Food Manufacturing Software Market Size and Forecast 2025 to 2034

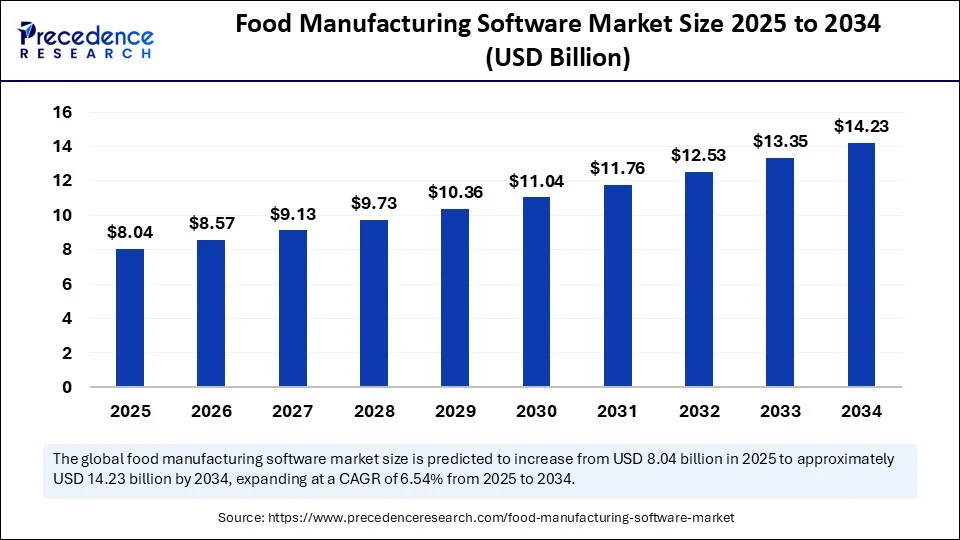

The global food manufacturing software market size accounted for USD 7.55 billion in 2024 and is predicted to increase from USD 8.04 billion in 2025 to approximately USD 14.23 billion by 2034, expanding at a CAGR of 6.54% from 2025 to 2034. With rising consumer demands for food, strict regoulations regarding food safety, and growing supply chain complexity, software solutions have become essential to streamline production, ensure safety, and reduce waste.

Food Manufacturing Software MarketKey Takeaways

- In terms of revenue, the global food manufacturing software market was valued at USD 7.55 billion in 2024.

- It is projected to reach USD 14.23 billion by 2034.

- The market is expected to grow at a CAGR of 6.54% from 2025 to 2034.

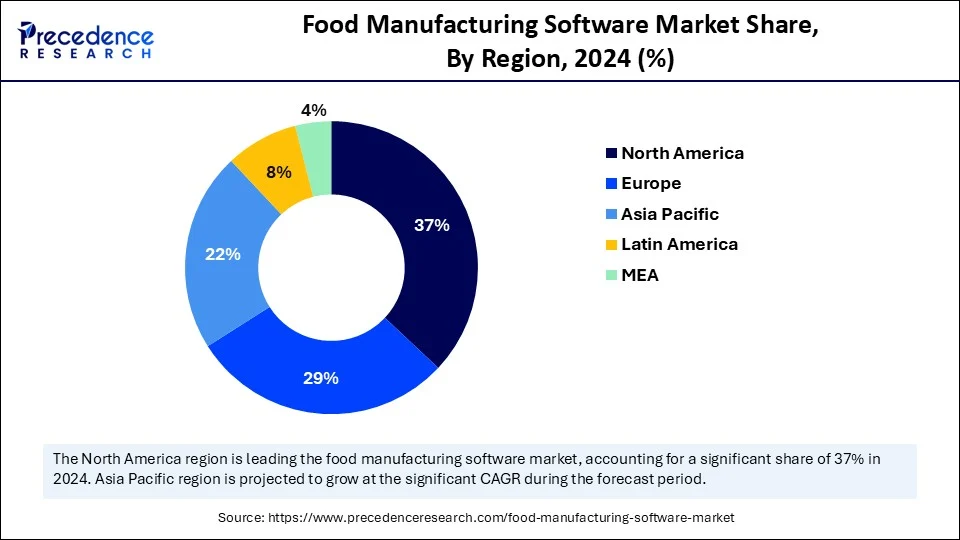

- North America dominated the food manufacturing software market with the largest market share of 37% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By deployment mode, the cloud-based segment held the biggest market share of 52% in 2024.

- By functionality, the enterprise resource planning (ERP) segment captured the highest market share of 27% in 2024.

- By functionality, the compliance & traceability segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By food category, the meat, poultry & seafood segment generated the major market share of 21% in 2024.

- By food category, the ready-to-eat/ready-to-cook meals segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By enterprise size, the large enterprises segment contributed the highest market share of 64% in 2024.

- By enterprise size, the SMEs segment is expected to grow at a remarkable CAGR between 2025 and 2034,

- By end-user department, the production operations segment held the major market share of 31% in 2024.

- By end-user department, the regulatory & compliance segment is expected to grow at a remarkable CAGR between 2025 and 2034.

Impact of AI on the Food Manufacturing Software Market

Artificial intelligence (AI) is transforming the food manufacturing software market by enabling advanced automation, predictive analytics, and enhanced decision-making capabilities. AI makes food manufacturing operations more predictive, agile, and data-driven. By leveraging real-time quality control using machine vision and AI-driven analytics for demand forecasting, companies are reducing waste while improving yield. Intelligent automation is streamlining inventory management, batch tracking, and packaging with unmatched accuracy. AI-powered recipe optimization tools are helping brands innovate faster while maintaining consistency. Moreover, generative AI is being leveraged to stimulate production scenarios and minimize downtime. As sustainability becomes non-negotiable, AI is also playing a pivotal role in energy optimization and carbon footprint monitoring.

U.S. Food Manufacturing Software Market Size and Growth 2025 to 2034

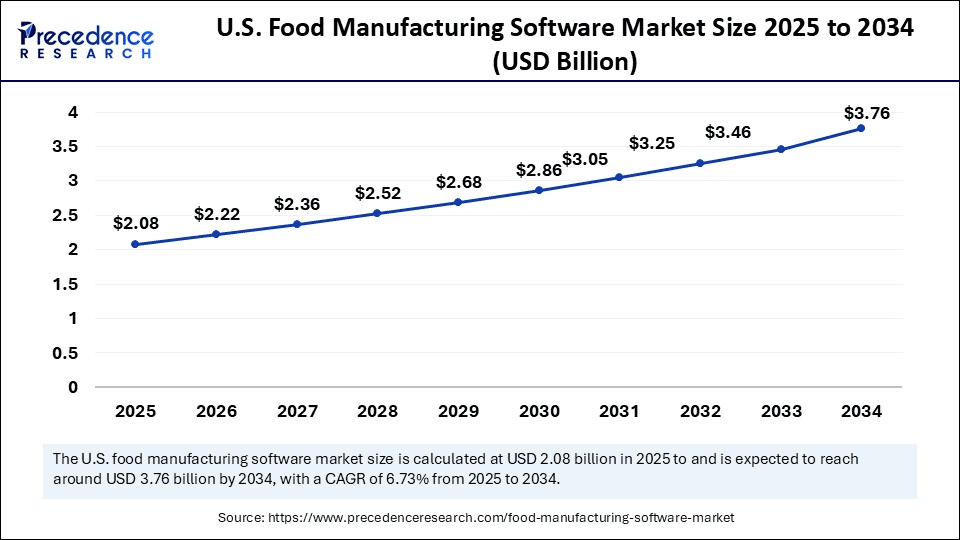

The U.S. food manufacturing software market size was exhibited at USD 1.96 billion in 2024 and is projected to be worth around USD 3.76 billion by 2034, growing at a CAGR of 6.73% from 2025 to 2034.

What Made North America the Dominant Region in the Food Manufacturing Software Market in 2024?

North America dominated the market with the largest share in 2024, due to high digital maturity and early adoption of advanced technologies. Major food producers are heavily investing in AI, IoT, and cloud platforms to streamline operations and ensure traceability. Regulatory pressure from agencies like the FDA has further driven the need for software that can ensure food safety compliance and track ingredients from farm to fork. The rise of health-conscious consumers and personalized nutrition has also accelerated the need for a data-driven product development tool. Moreover, the growing trend of clean-label and organic foods requires manufacturers to maintain high transparency, making automation critical. With a strong ecosystem of tech vendors and integrators, North America is at the forefront of smart food manufacturing.

The U.S. is a major contributor to the North American food manufacturing software market. Cloud-based ERP systems are in high demand in the U.S. for scalability, especially among regional food brands. The surge in e-commerce food delivery and D2C (direct-to-consumer) models has increased demand for systems that link production planning with logistics. Additionally, food safety recalls and audits have prompted companies to invest in preventive quality control and batch-level traceability. The labor shortage in manufacturing is also nudging businesses toward automation and AI-enabled workforce optimization. With continued investment and innovation, the U.S. is expected to maintain its position in the market.

What Factors Contribute to the Growth of the Food Manufacturing Software Market in Asia Pacific?

Asia Pacific is expected to grow at the fastest rate in the coming years due to the rising urbanization and shifting dietary patterns, and food production volumes are increasing rapidly across the region. Governments are actively imposing food safety regulations, boosting the demand for reliable software in the supply chain. Countries like India, China, and Southeast Asia are witnessing rising demand for affordable, scalable solutions suited to local market needs. Traditional food manufacturers are gradually embracing technology to reduce waste, boost output, and meet regulatory standards. The growing penetration of smartphones and internet connectivity is also enabling mobile-based manufacturing tools across rural production zones.

India is a major player in the market. Many food manufacturing companies in India are seeking user-friendly interfaces and modular platforms that allow incremental upgrades. Local governments are also offering incentives for digitization under food and safety and modernization schemes. Furthermore, the growing export demand for processed foods from APAC nations is creating pressure to meet international compliance, pushing the adoption of traceability and quality assurance software. Startups in the region are capitalizing on the momentum by offering localized solutions in native languages and culturally relevant formats. Overall, the Asia Pacific market holds immense potential and is rapidly becoming a global technology hotspot in food manufacturing.

Market Overview

Food manufacturing software refers to digital platforms and integrated systems designed to manage, automate, and optimize various operations across the food and beverage production lifecycle. These platforms typically support functionalities such as recipe/formulation management, batch and process tracking, compliance and traceability, inventory and supply chain planning, quality control, production scheduling, and overall equipment effectiveness (OEE) within food production environments.

The global food manufacturing software market is experiencing steady growth due to rising digital adoption across food processing businesses. With manufacturers striving to meet stringent food safety standards and ensure traceability, software tools for quality assurance, compliance, and real-time monitoring are in high demand. Cloud-based platforms are enabling seamless data integration across supply chains, unlocking deeper insights and agile decision-making. Small and mid-sized enterprises are also entering the fold with scalable, subscription-based solutions. Regional demand is growing fast in emerging markets, driven by food security initiatives and government incentives. The market outlook remains promising as manufacturers increasingly seek tech-driven differentiation.

Food Manufacturing Software Market Growth Factors

- Rising integration of AI and machine learning algorithms for predictive maintenance and process optimization boosts the growth of the market.

- There is a strong focus on food safety through automated tracking and digital traceability, contributing to market growth.

- Rising trend toward sustainability further supports market growth.

- Increasing production of processed food boosts the growth of the market.

- Growing focus on industrial automation drives market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.23 Billion |

| Market Size in 2025 | USD 8.04 Billion |

| Market Size in 2024 | USD 7.55 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.54% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Mode, Functionality, Food Category, Enterprise Size, End-User Department, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Need for Operational Efficiency

One of the key drivers of the food manufacturing software market is the rising need for operational efficiency and transparency across the production lifecycle. With increasing global demand for processed and packaged foods, manufacturers are turning to automation and intelligent systems to scale without compromising quality. Stringent food safety regulations are compelling companies to adopt robust tracking and compliance tools. Consumers are also demanding greater visibility into sourcing, nutrition, and sustainability, pushing companies towards software that offers real-time traceability. Labor shortages and rising costs have further accelerated the shift to digital systems. As margins tighten, businesses are increasingly relying on data-driven insights to optimize productivity and minimize waste.

Restraint

High Costs and Data Security Concerns

Despite strong potential, the market faces several challenges. One of the major factors restraining the growth of the food manufacturing software market is the high initial cost of implementation and integration of new software. Many small food manufacturers remain hesitant due to limited IT infrastructure or digital literacy. Complex legacy systems often make it difficult to migrate to modern cloud or AI-based platforms. Concerns about data security and compliance with international standards can further delay adoption. Customization challenges also persist, especially in highly specialized food segments where one-size-fits-all software does not work. Lastly, resistance to organizational change and workforce upskilling slows down the pace of digital transformation in many facilities.

Opportunity

Expansion into Emerging Markets and Demand for Customized Software

The market presents strong opportunities in developing economies where digital transformation in food manufacturing is still in its early stages. As small and mid-sized enterprises seek affordable and modular software solutions, vendors offering flexible pricing and cloud-based deployment models stand to benefit. Integration of AI, Internet of Things, and blockchain opens doors for next-gen capabilities like smart labelling, real-time recall management, and predictive quality control. Specialty food sectors such as plant-based, gluten-free, or functional foods offer niches where software can be tailored for compliance and innovation. Additionally, the growing popularity of direct-to-consumer food brands creates a need for seamless integration between production, inventory, and e-commerce. Vendors that offer scalable, intuitive, and mobile-first platforms will sustain long-term growth.

Deployment Mode Insights

How Does the Cloud-Based Segment Dominate the Food Manufacturing Software Market in 2024?

The cloud-based segment dominated the market in 2024 due to its flexibility, scalability, and low upfront investment. Companies are increasingly adopting SaaS platforms to streamline operations without heavy IT infrastructure. With real-time data access, remote monitoring, and multi-location integration, cloud software ensures agility in today's fast-moving food industry. AI, IoT, and machine learning further enhance operational intelligence. Cloud systems are also crucial for enabling predictive maintenance and demand forecasting, helping manufacturers stay ahead of market shifts. As cybersecurity features improve, even highly regulated segments are growing confident in cloud-based compliance solutions.

Many enterprises are choosing hybrid or full-cloud models to reduce downtime and improve efficiency across production lines. Cloud software also supports automatic updates, reducing the need for manual intervention and keeping systems up to date. Cost-effective subscription models appeal to both large and small enterprises, promoting widespread adoption. Cloud platforms enable easy integration with third-party logistics, e-commerce, and raw material vendors, creating a seamless digital economy. As remote work and decentralized operations continue, cloud-based food manufacturing software ensures continuity and adaptability. With increasing global internet penetration, even manufacturers in emerging economies are embracing the cloud shift.

The on-premises segment is expected to grow at the fastest rate during the forecast period due to the rising need for enhanced control and data sovereignty. The perceived security and customization flexibility of on-premise platforms attract businesses with complex legacy systems. Many large enterprises still rely on these solutions due to their ability to deeply integrate with existing infrastructure. For companies operating in regions with inconsistent internet connectivity, on-premise deployment ensures uninterrupted functionality. Additionally, some manufacturers favor full ownership of their software, viewing it as a long-term capital investment.

On-premise systems are also appealing in heavily regulated sectors like infant nutrition or pharmaceutical-grade food production, where absolute data control is essential. Further, many manufacturers are adopting hybrid approaches using the cloud for certain functions while keeping critical operations in-house. With newer on-premise solutions offering better UI, analytics, and automation, adoption barriers are diminishing. This blend of security, control, and modern capabilities is fueling the growth of on-premise deployments.

Functionality Insights

What Made Enterprise Resource Planning (ERP) the Dominant Segment in the Market in 2024?

The enterprise resource planning (ERP) segment dominated the food manufacturing software market in 2024, due to its central role in coordinating all facets of production. From procurement and inventory management to finance and distribution, ERP systems offer a unified platform. They enable real-time visibility into processes, helping manufacturers make data-driven decisions. Food-specific ERP solutions also integrate features like batch tracking, allergen control, and shelf-life management. These systems reduce duplication of efforts, improve resource utilization, and enhance cross-functional collaboration. With ERP, manufacturers gain a bird's eye view of their operations, ensuring quality, cost control, and speed to market.

ERP software is increasingly integrating with advanced modules such as AI forecasting, machine learning, and digital twins. Cloud-based ERPs are making these capabilities accessible to mid-sized and growing firms. Customization is another strength, as vendors now offer sector-specific modules, for example, for dairy, bakery, or meat processing. Real-time analytics dashboards help manage inventory fluctuations and plan production based on seasonal demand. Integration with IoT devices is enabling ERP systems to monitor equipment health and predict downtimes. As a result, ERP continues to dominate as the backbone of digital transformation in food manufacturing.

The compliance & traceability segment is expected to grow at the fastest rate in the market during the forecast period. With global food supply chains becoming more complex, companies must ensure full visibility into the source, processing, and packaging. Software tools that offer digital batch tracking, real-time alerts, and automated record-keeping are being rapidly adopted. These systems help manufacturers comply with local and international food safety standards, such as FSSAI, FDA, and ISO certifications. Blockchain-backed traceability is also being explored to ensure transparency in claims like organic, fair trade, or allergen-free. As clean-label trends rise, consumers are demanding proof, not promises, making traceability tools indispensable.

In baby food, meat, and ready-to-eat meal manufacturing businesses, even a single recall can damage brand trust. As a result, companies are investing in compliance modules that offer document management, audit trails, and real-time reporting. Automated regulatory updates ensure companies stay aligned with evolving standards. These tools are especially crucial for exporters who must meet diverse regional compliance norms. Traceability software also supports sustainability efforts by tracking carbon footprint and waste metrics. This dual advantage of regulatory protection and brand transparency is fueling rapid growth in compliance-focused solutions.

Food Category Insights

Why Did the Meat, Poultry & Seafood Segment Lead the Market in 2024?

The meat, poultry & seafood segment dominated the food manufacturing software market in 2024, due to strict safety regulations and short shelf lives of these products. Software solutions help manage complex inventory flows, ensure hygiene, and track cold chain logistics. These foods face intense scrutiny around traceability, contamination prevention, and humane sourcing, all of which require strong digital systems. Software tools assist in batch tracking, temperature monitoring, and expiration management, reducing losses and ensuring quality. Global trade in these products also demands multilingual compliance and international certification support. These operational and regulatory complexities make software adoption indispensable in this segment.

In addition, consumer demand for transparency in origin, handling, and ethical practices is increasing pressure on brands. Advanced software now enables manufacturers to trace meat from farm to fork and generate reports in seconds. Real-time production monitoring ensures yield optimization and consistent processing standards. ERP tools in this category often come integrated with HACCP planning and sanitation scheduling. Seafood exporters are using digital tools to meet import regulations and avoid rejections. As this sector continues to globalize, digital transformation remains key to maintaining efficiency and reputation.

The ready-to-eat/ready-to-cook meals expected to experience the fastest growth in the market during the forecast period. These products require software that can handle fast production cycles, multi-SKU batch management, and dynamic packaging. Food safety is paramount, as these items are often perishable and consumed without further cooking. Software tools help manage shelf-life, allergen control, and nutrition labelling efficiently. As the market becomes increasingly competitive, brands are using digital systems for rapid formulation, sampling, and compliance testing. Cloud-based platforms are particularly useful for agile startups in this space.

Personalization trends, such as keto-friendly, high-protein, or vegan meals, are also driving complexity in this segment. Software that can manage micro-batch production and support recipe version control is becoming essential. Integrated demand forecasting helps brands align supply with fluctuating consumer preferences. Packaging compliance, barcode tracking, and multi-channel distribution tools are all critical functionalities in this space.

Enterprise Size Insights

Why Did the Large Enterprises Segment Dominate the Food Manufacturing Software Market in 2024?

The large enterprises segment dominated the market in 2024, due to their scale, complexity, and global operations. These organizations require robust, enterprise-grade platforms capable of integrating thousands of processes across multiple geographies. Customizable ERP, advanced analytics, and AI-powered decision systems are commonly implemented. Budget flexibility allows them to invest in comprehensive digital transformation programs. Their focus is often on optimizing efficiency, maintaining brand trust, and ensuring global regulatory compliance. As innovation accelerates, large enterprises also act as early adopters and trendsetters in this space.

The small & medium enterprises (SMEs) segment is expected to experience the fastest growth in the market during the projection period. As consumer demands evolve and competition stiffens, SMEs are turning to digital tools for cost control and product innovation. Many vendors now offer modular, subscription-based software that fits SME budgets and needs. These tools help in streamlining procurement, batch production, inventory, and quality checks without a heavy upfront investment. Government incentives and digital literacy programs are also encouraging SMEs to adopt software solutions. With mobile-first interfaces, many tools are usable even in rural or semi-urban production units.

End-User Department Insights

How Does the Production Operations Segment Dominate the Food Manufacturing Software Market in 2024?

The production operations segment dominated the market in 2024 due to the increased demand for software solutions to optimize batch scheduling, monitor equipment performance, and ensure consistent quality across runs. Real-time dashboards provide actionable insights, reducing bottlenecks and improving throughput. Predictive analytics and machine learning tools are helping companies fine-tune process parameters and minimize downtime. Automation of tasks like mixing, cooking, and packaging further enhances efficiency. As demand for customization grows, software tools allow faster recipe switches without compromising output.

The regulatory & compliance segment is expected to grow at the fastest CAGR in the upcoming period. The rising complexity of global food laws, certifications, and audits requires centralized, automated solutions. Compliance tools enable digital documentation, audit readiness, and real-time flagging of violations. Software solutions simplify tracking of ingredients, additives, labeling, and packaging rules across different geographies. Features like version control, digital SOPs, and auto-alerts reduce human error and increase accountability. As brands expand into exports, the compliance burden grows, boosting the demand for food manufacturing software.

Food Manufacturing Software Market Companies

- Aptean

- BatchMaster Software

- CAT Squared

- Deacom

- JustFood ERP (Aptean brand)

- iRely

- Infor

- Microsoft Dynamics 365 (with food-specific modules)

- Oracle NetSuite

- Plex Systems (Rockwell Automation)

- ProcessPro (Aptean brand)

- QAD

- Radley Corporation

- SAP SE

- Sage Group

- SI Foodware (Schouw Informatisering)

- SYSPRO

- Trace One

- Vicinity Software

- YAVEON ProBatch (for Microsoft Dynamics NAV)

Recent Developments

- In July 2025, Share-ify introduced Clar-ify, its latest solution in the Share-ify platform built to eliminate data silos and drive end-to-end accuracy in product item management. The solution is intended to streamline item creation, governance and regulatory data accuracy across complex enterprise environments, which supports food safety, regulatory compliance and quality control. (Source: https://www.producegrower.com)

- In May 2025,FoodReady announced the rollout of major updates to its platform, including powerful new AI-powered tools, an upgraded inventory management module with intelligent lot tracking, and enhanced traceability features to support compliance with evolving FDA regulations like FSMA 204. These new software features help food manufacturers, processors, co-packers, and distributors who want greater automation, real-time visibility, and regulatory readiness. (Source: https://www.businesswire.com)

Segments Covered in the Report

By Deployment Mode

- on-premises

- cloud-based

- Hybrid

By Functionality

- Enterprise resource planning (ERP)

- Manufacturing Execution Systems (MES)

- Quality Management Systems (QMS)

- Inventory & Warehouse Management

- Supply Chain & Logistics Management

- Recipe/Formulation Management

- compliance & traceability

- Production Planning & Scheduling

- Customer Relationship Management (CRM)

- Laboratory Information Management Systems (LIMS)

By Food Category

- Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Dairy Products

- Bakery & Confectionery

- meat, poultry & seafood

- Fruits & Vegetables

- Canned & Preserved Foods

- ready-to-eat/ready-to-cook meals

- Frozen Foods

- Snack Foods

- Pet Food

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-User Department

- Production Operations

- R&D/Formulation

- Quality Control/Assurance

- Supply Chain & Procurement

- Sales & Distribution

- regulatory & compliance

- IT/Systems Management

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content