What is Fast Food Market Size?

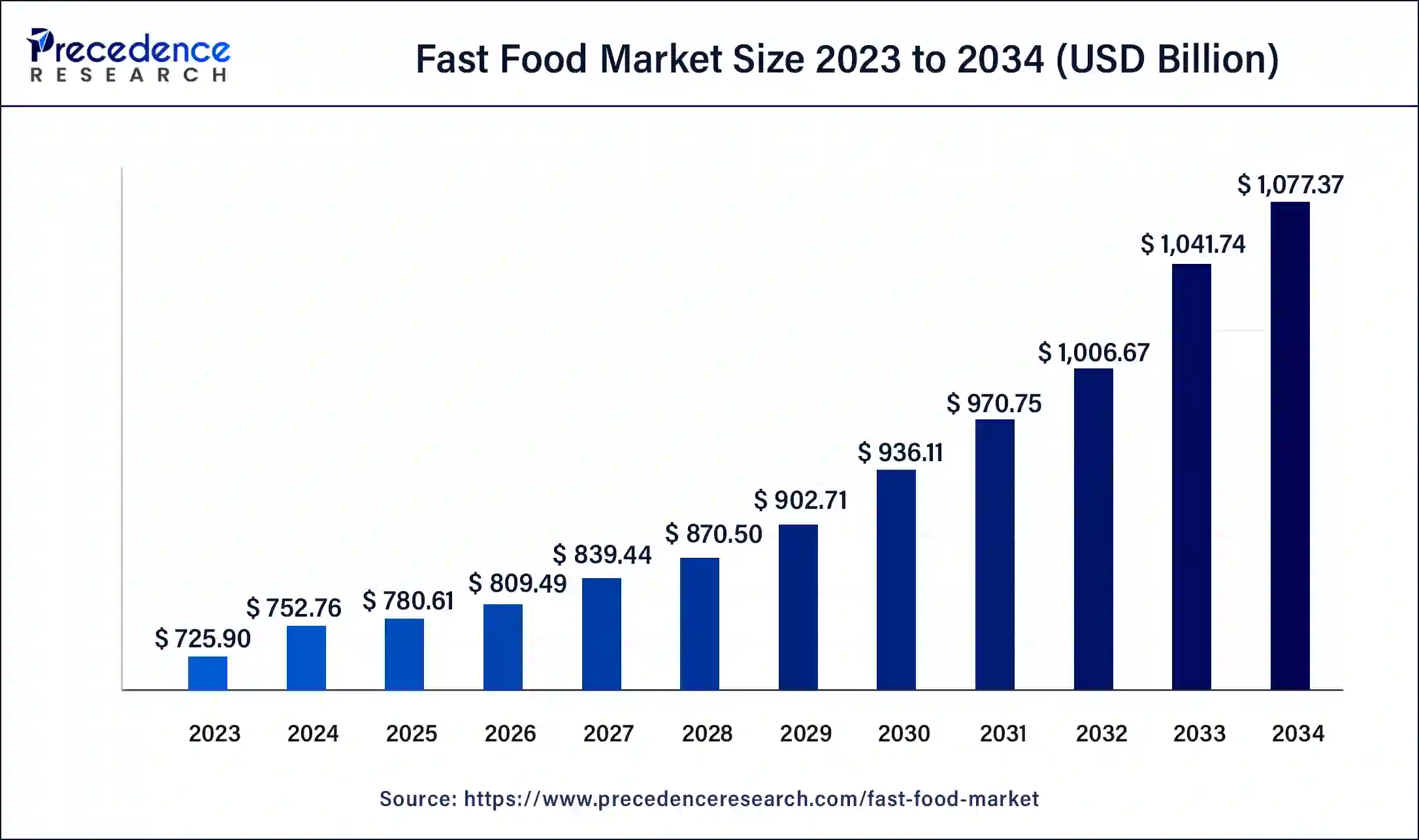

The global fast food market size is calculated at USD 780.61 billion in 2025 and is expected to reach around USD 1,112.63 billion by 2035, expanding at a CAGR of 3.61% from 2026 to 2035.

Market Highlights

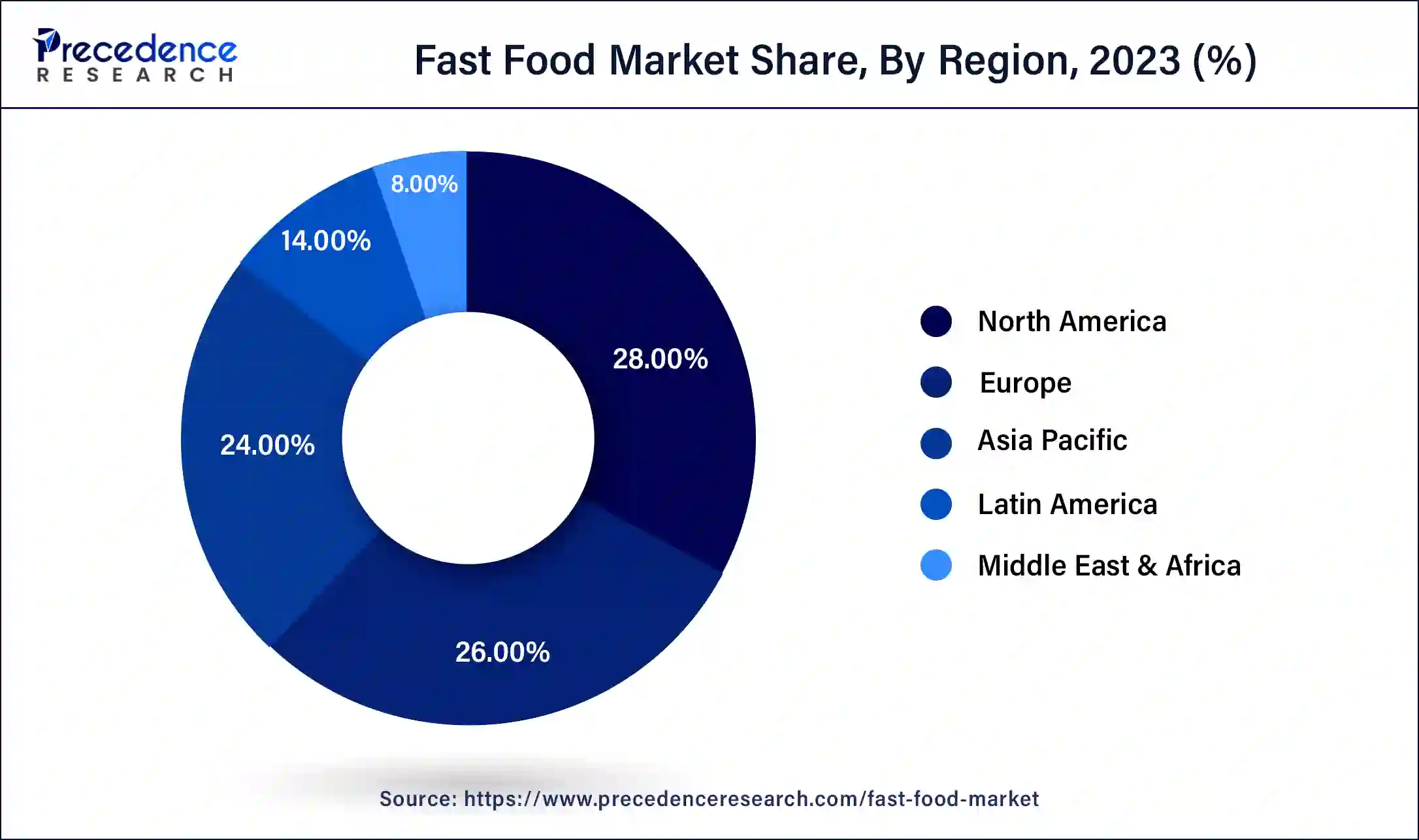

- North America dominated in the Fast Food Market with the largest market share of 28% in 2025.

- Asia-Pacific is observed to be the fastest growing in the Fast Food Market during the forecast period.

- By Product, the burgers/sandwich segment has contributed more than 43% of revenue share in 2025.

- By Product, the motion preservation technologies segment is anticipated to grow at the fastest rate in the market over the forecast period

- By End User, the quick service restaurants segment has held a major revenue share of 45% in 2025.

- By End User, the quick service restaurants segment is observed to be the fastest growing in the market during the forecast period.

Fast Food Market Growth Factors

One of the significant factors driving the growth of global fast food market is the growing number of working women globally. The female employment rate in the U.S. in 2019 was 46%, as per the U.S. Department of Labor. Consequently, women's employment rates in South Africa and China were around 45% and 43.7% respectively. In addition, the growing number of hotels and restaurants is also driving the expansion of global fast food market.

The fast food market is continuously developing due to rising demand for on the go snacks, convenience foods, and ready meals. The busy lifestyle of millennials and the worldwide rise of working people had an impact on the fast food consumption. This will almost certainly help the fast food industry expand globally. The consumer spending on food eaten away from home has increased over the last few years. The increase in employment rates around the world adds to this. Thus, it is now easier to consume on the go cuisine.

Another factor contributing towards the growth of global fast food market is rapid industrialization and urbanization. In addition, rising disposable income is also driving the global fast food market. The growing demand for ready to eat food and beverages is boosting the demand for fast food in the global market. Moreover, the expansion of food and beverage industry is supporting the expansion of worldwide fast food market over the projected period.

The other factors driving the expansion and development of global fast food market is the growing adoption of online sales channel as a distribution channel. The restaurants and hotels are selling their food products through e-commerce platforms, which is contributing towards the growth and development of global fast food market over the forecast period.

The fast food market's major players have well developed global distribution networks. To meet evolving consumer tastes, companies in the global fast food market are updating their menus and services. Furthermore, an increase in the number of quick service restaurants in the fast food market is assisting businesses in increasing sales. To broaden their presence globally, the market players are actively investing in media and collaborations with content providers. In addition, the corporation has introduced an application that allows employees to select their preferred career paths. All such strategies are driving the growth of global fast food market.

Market Overview

- Market Overview: The fast food market is growing steadily, driven by urbanization, rising disposable incomes, and increasing demand for convenient, on-the-go meals. Health-conscious trends and the popularity of digital ordering and delivery services are further fueling market expansion.

- Global Expansion: The market is expanding worldwide as fast-food chains continue to enter emerging economies with growing middle-class populations and urban centers. Opportunities are particularly strong in regions like Latin America, Asia-Pacific, and the Middle East & Africa, where increasing tourism, modern retail infrastructure, and e-commerce adoption enhance accessibility.

- Major Investors: Major investors include multinational fast-food corporations, private equity firms, and venture capital funds that support expansion, technological adoption, and menu innovation. Their investments help drive growth by funding new outlets, digital platforms, and healthier or localized menu offerings tailored to regional consumer preferences.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 780.61 Billion |

| Market Size in 2026 | USD 809.49 Billion |

| Market Size by 2035 | USD 1,112.63 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.61% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

The burgers/sandwich segment accounted revenue share of around 43% in 2025. The demand for burgers/sandwich is growing at rapid pace in the global market. The consumers consume about 50 billion burgers each year, according to the United States Department of Agriculture. The demand for convenience food is driving demand for burgers/sandwich. In addition, the growing trend of ready to eat food products is also propelling the expansion of segment.

The Asian/Latin American segment is projected to reach at the fastest rate over the forecast period. The expansion of this segment is fueled by rising demand for wide range of food products. The demand for Mexican food is increasing in the U.S., due to an increase in the Hispanic population. According to the Simmons National Consumer Survey and the U.S. Census Bureau, about 110 million Americans ate tortillas in 2017.

End User Insights

The quick service restaurants segment accounted largest revenue share 45% in 2025. The quick service restaurants serve cuisine that requires little preparation time and is served quickly. The quick service restaurants often offer a restricted menu of fast food items that can be prepared in a shorter amount of time with the least amount of diversity. Many fast food businesses have implemented hospitality point of sale systems to allow for speedy service while also ensuring security and reliability. This allows kitchen staff members to see real time orders placed at the front counter or through the drive through. The wireless technologies enable cashiers and cooks to take orders given at drive through speakers. Thus, technological advancements are driving the growth of the quick service restaurants segment.

The fast casual restaurants segment is expected to witness strong growth from 2023 to 20302. The fast casual restaurants provide customers with freshly cooked, high-quality meals in a relaxed setting with counter service to keep things moving quickly. The fast casual restaurant, which is mostly located in the U.S. and Canada, does not provide full table service but promotes high quality meals with less processed or frozen ingredients than fast food restaurants. It's a hybrid of fast food and informal dining.

Regional Insights

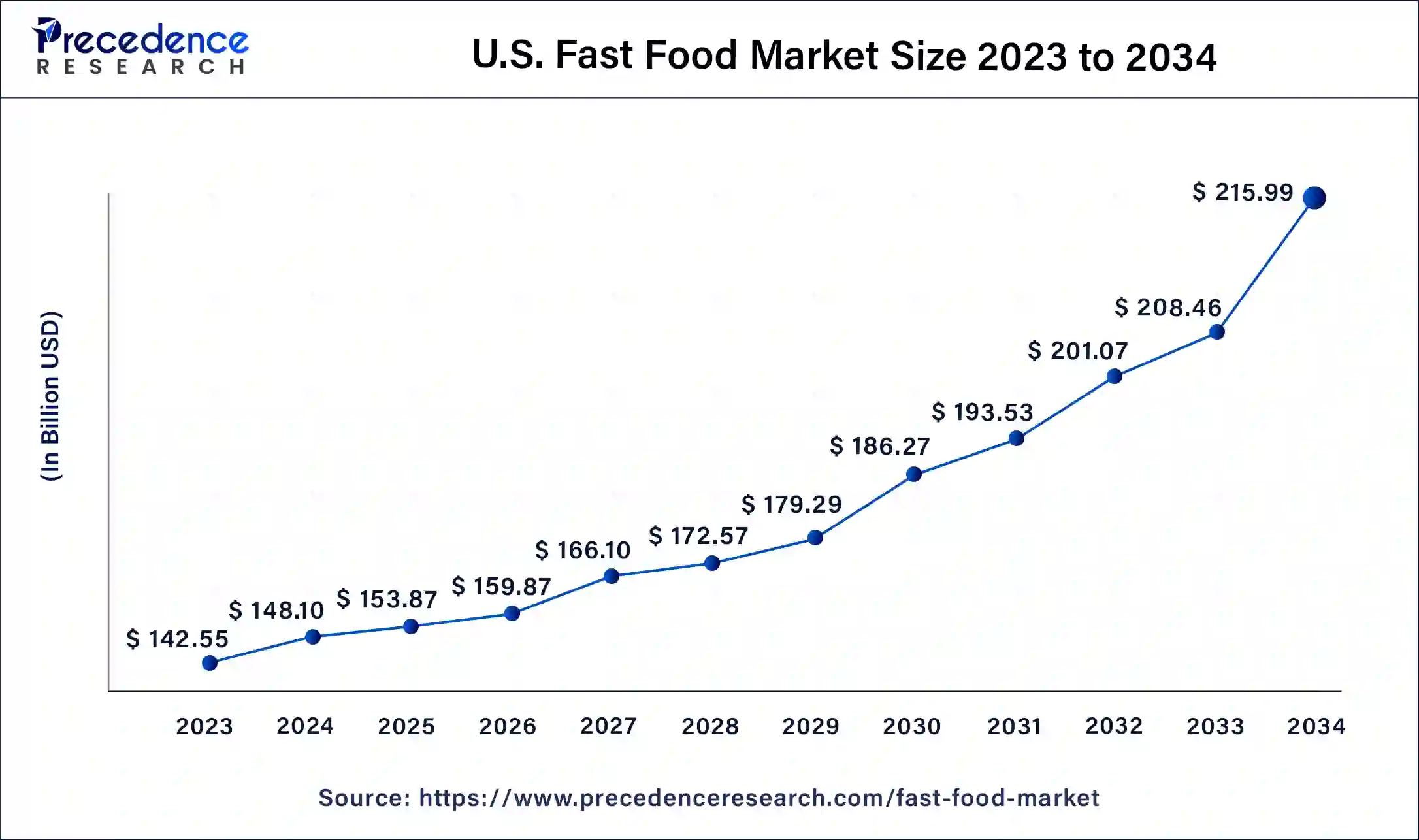

U.S. Fast Food Market Size and Growth 2026 to 2035

The U.S. fast food market size is valued at USD 153.87 billion in 2025 and it is predicted to reach USD 223.42 billion by 2035 with a CAGR of 3.8% from 2026 to 2035.

North America dominated the fast food market in 2025 with revenue share of 28%. The growth of North America fast food market is attributed to the growing consumer expenditure on fast food. In addition, the shift in consumer taste and preference is driving the demand for fast food in regional market. The introduction of new flavors is also driving the growth and expansion of fast food market in North America region.

In North America, the U.S. led the market owing to the affordability, convenience, and long-standing culture of eating fast food. The US market is majorly dominated by players such as Burger King, McDonald's, and Wendy's, and witnessing ongoing growth due to technological innovations, evolving consumer preferences, and expanding delivery networks.

What Makes Asia Pacific the Fastest-Growing Region in the Fast Food Market?

Asia-Pacific is expected to develop at the fastest rate during the forecast period. India, China, and Japan dominate the fast food market in Europe region. The factors are growing population, rising disposable income and changing consumer preferences. Furthermore, the fast food produced with natural ingredients is boosting the growth and development of Asia-Pacific fast food market.

In Asia Pacific, India dominated the market due to the changing consumer lifestyles, urbanization, and the option of quick dining options. Major cities such as Delhi, Mumbai, and Bangalore are leading the Indian market because of their cultural acceptance of global cuisines, high population density, and higher disposable incomes. Moreover, the market is also propelled by the emergence of international brands.

What Makes Europe a Notably Growing Area in the Fast Food Market?

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be credited to the evolving lifestyles, rapid urbanization, and the convenience-oriented behaviours of consumers. Furthermore, in Europe, the UK, Germany, and France are leading the market due to strong consumer bases and strong fast-food infrastructure.

The regional market growth is also driven by evolving consumer preferences and changing dietary habits due to urbanization. There is a growing demand for healthier options, as consumers are becoming more health-conscious and seeking meals that align with their individual dietary needs. This trend is pushing many fast-food establishments to innovate their menus by incorporating fresh ingredients and offering plant-based as well as gluten-free alternatives.

What Opportunities Exist in Latin America?

Latin America offers immense opportunities in the fast food market due to rapid urbanization and a growing middle-class population with increasing disposable incomes. Expanding modern retail chains and the proliferation of shopping malls are improving accessibility to fast-food options. The rise of digital platforms and food delivery services is further boosting market reach and convenience for consumers. Additionally, there is a growing demand for healthier menu options, encouraging fast-food operators to innovate with plant-based, fresh, and customizable meals.

What Potentiates the Market in the Middle East & Africa?

The fast food market in the Middle East & Africa is driven by factors such as rapid urbanization, a large and youthful population, rising disposable incomes, and continued lifestyle shifts toward convenient, on-the-go meals. Growing tourism has further boosted demand for diverse fast-food offerings and the presence of international brands. Countries such as Saudi Arabia, the UAE, and Turkey lead the market. This is mainly due to high income levels, a strong tourist base, and densely populated urban centers.

Value Chain Analysis

- Raw Material Sourcing

This stage involves sourcing agricultural and food inputs such as meat, poultry, vegetables, grains, dairy products, oils, and spices required for fast-food preparation.

Key players: Tyson Foods, Cargill, Nestlé, JBS, Sysco, and Archer Daniels Midland (ADM). - Food Processing & Ingredient Manufacturing

Raw materials are processed into semi-prepared or ready-to-use ingredients such as frozen patties, sauces, buns, and pre-cut vegetables.

Key players: Nestlé Professional, McCain Foods, Kerry Group, Hormel Foods, and Conagra Brands. - Distribution & Logistics

Processed ingredients are transported through cold-chain and ambient logistics networks to restaurants and franchise locations.

Key players: Sysco, US Foods, DHL Supply Chain, Lineage Logistics, and Americold Realty Trust.

Fast Food Market Companies

- Auntie Anne's Franchisor SPV LLC

- Domino's Pizza Inc.

- CKE Restaurants Holdings Inc.

- Firehouse Restaurant Group Inc.

- Jack in the Box Inc.

- McDonald's

- Restaurant Brands International Inc.

- Yum Brands Inc.

- Inspire Brands Inc.

- Doctor's Associates Inc.

Recent Developments

- In May 2025, Burger King and Wendy's have launched summertime promotions designed to boost lagging early-year sales, while McDonald's is opening later. Restaurant companies are intensifying their marketing efforts this summer as they look to break out of an early-year traffic slump. (Source: https://www.restaurantbusinessonline.com)

- In December 2024, KFC announced to launch of a new tender concept amid the fast-food chicken craze here's when the first one opens. Saucy will have 11 dips to pick from in a nod to the number of herbs and spices in Colonel Sanders' original recipe. Customers will be able to choose from chimichurri ranch, teriyaki, jalapeno pesto, and creole honey mustard, among others. (Source: https://www.yahoo.com)

- In March 2025, Leading vegan fast-food restaurant chain and food technology company announced its strategy to expand from Canada into the United States amid the recently announced tariffs on Canadian goods. The company also announced a non-brokered private placement to support the initiatives. (Source: https://www.streetwisereports.com)

- Papa John's International and franchisee operator Sun Holdings in the U.S. announced a domestic franchisee growth agreement in September 2021. Sun Holdings will open 100 new stores across Texas by 2029, as per the conditions of the contract.

- Domino's Pizza will produce ‘The Unthinkable Pizza', India's first plant protein-based product, in December 2020. The Unthinkable Pizza is a vegan pizza produced entirely of plant-based proteins with chicken like sensory qualities.

- Jack in the Box plans to build 98 more outlets in the U.S. by March 2022. In addition to the 2,208 existing Jack in the Box stores, the new sites represent the brand's highest level of expansion ever. Aside from that, Jack in the Box is set to acquire Del Taco, a prominent Tex-Mex fast food brand, which will add 600 more stores to the mix.

- McDonald's Corporation stated in March 2019 that it has reached an agreement to purchase Dynamic Yield, a leader in customization and decision logic technology with offices in Tel Aviv and New York. By buying Dynamic Yield, McDonald's adds to its significant technology investments for growth.

Segments Covered in the Report

By Product

- Pizza/Pasta

- Burgers/Sandwich

- Chicken

- Asian/Latin American

- Seafood

- Others

By End User

- Quick Service Restaurants

- Fast Casual Restaurants

- Caterings

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting