Credit Card Payments Market Size and Growth 2025 to 2034

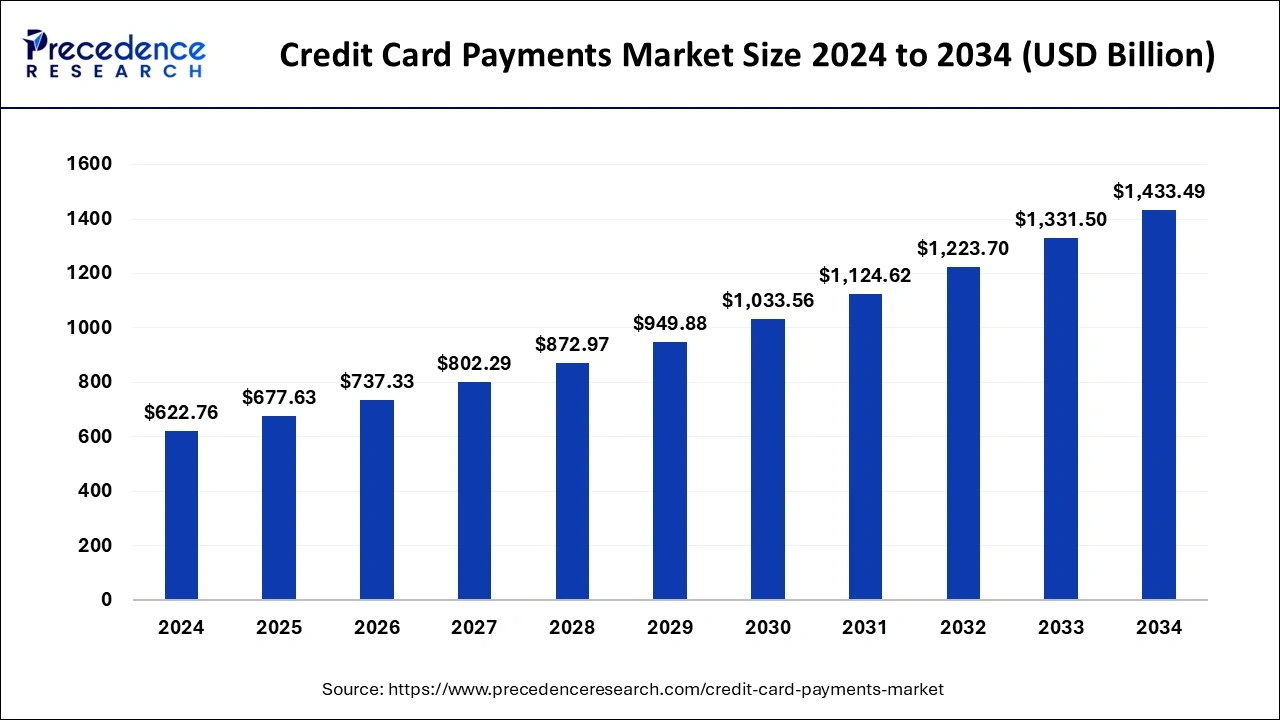

The global credit card payments market size was estimated at USD 622.76 billion in 2024 and is predicted to increase from USD 677.63 billion in 2025 to approximately USD 1,433.49 billion by 2034, expanding at a CAGR of 8.69% from 2025 to 2034.

Credit Card Payments Market Key Takeaways

- In terms of revenue, the global credit card payments market was valued at USD 622.76 billion in 2024.

- It is projected to reach USD 1,433.49 billion by 2034.

- The market is expected to grow at a CAGR of 8.69% from 2025 to 2034.

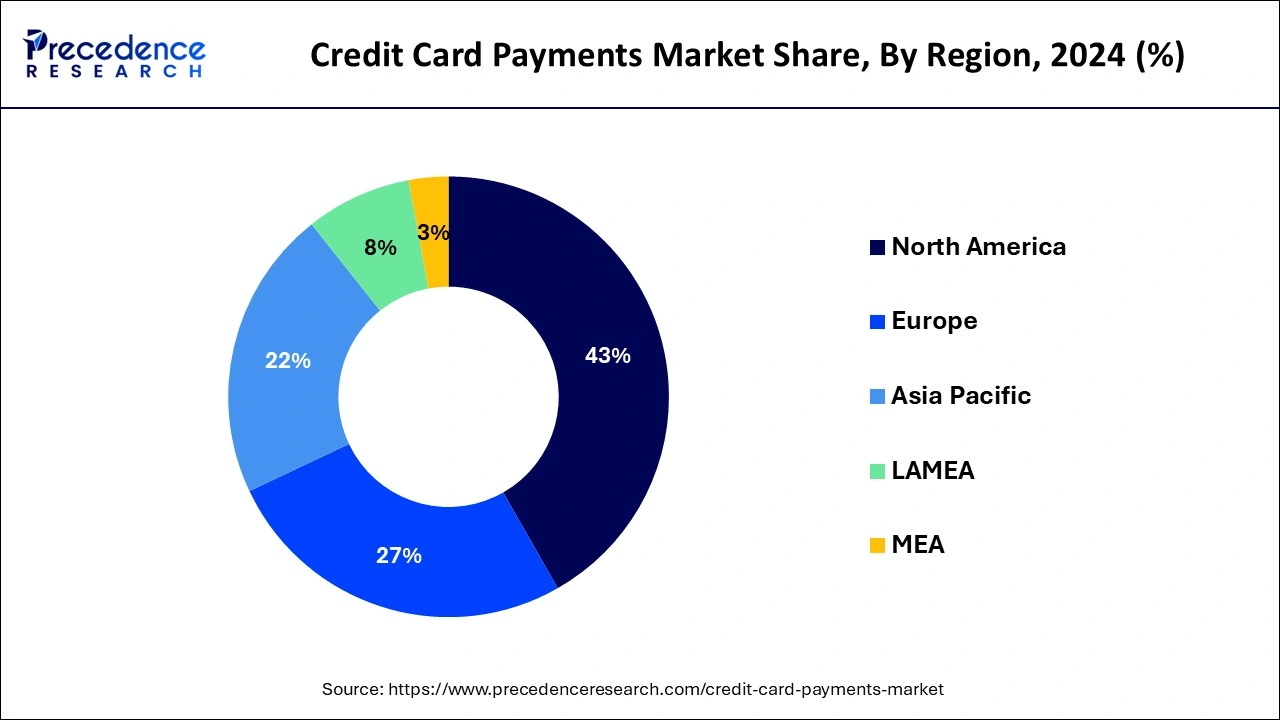

- North America dominated the credit card payments market with the largest share of 43% in 2024.

- Europe is expected to expand at a rapid pace in the market during the forecast period.

- By card type, the standard credit cards segment dominated the market with a 40% share in 2024.

- By card type, the virtual credit cards segment is expected to grow at the highest CAGR of 13.50% in 2024.

- By payment channel, The In-store/POS transactions segment held a 55% share in 2024.

- By payment channel, the mobile wallets linked to the credit cards segment are expected to grow at the highest CAGR of 14.20% in 2024.

- By end user, the individual consumers segment led the market by holding 70% share in 2024.

- By end user, the SMEs segment is expected to grow at the highest CAGR of 12.10% in 2024.

- By application category, the retail segment held a 35% market share in 2024.

- By application category, the entertainment & digital subscriptions are expected to grow at the highest CAGR of 13.80% over the projected period.

U.S. Credit Card Payments Market Size Growth 2025 to 2034

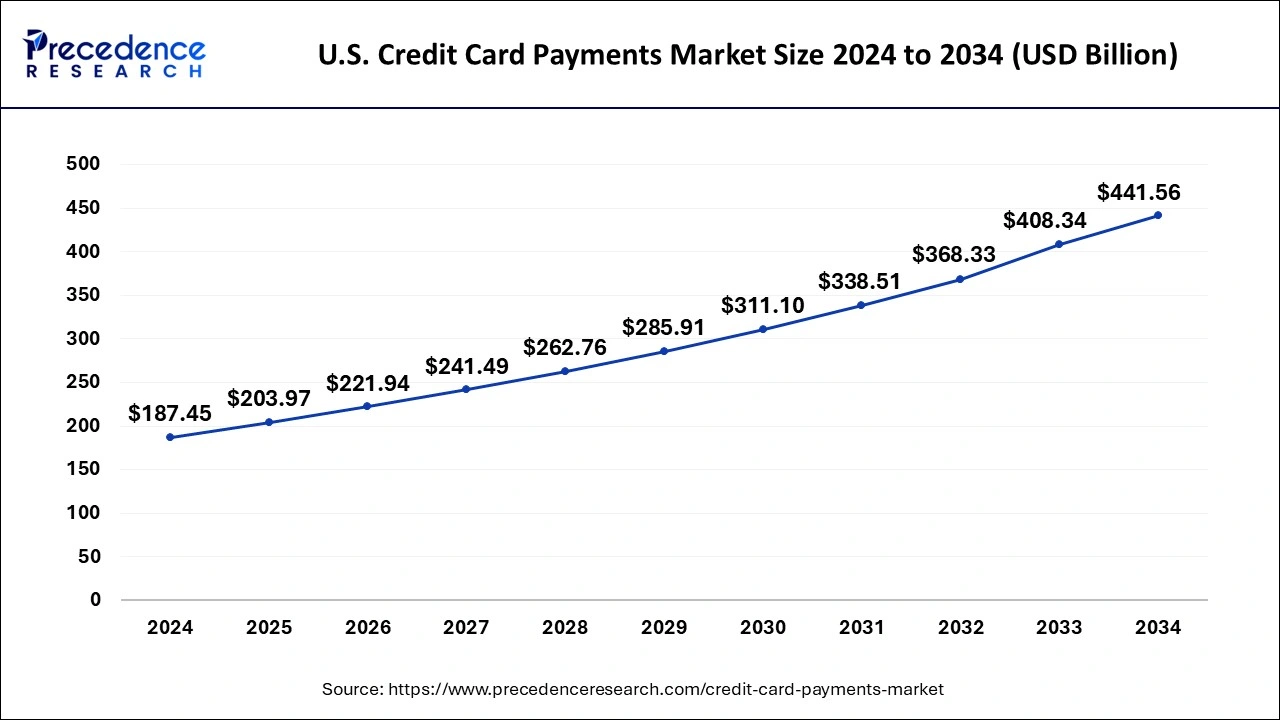

The U.S. credit card payments market size was valued at USD 187.45 billion in 2024 and is predicted to be worth around USD 441.56 billion by 2034, at a CAGR of 8.94% from 2025 to 2034.

North America held the dominant share of the credit card payments market in 2024 and is expected to witness prolific growth during the forecast period. The region is observed to witness prolific growth during the forecast period. The growth of the region is driven by the increasing presence of sophisticated financial services organizations, the economy's rapid growth, the rising acceptance of credit cards, the growing customer preference for digital transactions, and the advancement in technology.

The rapid growth of e-commerce platforms, along with the increasing use of touchless payment options, has resulted in increasing dependency on the credit card payments market in North America. In addition, there is the presence of key prominent players such as Mastercard, Visa, American Express, and Discover Financial Services. Among all of them, MasterCard is used by the majority of the population in the United States, according to secondary sources.

- According to the Federal Reserve, 82% of American adults had a credit card in 2022. Nearly 191 million American adults have at least one credit card account; half of all Americans have at least two cards, and 13% have at least five cards.

According to the Canadian Bankers Association, in 2023, credit cards will be widely preferred by both consumers and retailers as they offer valuable benefits. The majority of Canadians use credit cards as a method of payment rather than borrowing. Nearly two-thirds of consumers, or 65 %, say credit card purchases are beneficial to merchants and directly help them grow their businesses.

Europe is expected to expand at a rapid pace in the credit card payments market during the forecast period. In Europe, the market has witnessed the rapid adoption of credit cards owing to increasing loyalty programs and reward points offered by financial organizations to credit card holders. Thus, this is expected to propel the market growth in the region during the forecast period.

Additionally, the rising popularity of credit cards among young people in countries such as the United Kingdom, France, Italy, Germany, and others is anticipated to fuel the credit card payments market's growth during the forecast period. Additionally, the rise in retail and e-commerce sales is projected to be due to the significance of credit cards as a preferred method for online transactions in the region.

- According to secondary sources, roughly 33.8 million or 64 percent of adults in the United Kingdom have at least one credit card. There were 362 million credit card transactions in June 2023. Between June 2022 and June 2023, total outstanding credit card balances in the UK increased by £12.1 billion.

Market Overview

Earlier, cash was the most popular method of payment, but gradually, it is declining due to rapid digitalization around the world. Credit card payments have become the preferred choice for payments as a way to promote digital transactions. A credit card is a payment card issued by a bank to an account holder, allowing its cardholder to purchase goods or services or withdraw cash on credit. Credit cards are widely used to make payments around the world. The credit card also facilitates the conversion of purchases into easy EMIs.

A cardholder is liable to repay the used credit limit or minimum due on or before the due date to avoid additional interest. It is one of the flexible modes of payment that offers cardholders more time to pay accrued charges to card issuers. Payment through credit cards helps to enhance the purchasing power of individuals, create a credit score for loans, and offer cashback, zero foreign transaction fees, and others.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 622.76 Billion |

| Market Size by 2034 | USD 1,331.50 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.81% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Card Type, Application, Provider, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing adoption of credit card

The rapidly rising adoption of credit cards is expected to boost the credit card payments market revenue during the forecast period. In the digital revolution era, the rapid adoption of credit cards is owing to the customer preference for quick, safe, and cashless transactions. Credit cards offer a convenient and flexible way of borrowing money to pay for several products and services, with many relying on credit cards in day-to-day life for things such as paying petrol or bills, shopping, and others.

Credit cards are accepted in more than 200 countries and at millions of locations across the globe. It offers several other benefits, such as access to unsecured credit, interest-free payment from the time of purchase to the end of the billing period, instant receipt of goods and services, and a wide range of discounts and offers. Therefore, the rising use of credit cards to buy goods or services drives the growth of the credit card payments market.

- According to a report by Worldline, Of the total card transactions of ₹12.66 trillion between June and December 2023, credit card transactions rose by 11% to ₹9.30 trillion between June and December 2023 in India. 11% up from 2022.

Restraint

Security concerns and fraudulent activities

The security concerns and fraudulent activities are anticipated to hamper the market's growth. Credit card payments often face severe security issues and fraud risks. Despite the robust advancement in security technology, fraudsters continue to target credit card transactions, which causes data breaches, illegal access to sensitive information of card holders, and other security purposes. In addition, the market has experienced an increasing number of payment scams on e-commerce sites. In many cases, the purchased product is either not received or cannot be tracked by the customer, which is likely to limit the expansion of the global credit card payments market.

- In March 2024, Axis Bank credit card users were impacted by fraudulent overseas transactions. Multiple customers with Axis Bank credit cards have been impacted by fraudulent overseas transactions, according to a senior official. Customers witnessed unauthorized transactions where they received transaction alerts on certain low-value purchases being carried out at some e-commerce sites.

Opportunity

Robust growth of the e-commerce and retail sector

The robust growth of the e-commerce and retail sector is projected to offer lucrative growth opportunities for the credit card payments market in the coming years. The e-commerce and retail sector has encouraged and promoted the use of credit card payments rather than paying cash for shopping for electronics, apparel, accessories, food products, and others.

Several e-commerce companies offer attractive points, rewards, and cashback to their customers to engage them in purchase activities, leading to an increase in credit card payments. With the growth in e-commerce activities and the expanding popularity of credit card transactions, as well as while shopping on e-commerce and retail sector platforms, consumers prefer credit cards for ease, speed, security, and others. Thereby bolstering the credit card payments market growth.

- In March 2024, online credit card spending surged over rupees 1 lakh crore, hitting rupees 1,04,081 crore. This marked a 20 % increase from nearly rupees 86,390 crore in March 2023 and a 10 % rise from rupees 94,774 crore in February 2024. this reflected a growing trend of using cards for smaller purchases. HDFC Bank led the market share at 20.2%, followed by SBI, ICICI Bank, Axis Bank, and Kotak Mahindra Bank.

Card Type Insight

The standard credit cards segment dominated the market with a 40% share in 2024. The dominance of the segment can be attributed to the ongoing shift to digital payments, especially in developing countries, along with the increased consumer spending power globally. Credit card issuers give loyalty points, diverse rewards, and co-branded products to attract new cardholders

The virtual credit cards segment is expected to grow at the highest CAGR of 13.50% in 2024. The growth of the segment can be credited to the surge in the e-commerce sector and growing demand for improved expense and security management in the business and consumer sectors. Also, virtual cards offer improved security features and lower fraud risk.

Payment Channel Insight

The In-store/POS transactions segment held a 55% share in 2024. The dominance of the segment can be linked to the extensive proliferation of softPOS solutions and mobile POS (mPOS) terminals. Furthermore, the rising use of tablets and smartphones by retailers to accept payments via mPOS and SoftPOS solutions enables better acceptance and flexibility of credit cards.

The mobile wallets linked to the credit cards segment are expected to grow at the highest CAGR of 14.20% in 2024. The growth of the segment can be driven by growing adoption of digital payments, coupled with innovations in mobile wallet technology. Moreover, mobile wallets provide enhanced security through features such as tokenization, which is much safer than conventional card swipes.

End-user Insight

The individual consumers segment led the market by holding a 70% share in 2024. The dominance of the segment is owed to the growing consumer preference for online and digital shopping and the increasing adoption of digital wallets. In addition, consumers are drawn more towards credit cards for the enhanced flexibility and convenience they offer, leading to further segment expansion.

The SMEs segment is expected to grow at the highest CAGR of 12.10% in 2024. The growth of the segment is due to the growing demand for enhanced credit access and streamlined payment processes, which optimise credit card use among SMEs to improve business operations. Additionally, credit cards offer SMEs with changing credit facilities, providing freedom in managing cash flow.

Application Category Insight

The retail segment held a 35% market share in 2024. The dominance of the segment can be attributed to the growing adoption of contactless and mobile payments, coupled with the expansion of online shopping platforms. In addition, the rise of contactless cards, mobile payment apps, and integrated digital wallets has increased the speed and ease of transactions.

The entertainment & digital subscriptions are expected to grow at the highest CAGR of 13.80% over the projected period. The growth of the segment can be credited to the increasing popularity of subscription services across different industries and growing adoption of contactless payments and mobile wallets. Also, the growing popularity of subscription models for different entertainment and digital content services impacts positive market growth.

Credit Card Payments Market Companies

- American Express

- Bank of America

- Barclays

- Capital One

- Chase

- Citibank

- Discover

- HSBC

- ICICI Bank

- JPMorgan

- Mastercard

- MUFG

- Santander

- SBI Cards

- State Farm

- U.S. Bancorp

- Visa

- Wells Fargo

- Westpac

- Worldpay

Recent Developments

- In February 2024, American Express and Delta Air Lines unveiled upgraded Delta SkyMiles American Express Cards, intended to improve the travel experience and provide everyday value to consumers and business owners.

- In March 2024, SBI Card, in partnership with Titan Company Ltd, announced the launch of Titan SBI Card. Titan SBI Card offers features that include cashback, titan gift vouchers, and reward points. The cardholders can avail benefits worth over Rs. 2,00,000 per annum.

- In June 2024, Adani One and ICICI Bank announced the launch of India's first co-branded credit cards with airport-linked benefits in collaboration with Visa. Available in two variants - Adani One ICICI Bank Signature Credit Card and Adani One ICICI Bank Platinum Credit Card - the cards offer a substantial reward program.Companies

Segments Covered in the Report

By Card Type (Transaction Value Contribution)

- Standard Credit Cards

- Premium Credit Cards (Gold, Platinum, Black)

- Co-branded/Partnered Credit Cards

- Corporate Credit Cards

- Virtual Credit Cards

- Secured Credit Cards

By Payment Channel

- In-store/POS Transactions

- Online Transactions

- Mobile Wallets Linked to Credit Cards

By End-user (Transaction Originator)

- Individual Consumers (Retail/Personal Use)

- SMEs (Business purchases via credit cards)

- Large Corporates (Travel & procurement)

By Application Category

- Retail

- Travel & Hospitality

- Food & Beverage

- Healthcare & Wellness

- Education Services & Tuition

- Utilities & Recurring Bill Payments

- Government & Public Sector Services

- Entertainment & Digital Subscriptions

By Transaction Size

- Micro Payments (Below $10)

- Low-Value Payments ($10–$100)

- Mid-Tier Payments ($100–$1,000)

- High-Value Payments ($1,00+)

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting