What is Retail Logistics Market Size?

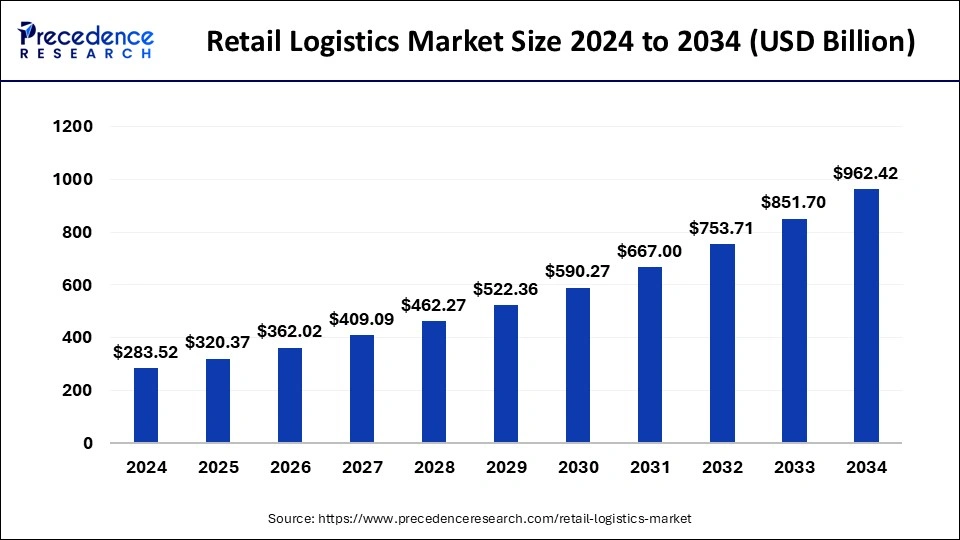

The global retail logistics market size is recorded at USD 320.37 billion in 2025 and is predicted to increase from USD 362.02 billion in 2026 to approximately USD 1064.65 billion by 2035, expanding at a CAGR of 12.76% from 2026 to 2035

Market Highlights

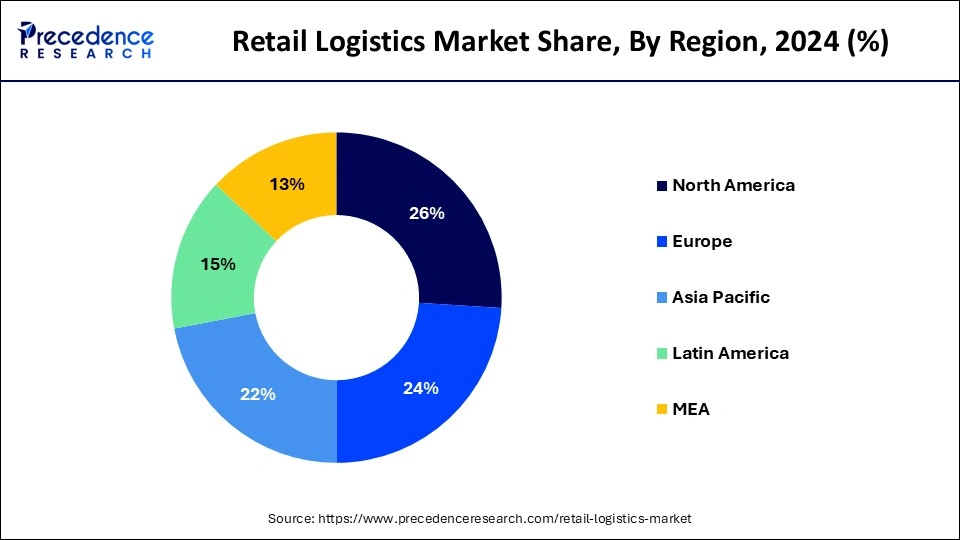

- Asia Pacific led the global market with the highest market share of 26% in 2025.

- By Solution, the supply chain segment has held the largest market share of 35% in 2025.

- By Mode of Transportation, the roadways segment captured the biggest revenue share of 52% in 2025.

Retail Logistics Market Growth Factors

Significant growth in the retail and e-commerce platform has significantly boosted the retail logistics business across the world. Further, rising trend for online purchasing is one of the other major factors that triggers the demand for retail logistics. Online purchasing has boosted the demand for easy and fast delivery and pick of products selected by the customers that prospers the demand for logistics both across nation and cross-border.

Moreover, with the sudden outbreak of COVID-19 in the start of the year 2020 various industries were badly hit by the lockdown scenario across the country, whereas retail logistics seeks profound growth. This has boosted the trend for online shopping because of public isolation that in turn triggered the market growth and hence the retail logistics market witnesses an opportunistic growth over the upcoming years.

Retail Logistics Market Trends

- Growing use of advanced technologies like Internet of Things (IoT) enabling real-time tracking with GPS trackers and RFID tags, fleet management with IoT-enabled telematics systems, monitoring cargo integrity with temperature and humidity sensors, predictive maintenance and inventory management for enhancing operational efficiency and visibility with reduced costs throughout the supply chain.

- Adoption sustainable practices by retailers like using renewable energy, reducing carbon emissions and upgrading to circular economy models.

- Retailers are offering omnichannel retail experiences to customers by integration of online and offline channels.

- Rising investments in last-mile delivery solutions and collaborations with delivery services is helping retailers to meet the consumer demand for faster and convenient delivery options.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 320.37 Billion |

| Market Size in 2026 | USD 362.02 Billion |

| Market Size in 2035 | USD 1064.65 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.76% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Solution, Mode of Transport, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Retail Logistics Market Segment Insights

Solution Insights

Based on the solution, supply chain captured the largest market revenue share of 35% in the year 2024 and is anticipated to continue its dominance during the future outlook period. Significant growth of the segment is mainly attributed to its favorable features such as on-time delivery, optimization of omnichannel operations, personalizing the kitting & order fulfillment, and effectively manages the customer return. Supply chain also enables direct-to-store and direct-to-customer shipping that significantly decreases the time of delivery and improves the efficiency of warehouses as well as also optimizes the inventory. The supply chain segment also registers a rapid growth rate of approximately 13% due to penetration of cloud and data analytics solutions in the supply chain management.

On the contrary, reverse logistics & liquidation segment registers a considerable growth during the forecast period owing to magnificent growth in e-commerce platform along with rising number of e-shoppers across the world. Today, consumer prefer easy return and exchange process on the purchase of any goods. This emphasizes retailers to make return process for online goods easy and convenient for their customers.

Mode of Transportation Insights

Roadways segment accounted for the major share of revenue of approximately 52% in the year 2024 and was predicted to forecast the same trend over the upcoming years. The impressive growth of the segment is mainly because of increasing demand for road transportation for long distances, preferably in the domestic regions. Further, an easy and fast possible way for delivering and return process of goods is the other major factor propelling the growth of the segment. Besides, various government initiative to improve the condition of national and international highways. In addition, the government also focuses on continuous monitoring the health of highways by using cognitive analytics and Internet of Things (IoT). These all factors collectively support the growth of the segment.

Moreover, the roadways segment also registers the fastest growth over the forthcoming years attributed to increasing road connectivity particularly in the developing nations. This triggers the demand for road transportation compared to other modes of transportation. Further, tier 1 and tier 2 cities are well connected through road networks that again propels the demand for road transportation among retailer as is an easy way to deliver and pick up of goods.

Retail Logistics Market Regional Insights

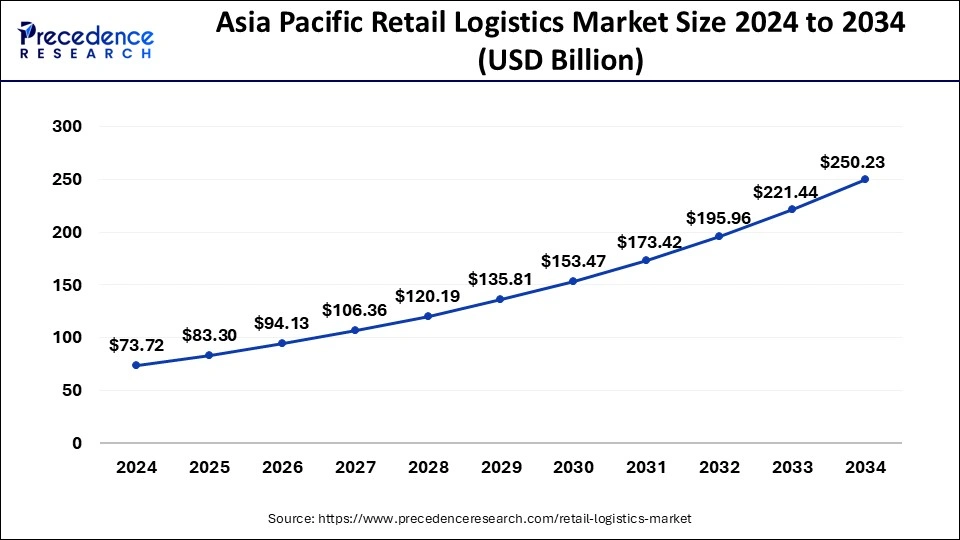

The Asia Pacific retail logistics market size is exhibited at USD 83.30 billion in 2025 and is predicted to be worth around USD 276.81 billion by 2035, at a CAGR of 12.76% from 2026 to 2035.

In terms of geography, the Asia Pacific is the front-runner in the global retail logistics market holding a revenue share of approximately 26% in the year 2024 and anticipated to maintain its dominance in the forthcoming years. This is majorly attributed to the significant developments in the logistics infrastructure, particularly in the emerging nations such as China, India, South Korea, Australia, Singapore, ASEAN nations, and many others. For instance, a framework agreement was signed between Cambodia's Ministry of Public Works and Transport (MPWT) and Singapore based YCH Group Pte Ltd in order to develop Phnom Penh Logistics Complex Project.

In addition, several manufacturers are planning to shift their manufacturing sites in the Asia Pacific region is the other most prime factor that drives the retail logistics market growth. For example, in July 2021, Taiwan Semiconductor Manufacturing Company announced its plan to open its first chip manufacturing plant in Japan and stat its operation by the early of year 2024. Again, in November 2018, Alltech, leading supplier of animal foods expanded its manufacturing facility in India. Similarly, various other companies of different markets are expanding their manufacturing facilities in the region owing to low labor cost and other favorable conditions for decreasing the overall manufacturing cost. These activities from the manufacturers significantly boosts the growth of retail logistics in the region.

North America and Europe are the other significant revenue contributors to the global retail logistics market owing to prominent growth in the food & beverages industry for online delivery. In 2019, the UK food delivery market accounted for a value of US$ 10 billion registering a growth of 39% over the past three years. Similarly, US online food delivery market was valued at US$ 26.5 billion in the year 2020 and expected to grow at a rate of 11% during the forecast period. This all above statistics states the significant contribution to the growth of retail logistics in the North America and Europe markets.

Retail Logistics Market Companies

- A.P. Moller - Maersk

- APL Logistics Ltd

- DSV

- C.H. Robinson Worldwide, Inc.

- DHL International GmbH

- Kuehne + Nagel International

- FedEx

- Nippon Express

- United Parcel Service

- Schneider

- XPO Logistics, Inc.

Recent Developments

- In May 2025, DHL Supply Chain made a strategic move by acquiring IDS Fulfillment, the U.S.-based provider of e-commerce fulfillment and retail distribution logistics, for enhancing its e-commerce capabilities and expanding its service offerings to small and midsized customers. The acquisition includes strategically located facilities spread across the U.S. in Indianapolis, Ind., Salt Lake City, Utah, Atlanta, Ga., and Plainfield, Ind., further adding over 1.3 million square feet of multi-customer warehouse and distribution space.

- In March 2025, FedEx partnered with Blue Yonder for assisting retailers in the management of reverse logistics while balancing the control and predictability offered in outbound shipping, by leveraging FedEx's transportation network and with Blue Yonder's AI-driven supply chain platform to simplify e-commerce returns.

- In January 2025, Honeywell, a leading hardware, software and services company, declared a strategic collaboration with Verizon for creating a flawless technology experience to retail and logistics companies by leveraging Verizon's high-speed 5G connectivity. The partnership aims at launching a transformative Honeywell-Verizon bundled solution for streamlining the retail lifecycle through streamlined procurement, contracting and future deice and data plan expansions for businesses.

Retail Logistics Market Segments Covered in the Report

By Type

By Solution Type

By Mode of Transport Type

By Region

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting