Edge Artificial Intelligence Chips Market Size and Forecast 2025 to 2034

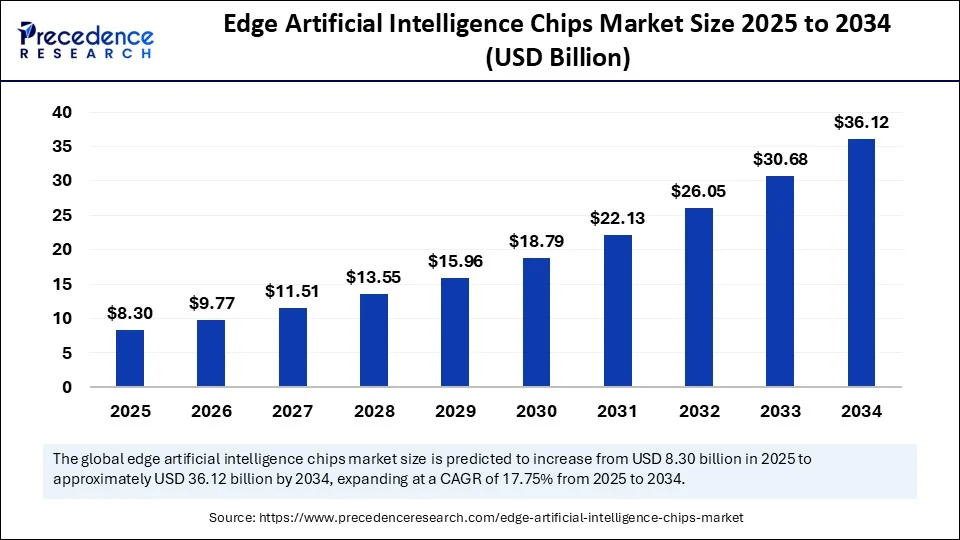

The global edge artificial intelligence chips market size accounted for USD 7.05 billion in 2024 and is predicted to increase from USD 8.3 billion in 2025 to approximately USD 36.12 billion by 2034, expanding at a CAGR of 17.75% from 2025 to 2034. The market is growing due to increasing demand for low-latency and real-time processing of data at the edge. The rising demand for AI-powered devices also boosts the growth of the market.

Edge Artificial Intelligence Chips Market Key Takeaways

- In terms of revenue, the global artificial intelligence chips market was valued at USD 7.05 billion in 2024.

- It is projected to reach USD 36.12 billion by 2034.

- The market is expected to grow at a CAGR of 17.75% from 2025 to 2034.

- Asia Pacific dominated the edge artificial intelligence chips market with the largest share of 35 % in 2024.

- North America is expected to grow at the fastest CAGR between 2025 and 2034.

- By chip type, the ASICs segment held the largest share of 35% in 2024.

- By chip type, the NPU/AI accelerators segment is expected to grow at the fastest CAGR during the forecast period.

- By component type, the hardware segment held the biggest share of 75% in 2024.

- By component type, the software segment is expected to grow at the fastest CAGR in the coming years.

- By technology node, the 7 nm and below segment captured the biggest market share of 50% in 2024.

- By application, the consumer electronics segment contributed the highest market share of 40% in 2024.

- By application, the automotive segment is expected to grow at the fastest CAGR during the forecast period.

- By end-use industry, the consumer electronics segment generated the major market share of 38% in 2024.

- By end-use industry, the automotive segment is observed to grow at the fastest CAGR during the forecast period.

- By form factor, the embedded edge AI chips segment accounted for the biggest market share of 60% in 2024.

- By form factor, the standalone edge AI chips segment is emerging as the fastest growing.

How is the integration of Artificial Intelligence accelerating the adoption of edge computing chips?

The integration of Artificial Intelligenceis accelerating the adoption of edge computing chips by enabling real-time data processing and decision-making directly on devices, reducing the need for constant cloud connectivity. This minimizes latency, enhances privacy, and improves efficiency for applications like autonomous vehicles, smart cameras, and industrial automation. As AI algorithms become more sophisticated, the demand for powerful edge AI chips that can handle complex computations locally continues to rise, driving widespread adoption across multiple industries.

Asia Pacific Edge Artificial Intelligence Chips Market Size and Growth 2025 to 2034

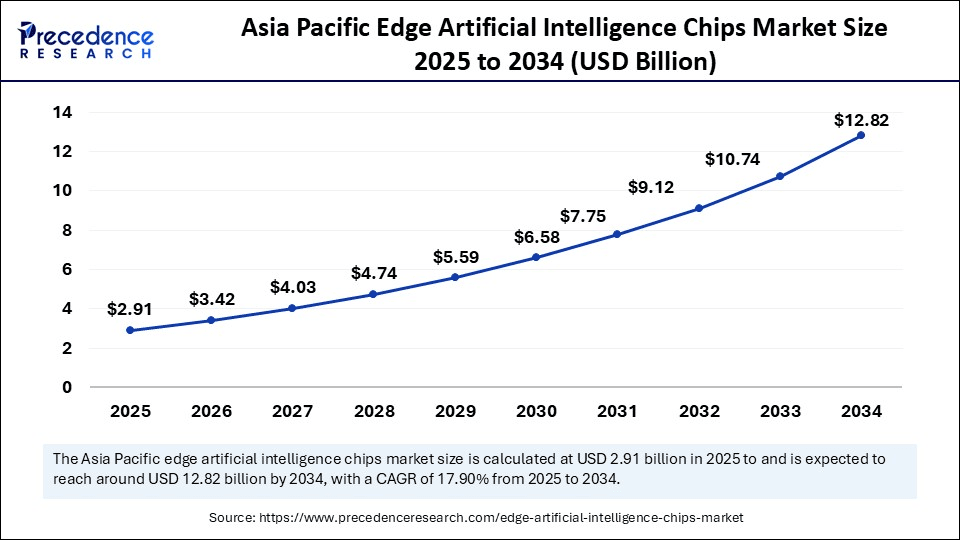

Asia Pacific edge artificial intelligence chips market size was exhibited at USD 2.47 billion in 2024 and is projected to be worth around USD 12.82 billion by 2034, growing at a CAGR of 17.90% from 2025 to 2034.

What made Asia Pacific the dominant region in the market in 2024?

Asia Pacific dominated the edge artificial intelligence chips market by capturing the largest share in 2024. This is because of its robust semiconductor manufacturing ecosystem, quick uptake of consumer electronics with AI, and growing investments in industrial automation and the Internet of Things. Large-scale production capacity and strong demand for AI-powered electronics underpin the region's dominance, making it the main source of income for the global market. The region's leadership in edge computing technologies is further reinforced by government-backed programs encouraging the use of AI in industrial and smart city projects.

North America is expected to grow at the fastest rate in the coming years, driven by substantial expenditures in edge computing powered by AI, expanding use of self-governing systems, and a strong emphasis on digital transformation across sectors. Leading technological innovators are present, and ongoing developments in AI hardware and software solutions are accelerating the region's rate of growth. Furthermore, North America will be a major growth engine in the upcoming years due to the early adoption of edge AI in the healthcare, retail, and defense sectors, as well as robust venture funding for AI startups.

Market Overview

Edge artificial intelligence (AI) chips are specialized semiconductor chips designed to process AI algorithms directly on edge devices, that is, computing devices physically close to the data source, rather than relying on cloud-based servers. These chips enable real-time data processing with low latency, reduced bandwidth usage, enhanced privacy, and energy efficiency for applications like IoT, autonomous vehicles, smart cameras, industrial automation, and consumer electronics.

How do privacy and security concerns affect the demand for on-device processing?

Businesses and consumers wish to reduce the risks involved in sending sensitive data to cloud services. Privacy and security concerns greatly increase the demand for device processing. By enabling local data processing on device edges, AI chips lessen the devices' vulnerability to data breaches, cyberattacks, and compliance problems. This localized strategy guarantees more control over private and sensitive data, which makes it very appealing for industries where data security is crucial, such as government applications, healthcare, and finance.

Edge Artificial Intelligence Chips MarketGrowth Factors

- The rising need for real-time decision-making in autonomous vehicles and smart devices boosts the growth of the market.

- The growing usage of connected devices significantly propels the growth of the market.

- Advances in AI algorithms fuel the growth of the market. Evolving algorithms require powerful edge chips.

- Rising use of smartphones, wearables, and home automation drives the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.12 Billion |

| Market Size in 2025 | USD 8.3 Billion |

| Market Size in 2024 | USD 7.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.75% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chip Type, Component Type, Technology Node, Application, End-Use Industry, Form Factor, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Need For Real-Time Processing

Real-time decision-making is necessary in industrial automation, robotics, and driverless cars, which are driving up demand for edge AI chips. Delays brought about by cloud processing are frequently hazardous for applications such as robotic surgery or driverless cars. These chips lower latency, increase performance, and enhance safety by allowing computations at the edge. For automated warehouses next next-generation mobility, and medical devices, where a prompt reaction could save a life, real-time processing is essential. Furthermore, edge AI chips guarantee low-latency analytics and operational precision as robotics and automation proliferate in manufacturing and logistics. On-device computing is becoming an essential component of the industrial ecosystem due to these trends.

5G Adoption

The rising adoption of 5G technologies drives the growth of the edge artificial intelligence chips market. The rollout of 5G technology enables fast data transmission and supports edge computing ecosystems. Combined with edge AI chips, 5G allows seamless, low-latency processing for applications such as smart autonomous vehicles, and AR/VR high-speed connectivity enhances real-time analytics, enabling innovations like remote surgery and immersive experiences. Furthermore, 5G networks facilitate the scaling of connected devices without overwhelming cloud infrastructure, making edge AI solutions more viable. Telecom operators and chip manufacturers are increasingly collaborating to optimize AI workloads at the edge. The synergy between 5G and AI accelerates the deployment of distributed computing models worldwide.

Restraint

High Development Costs

Developing and manufacturing edge AI chips require significant investments in R&D, specialized hardware, and advanced semiconductorfabrication, which hamper the growth of the edge artificial intelligence chips market. Many businesses strive to have cutting-edge nodes (e.g., G 5nm or less) tape out cycles by themselves that could cost tens of millions of dollars, increasing the competitiveness of incumbents with substantial financial resources. This financial barrier slows the rate of innovation in more fragmented segments and restricts market entry for startups and SMEs. Furthermore, deployment in price-sensitive areas may be discouraged by such high upfront costs, which also impact ROI timelines. The combination of manufacturing costs, specialized design tools, and quality assurance procedures greatly increases the total cost of ownership. This limitation is particularly noticeable in sectors looking for quick, inexpensive integrations.

High Energy Consumption & Thermal Constraints

Edge AI chips in battery-operated or finless devices consume high energy, increasing concerns over energy consumption. High-performance AI workloads can limit sustained peak performance due to thermal throttling, shortening device battery life, and rapidly depleting energy. System design that preserved effectiveness in a variety of environmental circumstances (e.g., A complicated industrial outdoor environment). Chips may perform poorly or lower device reliability if power management and cooling procedures are not strictly followed. These limitations particularly impact mobile wearable and remote IoT deployments. Businesses need to invest in advanced optimization frameworks and energy-conscious architectures.

Opportunities

Strategic Partnerships & M&A in Semiconductor Ecosystem

Partnerships between semiconductor firms, cloud providers, and telecom companies are creating new business models for edge computing solutions. Collaborations allow companies to integrate hardware with software stacks and optimize performance across platforms. Strategic acquisitions n chip IP, low-powered design, and packaging technology also present growth opportunities. Vendors that leverage partnerships for ecosystem integration will gain a competitive edge in both enterprise and consumer segments.

Rising Usage in the Automotive Industry

The automotive sector remains a key non-cloud-driven growth area for edge AI chips. Chips embedded in ADAS (Advanced Driver Assistance Systems) and infotainment platforms enable real-time decision-making without depending on cloud connectivity. Collaborations between chip vendors and automakers create opportunities to standardize platforms for autonomous and semi-autonomous vehicles.

Chip Type Insights

Why did the application-specific integrated circuits (ASICs) segment dominate the edge artificial intelligence chips market in 2024?

The application-specific integrated circuits (ASICs) segment dominated the market with the largest share in 2024. The dominance of ASICs stems from their ability to offer high performance, low latency, and optimized power efficiency tailored for specific AI tasks such as image recognition and voice processing. Major tech players are using ASICs for mass deployment in smartphones, smart cameras, and IoT devices due to their scalability and cost efficiency at high volumes. Their ability to deliver customized computing power with reduced energy consumption makes them the most widely adopted solution in consumer electronics and industrial automation.

The neural processing units (NPUs)/AI accelerators segment is expected to grow at a rapid pace in the upcoming period because of the growing need for deep learning capabilities and real-time inference at the edge. With their high parallel processing and neural network workload optimization, these chips are ideal for applications such as robotic autonomous driving and intelligent surveillance. The exponential growth of NPUs is being driven by the rise in AI-powered edge devices and automotive autonomy projects, positioning them as the go-to option for edge computing solutions of the future.

Component Type Insights

What made hardware the dominant segment in the edge artificial intelligence chips market in 2024?

The hardware segment dominated the market in 2024 because physical AI chipsets such as ASICs, GPUs, and NPUs are the backbone of edge computing infrastructure. The increasing integration of AI hardware in smartphones, industrial machines, and IoT devices reinforces their dominance. Hardware's role in enabling high-speed processing, energy efficiency, and compact device integration makes it the primary revenue generator for the industry.

The software segment is expected to expand at the fastest growth rate in the upcoming period, as developers and enterprises demand tools for model optimization, deployment, and hardware-software integration. Software solutions, such as AI frameworks and software development kits (SDKs), allow businesses to leverage hardware capabilities efficiently while reducing development complexity. The growth of AI application ecosystems, cloud-to-edge integration, and demand for customizable solutions fuels the rapid expansion of AI software frameworks in edge environments.

Technology Node Insights

How does the 7 nm and below segment dominate the market in 2024?

The 7nm and below segment dominated the edge artificial intelligence chips market in 2024 and is expected to grow at the fastest rate during the projection period. This is because smaller nodes provide better transistor density, reduced power consumption, and increased performance, all of which are critical for small devices. Mobile phones, driverless cars, and industrial IoT devices can all benefit from these nodes' latency processing and highly effective inference. The demand for edge AI computing that uses less energy is what is driving the move toward more sophisticated nodes.

To ensure quicker adoption in AI accelerators, edge servers, and next-generation IoT products, top semiconductor companies like TSMC and Samsung are making significant investments in 5nm and 3nm process technologies. The rise in AI-driven applications that demand small but potent chips is responsible for this expansion.

Application Insights

Why did the consumer electronics segment dominate the market in 2024?

The consumer electronics segment dominated the edge artificial intelligence chips market in 2024, as smartphones, wearables, and smart home devices increasingly rely on on-device AI processing for tasks such as voice assistants, image enhancement, and predictive analytics. The demand for real-time processing without cloud dependency is pushing manufacturers to embed AI chips in everyday gadgets, making this segment the largest contributor to market revenue.

The automotive (autonomous vehicles) segment is likely to grow at the fastest rate over the forecast period because real-time processing of massive amounts of sensor data requires sophisticated AI chips. Safety-critical features like lane assistance, collision avoidance, and self-driving navigation are made possible by edge AI chips, which provide low-latency decision-making. The quick developments in connected and electric vehicles further accelerate the adoption of edge AI solutions.

End-Use Industry Insights

Why did the consumer electronics segment dominate the edge artificial intelligence chips market in 2024?

The consumer electronics segment led the market while holding the largest share in 2024 due to the massive integration of AI-powered chips in smartphones, smart TVs, and home automation systems. High consumer adoption rates and the proliferation of AI-enabled functionalities such as virtual assistants, image recognition, and predictive recommendations in everyday devices also drive the segment's dominance.

Automotive is the fastest-growing end-user segment as connected and autonomous vehicles become mainstream, requiring real-time edge processing for safety and performance. AI chips in vehicles enable decision-making independent of cloud connectivity, which is critical for navigation, obstacle detection, and infotainment systems. Government support for smart mobility initiatives further boosts growth in this segment.

Form Factor Insights

How does the embedded edge AI chips segment led the market in 2024?

The embedded edge AI chips segment dominated the edge artificial intelligence chips market in 2024, driven by the increased need for real-time data processing. Real-time processing of AI data is made possible by its direct integration into devices such as security cameras, industrial robots, and smartphones, eliminating the need for external components. For consumer electronics and Internet of Things deployments that demand smooth AI capabilities, their small size and quick response time make them perfect.

On the other hand, the standalone edge AI chips segment is expected to grow at the fastest rate in the upcoming period, as developers and enterprises seek modular, scalable solutions for AI processing across multiple devices. These chips provide flexibility for diverse applications, including industrial automation, healthcare, and autonomous vehicles, where upgrading or customizing AI capabilities is essential.

Edge Artificial Intelligence Chips Market Companies

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Technologies, Inc.

- Advanced Micro Devices, Inc. (AMD)

- Google LLC (Tensor Processing Unit - TPU)

- Xilinx, Inc. (Now part of AMD)

- Broadcom Inc.

- MediaTek Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Arm Holdings (Soft IP for edge AI)

- Graphcore Ltd.

- Cambricon Technologies Corporation Limited

- Baidu, Inc.

- Horizon Robotics, Inc.

- Ambarella, Inc.

- Apple Inc. (Neural Engine)

- Texas Instruments Incorporated

- NXP Semiconductors

- Mythic AI

Recent Developments

- On 24 July 2025, Hailo launched the Hailo 10H edge AI accelerator, the first discrete chip optimized for generative AI workloads at the edge, delivering 40 TOPS INT4 and 20 TOPS INT8 performance at just ~2.5 W. It supports LLMs and VLMs on-device and is being adopted by HP for its AI Accelerator M.2 Card

(Source: https://www.crn.com) - On 3 July 2025, Netra semi (India) raised Rs 107 crore in Series A funding to develop SoCs for edge AI applications in IoT, surveillance, industrial robotics, smart retail, and automation.(Source: https://timesofindia.indiatimes.com)

- In April 2025, Intel announced a strategic pivot toward homegrown AI chip development for edge and robotics use cases, moving away from acquisitions towards evolving its in-house platforms.(Source: https://www.reuters.com)

Segments Covered in the Report

By Chip Type

- Application-Specific Integrated Circuits (ASICs)

- Field Programmable Gate Arrays (FPGAs)

- Graphics Processing Units (GPUs)

- Central Processing Units (CPUs)

- Neural Processing Units (NPUs) / AI Accelerators

- Digital Signal Processors (DSPs)

- Others (e.g., Vision Processing Units - VPUs)

By Component Type

- Hardware

- Processor Units (ASICs, GPUs, NPUs, etc.)

- Memory Units (RAM, Cache)

- Sensors (integrated or external)

- Software

- AI Frameworks & SDKs

- Middleware & APIs

By Technology Node

- 7 nm and below

- 8 nm to 14 nm

- 15 nm to 28 nm

- Above 28 nm

By Application

- Consumer Electronics

- Smartphones

- Wearables

- Smart Home Devices

- Automotive

- Autonomous Vehicles

- ADAS (Advanced Driver Assistance Systems)

- Healthcare

- Portable Medical Devices

- Diagnostic Equipment

- Industrial Automation

- Robotics

- Predictive Maintenance

- Surveillance and Security

- Smart Cameras

- Drones

- Retail

- Smart Vending Machines

- Customer Analytics

- Others (Smart Agriculture, Smart Cities)

By End-Use Industry

- Automotive

- Healthcare

- Consumer Electronics

- Manufacturing & Industrial

- Telecommunications

- Retail & E-commerce

- Others

By Form Factor

- Embedded Edge AI Chips

- Standalone Edge AI Chips

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content