networks, authorities are turning to advanced scanning tools for quicker, more accurate detection of hidden threats. The push for technological upgrades at airports, seaports, and border points, combined with government support for surveillance modernization, is driving broader deployment of these systems across the country.

How is Europe approaching the Backscatter X-Ray Devices Market in 2024?

In 2024, Europe adopted a balanced approach to the market, focusing on enhancing security while maintaining strict privacy and health regulations. Governments emphasized the use of non-intrusive technologies for cargo inspection, border control, and transportation hubs. Countries prioritized portable and handheld systems that comply with EU safety standards. Growing concerns over smuggling, illegal trafficking, and public safety encouraged gradual adoption, especially in high-risk areas, without compromising citizen rights or regulatory compliance.

The UK Backscatter X-Ray Devices Market Trends

The UK market is increasing due to ongoing upgrades in airport security and border control systems. In 2024, several major airports began replacing outdated scanners with advanced, non-intrusive imaging systems to improve screening speed and accuracy. Additionally, rising concerns over smuggling and concealed threats have driven customs and law enforcement agencies to adopt portable and efficient backscatter solutions, contributing to broader deployment across transportation hubs and critical infrastructure nationwide.

The German Backscatter X-Ray Devices Market Trends

Germany's market is expanding due to heightened investment in border security and customs enforcement, driven by periodic reinstatement of land border checks across the country. Authorities are increasingly deploying mobile and fixed backscatter scanners to inspect vehicles and cargo without causing logistical disruptions. Rising concerns over smuggling and irregular migration, together with the need for efficient surveillance at transit corridors and internal checkpoints, are fueling demand for these advanced screening systems.

How Backscatter X-Ray Devices Market Evolving?

The technique encompasses systems that utilize Compton scattering principles to generate images by detecting X-rays that are scattered back from the object rather than those passing through it, leading to growth trends in the backscatter X-ray devices market. Unlike traditional transmission X-ray systems, backscatter X-ray technology provides superior imaging of low-density and organic materials (like explosives or narcotics), making it especially useful for security screening in airports, border checkpoints, and critical infrastructure. These devices are also gaining traction in non-destructive testing (NDT) and industrial inspection. Their ability to deliver high-contrast imaging of surface and near-surface features has driven adoption in multiple industries despite concerns regarding privacy and radiation exposure.

The market is evolving through rapid technological enhancements such as AI-powered imaging, compact handheld scanners, and dual-energy systems that improve detection accuracy and reduce radiation exposure. Broader deployment across sectors like airports, customs, law enforcement, and infrastructure inspection is further accelerating growth, driven by heightened security demands and smarter, versatile screening solutions.

The backscatter X-ray devices market is witnessing steady growth due to increasing demand for advanced security screening across airports, border checkpoints, and government facilities. These devices offer non-intrusive, high-resolution imaging ideal for detecting concealed threats. Technological improvements, rising global terrorism concerns, and growing investments in surveillance infrastructure are further supporting market expansion. The market is also benefiting from the adoption of portable and handheld scanning solutions.

What are the Key trends in the Backscatter X-Ray Devices Market in 2024?

- Rising global security concerns are boosting adoption in airports, borders, and infrastructure.

- Advancements in dual-energy, multi-view, and AI-driven imaging for better detection.

- Surge in handheld and portable backscatter devices for flexible field use.

- Expanding applications in medical imaging, industrial testing, and art/heritage preservation.

- High device costs, privacy concerns, and detection limits remain key restraints.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 253.92 Billion |

| Market Size in 2025 | USD 158.17 Billion |

| Market Size in 2024 | USD 150.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.40% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Imaging Mode, End Use Sector, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Advanced Security and Screening Systems

Growing concern about public safety and the need for efficient threat detection have significantly boosted the adoption of these devices and growth in the backscatter X-ray devices market. These systems provide rapid, non-intrusive imaging capabilities, allowing authorities to detect hidden weapons, explosives, and contraband without physical contact. Their effectiveness in enhancing security at airports, broader control, and government buildings has made them essential in modern surveillance infrastructure, driving market growth as global security continues to tighten.

- In April 2024, Heathrow Airport in the UK began pilot installations of new backscatter X-ray scanners that allow passengers to keep electronics, liquids, and outerwear in their bags. Travelers reported significantly reduced queue times; some claimed they moved from curbside to duty-free in just five minutes. This modern screening technology boosted passenger throughput and operational efficiency, reinforcing market demand for these advanced screening solutions.

(Source: https://www.business-standard.com)

Restraint

Growing Privacy and Healthcare Concerns

Concerns over individual privacy and radiation exposure have slowed the adoption and expansion of the backscatter X-ray devices market. These systems can reveal intimate body details, sparking debates about human dignity and potential misuse of scanned images. Moreover, although radiation levels are low, repeated exposure raises health-related questions, especially for frequent travelers and operators. Regulatory pushback and public discomfort surrounding these issues have led to restricted use in some regions, creating barriers for market expansion and deployment in certain applications.

Opportunity

Technological Advancements in X-ray

Ongoing improvements in X-ray technology are opening new doors for the backscatter X-ray devices market. Modern systems now offer clearer imaging, faster processing, and reduced radiation exposure, making them more efficient and safer for users and operators. These enhancements support wider use in areas like cargo inspection, transportation hubs, and public event security. As performance and safety standards rise, demand for next-generation scanning systems is expected to grow across both developed and emerging regions.

- In March 2024, countries like India and Vietnam began deploying advanced handheld backscatter X-ray scanners equipped with cloud connectivity. These upgraded devices deliver faster scans, enhanced image clarity, and allow remote analysis, streamlining customs inspections. The integration of such technologies is boosting efficiency and driving broader adoption in emerging markets, highlighting how innovation continues to create new growth opportunities in the backscatter X-ray devices market.

Product Type Insights

How Did the Portable Devices Segment Dominate the Backscatter X-ray Devices Market in 2024?

The portable devices segment led the market in 2024, capturing the highest revenue shares due to its growing use in on-the-go security checks. These lightweight and mobile systems are preferred by law enforcement, border patrol, and military units for their ability to perform quick and efficient scans in areas where fixed systems are impractical. Their adaptability and operational convenience have made them the top choice for various real-time inspection needs across sectors.

The handheld devices segment is anticipated to witness the most rapid growth in the market, fueled by increased adoption across defense, broader security, and emergency response teams seeking flexible and quick scanning tools. These compact systems enable effective detection of hidden threats without fixed setups, making them suitable for unpredictable or high-mobility scenarios. Their growing use in field operations is expected to significantly boost market expansion.

Application Insights

Why Did the Security & Surveillance Segment Dominate the Backscatter X-ray Devices Market in 2024?

In 2024, the security & surveillance segment held the largest revenue share in the backscatter X-ray devices market due to increasing global threats and the growing need for effective screening systems. These devices are widely used at airports, border checkpoints, and government facilities to detect concealed weapons, explosives, and contraband. Their ability to provide fast, non-intrusive imaging makes them ideal for high-traffic security environments, driving strong demand and positioning the market leader.

The industrial inspection segment is projected to experience the fastest growth in the backscatter X-ray devices market during the forecast period, driven by the growing need for efficient internal inspections across complex equipment and materials. Industries such as aerospace, electronics, and heavy manufacturing are increasingly using these systems to identify hidden flaws or structural inconsistencies without damaging components. Their ability to ensure product integrity and operational safety is accelerating their use in routine quality control and maintenance processes.

Imaging Mode Insights

How the Single-View Imaging Systems Segment Dominated the Backscatter X-ray Devices Market in 2024?

The single-view imaging systems segment dominated the market for backscatter X-ray devices mainly due to its widespread use in high-traffic screening environments. These systems are valued for their compact design, faster image processing, and operational efficiency, making them suitable for rapid threat detection. Their reliability in detecting concealed objects with minimal resource input has led to strong adoption across broader security transportation hubs and government facilities, contributing to their leading market share.

The multi-view/3D reconstruction systems segment is projected to grow at the highest CAGR during the forecast period as organizations seek advanced imaging capabilities for complex security scenarios. These systems allow comprehensive analysis by generating layered, three-dimensional visuals, which significantly improve object identification and threat assessment. Their growing use in critical infrastructure, cargo screening, and densely trafficked transit points reflects a shift towards more intelligent and reliable security technologies, driving the rapid market adoption.

End Use Sector Insights

What Made the Aviation & Transportation Segment Dominant in the Market in 2024?

The aviation and transportation segment secured the highest revenue share in the backscatter X-ray devices market in 2024, driven by expanding air traffic and stricter international safety protocols. These sectors required efficient, high-throughput screening tools to manage large passenger volumes and cargo flow. Backscatter systems, which met these demands with rapid deployment in airports and transport terminals worldwide, significantly contributed to the leading market position during the year.

The defense forces segment is projected to witness the fastest CAGR in the backscatter X-ray devices market during the forecast period, fueled by the rising need for mobile and effective inspection tools in conflict zones and military bases. These devices support quick, non-intrusive checks of cargo vehicles and infrastructure, enhancing security and operational efficiency. Growing geopolitical tension and broader monitoring requirements are prompting defense forces to adopt advanced scanning solutions, accelerating demand within the market globally.

Technology Insights

How the Backscatter-Only Systems Segment Dominated the Market in 2024?

The backscatter-only system segment held the largest revenue share in the backscatter X-ray devices market in 2024, mainly due to its strong adoption in routine security screening tasks. These systems offer clear surface imaging and care effective for detecting concealed items without requiring complex setup ot dual-source mechanisms. Their simplicity, affordability, and proven performance in applications like customs, border control, and facility security contributed to their market leadership during the year.

The hybrid transmission & backscatter X-ray system segment is projected to expand rapidly as it combines the strengths of both imaging methods, offering a more complete view of scanned objects. This integrated approach allows for the identification of both concealed surface threats and internal anomalies, increasing detection efficiency. As security operations seek more advanced, all-in-one solutions to handle evolving threats, the versatility and enhanced performance of hybrid systems are driving their rising adoption across critical inspection points.

Backscatter X-Ray Devices Market Companies

- Rapiscan Systems (OSI Systems)

- Smiths Detection (Smiths Group plc)

- Varex Imaging Corporation

- Leidos Holdings, Inc.

- Nuctech Company Limited

- 3DX-Ray Ltd

- Autoclear LLC

- Tek84 Inc.

- Astrophysics Inc.

- Scanna MSC Ltd

- Adani Systems Inc.

- American Science and Engineering (AS&E)

- Gilardoni S.p.A.

- Securina Detection System Co., Limited

- Viken Detection

- Rapiscan Eagle

- NUCLEAR SHIELDS

- Kromek Group plc

- Durham Geo Slope Indicator (DGSI)

- FLIR Systems, Inc. (a Teledyne company)

Recent Developments in the Backscatter X-Ray Devices Market

- In March 2025, OSI Systems secured a $76 million contract to supply aviation security equipment. The order includes RTT 110 units for explosives detection and Itemiser 5X systems for identifying narcotics, strengthening airport screening capabilities.(Source: https://investors.osi-systems.com)

- In February 2025, OSI Systems announced receiving a $32 million order for RF-based communication systems designed to enhance its existing security imaging solutions, supporting more integrated and efficient surveillance operations.(Source: https://investors.osi-systems.com)

Segments Covered in the Report

By Product Type

- Portable Backscatter X-Ray Devices

- Fixed Backscatter X-Ray Devices

- Handheld Backscatter X-Ray Devices

- Others

By Application

- Security & Surveillance

- Airport Security

- Border Control & Customs

- Military & Defense

- Cargo & Freight Inspection

- Industrial Inspection

- Pipeline Inspection

- Aerospace Maintenance

- Automotive Quality Testing

- Archaeology & Art Conservation

- Research & Development

By Imaging Mode

- Single-view Imaging Systems

- Dual-view Imaging Systems

- Multi-view / 3D Reconstruction Systems

By End Use Sector

- Aviation & Transportation

- Government & Homeland Security

- Industrial & Manufacturing

- Logistics & Freight

- Defense Forces

- Archaeological Institutes

- Others

By Technology

- Backscatter-only Systems

- Dual-energy X-ray Backscatter

- Hybrid Transmission & Backscatter X-ray

- Advanced AI-based Backscatter Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting