What is the Dairy Products Market Size?

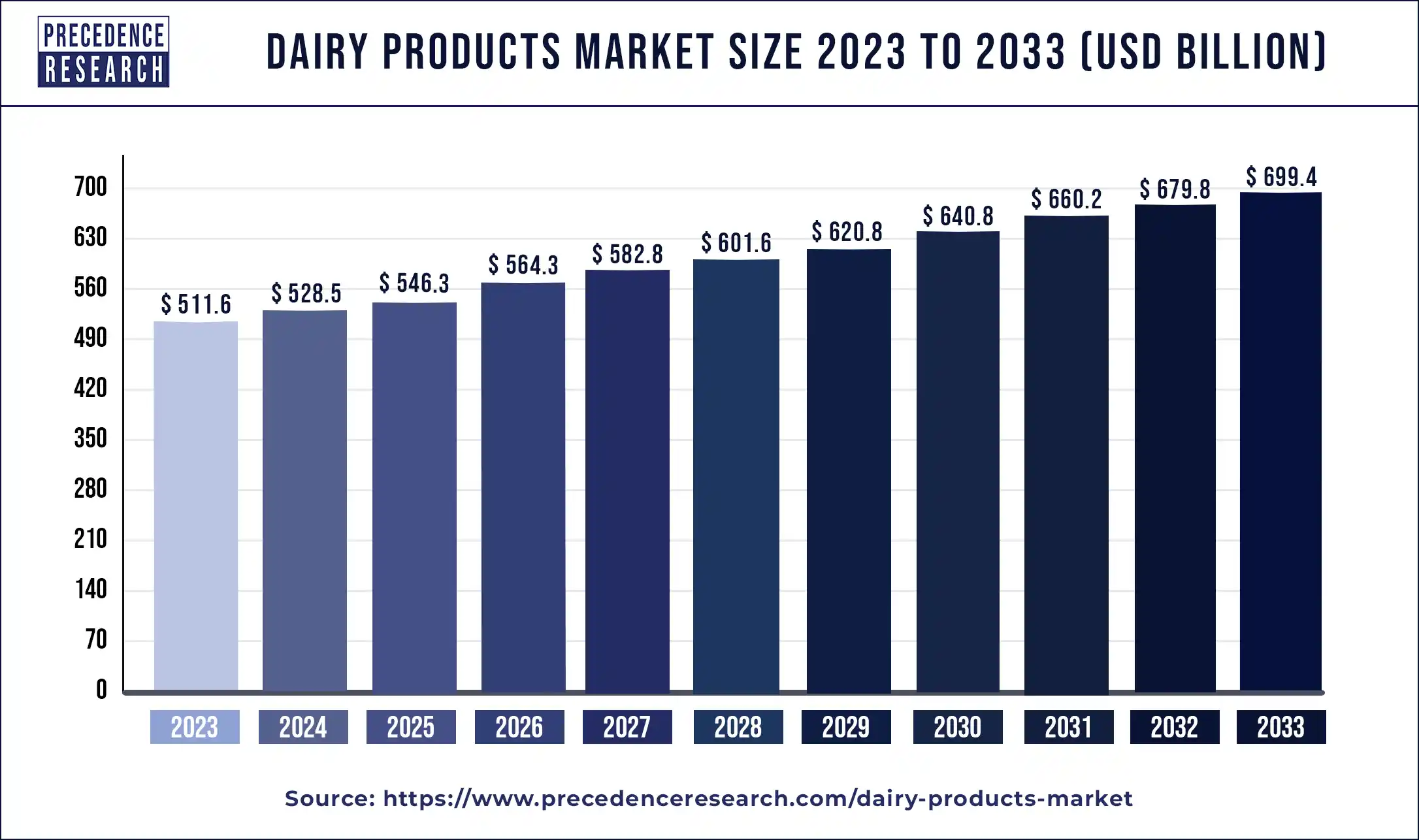

The global dairy products market size is calculated at USD 546.30 billion in 2025 and is predicted to increase from USD 564.30 billion in 2026 to approximately USD 719.00 billion by 2034, expanding at a CAGR of 3.13% from 2025 to 2034.

Dairy Products Market Key Takeaways

- North America dairy product market size was valued at USD 62.8 billion in 2024 and is expected to grow at a CAGR of 2.9% from 2025 to 2034.

- Europe dairy products market size was valued at USD 136.8 billion in 2024 and it is growing at a CAGr of 3.3% from 2025 to 2034.

- China dairy product market was estimated at USD 63.4 billion in 2024 and is anticipated to reach at a CAGR of 3.6% from 2025 to 2034.

- India dairy product size was reached at USD 55.7 billion in 2024 and is predicted to grow at a CAGR of 4% from 2025 to 2034.

What is the role of AI in the Dairy Products Market?

Artificial intelligence (AI) allows farmers to access the best bull (male) genetics from all across the globe. Animal health is improved through the use of AI. AI-based machines milk cows with precision and consistency schedules are strictly adhered to, which can enhance milk yield and quality. The key benefit of production systems in AI is their ability to handle complex, multi-step workflows with minimal human oversight. AI technologies have simplified dairy processes, improving production, labor costs, and efficiency. Accurate farming, using modern sensors and data analytics, improves feed and water, leading to better milk quality and increased production.

Dairy Products Market Outlook

- Industry Growth Overview: Global dairy production is expected to grow steadily between 2025 and 2030, with milk production projected to exceed 992 million tons by 2025, according to the FAO. This growth is primarily driven by emerging markets such as India, Pakistan, and China, where demand for both fluid milk and processed dairy products continues to rise. The OECD-FAO Agricultural Outlook (2025–2034) also forecasts that global dairy trade volumes will increase by 12% over the next decade, largely fueled by growing exports of cheese and milk powders.

- Value-Added & Product Differentiation Trends: The dairy sector worldwide is increasingly focused on premiumization and functional innovation, responding to consumers seeking products that go beyond basic nutrition. Probiotic yogurts, fortified milks, lactose-free options, and high-protein snacks are experiencing rapid growth, not only in high-income economies but also in middle-income countries such as Indonesia, Vietnam, and Brazil. This shift toward value-added, functional dairy products reflects changing consumer preferences for health, convenience, and indulgence.

- Sustainability, Health & Innovation Focus: Sustainability is no longer just a mandatory narrative in the global dairy industry; it has become a vital part of strategic planning for both farmers and regulators. Arla Foods and other major cooperatives like Fonterra and Friesland Campina are leading initiatives to achieve net-zero dairy emissions by 2050. These innovations are shaping the future of sustainable dairy production, supported by EU policies such as the Green Deal and the USDA Climate-Smart Commodities Initiative.

- Global Expansion & Supply Chain Shifts: The international dairy trade system is becoming more dynamic as exporters and importers re-align based on logistical efficiency and regulatory advantages. The OECD estimates that the European Union, the United States, and New Zealand will be the three largest exporters, accounting for more than two-thirds of the world's dairy exports by 2034. However, the global supply chain remains vulnerable to geopolitical disruptions and shipping bottlenecks, emphasizing the importance of diversification and investing in local processing.

- Major Investors & Startup Ecosystem: The trends in investment include a growing interest in cold-chain logistics, dairy automation, ingredient processing, and alternative dairy proteins. Other startups, including Perfect Day (U.S.), which makes animal-free dairy proteins using precision fermentation, and New Culture (New Zealand), are working on creating sustainable cheese alternatives and pushing the boundaries of dairy science. These ecosystem advances indicate that the future of dairy development will be just as focused on technology and sustainability as it has historically been on production capacity.

- Critical Risks/Strategic Thinking: Despite its strong fundamentals, the dairy industry faces a complex risk landscape that requires proactive management. The unpredictability of feed and energy prices continues to impact farm-level margins, especially in Europe and Oceania. Supply diversity, technological modernization, and sustainable sourcing will be crucial for strategic resilience, with leading players already taking bold steps to safeguard profitability in the long term.

Growth Factors

The rising demand for the dairy products is driven by several factors such as growing population, rising personal disposable income of the consumer, rising health awareness, increasing production of milk in developing nations, and rising consumption of protein enriched food. According to the Population Reference Bureau, the global population is expected to reach around 9.9 billion by 2050. The growing population is expected to drive the demand for milk, butter, yogurt, various other dairy products owing to its extensive uses in various dishes and direct consumption. Dairy products provide high value protein and essential micronutrients to the consumers. Studies have shown that cheese is good for the heart health. The rising awareness regarding the health benefits of dairy products is further boosting the demand for the dairy products across the globe. Moreover consumers shifting preference from meat to dairy-based products for micronutrients and proteins, the demand is estimated to rise significantly in the upcoming years.

The dairy products market is expected to grow owing to the rising government schemes and initiatives regarding milk production and improving cattle productivity. For instance, National Dairy Program by the government of India, focuses on the development of cattle and milk production. The rising penetration of fast food chains is significantly boosting the consumption of dairy products such as cheese, dairy desserts, and butter. These dairy products are extensively used in various dishes like pasta, burger, pizza, and many more. The delicious taste and protein content of the dairy products is propelling the consumption of dairy products in households. Further, milk is now considered as an essential and daily use product in majority of the households. Therefore, the global dairy products market is expected to grow at a considerable rate during the forecast period.

Growing Demand for Alternatives such as Plant Protein

The demand for plant-based food alternatives is increasing among consumers, owing to growing awareness about animal welfare. Plant-based dairy products alternatives such as soy milk, almond milk, non-dairy ice-creams, cheese analogues, and whipped cream are rapidly moving into the mainstream retail market, owing to the growing perception that plant-based products are healthier and safer.

The rapidly developing dairy alternatives industry with new product innovations such as non-dairy ice-creams, cheese analogues, and whipped creams is expected to hamper the global dairy products market growth. Increasing number of people who do not consume lactose is a major restraining factor for the growth of global dairy products market. Additionally, increasing incidence of lactose intolerance such as allergies from milk or milk-based products, and a shift toward vegan diets due to potential health benefits offered by vegan diet and healthy lifestyles are also expected to restrain the market growth during the forecast period. For instance, according to the Survey conducted by National Institutes of Health (NIH) in 2020, in the U.S., Europe, and China, more than 5%, 10%, and 90% of the population are intolerant to lactose, respectively. Thus aforementioned factors are expected to restrain the market growth during the forecast period.

Additionally, dairy product manufacturers require high capital investments to install processing equipment. This processing equipment has high installation costs and requires timely maintenance, which is a costly addition affecting the operating margins of dairy product processors. Hence, high capital investment is also expected to restrain the market growth.

Catalysts of Growth: Unveiling the Forces Driving the Global Dairy Market

- Rising Demand for Gamified Workouts: The growing popularity of immersive, game-based fitness platforms is fuelling higher user engagement and retention across digital training ecosystems.

- Expanding Connected Equipment Ecosystem: Integration of IoT-enabled bikes, treadmills, and wearables is driving seamless, data-rich fitness experiences for home and gym users alike.

- Growing Adoption of AI-Powered Coaching: Smart algorithms providing real-time feedback and adaptive training programs are boosting personalization and workout efficiency.

- Surge in Virtual and Hybrid Fitness Models: The post-pandemic shift toward digital-first fitness solutions is propelling demand for interactive streaming and on-demand training content.

- Increased Focus on Corporate Wellness Programs: Companies investing in interactive wellness platforms are driving large-scale adoption among working professionals seeking flexible fitness engagement.

Sustainable Dairy: A Green Revolution Creates a New Global Market

The dairy industry is moving to a more sustainable economy than just a few years ago, creating new avenues for growth. Companies in Europe and North America are allocating funds to invest in climate-friendly and carbon-neutral milk, plant-based packaging, and renewable energy for dairy processing. For example, Arla Foods has started with some climate-friendly farms, and Danone is strengthening regenerative farming practices.

Meanwhile, dairy product exports are experiencing a resurgence, particularly in demand from emerging markets and health-oriented consumers. This parallel growth offers opportunities for innovation in green technologies, sustainable supply chains, and value-added products around the world. According to the Foreign Agricultural Service (FAS), dairy product export is significantly increased in 2024, where Mexico, with USD 2.47 billion in exports, leads the market, followed by Canada (USD 1.14 billion), China (USD 584 million), and Japan (USD 394.61 million).

Market Scope

| Report Highlights | Details |

| Market Size by 2034 | USD 719.00 Billion |

| Market Size in 2025 | USD 546.30 Billion |

| Market Size in 2026 | USD 564.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 3.13% |

| Fastest Growing Market | North America |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Distribution Channel, Region |

Market Dynamics

Driver

Rising consumer demand for functional foods:

Functional foods offer a wide range of health benefits beyond basic nutrition by providing additional nutrients and bioactive compounds that can help prevent or manage chronic diseases. These foods can enhance gut health, reduce inflammation, aid in weight management, and support cardiovascular & cognitive function. They can prevent nutrient deficiencies and also protect against disease and promote proper growth and development. Functional foods play an important role in maintaining a healthy lifestyle and reducing the risk factors of many diseases. Several foods have functional elements which is responsible for enhancing the healthy state.

Restraint

Competition from plant-based alternatives:

The advantages of plant-based alternatives to dairy products include that they are generally lower in calories and saturated fats compared to dairy milk, making them a heart-healthy option. In addition, plant-based milks are fortified with essential nutrients like vitamin B12, vitamin D, and calcium, ensuring they provide a balanced nutritional profile. With 65-70% of the global population experiencing some level of lactose intolerance, non-dairy alternatives offer a more digestible, lactose-free option. Other benefits including, various plant-based milks are naturally lower in calories and saturated fat than whole milk.

Opportunity

Preference for fewer artificial additives:

Real dairy products are packed with nutrients that each person needs. In comparison, artificial dairy products may depend on calcium fortifications and other synthetic nutrients like milk's unique package of proteins, vitamins, and essential minerals like phosphorous. Most of the time, these imitation products still fall short. Milk additives include carrageenan, flavor enhancers, preservatives, acidity regulators, vitamin fortifiers, emulsifiers, and stabilizers.

Product Type Insights

The milk segment held a dominant presence in the dairy products market in 2024 and is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034. This is mainly due to its widespread consumption as a staple beverage and its use as a key ingredient in various processed dairy products like cheese, yogurt, and infant formula. Additionally, growing health-conscious trends and rising demand for fortified and functional milk products further boosted its market share. Strong production capacity and distribution networks also helped maintain milk's leading position.

- In July 2025, a new range for kids in the UK, starting with low sugar milk and yoghurt alternatives, was introduced by Danone-owned plant-based dairy leader Alpro. The new Alpro Kids comprises chocolate oat milk, strawberry soy milk, and vanilla and strawberry soy yogurts, which contain 30% less sugar than the market average for similar products, according to the brand.

Alpro Launches Low-Sugar Plant-Based Milk & Yoghurt Range for Kids

The yogurt segment is estimated to be the most opportunistic segment during the forecast period due to increasing consumer preference for healthy, probiotic-rich, and convenient snack options. Rising awareness of gut health and protein intake further drove demand, while product innovations such as flavored, fortified, and plant-based yogurts expanded its appeal across various age groups. Strong distribution in both retail and e-commerce channels also supported its market leadership.

- In July 2025, a new product line targeted at children, responding to concerns from parents about healthy food options, was introduced by Alpro, a plant-based brand owned by Danone. The new range includes a chocolate-flavored oat-based drink, a strawberry-flavored soya drink, and soya-based yogurt alternatives in vanilla and strawberry flavors.

Distribution Channel Insights

The supermarkets/hypermarkets segment is expected to account for a considerable share of the market in 2024.

- In April 2025, an own-name sub-brand-named Vege, which offers an affordable range of vegan foods, was introduced by the French hypermarket chain E.Leclerc. The new Vege line aims to make plant-based foods more accessible to French consumers with a strategic approach to pricing the products and by increasing the availability of vegan food across the country.

E.Leclerc Launches Major New Plant-Based Line

The other segment is projected to experience the highest growth rate in the market between 2025 and 2034.because it includes small retail stores, convenience stores, online platforms, and local vendors, which provide easy access to dairy products in both urban and rural areas. Growing consumer preference for home delivery and neighborhood shopping further boosted this segment. Additionally, the flexibility and localized reach of these channels helped cater to diverse consumer needs, supporting steady market growth.

- In May 2025, a new whole milk product that is said to be ‘indistinguishable' from traditional animal-derived options was launched by Californian plant-based dairy brand Eclipse Foods. According to Eclipse, its Non-Dairy Whole Milk “truly replicates milk” by taking isolated proteins from peas and chickpeas and replicating the molecular structure of dairy.

Eclipse Foods Launches Plant-Based Whole Milk 'Indistinguishable' From Dairy

Regional Insights

Asia Pacific Dairy Products Market Size and Growth 2025 to 2034- Milking the Momentum: Asia-Pacific's Dairy Products Market Poised for a Decade of Growth

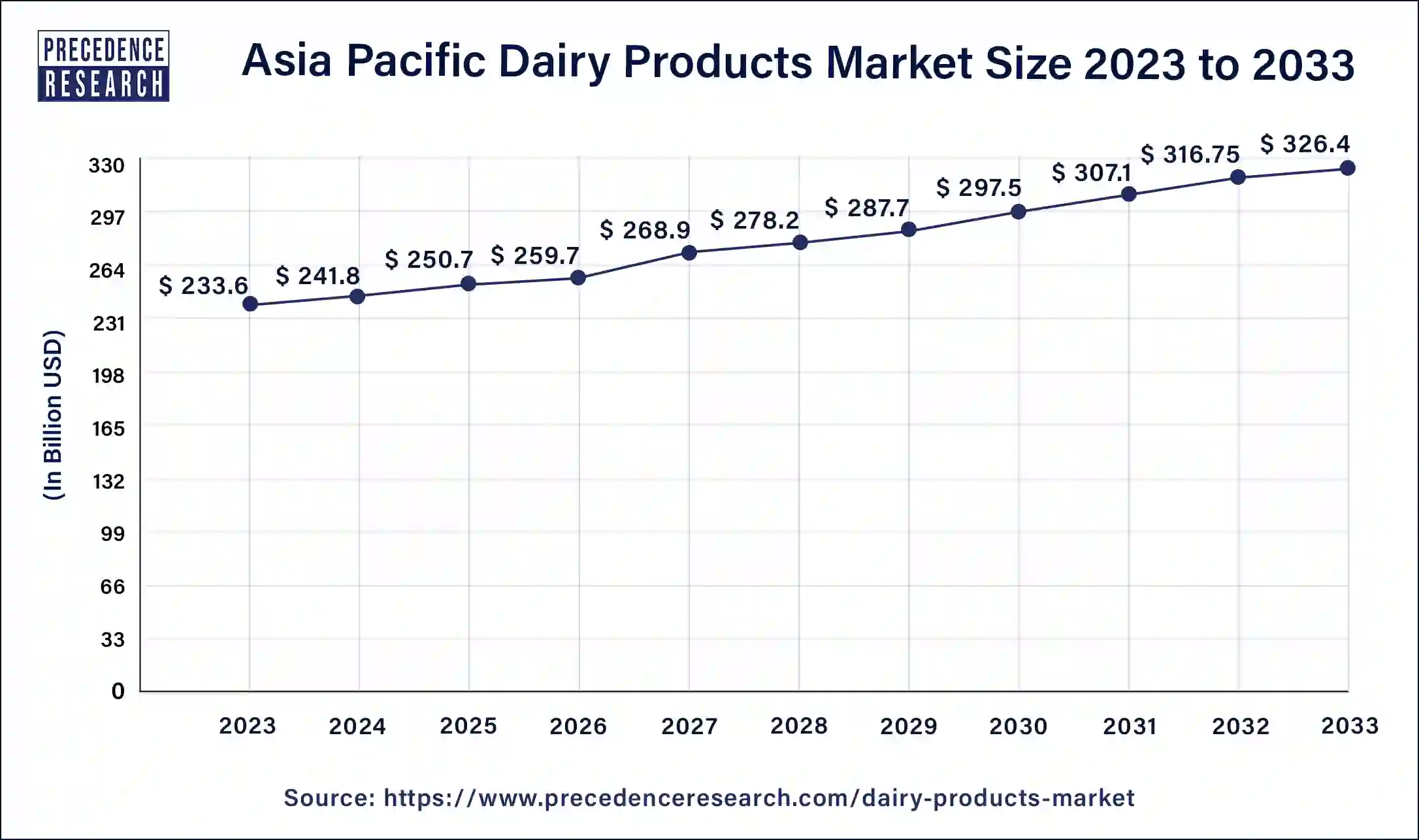

The Asia Pacific dairy products market size was estimated at USD 250.70 billion in 2025 and is projected to surpass around USD 336.05 billion by 2034 at a CAGR of 3.35% from 2025 to 2034.

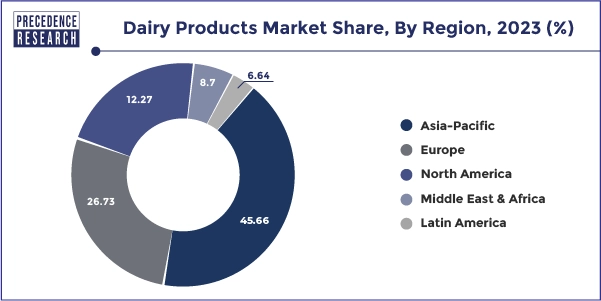

Based on the region, the Asia Pacific dominated the global dairy products market in 2024 with revenue share of 45.66% and is estimated to sustain its dominance during the forecast period. The region is expected to generate revenue of USD 297.5 billion by 2030.

The region is characterized by huge population, increased demand for milk, increasing milk production, rising government initiatives for boosting milk production, rising disposable income, and rapid urbanization. The rising consumer awareness regarding the health benefits of dairy products is fueling the market growth. Moreover, the increased usage of milk in almost every household in nation like India and China had significantly contributed towards the dairy products consumption. Therefore, the Asia Pacific region is expected to sustain its dominance throughout the forecast period.

On the other hand, North America is estimated to be the most opportunistic market during the forecast period. This is due to the increased penetration of restaurants and fast food chains such as Burger King, Pizza Hut, Domino's, and Yum Brands. These restaurants extensively usecheese and butter in the majority of its products. Furthermore the growing popularity of yogurt and dairy desserts among the North American consumers is boosting the growth of the North America dairy products market during the forecast period. The rising consumer awareness regarding A2 milk is expected to fuel the market growth in North America.

- In June 2025, to launch Amul Milk in Spain and the EU, the Gujarat Co-operative Milk Marketing Federation Ltd (GCMMF) announced its collaboration with cooperative Ganadera del Valle de los Pedroches (COVAP), Spain's first-tier cooperative. Through this collaboration, Amul Milk will be launched initially in Madrid, Barcelona, and subsequently it will be launched in Malaga, Valencia, Alicante, Seville, Cordoba, and Lisbon in Portugal.

GCMMF launches Amul Milk in Spain - Daily Excelsior

- In September 2025, Vivitein BLG in the U.S. market was launched by Vivici, a Dutch ingredients startup. The flagship ingredient under its Vivitein protein platform, Vivitein BLG, is available now, enabling B2B customers to launch “disruptive and differentiated products to consumers in the U.S. market.”

New protein launches in the U.S. | Dairy Foods

India - The Growing Dairy Giant of Asia

The FAO estimated that India produced nearly 23% of the world's milk in 2024. The main domestic products included liquid milk and traditional dairy items. Value-added products, such as cheese, yogurt, and UHT milk, are expected to grow at the fastest rate during the forecast period due to increasing urbanization and a rising middle class. Additionally, India's growing involvement in dairy ingredient exports, especially casein and SMP, is anticipated to provide a diverse source of income beyond the domestic market.

North America Dairy Products Market Analysis

The Dairy Innovation Powerhouse of North America - United States

Cheese and high-protein dairy products have emerged as the leading segments in U.S. dairy production and exports, driven by efficient industrial-scale processing and strong international demand. The United States accounts for more than 30% of global whey exports, supported by significant investments from cooperatives such as Dairy Farmers of America and major companies like Leprino Foods and Agropur. At the same time, growing domestic demand for clean-label and high-protein snacks is further fueling the production of value-added dairy products, reinforcing the U.S.'s position as a key player in both domestic and global markets.

Europe Dairy Products Market Analysis

Europe accounted for the largest share of the region's dairy exports, benefiting from premium margins in both established and emerging markets. Over the next decade, infant-formula ingredients and specialty dairy proteins are expected to be the fastest-growing sub-segments, as manufacturers increasingly focus on high-value formulations rather than commodity powders. Additionally, sustainability initiatives under the European Green Deal and ongoing farm modernization programs are likely to further stimulate market growth by encouraging sustainable practices and boosting production efficiency.

Germany - Precision Dairy Export Engine of Europe

In 2024, Germany remained the largest dairy producer in the European Union, with cheese and butter leading not only in output but also in export value. German dairy exports exceeded USD 12.57 billion, driven by strong demand within the EU and steady shipments to the Middle East and China. Furthermore, Germany's sustainability goals, as outlined in the EU Green Deal, are likely to accelerate investments in energy-efficient dairy plants and low-emission packaging.

Latin America Dairy Products Market Analysis

The market in Latin America is expected to grow steadily in the coming years. Fluid milk and commodity powders have been the main sources of national supply in leading producing countries, including Brazil and Argentina, which serve both the domestic and regional markets. The growth rate of investment is also likely to be influenced by currency fluctuations and the relationship between farm costs and prices, while structural improvements in processing capacity will help advance the shift toward premium product lines.

Brazil: Latin America Dairy Export Pivot

There is high demand for fluid milk and milk powder in Brazil, driven by growing domestic consumption and trade with neighboring countries. The likely impact of expanding refrigeration logistics routes in southern Brazil and easing trade through Mercosur agreements is to improve the country's competitiveness in high-end dairy products.

Middle East and Africa Dairy Products Market Analysis

The regional market is poised for steady growth over the next several years, primarily driven by rising demand for processed and branded dairy products such as UHT milk, premium cheeses, and fortified milks. This expansion is supported by increased investments in cold-chain infrastructure and local processing joint ventures by GCC countries, enabling wider distribution and access to higher-quality dairy products. Rising consumer demand for convenience and premium offerings is further fueling the uptake of branded and processed dairy items.

Meanwhile, domestic consumption of fresh milk and locally produced fermented dairy products has remained common in most countries, supported by smallholder farms and short, local value chains. Looking ahead, the market is expected to increasingly depend on imported milk powders, which can be processed into consumer-ready dairy products and fortified drinks. These products are especially important in urban areas, where longer shelf life, better food safety, and convenience are vital for meeting consumer demands. In the near future, importing processed milk products is likely to be a major factor driving growth in the regional dairy market.

Strategic Dairy Processing Hub of the Middle East in Saudi Arabia

The localized processing and branding of dairy products are quickly transforming the dairy sector in Saudi Arabia, which is dominated by UHT milk and processed cheese. Almarai, Al Safi, Danone, and Nadec are companies investing in vertically integrated operations to meet domestic and regional demand for high-quality dairy products. Growth in export markets to GCC nations and Africa is expected to turn Saudi Arabia into a re-export hub for dairy products. Additionally, the development of low-lactose and protein-enriched product lines is likely to further boost domestic value-added production.

South Africa - Formal Dairy Transformation in Africa

Fresh milk and fermented dairy products are widely available in South Africa due to well-established cooperatives and an extensive retail distribution network. The country's ability to supply dairy to the SADC region is expected to improve as cold-chain infrastructure and quality control standards are enhanced to increase export reliability.

Key Companies & Market Share Insights

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedproducts. Moreover, they are also focusing on maintaining competitive pricing.

In March 2019, Danone launched Australian style yogurt named Wallaby. It is a no sugar added yogurt introduced to serve the health conscious consumers. It was launched in the US in three flavors.

In August 2019, Arla Foods entered into a partnership with Walki, for providing sustainable and recyclable packaging solution in order to contribute towards the mission of reducing carbon footprint.

These developmental strategies adopted by the top market players are expected to boost the growth of the dairy products market in the foreseeable future and provide lucrative growth opportunities.

Global Dairy Trade Landscape: Regional Competitiveness, Export Corridors, and Evolving Consumption Patterns

- New Zealand remains the world's largest exporter of dairy products, growing with roughly 1.5% of global dairy exports, driven primarily by whole milk powder and butter shipments in 2024.

- The European Union (EU) collectively holds about 40% of global cheese exports, with Germany, the Netherlands, and France leading in processed cheese, butterfat, and milk powder.

- The United States ranks among the top three dairy exporters, generating nearly USD 8.2 billion in dairy export revenue, led by whey protein, cheese, and milk powder exports to Mexico, Southeast Asia, and the Middle East.

- India, despite being the world's largest milk producer, accounting for 22% of global share, imports high-value dairy derivatives such as whey proteins and lactose valued at over USD 1.5 billion, mainly from the U.S. and the EU.

- Poland and Denmark are expanding their dairy export footprint in Central and Eastern Europe, growing exports by 8–10% year-on-year, supported by EU-funded modernization programs.

- Global milk production grew by about 1.1% in 2024 to roughly 950 million tonnes.

- In 2024, Asian milk output is estimated at nearly 459 million tonnes, up ~2.7% vs 2023, driven by increases in India, Pakistan, and China

Source:

- https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Dairy%20and%20Products%20Annual_Wellington_New%20Zealand_NZ2024-0010.pdf

- https://ec.europa.eu/eurostat/web/products-eurostat-news/-/edn-20190119-1

- https://www.idfa.org/news/u-s-dairy-exports-reach-8-2-billion-marking-second-highest-level-ever-industry-poised-for-a-golden-age-of-trade

- https://aau.in/sites/default/files/research_bullettin_dairy_export_2020.pdf

- https://www.poland-export.com/articles/milk-export-polish-milk-in-the-eu-7134.html#:~:text=Poland%20exports%20various%20dairy%20products,it%20a%20cornerstone%20of%20exports.

- https://www.oecd.org/en/publications/2025/07/oecd-fao-agricultural-outlook-2025-2034_3eb15914/full-report/dairy-and-dairy-products_1dd2e5a6.html

- https://www.dairyindustries.com/news/46055/fao-says-volume-up-for-asian-dairy-in-2024/

From Farm to Fridge: Inside the Global Value Chain Powering the Dairy Revolution

- Raw Milk Production & Collection

The foundation of the dairy products value chain begins at the farm level, involving milk production, collection, and quality testing. This stage focuses on animal health, feed management, and hygiene to ensure optimal yield and composition.

Key Players: Amul (India), Fonterra Co-operative Group (New Zealand), FrieslandCampina (Netherlands), Dairy - Milk Procurement & Transportation

Once collected, raw milk is chilled and transported through cold-chain logistics to processing plants, ensuring freshness and microbial safety. Advanced traceability and automated tanker systems are increasingly used to maintain quality standards across borders.

Key Players: Schreiber Foods (U.S.), Lactalis (France), Saputo (Canada), Nestlé (Switzerland), Meiji Holdings (Japan). - Processing & Standardization

At this stage, raw milk undergoes pasteurization, homogenization, and separation into cream, skim, and whey fractions. The processed milk is standardized for fat and solids content, serving as the base for multiple dairy product lines. Automation and quality control systems ensure consistency and compliance with global safety standards.

Key Players: Danone (France), Yili Group (China), Mengniu Dairy (China), Arla Foods (Denmark), Amul (India). - Product Manufacturing & Diversification

This segment includes the conversion of standardized milk into value-added products such as cheese, yogurt, butter, infant formula, lactose-free milk, and dairy-based beverages. Innovation in fermentation, functional fortification, and plant-based hybrid formulations is expanding the product portfolio across regions.

Key Players: Nestlé (Switzerland), Saputo (Canada), Lactalis (France), Fonterra (New Zealand), Bel Group (France). - Packaging & Cold Chain Logistics

Once manufactured, dairy products are packaged using aseptic, recyclable, and eco-efficient materials to extend shelf life. Cold storage and distribution networks ensure temperature-controlled handling across domestic and export markets. Investment in smart logistics systems is improving real-time visibility and reducing wastage.

Key Players: Tetra Pak (Switzerland), SIG Combibloc (Germany), Elopak (Norway), Lineage Logistics (U.S.), Americold (U.S.). - Retail & Distribution

Finished products reach consumers through modern trade channels, e-commerce platforms, and institutional buyers. In developed markets, supermarkets and online grocery services dominate, whereas cooperative retail networks are expanding in emerging economies. Private label and direct-to-consumer dairy brands are reshaping retail dynamics.

Key Players: Walmart (U.S.), Carrefour (France), Alibaba Group (China), Reliance Retail (India), Tesco (U.K.). - End-Use & Recycling

Consumers drive demand for fresh, fortified, and ethically sourced dairy, while sustainability programs target packaging recovery and waste reduction. Circular models, such as whey valorization, manure biogas recovery, and recyclable milk cartons, are gaining traction in the global dairy ecosystem.

Key Stakeholders: Environmental Protection Agency (U.S.), European Dairy Association (EDA), Food and Agriculture Organization (FAO), and sustainability-driven dairy cooperatives worldwide.

Dairy Products Market Companies

- Arla Foods Amba

- Nestle

- Danone

- Fonterra

- Lactalis

- Frieslandcampina

- DMK Group

- GCMMF

- Dairy Farmers of America, Inc.

- Meiji Holdings Co. Ltd.

- The Kraft Heinz Company

Recent Development

- In August 2025, to develop a Breast Milk scoop that is freshly expressed and oddly familiar sweet, salty, and smooth with hints of honey and many of the nutrients included in breast milk, like colostrum, the company Frida teamed with OddFellows.

Frida Breast Milk Ice Cream to officially launch in NYC | Dairy Foods - In July 2025, dairy and cooperative projects worth over Rs. 400 Crore in Gujarat, which urge transparency and technology adoption, were launched by Amit Shah. Amit Shah virtually inaugurated the expansion of Amul's Rs. 105 crore chocolate plant at Tribhuvandas Food Complex, Mogar, and the Rs. 260 crore Dr. Verghese Kurien Cheese Plant in Khatraj.

Amit Shah Launches Dairy and Cooperative Projects Worth Over Rs 400 Crore in Gujarat, Urges Transparency and Technology Adoption

Segments Covered in the Report

By Product Type

- Milk

- Cheese

- Butter

- Desserts

- Yogurt

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Stores

- Convenience Stores

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting