What is the Food Safety Testing Market Size?

The global food safety testing market size is accounted at USD 26.90 billion in 2025 and predicted to increase from USD 28.99 billion in 2026 to approximately USD 51.88 billion by 2034, representing a CAGR of 7.59% from 2025 to 2034.The rising demand for safe food products with high quality, initiation of various policies and strategies for ensuring consumer safety, expansion of the food industry and the technological innovations are driving the growth of the food safety testing market.

Food Safety Testing Market Key Takeaways

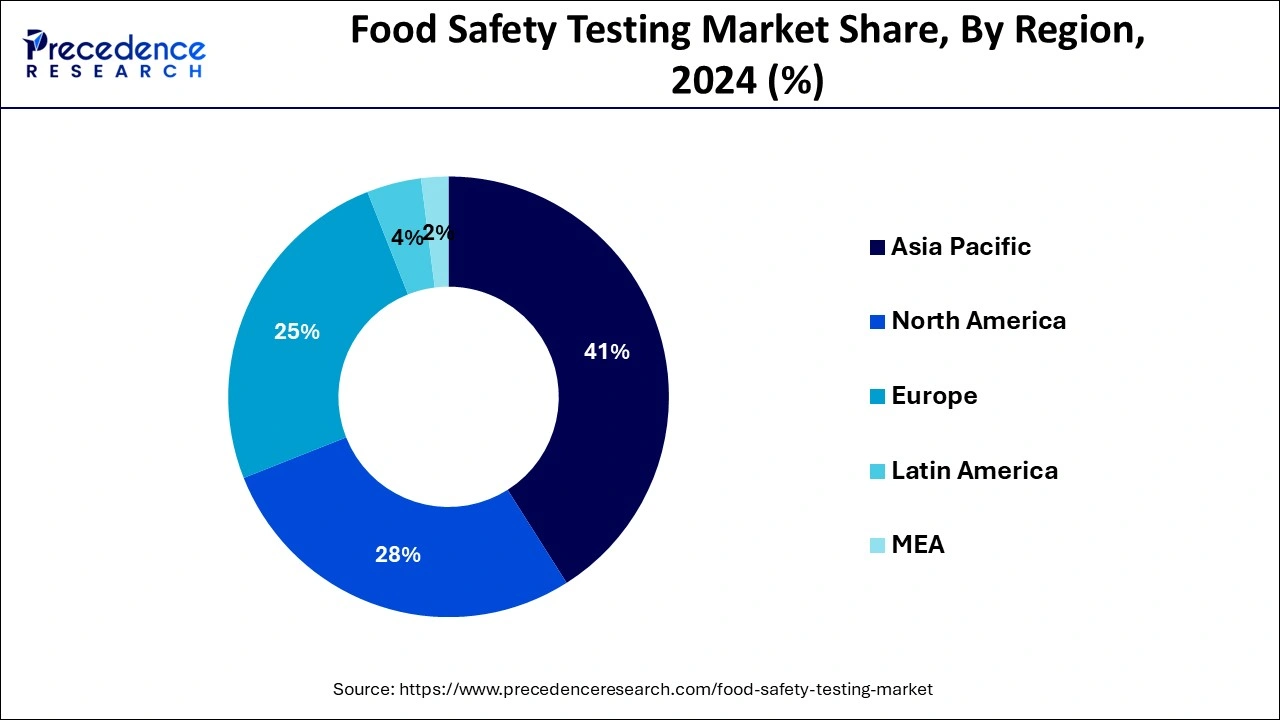

- Asia Pacific dominated the global market with the largest market share of 41% in 2024.

- By food tested, the processed food segment has held 37% in 2024 and it is growing at the fastest CAGR over the forecast period.

- By type, pathogen has held a market share of 42% in 2024.

Why is AI Playing an Important Role in the Food Safety Testing Market?

The food safety testing and quality can be enhanced with the application of AI and machine learning tools which will ultimately lead to faster identification of contaminants with improved accuracy. The increased use of machine learning algorithms for predictive analytics, convolutional neural networks (CNNs) for analysing food sample images, computer vision technology providing automated assessment, Internet of Things (IoT) for environmental monitoring with enhanced traceability and natural language processing tools for improving regulatory compliance are enhancing the consumer expectance for safe and quality food while securing the standards of food products.

Safety Testing Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the growing demand for high-quality food products coupled with technological advancements in food testing methodology.

- Major Investors:Several market players and strategic investors are actively entering this market, drawn by partnerships, R&D and joint ventures. Numerous testing companies such as SGS S.A., Eurofins SGS Group, TUV SUD, Bureau Veritas, Intertek, Agilent Technologies Inc and some others have started investing rapidly for developing advanced technologies for testing food products.

- Startup Ecosystem:Numerous startup brands are engaged in developing advanced technologies for enhancing food testing procedure. The crucial startup companies dealing in food safety testing consists of Eureka Analytical Services, pathOtrak, Oritain and some others.

Food Safety Testing Market Growth Factors

Since last few years, food producers are beneath cumulative pressure to make sure the safety of the products they are offering in the market. Different rules under the Food Safety Modernization Act have amplified the need to guarantee that the products in the U.S. food supply are harmless, tested, and testing should be documented and substantiated. Augmented safety and health risks pretended by microbiological, chemical, and chemical pollutants have progressively made analytical testing approaches a cornerstone of food safety programs. The global food safety testing market is projected to record noteworthy progression account of growing occurrences of food-borne diseases that have forced to implement stringent food safety regulations across the world.

Furthermore, escalating sale of processed and packaged food in developing and developed nations due to influences such as increasing popularity of quick-service restaurants and varying lifestyle is expected to push the requirement for safety testing of eatable items.

Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 7.59% |

| Market Size in 2025 | USD 26.90 Billion |

| Market Size in 2026 | USD 28.99 Billion |

| Market Size by 2034 | USD 51.88 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application Type, Technology Type, Region Type |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Growing prevalence of foodborne illnesses

According to the Centers for Disease Control and Prevention CDC estimate, the burden of foodborne illness in the U.S. is one in six Americans (or 48 million people); 128000 are hospitalized, and 3000 die of foodborne diseases.

Moreover, according to WHO, Contaminated food causes an estimated 600 million people to become ill each year, resulting in 420,000 deaths and the loss of 33 million healthy life years (DALYs). This has a devastating impact not only on public health but also on productivity and medical expenses, resulting in a staggering loss of US$ 110 billion each year in low- and middle-income countries. Moreover, children under the age of five bear a disproportionate burden, accounting for 40% of all foodborne illnesses and causing 125,000 deaths each year. Addressing food safety is critical for improving public health and promoting global economic growth.

Technological advancement

The food safety testing market is being driven by several key trends that are shaping the industry's future. One of these trends is the FDA's "New Era of Smarter Food Safety" program, which focuses on developing more modern approaches to food safety, such as a technology-driven traceability system and smart tools for addressing outbreaks. This program aims to enhance predictive assessments for food safety purposes and improve responses to issues and outbreaks. Another trend is the post-pandemic approach to food service, where food businesses are finding new ways to protect their customers. This includes a stricter cleaning and sanitation schedule and a more aggressive approach to preventing cross-contamination. Sustainability is also a top trend in the food industry, with more companies pursuing sustainability as one of their main objectives in the next few years.

Market Restraint

High cost

Food safety testing requires specialized equipment and expertise, both of which are expensive for businesses, particularly small ones. Some businesses find it difficult to implement adequate food safety measures because they lack the resources to invest in expensive testing equipment or hire trained personnel. As a result, they choose to conduct less thorough testing or none, putting consumers at risk. Furthermore, the cost of testing is passed on to consumers, leading to higher food prices. The high cost of food safety testing equipment and services limits market growth, particularly in developing countries with limited resources.

Market Opportunity

Integration of Digital Solutions to Enhance Accuracy, Efficiency, and Compliance in Food Safety Testing

Food safety is increasingly becoming digitalized in the food industry, with businesses adopting digital solutions for more accurate recording of food safety data, minimizing human error, and easing compliance. This trend is expected to continue as new software programs and automated applications help food businesses streamline their processes. Software and applications, for instance, are now linked to machines and sensors, allowing for streamlined and automated data recording without the need for human intervention. Although these digital solutions are not meant to replace human workers, they do make food safety recording faster and less prone to error, allowing the food safety testing market to grow by offering innovative and effective digital solutions to food industry businesses.

Application Insights

Among different application segments, meat, poultry, & seafood products dominated the global foodsafety testing market in 2024 by occupying major chunk of the market demand in 2024. Cumulative intake of meat and meat products around the world and great risk probability of infections in red meats are estimated to push these segments during years to come. The adulteration of poultry and meat products is frequently witnessed while packaging, processing, and storage. The food safety and Inspection Service have bordered guidelines to regulate the adulteration of poultry and meat products in processing plants and slaughter houses, depending on HACCP food safety control system. Furthermore, foremost factor that pushes the development of the seafood testing service sector is the huge sale for seafood products like shrimp, crustaceans, crabs, tuna, lobsters, swordfish, marlin and others on account of their nutritional values including existence of vital nutrient and omega fatty acids.

Technology Insights

Different technologies involved in this market include genetically modified organism testing, allergen testing, chemical & nutritional testing, residues & contamination testing, microbiological testing, and others. Out of these, microbiological testing segment appeared as a governing market segment with sizable revenue share in 2024. It is predicted to achieve momentum as it aids to identify microorganisms in eatables with the help of biological, chemical, molecular, and biochemical techniques, offering extremely precise results regarding their composition.

Further, genetically modified organism testing segment is estimated to observe the firmest growth pace, during assessment period mostly motivated by escalating alertness with in users concerning the existence of harmful GMOs in eatable. Also, growing production of GMO eatable products is anticipated to boost the request for safety tests to safeguard finest food quality.

Regional Analysis

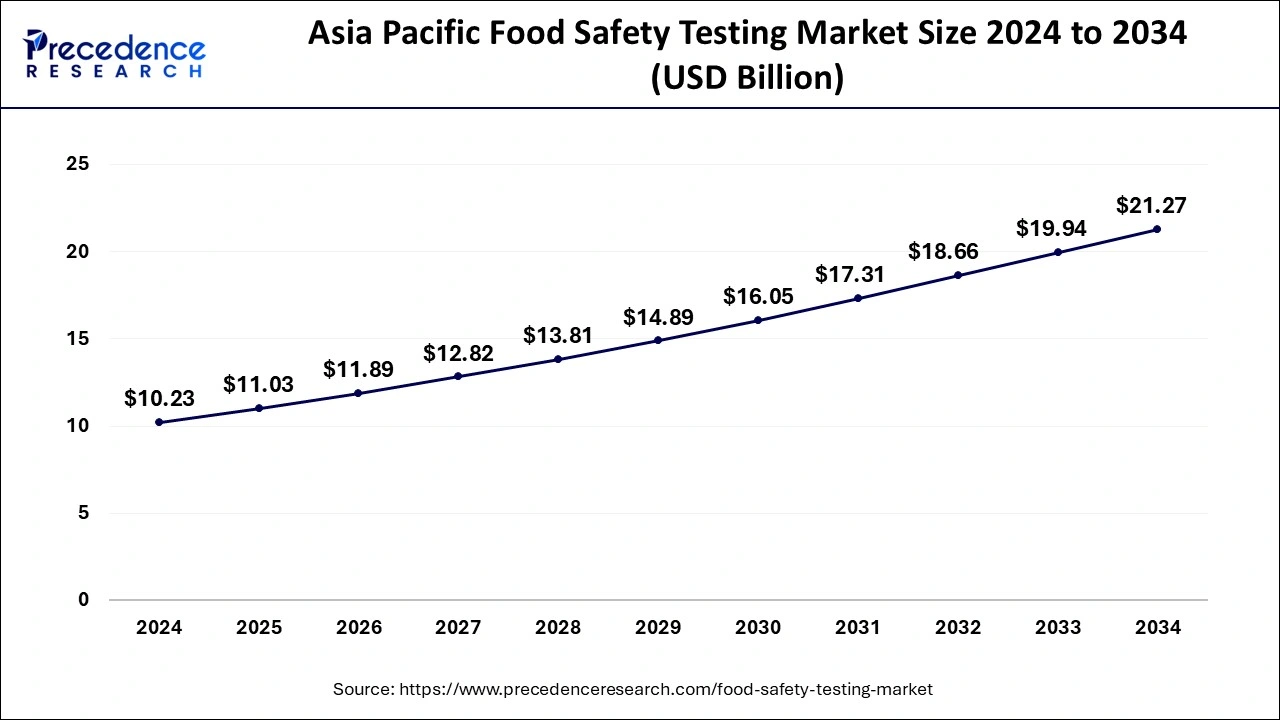

Asia Pacific Food Safety Testing Market Size and Growth 2025 To 2034

The Asia Pacific food safety testing market size is valued at USD 11.03 billion in 2025 and is expected to reach USD 21.27 billion by 2034, poised to grow at a CAGR of 8% from 2025 to 2034.

How is Food Testing Sector Growing in India?

The Indian food safety testing market is expected to grow significantly in this region. The growth can be attributed to the rising consumer awareness, enforcement of consumer protection policies by government, increased investments and initiatives for expanding food testing infrastructure. Furthermore, the science-based standards set by the Food Safety and Standards Authority of India (FSSAI) for food safety testing labs and the Food Safety on Wheels program by FSSAI which provides mobile units for food testing by conducting simple tests for adulterants is boosting the market growth.

Europe occupied prevalent revenue share in the global food safety testing market in 2024. Over the past many years, European nations have documented several concerns associated to food safety which established stringent policies to apply complete food protection for the public. Food safety policies have been underlined by struggles from National Reference Laboratories, Control Laboratories and EU Reference Laboratories. These authorities are playing an imperative role in continuing food standards and defending user health by confirming the excellence of the food supply chain. In the UK, the Food Safety Agency takes care of food-borne diseases and regulates the phases of sicknesses triggered by diverse pathogens. Nevertheless, regulations vary region to region.

North American food safety testing market is estimated to show healthy growth due to implementation of stringent food safety regulations across the region. For instance, Food Safety and Inspection Service of the US Department of Agriculture controls the safety of exported and imported food items. It is also accountable for the examination of items at borders and ports, alongside the ruling of food labeling. Furthermore, in the U.S., food processors or manufacturers subject to Consumer Product Safety Commission standards need to obey with the guidelines of the U.S. Consumer Product Safety Improvement Act and attain the essential certifications.

Germany Food Safety Testing Market Trends

- The food safety testing market in Germany is anticipated to grow due to various factors such as expansion of food industry, development of cost-effective technologies such as rapid testing and next-generation sequencing, rising incidences of foodborne disorders, national control initiatives such as the Food Monitoring Program and enforcement of stringent food safety policies.

The Middle East & Africa are expected to grow significantly in the food safety testing market during the forecast period. Increasing cases of food contamination of foodborne diseases are increasing the demand for food safety testing in the Middle East & Africa. Furthermore, the growing awareness is also contributing to the same. At the same time, growing demand for safe and quality food is increasing the adoption of food safety testing services. Thus, the implementation of various policies as well as of rules and regulations to increase food safety testing is also being encouraged. Thus, all these factors, along with the implementations by the government and regulatory bodies, are promoting the market growth.

Why Latin America held a considerable share of the market?

Latin America held a considerable share of the industry. The increasing demand for high-quality food products in several countries such as Brazil, Argentina, Chile, Colombia and some others has boosted the market expansion. Additionally, the growing prevalence of food poisoning among the people is expected to drive the growth of the food safety testing market in this region.

Key Companies & Market Share Insights

Growing concentration on dropping lead time, testing cost, sample utilization, and short comings connected with numerous technologies have lead different technological revolution and improvement of new technologies in chromatography and spectrometry. The food safety testing sector is undergoing technological inventions as major performers are proposing novel, fast, and more precise technologies including inductively coupled plasma-optical emission spectrometry, inductively coupled plasma mass spectrometry, near-infrared spectroscopy nuclear magnetic resonance and others for testing the safety of food products.

Key Players: Testing food products globally

- SGS S.A.: SGS S.A. is a multinational company headquartered in Geneva, Switzerland, that provides inspection, verification, testing, and certification services. It is a global leader in the testing, inspection, and certification (TIC) industry, with a large network of laboratories and offices worldwide.

- Eurofins SGS Group: Eurofins Scientific, a global leader in life sciences testing, and SGS SA, a separate global leader in testing, inspection, and certification services. It offers a wide range of services such as discovery pharmacology, forensics, advanced material sciences, genomics, clinical diagnostics, and biopharma services.

- TUV SUD: TÜV SÜD is a German company providing safety, security, and sustainability solutions through testing, certification, auditing, and advisory services across a wide range of industries. The company performs testing and certification for a wide variety of products and systems, from medical devices and industrial equipment to automotive technology and food contact materials.

- Bureau Veritas: Bureau Veritas is a global leader in testing, inspection, and certification (TIC) services, helping businesses ensure their assets, products, and processes meet quality, health, safety, and environmental standards. The company offers a wide range of services such as laboratory testing, on-site inspection, management system certification, and innovative digital solutions like 3D digital twinning for assets

- Intertek: Intertek is a leading global "Total Quality Assurance" provider that offers Assurance, Testing, Inspection, and Certification (ATIC) services to various industries worldwide. The company helps businesses by ensuring the quality, safety, and sustainability of their products, processes, and systems through a wide range of testing and compliance solutions.

- Agilent Technologies Inc:Agilent Technologies is a global leader in life sciences, diagnostics, and applied markets, providing instruments, software, services, and consumables for laboratories. The company focuses on delivering solutions for a wide range of customers, including those in the pharmaceutical, clinical diagnostics, and applied chemical fields.

Other Companies

- Thermo fisher Scientific Inc

- Shimadzu Corporation

- PerkinElmer Inc

Latest Announcements

- In January 2025, the Indian Export Inspection Council (EIC) announced the expansion of food testing infrastructure by integrating advanced technologies such as IoT-based sampling techniques for boosting export processes.

- In December 2024, Neogen Corporation, an innovative leader in food safety announced the addition of its pioneering Neogen Petrifilm Bacillus cereus Count Plate method expanding its Petrifilm product portfolio. John Adent, Neogen's President and CEO said that, “The Bacillus cereus bacteria is a pervasive threat within the food safety industry. For over 40 years, Petrifilm Plates have been a trusted method for microbial testing. Our new Bacillus cereus Count Plate continues this tradition of reliability and efficiency, helping food safety professionals address a critical need with a solution they can count on.”

Recent Developments

- In November 2025, Thermo Fisher Scientific launched Thermo Scientific Orbitrap Exploris EFOX Mass Detector. This mass detector system is designed for enhancing food testing.

(Source: foodindustryexecutive.com) - In September 2025, Bio-Rad Laboratories launched EZ-Check Salmonella spp kit. This kit is designed for detection of Salmonella in a variety of food and environmental samples.

(Source: qualityassurancemag.com) - In January 2025, the government of India announced the opening of new microbiology lab in Thiruvananthapuram, India. This microbiology lab is inaugurated to enhance food testing capabilities across this nation.

(Source: newindianexpress.com) - In June 2025, to ensure the highest Food Safety and Hygiene Standards across all sectors, the directions were provided by Dr Bilal Mohi-Ud-Din Bhat, who is the Deputy Commissioner (DC) of Srinagar, due to which the Food Safety Department intensified market checking across the city. Intensive inspection in different areas of Srinagar District, such as Nowhatta, Safa Kadal, Rajori Kadal, Sakedafar, Nawakadal, along with other areas in various bakery shops, was conducted by a team led by Yameen ul Nabi, Assistant Commissioner.

- In May 2025, as per the latest announcement by the Chief Minister the food adulteration and counterfeit medicines will be considered as a “social crime” and a major threat to public health. Furthermore, stringent action against offenders was announced to be taken along with the photos displayed at intersections to increase public awareness, according to a high-level meeting conducted with the officials of the Food Safety and Drug Administration (FSDA).

- In October 2024, Mérieux NutriSciences acquired the food testing business of Bureau Veritas including food laboratory testing services which are offered to across 15 countries through a network of 34 laboratories to food sector consumers.

- In July 2024, Alden announced its cutting-edge new suspended simultaneous sandwich assay (SSSA) for food safety and quality testing which will transform the food industry.

Segments Covered in the Report

By Food Tested

- Beverages

- Meat, poultry, & seafood products

- Dairy & dairy product

- Cereal, grain, & pulse

- Processed food

- Others

By Target Tested

- Pathogens

- E. coli

- Salmonella

- Campylobacter

- Listeria

- Others

- Pesticides

- GMOs

- Mycotoxin

- Allergens

- Heavy metals

- Others

By Technology

- Traditional

- Rapid

- Convenience-based

- Polymerase chain reaction (PCR)

- Immunoassay

- Chromatography & spectrometry

By Regional Outlook

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting