What is Automotive Logistics Market?

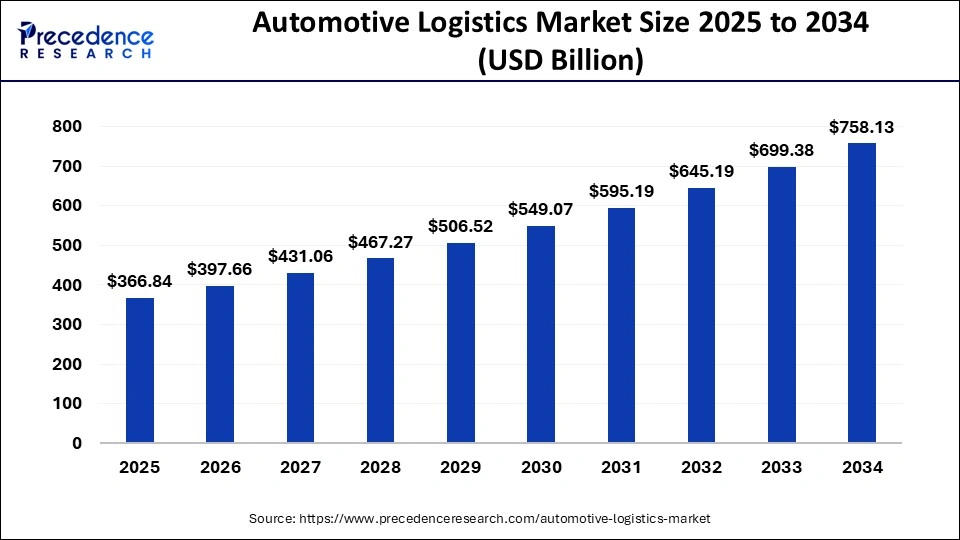

The global automotive logistics market size is accounted for USD 366.84 billion in 2025 and is predicted to increase from USD 397.66 billion in 2026 to approximately USD 813.84 billion by 2035, expanding at a CAGR of 8.29% from 2026 to 2035.

Automotive Logistics Market Key Takeaways

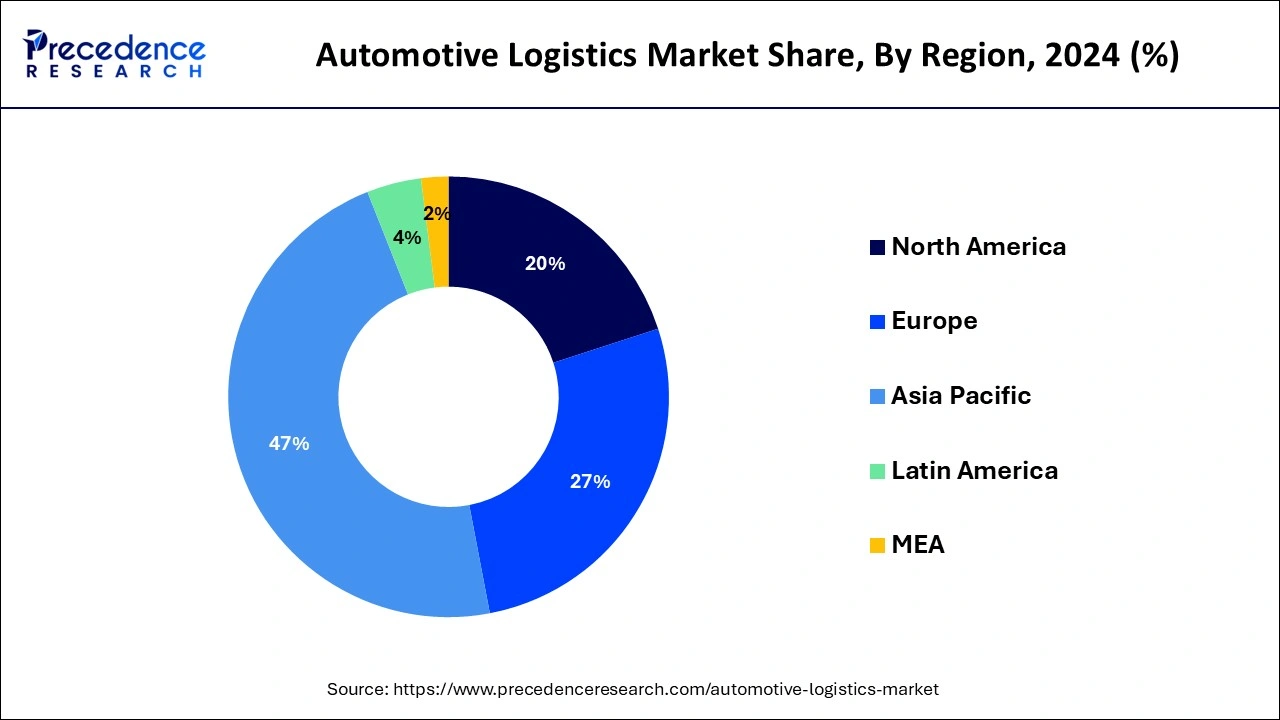

- Asia Pacific contributed more than 47% of revenue share in 2025.

- By type, the automobile parts segment has held the largest market share in 2025.

- By type, the finished vehicles segment is anticipated to grow at a solid CAGR during the forecast period.

- By activity, the transportation segment generated largest revenue share in 2025.

- By activity, the warehousing segment is expected to expand at the fastest CAGR over the projected period.

Market Outlook

- Industry Overview: Automotive logistics is an integrated discipline combining transportation planning, yard and terminal operations, inventory orchestration, packaging and kitting, customs and trade compliance, and aftersales spare-parts networks. Logistics firms operate across multiple modes ocean, rail, road, and air optimizing for speed, cost, and damage risk.

- Value-added services such as sequencing, pre-delivery inspection (PDI), accessory fitting, and light final assembly are increasingly outsourced to logistics hubs adjacent to assembly plants or port facilities. Collaboration across suppliers, carriers, and OEMs via shared data platforms and standardized protocols is essential to maintain JIT/JIS flows. Competitive advantage is derived from hub location, fleet optimization, damage-minimization processes, and the ability to scale for model ramp-ups and global launches.

- Sustainability Trend: Sustainability in automotive logistics focuses on lowering emissions across transport modes, reducing packaging waste, optimizing routing and load factors, and electrifying fleets for last-mile and short-haul moves. Modal shifts from road to rail and short-sea shipping are promoted where feasible, and consolidation centres reduce empty-mile movements.

- Innovations in reusable and returnable packaging for components, improved reverse logistics for end-of-life vehicles and batteries, and greener warehousing solar, LED, efficient HVA are growing priorities. OEMs also evaluate logistics partners on carbon reporting and scope-3 emissions transparency, pushing the sector toward measurable decarbonization targets and supplier-level sustainability commitments.

- Major Investment Themes: Investors and corporates are targeting digital control towers, real-time visibility platforms, automated warehousing and robotics, electrified and autonomous yard operations, and decarbonized transport solutions EV truck fleets, hydrogen for long haul, modal-shift facilitation. Capital also flows into near-shore and regional distribution hubs to shorten lead times, advanced packaging solutions that reduce damage and weight, and joint ventures that secure capacity in constrained ocean and rail corridors.

- Companies offering integrated aftersales distribution, spare-parts analytics to reduce obsolescence, and financing models for large fleets are attracting strategic interest. Investment in skilled logistics talent and partnerships with mobility/charging infrastructure providers is also on the agenda as EV supply chains evolve.

- Sustainable Ecosystems and Startups: Sustainable ecosystems emerge where logistics providers, OEMs, port authorities, and tech startups co-invest in pilot corridors, shared inland depots, and circular packaging systems. Startups commonly specialize in visibility IoT telematics and blockchain for provenance, intelligent yard management, modular reusable packing, and niche last-mile EV fleets optimized for vehicle delivery. Incubators linked to OEM supply-chain programs help scale pilots into operational models especially around battery handling, reverse logistics for EV packs, and remanufacturing flows.

Automotive Logistics Market Growth Factors

Increasing outsourcing of automotive components, emergence of logistics services, and technological advancement are some of the prime factors that drive the market growth. Requirement of an effective and customized logistic service have established a differentiating factor among various logistic service providers and plays a crucial role in maintaining competition in the market. Logistics service providers are also incorporating disruptive technologies such as Big Data, Internet of Things (IoT), and connected ship to enhance their supply chain management system. These technologies aid in reducing the labor cost and also eliminate the delay in shipments. The aforementioned factor propels the demand of automotive logistics significantly over the coming years. Further, increasing sale of automobiles across the globe along with a significant rise in the demand for automotive spare parts positively influence the market growth. Advancement in the distribution channel and rising trend for Do it yourself (DIY) has again prominently boosted the demand for automotive aftermarkets, thereby triggers the market growth of automotive logistics.

Market Scope

| Report Highlights | Details |

| Market Size by 2025 | USD 366.84 Billion |

| Market Size in 2026 | USD 397.66 Billion |

| Market Size in 2035 | USD 813.84 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.29% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Logistics Solution, Distribution, Activity, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Type Insights

Automotive logistics market has been segregated into automobile parts and finished vehicles. Automobile parts encountered the maximum market value share in 2024. The segment includes both the revenue generated from the logistics of spare parts from both aftermarket as well as automobile manufacturers. In addition, stringent government norms for carbon emission have triggered the need for upgradation of automotive parts that again flourishes the demand for automobile parts in the coming years.

On the other hand, finished vehicles expected to register the highest growth over the forecast period due to rising demand for electric vehicles and low emission vehicles. Several government initiatives to curb the harmful emission is promoting the sale of electric and battery-powered vehicles across various regions. Additionally, governments of different regions are offering tax credits and other numerous benefits on the purchase of electric cars. Consequently, the above mentioned factors predicted to fuel the growth of finished vehicle segment during the forecast period.

Activity Insights

Transportation segment led the global automotive logistics market with significant revenue in 2024 and analyzed to maintain its dominance over the projected years. Transportation is among the critical services in automobile manufacturing. This is mainly because of the automobile manufacturer source various parts and components of the vehicles from different companies, assemble them in their manufacturing plants and sell the finished vehicle across the globe.

Besides this, warehousing projected to exhibit the fastest growth over the analysis period. This is mainly due to increasing demand for capacity expansion in storage centers and warehouses. Furthermore, implementation of various warehouse management systems, effortless material handling, and systematic storage boost the warehouse segment growth in the coming years.

Regional Insights

What is the Asia Pacific Automotive Logistics Market Size?

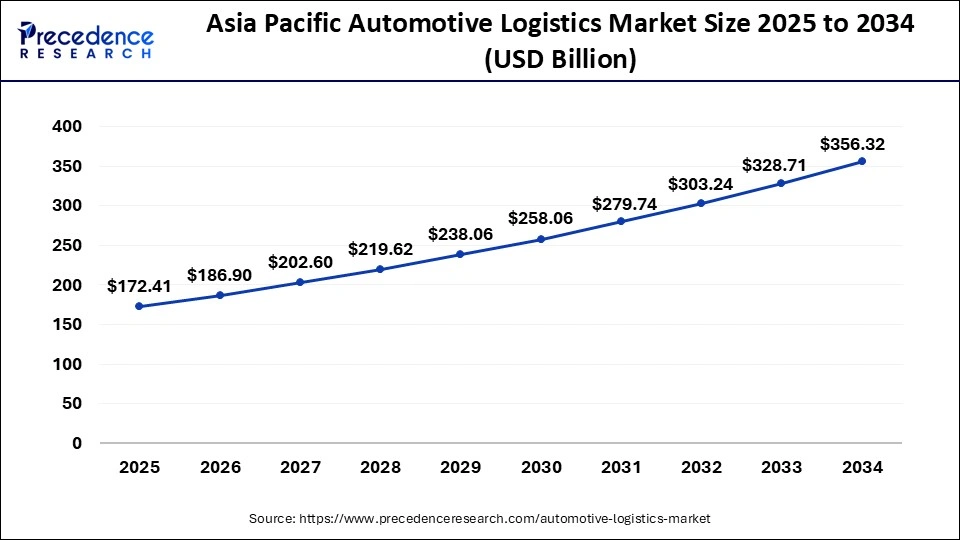

The Asia Pacific automotive logistics market size is exhibited at USD 172.41 billion in 2025 and is predicted to be worth around USD 382.50 billion by 2035, at a CAGR of 8.29% from 2026 to 2035.

In terms of revenue, the Asia Pacific captured more than 47% market value share in the global automotive logistics market and expected to witness the highest growth during the forecast period. Economic growth in India and China has significantly boosted the market growth in the region. Economic revival and rising e-commerce penetration significantly contributes for the industry growth in India and China. Furthermore, increasing investments in railways, roadways, airways, and maritime trade across emerging nations, such as India, China, and Japan, are projected to bolster the demand for warehousing and logistics over the forecast period.

What Potentiates the European Automotive Logistics Market?

On the other side, Europe analyzed to witness slower growth as compared to the Asia Pacific over the next few years due to concern related to labor shortage and talent management. However, expansion of e-commerce sector and restructuring of supply chain activities is anticipated to positively influence the industry progress during forthcoming years. The region is a home for many automotive manufacturers that again triggers the market growth. In addition to this, rising demand for electric transportation in the region and favorable government initiatives significantly drive the market for automotive logistics over the forecast period.

Can Latin America Rewire Vehicle Flows to Match Growing Demand?

Latin America's automotive logistics market faces a mix of opportunities and structural constraints. Major manufacturing hubs Mexico, Brazil, and Argentina are integrated into global manufacturing networks, requiring sophisticated inbound sequencing, cross-border customs expertise, and reliable finished-vehicle export logistics. However, infrastructure gaps (rail capacity, port congestion, road quality) and regulatory complexity create variability in transit times and costs.

Opportunities lie in regional consolidation centers, enhanced cross-border corridors improved customs processes and bonded logistics zones, and tailored last-mile strategies for urban centres with congestion and parking limitations. Investment in modular, reusable packaging and improved reverse logistics for spare parts can reduce inventory carrying costs across fragmented dealer networks. Public-private coordination to upgrade multimodal links and digitalize customs processes would substantially boost competitiveness.

Mexico Automotive Logistics Market Trends

Mexico benefits from proximity to North American assembly and distribution, making nearshoring trends particularly impactful; Brazil's large domestic market and export industries create scale but suffer from internal logistics friction; smaller markets often rely on imports and need efficient regional consolidation to lower landed costs and improve service levels.

What Makes North America the Fastest-Growing Region in the Automotive Logistics Market?

North America is expected to grow at the fastest rate in the market during the forecast period, owing to specialized logistics requirements, growth of e-commerce and aftermarket, and digital transformation. Rising vehicle production volumes, expanding electric vehicle manufacturing, and rising cross-border trade between the U.S., Canada, and Mexico also drive the market within the region. Moreover, advanced logistics infrastructure, widespread adoption of digital supply chain solutions, and increasing investments in warehouse automation and last-mile delivery further support rapid growth.

- In December 2025, Autolane secured $7.4 million in funding to launch a curbside operating system at Simon centers to revolutionize retail curbs for autonomous vehicles.

How is the Opportunistic Rise of the Middle East & Africa in the Automotive Logistics Market?

The Middle East & Africa (MEA) is expected to experience an opportunistic rise in the market due to the rising infrastructure development, the expansion of smart city projects, and improved battery logistics. Strategic investments in ports, free trade zones, and multimodal logistics infrastructure are improving supply chain efficiency across the region. Additionally, government-led diversification initiatives and the development of regional manufacturing hubs are creating new growth opportunities for automotive logistics providers.

Market Value Chain Analysis

- Raw Material Sourcing: Raw material sourcing for automotive logistics primarily concerns procurement of packaging materials, pallets and containers, protective films, load-securing devices, and digital hardware telemetry devices, RFID tags, sensors. Logistics providers also source fuel, electric charging infrastructure components, and spare parts for fleets. Strategic sourcing emphasizes durable, reusable packaging to reduce lifecycle cost and waste, certified timber or recycled plastics for pallets, and traceable material origins for compliance.

- Technological Advancements: Technology is reshaping automotive logistics through digital twins and control towers that provide end-to-end visibility, predictive analytics for demand and disruption management, IoT-enabled cargo monitoring vibration, temperature, tilt, and automation in yards and distribution centres, autonomous guided vehicles, robotic kitting. Blockchain experiments for provenance and secure documentation reduce friction in customs and consignment transfers.

Top Companies in the Automotive Logistics Market

- Hellmann Worldwide Logistics (A global logistics provider offering a comprehensive range of services including sea freight, air freight, road and rail transport, and contract logistics. Its importance lies in its extensive global network and expertise in complex international supply chains.)

- Ryder System, Inc. (A North American leader in commercial fleet management, dedicated transportation, and supply chain solutions.)

- GEFCO (Historically a major European leader in automotive logistics and supply chain management.)

- CFR Rinkens ( major player in the international vehicle shipping industry. Their importance is in providing specialized, reliable, and compliant logistics services for shipping cars, motorcycles, boats, and other vehicles worldwide.)

|

Company |

Company |

|

Hellmann Worldwide Logistics |

€3.8 billion |

|

Ryder System Inc |

US $ 8.9 billion |

Automotive Logistics Market Companies

- CEVA Logistics

- BLG LOGISTICS GROUP AG & Co. KG

- Hellmann Worldwide Logistics

- Ryder System, Inc.

- GEFCO

- CFR Rinkens

- Penske Automotive Group, Inc.

- Imperial Logistics

- Expeditors International of Washington, Inc.

- Nippon Express Co. Ltd.

- Kerry Logistics Network

- Schnellecke group ag& co. Kg

Companies Share Insights

The global automotive logistics market is oligopolistic in nature and dominated by the some of the key players operating in the market. Market players are incorporating advanced technologies for route optimization, real-time tracking of shipments, and also provide technology-driven services to their customers. Collaboration, merger & acquisition of various other automotive logistics companies are the prime strategies adopted by the industry participants to capture maximum revenue share in the market. Furthermore, the market players are also focusing to improve their automation technology to achieve a competitive advantage among different end-users.

Recent Developments

- In March 2024, CEVA Logistics and the Port of Dunkirk announced the launch of a new vehicle logistics business for import and export at the Port of Dunkirk.(Source: https://www.cevalogistics.com )

- In October 2024, Imperial Logistics International explored the delivery of a Volvo FM Electric 4x2 tractor unit supplied by Dawsongroup and Volvo.

(Source: https://www.commercialmotor.com )

Segments Covered in the Report

By Type

- Automobile Parts

- Finished Vehicle

By Activity

- Transportation

- Airways

- Roadways

- Railways

- Maritime

- Warehousing

By Logistics Solution

- Outbound

- Inbound

- Reverse Distribution (International and Domestic)

By Distribution

- International

- Domestic

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting