What is the Smart Grid Data Analytics Market Size?

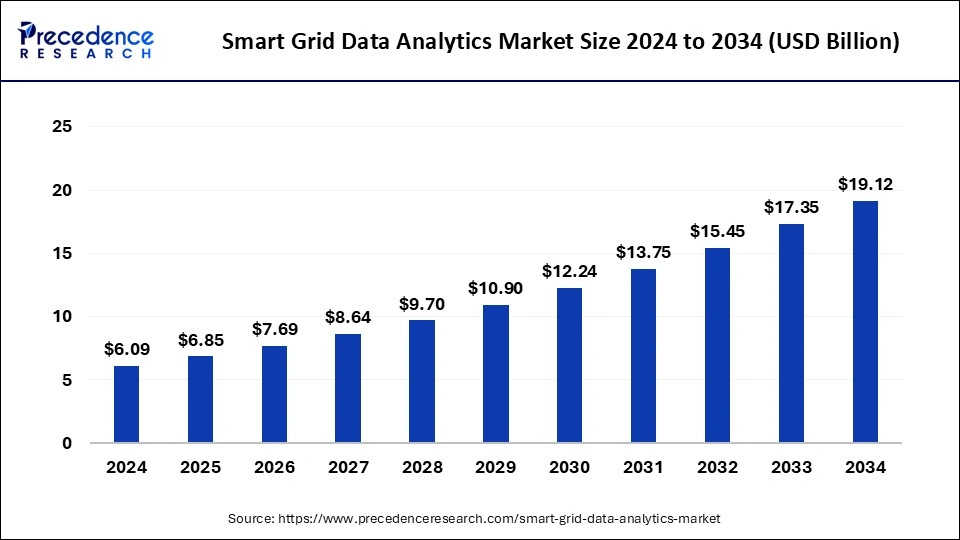

The global smart grid data analytics market size is calculated at USD 6.85 billion in 2025 and is predicted to increase from USD 7.69 billion in 2026 to approximately USD 20.98 billion by 2035, expanding at a CAGR of 11.84% from 2026 to 2035.

Smart Grid Data Analytics Market Key Takeaways

- The global smart grid data analytics market was valued at USD 6.85 billion in 2025.

- It is projected to reach USD 20.98 billion by 2035.

- The smart grid data analytics market is expected to grow at a CAGR of 11.84% from 2026 to 2035.

- North America dominated the smart grid data analytics market in 2025.

- Asia Pacific is poised to be the fastest-growing market in the coming years.

- By component, the solution segment held the largest share of the market in 2025.

- By deployment, the cloud-based segment is expected to grow at the fastest rate in the market during the forecast period.

- By application, the advanced metering segment is expected to grow at a significant rate in the market in the upcoming period.

- By end user, the large enterprise segment dominated the market in 2025

- By end users, the small & medium enterprise segment is projected to register the fastest growth in the market during the forecast period 2026 to 2035.

Market Overview

The smart grid data analytics market is experiencing substantial growth due to the rising adoption of smart grid technologies and the growing demand for energy efficiency and reliability. With the integration of advanced metering structures, utilities are generating vast amounts of data, which further needs sophisticated analytics to derive actionable plans and insights. The market is propelled due to the government's initiatives and regulatory mandates aimed to modernize electric grids, reduce carbon emissions to enhance energy management.

Smart grid data analytics market has some key trends which includes deployment of AI machine learning particularly for predictive analytics enabling proactive maintenance and real-time decision making. Utilities are leveraging these technologies to optimize operations of grids, to reduce wastages helps in improving consumer service and experience as well. The rise of renewable energy sources and distributed energy sources needs advanced predictive analytics for overall integration and management.

Region-wise, North America currently leads the smart grid data analytics market due to the early adoption of cutting-edge technologies and significant advancements in smart grid projects, followed by Europe and the Asia Pacific. Major players in the market are aiming to make strategic partnerships, mergers, and acquisitions to expand their portfolio on a global scale.

Smart Grid Data Analytics Market Growth Factors

- Enhanced grid reliability and efficiency

- Regulatory mandates for energy efficiency and carbon reduction.

- Development of advanced data analytics tools and platforms.

- Rising emphasis on optimizing the use of stored energy.

- Enhanced data collection and analysis capabilities.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 20.98 Billion |

| Market Size in 2025 | USD 6.85Billion |

| Market Size in 2026 | USD 7.69 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.84% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Advancement in metering infrastructure

A significant driver for the smart grid data analytics market is advancements in smart metering infrastructure (AMI). Smart meters are equipped with digital communication technology to provide real-time data on electricity consumption, power quality, and voltage level with time, which enables both providers and consumers to manage and monitor energy usage effectively. Such real-time data collection is critical for the deployment of smart grid analytics, which transforms raw data into useful insights to improve grid reliability, efficiency, and sustainability.

AMI system extends beyond smart meters and facilitates robust infrastructure support for remote meter reading, data collection and analysis, peak in demand, and its management without failure in provision. The precise data provided by AMI allows utilities to actively address issues before they arise, reducing downtime and saving the overall operational cost.

Additionally, the continuous evolvement in AMI systems incorporated with advanced technologies like IoT and cloud computing again boosts the capabilities of smart grid analytics. These advancements drive the smart grid data analytics market exponentially on a larger scale.

Restraint

Lack of awareness

Despite the significant advancements in smart meters and advanced metering infrastructure, a major restraint for the smart grid data analytics market is the lack of awareness among consumers and some utility companies. Many consumers are not fully aware of the benefits that smart grid technologies can offer, such as improved energy efficiency, cost savings, and enhanced reliability of electricity supply. This lack of awareness can lead to resistance or reluctance to adopt smart meters and participate in demand response programs.

Similarly, smaller utility companies, especially in developing regions, may lack the knowledge and resources to implement and utilize advanced metering infrastructure and data analytics effectively. These utilities might be unaware of the potential return on investment or the long-term operational benefits that smart grid analytics can provide. Additionally, the perceived complexity and cost of deploying AMI systems and integrating sophisticated analytics tools can be a hindrance for utilities with limited budgets and technical expertise. This gap in awareness and understanding hampers the widespread adoption of smart grid technologies, slowing down market growth.

Addressing this challenge requires concerted efforts in education and outreach by industry stakeholders, including governments, utility companies, and technology providers, to demonstrate the value proposition and benefits of smart grid data analytics to both consumers and utilities.

Opportunity

Hybrid deployment model

The hybrid deployment model presents a significant opportunity for the smart grid data analytics market. This approach combines the best aspects of on-premises and cloud-based solutions, offering a flexible and scalable option for utilities seeking to optimize their grid operations without compromising on security and control. With a hybrid model, utilities can manage sensitive data and critical infrastructure on-premises, ensuring compliance with regulatory requirements and maintaining high levels of security. At the same time, they can leverage the cloud for processing large volumes of data and advanced analytics, benefiting from the cloud's scalability, cost-effectiveness, and ease of access to the latest technological advancements.

This model also supports utilities in managing peak loads and enhancing disaster recovery capabilities. During normal operations, utilities can rely on their on-premises infrastructure, but during peak demand or unforeseen events, they can seamlessly shift some of their data processing and analytics workloads to the cloud. This flexibility helps maintain continuous operations and minimize downtime.

Hybrid models facilitate a gradual transition to cloud technologies, enabling utilities to modernize their infrastructure incrementally without significant upfront investments. This reduces the financial and operational risks associated with full-scale cloud adoption. As utilities increasingly recognize the benefits of a hybrid deployment model, the demand for smart grid data analytics solutions that support this flexible approach is expected to grow, driving innovation and expansion in the market.

Segment Insights

Component Insights

The solution segment held the largest share of the smart grid data analytics market in 2025. The growth rate of the solution segment is increasing owing to the numerous benefits provided by the solution segment, like enhanced grid reliability, enhanced security, regulatory compliance, and improved energy maintenance by forecasting it. Real-time data analysis enables utilities to optimize energy distribution and effectively aid in balancing supply and demand. It also ensures adherence to regulatory standards to maintain the reliability and authenticity of the solutions provided.Advanced analytics solutions are a boon for every sector, including the smart grid data analytics market, as it has a proactive approach to safeguard a system from a cyber threat before it collapses completely. These benefits propel the growth of the smart grid data analytics market globally.

Deployment Insights

The cloud-based segment is expected to grow at the fastest rate in the smart grid data analytics market during the forecast period. The growth factors of this segment include cost effectiveness, high scalability, and precise outcomes by advanced analytics methods. Cloud-based deployment helps reduce further capital expenditures, such as hardware and maintenance costs. Cloud-based deployment enables real-time data analysis and access to it, which improves efficiency and decision-making. Additionally, the advancement in smart grid technologies generates massive amounts of data that needs to be analyzed effectively; hence, data analytics has emerged as a key factor for analyzing and visualizing the data, which further propels the growth of cloud-based segment by deployment insight, fuelling the smart grid data analytics market exponentially.

Application Insights

The advanced metering segment is expected to grow at a significant rate in the smart grid data analytics market in the upcoming period. Advanced metering has completely transformed the smart grid data analytics market due to several key factors likepredictive maintenance, load forecasting, anomaly detection, and demand response optimization. Advanced metering infrastructure data provides precise information on the consumption of energy and its patterns. By analyzing these patterns, operators can gain valuable insight, such as peak time for demand and how to optimize supply according to it. Moreover, advanced metering is fostered due to its ability to detect anomalies, such as spurs in energy consumption or sudden drops, which helps to avoid equipment failure and ensures efficient energy distribution.

End-use Insights

The large enterprise segment dominated the smart grid data analytics market in 2025. Large enterprises have significant financial capabilities, which allows them to invest heavily in advanced technologies with robust infrastructure to support smart grid analytics. They offer a skilled manual workforce to manage and operate complex grid networks and optimize their operations effectively. Moreover, large enterprises are often involved in strategic partnerships and alliances with other firms, which propels the growth of the market further at a significant rate.

The small & medium enterprise segment is projected to register the fastest growth in the smart grid data analytics market during the forecast period 2024 to 2033. The major reason behind the proliferation of small and medium enterprises in a market is government support for start-ups and policies offered by authorities to propel the business further. Also, cloud-based solutions are increasingly becoming affordable, which makes SMEs purchase them and implement these data analytics solutions into the business model, fuelling the SME's growth, notably in the smart grid data analytics market.

Regional Insights

North America dominated the smart grid data analytics market in 2024. The region's early adoption of advanced technologies and substantial investments in grid modernization projects laid a strong foundation for market leadership. The United States and Canada have been at the forefront of implementing smart meters, AMI, and other smart grid technologies, generating vast amounts of data that necessitate sophisticated analytics.

Government initiatives and regulatory mandates significantly contributed to market dominance. Policies aimed at enhancing energy efficiency, reducing carbon emissions, and improving grid reliability drove utilities to adopt smart grid solutions. Programs like the U.S. Department of Energy's Smart Grid Investment Grant Spurred extensive deployment of smart grid technologies across the country. Technological innovation and the presence of key market players also played a vital role. North America is home to numerous leading technology firms and solution providers specializing in smart grid analytics, offering cutting-edge tools and services. These companies continuously drive advancements in AI, machine learning, and big data analytics, further strengthening the market.

- Additionally, high consumer awareness and acceptance of smart grid benefits, coupled with the increasing demand for reliable and efficient energy management, boosted market growth. These combined factors ensured that North America remained the dominant force in the smart grid data analytics market in 2023.

Asia Pacific is poised to be the fastest-growing smart grid data analytics market in the coming years. The growth of this region has several key factors, including rapid urbanization and industrialization in countries like China, India, and Japan, which are driving the need for more efficient and reliable energy management systems. These nations are heavily investing in smart grid technologies to address the increasing demand for electricity and to modernize their aging grid infrastructures.

Government initiatives and regulatory frameworks are also playing a significant role. Numerous policies and programs aimed at reducing carbon emissions, enhancing energy efficiency, and promoting renewable energy sources are encouraging the AMI and smart grid solutions. For instance, China's ambitious plans for grid modernization and India's smart city projects are significant contributors to market growth.

Technological advancements and increasing investments from both public and private sectors further support this trend. The integration of Internet of Things (IoT) devices and advancements in AI and machine learning for predictive analytics are enhancing the capabilities of smart grid systems in the region. Additionally, the growing awareness of the benefits of smart grid analytics among utilities and consumers is accelerating adoption. These combined factors make Asia Pacific the fastest-growing market for smart grid data analytics in the foreseeable future.

Europe is expected to grow at a significant rate throughout the forecast period. This is because the region has strong, ambitious energy transition goals, a robust regulatory support, and a high degree of renewable energy integration. Countries such as Germany and France are leading the region when it comes to smart grid deployment, as they efficiently leverage analytics solutions in order to optimize grid operations and support the integration of distributed energy resources. The European Union's focus on sustainability, energy efficiency, and grid reliability further drives significant investments, thus boosting the region's position in the market.

The smart grid data analytics market in Latin America is expected to pick up pace, driven by plans to spread reliable electricity and upgrade grid systems in areas still lacking stable access. Countries all across the region are researching and deploying smart technologies that can improve the overall process and also help in pinpointing faults by tapping into live grid data. Decentralized generation, especially in rural and remote areas is raising the need for local analytics tools. The region is also witnessing a rise in consumer awareness regarding energy savings. It is also backed by analytics to encourage more efficient energy habits.

The smart grid data analytics market in the Middle East and Africa is seen to be growing at a steady pace. This growth is supported by the region's expanding smart city plans and digital upgrades throughout utilities. There is also a much stronger focus on managing the water-energy link in a better way, which is leading to more use of analytics for improved resource use. Governments and utilities in the region are seen putting data insights to work to plan grid expansion and cut energy losses during transmission, helping create a more data-based and efficient energy system that is able to meet the area's unique challenges and development needs.

Value Chain Analysis

- Input and Raw Material Sourcing

Smart grid analytics begins with raw data that is sourced from smart meters, IoT sensors, phosphate transformers and automation devices. Utilities rely on high accuracy smart meters that are capable of capturing real time energy flow, voltage fluctuations, load patterns, and outage data, thus forming the very backbone of analytics. Major investments are being made recently in edge computing hardware and 5G based connectivity modules.

Key Players: Honeywell, Cisco, Siemens - Manufacturing and Processing

This stage includes the development of analytics platforms that process massive amounts of data sets from various sources like meters, DERs, and EV charging networks, thus turning them into an actionable form of intelligence. Vendors are seen increasingly integrating AI for better optimization, digital twins and better predictive outage management.

Key Players: IBM, Oracle, Hitachi Energy - Distribution Process

Smart grid analytics are distributed or delivered through cloud platforms, hybrid on premise set ups and managed service models where vendors are able to provide continuous monitoring for utilities. Its deployment involves configuring analytics engines to fit various regional rules, tariff structures, thus making it a major value driver. Utilities are expected to shift towards SaaS based analytics, enabling faster roll out of demand forecasting, fraud detection as well as renewable balancing solutions.

Key Players: AWS Energy, Google Cloud, Accenture

Smart Grid Data Analytics Market Companies

- Amdocs Ltd.

- Auto Grid Systems Inc.

- Tata Consultancy Service Ltd.

- Siemens AG

- Capgemini SE

- Dell EMC

- General Electric

- Hansen Technologies

- L.P.

- Hitachi Ltd

- Oracle Corp.

- IBM Corp.

- Itron Inc.

Recent Development

- In July 2024, AES Ohio chose Landis+Gyr as its technology provider for a grid upgrade project aimed at improving the efficiency of the power distribution system and customer services. AES Ohio will use Landis+Gyr cloud solutions for network management, installation support, and system operating software. The utility will install approximately 500,000 smart meters and a Gridstream Connect IoT platform using RF Mesh IP and cellular networks.

(Source: www.landisgyr.com ) - In June 2024, Schneider Electric, the leader in the digital transformation of energy management and automation, announced the launch of its microgrid solution Villaya Flex. Villaya Flex is a packaged microgrid solution that maximizes clean energy while reducing pollution from genset usage. It was specially designed for communities, facilitating the journey toward decarbonized, independent electricity while meeting today's energy challenges. The solution can be sized, ordered, commissioned, operated, and maintained easily with high levels of battery storage scalability.

(Source:www.se.com) - In June 2024, 360factors announced the launch of Lumify360, a cutting-edge predictive data analytics platform designed to capture, integrate, and enrich key performance indicators (KPIs) and key risk indicators (KRIs) data with strategic goals, business objectives, and risk appetites. This is further helpful in the smart grid data analytics applications that propel the growth of the market.

Segments Covered in the Report

By Component

- Solutions

- Services

- Professional

- Managed

By Deployment

- Cloud-based

- On-premises

- Hybrid

By Application

- Advanced Metering Infrastructure Analysis

- Demand Response Analysis Grid Optimization Analysis

- Others

By End-use

- Public Sector

- Large Enterprise

- Small And Medium Enterprises

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content