What is Smart Cities Market Size?

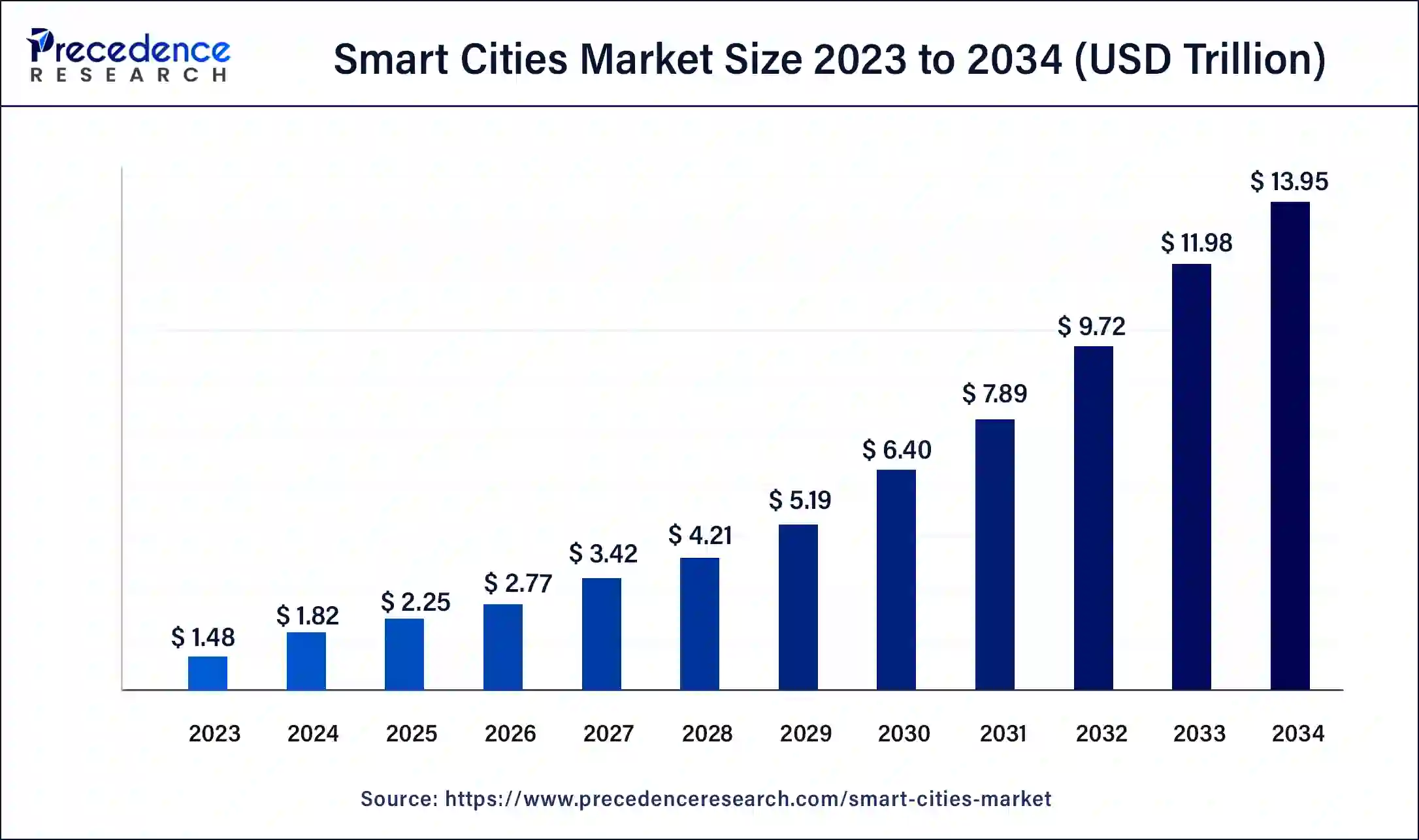

The global smart cities market size accounted for USD 2.25 trillion in 2025 and is predicted to increase from USD 2.25 trillion in 2025 to approximately USD 13.95 trillion by 2034, growing at a CAGR of 22.59% from 2025 to 2034

Market Highlights

- North America region has held a market share of 33% in 2024.

- Asia Pacific is poised to reach a registered CAGR of 29.2% during the forecast period.

- By application, the smart transportation segment has generated a market share of 21% in 2024.

- The environmental solution segment is poised to grow at a CAGR of 28.7% during the projected forecast period.

- By smart utilities, the energy management segment accounted for 57% of the market share in 2024.

- The waste management segment is predicted to reach a CAGR of 28% from 2025 to 2034

- By smart transportation, the Intelligent Transportation System (ITS) segment has held a market share of 47% in 2024.

- The parking management segment is expected to hit a CAGR of 26.3% during the forecast period.

- By smart governance, the smart infrastructure segment has accounted market share of 29% in 2024.

- The smart lighting segment is projected to reach a CAGR of 25.9% from 2025 to 2034

Market Size and Forecast

- Market Size in 2025: USD 2.25 Trillion

- Market Size in 2026: USD 2.77 Trillion

- Forecasted Market Size by 2034: USD 13.95 Trillion

- CAGR (2025-2034): 22.59%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What role does AI play in the Smart Cities Market?

AI is a major player in smart cities as it processes massive amounts of urban data to enhance energy, transport, and safety sectors. It facilitates the use of resources in an efficient way, the real-time control of city maintenance, and anticipatory action for improvement of the aforementioned systems. One way AI makes city management more effective and responsive is through automating the whole process, thus reducing operational costs, improving the environment among the citizens, and promoting sustainability.

Smart Cities Market Growth Factors

The rising urbanization, growing need for infrastructure management, and assets management are the various factors that are boosting the government investments towards the development of smart cities. As per the Consumer Technology Association, the global spending on the development of smart city is estimated to be US$34.35 billion in 2020. The advancements in the technology has fueled the adoption of the internet of things technology in the smart cities to manage traffic flows, monitoring city infrastructure, and monitor air and water quality. The rising need for ensuring public safety, efficient utilization of resources, rising demand for efficient energy consumption, and healthy environment are expected to boost the growth of the smart cities market during the forecast period. According to the United Nations Department of Economic and Social Affairs, the urban population in 2019 was 55.7%, which is projected to reach to 68.4% by 2050.

The rapidly increasing global population and rapid growth in the urban population is driving the demand for the sustainable infrastructure across the globe. The governments across various countries are taking steps and investing heavily to counter the concerns related to rising population rapid urbanization through the development of smart cities. Utility management, safety, and mobility are the major aspects that are efficiently handled in the smart cities. The surging adoption of the novel technologies like artificial intelligence, nanotechnology, big data analytics, cloud computing, internet of things, cognitive computing, and open data are the major drivers of the growth of the smart cities market across the globe.

The growing implementation of various public-private partnership models such as Build, operate, transfer (BOT), Build, own, operate (BOO), Organizational Behavior Management (OBM), and Bill of Materials (BOM) are significantly driving the implementation of the various smart city projects across the globe.

Market Outlook

- Industry Growth Overview:The smart cities market is experiencing a huge increase in size, the main driving forces being the use of AI, IoT, and digital transformation, which made the communication, being green, and the working of the cities more efficient on a worldwide basis.

Sustainability Trends: The market is heading towards long-term environmental and social sustainability due to green innovations, smart grids, energy efficiency, and eco-friendly technologies. - Global Expansion:Asia-Pacific and other developing regions are the ones creating the largest demand for smart infrastructure by digitalizing, investing, and the government actively supporting and initiating these processes.

Major Investors: Big companies, government funds, and venture capital investments are the main drivers of innovation and AI development in smart urban solutions. - Startup Ecosystem: Newcomers create AI-based technologies for mobility, energy, and governance solutions, which act as a catalyst for the whole smart city sector worldwide.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 22.59% |

| Market Size in 2025 | USD 2.25 Trillion |

| Market Size in 2026 | USD 2.77 Trillion |

| Market Size by 2034 | USD 13.95 Trillion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Smart Utilities, By Smart Governance, By Application, By Components, and By Technologies and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Smart Utilities Insights

Based on the smart utilities, the energy management segment accounted for a market share of around 57% and dominated the global smart cities market in 2024. With rising urbanization and industrialization, the demand for the energy has spurred significantly, which has fostered the adoption of the virtual power plants that uses artificial intelligence, internet of things, and machine learning technologies to ensure safety and higher efficiency. The rising investments by the market players in the research and development to boost the introduction and development of technologically advanced energy management systems and integrate technologies like Blockchain have favored the growth of this segment.

The water management segment is anticipated to be the fastest-growing segment during the forecast period. The rising scarcity of drinking water and growing initiatives to promote sustainable living has resulted in the implementation of laws and regulations to implement water management systems across the globe. Rising technological advancements has led to the adoption of IoT-based water management systems like Advanced Metering Infrastructure smart water meters, which facilitates smart water utilization and distribution in the cities.

Smart Governance Insights

The city surveillance was the dominating segment that accounted for 22% of the revenue in 2024in the global smart cities market. The city surveillance plays a crucial role in the management and monitoring public assets, civil services, transportation systems, and community services in the smart cities. The increased concerns related to the public safety has led to the adoption of video management solutions IP cameras across the smart cities, which is boosting the growth of the city surveillance segment exponentially. Declining prices of IP cameras and rising advancements in the analytics and software technology are the major drivers of the city surveillance segment.

The command and control center (CCC) is anticipated to be the most opportunistic segment during the forecast period as it is expected to witness the highest CAGR of 21.5% from 2024 to 2033. Almost every smart city systems and applications such as smart lighting, city surveillance, waste management, energy management, intelligent traffic management systems, and water management system are accessed and controlled from the CCC. The CCC is considered to the brain of any smart city.

The smart lighting segment is predicted to reach at a CAGR of 25.9% during the forecast period.

Application Insights

Based on the application, the smart transportation segment garnered a revenue share of 21% and led the global smart cities market in 2024. The rapid urbanization and increasing economic activities has led to the increased traffic congestion. This factor is stimulating the various governments across the globe to adopt smart transportation solutions to manage assets and infrastructure. The growing adoption of the artificial intelligence and internet of things in the transportation field has led to the growth of the smart transportation segment across the globe. Further, the rising demand for the electric vehicles and on-demand ridesharing is significantly boosting the demand for the smart transportation solutions across the globe.

On the other hand, the smart governance segment is anticipated to be the fastest-growing segment during the forecast period. The rising adoption of the smart technologies by the government to improve and promote transparency, security, accountability, and collaboration is booting the growth of this segment. With the support of the distributors and OEMs, the various governments are deploying video surveillance solutions to ensure public safety and eliminate criminal activities, which are expected to improve smart governance.

Regional insights

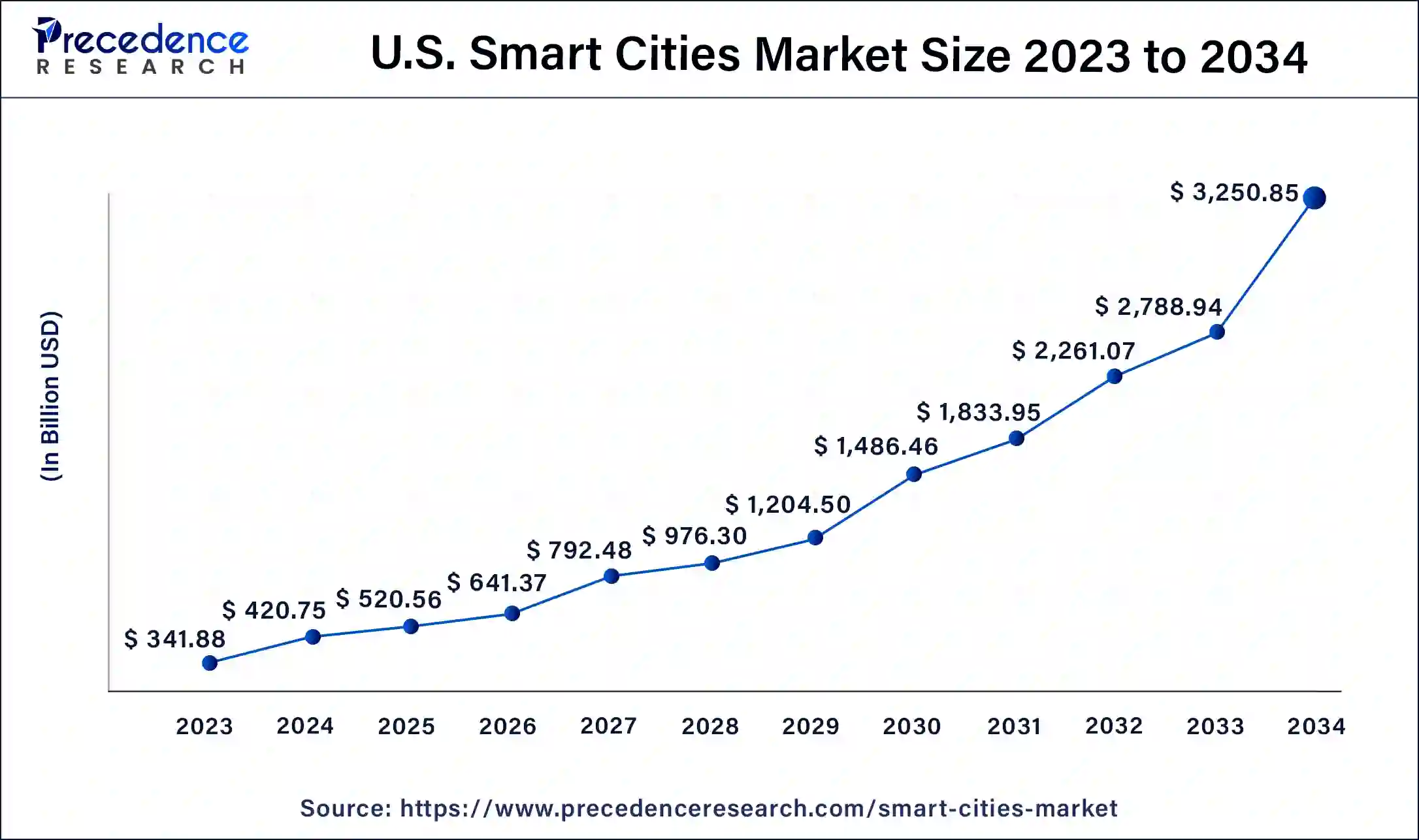

U.S. Smart Cities Market Size and Growth 2025 to 2034

The U.S. smart cities market size reached USD 520.56 billion in 2025 and is anticipated to be worth around USD 3,250.85 billion by 2034, poised to grow at a CAGR of 23% from 2025 to 2034

United States Smart Cities Market Trends:

The U.S. is the country that is leading in smart cities by bringing AI into transportation, governance, and energy systems. The R&D capabilities, supportive governments, and private funds make modernization effortless, leading to smart and efficient cities characterized by the continuous adoption of green practices and real-time management.

North America dominated the global smart cities market, accounting for around 33% of the market share in 2024. The rising technological advancements and digital transformations across various industry verticals such as telecommunications, IT, retail, and banking has led to the growth of the North America smart cities market. North America has well-established information and communication technology (ICT) infrastructure and the strong collaboration of the local and the Federal governments with the various startups and vendors in the ICT industry has significantly contributed to the growth of the North America smart cities market in the past few years. The rising deployment of the civic connectivity infrastructure will lead to the growth of the smart cities market growth. The US Department of Transportation and the Smart Cities Council together promote the smart cities concept in the North American region by organizing various networking events in the region.

Asia Pacific is expected to witness the highest CAGR of over 27.9% from 2025 to 2034. The increased focus of the government towards the digital infrastructure and digital transformation is spurring the growth of the smart cities market in Asia Pacific. Rapid urbanization, growing population, strong economic growth, and rise in globalization are the major factors that are expected to drive the growth of the Asia Pacific smart cities market during the forecast period. The rising government investments to spruce up various industries such as public security, transportation, and energy are anticipated to be the major growth drivers in the foreseeable future.

India Smart Cities Market Trends:

The Indian smart city grid is shaped by the government that supports the programs that promote the use of Artificial Intelligence in the mentioned areas of public life: energy, transport, and waste management. Digital transformation and tri-sector collaboration are making the cities and the less developed areas around them increasingly more efficient, safer, and sustainable.

South Korea Smart Cities Market Trends:

South Korea is recognized as a pioneer in putting AI urban innovations into practice. It connects smart mobility, health care, and green energy systems. The South Korean city model in which intelligent automation, efficient management, and database decision making are employed for improved citizens' well-being.

Value Chain Analysis

1. Inbound Logistics: Receiving, storing, and managing raw materials, components, and smart infrastructure inputs.

Key players: TSMC, Samsung

2. Operations: Transforming inputs into connected, AI-based smart city platforms and services.

Key Players: Cisco, Siemens, IBM

3. Outbound Logistics: Delivering integrated smart infrastructure and digital services to end users.

Key Players: FedEx, Blue Dart Express

4. Marketing and Sales: Promoting smart technologies, IoT platforms, and urban solutions to governments.

Key Players: Apple, Cisco, and IBM

5. Service of Smart Cities: Providing ongoing maintenance, technical support, and solution optimization services.

Key players: IBM (IT services), Cisco

Smart Cities Market Companies

Recent Development

- In October 2025, World Cities Day 2025 emphasizes digital innovation's role in enhancing urban life, promoting the theme of People-Centred Smart Cities for inclusion, accessibility, and equal opportunities.(Source:https://www.citiesalliance.org)

- In September 2025, Hyundai Motor Group launched the Next Urban Mobility Alliance (NUMA) to transform urban transportation with advanced technologies, focusing on inclusive mobility innovation and transitioning to smart cities. (Source:https://www.hyundai.com/worldwide)

Segments Covered in the Report

By Smart Utilities

- Water Management

- Waste Management

- Energy Management

By Smart Governance

- CCS

- E-governance

- City Surveillance

- Smart Infrastructure

- Smart Lighting

By Application

- Smart Building

- Smart Governance

- Smart Utilities

- Smart Transportation

- Environmental Solution

- Smart Healthcare

- Smart Mobility Management

- Smart Public Safety

By Component

- Hardware

- Software

- Service

By Smart Transportation

- Intelligent Transportation System

- Parking Management

- Smart Ticketing & Travel Assistance

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content