What is Smart Manufacturing Market Size?

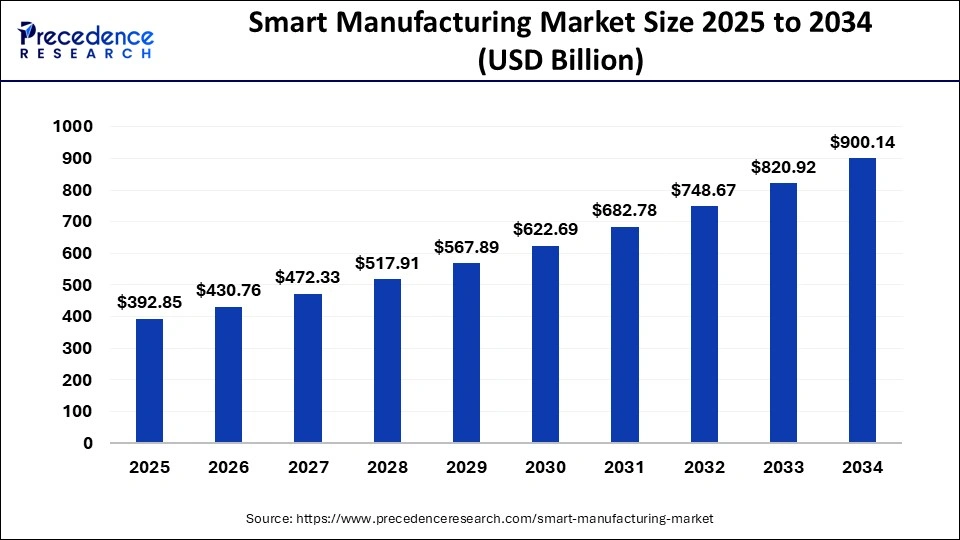

The global smart manufacturing market size is anticipated at USD 392.85 billion in 2025 and is projected to grow from USD 430.76 billion in 2026 to approximately USD 900.14 billion by 2034, growth rate CAGR of 9.65% from 2025 to 2034.

Market Highlights

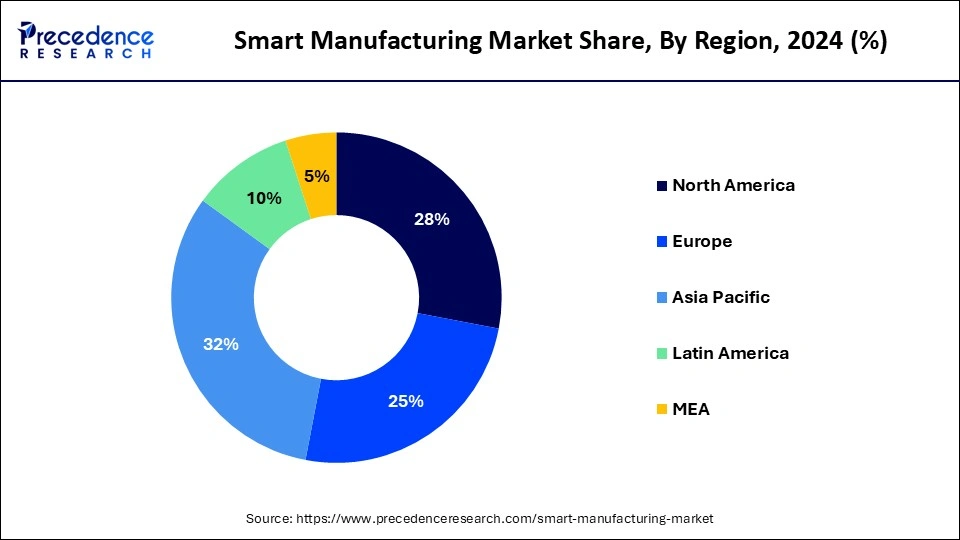

- Asia Pacific led the global market with the highest market share of 32% in 2024.

- By technology, the 3D printing segment has held the largest market share in 2024.

- By end-use, the automotive segment registered the maximum market share in 2024.

Smart Manufacturing Market Growth Factors

The growth of market is driven by increasing demand for connected supply chains and knowledge-based manufacturing that are equipped with advanced modeling, sensing, control, and simulation capabilities. With the advent of Internet of Things (IoT) revolution, there has been significant transformation in the manufacturing sector in form of automation and digitization. Further, cloud technology, Industrial Internet of Things (IIoT), and industrial analytics anticipated to play an important role towards prosper growth of the market.

The industrial sector worldwide has been significantly impacted by numerous factors over the years that include uncertainties in supply chain, intense competition, and exponential operational costs. As a result, market players are actively searching a way that reduces cost and transform enterprises into efficient, accelerated, agile, and compliant with the product quality. Hence, smart industrial solutions estimated to boost the efficiency and productivity in years to come. As per GSMA intelligence report, the industrial IoT connections expected to reach around 13.8 Billion by the end of 2025 along with increase in number of IoT connections in the consumer sector. Growth in the number of IoT connections will stimulate the digitization and connectivity among enterprises. Moreover, different aspects of smart manufacturing predicted to offer additional benefits that include dynamic production and real-time optimization that in turn bolster the need for smart manufacturing at a rapid pace.

Statistics, Data, initiatives, and investments

- By 2026, India is estimated to have approximately 1 billion smartphone users. On this basis, Samsung has planned to invest in smart manufacturing processes in its plant based in Noida India. the Korean major, Samsung aims to bring competitiveness in the production sector with this significant investment.

- While focusing on the smart manufacturing in the construction sector, the Obayashi Corporation completed its 3D printed demonstration building in Japan. The building is approved by the Ministry of Land, Infrastructure, Transport and Tourism and is considered to be the first building in the country with 3D printed cement-based material.

- A network of public and private sector organizations, Next Generation Manufacturing Canada received investment of $177 million from the Canadian government. The investment aims to focus on promoting Canada's manufacturing capabilities. The investment and funding by the government is renewed in February 2024 to scale up transformative solutions in manufacturing sector.

- Intel stated that by 2025, 80-100% manufacturing could be using Internet of Things (IoT) for operating sensors, machines and other manufacturing devices.

- The Japanese government in 2022 provided more than $930.5 million in order to support the country's National Robot Strategy.

- According to Deloitte's 2024 manufacturing survey, 62% of large companies plan to invest in robotics and automation for operational activities this year. Whereas 39% of large companies plan to invest in Internet of Things (IoT) platforms.

- The State of Smart Manufacturing Report by Rockwell Automation, 97% of manufacturers plan to invest in smart manufacturing technology to accelerate the transformation and manage risk factors in the manufacturing sector. Rockwell Automation surveyed 1353 global manufacturers for the survey.

- The Indian government has started Production Linked Incentive (PLI) scheme to promote the adoption of smart manufacturing. The scheme supports manufacturers in the country to adopt automated solutions for boosting their capabilities of production.

- According to the International Federation of Robotics, the automotive industry alone represents one-third of installed robots for working in factories around the world.

Market Outlook

- Industry Growth Offerings- Industry growth in the market is driven by rising demand for automation, IoT, and AI-driven analytics. Companies are delivering connected robots, predictive maintenance, digital twins, and smart sensors to increase efficiency, reduce downtime, and optimize operations.

- Global Expansion- Global expansion in the market is fueled by increasing industrial automation, rising adoption of Industry 4.0 technologies, and growing investments in digital factories. Key regions such as Asia-Pacific, North America, and Europe are scaling smart production through IoT, robotics, AI, and cloud-based industrial platforms.

- Startup ecosystem- Startups in the market are driving innovation through AI-powered robotics, IoT-enabled automation, 3D vision systems, and real-time analytics. They focus on predictive maintenance, process optimization, and intelligent factory solutions, complementing traditional industrial players.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 392.85 Billion |

| Market Size in 2026 | USD 430.76 Billion |

| Market Size by 2034 | USD 900.14 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.65% |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, End Use, and Region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising focus on local production of goods

The Indian government has already started the ‘Make in India' initiative to promote the manufacturing in India in order to reduce the dependencies on importing goods from other countries. In order to boost local manufacturing, the government also offers production linked incentives (PLI) to manufacturers. The scheme also promotes the application and installation of products that are produced in India in various sectors. Many governments are actively promoting local manufacturing through policies, incentives, and funding. These initiatives often align with the adoption of advanced technologies in manufacturing processes. Localized production reduces dependence on far-flung suppliers and makes supply chains more resilient to global shocks. Smart manufacturing technologies enable companies to quickly adapt to changes in demand and supply, ensuring a faster response to market fluctuations. Local production encourages collaboration among manufacturers, suppliers, and customers within a region. Smart manufacturing technologies facilitate seamless communication and information sharing among stakeholders, leading to better coordination, innovation, and joint problem-solving. Thus, the rising focus on local production of goods is observed to act as a driver for the market.

Restraint

Infrastructural limitations

Smart manufacturing involves the integration of advanced technologies such as IoT devices, data analytics, artificial intelligence, and automation into manufacturing processes to improve efficiency, productivity, and flexibility. Smart manufacturing relies heavily on a robust and high-speed internet connection to transmit real-time data between devices, machines, and systems. In regions with poor internet infrastructure or limited connectivity, the adoption of smart manufacturing technologies can be hampered. Smart manufacturing involves the collection, storage, and transmission of sensitive data, making it vulnerable to cyberattacks. Inadequate cybersecurity infrastructure can expose manufacturing facilities to risks such as data breaches, intellectual property theft, and operational disruptions. Thus, infrastructural limitations are observed to act as a major restraint for the market.

Opportunity

Rising emphasis on supply chain optimization

Supply chain optimization combined with smart manufacturing provides real-time visibility into the entire production and distribution process. This visibility enables manufacturers to track the movement of raw materials, work-in-progress, and finished goods, allowing for quick response to any disruptions or delays. The integration of smart manufacturing and supply chain optimization supports agile manufacturing practices. Manufacturers can quickly adapt to changes in demand, product design, or market conditions by adjusting production schedules and processes in real time. This flexibility enhances a company's ability to respond to market fluctuations. Supply chain optimization encourages closer collaboration with suppliers. By sharing real-time data and insights, manufacturers and suppliers can work together to optimize inventory levels, reduce lead times, and enhance the overall efficiency of the supply chain. Thus, the rising emphasis on supply chain optimization aims to present potential opportunities for the market.

Challenge

Difficulties in adoption for small-scale industries

Large corporations often have access to extensive networks, partnerships, and collaborations that can facilitate the adoption of new technologies. Small-scale industries might lack these resources, making it harder to find guidance and support during the adoption process. Many smart manufacturing solutions are designed with larger enterprises in mind. Adapting these solutions to fit the specific needs and scale of small-scale industries can be difficult and might require customization, which can be expensive and time intensive. Thus, such complexities for small-scale industries are observed to pose a challenge for the market.

Segment Insights

Technology Insights

Some of the smart manufacturing technologies have been in use in the industries for quite some time; however, segments such as 3D printing have been gaining prominent traction in the recent times. Implementation of machine learning and Artificial Intelligence (AI) as an additive manufacturing technology, design aid, or 3D printing is shifting the manufacturing sector towards automation. Additionally, 3D printing segment projected to witness the fastest growth rate over the analysis period because of its escalating adoption in agile product iterations and design process.

On the contrary, Machine Execution System (MES) holds the leading market position in terms of revenue on account of rising demand for streamlined workflow along with reduced lead time. The application of MES offers strong ground for the manufacturers to implement the IoT in their manufacturing facilities. Rising demand for industrial automation along with growing importance of regulatory compliance is likely to drive the market growth. For example, Microsoft Corporation along with Google, IBM, and Amazon has become one of the prominent contributors of Industrial IoT offerings that provide PaaS + IaaS platform offerings for smart manufacturing vendors.

End-use Insights

The aerospace & defense and automotive segments are estimated to be the prominent contributors towards the industry growth. The automotive segment led the market in 2024 and further anticipated to grow impressively over the forecast period. This is majorly due to the introduction of autonomous vehicles and other advanced driver assistance systems.

An unusual trend in the industry can be seen for the active adoption of smart manufacturing technologies at two different levels that are connected supply chains and connected products. Process manufacturer invests in the connected supply chain while discrete manufacturers invest significantly in connected products. Automotive leaders forecast that nearly 25% of their manufacturing sites will be transformed into smart factories over the upcoming timeframe. Hence, the rising level of awareness among automotive manufacturers pertaining to the implementation of smart manufacturing technologies to boot their production is likely to impel the market growth for automotive segment.

Regional Insights

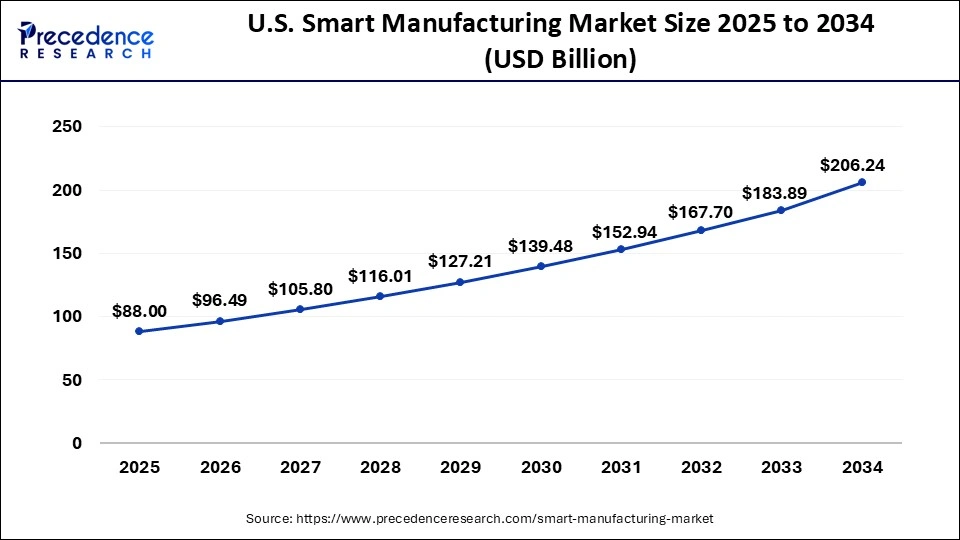

U.S. Smart Manufacturing Market Size and Growth 2025 to 2034

The U.S. smart manufacturing market size is recorded at USD 88.00 billion in 2025 and is predicted to be worth around USD 206.24 billion by 2034, at a CAGR of 9.90% from 2025 to 2034.

U.S. Smart Manufacturing Soars: Technologies Transform Production

The U.S. market is increasing due to growing adoption of advanced technologies such as IoT, AI, robotics, and industrial automation to improve efficiency, reduce costs, and enhance product quality. Government initiatives supporting Industry 4.0, rising investments in digital factories, and demand for predictive maintenance and data-driven decision-making are further driving market growth across sectors like automotive, aerospace, and electronics.

The Asia Pacific region holds the largest market share of around 32% in 2024 and is also predicted to hit as the fastest-growing region over the forecast period 2025 to 2034.

Every region is now investing predominantly in the smart manufacturing technologies, yet the level of maturity varies as per the region. Developed countries such as Germany, the U.S., and Japan have numerous on-going projects in support of the penetration of smart manufacturing or industrial IoT, whereas emerging countries for example China and India are struggling with the technological developments and advancements. For instance, in 2018, Alibaba cloud and Siemens form a partnership to bolster the adoption of industrial IoT in China. The partnership will offer innovative solutions for Chinese manufacturers to implement industrial IoT into their existing system.

Why is Smart Manufacturing Adoption Increasing Across Asia-Pacific?

The Asia-Pacific market is increasing due to rapid industrialization, rising adoption of Industry 4.0 technologies such as IoT, AI, and robotics, and supportive government initiatives promoting automation and digitalization. Growing demand for high-quality, cost-efficient products, coupled with investments in intelligent factories and predictive maintenance, is driving market expansion across key sectors like automotive, electronics, and machinery throughout the region.

China Accelerates Industry: Smart Manufacturing Drives Efficiency and Growth

China's market is growing due to rapid industrial automation, government initiatives like “Made in China 2025,” and rising adoption of IoT, AI, and robotics. Manufacturers are modernizing factories to improve efficiency, reduce costs, and enhance product quality. Additionally, the demand for data-driven decision-making, predictive maintenance, and intelligent production systems is driving investments in smart manufacturing technologies across key sectors such as automotive, electronics, and machinery.

North America Embraces Intelligent Manufacturing: Automation and AI Fuel Market Expansion

North America's market is expanding due to increasing adoption of automation, IoT, AI, and robotics to enhance productivity, reduce operational costs, and improve product quality. Strong investments in Industry 4.0 technologies, government support for advanced manufacturing, and rising demand for data-driven decision-making and predictive maintenance are fueling growth. Additionally, industries such as automotive, aerospace, and electronics are driving the integration of intelligent manufacturing solutions across the region.

Europe Advances with Smart Manufacturing: IoT and Automation Reshape Industries

Europe's market is growing due to increasing adoption of Industry 4.0 technologies, including IoT, AI, robotics, and automation, to enhance efficiency, productivity, and product quality. Supportive government policies, investments in digital factories, and the need for predictive maintenance and data-driven decision-making are fueling growth. Key industries such as automotive, aerospace, and electronics are driving the integration of intelligent manufacturing solutions across the region.

UK Accelerates Digital Factories: Smart Manufacturing Enhances Efficiency and Quality

The UK market is growing due to rising adoption of Industry 4.0 technologies, including IoT, AI, robotics, and automation, to improve productivity, efficiency, and product quality. Government support for digital transformation, investments in advanced manufacturing infrastructure, and increasing demand for predictive maintenance and data-driven decision-making are driving growth. Key sectors such as automotive, aerospace, and electronics are leading the integration of smart manufacturing solutions across the UK.

Top Vendors and their Offerings

- ABB Ltd: Through its ABB Ability™ platform, ABB provides intelligent robots, smart sensors, and digital twin solutions for predictive maintenance and optimized operations.

- Siemens AG: Offers automation, digital-twin technology, low-code app development, and IIoT tools via its Digital Enterprise suite and MindSphere cloud.

- Emerson Electric Co.: Delivers industrial software and control systems (via AspenTech) for real-time analytics, process optimization, and smart operations.

- Fanuc Corporation: Provides smart factory robotics, collaborative robots, and the FIELD open IIoT platform with edge computing and predictive analytics.

- General Electric Co.: Through GE Digital, offers Predix industrial IoT platform for edge-to-cloud analytics, asset performance, and condition-based maintenance.

Smart Manufacturing Market Companies

- Emerson Electric Co.

- ABB Ltd.

- Fanuc Corporation

- Honeywell International, Inc.

- General Electric Co.

- Mitsubishi Electric Corporation

- Rockwell Automation, Inc.

- Robert Bosch GmbH

- Schneider Electric SE

- Yokogawa Electric Corporation

- Siemens AG

Segments Covered in the Report

By Technology

- Programmable Logic Controller

- Machine Execution Systems

- Enterprise Resource Planning

- Discrete Control Systems

- SCADA

- Human Machine Interface

- 3D Printing

- Machine Vision

- Plant Asset Management

- Product Lifecycle Management

By Component

- Software

- Hardware

- Services

By End-Use

- Aerospace & Defense

- Automotive

- Chemicals & Materials

- Industrial Equipment

- Healthcare

- Electronics

- Oil & Gas

- Food & Agriculture

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content