What is the Logistics Market Size?

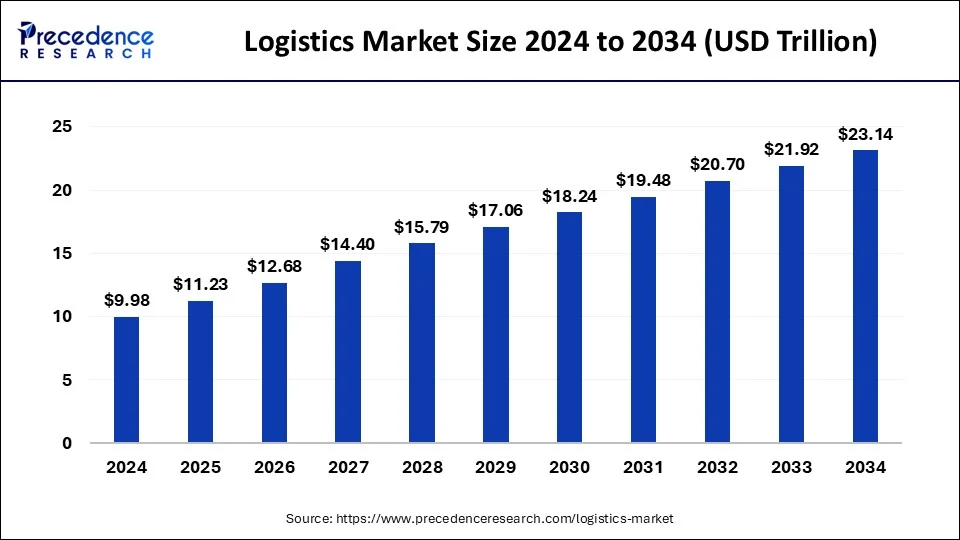

The global logistics market size is accounted at USD 11.23 trillion in 2025 and predicted to increase from USD 12.68 trillion in 2026 to approximately USD 24.36 trillion by 2035, expanding at a CAGR of 8.05% from 2026 to 2035.

Logistics Market Key Takeaways

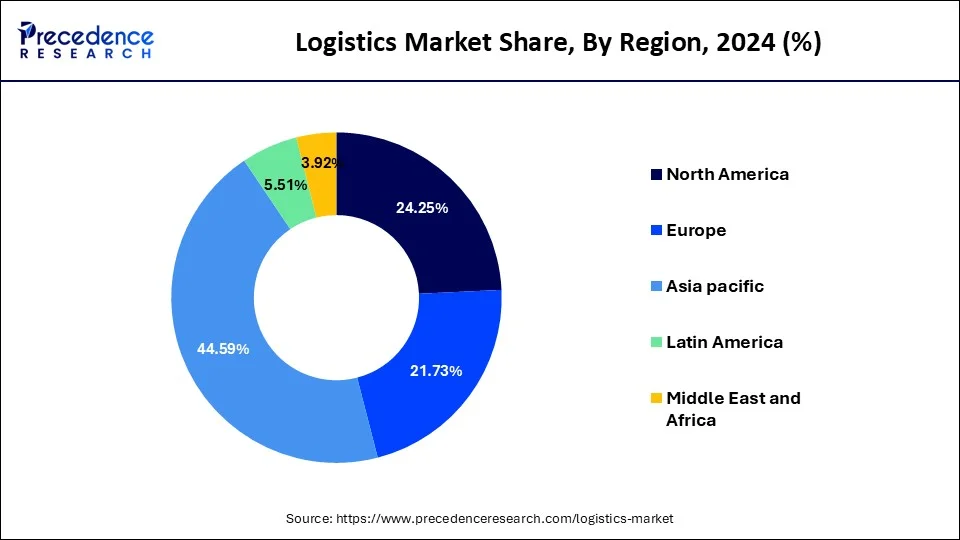

- Asia Pacific dominated the global market with the largest market share of 44.59% in 2025.

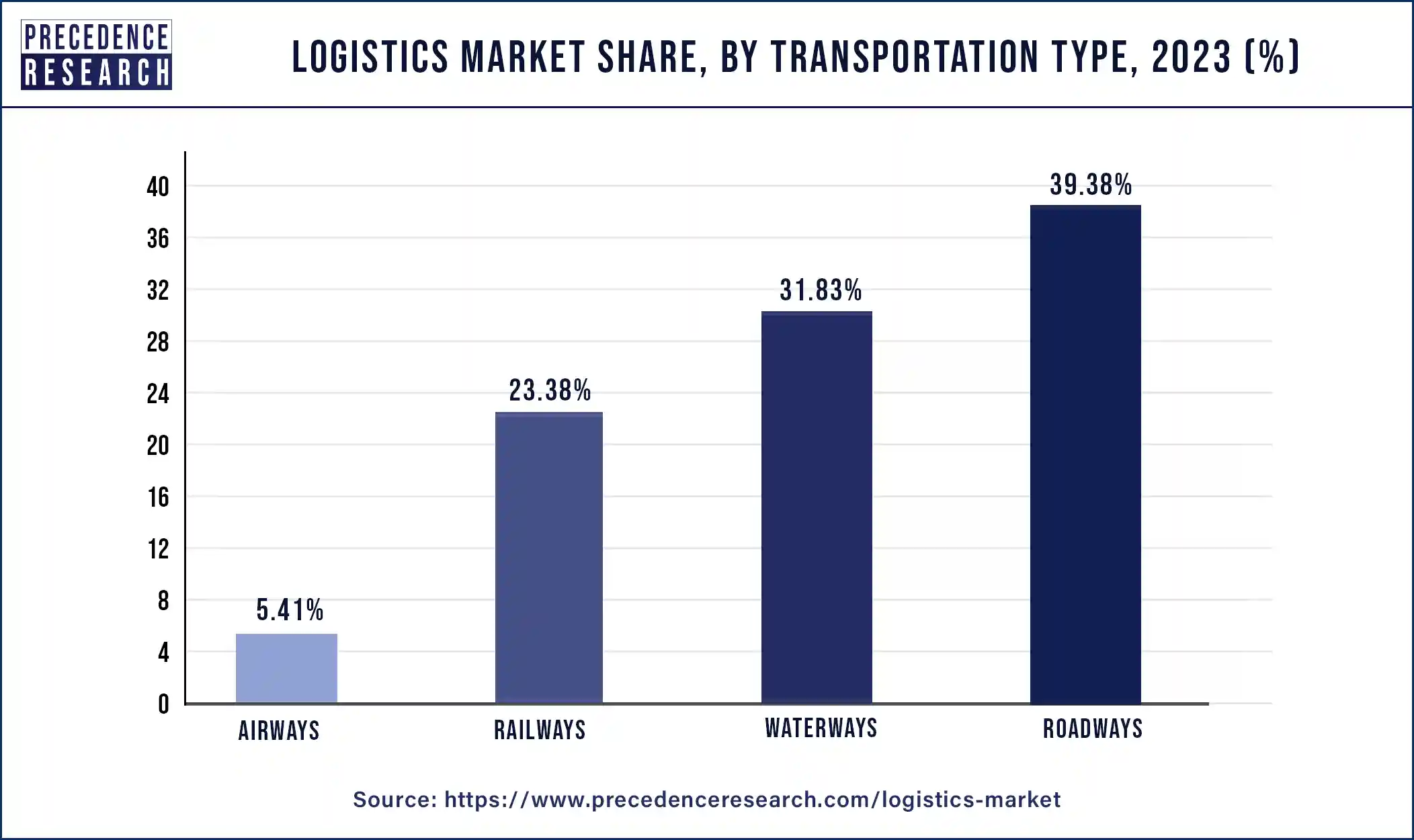

- By transportation type, roadways segment captured the biggest market share of 39.04% in 2025.

- By logistics type, second party segment contributed the largest market share in 2025.

- By end user, industrial and manufacturing segment generated the major market share of 31.78% in 2025.

Logistics Market: An In-depth Overview

One of the key factors positively influencing the market is the booming e-commerce industry, as well as the improving availability of high-speed network connectivity. The need for effective logistics services is rising as the e-commerce industry grows. Furthermore, the market is being driven by a shift in customer preference toward online purchases.

Online retail networks provide convenient home delivery facilities, which aid in market expansion. Aside from that, manufacturers are aiming for green logistics solutions to diminish environmental impact as well as improve their business's green credentials. They also provide logistics monitoring systems that incorporate cutting-edge technologies like blockchain, artificial intelligence (AI), the internet of things (IoT), and augmented reality (AR).

The logistics market forms the connective tissue of the global economy, enabling the movement of goods from suppliers to factories, distributors, retailers, and end customers. It encompasses transportation road, rail, air, sea, warehousing, freight forwarding, last-mile delivery, cold-chain solutions, and integrated supply-chain orchestration. As global commerce scales and consumer expectations shift toward speed, transparency, and reliability, logistics has transitioned from a back-office function to a strategic enabler of competitiveness. The market is fueled by cross-border trade, e-commerce expansion, industrial production cycles, and the digitization of supply-chain workflows.

Logistics Market Trends

Increasing digitization and automation

- Logistics is a part of supply chain in which the process of transportation of goods, services, and related information is done from the point of origin to the point of consumption. Nowadays, the logistics industry is experiencing a significant shift toward digitization and automation. Logistic companies are increasingly adopting technologies such as internet of things (IoT), Artificial Intelligence(AI), Machine learning, and robotics to streamline operations, improving efficiency and reduce cost. This includes warehouse automation, autonomous vehicles, predictive analysis, and others.

Increasing demand for waterways transportation

- Waterways transportation is also called as inland waterways transportation and it refers to movement of goods and passenger through rivers, canals, lakes, and coastal waters. Water transport is generally cost effective for transporting large volume of goods over a long distance and it has high carrying capacity. Hence, the demand for water transportation is increasing. Such a factors are driving the growth of global logistics market in the forecast period.

Market Outlook

- Industry Outlook: The logistics industry is evolving into a technology-centric, data-rich sector anchored in efficiency, resiliency, and customer experience. Companies are repositioning themselves from pure transporters to end-to-end supply-chain partners, providing value-added services such as integrated WMS/TMS systems, customs management, returns processing, and real-time monitoring.

- Sustainability Trend: Sustainability is becoming a defining driver of logistics transformation. Key trends include: fleet electrification and adoption of alternative fuels hydrogen, biofuels, CNG. Carbon-optimised routing using AI to reduce fuel consumption.

- Startups: Digital freight marketplaces that match shippers to carriers in real time. AI-based routing & fleet optimization platforms reducing cost and emissions. Robotic and micro-fulfilment technologies enabling rapid urban fulfilment. Autonomous delivery startups are working on drones, sidewalk robots, and autonomous vans.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 24.36 Trillion |

| Market Size in 2025 | USD 11.23 Trillion |

| Market Size in 2026 | USD 12.68 Trillion |

| Growth Rate from 2026 to 2035 | CAGR of 8.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Transportation Type, Logistics Type, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Logistics Market Dynamics

Drivers

The expanding e-commerce industry and an increase in trade-related agreements will drive market growth.

E-commerce belongs to the buying and selling of goods over the internet. Shipping goods to customers is handled by third-party service providers. Logistics services are also used in the e-commerce sector to manage and oversee e-commerce businesses' supply chains, allowing these businesses to focus on marketing and other company operations.

As a result of the numerous benefits that logistics provides the e-commerce business, the adoption of these services is increasing significantly, boosting market expansion. For instance, the most recent UNCTAD (United Nations Conference on Trade and Development) study, released in April 2020, estimates that e-commerce sales reached $25.6 trillion in 2018, equivalent to 30% of GDP.

- In 2018, B2B e-commerce was worth $21 trillion, accounting for 83% of all e-commerce, while B2C e-commerce was worth $4.4 trillion. Cross-border sales and rapid customer expansion are credited with the expansion. According to one report, over 1.4 billion people made online purchases in 2018, with the US, China, and Japan dominating consumer e-commerce sales.

During the predicted period, the global logistics market is expected to grow due to the emerging popularity of outsourcing in multinational corporations (MNCs) to distribute and manufacture on a global scale.

Logistics provides numerous benefits, including improved delivery performance, lower operational costs, and higher levels of customer satisfaction. As a result, many manufacturers and retailers around the world consider it a critical aspect of their business. Additionally, it contributes to an organization's competitiveness in terms of flexibility, delivery, quality, and cost.

Globalization is a new factor driving market growth, with many multinational corporations outsourcing logistics results. Furthermore, logistics enables organizations to separate different stages of a manufacturing process across multiple countries. It further reduces the total cost of manufacturing.

Restraints

Inconsistent governance standards

To increase profitability and viability, transportation and logistics companies around the world are concentrating on improving supply chain efficiency. Common governance guidelines are necessary for the logistics sector.

The lack of government involvement and the absence of regional organizations, that may actively launch and coordinate global logistics standardization activities, has hampered the level of logistics standardization in European nations like the United Kingdom, Germany, and France. Every vendor is able to offer the majority of solutions in one package due to the common standardization in logistics management.

Opportunity

The introduction of warehouse management systems (WMS) opens new business opportunities.

Many businesses lack a Warehouse Management System (WMS) or have a WMS that does not have features such as directed put away, interfacing with a TMS or ERP system, and zone picking. WMS upgrade is expected to increase in future years as companies focus on improving these services.

- For instance, Manhattan Associates launched a novel Manhattan Active Warehouse Management solution in May 2020, a cloud-native corporate warehouse management system that unifies all factors of distribution without requiring any upgrades.

Segment Insights

Transportation Type Insights

In 2025, the roadways segment held the majority share. The roadways segment has grown in response to increased demand for roadway vehicles to transport retail products over long distances, particularly in domestic markets. When choosing road transportation, retail businesses use trucks and cargo with large carrying capacities.

Furthermore, improved road connectivity in developing nations, as well as excellent road connectivity in all developed countries, is vital in driving the expansion of the highway mode of transportation. Most tier 2, as well as tier 3 cities in various countries, are well linked by roadways, allowing retail logistics companies to deliver and pick up products. This trend is anticipated to continue in the upcoming years due to advancements in road transportation systems and the improvement of highways around the world.

On the other hand, the waterway sector was the fastest-growing segment in 2025. Water transport is a transportation mode that uses ships as well as boats which have the ability to float on water surfaces to transport people, goods, barges, and freight. The aforementioned mode of transportation is less pricey than air, rail, and road transportation, and it is beneficial in international trade for transporting heavy goods over long distances.

It is also utilized to defend navies' borders in military operations. Sensor technologies are increasingly being used by water transportation service providers to monitor ships in remote locations. The sensor's data allows ship owners to improve the overall maintenance cycle of visits, which includes condition monitoring and condition-based monitoring. NoraSens and Silicon Radar, for example, are two companies that make sensors for ships.

Logistics Market Revenue, By Transportation Type, 2022-2024 (USD Billion)

| Transportation Type | 2022 | 2023 | 2024 |

| Airways | 428.41 | 485.38 | 545.14 |

| Waterways | 2,524.17 | 2,853.85 | 3198.64 |

| Railways | 1,862.44 | 2,095.78 | 2337.90 |

| Roadways | 3,168.25 | 3,528.38 | 3895.02 |

Logistics Type Insights

Third-party logistics dominated the market in 2025 and is expected to grow at the fastest rate during the projected period, 2026-2035. Third-party logistics outsource the management of multiple supply chain operations. The ability of third-party logistics to reduce overall distribution and warehousing costs allows for greater flexibility. As a result, providing outsourced services to handle various supply chain functions has a positive impact on market growth.

The growing need for outsourcing major logistics and transportation services to decrease shipping costs as well as manage delivery span is attributed to being widely used in the retail, telecommunications, automotive, construction, e-commerce, manufacturing, food and beverage (F&B), and hospitality industries. As a result, the market is currently expanding.

Furthermore, the second-party logistics sector was the fastest-growing segment in 2025. Second-party logistics is the transportation of goods from one supply chain transport area to another, such as rail, road, sea, or air. Second-party logistics providers are asset-based carriers that include transport via their ships and contracted airlines. They are primarily used for international transportation of heavy and wholesale goods, as well as for trading. By utilizing a second party, the company frees up time and resources to focus on other aspects such as growth. They may also save money by not hiring additional staff and trucks to handle their deliveries.

End User Insights

Application segmentation of the logistics market includes industrial and manufacturing, oil and gas, retail, and healthcare. The industrial and manufacturing sector ruled the market in 2025 and is expected to be the fastest-growing segment between 2025 and 2035 as logistics improve efficiency and productivity while lowering costs and enhancing consumer satisfaction. The anticipated growth in the segment is due to a rise in the need for industrial manufacturing facilities.

On the other hand, the healthcare sector was the fastest-growing segment in 2025. Healthcare logistics is a critical component of the medical system since medical devices and pharmaceuticals need to be transported and handled with extreme care. Healthcare logistics is a subgroup of logistics services that deal with storing, transporting, delivering, and handling medical products from the production unit to the final destination.

Increased consumption and production of pharmaceutical drugs as well as innovative medical devices, in addition to intense development in the target patient group, are predicted to drive expansion in the healthcare logistics sector over the projected period.

Logistics Market Revenue, By End User, 2022-2024 (USD Billion)

| End User | 2022 | 2023 | 2024 |

| Industrial & Manufacturing | 2,570.59 | 2,867.46 | 3171.02 |

| Retail & E-Commerce | 1,439.24 | 1,607.90 | 1780.80 |

| Healthcare | 899.54 | 1,032.35 | 1174.50 |

| Oil & Gas | 600.09 | 681.54 | 767.34 |

| Others | 2,473.81 | 2,774.13 | 3083.05 |

Regional Insights

What is the Asia Pacific Logistics Market Size?

The Asia Pacific logistics market size was valued at USD 5.07 trillion in 2025 and is expected to reach around USD 12.11 trillion by 2035 with a CAGR of 9.10% from 2026 to 2035.

The expansion of retail industry in the area is observed to be the main factor for the dominance of Asia Pacific in the logistics market. Governments in the Asia Pacific region have invested heavily in improving transportation infrastructure, such as roads, ports, and airports. These investments have enhanced the efficiency and capacity of logistics networks, making the region more competitive in global trade. The region has seen a significant rise in e-commerce activities, with countries like China and India leading the way. The growth of online retail has created a high demand for logistics services, including warehousing, transportation, and last-mile delivery. Many countries in the Asia Pacific region, particularly China and India, have experienced rapid economic growth. This growth has led to increased industrial production and trade activities, boosting the demand for efficient logistics services.

North America is anticipated to grow at a significant CAGR during the analysis period. The region's growth can be attributed to the existence of a well-developed infrastructure in terms of road and rail connectivity. The US is the primary logistics market, with a highly combined supply chain network that connects consumers and producers through various modes of transportation such as express and air delivery services, rail, truck transport, and maritime transport.

- In 2025, the Europe logistics market accounted for the second-largest market share. The market's growth is being fueled by expanding e-commerce trends as well as a region that is becoming increasingly reliant on it. Additionally, European countries are financing logistics research and development.

Furthermore, the region's labor availability and potential infrastructure provide European nations with a profitable opportunity to propel this division. Furthermore, the logistics market in Germany had the largest market share, while the logistics industry in the United Kingdom was the fastest-expanding market in the European region.

North America: Automation and Nearshoring Augment Regional Leadership

North America retains a dominant logistics position in the global market as automation and relocation of supply chains continue. More than 70% of logistics companies in the U.S. use AI for improved routing and warehousing effectiveness, enabling delivery accuracy. Nearshoring activity to Mexico climbed with a 25% increase in cross-border freight activity. While East Coast ports experienced record volumes of container ships, geopolitical concerns have pushed domestic logistics companies to invest in more resilient logistics networks that leverage technology.

Asia-Pacific: E-Commerce and Technology Influence Rapid Growth

Asia Pacific's impressive logistics growth is propelled by e-commerce and technology. China's infrastructure is pushing forward with a USD 548 billion investment policy, and key improvements like the Tuas mega port will increase regional efficiency. The market for contract logistics is booming, with an increase in tech use, including artificial intelligence and IoT applications in supply chains, creating exciting opportunities. Singapore and India are the early leaders on smart logistics and digitization, but distinct variations and gaps in labor will challenge logistics services. Strategic digitization continues to support Asia Pacific's rapid logistics evolution in the forecast period.

Latin America Logistics Market

Latin America presents a mixed landscape: dynamic urban markets, expanding digital freight networks, and rising cross-border commerce alongside infrastructure gaps and regulatory fragmentation. Brazil leads with advanced e-commerce logistics, strong domestic transportation networks, and investment in warehousing automation. Mexico benefits from nearshoring, manufacturing clusters, and North American trade integration. Chile and Colombia are strengthening their logistics capabilities through modern ports, digital customs, and robust cold-chain growth. Challenges include road quality, customs bottlenecks, and high logistics costs but opportunities in last-mile delivery, cold chain, and digitalization remain strong across the region.

Middle East Logistics Landscape

The Middle East logistics market is becoming eminent as a global transshipment and distribution location, supported through world-class ports, free-trade areas, and robust infrastructure strategies that are backed by the government. Countries within this area of the world continue to invest in a multimodal connectivity environment, implementing smart ports and cross-border trade facilitation to assist with non-oil-based economic diversification.

Saudi Arabia Logistics Market Trends

Rapid growth in the logistics sector in Saudi Arabia is being experienced through vision-driven technology investments, logistics area developments closely in proximity to ports, and the continued aggressive investment into digitalization associated with the supply chain, thereby paving the way for Saudi Arabia to be positioned as a hub of logistics across the region.

Nigeria Logistics Market Trends

Nigeria is beginning to experience rapid growth within its logistics environment, driven primarily by the continued expansion of e-commerce, high levels of manufacturing growth, and an increasing demand for last-mile delivery services and inland transportation services in urban areas.

Value Chain Analysis

- Raw Material Sourcing: Though logistics is service-driven, it heavily relies on upstream sourcing of key materials: vehicles, trailers, containers, pallets, fuel, spare parts, warehouse racking systems, automation hardware, packaging materials, and digital infrastructure components sensors, telematics units, battery systems, and communication modules.

- Technological Advancements: Technology is redefining logistics through automation, intelligence, and connectivity. AI and machine learning power demand forecasting, route optimization, and predictive maintenance. IoT sensors provide real-time tracking of cargo, temperature, humidity, and fleet performance.

Logistics Market Companies

- C.H. Robinson Worldwide Inc: A major third-party logistics (3PL) provider, C.H. Robinson offers a comprehensive suite of services including truckload, LTL Less-Than-Truckload, ocean, air, and intermodal freight transportation.

- FedEx: FedEx provides a broad portfolio of transportation, e-commerce, and business services. Core offerings include time-definite express parcel delivery domestic and international, LTL and truckload freight services, and comprehensive supply chain solutions through FedEx logistics.

- Kuehne+Nagel: They are a top global sea and air freight forwarder and offer specialized end-to-end solutions for various industries, including healthcare and perishables, along with e-commerce fulfillment, warehousing, and customs clearance services.

- Nippon Express: Nippon Express offers integrated logistics solutions, including air, ocean, and ground transportation, warehousing, distribution, and customs clearance. They provide end-to-end supply chain management services globally, catering to a wide range of industries.

- DHL Supply Chain: provides a comprehensive suite of logistics solutions from start to finish of the supply chain, which includes warehousing automation and advanced predictive and analytical capabilities, based on global, national, and local, emerging and mature markets.

- FedEx Corporation: provides time-definite express transportation, international freight forwarding, and digital shipment tracking capabilities, which enhance the efficiency of global trade.

- United Parcel Service Inc. (UPS): delivers parcels and freight, with specific areas of expertise including small parcel delivery and international logistics through the use of data-driven route optimization software to improve the efficiency of your supply chain processes.

- Kuehne+Nagel International AG: offers sea freight services for a variety of products; air freight services for perishables, pharmaceuticals, and industrial supply chains; and contract logistics services with strong capabilities.

- DB Schenker: supplies integrated logistics services involving land transport of goods, global freight forwarding, and bespoke supply chain solutions for both industrial and automotive customers.

- C.H. Robinson: Worldwide provides digital freight brokerage and multimodal transportation services, as well as a wide variety of supply chain visibility solutions, to enterprise customers, including those that operate worldwide.

Other Major Key Players

- MOLLER – MAERSK

- DSV (DSV Panalpina)

- Robinson Worldwide Inc.

- Kuehne+Nagel

- GEODIS

Recent Developments

- In January 2025, Sustainable Shared Transport Inc. (SST), a subsidiary of Yamato Holdings Co., Ltd. and Fujitsu Limited, today announced the launch of a joint transportation and delivery system for shippers and logistics providers in Japan.

- In May 2025, Firnal announced the launch of an international manufacturing and logistics division in partnership with DVR International. This new division focuses on international manufacturing, shipping, and risk mitigation to meet global supply chain challenges and offer stability.

- In April 2025, Swan Defence and Heavy Industries launched a commercial logistics ecosystem at Pipavav Yard. The model is designed to help companies shorten project execution timelines, minimise handoffs, and reduce overall project risk.

- In April 2025, Gulf Warehousing Company (GWC) Q.P.S.C. will launch one of the largest private solar energy projects in the Gulf Cooperation Council (GCC), marking a significant step in its sustainability journey and reinforcing its position as a leader in green logistics.

- United Parcel Service Inc. acquired the Bomi Group, a European company specializing in temperature-controlled transport and warehousing, in November 2022.

- H. Robinson paid $225 million for Prime Distribution Services in January 2020. The acquisition includes 2.6 million square feet of warehouse space and provides the corporation with retail consolidation services such as distribution, fulfillment, and inventory control.

Segments Covered in the Report

By Transportation Type

- Airways

- Waterways

- Railways

- Roadways

By Logistics Type

- First Party

- Second Party

- Third Party

- Contract Logistics

- Freight Forwarders

- Asset-based logistics provider

- Contract Warehousing

- Providers

- Others

By End User

- Industrial and Manufacturing

- Retail

- Healthcare

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting