What is the Cold Chain Logistics Market Size?

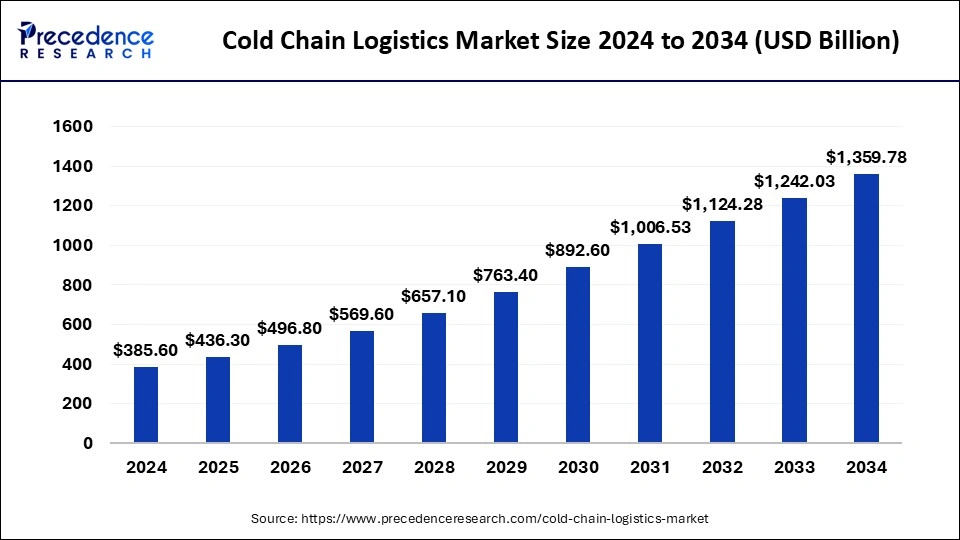

The global cold chain logistics market size accounted for USD 436.30 billion in 2025 and is predicted to increase from USD 496.80 billion in 2026 to approximately USD 1,477.53 billion by 2035, expanding at a CAGR of 12.97% from 2026 to 2035.

Market Highlights

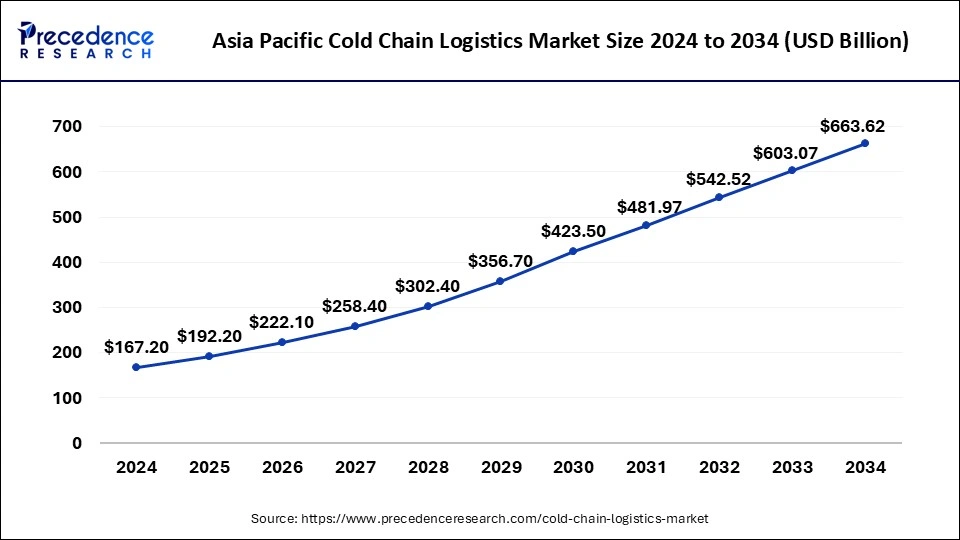

- Asia Pacific region will grow at the highest CAGR of around 14.3% from 2026 to 2035.

- By application, the dairy and frozen desserts segment accounted largest revenue share of 36.10%.

- By Process, the pre-cooling facilities segment was valued at USD 204.4 billion in 2025.

- By Technology, the dry ice segment garnered the highest market share of 55.16% in 2025.

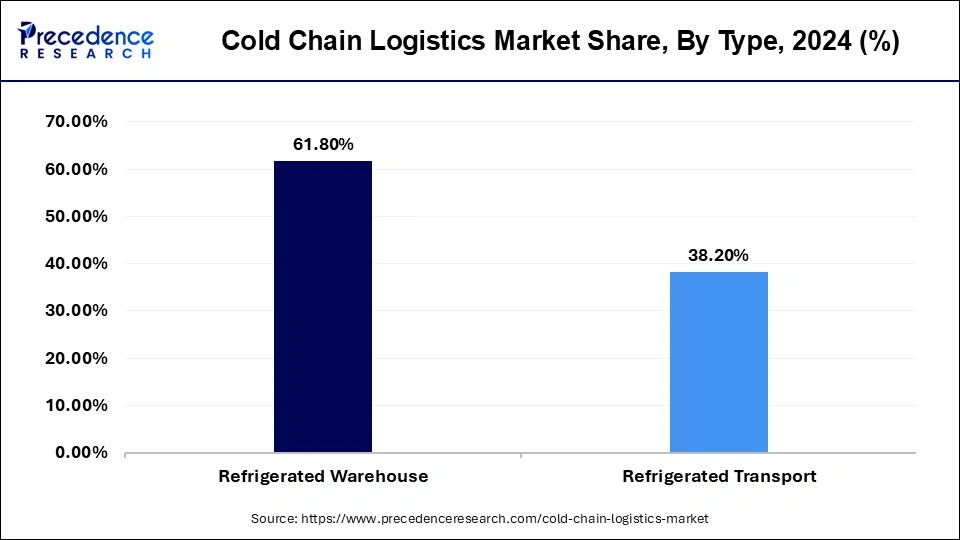

- By type, the refrigerated warehouse segment was valued at USD 238.29 billion in 2025.

- By type, the refrigerated transportation type segment is anticipated to expand at a CAGR of 13.0% over the projected period.

Market Overview

In order to transport various goods and products that need to be stored at a particular temperature make use of the cold chain logistics technology. In order to transport various goods in a good condition this technology is used. Frozen food and various pharmaceutical products make use of this supply chain technology. In order to deliver agricultural products in the fresh form cold chain logistics is used. There is an increase in the use of this technology in every aspect of the supply chain. This technology is used for delivery purposes. It is also used for large scale storage of various products. And it is also used in the transportation of these products to its destination.

The transportation usually occurs through the use of the refrigerated cargo. Cold chain logistics makes use of roadways, Airways and even railways. When it comes to the storage a storage facility which has a warehouse which is insulated in order to have a temperature control is used. The increased use of cold chain logistics is due to and increases in the production of various goods. The use of this technology has been helpful in capturing larger markets for various products manufactured by the companies. The cold chain supply or logistics is extremely beneficial in maintaining the quality of various food products or even drugs.

During the pandemic due to a complete lockdown across various nations the logistics services were affected to a great extent. The cold storage logistics market was affected in different regions due to a restriction on movement. As there was restriction on transportation various industries were shut down during the pandemic. Restricted movement also caused lack of row material used in the production of various goods. After the pandemic there has been a steady growth in the market. Various companies are bringing in new policies that will be helpful in generating good amount of sales in order to recover the damage is caused during the pandemic.

What is the role of AI in Cold Chain Logistics Market?

Artificial intelligence (AI) in cold chain logistics can be used to automate routine tasks in order to reduce costs, enhance efficiency, and provide better customer service. AI in ecommerce logistics also provides real-time tracking and monitoring of parcels, which improves the overall customer experience. Cold chain logistics can be transformed by AI to handle conflict between priorities, improving in temperature reporting, and alerts, and find anomalies and fluctuations in temperature. AI in cold chain logistics also include benefits like route optimization, data analysis & compliance monitoring, anomaly detection & alerts, improve fleet health & maintenance, improve temperature reporting, and conflicting priorities management.

AI can analyze large datasets, reduces congestion, minimizes accidents, and streamlines logistics operations. In addition, AI reroutes vehicles to avoid congested areas. It ensures quick responses to emergencies by clearing paths for emergency vehicles. The most significant benefit of AI in cold chain logistics and reducing spoilage.

Market Trends

- Stringent food safety regulations

- Globalization and rising international trade in food products

- Technological benefits allow next generation cold chain solutions

- Expansion of pharmaceutical sectors that creates new cold chain imperatives

- Growing fresh food demand accelerates cold chain adoption

Cold Chain Logistics Market Growth Factors

The global cold chain logistics market is expected to grow well during the forecast period. Due to a growing demand for refrigerated warehouses in the developed as well as the developing economies. During the pandemic cold chain logistics or cold storage transportation was used in order to carry out the vaccination rise. This market is expected to grow as there is a great demand through the pharmaceutical sector. The pharmaceutical market will provide a great business for the cold chain logistics. The food and beverages industry also makes use of cold chain logistics and it is expected to boost the demand for cold chain logistics. There has been a growth in the market due to constant research and development to have more effective services. There is an increase in the use of radio frequency identification technology in this market and this is expected to provide good growth during the forecast period.

The increased use of this software in various industries that make use of cold chain logistics will provide a better growth for the market. As there is a growth in the number of the various distribution channels like the supermarkets or the hypermarkets, different types of convenience stores there shall be a greater demand for cold storage logistics. Bully policies adopted by the government relating to the trade of various food products that will be helpful in reducing the wastage of food will also be helpful in having a effective distribution channel. They shall be an increase in the use of coal storage options and transportation options.

The larger retail chains in the organized form like spar, Walmart are focusing on providing their outlets in different developed nations. Apart from the developed nations these organized retail chains are also planning to expand their business to the developing nations. These expansions shall lead to an increase in the demand for cold chain logistics in the developed as well as the developing economies. Walmart is present in 24 countries which is a US based retail chain. It has 10,526 outlets in these 24 countries.

The expanding business of these retail chains across the globe and they are increasing operations in the developing as well as the developed nations will be helpful in providing better opportunities for growth of the cold chain logistics during the forecast period as the demand for refrigeration for transportation as well as storage will increase. There has also been an increase in the initiatives taken by various countries that are supportive of developing the market for coal chain logistics in developing nations. These government policies are also focusing on providing innovative solutions that will provide effective transportation as well as storage options for various food products that need temperature control. After the pandemic as there is a growth in the delivery services as the demand for the processed and the perishable food items has increased there shall be more opportunities in the market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 436.30 Billion |

| Market Size in 2026 | USD 496.80 Billion |

| Market Size by 2035 | USD 1,477.53 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 12.97% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Temperature Type, Technology, Process, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of e-commerce sector

Cold chain logistics refers to the process of storing, transporting, and handling products that must be kept within a specific temperature range to maintain their quality. This includes a wide range of products like cosmetics, dairy products, fresh foods, and pharmaceuticals. Logistics and supply chain management in e-commerce are transforming how businesses handle fulfilment, distribution, and customer satisfaction.

Restraint

Maintaining temperature integrity:

Temperature control is important for preserving food taste and texture and preventing foodborne illnesses. Maintaining a specific temperature with proper refrigeration can prevent bacteria growth and food spoilage. Temperature fluctuations during transportation pose one of the most significant challenges to maintaining the integrity of the cold chain. Challenges in cold chain logistics also include natural disasters, transportation delays, power outages, and equipment failures can compromise temperature control and lead to product spoilage.

Opportunity

Innovation in new revenue streams:

By using IoT, cold chain logistics can achieve many benefits like IoT improves cold chain operations by allowing data driven decision making, including risk mitigation, inventory management, route planning, and demand forecasting. Cold chain logistics refers to the cold chain logistics process of handling, storing, and transporting perishable goods under temperature-controlled conditions. Digitalization also transforms logistics industry.

Segments Insights

Type Insights

Refrigerated warehouse:

- In April 2025, CHILLOX, an energy efficient solution for cold storage warehouse businesses in the logistics industry was launched by SCGC. CHILLOX features technology that consistently maintains stable temperatures within cold storage facilities and provides backup cooling capacity during abnormal situations. This effectively helps preserve the quality of goods stored in the warehouses.

The refrigerated transport segment:

- In January 2025, to launch innovative solutions that redefine sustainability in the refrigerated transport sector, SeaCube Containers, a leading global refrigerated intermodal equipment leasing company, has partnered with Greensee, a provider of AI-driven CO2 emissions reporting technology.

Global Cold Chain Logistics Market Revenue, By Type, 2022-2025 (USD Billion)

| By Type | 2022 | 2023 | 2024 | 2025 |

| Refrigerated Warehouse | 187.40 | 211.26 | 238.29 | 270.41 |

| Refrigerated Transport | 117.43 | 131.49 | 147.28 | 165.88 |

Temperature Type Insights

The frozen segment accounted for a considerable share of the market in 2025. The frozen temperature type of cold chain logistics includes room temperature store at 15°-25°C, cool store between 8°-15°C, for heat sensitive products that must not be frozen, and store frozen transported within a cold chain and stored at -20°C. The guidelines for freezer storage are for quality only, frozen foods stored continuously at 0°F or below can be kept indefinitely.

The chilled segment is projected to experience the highest growth rate in the market between 2026 and 2035. Chilled foods for reasons of safety or quality are designed to be stored at refrigeration temperatures throughout their entire life. The coldest part of the fridge should be between 0° C and 5°C.

Technology Insights

The dry ice segment led the cold chain logistics market. It is used primarily as a cooling agent, but is also used in fog machines at theatres for dramatic effects. Its benefits include lower temperature than that of water ice and not leaving any residue. The primary benefit of dry ice in cold chain logistics is its superior temperature control capabilities. As compared to traditional ice, dry ice sublimates directly from a sold to a gas, leaving no liquid residue. This property makes it ideal for shipping frozen foods, pharmaceuticals, and biological samples that need consistent ultra-low temperatures.

The gel packs segment is set to experience the fastest rate of the market growth from 2026 to 2035. The next generation gel pack technologies represent a significant leap forward in cold chain logistics. These modern solutions use high tech materials and designs that improve durability, reusability, and environmental sustainability.

The refrigerated vehicles segment held the largest share of 38.50% in the 2025 global cold chain logistics market. The refrigerated vehicles like insulated vans, reefer containers and refrigerated trucks (small, medium, large), depending on the product's space, volume and sensitivity, are in demand with the range of existing and new products. The segment is said to be effective during transit and ensures freshness and safety while navigating the position of the goods with advanced features in the system. The major role of this segment is to avoid degradation, spoilage or contamination.

The telematics and IoT solutions segment is expected to grow at a CAGR of 16.00% during the forecast period. The segment has transitioned the global cold chain logistics industry with its end-to-end transparency, accelerated operational efficiency and major role in improving product integrity. Especially for temperature-sensitive goods such as food and pharmaceuticals, this IoT and telematics technology promises mitigation of waste, and higher compliance and protection of the product quality.

The data loggers, cloud-based visibility platforms and RFID & barcode scanners are gaining traction in this segment and further elevating the global cold chain logistics sector.

Process Insights

The pre-cooling facilities segment registered its dominance over the market in 2025. The benefits of pre-cooling facilities include delays chilling injuries in specific fruits, reduces ethylene production and its impact on ethylene sensitive produce, inhibits microbial growth including fungi and bacteria, restricts respiratory activity, and accelerates reaching the optimum storage temperature, reducing the workload of cold storage facilities.

The gel packs segment is anticipated to grow with the highest CAGR in the market during the studied years. Gel packs offer adaptability, flexibility, and ease of use, making them an ideal choice for cold chain shipping across many industries. Gel packs are great for medications, blood samples, pharmaceuticals, and fresh seafood.

Application Insights

The frozen desserts and dairy segment dominated the market. Cold chain logistics is simply moving and storing temperature-controlled products from frozen foods, fresh fruits, dairy products, and vegetables to pharmaceuticals products, vaccines, and biotech samples, all of these fall under the cold chain logistics umbrella.

The pharmaceuticals segment is projected to expand rapidly in the market in the coming years. In pharmaceuticals, cold chain logistics offers benefits like lower costs and improved storage space. Effective cold chain logistics is important in the healthcare and pharmaceutical industry to safeguard these sensitive products from contamination, spoilage, or loss of potency.

Global Cold Chain Logistics Market Revenue, By Application, 2022-2025 (USD Billion)

| By Application | 2022 | 2023 | 2024 | 2025 |

| Pharmaceuticals | 77.9 | 86.2 | 94.6 | 104.2 |

| Dairy & Frozen Desserts | 98.9 | 117.4 | 139.2 | 166.1 |

| Fruits & Vegetables | 63.2 | 69.8 | 77.4 | 86.2 |

| Bakery & Confectionary | 36.5 | 39.4 | 42.6 | 46.1 |

| Process Food | 28.4 | 30.0 | 31.7 | 33.6 |

| Others | 21.7 | 23.0 | 24.4 | 25.9 |

Service Type Insights

The transportation segment held the largest share of 36.10% in the 2025 global cold chain logistics market. Transportation plays a fundamental role in this market. As the segment manages the temperature volume and ensures safety for the temperature-sensitive and fragile goods. The huge responsibility of this segment is to select an accurate transport facility, such as road, sea, air and rail transportation. Different perishable products carry a specific intensity of their formation and appearance. Based on this, the consideration and export/import quality describe the segment in the best way.

Any type of transportation should ensure temperature integrity covering the end-to-end journey of the cold chain logistics with continuous control, navigation and monitoring to avoid damage and delays. Notifying this, the transportation segment has been developed over time and the demand of different manufacturers and their concerns.

The warehousing and storage segment is expected to grow at a CAGR of 15.00% during the forecast period. For cold products, the life span is a huge concern to be addressed by the production company as well as the warehousing department. The frozen, chilled and refrigerated warehousing is classified to ensure an accurate place for the product to survive and retain its essence, the same to successfully reach the target consumers.

The other major task of the segment is to ensure power backup, packaging and labelling of valuable items such as perishables and pharmaceuticals.

Temperature Range Insights

The frozen (-18°C to-25 °C) segment held the largest share of 41.30% in the 2025 global cold chain logistics market. The frozen temperature is a main component of the market. The segment is the heart of the market as it protects safety, shelf life and quality of temperature-sensitive goods, especially pharmaceuticals and food. The food and pharmaceuticals are directly linked to health, and all aspects of the safety of the goods are essential.

The increasing demand for healthy consumption needs appropriate storage and handling, following the origin and storage requirements of the product. The segment is driven by continuous manufacturing and production of new elements or products in the pharmaceutical and food, and beverage markets.

The deep-frozen (<- 25°C) segment is expected to grow at a CAGR of 14.80% during the forecast period. The segment holds rigorous temperature, promoting refrigerated vehicles like trucks and vans based on product timeframe tolerance and other functions. The perishable goods require extensive protection and destination lasting maintenance to maintain the product quality. Many specialised function needs stringent temperature maintenance in the entire supply chain, for which this segment fits best.

End-user Industry Insights

The food manufacturers segment held the largest share of 33.80% in the 2025 global cold chain logistics market. The segment is leading with the rising demand for cold packaged and ready-to-eat food. With this demand, the cold chain logistics business has earned substantial profit. The popular fresh produce, dairy products, cold drinks, seafood and meat are regular essentials. The segment is a consistent client of this market, bolstering the industry reach. The highly perishable goods manufacturers of cheese, yoghurt, and milk have accelerated the refrigerated trucks business. Overall, the segment elongates the value of the product and the cold chain logistics.

The e-commerce grocery platforms segment is expected to grow at a CAGR of 15.70% during the forecast period. The segment is crucial and a transitional shift to the global cold chain logistics market. The e-commerce grocery platform is the first responsible platform to safeguard perishable products to deliver them in their original state from the warehouse to consumers' doorsteps. To adapt the excellent cold chain infrastructure, the segment moved from larger to hyper, compact, and local storage warehousing hubs to attend to customers at the first stage.

Regional Insights

Asia Pacific Cold Chain Logistics Market Size and Growth 2026 to 2035

The Asia Pacific cold chain logistics market size is exhibited at USD 192.20 billion in 2025 and is projected to be worth around USD 724.17 billion by 2035, growing at a CAGR of 14.18% from 2026 to 2035.

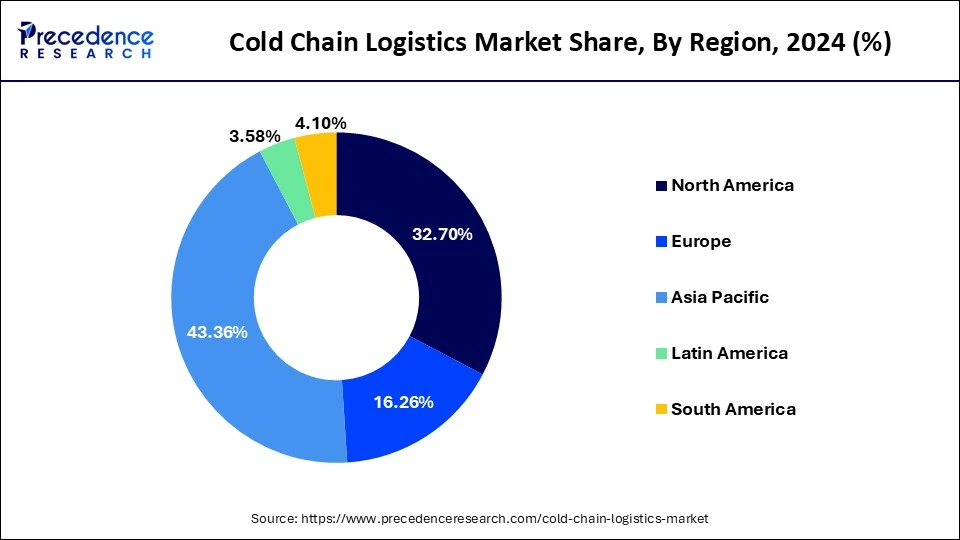

On the basis of geography, there shall be a great demand for cold chain logistics in the Asia Pacific region. The Asia Pacific region is expected to have the fastest growth during the forecast period as there has been an increase in the investment through the government of various nations for developing the infrastructure of cold chain logistics. There is a great demand for different types of processed food items and an increased demand for frozen dairy or even meat products which has led to a growth in the cold chain logistics market. There has been a maximum amount of growth in the regions like India, China, South Korea as well as Japan. These regions are expected to have the highest market share for the usage of cold chain logistics. Increase the number of different pharmaceutical companies and the increasing amount of FDI the market for cold chain logistics is expected to grow during the forecast period.

Apart from the Asia Pacific region other developing nations like Africa, Latin America as well as Middle East is also seeing a good demand for various food products that require cold storage warehousing and transport. Rapid industrialization is also expected to drive the market growth in the developing nations. In the developing nations there is a growth in the demand for frozen food products that are easy to cook and consume as the people in these nations have a hectic lifestyle.

- In China, the cold chain logistics market size was valued at USD 103.3 billion in 2025 and will grow at a CAGR of 13.54% during the forecast period.

- In the U.S., the cold chain logistics market size was valued at USD 126.4 billion in 2025 and will expand at a CAGR of 14.35% during the forecast period.

- In Germany, the cold chain logistics market size was valued at USD 13.4 billion in 2025 and will expand at a CAGR of 8.99% during the forecast period.

Asia Pacific dominated the global cold chain logistics market in 2025 and is projected to host the fastest growing market in the coming years.

- In May 2025, a sustainable cold chain warehouse in Taloja, Navi Mumbai, aiming to transform India's logistics landscape and meet the needs of the pharmaceuticals, FMCG, and QSR sectors was opened by DP World. The 110000 sq. ft. grade-A warehouse has 11000 pallet positions and supports multiple temperature zones for secure and efficient movement of perishable and temperature sensitive cargo.

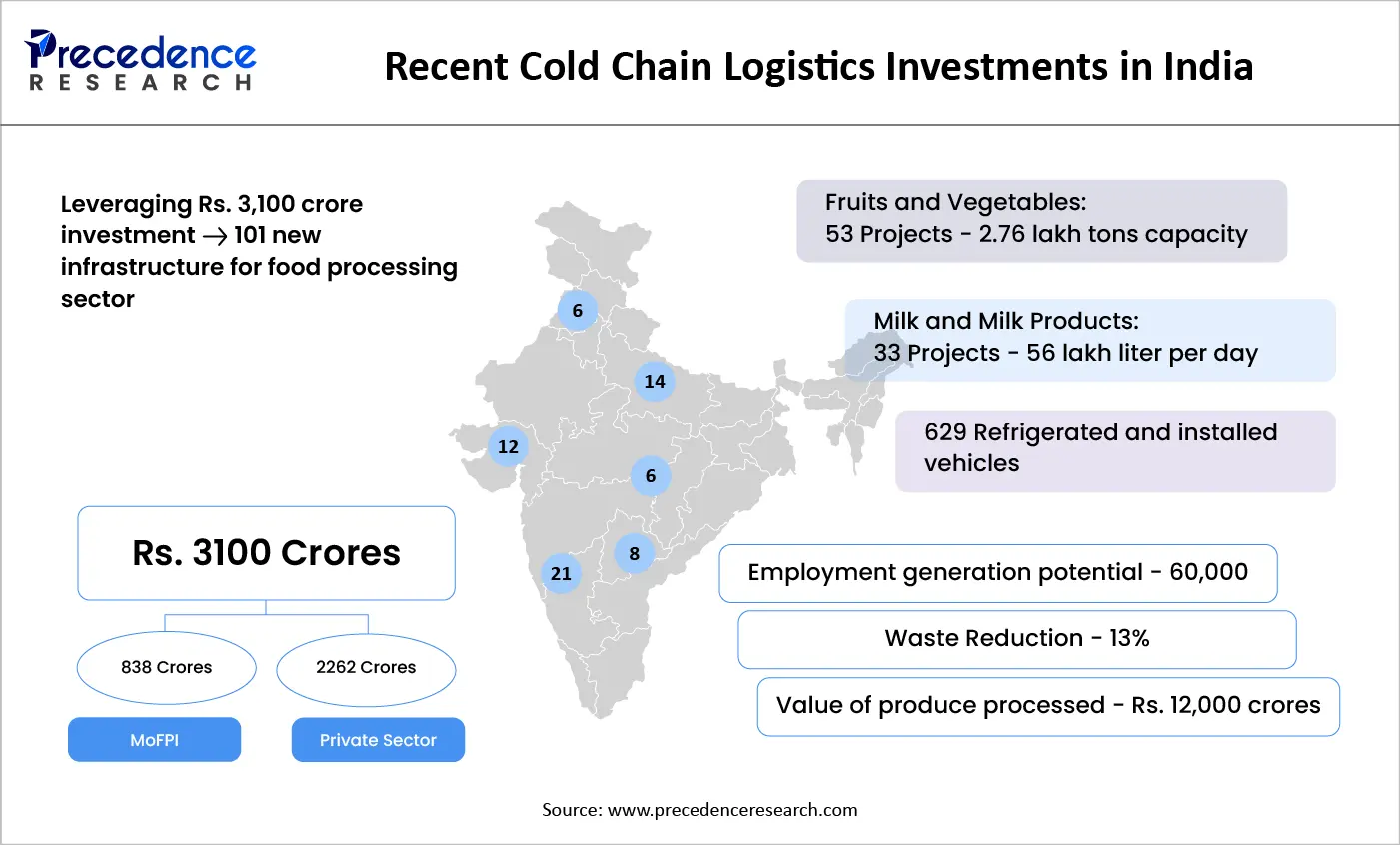

Strengthening India's Food Processing & Cold Chain Infrastructure

The image highlights India's major push toward strengthening food processing infrastructure through an investment of Rs. 3,100 crores, enabling the development of 101 new projects nationwide. Of this total investment, Rs. 838 crores is contributed by the Ministry of Food Processing Industries, while Rs. 2,262 crores comes from the private sector. The initiatives include 53 fruits and vegetables projects with a combined capacity of 2.76 lakh tons, and 33 milk and milk product projects processing over 56 lakh liters per day. Additionally, 629 refrigerated vehicles enhance cold-chain logistics. These projects are expected to generate employment for over 60,000 people, reduce waste by 13%, and increase the value of processed produce to Rs. 12,000 crores, reinforcing India's agri-processing growth.

Cold Chain Logistics Market Companies

- Lineage Logistics Holdings LLC

- Snowman Logistics Ltd.

- AmeriCold Logistics LLC

- Nichirei Corporation

- Preferred Freezer Services Inc.

Recent Developments

- In July 2025, a new packing and cold chain logistics center in Olmos, Peru, a strategic move to support the country's booming agro-expert sector was officially launched by Maersk. Strategically positioned in the heart of northern Peru's agriculture corridor, the Olmos site is newly developed multi-product fruit logistics center designed to streamline the region's export capabilities.

- In June 2025, a new temperature-controlled warehouse in Taloja, Navi Mumbai, India strengthening its cold chain logistics infrastructure in the region was opened by Dubai-headquartered DP World.

Segments Covered in The Report

By Service Type

- Transportation

- Road Transportation

- Rail Transportation

- Sea Transportation

- Air Transportation

- Warehousing & Storage

- Refrigerated Warehousing

- Frozen Warehousing

- Chilled Warehousing

- Value-Added Services

- Packaging & Labeling

- Kitting & Assembly

- Order Fulfillment

- Cross Docking

- Monitoring & Telemetry

- Real-Time Temperature Monitoring

- Location Tracking (GPS, RFID)

- Automated Alerts & Reporting

- Installation & Maintenance of Equipment

- Refrigeration Units

- Temperature Sensors

- Warehouse Infrastructure

By Temperature Range

- Chilled (2°C to 8°C)

- Frozen (-18°C to -25°C)

- Deep-Frozen (< -25°C)

- Ambient Controlled (8°C to 15°C or 15°C to 25°C)

By Technology

- Refrigerated Vehicles

- Insulated Vans

- Refrigerated Trucks (Small, Medium, Large)

- Reefer Containers

- Refrigeration Equipment

- Compressors

- Evaporators

- Condensers

- Storage Technologies

- Blast Freezers

- Cold Rooms

- Modular Cold Storage

- Telematics and IoT Solutions

- RFID & Barcode Scanners

- Data Loggers

- Cloud-Based Visibility Platforms

- Automation and Robotics

- ASRS (Automated Storage & Retrieval)

- Automated Guided Vehicles (AGVs)

- Warehouse Management Systems (WMS)

By End User Industry

- Pharmaceutical & Biotechnology Companies

- Food Manufacturers

- Retail Chains & Supermarkets

- E-commerce Grocery Platforms

- Hospitals & Clinics

- Diagnostic Labs

- Chemical Manufacturers

- Government / Defence / NGOs

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content