What is the Grid Cybersecurity Market Size?

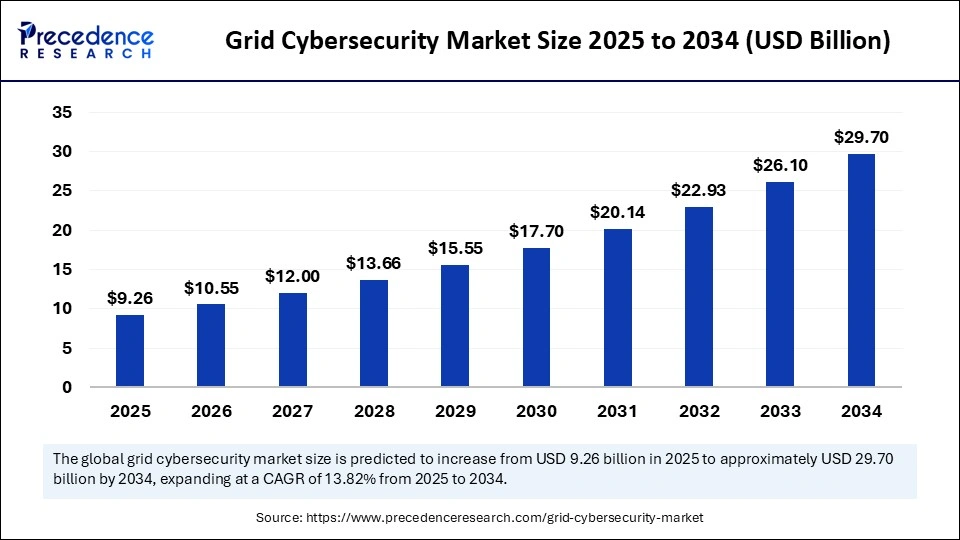

The global grid cybersecurity market size was calculated at USD 9.26 billion in 2025 and is predicted to increase from USD 10.55 billion in 2026 to approximately USD 29.70 billion by 2034, expanding at a CAGR of 13.82% from 2025 to 2034. In an era where electricity is the lifeblood of civilization, the grid has emerged as both an enabler of progress and a vulnerable digital frontier.

Market Highlights

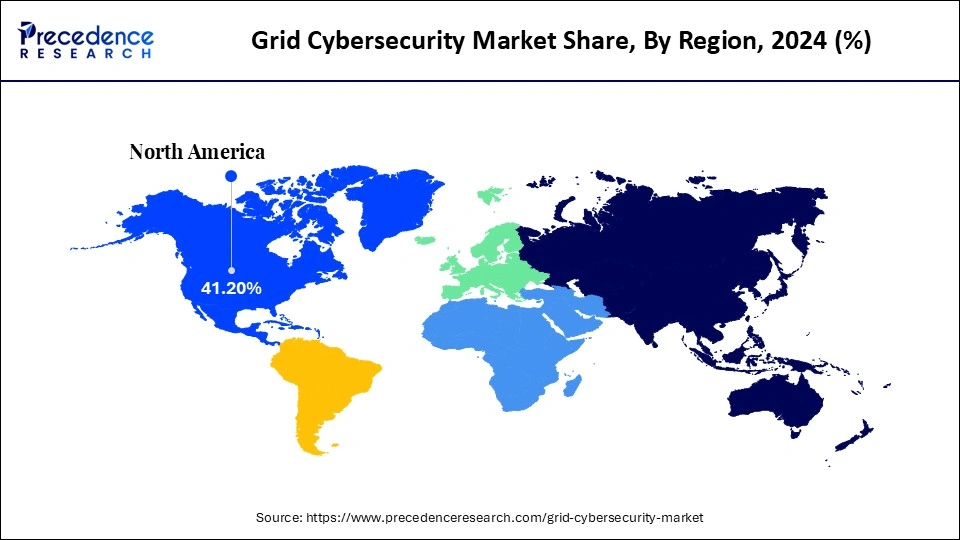

- By region, North America dominated the market, holding largest market share of 41.20% in the year 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR of 12.8% in the market between 2025 and 2034.

- By component, the solution segment held the largest market share of 65.8% in 2024.

- By component, service is expected to grow at a remarkable CAGR of 12.4% between 2025 and 2034.

- By solution, the identity & access management segments held the largest market share of 31.5% in 2024.

- By solution, SEIM is expected to grow at a remarkable CAGR of 12.5% between 2025 and 2034.

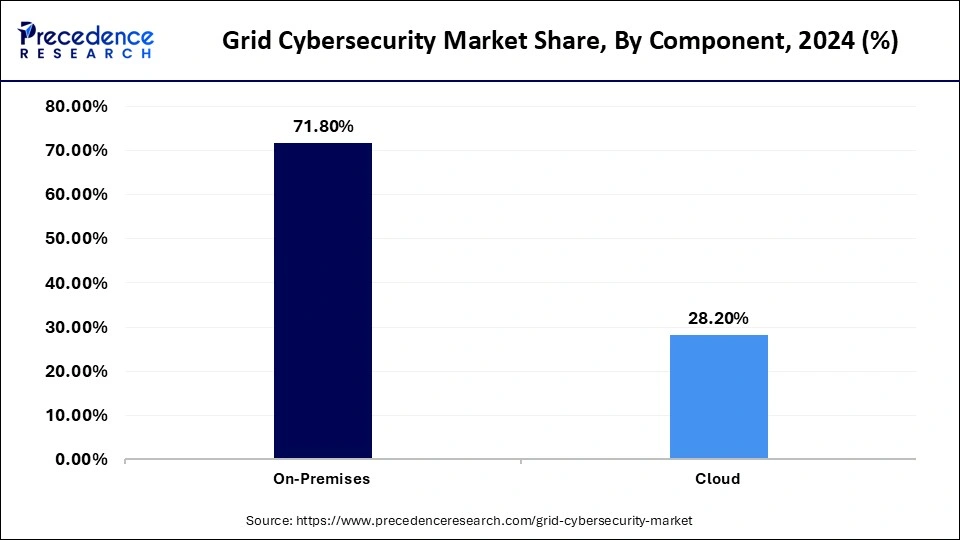

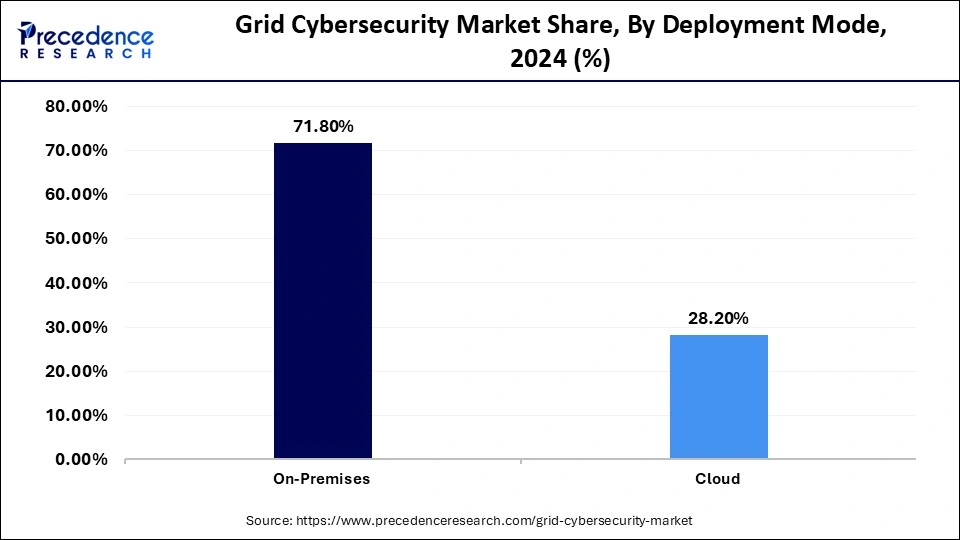

- By deployment mode, the on-premises segment held the largest market share of 71.8% in 2024.

- By deployment mode, cloud segment grow is expanding at a remarkable CAGR of 12.7% between 2025 and 2034.

- By security type, the network security segment held the largest market share of 33.5% in 2024.

- By security type, data security segment is poised to grow at a remarkable CAGR of 11.8% between 2025 and 2034.

- By end-user, the public utilities segment held the largest share of 57.5% in 2024.

- By end-user, the private utilities segment is growing at a solid CAGR of 12.5% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 9.26 Billion

- Market Size in 2026: USD 10.55 Billion

- Forecasted Market Size by 2034: USD 29.70 Billion

- CAGR (2025-2034): 13.82%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Grid Cybersecurity Market?

The grid cybersecurity market focuses on protecting electrical grids and critical power infrastructure from cyber threats, ensuring operational reliability, data integrity, and system resilience. It encompasses security solutions for transmission, distribution, and smart grids to safeguard against ransomware, data breaches, and control system attacks. The market growth is driven by increasing digitalization of utilities, integration of IoT and SCADA systems, expansion of smart grids, and growing regulatory mandates emphasizing critical infrastructure protection and network security.

Market growth in grid cybersecurity is being propelled by the escalating sophistication of cyberattacks and the expansion of digitized grid infrastructure. With utilities embracing smart meters, real-time monitoring, and remote-control systems, vulnerabilities have multiplied, demanding more robust security frameworks. The industry's focus has shifted from reactive patching to proactive prevention, emphasizing encryption, AI-driven anomaly detection, and blockchain-led authentication. Governments and private utilities alike are investing heavily in risk intelligence platforms that fortify both operational technology (OT) and information technology (IT) layers. This shift towards holistic cyber fortification underscores the indispensable role of cybersecurity in sustaining an uninterrupted energy supply and public confidence.

Key Technological Shifts in the Grid Cybersecurity Market

The grid cybersecurity landscape is undergoing a profound metamorphosis through the infusion of automation, AI, and digital twins. Cyber-physical convergence is reshaping how grid operators visualize and mitigate risks. Adaptive AI frameworks now predict intrusion patterns, while blockchain fortifies identity management and transaction integrity. The emergence of zero-trust architectures and autonomous threat intelligence platforms signals a paradigm shift from protection to prevention, from passive defense to self-healing networks.

Grid Cybersecurity Market Outlook

- Industry Growth Overview: The industry's growth trajectory is defined by the convergence of energy intelligence, cloud-based command systems, and machine learning defense. Innovations in SCADA protection, microgrid resilience, and zero-trust network models are creating new benchmarks for digital reliability.

- Sustainability Trends: Sustainability in grid cybersecurity transcends carbon consciousness; it is about safeguarding the integrity of clean energy transitions. Protecting renewable assets from offshore wind farms to solar microgrids ensures uninterrupted green power delivery and fortifies the ethical backbone of sustainable modernization.

- Major Investors & Startup Economy: Investment momentum is steered by both legacy tech giants and cybersecurity startups redefining grid protection. Venture capital inflows are nurturing innovations in predictive threat modeling, AI-driven forensics, and post-quantum cryptography. Startups focusing on grid behavioral analytics and high-end, powered resilience modeling are fast becoming integral allies to energy utilities.

Market Key Trends in Grid Cybersecurity

- From Firewalls to Fortresses: Cybersecurity is no longer an afterthought but an embedded pillar of grid design. Trends such as real-time intrusion analytics, edge-level encryption, and inter-utility data collaboration are defining this evolution.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.26 Billion |

| Market Size in 2026 | USD 10.55 Billion |

| Market Size by 2034 | USD 29.70 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Solution Type, Deployment Mode, Security Type, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The Rise of the Resilient Grid

The most powerful driver is the global realization that energy security is national security. The increasing electrification of transportation, industry, and households has rendered thegrid a strategic asset. Governments are mandating robust cyber governance, while utilities invest in self-learning defense frameworks that can preempt and neutralize threats in real time.

Restraint

Complexity Breeds Vulnerability

The integration of legacy systems with next-gen smart technologies creates an intricate web of potential vulnerabilities. The lack of standardized global security protocols and workforce skill gaps hinders the rapid deployment of advanced defense solutions.

Opportunity

Turning Threats into Intelligence

Opportunities lie in harnessing AI-driven predictive modeling, quantum-resistant encryption, and cloud-based incident orchestration. As digital twins simulate real-world attack scenarios, utilities gain the power to preempt breaches, transforming risk management into a strategic advantage. From sensor manufacturers to utility cybersecurity integrators, each node contributes to fortifying the digital grid ecosystem. Partnerships between IT vendors, telecom providers, and energy utilities enhance collective intelligence sharing and strengthen resilience.

Segment Insights

Component Insights

How Solutions is Dominating the Grid Cybersecurity Market

The solution is dominating the grid cybersecurity market, holding a share of 65.8%. Utilities prioritize end-to-end cybersecurity platforms encompassing threat detection, intrusion prevention, and incident response systems. These solutions offer scalability, interoperability, and real-time visibility into network operations, key to maintaining grid integrity. Furthermore, regulatory compliance and national security concerns have accelerated investments in robust security solutions. The growing interlinkage between operational technology and information technology has made unified cybersecurity frameworks indispensable. This convergence positions cybersecurity solutions not as an optional safeguard but as foundational pillars of grid modernization.

The service segment is the fastest growing in the grid cybersecurity market, holding a share of 12.4%, as they increasingly rely on expert-driven consultation, integration, and managed security operations. As the threat landscape evolves, companies seek specialized partners to continuously monitor, assess, and upgrade their defense systems. Managed security service providers are emerging as strategic allies, offering 24/7 surveillance and threat intelligence tailored to grid environments. Additionally, the shortage of in-house cybersecurity talent is driving reliance on outsourced expertise. Service-based models ensure cost efficiency and agility in adapting to new threats. This dynamic evolution underscores and shift from product acquisition to holistic, lifecycle-oriented security management.

Solution Type Insights

How Identity & Access Management (IAM) is Dominating the Grid Cybersecurity Market?

The Identity & Access Management (IAM) is dominating the grid cybersecurity market, holding a share of 31.5%, due to its critical role in safeguarding access to essential grid control systems. As grid operations become digitalized, the need to control, authenticate, and audit user access has become paramount. IAM platforms prevent unauthorized intrusions, reduce insider threats, and ensure accountability across all operational nodes. The rise of multi-factor authentication and role-based access models enhances control precision. IAM also aligns with stringent energy cybersecurity regulations, ensuring compliance while maintaining operational flexibility. As distributed energy resources and IoT devices multiply, IAM has emerged as the backbone of grid integrity and secure collaboration.

The SIEM segment is the fastest-growing in the grid cybersecurity market, holding a share of 12.5%. SIEM systems are witnessing exponential growth as utilities seek real-time visibility and predictive defense. SEIM integrates logs, alerts, and analytics from diverse endpoints to provide a unified threat intelligence dashboard. Its ability to detect anomalies and correlate complex attack vectors empowers grid operators with foresight rather than hindsight. The integration of AI-driven pattern recognition has transformed SEMI into an anticipatory security tool. Moreover, SIEM solutions facilitate compliance reporting and incident forensics critical in an era of rising grid-targeted cyber assaults. As cyber threats become more sophisticated, SIEM stands as the nerve center of modern grid defense.

Deployment Mode Insights

How On-Premises is Dominating the Grid Cybersecurity Market?

The on-premises is dominating the grid cybersecurity market, holding a share of 71.8%, driven by the inherent sensitivity and criticality of energy infrastructure data. Utilities preferin-house systems that offer direct control over data sovereignty, system customization, and regulatory compliance. Many national grid operators still rely on localized, air-gapped systems to minimize exposure to external networks. On-prem solutions allow organizations to maintain tight integration with legacy SCADA and industrial control systems. Furthermore, the fear of cloud-related breaches has reinforced this conservative approach to deployment. In essence, the preference for on-premises architecture reflects a cautious yet calculated balance between control, security, and operational assurance.

The cloud segment is the fastest-growing in the grid cybersecurity market, holding a share of 12.7%. Reflecting the global shift toward digital agility and scalability. Cloud-based cybersecurity enables utilities to deploy, update, and manage systems with unparalleled speed and efficiency. The flexibility to integrate multi-tenant infrastructures across geographically dispersed grids has made cloud adoption increasingly attractive. Moreover, advancements in encryption and hybrid security models have mitigated traditional concerns over data exposure. Utilities leveraging cloud systems benefit from real-time analytics, AI-driven threat mitigation, and centralized governance. This transformation represents not just modernization but a paradigm shift toward adaptive, intelligent grid defense.

Security Insights

How Is Network Security Leading the Grid Cybersecurity Market?

The network security is dominating the grid cybersecurity market, holding a share of 71.8%. With the proliferation of smart substations, connected sensors, and IoT devices, protecting data in transit is non-negotiable. Network firewalls, intrusion prevention systems, and encrypted communication protocols form the backbone of resilience. Utilities are increasingly adopting network segmentation and zero-trust principles to limit potential breach impacts. The dynamic nature of power distribution demands continuous monitoring and adaptive defenses. As the grid expands its digital reach, network security remains the unyielding guardian of continuity and stability.

The data security segment is the fastest-growing in the grid cybersecurity market, holding a share of 11.8%, driven by the exponential surge in energy data generation. From smart meters to predictive maintenance systems, vast streams of sensitive information require end-to-end protection. Encryption, tokenization, and secure storage solutions are becoming vital to ensure privacy and compliance. As data becomes the new energy currency, utilities are investing in advanced analytics that preserve integrity without compromising accessibility. AI-powered data governance systems now enable proactive anomaly detection. This segment's rise highlights the shift from reactive measures to a data-centric cybersecurity paradigm.

End-User Insights

How Are Public Utilities Leading the Grid Cybersecurity Market?

The public utilities are dominating the grid cybersecurity market, holding a share of 71.8%, given their pivotal role in national infrastructure and public service continuity. Their vast and distributed network architectures necessitate comprehensive cybersecurity frameworks. Government mandates, such as national grid protection initiatives, further strengthen their focus on cyber resilience. Public utilities also have greater access to funding and technical partnerships, enabling large-scale deployment of advanced security systems. Moreover, their accountability to citizens drives transparency and adherence to international cybersecurity norms. In this regard, they serve as both guardians of the grid and benchmarks of cyber preparedness.

The private utilities segment is the fastest growing in the grid cybersecurity market, holding a share of 12.5%. With rising digitalization, these entities face growing exposure to sophisticated cyber threats targeting automation layers. Their agility enables faster adoption of AI-driven defense models and blockchain-secured control systems. Collaboration with cybersecurity startups and research institutions has become a hallmark of their evolution. Furthermore, competitive market dynamics encourage proactive risk mitigation to avoid operational disruptions. This surge underscores a pivotal trend: cybersecurity is no longer just a regulatory obligation but a strategic differentiator in private energy ecosystems.

Analyst Commentary: Grid Cybersecurity Market

The grid cybersecurity market is best characterized as a policy-coupled, capital-intensive security play at the juncture of critical-infrastructure resilience and digital transformation. The market's architecture is being re-underwritten by three contemporaneous forces pervasive IT/OT convergence, regulatory intensification around critical-infrastructure standards, and a rapidly escalating threat surface driven by geopolitical friction and commoditized attack tooling. Each of these vectors materially reconfigures both the demand profile and the vendor economics for grid-grade cybersecurity solutions.

Market character and sizing intuition

From a top-down vantage, the market presents as an expanding addressable expenditure line embedded within utility capex and opex budgets not a narrow point-solution spend. Recent market syntheses and forecasting exercises place the smart-grid / grid cybersecurity market in the single-digit to low-teens CAGR range over the coming decade, with total market sizes converging in the low-to-mid tens of billions USD depending on definitional scope (OT solutions, network security, managed detection and response, compliance automation, and incident response). These estimates should be treated probabilistically: methodological variance between vendors reflects differences in inclusions (e.g., whether OT asset hardening and meter-level encryption are counted as cybersecurity).

- Analytical implication: model the market as a policy-anchored annuity with episodic re-rating around high-impact incidents and regulatory milestones rather than steady linear spend.

Demand drivers — three durable secular pulls

- IT/OT Convergence: The removal of traditional air-gaps and the proliferation of connected sensors, DERs (distributed energy resources), and smart meters generate exponential attack vectors, necessitating bespoke OT security controls and cross-domain orchestration. This convergence drives demand for solutions that can reconcile availability-first OT requirements with confidentiality-first IT paradigms.

- Regulatory & Compliance Tightening: Mandates and standards (e.g., NERC CIP in North America, NIS/NIS2 in Europe) are shifting cybersecurity from discretionary to prescriptive capital allocation, converting regulatory compliance into a persistent baseline for procurement. Utilities thus increasingly treat cybersecurity spend as a non-discretionary, long-cycle line item.

- Threat Acceleration & Geopolitics: A measurable uptick in attempted intrusions and ransomware targeting utilities makes cybersecurity spend actuarially sensible; regulators and investors alike price exposure to systemic outages as a financial risk. High-frequency reporting of attacks has materially altered stakeholder risk tolerance.

Competitive & technology topology

The vendor landscape bifurcates into:

- Device & infrastructure security providers (secure RTUs, secure meter firmware, hardware root of trust),

- Network & comms security specialists (segmentation, SASE/edge security for grid telemetry),

- OT-centric MDR / XDR providers that blend industrial protocol understanding with anomaly detection, and

- Integration and managed service firms (metering-as-a-service, SOC-as-a-service for utilities).

Technologies of increasing salience include deep-protocol behavioral baselining for industrial control systems, cryptographic anchoring for distributed measurement (meter-level PKI / TPM), and converged IT/OT SIEMs with model-driven forensics. Vendors that can materially reduce mean-time-to-detect (MTTD) while preserving deterministic control-plane latency will command premium commercial terms.

- Business inference: sustainable economic moats will be hybrid a combination of industrial-protocol domain expertise, long-tail managed services contracts, and regulatory-grade certification footprints.

Commercial models & procurement dynamics

Procurement is migrating from CAPEX device purchases to outcome-based contracting and recurring revenue models: managed detection and response, continuous compliance services, and resilience insurance-linked offerings. Institutional buyers (regulated utilities, ISOs/RTOs, and government agencies) favor vendors able to demonstrate full lifecycle stewardship — from secure design and deployment to 24/7 incident handling and post-incident remediation. Financing structures are increasingly creative: utilities are leveraging green bonds and infrastructure funds to underwrite grid modernization packages that bundle cybersecurity as a contractual deliverable.

Regulatory & systemic risk considerations

Regulatory enforcement raises the bar for baseline investments but also creates concentration risk: a single successful exploit with physical consequences would not only catalyze massive discretionary catch-up spend but could also precipitate policy responses that reallocate economic rents (e.g., mandated vendor qualification schemes, liability attribution rules). Scenario planning should therefore incorporate both (a) continuous compliance costs and (b) episodic, politically driven capital infusions following systemic events.

Investment thesis & capital markets view

- Defensive core allocation: Infrastructure-grade managed service providers and certified OT security integrators present lower beta, regulatory-defensive exposures — appropriate for long-duration allocations seeking predictable contracted revenue.

- Growth-option satellites: Network security innovators, cryptographic-hardware specialists, and AI-driven anomaly detection platforms offer higher upside but require careful de-risking tied to integration proofs and utility procurement cycles.

- M&A and consolidation: Expect disciplined roll-up activity as incumbents seek to internalize OT domain expertise and recurring managed-services revenue; strategic acquirers will prize field-proven deployments and regulatory credentials.

Key risks and downside scenarios

- Procurement inertia / budgetary constraints in utilities facing competing modernization priorities (e.g., DER interconnection, EV infrastructure) can dampen near-term spend.

- Technology mismatch where IT-centric solutions fail to meet OT availability SLAs; such a mismatch risks procurement rework and wasted integration expense.

- Fragmented standards across jurisdictions elevate compliance costs for vendors and can lengthen sales cycles.

- Adversary evolution attackers exploiting zero-day vulnerabilities in widely deployed grid components could trigger outsized remediation costs and reputational fallout.

Tactical recommendations for stakeholders

- For utilities/buyers: adopt a defense-in-depth procurement posture, prioritize demonstrable OT interoperability, and favor providers with delegated incident-response capacity and insurance linkages.

- For vendors: pursue certified reference architectures, tightly couple product bundles with managed services, and develop outcome-based pricing (SLA-linked) to migrate to annuity models.

- For investors: allocate via staged commitments tied to regulatory milestones and installed-base wins; prioritize balance sheets that can support multi-year pilots and long sales cycles.

Regional Insights

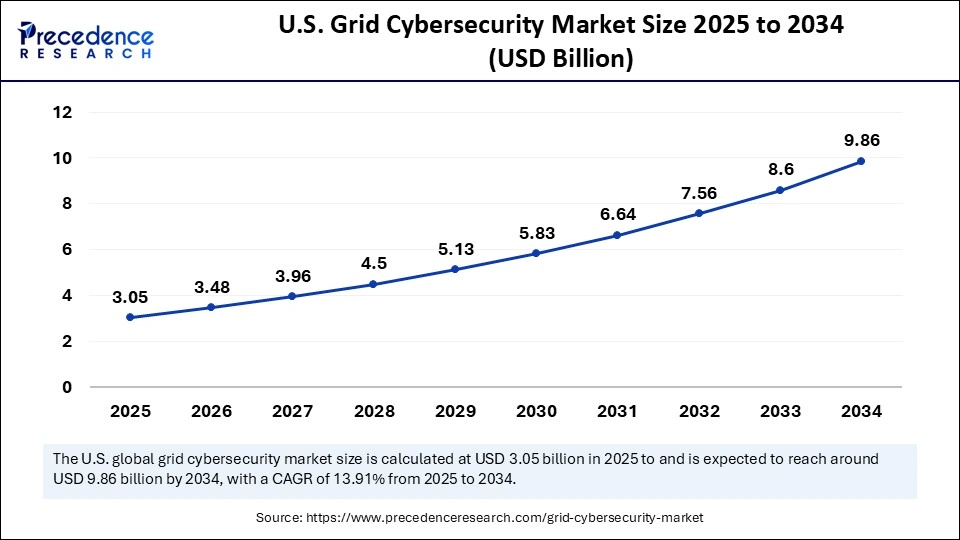

U.S. Grid Cybersecurity Market Size and Growth 2025 to 2034

The U.S. grid cybersecurity market size was exhibited at USD xx billion in 2025 and is projected to be worth around USD xx billion by 2034, growing at a CAGR of xx% from 2025 to 2034.

How is North America Dominating the Grid Cybersecurity Market?

North America dominates the grid cybersecurity market, underpinned by its advanced energy infrastructure and proactive regulatory frameworks. The U.S. leads in implementing layered security mechanisms integrating AI and blockchain into utility systems. The increasing digitization of grid assets across states has prompted investments from both federal and private sectors. In Canada, the focus remains on safeguarding renewable integration and smart metering systems. The collaboration between energy departments and private cybersecurity firms is fostering a unified digital defense strategy. North American utilities are also spearheading pilot projects in predictive cybersecurity using quantum encryption and real-time resilience analytics.

The U.S. grid, a complex tapestry of public and private entities, has become the focal point for global cybersecurity innovation. With federal mandates emphasizing cyber resilience, U.S. firms are pioneering autonomous protection frameworks that set global benchmarks.

Why is Aisa Pacific the fastest-growing in the Grid Cybersecurity Market?

Asia Pacific is the fastest-growing region in the grid cybersecurity market, holding a share of 12.8%, fuelled by massive electrification and smart city initiatives. Nations like Japan, South Korea, and India are rapidly digitizing their energy networks, increasing exposure to cyber threats. Governments are emphasizing indigenous cybersecurity capabilities and international collaboration for critical infrastructure protection. In Southeast Asia, cross-border grid interconnections have accelerated the need for shared cyber defense frameworks. Local startups are developing adaptive firewalls and AI-led control systems to counter region-specific threats.

India's surge in renewable capacity and smart grid modernization has magnified its cybersecurity priorities. The government's thrust on digital infrastructure and indigenous AI-driven defense tools marks the dawn of a new era, one where security becomes synonymous with sustainability.

Market Value Chain Analysis

- Raw Material Sources: The supply ecosystem includes semiconductor components for intrusion detection hardware and specialized cryptographic chipsets used in control systems. These foundational technologies enable efficient data protection and real-time grid monitoring.

- Technology Used: Advanced encryption algorithms, AI-powered intrusion detection systems, and blockchain for audit trails dominate the technology landscape. Cloud security frameworks and zero-trust architectures are redefining control across distributed networks.

- Investment by Investors: Investors are increasingly channelling capital into companies specializing in cross-domain cybersecurity, bridging IT and OT. Energy-focused venture funds are backing scalable models that promise rapid adaptation to emerging threats.

- AI Advancements: Artificial intelligence is emerging as the sentient guardian of the grid, detecting anomalies, tracing intrusions, and forecasting threats. Reinforcement learning models are enabling real-time decision-making that surpasses human response capabilities.

Top Companies in the Grid Cybersecurity Market

- Siemens AG: Siemens is a global leader in smart grid automation and digital energy transformation, offering end-to-end solutions that integrate cybersecurity directly into operational technologies (OT). Its Spectrum Power and Siemens EnergyIP platforms use AI and predictive analytics to secure critical grid infrastructure, enabling utilities to detect and neutralize cyber threats in real time.

- General Electric Company (GE): GE enhances grid reliability through its GE Digital division, providing advanced cybersecure control systems and grid management software for utilities worldwide. The company's GridOS and Predix platforms use data analytics and industrial cybersecurity to safeguard transmission and distribution networks from evolving digital threats.

- Schneider Electric SE: Schneider Electric integrates cybersecurity into its EcoStruxure architecture, ensuring end-to-end protection for smart grids, automation systems, and distributed energy resources. Through partnerships with Claroty and other cybersecurity firms, Schneider delivers real-time threat monitoring, compliance assurance, and resilience for energy infrastructure.

- ABB Ltd. : ABB combines industrial automation, IoT, and cybersecurity across its Ability™ Energy Management Suite, helping utilities achieve safer and smarter grid operations. The company focuses on embedding zero-trust principles and secure communication protocols into substation automation, energy monitoring, and control networks.

- Honeywell International Inc. : Honeywell offers industrial cybersecurity and secure process automation solutions tailored for energy and critical infrastructure sectors. Its Honeywell Forge Cybersecurity Platform provides continuous monitoring, intrusion prevention, and asset protection, enabling utilities to defend against sophisticated OT cyberattacks.

Other Companies in the Grid Cybersecurity Market

- IBM Corporation: Offers AI-powered cybersecurity and analytics through IBM Security and Watson IoT, helping utilities safeguard grid data and operational technologies.

- Cisco Systems, Inc.: Specializes in secure network infrastructure for smart grids, using advanced encryption and intrusion prevention systems for utility data communication.

- Hitachi Energy Ltd.: Focuses on digital substations, grid automation, and cybersecurity solutions, combining IT and OT protection for modernized electric grids.

- BAE Systems plc: Provides defense-grade cybersecurity and data protection services to safeguard critical infrastructure and smart energy systems from advanced persistent threats.

- Leidos Holdings, Inc.: Offers cybersecurity and digital modernization solutions to the energy and defense sectors, supporting grid resilience and risk management.

- Fortinet, Inc.: Delivers integrated cybersecurity platforms with high-performance firewalls and network security tools designed for industrial and smart grid environments.

- Palo Alto Networks, Inc.: Provides advanced network protection and threat intelligence for smart infrastructure, leveraging AI and automation for secure energy operations.

- Lockheed Martin Corporation: Integrates cybersecurity, analytics, and digital twin technologies to protect defense and national energy infrastructure against cyber threats.

- Accenture plc: Offers consulting and managed cybersecurity services for energy and utilities, helping clients modernize and secure digital grid transformation initiatives.

- Mitsubishi Electric Corporation: Develops intelligent power systems and digital substation technologies with embedded cybersecurity for utility control and smart energy networks.

Recent Developments

- In September 2025, advancements in smart grid technology have fundamentally reshaped the vehicle-to-grid (V2G) engineering paradigm within the electric vehicle (EV) ecosystem. Since the 1970s, the evolving collaboration among the power sector, automotive manufacturers, and regulatory authorities has reimagined the role of EVs in contemporary energy frameworks. This article explores the pivotal industry trends, enabling technologies, and multifaceted challenges that must be overcome to achieve large-scale implementation while also delving into the socio-economic dynamics and policy frameworks poised to influence the future trajectory of V2G integration.

- In October 2025, the education technology charity LGfl, the National Grid for learning, has introduced a free online cybersecurity training program for school governors, aimed at empowering them to effectively oversee and enhance their school's digital security frameworks.

Segments Included in the Report

By Component

- Solutions

- Services

By Solution Type

- Identity & Access Management (IAM)

- Firewall & Network Security

- Encryption

- Security Information & Event Management (SIEM)

- Intrusion Detection System (IDS) / Intrusion Prevention System (IPS)

- Risk & Compliance Management

- Disaster Recovery

- Others

By Deployment Mode

- On-Premises

- Cloud

By Security Type

- Endpoint Security

- Network Security

- Application Security

- Data Security

By End-User

- Public Utilities

- Private Utilities

- Industrial Grid Operators

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content