Fuel Card Market Size and Growth 2025 to 2034

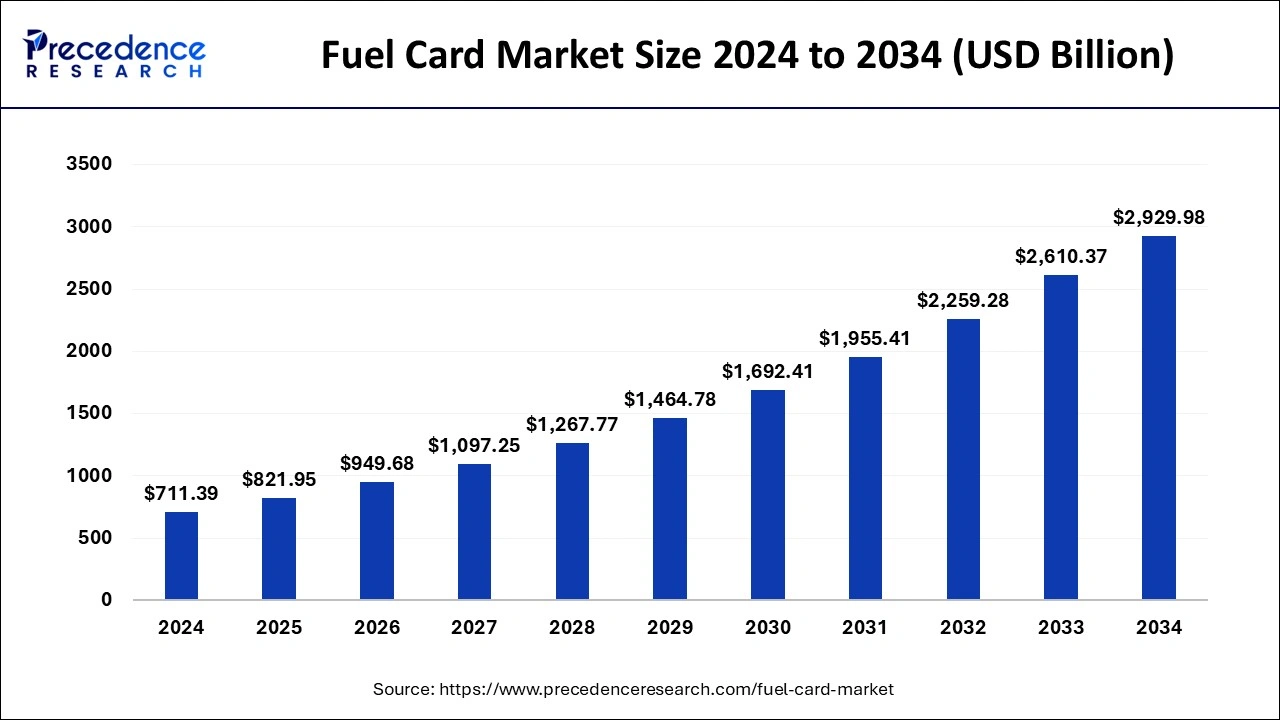

The global fuel card market size was estimated at USD 711.39 billion in 2024 and is predicted to increase from USD 821.95 billion in 2025 to approximately USD 2,929.98billion by 2034, expanding at a CAGR of 15.21% from 2025 to 2034. The market is mainly driven by add-on features such as transaction report generation, discounts on fuel, roadside assistance, route optimization, and so on that attract consumers.

Fuel Card MarketKey Takeaways

- In terms of revenue, the global fuel card market was valued at USD 711.39 billion in 2024.

- It is projected to reach USD 2,929.98 billion by 2034.

- The market is expected to grow at a CAGR of 15.21% from 2025 to 2034.

- North America held the largest share of the fuel card market in 2024.

- Asia Pacific is projected to expand at the fastest rate during the forecast period of 2025-2034.

- By fleet operator, the trucking companies segment held the largest share of the market in 2024.

- By fleet operator, the delivery and logistics companies segment is expected to show the fastest growth.

- By card type, the fleet fuel cards segment held the dominating share of the market in 2024.

- By card type, the Individual/personal fuel cards segment represents another highly influential segment for the forecast period.

- By subscription, the fleet subscription segment held the dominating share of the market in 2024.

- By subscription, the personal subscription segment is expected to witness a significant rate of expansion during the forecast period.

Market Overview

A fuel card, also called a fleet card, is a payment means businesses employ to manage expenses related to vehicle fuel and maintenance. It is a payment card designed explicitly for purchasing fuel at gas stations. It functions similarly to a credit or debit card. Still, it is typically restricted to use only at fuel stations and often offers additional benefits and features tailored to fleet management or individual drivers. These cards streamline the fuel purchasing process, provide detailed transaction reports, and offer perks such as discounts on fuel, roadside assistance, and expense tracking features.

There are several types of fuel cards available, each catering to different needs and user groups. Fleet fuel cards are commonly used by businesses with multiple vehicles, allowing them to manage and monitor fuel expenses for their entire fleet. Individual fuel cards are more suited for personal use, providing drivers with convenient access to fuel while offering benefits such as rewards points or cashback on purchases.

Fuel cards find widespread application across various industries and sectors, including transportation, logistics, construction, and retail. For businesses, fuel cards offer efficient expense management tools, helping to track fuel consumption, optimize routes, and control costs. Individual users benefit from the convenience and potential savings provided by fuel cards, making them a popular choice for regular commuters and road-trippers alike.

Co-branded fuel cards are issued in partnership with specific fuel companies or retailers, offering users additional discounts or rewards when purchasing fuel at affiliated locations. Overall, fuel cards play a crucial role in simplifying fuel purchases, enhancing financial control, and maximizing benefits for both businesses and individuals involved in the fuel card market.

- In April 2023, HPCL and IDFC FIRST Bank collaborated to introduce a co-branded fuel credit card on the RuPay platform, catering to diverse customer needs. Offered in two variants – FIRST Power and FIRST Power+, the card provides savings on mobility and utility expenses alongside exclusive lifestyle privileges. Consumers can conveniently apply for the card through IDFC FIRST Bank's website and app, select branches, and HPCL locations.

- In November 2023, Rightcharge introduced the UK's most comprehensive electric fuel card, facilitating seamless EV charging for fleets. This innovative card enables fleet managers to oversee employee charging across various locations – at home, at work, and on the road. With payments consolidated into a single bill, managing EV charging becomes effortless.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 15.21% |

| Market Size in 2025 | USD 821.95 Billion |

| Market Size by 2034 | USD 2,929.98 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Fleet Operator, By Cards, and By Subscription |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Cost management and efficiency

The fuel card market is driven by several factors emphasizing cost management and operational efficiency. Businesses utilizing fleet fuel cards seek to optimize fuel expenses through discounts, volume rebates, and centralized expense tracking. These cards enable companies to negotiate favorable fuel rates and monitor driver behavior, promoting fuel-efficient practices. Additionally, fuel cards streamline administrative tasks associated with fuel purchases, reducing paperwork and streamlining expense reconciliation processes. As businesses prioritize cost-effectiveness and operational efficiency, fuel cards continue to be a preferred solution for managing fuel-related expenses.

Technological advancements and integration

Market dynamics driving fuel card adoption are increasingly influenced by technological advancements and integration capabilities. Fuel card providers are leveraging innovations such as GPS tracking, telematics, and mobile apps to offer enhanced features and services. Integration with fleet management systems allows businesses to access real-time data on fuel usage, vehicle location, and maintenance needs. Moreover, the integration of fuel cards with expense management platforms enables seamless reconciliation and reporting, improving financial visibility and control. As technology continues to evolve, fuel card solutions evolve to meet the changing needs of businesses, driving their adoption in the fuel card market.

Restraints

Market fragmentation and compatibility constraints

One significant restraint facing fuel cards is market fragmentation and compatibility constraints. With numerous fuel card providers and networks operating globally, businesses may encounter challenges in finding a single, universally accepted solution that aligns with their operational needs. Different fuel card networks often have varying acceptance rates among fuel stations, leading to potential limitations in coverage and accessibility. Additionally, compatibility issues may arise when integrating fuel card data with existing fleet management systems or accounting software, hindering seamless expense management and reporting. As a result, businesses may face complexities and inefficiencies in managing their fuel expenses, impacting the widespread adoption of fuel cards.

Opportunities

Expansion into new markets and industries

Fuel cards present opportunities for expansion into new markets and industries, driving growth and revenue diversification for providers. As the demand for efficient fuel management solutions continues to rise across various sectors, including transportation, logistics, and construction, fuel card companies can capitalize on these opportunities by tailoring their offerings to meet the specific needs of different industries and targeting emerging markets with growing transportation infrastructure needs or expanding into industries such as agriculture or healthcare that rely heavily on vehicle fleets for operations. By identifying and addressing the unique pain points and requirements of diverse market segments, fuel card providers can unlock new revenue streams and establish themselves as key players in the broader fuel management ecosystem.

Integration with emerging technologies

Another significant opportunity for fuel cards lies in the integration with emerging technologies, enhancing their value proposition and relevance in a rapidly evolving digital landscape. Advancements in telematics, artificial intelligence, and mobile payment technologies offer fuel card providers the opportunity to innovate and offer enhanced features such as real-time vehicle tracking, predictive maintenance alerts, and contactless payment options. By leveraging these technologies, fuel card companies can deliver more personalized and convenient solutions to their customers, improving operational efficiency and driving user satisfaction.

Moreover, integration with emerging technologies opens up possibilities for data-driven insights and analytics, enabling businesses to optimize fuel usage, reduce costs, and make informed strategic decisions. As technology continues to evolve, fuel card providers have the opportunity to differentiate themselves in the fuel card market by offering innovative solutions that address the changing needs of their customers.

Fleet Operator Insights

The trucking companies segment held the largest share of the fuel card market in 2024. Trucking companies rely heavily on fuel cards to manage their extensive fleets efficiently. The Pilot Flying J Fleet Card, Comdata Fleet Card, and WEX Fleet Card are among the most popular choices in this segment. These cards offer features tailored to the unique needs of trucking operations, such as discounts on fuel purchases at truck stops, detailed reporting for each vehicle, and tools for optimizing routes to reduce fuel consumption and costs. With a focus on streamlining operations and maximizing cost savings, trucking companies are significant drivers of the fuel card market's growth.

The delivery and logistics companies segment is expected to show the fastest growth during the forecast period. Delivery and logistics companies also constitute a significant segment of the fuel card market. Shell Fleet Solutions, BP Fuel Cards, and ExxonMobil Fleet Cards are widely utilized by these businesses to manage their fleets' fuel expenses. These cards often provide benefits such as access to a network of fueling locations, customizable reporting options, and integration with fleet management software. Delivery and logistics companies rely on fuel cards to maintain operational efficiency, monitor fuel consumption, and control costs in a highly competitive industry where margins can be tight. As e-commerce continues to expand, fuel card usage within this segment is expected to grow further, driving innovation and competition among providers.

Cards Insights

The fleet fuel cards segment held the dominating share of the fuel card market in 2024. These cards cater to businesses with multiple vehicles, offering comprehensive features for managing fuel expenses efficiently. Fleet fuel cards provide detailed transaction reports, centralized expense tracking, and customizable controls, allowing businesses to monitor and control fuel expenditures across their entire fleet. With the ability to set spending limits, track fuel consumption in real time, and access data analytics, fleet fuel cards empower businesses to optimize routes, reduce fuel waste, and streamline administrative processes.

The individual/personal fuel cards segment represents another highly influential segment for the forecast period. Individual/personal fuel cards are beneficial for everyday consumers and drivers. These cards offer convenience and flexibility, allowing individuals to access fuel at various gas stations while enjoying perks such as rewards points, cashback, or discounts on fuel purchases. Individual fuel cards simplify the fuel purchasing process, eliminating the need for cash and providing users with a convenient payment method for their transportation needs. Some personal fuel cards also offer features like expense tracking and budgeting tools, helping users manage their fuel expenses effectively. Both fleet fuel cards and individual/personal fuel cards play essential roles in meeting the diverse needs of businesses and consumers in today's fuel card market.

Subscription Insights

The fleet subscription segment held the dominating share of the market in 2024. A fleet subscription in the fuel card market caters specifically to businesses with multiple vehicles, offering tailored solutions to manage fuel expenses efficiently. This subscription type typically provides features such as centralized expense tracking, customizable spending limits for individual drivers or vehicles, and detailed reporting functionalities. Fleet subscriptions streamline administrative tasks associated with fuel management, allowing businesses to monitor fuel consumption, track vehicle locations, and analyze driver behavior in real-time.

Additionally, fleet subscriptions may offer benefits such as volume discounts, fuel network coverage, and integration with fleet management systems for enhanced operational efficiency. By choosing a fleet subscription, businesses can optimize their fuel-related expenses, improve fleet performance, and gain better control over their overall transportation operations.

The personal subscription segment is expected to witness a significant rate of expansion during the forecast period. A personal subscription in the fuel card market targets individual drivers, offering convenient access to fuel while providing benefits tailored to personal use. This subscription type is ideal for regular commuters, road-trippers, and individuals who frequently rely on their vehicles for transportation needs. Personal subscriptions may include features such as rewards points or cashback on fuel purchases, discounts at affiliated fuel stations, and simplified expense tracking for personal budgeting purposes.

With an individual subscription, drivers can enjoy the convenience of cashless transactions at fuel stations, access to a vast network of participating locations, and potential savings on fuel expenses over time. Whether for daily commuting or occasional road trips, a personal fuel card subscription offers drivers a hassle-free way to manage their fuel purchases and maximize benefits tailored to their individual needs and preferences.

Regional Insight

North America dominated the fuel card market with a mature and well-established infrastructure, extensive road networks, and a highly developed transportation industry. The region's large economies, such as the United States and Canada, have a high concentration of trucking companies, delivery services, and logistics firms, all of which heavily rely on fuel cards to manage their fleets efficiently.

Additionally, the presence of significant fuel card providers with comprehensive networks and offerings further solidifies North America's dominance in the market. These providers offer a wide range of services tailored to the specific needs of businesses operating in the region, including customizable reporting, discounts at fueling stations, and integration with fleet management systems. Moreover, regulatory requirements and industry standards in North America often mandate the use of fuel cards for compliance and accountability purposes, further driving their widespread adoption.

Asia Pacific presents an emerging fuel card market characterized by rapid urbanization, expanding economies, and a growing need for efficient transportation and logistics solutions. While the use of fuel cards is not as prevalent in Asia Pacific compared to North America, increasing commercial activities, rising e-commerce trends, and government initiatives to improve transportation infrastructure are driving the demand for fuel cards in the region.

As businesses in Asia Pacific seek to streamline operations, control costs, and enhance fleet management practices, fuel cards are becoming an increasingly attractive solution. Furthermore, the presence of key players in the fuel card industry expanding their operations into the Asia Pacific region underscores its potential for growth and development in the coming years. As infrastructure and regulations continue to evolve, fuel card usage in Asia Pacific is expected to rise, presenting significant opportunities for the expansion of the fuel card market.

Fuel Card Market Companies

- Shell

- Chevron

- ENGEN

- China Sinopec

- U.S. Bancorp

- ARCO

- Allstar

- PetroChina

- Caltex

- PUMA ENERGY

- FleetCor Technologies

- OILIBYA

- Total

- EonMobil

- UTA

- Radius Payment Solutions Ltd

- DKV EURO SERVICE GmbH + Co. KG

- BP

- WEX

Recent Developments

- In November 2023, Comdata introduced a new payment solution merging fuel card benefits with existing credit card rewards for fleet owners, enhancing convenience and maximizing savings.

- In December 2023, Enfuce, in partnership with Visa, unveiled Visa Fleet 2.0, a versatile payment solution tailored for the fleet management sector. Unlike traditional closed-loop cards, Visa Fleet 2.0 offers flexibility by not restricting usage to specific retailers or fuel types. The integrated card, accessible via physical and digital wallets, streamlines processes and eliminates the need for multiple fuel cards.

Segments Covered in the Report

By Fleet Operator

- Trucking Companies

- Delivery and Logistics Companies

- Construction and Contracting Firms

- Public Transit Agencies

- Utility and Service Companies

- Rental Car Agencies

- Government and Municipal Fleets

By Cards

- Fleet Fuel Cards

- Individual/Personal Fuel Cards

- Co-branded Fuel Cards

- Prepaid Fuel Cards

- Business Fuel Cards

- Commercial Fuel Cards

- Retailer-Specific Fuel Cards

- Travel Fuel Cards

- Corporate Fuel Cards

- Rewards Fuel Cards

By Subscription

- Basic Subscription

- Premium Subscription

- Fleet Subscription

- Individual Subscription

- Corporate Subscription

- Business Subscription

- Enterprise Subscription

- Small Business Subscription

- Large Fleet Subscription

- Personal Subscription

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting