Credit Risk Assessment Market Size and Forecast 2025 to 2034

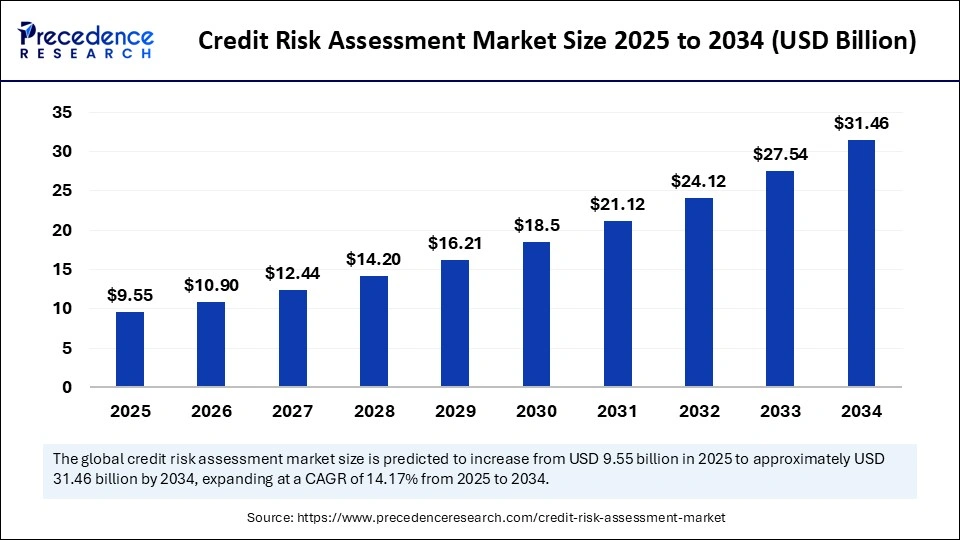

The global credit risk assessment market size accounted for USD 8.36 billion in 2024 and is predicted to increase from USD 9.55 billion in 2025 to approximately USD 31.46 billion by 2034, expanding at a CAGR of 14.17% from 2025 to 2034. The market growth is attributed to the increasing adoption of AI-powered analytics and real-time credit monitoring systems that enhance risk accuracy and operational efficiency.

Credit Risk Assessment MarketKey Takeaways

- The credit risk assessment market was valued at USD 8.36 billion in 2024.

- It is projected to reach USD 31.46 billion by 2034.

- The market is expected to grow at a CAGR of 14.17% from 2025 to 2034.

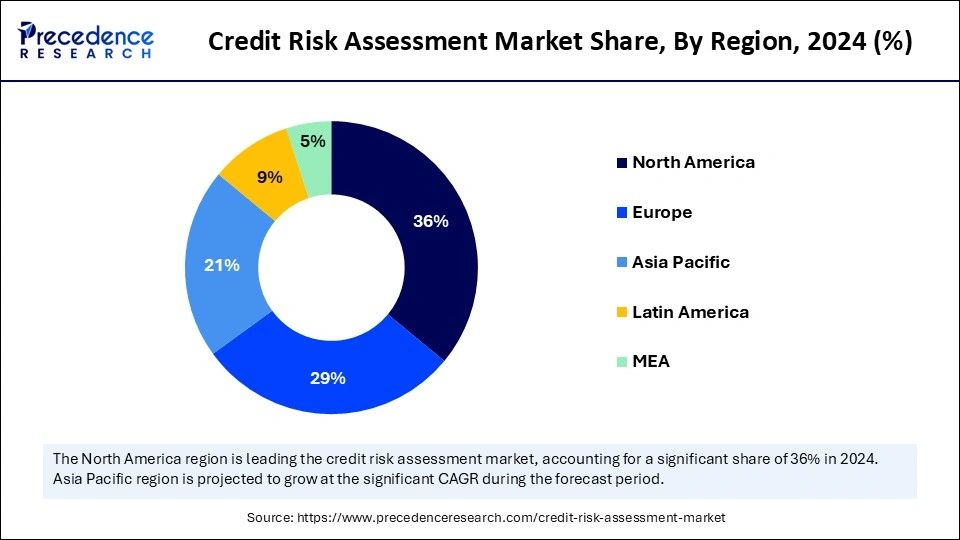

- North America dominated the credit risk assessment market with the largest share of 36% in 2024.

- Asia Pacific is expected to grow at the highest CAGR from 2025 to 2034.

- By component, the software segment held the major market share in 2024.

- By component, the service segment is projected to grow at the fastest CAGR between 2025 and 2034.

- By deployment model, the on-premises segment contributed the biggest market share in 2024.

- By deployment model, the cloud segment is expected to expand at a significant CAGR between 2025 and 2034.

- By organization size, the large enterprises segment led market in 2024.

- By organization size, the SMEs segment is expected to grow at a significant CAGR over the projected period.

- By vertical, the BFSI segment accounted for major market share in 2024.

- By vertical, the telecom & IT segment is expected to grow at a notable CAGR in the coming years.

- By technology, the traditional credit risk assessment held the largest market share in 2024.

- By technology, AI and ML-enabled credit risk assessment segment is expected to grow at the highest CAGR from 2025 to 2034.

Impact of Artificial Intelligence on the Credit Risk Assessment Market

Artificial intelligence redefines credit risk assessment technology in a positive way, as it speeds up decision-making and provides better accuracy. AI allows financial institutions to review traditional and non-traditional forms of data, including income statements, transactions, information from social media, and patterns of telephone and web usage. These systems check financial patterns not limited to numbers, which helps discover the state of someone's finances. Furthermore, AI-based tools decrease subjective decisions and make things more standard. They enable institutions to have fewer defaults, better organize their loans, and maintain their adherence to rules by having traceable decision paths.

U.S. Credit Risk Assessment Market Size and Growth 2025 to 2034

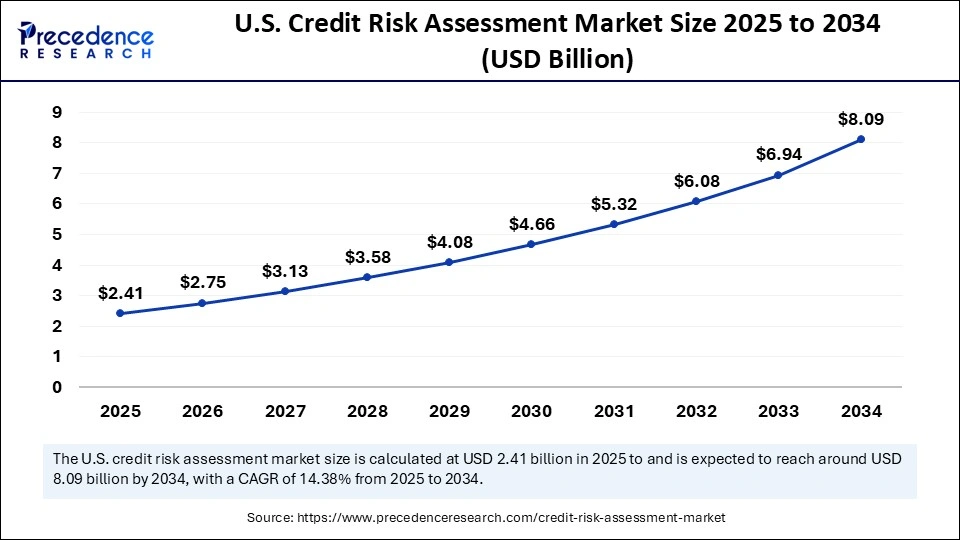

The U.S. credit risk assessment market size was exhibited at USD 2.11 billion in 2024 and is projected to be worth around USD 8.09 billion by 2034, growing at a CAGR of 14.38% from 2025 to 2034.

What Factors Contribute to North America's Dominance in the Market?

North America dominated the credit risk assessment market, capturing the largest revenue share in 2024. This is mainly due to its advanced financial system and strict regulations. The fact that the region's banks are well-structured and use advanced risk methods fueled the demand for full credit evaluation. To address increased risks, the U.S. Federal Reserve, OCC, and SEC introduced new guidelines that suggest banks and financial institutions to pay more attention to credit risks and use robust assessment models. North America is leading in using data analytics and AI to strengthen credit risk systems. Investment in fintech research and cloud computing made it possible for the region to quickly introduce new credit risk systems, contributing to its leading role.

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period. This is mainly due to the increasing demand for credit among consumers and SMEs in countries like China, India, and those in Southeast Asia. There is a high adoption of AI and cloud technology in credit risk management. In its 2024 assessment, the International Monetary Fund (IMF) pointed out that Asia Pacific's fintech sector supports the creation of new credit assessment techniques. Asian countries are dedicated to providing credit to more individuals, thanks to technology-based risk assessments. Government efforts to expand credit assessments through technology-based assessments, a growing smartphone user base, and a supportive digital financial framework contribute to market growth.

Europe is a significantly growing area. At the start of 2023, the rules put in place by the ECB and national officials' focus on strengthening financial resilience led the banks and financial institutions to update their credit risk models. BIS stated in its 2024 report that European banks must include ESG factors into credit assessments to fulfill the European Union's sustainable finance ambitions. Regulations from the Basel Committee indicate that banks must use advanced analytics to better forecast possible credit defaults. Furthermore, the introduction of the GDPR in Europe prompted organizations to create credit risk technologies that emphasize data security and have clear explanations for the results they produce.

Market Overview

Increasing usage of credit risk assessment technologies around the world is the result of fast digitalization and complex financial processes. Lenders use data and AI algorithms to predict and handle the possible loss from defaults by borrowers. Technologies in credit scoring go from the traditional statistical ones to more advanced AI and machine learning, which look at huge amounts of data. The report by the BIS in 2024 demonstrated that introducing AI into risk evaluation has helped banks achieve higher accuracy and work more efficiently. Recently, government agencies and regulators, such as the U.S. Federal Reserve and the European Central Bank (ECB) urged financial institutions to pay more attention to their credit risk rules to ensure financial stability in the current economic uncertainty. Furthermore, because there is greater regulation and a growing number of market risks, lenders everywhere are using advanced credit risk methods to better identify and address risks in a quicker way.

(Source: https://www.bis.org)

Credit Risk Assessment Market Growth Factors

- Rising Adoption of Alternative Credit Data: Growing use of non-traditional data sources like social and behavioral data is driving more accurate credit risk profiling.

- Boosting AI Explainability Standards: Increasing focus on transparent AI models is propelling regulatory acceptance and wider deployment of machine learning in credit risk.

- Driving Cross-Border Credit Analytics: Expanding global trade and finance activities are fueling demand for integrated, multi-jurisdictional credit risk solutions.

- Propelling Cybersecurity Integration: Heightened cyber threats are driving credit risk systems to incorporate advanced fraud detection and data protection capabilities.

- Growing Demand for Real-Time Risk Insights: Rising market volatility is boosting investment in continuous credit monitoring and instant risk adjustment tools.

- Accelerating Cloud-Native Credit Platforms: Widespread cloud adoption is driving scalable, flexible credit risk infrastructures that support rapid innovation.

- Fueling SME Financial Inclusion Initiatives: Expanding governmental and NGO programs targeting SME lending are propelling development of tailored credit risk assessments for underserved sectors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 31.46 Billion |

| Market Size in 2025 | USD 9.55 Billion |

| Market Size in 2024 | USD 8.36 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.17% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Deployment Model, Organization Size, Vertical, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Real-Time Risk Evaluation

The increasing demand for real-time risk evaluation capabilities is expected to drive the growth of the credit risk assessment market. Since enterprises want to monitor risks at all times, AI-equipped tools for assessing credit are expected to be embraced more quickly. Businesses in the financial sector focus on quick decisions to cut down on loan processing and offer better service to customers. By using advance credit risk assessment technology, loans are examined quickly to find out if a borrower qualifies for credit. Because lenders use up-to-date models, they are informed of any threats, spot a borrower's possible default early, and change their lending policies as needed. The 2024 report from BIS pointed out that using AI in SupTech is becoming more important for real-time credit monitoring with important banks already integrating such technology into their daily work. Furthermore, the risk detection and forecasting made it easier for financial firms to spot and react to fast changes in credit risk, thus further facilitating the market growth in the coming years.

(Source: https://www.bis.org)

Restraint

Data Privacy and Security Concerns

Data privacy and security concerns are hindering the widespread adoption of advanced credit risk assessment technologies. Since privacy and security issues exist around data, using advanced credit risk assessment technologies reportedly is difficult. These rules prevent banks from collecting or using customers' information to assess creditworthiness too much. To stay safe from cyber security breaches and avoid punishments for non-compliance, institutions invest adequately in these areas. Adhering to all these rules adds to a company's general expenses and makes it harder to integrate data from various sources. Additionally, the new data protection laws expect new adjustments in technology use, which in turn slows down rapid progress and implementation in some locations.

Opportunity

How Does the Growing Volume of Non-Traditional Data Impact Credit Risk Assessment Market in the Coming Years?

Growing volume of nontraditional data in credit assessment is expected to create immense opportunities for the players competing in the market. The amount of non-traditional data is forecast to alter how credit risk modeling works. Lenders now use records, including payment for utilities, how people use their phones, and their online activities to make decisions about borrowers who have not built a credit history. Such information allows financial institutions to devise detailed profiles for people in underserved markets. Companies in the world of fintech and digital banks drive this advancement by using different indicators in their risk scoring. A 2024 IFC report stated that digital banks with new data collection surpassed banks that only relied on traditional credit scores in getting first-time borrowers to repay their loans. Furthermore, the regulators pay attention to the broader effects of using alternative data, and they introduce safety measures to prevent unfairness, thus further boosting the demand for credit risk assessment market in the coming years.

Component Insights

How Did the Software Segment Dominate the Credit Risk Assessment Market?

The software segment dominated the market with the largest revenue share in 2024. This is mainly due to its benefits in the process of assessing risks. Software streamlines risk assessment processes by analyzing data. A large number of financial institutions were using advanced applications to make credit scoring, keeping track of portfolios, and hazard prediction simpler. The growing importance of various credit guidelines and products, companies started adopting advanced algorithms and machine learning-based software. Furthermore, software solutions automate various tasks like data collection and processing.

The service segment is projected to grow at the fastest CAGR in the coming years, as enterprises are seeking assistance, implementation, and maintenance services. A lot of institutions now expect these types of services to streamline data handling and model verification and ensure adherence to regulations. As the adoption of risk assessment solutions increases, so does the need for managed services. Furthermore, training and maintenance services make it possible for financial entities to maximize their use of advanced software, boosting the reliability of their risk management services.

Deployment Model Insights

What Factors Contribute to the On-Premises Segment Dominance in the Market?

The on-premises segment dominated the credit risk assessment market with the largest revenue share in 2024. Banks and lenders often prioritize to store sensitive credit details on their own systems to make sure they adhere to strict data privacy regulations. On-premises solutions enable institutions to manage risk assessment tasks themselves, ensuring data security. According to the ECB annual report on supervisory activities 2024, banks must have adequate systems for risk data aggregation and risk reporting capabilities, which prompted most institutions to choose on-premises solutions. Moreover, the bank for International Settlements (BIS) stated that data sovereignty is very important to banks, thereby highlighting the necessity of on-premises credit risk assessment solutions.

(Source: https://www.bankingsupervision.europa.eu)

The cloud segment is expected to expand at a significant CAGR in the coming years. This is mainly due to the increasing demand for flexible, cost-effective, and responsive credit risk management. With cloud platforms, financial institutions can rapidly deploy advanced analytics, real-time data processing, and AI-driven risk management without making major initial investments. Furthermore, cloud deployment facilitates the scale up and down of risk assessment capabilities as per requirements and ensures easier adaptation to regulatory and technological changes.

Organization Size Insights

How Does the Large Enterprises Segment Dominate the Credit Risk Assessment Market?

The large enterprises segment dominated the market in 2024, as they often deal with substantial financial portfolios and complicated risk profiles. Large enterprises prioritize advanced credit risk solutions in order to meet strict regulations and manage lending operations. Many large businesses heavily invest in AI-driven data analytics and real-time monitoring for enhanced risk identification and make decisions quickly. According to the Basel Committee on Banking Supervision and central banks, including the U.S. Federal Reserve, it is critical for large institutions to put in place robust risk management solutions. Additionally, advanced risk analytics helps protect large banks from serious effects of economic ups and downs, driving investment in credit risk assessment.

The SMEs segment is expected to grow at a significant CAGR over the projected period. SMEs are heavily investing in digital technologies and cloud-based automated risk management solutions for credit evaluations. SMEs are managing bad debt risks using ways that are appropriate for them and don't use their limited resources. Additionally, the rise in SME adoption shows more people are being included in the process of credit risk assessment and how financial services are provided.

Vertical Insights

Why Did the BFSI Segment Hold the Largest Revenue Share in 2024?

The BFSI segment dominated the credit risk assessment market by holding the largest revenue share in 2024. BFSI institutes require to comply with stringent rules for managing a wide range of credit accounts. BFSI institutions prioritize modern credit risk models to support the underwriting process and early detection of loan defaults. BFSI companies rely on advanced AI analytics and instant risk surveillance tools. They heavily prefer solutions that merge several kinds of data and use smart algorithms to boost the accuracy of predicting risks and the toughness of their portfolios. Furthermore, changes in the rules for capital adequacy and stress tests increased the need for complete credit risk assessment solutions in the finance sector.

The telecom and IT segment is expected to grow at a notable CAGR in the coming years, driven by rapid digital transformation and increased consumers credit applications for tech products and services. Telecom operators are offering more credit options for devices and services. Since cyber threat and fraud risk is rising, there is a heightened need for advanced models to address cyber threats and fraud risks. Additionally, the Bank of England's 2024 quarterly bulletin indicated that the companies in telecom credit portfolios is growing, so it is necessary to focus on risk modeling to effectively manage associated risks.

Technology Insights

Why did the Traditional Credit Risk Assessment Segment Dominate the Market in 2024?

The traditional credit risk assessment segment dominated the global market with the largest revenue share in 2024 due to its well-known practices. Many institutions still use traditional strategies, such as credit scoring, reviewing a company's financials, and the judgment of professionals. Because rules and requirements tended to favor the established methods, credit evaluations were always done in a similar and clear manner. Moreover, some organizations chose not to rely on AI due to their technology constraints or stringent privacy laws in the area, thus further boosting the demand for traditional credit risk assessment technologies.

The AI and ML-enabled credit risk assessment segment is expected to grow at the highest CAGR in the upcoming period, owing to their predictive capabilities and ability to process diverse data quickly. AI and ML technologies analyze big data and various sources of alternate information, identifying risk factors that other approaches may miss. Furthermore, AI helps automate processes, reduce operational costs, and make it possible to scale up easily, attracting both large companies and startups in the finance sectors.

Credit Risk Assessment Market Companies

- ACL

- BRASS

- Equifax

- Experian

- FICO

- Fiserv

- Genpact

- IBM

- Kroll

- Misys

- Moody's Analytics

- Oracle

- Pegasystems

- PRMIA

- Risk data

- Risk Spotter

- Riskonnect

- SAP

- SAS Institute

- TransUnion

Latest Announcements by Industry Leaders

- In March 2025, MSCI Inc. and Moody's Corporation announced a partnership to develop a unique solution that provides independent risk assessments for private credit investments on a large scale. As the private credit market continues to evolve and expand, there is an increasing demand for consistent standards and improved tools to help investors assess, compare, and communicate the risks associated with their investments. Rob Fauber, President and CEO of Moody's, stated, “As the private credit market evolves, investors are seeking reliable, independent assessments to help benchmark credit risk, inform investment decisions, and monitor their portfolios. Our partnership with MSCI will be instrumental in delivering these insights, enabling market participants to make informed choices.” Henry A. Fernandez, Chairman and CEO of MSCI, added, “The rapid growth of private credit is reshaping the global investment landscape and underscoring the need for greater transparency, consistent standards, and independent risk assessments. We are proud to collaborate with Moody's to create innovative solutions that will enhance clarity and confidence in this market.”

(Source: https://ir.moodys.com)

Recent Developments

- In March 2025, martini.ai, a leader in AI-driven credit risk analysis, introduced Financials Agent, an AI-powered tool that allows users to upload financial documents, such as 10-K filings, and instantly generate a financial risk report. Instead of spending hours manually extracting data and calculating credit scores, professionals can now obtain a comprehensive financial assessment in just minutes.

(Source:https://www.businesswire.com)

- In April 2025, FinVolution Group ("FinVolution"), a leading fintech platform, showcased its latest advancements in AI-powered lending and credit risk management at Money20/20 Asia, taking place in Bangkok from April 22 to 24. This premier fintech event brings together innovators from across the global digital finance ecosystem to explore the future of financial services.

(Source: https://www.prnewswire.com)

- In March 2025, Union Finance and Corporate Affairs Minister Nirmala Sitharaman, along with Minister of State for Finance Pankaj Chaudhary, officially launched a new Credit Assessment Model for Micro, Small, and Medium Enterprises (MSMEs). This initiative, announced as part of the Union Budget for 2024-25, aims to enhance the credit evaluation process for MSMEs by leveraging digital data. The launch occurred during a post-budget interaction in Visakhapatnam, where the Finance Minister engaged with industry leaders, tax professionals, and 0other stakeholders. The newly introduced model will enable public sector banks (PSBs) to develop in-house capabilities for assessing MSME creditworthiness, thereby reducing their reliance on external evaluations.

(Source: https://bfsi.eletsonline.com)

Segments covered in the report

By Component

- Services

- Software

By Deployment Model

- Cloud

- On-premises

By Organization Size

- Large Enterprises

- SMEs

By Vertical

- BFSI

- Government

- Healthcare

- Manufacturing

- Retail

- Telecom & IT

- Others

By Technology

- AI & ML-enabled Credit Risk Assessment

- Traditional Credit Risk Assessment

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting