What is Grid Edge Technologies Market Size?

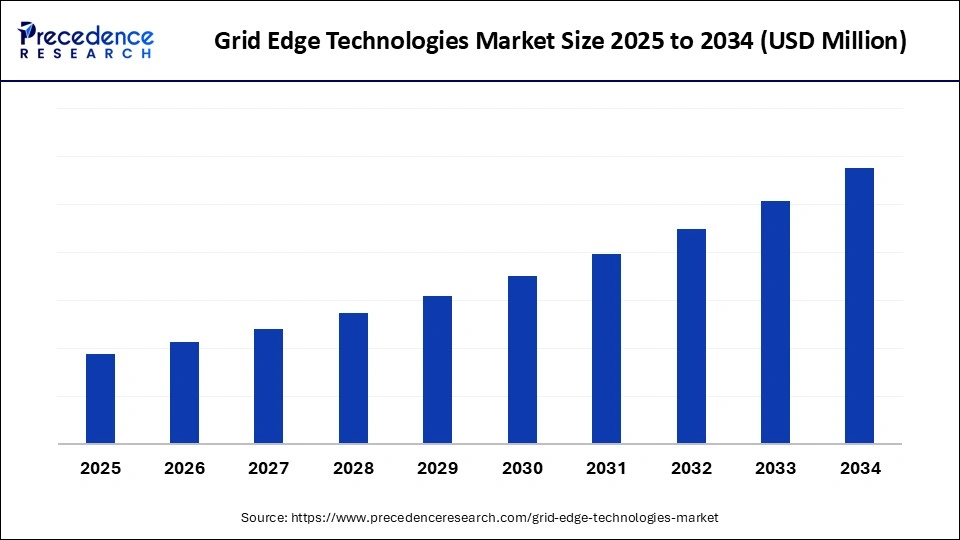

The global grid edge technologies market growth is propelled by investment in advanced metering, DER management systems and grid-edge analytics as electrification rises. This market is growing due to increasing adoption of distributed energy resources, smart grid solutions, and advanced energy management systems that enhance efficiency, reliability, and sustainability.

Market Highlights

- North America dominated the market, holding the largest market share of 38% in 2024.

- Asia Pacific is expected to grow at a notable rate in market share.

- By offering, the hardware segment held the largest share of the market at 43% in 2024.

- By offering, the software segment is expected to grow at the fastest rate during the forecast period.

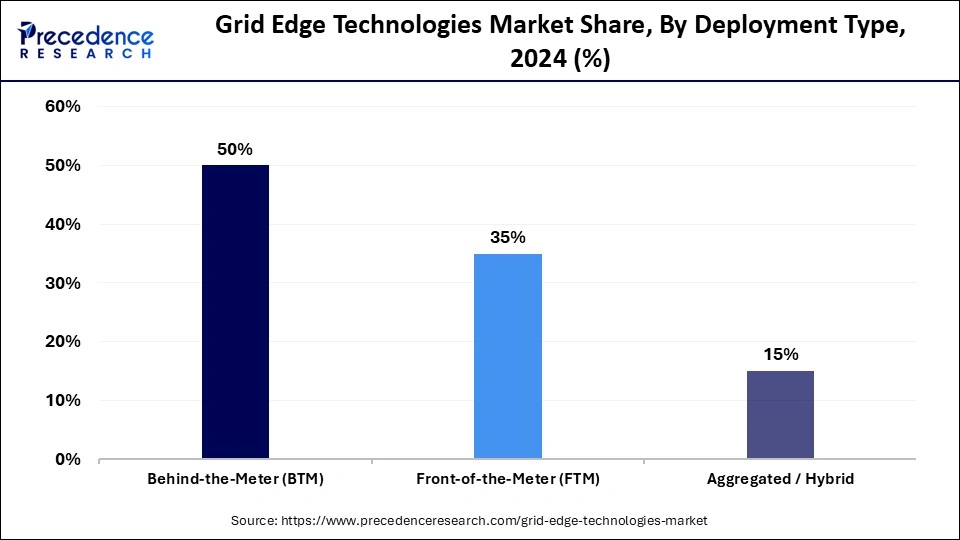

- By deployment type, the behind-the-meter segment held the largest market share of 50% in 2024.

- By deployment type, the aggregated/hybrid segment is expected to grow at the fastest rate during the forecast period.

- By end-user, the utilities & distribution system operators segment is expected to grow at the fastest rate of 40% in the grid edge technologies market.

- By end-user, the commercial and industrial entities segment held the largest share in the market in 2024.

- By application, the grid reliability and resilience segment held the largest share at 25% in 2024.

- By application, the energy trading and market participation segment is expected to grow at the fastest rate during the forecast period.

- By technology, the battery energy storage systems segment held the largest market share of 30% in 2024.

- By technology, the AI and ML segment is expected to grow at the fastest rate during the forecast period.

Key Technological Shifts in the Grid Edge Technologies Market

Edge Computing and Localized Data Processing

Processing data closer to energy assets reduces latency and improves decision-making speed. This shift supports real-time control of distributed systems and enhances grid resilience. Edge computing also reduces bandwidth requirements and ensures faster response during grid distribution.

Blockchain and Peer-to-Peer Energy Trading

Distributed producers and consumers can transact energy in a safe, transparent, and automated manner thanks to blockchain technologies. In decentralized energy markets, it guarantees efficiency, traceability, and trust. Prosumers and regional energy communities can also benefit from new business models made possible by this technology.

Market Overview

What is the Grid Edge Technologies Market?

The grid edge technologies market is experiencing transformative growth driven by the growing need for real-time energy management solutions, the growing integration of distributed energy resources, and developments in edge computing. Strategic alliances and investments that modernize grid infrastructure and improve energy resilience also support this expansion. The use of smart grids and connected energy devices accelerates global market expansions.

- In January 2025, Maharashtra State Electricity Distribution Company Ltd (MSEDCL) &partnered with the Global Alliance for People and Planet (GEAPP) to modernize its power grid, focusing on digitization, AI, and battery energy storage systems. (Source: https://timesofindia.indiatimes.com)

Growth Factors

- Industry Growth Overview: The industry is expanding because of electrification, advanced grid management technologies, and the growing use of renewable energy. Pressure on utilities to provide low-carbon, resilient, and efficient energy is driving investment in cutting-edge grid-edge technologies. Technologies and energy companies are collaborating to develop a scalable solution to accelerate market growth.

- Sustainability Trends: Sustainability is central to the grid edge market, with technologies helping integrate renewable energy, optimize storage, and reduce overall energy consumption. Innovative solutions, such as energy storage optimization and smart demand management, support cleaner and more efficient grids.

- Startup Ecosystem: With new businesses creating cutting-edge solutions for energy management, optimization, and monitoring, the startup ecosystem in grid edge technologies is flourishing. Numerous startups work with utilities to test innovative technologies and hasten their commercialization.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, Application, End user, Deployment Type, Technology, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Restraints

Regulatory Uncertainties

Diverse laws about data privacy, energy management, and distributed energy integration may restrict market growth. Regionally inconsistent standards frequently cause delays in project rollouts and approvals. Operational risks and compliance costs can rise as a result of frequent policy changes and a slow regulatory response to new technologies.

Opportunity

Renewable Energy Integration

Wind, solar, and other distributed energy resources can be distributed and managed more effectively thanks to grid-edge technologies. This encourages the use of cleaner energy sources and lessens reliance on centralized power production. In real time, energy providers can optimize renewable output, lower curtailment, and enhance grid stability.

Segmental Insights

Offering Insights

Why Did the Hardware Segment Dominate the Grid Edge Technologies Market?

The hardware segment dominates the market with a 43% share in 2024 because the foundation of grid operations consists of physical components like energy storage systems, inverters, sensors, and smart meters. These gadgets are necessary for utilities to manage the load monitor in real time and maintain grid stability. Reliability in grid performance and the integration of distributed energy resources depend on a strong hardware infrastructure.

The software segment is expected to be the fastest-growing segment in the market during the forecast period, driven by the need for predictive maintenance tools, energy management systems, and analytics powered by AI to maximize energy flows and boost operational efficiency. Utilities and commercial users are increasingly depending on software. AI integration with cloud-based software is improving decision-making and allowing for adaptable grid operations.

Deployment Type Insights

What Made the Behind-the-Meter Segment Dominate the Market in 2024?

Behind-the-meter segment dominates the market with a 50% share in 2024 as it directly manages energy generation and storage at the consumer or facility level. This setup enables real-time monitoring and optimization of local energy resources. Widespread adoption in residential, commercial, and industrial setups reinforces its dominance in the market.

The aggregated/hybrid segment is expected to be the fastest-growing segment in the market during the forecast period, due to the integration of various dispersed energy sources into a single system. Better energy trading, balancing, and grid optimization are made possible by this strategy. His market is expanding as a result of growing community energy initiatives and microgrid adoption.

End-User Insights

What Made the Utilities & Distribution System Operators Segment Dominate the Market?

The utilities & distribution system operators segment dominates the market with a 40% share in 2024 because of the main grid infrastructure operators. They use grid edge technologies to optimize energy distribution, control distributed generation, and increase reliability. The leading adopters are driven by their extensive operations and regulatory requirements, adopting energy management systems to reduce costs and enhance sustainability

The commercial and industrial entities segment is expected to be the fastest-growing segment in the market during the forecast period they are adopting energy management systems to reduce costs and enhance sustainability. Increasing focus on energy efficiency, peak demand reduction, and integration of on-site generation is driving adoption in this segment.

Application Insights

What Made the Grid Reliability and Resilience Segment Dominate the Grid Edge Technologies Market in 2024?

Grid reliability and resilience dominate as critical applications, ensuring uninterrupted power supply and minimizing outages. Technologies like energy storage, smart sensors, and automated controls enhance grid stability. Maintaining operational continuity and addressing grid vulnerabilities are top priorities for utilities.

Energy trading and market participation are growing rapidly, driven by the rise of consumers and decentralized energy systems. Grid edge technologies enable participation in demand response programs and real-time energy markets. Advanced analytics and cloud platforms facilitate optimized trading strategies and revenue generation.

Technology Insights

Why Did the Battery Energy Storage Systems Segment Dominate the Market in 2024?

The battery energy storage systems segment dominates the market with a 30% share in 2024 because it enables peak shaving, effective energy storage, and backup power during grid fluctuations. For contemporary grids, it is an essential technology due to its integration with DERs and renewable generation. Growing use in behind-the-meter and utility-scale applications solidifies its position in the market.

AI and ML are the fastest-growing technologies, offering predictive analytics, anomaly detection, and automated grid optimization. These tools improve operational efficiency and enable data-driven decision-making across energy networks. The growing adoption of AI-enabled platforms for real-time energy management is driving rapid growth.

Regional Insights

Why Did North America Dominate the Grid Edge Technologies Market in 2024?

North America dominated the market in 2024, backed by significant utility investments, cutting-edge infrastructure, and early adoption of smart grid initiatives. Its dominant position is further strengthened by regulatory support and technological advancement. Advanced grid modernization initiatives and a high penetration of renewable energy further solidify dominance.

Asia Pacific is expanding rapidly due to the increasing integration of renewable energy sources, rapid electrification, and rising use of smart grid and grid edge technologies. The region's emerging economies are making significant investments in cutting-edge energy infrastructure, which is propelling market growth. Adoption is accelerating in several nations thanks to government incentives and private sector involvement.

Country-Level Investments/Funding Trends for the Grid Edge Technologies Market

|

Country |

Key Investment/Funding Trends |

Focus Areas & Drivers |

Informative Key Point |

|

India |

Rapidly growing market and, strong government push to reduce energy losses and integrate renewables. |

Reducing AT&C losses, solar integration, smart meters, and Green Hydrogen. |

The government's RDSS scheme is the core driver for improving distribution efficiency via grid edge tech. |

|

UK |

There is significant investment in infrastructure expansion and modernization. Steady smart grid market growth. |

Offshore wind integration, EV/heat pump load management, resilience enhancement, Net Zero goals. |

Smart grid tech is considered crucial for meeting long-term Net Zero carbon emissions targets. |

|

UAE |

Major government-led investments in smart grid projects. Rapid infrastructure transformation. |

Reliability, sustainability, efficiency (AI/IoT), and large-scale solar integration. |

Dubai's authority (DEWA) is building an advanced, AI-driven grid for regional resilience and efficiency. |

|

Germany |

High commitment to grid modernization to meet ambitious renewable targets. Strong market growth projected. |

The 80% renewables target by 203 includes advanced distribution management, smart meters, and storage. |

The "Energiewende" (energy transition) mandates massive investment in digitalization and storage to balance decentralized power generation. |

Top Grid Edge Technologies Market Companies

- Siemens: Siemens is a global pioneer in grid edge innovation, delivering digitalized and decentralized energy management systems through its Siemens Xcelerator and Grid Edge Suite. The company enables real-time data analytics, DER (Distributed Energy Resource) orchestration, and AI-based grid automation, helping utilities and businesses transition toward a low-carbon, flexible energy future.

- Schneider Electric: Schneider Electric leads in digital energy management and grid automation, integrating IoT and AI within its EcoStruxure Grid platform. Its solutions focus on real-time grid optimization, prosumer integration, and microgrid management, supporting a smarter, more resilient decentralized energy network.

- ABB: ABB's Ability™ Energy and Asset Manager platform enables data-driven grid operation, predictive maintenance, and distributed asset optimization. The company's strength lies in AI-enabled grid edge automation and storage integration, empowering utilities to balance renewable generation with demand-side management.

- Hitachi Energy: Hitachi Energy (formerly ABB Power Grids) provides cutting-edge grid edge control systems, hybrid microgrids, and DER integration technologies. Its Lumada Energy Platform uses AI and advanced analytics to forecast energy loads, stabilize renewable variability, and optimize distributed generation in real time.

- GE Grid Solutions: GE Grid Solutions offers advanced digital substations, distribution automation, and energy orchestration platforms to enhance grid flexibility and reliability. Its GridOS™ software suite combines cloud analytics, predictive grid modeling, and DER management to enable utilities to manage grid edge assets more efficiently.

Other Companies in the Grid Edge Technologies Market

- Landis+Gyr: Specializes in smart metering and energy data management, enabling utilities to optimize grid performance and customer energy efficiency.

- Itron: Offers IoT-enabled smart grid, metering, and demand response solutions, empowering utilities to manage distributed resources and improve grid flexibility.

- Enphase Energy: A pioneer in microinverter and energy management systems, Enphase connects solar, storage, and EV assets at the grid edge for optimized performance.

- SolarEdge Technologies: Provides smart inverters, energy optimizers, and grid-interactive software, supporting distributed renewable integration and grid balancing.

- SMA Solar Technology: Focuses on solar and storage inverters with grid-stabilization capabilities, enabling seamless renewable energy integration.

- Tesla: Integrates grid-scale battery storage (Megapack) and home energy systems (Powerwall, Powerhub) for decentralized grid resilience and virtual power plant (VPP) operations.

- Eaton: Offers smart switchgear, power management, and grid modernization technologies, enhancing energy efficiency and resilience across grid-edge systems.

- Honeywell: Develops AI-driven energy optimization and grid automation platforms, supporting digital twin technologies for predictive grid management.

- Panasonic: Provides distributed energy management and smart energy storage solutions, integrating solar, EV charging, and battery technologies for grid-edge ecosystems.

- Mitsubishi Electric: Delivers advanced grid control systems, power electronics, and renewable integration solutions, driving next-generation smart grid evolution.

Recent Developments

- In October 2025, Itron (USA) announced the acquisition of Urbint, an AI-based infrastructure software company, for $325 million to strengthen its grid-edge analytics, predictive maintenance, and safety solutions.(Source: https://www.renewableenergyworld.com)

- In September 2025, Landis+Gyr (Switzerland) partnered with PLUS ES to deploy advanced edge-sensing meters and software solutions designed to enhance Australia's grid reliability and support its clean energy transition. (Source: https://www.prnewswire.com)

- In October 2025, Researchers launched a new Edge-to-Cloud architecture enabling 5G-driven, software-defined energy networks to improve real-time monitoring and automation in smart grids. (Source: https://arxiv.org)

Segments Covered in the Report

By Offering

- Hardware

- Inverters

- Energy Storage Systems

- Smart Meters & AMI Devices

- EV Chargers & V2G Hardware

- Sensors & Edge Gateways

- Power Electronics & Switchgear

- Software

- DERMS (Distributed Energy Resource Management Systems)

- VPP Platforms (Virtual Power Plant Software)

- EMS / BMS / HEMS / BEMS

- Analytics & Forecasting Platforms

- Grid Optimization & Planning Tools

- Services

- System Integration & Commissioning

- Operation & Maintenance (O&M)

- Managed Services

- Financing & Leasing Solutions

By Deployment Type

- Behind-the-Meter (BTM)

- Residential

- Commercial & Industrial (C&I)

- Front-of-the-Meter (FTM)

- Distribution Utility Applications

- Transmission-Level Applications

- Aggregated / Hybrid

- Community Microgrids

- Virtual Power Plants

By End-User

- Utilities & Distribution System Operators (DSOs)

- Residential Consumers

- Commercial & Industrial Entities

- Fleet & Mobility Operators

- Microgrid / Campus Operators

By Application

- Energy Management & Optimization

- Grid Reliability & Resilience

- Peak Shaving & Demand Charge Management

- Demand Response & Load Control

- Energy Trading & Market Participation

- EV Charging & V2G Integration

By Technology

- Smart Inverters & Power Electronics

- Battery Energy Storage Systems

- Advanced Metering Infrastructure (AMI)

- Edge Computing & IoT Integration

- Artificial Intelligence & Machine Learning

- Blockchain & Transactive Energy Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content